Here’s The MileLion’s review of the HSBC Premier Mastercard, which has seen a meteoric rise in value over the past couple of years.

It all started back in October 2024, when the HSBC Premier Mastercard ditched cashback for miles, added four airport lounge visits and a limo benefit, and received an upgrade to World Elite Mastercard.

The card then received a further enhancement in August 2025, which buffed its earn rates, doubled its free limo rides, and added unlimited airport lounge access for up to four cardholders. And if that wasn’t enough, HSBC also added a sign-up bonus worth up to 106,200 miles— even for existing HSBC cardholders!

The main catch is that this card is exclusively for HSBC Premier customers, which requires a minimum total relationship balance (TRB) of S$200,000 — and you’ll want to deploy those funds strategically to minimise the opportunity cost — but if that’s not a concern, then this card firmly belongs in the “too good to be true” category.

HSBC Premier Mastercard HSBC Premier Mastercard |

|

| 🦁 MileLion Verdict | |

| ☑Take It ☐ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? |

|

| A generous welcome bonus, 4x unlimited lounge passes and an annual fee waiver make the HSBC Premier Mastercard almost too good to be true- provided you how to put the $200K deposit to work. | |

| 👍 The good | 👎 The bad |

|

|

Overview: HSBC Premier Mastercard

Let’s start this review by looking at the key features of the HSBC Premier Mastercard.

HSBC Premier Mastercard HSBC Premier Mastercard |

|||

| Apply | |||

| Income Req. | S$30,000 p.a. | Points Validity | 37 months |

| Annual Fee | S$708.50 (waivable) |

Min. Transfer |

25,000 HSBC Points (10,000 miles) |

| Miles with AF | – | Transfer Partners | 20 |

| FCY Fee | 3.25% | Transfer Fee | Free |

| Local Earn | 1.68 mpd | Points Pool? | Yes |

| FCY Earn | 2.76 mpd |

Lounge Access? | Yes |

| Special Earn | – | Airport Limo? | Yes |

| Cardholder Terms and Conditions | |||

| ^After the first block of 10,000 miles, additional transfers are in blocks of 2 miles | |||

How much must I earn to qualify for a HSBC Premier Mastercard?

Technically speaking, the HSBC Premier Mastercard has a minimum income requirement of S$65,000 p.a., following HSBC’s recent decision to tighten card eligibility across the board.

However, the income requirement is lowered to S$30,000 p.a. for HSBC customers with a total relationship balance (TRB) of at least S$50,000, and since HSBC Premier requires a TRB of at least S$200,000, the de facto income requirement is S$30,000.

For more information on how the TRB is calculated, refer to this document.

How much is the HSBC Premier Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$708.50 | Up to 3x free |

| Subsequent | S$708.50 | Up to 3x free |

The HSBC Premier Mastercard has an annual fee of S$708.50 for the principal cardholder, and offers up to three supplementary cards free for life.

The annual fee is waived so long as:

- you have a Premier or Premier Elite relationship with HSBC and maintain a total relationship balance (TRB) of S$200,000 (or FCY equivalent) with HSBC Singapore, or

- you have a Private Banking relationship with HSBC Private Bank

Since the HSBC Premier Mastercard is exclusively for HSBC Premier customers, and a TRB of S$200,000 is required to become a HSBC Premier customer in the first place, who actually pays the annual fee?

First, HSBC Premier status is global, so you could have HSBC Premier status in Singapore by virtue of your relationship with HSBC in some other country. If you wanted the HSBC Premier Mastercard in Singapore, you would need to pay the annual fee.

Second, you may have started your HSBC Premier relationship in Singapore with a TRB of S$200,000, but fallen below that amount over time. HSBC won’t downgrade your relationship immediately (though you will be charged a S$50 monthly service fee), and if you apply for a HSBC Premier Mastercard in this state, you would need to pay the annual fee.

What about the opportunity cost?

At the risk of stating the obvious, the HSBC Premier Mastercard is not “free” in the sense that you must deposit at least S$200,000 with HSBC. If you park those funds in a savings account that earns close to negligible interest, then the opportunity cost is effectively the “annual fee” of your HSBC Premier Mastercard.

Fortunately, it doesn’t have to be that way. HSBC includes the following in its TRB calculation:

- Credit Balances for demand deposit accounts, time deposits and Dual Currency Plus (DCP)

- Market value for unit trusts, retail securities, and non-capital guaranteed structured products

- Nominal value for capital guaranteed structured products and bond

- Surrender value for insurance policies

In other words, you could use the funds to purchase equities, ETFs, index funds and money market funds. It’s beyond the scope of my expertise to tell you how you should be allocating the S$200,000, suffice to say the higher the return you can generate, the better a deal the HSBC Premier Mastercard is.

What sign-up bonus or gifts are available?

Customers who apply for a HSBC Premier Mastercard from 19 August to 19 October 2025 (with approval by 2 November 2025) are entitled to one of the following offers.

| Customer | Criteria | Gift |

| Premier Qualified Customer |

|

Up to 106,200 miles (265,500 HSBC Points) |

| Non-Premier Qualified Customer |

|

Up to 46,200 miles (115,500 HSBC Points) |

The bigger welcome offer of up to 106,200 miles is reserved for Premier Qualified Customers, defined as those who:

- Have a Premier relationship with HSBC, and

- Maintain a Total Relationship Balance (TRB) of at least S$200,000 (or its foreign currency equivalent)

All cardholders will need to meet a minimum spend of S$5,000 by the end of the month following approval, and provide consent to receiving marketing and promotional materials from HSBC at the time of submitting their application. This must not be revoked at the time the gift is credited.

This offer is available to HSBC Premier customers who:

- do not currently hold a principal HSBC Premier Mastercard, and

- have not cancelled a principal HSBC Premier Mastercard in the past 12 months before approval

This is a much more generous scope than HSBC’s regular welcome offers, which exclude anyone who holds any principal HSBC credit card, or has cancelled one in the past 12 months.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.68 mpd | 2.76 mpd | N/A |

SGD/FCY Spend

HSBC Premier Mastercard cardholders will earn:

- 4.2x HSBC points per S$1 (up to 1.68 mpd) on local spend

- 6.9x HSBC points per S$1 (up to 2.76 mpd) on foreign currency spend

The “up to” caveat is necessary because the actual earn rates depend on the partner you choose— different partners have different conversion ratios (I cover this in more detail later in the review).

Assuming 1.68/2.76 mpd rates, however, this would make the HSBC Premier Mastercard the highest-earning general spending card in Singapore.

| 💳 Earn Rates for General Spending Cards | ||

| Cards | Local Spend | FCY Spend |

HSBC Premier Mastercard HSBC Premier Mastercard |

1.68 mpd | 2.76 mpd |

StanChart Visa Infinite StanChart Visa Infinite |

1.4 mpd# | 3 mpd# |

Maybank Visa Infinite Maybank Visa Infinite |

1.2 mpd | 3.2 mpd@ |

UOB PRVI Miles Card UOB PRVI Miles Card |

1.4 mpd | 3 mpd IDR, MR, THB, VND 2.4 mpd All Others |

BOC Elite Miles BOC Elite Miles |

1.4 mpd | 2.8 mpd |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

1.4 mpd | 2.4 mpd |

HSBC TravelOne Card HSBC TravelOne Card |

1.2 mpd | 2.4 mpd |

DBS Altitude Card DBS Altitude Card |

1.3 mpd | 2.2 mpd |

OCBC 90°N Card OCBC 90°N Card |

1.3 mpd | 2.1 mpd |

Citi PremierMiles Card Citi PremierMiles Card |

1.2 mpd | 2.2 mpd |

StanChart Journey Card StanChart Journey Card |

1.2 mpd | 2 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd | 1.2 mpd |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd | 1.1 mpd |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

1.2 mpd | 1.2 mpd |

| #With minimum S$2K spend per statement month. Otherwise 1 mpd for both @With minimum S$4K spend per calendar month. Otherwise 2 mpd |

||

All FCY transactions are subject to a 3.25% fee, which is on par with the market.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

With a 2.76 mpd earn rate and a 3.25% FCY fee, using the HSBC Premier Mastercard overseas represents buying miles at 1.18 cents apiece.

There is also the option of pairing the HSBC Premier Mastercard with Amaze in order to enjoy better conversion rates, but you’ll earn 1.68 mpd instead of 2.76 mpd in that case since transactions will be converted into SGD. Based on Amaze’s ~2% spread, the cost per mile is slightly higher at 1.19 cents apiece, so I would not recommend pairing it.

Transaction date or posting date?

The HSBC Premier Mastercard tracks spending based on the posting date, not transaction date.

If you’re accumulating spend towards your welcome bonus, be careful about making transactions towards the end of the qualifying period- anything that posts beyond the deadline will not be included, even if the transaction was made during the qualifying period!

Which cards track spending by transaction date vs posting date?

When are HSBC Rewards Points credited?

HSBC Rewards Points are credited when the transaction posts, usually in 1-3 days.

How are HSBC Rewards Points calculated?

Here’s how you can work out the HSBC Rewards Points earned on your HSBC Premier Mastercard.

| Local Spend (4.2x) | Multiply by 1, round to the nearest whole number. Multiply by 3.2, round to the nearest whole number. Add both figures |

| FCY Spend (6.9x) |

Multiply by 1, round to the nearest whole number. Multiply by 5.9, round to the nearest whole number. Add both figures |

The minimum spend required to earn points is S$0.16 (SGD) and S$0.09 (FCY) respectively.

If you’re an Excel geek, here’s the formulas you need to calculate points:

| Local Spend | =ROUND(X*1,0) + ROUND(X*3.2,0) |

| FCY Spend |

=ROUND(X*1,0) + ROUND(X*5.9,0) |

| Where X= Amount Spent |

|

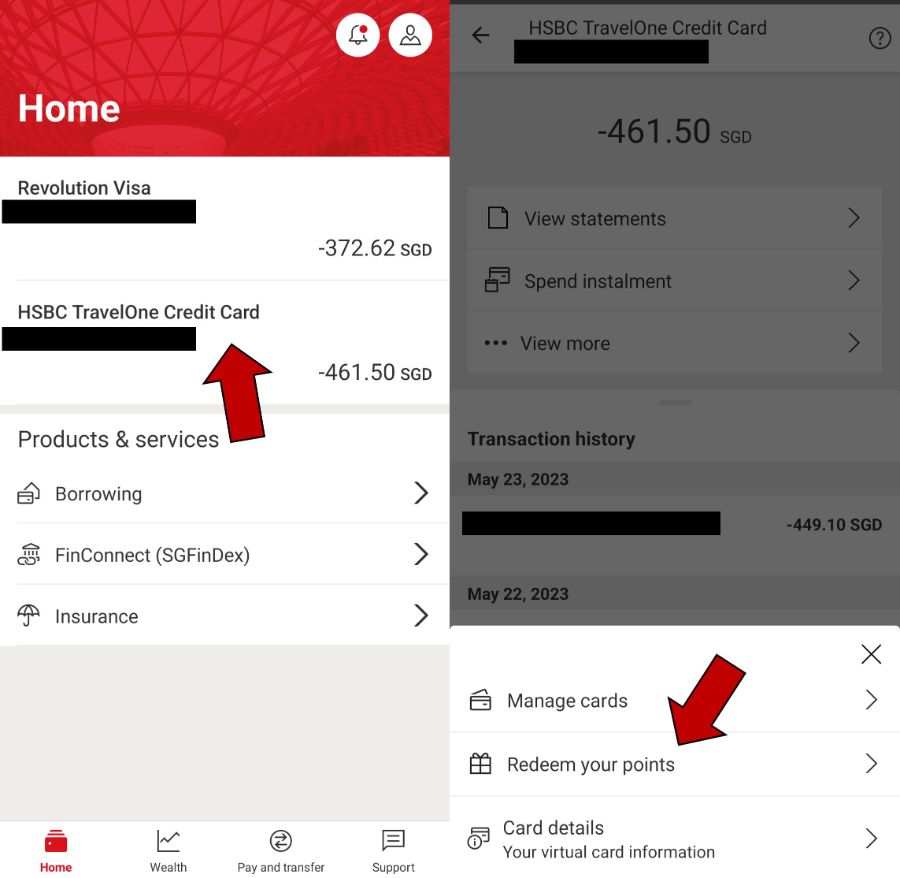

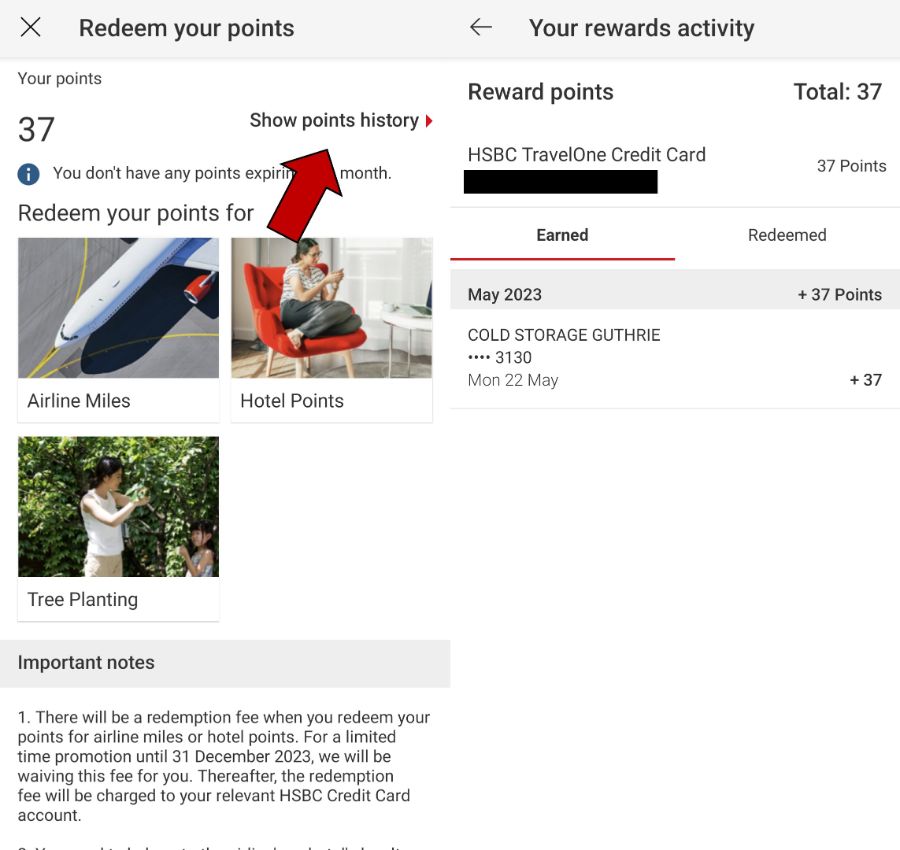

HSBC provides transaction-level points breakdowns, which can be found on the HSBC mobile app. To view this, log in to the HSBC mobile app and tap on your HSBC card > View More > Redeem Your Points (the screenshots below are for the HSBC TravelOne Card but it works the same for any HSBC card).

On the next screen, tap ‘Show points history’, and you’ll see a breakdown of points earned per transaction.

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for HSBC Rewards Points?

A full list of transactions that do not earn HSBC Points can be found in the T&Cs (at Point 3).

I’ve highlighted a few noteworthy categories below:

- Charitable Donations

- Education

- Government Services

- GrabPay top-ups

- Hospitals

- Insurance

- Professional services providers (e.g. Google & Facebook Ads, AWS)

- Real Estate Agents & Managers

- Utilities

HSBC also excludes CardUp, ipaymy and RentHero transactions from earning points.

What do I need to know about HSBC Rewards Points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| 37 months | Yes | Free |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 10,000 miles (2 miles after) |

20 | Instant* |

| *For all partners except Hainan and JAL | ||

Expiry

HSBC Points expire at the end of 37 months following the time they were earned.

For example, any points awarded from 1-31 August 2022 will expire on 30 September 2025. This means the actual validity is 36-37 months, depending on when the points are earned.

Pooling

In May 2024, HSBC added points pooling to its cards, bringing them all onto the same platform.

Therefore, if you have 10,000 HSBC Points on the HSBC Premier Mastercard, and 15,000 HSBC Points on the HSBC Revolution Card, you can redeem a combined balance of 25,000 HSBC Points.

Do note that even though HSBC Points pool, you will lose any unutilised points if you cancel a card. Be sure to cash them out before cancelling.

Transfer Partners & Fees

The HSBC Premier Mastercard has 20 airline and hotel partners, the most of any bank in Singapore.

| ✈️ HSBC Airline Partners | |

| Frequent Flyer Programme | Conversion Ratio (HSBC Points : Partner) |

| 50,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 30,000 : 10,000 |

|

|

30,000 : 10,000 |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 |

|

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

|

25,000 : 10,000 |

| 🏨 HSBC Hotel Partners | |

| Hotel Programme | Conversion Ratio (HSBC Points : Partner) |

|

30,000 : 10,000 |

| 25,000 : 5,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

The catch is that not all partners share the same transfer ratios. With airlines, for instance, the ratio ranges from 25,000 to 50,000 points : 10,000 miles.

This is important, because the HSBC Premier Mastercard’s advertised earn rates of 1.68/2.76 mpd only apply if you choose a partner with a 25,000 points : 10,000 miles ratio. The earn rates drop as the transfer ratio worsens, going as low as 0.6/1.2 mpd at the other end of the spectrum.

| Transfer Ratio (Points : Miles) |

HSBC PMC (SGD)* |

HSBC PMC (FCY)^ |

| 25,000 : 10,000 (8x partners) |

1.68 mpd | 2.76 mpd |

| 30,000 : 10,000 (2x partners) |

1.4 mpd | 2.3 mpd |

| 35,000 : 10,000 (5x partners) |

1.2 mpd | 1.97 mpd |

| 50,000 : 10,000 (1x partner) |

0.84 mpd | 1.38 mpd |

| *4.2 points per S$1 on SGD spend ^6.9 points per S$1 on FCY spend |

||

Likewise, the welcome bonus of 106,200 miles assumes you choose a partner with a 25,000 points : 10,000 miles ratio. Otherwise, it can go as low as 53,100 miles on the other extreme (still not too bad, mind you!).

It’s especially important to highlight that the transfer ratio for Singapore Airlines KrisFlyer was devalued to 30,000 points : 10,000 miles on 16 January 2025, which makes the HSBC Mastercard a 1.4/2.3 mpd card if KrisFlyer miles are your goal. That’s still decent, mind you, but it’s hard to make a case for KrisFlyer miles when you have so many other choices available.

Cardholders will need to convert a minimum of 10,000 miles. However, the subsequent conversion block drops to just 2 miles after that, which means you could convert 10,002 miles, or 200,006 miles for instance. This is a great feature, because it helps avoid the problem of orphan miles. So long as you keep at least 10,000 miles in your account, you can cash out your entire balance with almost nothing left behind.

All conversion fees are waived until further notice.

Transfer Time

All HSBC Points transfers are processed instantly, with the exception of:

- Hainan Airlines Fortune Wings Club (5 working days)

- JAL Mileage Bank (10 working days)

Other card perks

Unlimited airport lounge visits

The HSBC Premier Mastercard offers unlimited Priority Pass visits for the principal cardholder, and up to three supplementary cardholders.

There is no guest allowance, and any guests will incur a US$35 fee. However, if you travel frequently with family members, you can give them a supplementary card, which would grant lounge access even when you’re not travelling with them. Do note that a supplementary cardholder must be at least 18 years old (or 16 years old, with proof of overseas studies).

Unlike American Express and OCBC, HSBC does not have any lounge pass restrictions— you can use your Priority Pass visits at lounges, spas, restaurants, or any of the thousands of other experiences available.

2 free airport limo rides per quarter

The HSBC Premier Mastercard offers 2x complimentary airport limo transfers with a minimum spend of S$12,000 per calendar quarter. This is capped at a maximum of 2x rides per quarter, and 8x rides per calendar year.

The minimum spend requirement is waived for HSBC Premier Elite customers who have a minimum TRB of S$1.2M.

| 👍 First quarter concession |

|

HSBC offers a concession for new HSBC Premier Mastercard cardholders. During your first calendar quarter, the minimum spend for limo rides is S$6,000 instead of S$12,000. For example, if your card was approved in August 2025, the minimum spend for the July to September 2025 period need only be S$6,000. |

Codes to redeem limo rides will be sent by the end of the second month following the quarter in which the criteria was met.

| Calendar quarter where eligibility criteria is met | Limo code sent by |

| 1 January to 31 March | 31 May |

| 1 April to 30 June | 31 August |

| 1 July to 30 September | 30 November |

| 1 October to 31 December | 28 or 29 February |

Codes are valid for 12 months from the month of issuance, and can be used for rides to or from Changi Airport.

Entertainer with HSBC

|

| ENTERTAINER with HSBC |

Principal HSBC Mastercard cardholders receive a complimentary ENTERTAINER with HSBC app membership, which includes:

- 1-for-1 dine-in offers at more than 150 merchants across Singapore, including Sushi Jiro @ PARKROYAL COLLECTION, Bangkok Jam, Paul Bakery and more

- 1-for-1 takeaway offers at more than 50 merchants including Canadian 2 For 1 Pizza, Andersen’s of Denmark and more

- Up to 50% off leisure, attraction and wellness offers at BOUNCE Singapore, Spa Infinity, Virtual Room and more

- 1-for-1 stays in rooms at over 175 hotels around the world

You’ll need an activation key to start using your ENTERTAINER membership. This should have been emailed to you; if not you’ll need to call 1800 4722 669 to get it from customer service.

Complimentary golf games

HSBC Premier Mastercard cardholders with HSBC Premier Elite status enjoy six complimentary golf games per calendar year across selected golf clubs in Asia.

Bookings must be made through the HSBC Premier Golf website, and made at least five calendar days in advance.

Complimentary travel insurance

| Accidental Death | US$500,000 |

| Medical Expenses | US$500,000 |

| Travel Inconvenience | Flight Delay: S$500 Baggage Delay: S$500 Lost Baggage: S$3,000 |

| Policy Wording | |

HSBC Premier Mastercard cardholders will receive complimentary travel insurance when they pay for their air tickets with their card, or redeem award tickets and use their card to cover the taxes and surcharges.

This provides up to US$500,000 of coverage for accidental death or permanent total disablement, US$500,000 for overseas medical expenses and emergency medical evacuation, US$7,500 for trip cancellation, US$3,000 for personal baggage protection, as well as coverage for flight delays and personal liability.

Protection is provided for the cardholder, spouse, and children or domestic helper.

It’s a fairly comprehensive policy in my opinion, but you should read the policy wording and decide whether the level of coverage is adequate for your needs.

World Elite benefits

Principal and supplementary HSBC Premier Mastercard cardholders enjoy standard World Elite Mastercard benefits, including:

| 🏨 Hotel Elite Status | |

| 🚗 Rental Car Elite Status | |

| 👍Other Perks |

Summary Review: HSBC Premier Mastercard

HSBC Premier Mastercard HSBC Premier Mastercard |

| Apply |

| 🦁 MileLion Verdict |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

| What do these ratings mean? |

In many ways, the HSBC Premier Mastercard feels a little too good to be true.

106,200 bonus miles, four unlimited Priority Pass cards (with no restrictions on non-lounge experiences!), complimentary airport limo transfers, and World Elite Mastercard benefits, all for the grand total of…zero?

Of course, as I mentioned earlier, the true price of this card depends on how you deploy the S$200,000 required for a HSBC Premier relationship. If you put it in a low-yield savings account, you’re basically paying for the card in another way. And you can be sure that your HSBC Premier relationship manager will be sounding you out on some “very compelling” (from their perspective, at least!) mutual funds and insurance products.

But if you know how to navigate your way around those things, then this is quite possibly the best overall package I can think of at the moment.

What do you make of the HSBC Premier Mastercard?

To be entitled for the sign up bonus, the minimum spend of S$5,000 allow insurance spending? The T&C does not seem to indicate they do not allow such spending.

My HSBC banker says insurance spending allowed. but I didn’t test this myself. Do check again when applying.

Im stuck on this now as well. Jacky did you try it? did anyone else try it?

Actually HSBC has a promo for new premier customer sign up. If you put in $200k, you get $350 bonus cash back AND 1.8% interest rate for 3 mths, so overall the “opportunity cost” is not much at all.

Can I transfer my US securities to HSBC to fulfill TRB?

NO you can’t. I just spoke to HSBC about this. Only new securities acquired through the trading account you create through them will be considered. The only way to do this is to sell your securities through your other broker, and then buy back straightaway through the HSBC trading account. You will make a loss because of the spread. Or maybe if you see a further downtrend, then wait to buy more shares back later.

Please be aware of the Apple products discount promotion offered on the Premier Credit card website. I bought an iPhone through the portal, and throughout the process, the prices were shown in SGD. I then saw a 1% DCC fee charged to the card several days later. I tried to dispute the case with HSBC, but never got anything back.

Would hsbc allow you to withdraw the full 200k cash after having approved the card? Apologies if I missed it in the article.

Hope HSBC would consider making this card metal. Wonder why it wasn’t even considered with it’s competition.

Is there an annual/monthly fee on account balances for HSBC premier customers? Their latest fee sheet seems to indicate that there is – amounting to the equivalent of 1 to 2% p.a. on maintained balances. Though the fee sheet is very hard to read.

The biggest challenge with the $200k to your point Aaron is how to put it to get the best ROI. Unfortunately, HSBC premier does not have a good variety of wealth banking products to offer. They seem to push for insurance products. Trading platform is limited to UK and HK (I think). As much as the card itself is attractive, the bank needs to get their act together to create a proper premier banking for customers which is MISSING.

i haven’t been fully onboarded yet, but I’d be very surprised if they don’t support US equities?

yes, but don’t think they are so sophisticated to offer pre market trading etc

They do US Singapore and HK markets. Basic equities and other stuff including inverse leveraged single-stock ETF which some other banks do not have. Most RM will push high-commission products like insurance or structured products with complicated KI/KO etc but 200K in equity or ETF is easy I should think, for most people aiming for this card.

FWIW, SCB and DBS offer the widest range countries for equity trading among local banks. But if you need KSE then it probably has to be something like IBKR.