Legend has it that once upon a time, there was a bank called UOB. Long before UOB fell under the dark spell of inflated marketing, it issued an enchanted pair of cards called the “Preferred Platinum” series.

Now, like every enchanted pairing, there was a magical twin and a non-magical twin. The Mastercard was not magical. To the contrary, it was the Magikarp of credit cards, spending its days running around the house shouting “wingardium leviosa!” at the top of its voice and making coworkers uncomfortable with jokes about its “magic wand”.

The AMEX, on the other hand, was indeed magical. It gave the wielder a 10X bonus on miles earned for dining, both in the homestead and worlds beyond. Yes, it was part of the AMEX race and therefore shunned by many (less enlightened) merchants. But for those who knew how to harness its powers, it became a formidable tool indeed.

And although there was, for a period of time, a challenge to its title as the most powerful dining card in the realm from the HSBC Advance, said card was eventually lured over by the dark armies of cashback. This left the UOB PP Amex as the undisputed ruler of the dining cards, one card to rule them all.

And you can’t have it, because it’s no longer issued.

Or can you?

Well, that’s the question everyone’s asking, because although the vast majority of people are still getting computer says no responses from UOB, there are drips and drabs of successful PPA applications.

I’ve published three articles on the UOB PPA to date, which have attracted almost 300 comments in total from readers

The death of the dining card in Singapore

Last call for the UOB Preferred Platinum AMEX dining card!

UOB Preferred Platinum AMEX: Dead or alive?

So here’s my compilation of sightings of the UOB PPA, the ultimate rare pokemon, based on readers’ accounts over the past 18 months.

A History of Bigfoot Sightings UOB PP AMEX Sightings

October 2015

A user on HWZ reports that the UOB PPA has disappeared from UOB’s website.

Unfortunately, Wayback Machine coverage of the UOB credit card subpage is patchy, so I can’t verify exactly when UOB took down the card. But subsequent calls by forum members to UOB customer service suggest the card is in the process of being “demarketed”.

December 2015

Thanks to a tip off from an anonymous reader, I post an article on how you can still apply for a UOB PPA, provided you’re an existing UOB card member. Apparently, UOB has an automated SMS system that allows existing cardholders to add on additional cards without the need for further verification. All you have to do is the following-

If you are an existing UOB card member perhaps you can try this to apply for the UOB Preferred Platinum cards. I applied using SMS on 10 Oct which was after they removed the application links from their website but still got the card sent to me about 1.5 months later.

SMS spacespace to 77862

For example: SMS Yespp 7890 S1234567H to 77862.

January 2016- December 2016

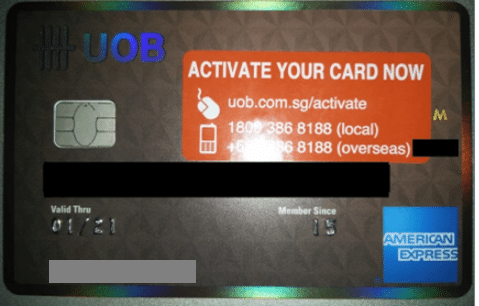

Numerous people report successfully applying for the card through the SMS method, with photographic proof (note the valid thru date- cards are issued with 5 year validity, so an expiry date of 01/21 implies a 01/16 issuance)

I’ve gone to tally up the comments of people reporting successful applications by month, only counting people who reported receiving the physical card (others have received approval messages via SMS but the cards never came). Here’s how it looks-

(note: there’s no way of verifying if all these accounts are true, but I’d like to believe that Milelion readers are people of impeccable character and personal hygiene)

Jan 2016: 3

Feb 2016: 8

Mar 2016: 6

Apr 2016: 12

May 2016: 1

June 2016: 8

July 2016: 4

Aug 2016: 4

Sept 2016: 0

Oct 2016: 0

Nov 2016: 0

Dec 2016: 3

You’ll note that the earliest applicants had the most success. April in particular was a bumper crop, with 12 people reporting successful applications.

And then it goes kind of quiet post August. From Sept- Dec 2016 we get a grand total of 3 successful applications, all in December.

Of course this is far from scientific- there’s a whole lot of self selection bias here. Also note that there were many others who were unsuccessful during this period (but thankfully reported it too so we’d have that data point), getting a range of excuses from CSOs about the card being demarketed and unavailable.

January 2017- April 2017

So continued the dry patch with denials, denials, denials. People who try the SMS method got met with a wave of rejections, from CSOs calls to a poor soul who applied for the UOB PPA and got a UOB YOLO card in the mail. Talk about a cruel joke.

And yet, no success reported. Until…

May 2017- June 2017

Breakthrough. 3 successful applications reported, again corroborated with photographic evidence. (note the 05/22 expiry date, evidencing a 05/17 approval)

What’s going on?

I have a theory.

I believe that when UOB demarketed the card in late 2015, the change was mostly cosmetic, in that they took the card off their front end webpage but didn’t update anything on the back end.

Now, a big bank like UOB handles thousands if not tens of thousands of credit card applications in a month. It’s not practicable for each of them to be manually approved. So UOB probably has an automated card printing press that kicks into action once the system approves a new application (based on credit risk, income requirements etc). The cards are embossed, the account is opened on iBanking, the CBS warnings/ promotional vouchers are added to the envelope and the package is dispatched, with little to no human intervention.

Therefore, although CSOs were trained to say the card had been demarketed, the system was still set up to produce such cards upon approval. It doesn’t explain why some people who applied in early 2016 didn’t get the card, but it does explain how some people could still get the card despite it being “demarketed”.

The other thing that intrigues me? Look at the most recent version of the UOB PP Mastercard. Yes, it’s still useless, but the design tells us something.

That there is Mastercard’s new logo.

Now hear me out. The way I understand it, card production has two components. There is the “raw” cardstock, which doesn’t have names, card numbers or expiry dates embossed. They have the base design (the card artwork + the Mastercard logo) and maybe a blank chip there, but nothing else. The cardstock sits around waiting until it’s needed. When a card is approved, the embossing happens, the chip is activated and the card is sent out.

Which means at some point in the recent past, UOB must have updated the cardstock’s design to incorporate the new Mastercard graphic. I’m guessing this didn’t take a lot of time, because in all likelihood there’s a placeholder for the Mastercard graphic on all cards, and it was a simple matter of replacing the old object with the new one.

But then they also bothered to do a print run of the new PP Mastercard cardstock, which implies in a warehouse somewhere there’s a pile of these babies waiting to be embossed. Now why would they do that for a card that’s supposedly demarketed? Card replacements, possibly, but this may also lend some hope that UOB hasn’t decided to kill the account entirely.

How do I get one?

And that begs the question, how do I get one?

Unfortunately, there seems to be absolutely no rhyme or reason why some people’s applications are successful and others aren’t. The UOB PP Amex was always a $30K income requirement card, so income can’t be a factor for why some people get it and others don’t.

Could it simply be a matter of persistence? Three accounts from successful applicants suggest so.

Account 1 from Anonymous:

15Nov – applied for card via SMS

20Nov – received call saying discontinued, but continued to push them citing other people who have received the card recently, CSO agreed to apply for me.

8Dec – received card in mailbox

still works! goodluck guys!

Account 2 from Martin:

I applied for this card mid of April 17 via SMS and shortly after via mail again. Called up 3 CSOs after, all saying the system doesn’t allow an application any more. Nothing they can do. Today I saw the card (with number) showing up in the ibanking. But can only be certain once the card is in the Mail.

(later)

Cards have arrived today, 03/05/17. Still works.

Account 3 from Chelsea:

I sent 12 SMS and 2 paper applications…UOB really makes you work for this card

These accounts seem to suggest that those who eventually got the card had to jump through a lot of hoops to get it. I certainly don’t think you should badger the poor CSOs for something they’re trained to reject, but I imagine SMS channels don’t mind being harassed.

What now?

To those who are still waiting- given the point we’re at, no one should apply for the UOB PPA and expect to be approved. We’re far past that point already. You can only hope against hope that one day you’ll log into your iBanking and see that glorious account opened.

To the banks- there’s a giant sized hole now in the credit card market for a good dining card. Come on, bring back a 4 mpd card. You can put a minimum spend. You can put a cap on bonus points. But just give us something, anything!

Does anyone know what are the annual fees for this card? I’m guessing there’s no waiver of the first year fees either. Since we will receive both Amex and MC versions, does that mean we have to pay annual fees for both cards?

there is a first year fee waiver as is the case for most uob cards. You pay one annual fee for both cards of 192.60. for what it’s worth, i’ve always gotten my annual fee waived.

Thanks Aaron!

To add on to Aaron’s reply, the annual fee will be charged to the Preferred Platinum MasterCard. So despite using the AMEX but not using the MasterCard, do take note that the annual deduction of UNI$4800 happens on the MasterCard. When asking CSO for reinstatement of the UNI$, some will be lost (as this card do not exist anymore) so you have to guide them, by citing the card number of the Preferred Platinum MasterCard and NOT the AMEX.

I tried the SMS method in May 2017 and instead gotten a UOB PP Visa card, and technically I can’t dispute since it is part of the PP Account series? Any idea if using the SMS method will work again, given that I have PPVisa and want to try out for Amex?

When you send the sms yespp how does the system know you want the amex, since there is also a pp visa (no 4mpd for dining so useless for this purpose).

Hey Aaron, That’s a very fair assessment. The scenario is very likely for folks who currently hold a card with UOB and have a set credit limit. Essentially the bank has done a credit evaluation and have approved an unsecured loan against your account. Every additional card with the bank shares the same underlying limit and hence the approval process can be automated/STPed without needing any additional checks (unless ofcourse there are flags set for the card like requiring higher salary, if customer is a Foreigner and their EP is expiring in under 6 months, etc). In fact when I… Read more »

Just tried sending the SMS. Got an acknowledgement saying my account will be opened in 10 Days.

Fingers crossed

Same message but CSO called to say the Amex card is demarketed, and only have the PP Visa, which is also part of PP account series. Hope you’ll get a positive result!

I tried the same a few days ago and got a message saying that I would receive the card within 10 working days if it was approved. Not sure if it would be the PP Amex, but when I tried applying for the Visa Signature and PRVI Miles online on separate consecutive days after, only my Visa Signature was approved with the PRVI rejected (I applied for the Visa Signaute first and even received the card already). Haven’t called UOB to find out why, but I understand from a friend who used to work at UOB that there is an… Read more »

No way on the limit. I hold more than 3 uob cards.

Thanks Tim. I’ll call to check them. Don’t understand why they’re not giving the PRVI automatically. Tempted just to try online again to see what happens …

Hmm I already have the PP Visa and Privi Miles on hand, so we’ll just have to see how it goes with the ‘PP Account’ situation haha. (Hopefully the process really is fully automated)

Would be awesome to be able to earn 4mpd on dining again now that the HSBC Advance is dead.

I can say the 3 UOB card limit is not accurate as I had 6, now 5. My PPA was approved in 04/16, applied after seeing Aaron’s post. The first thing that caught my eyes in this post was the new Masters logo for PPM. I only have 1 card among all banks which has the new Masters logo, i.e. I agree that somehow this card is being kept alive with them getting a new printwork for the new logo via BTL Chances of approval are high if there’s no human intervention (auto approval for SMS, no further review/documents required).… Read more »

Thanks Smudger. Looks like I’ll have to give them a call after all.

I spoke (face-to-face) with Head of Operations Card Ops Processing Centre in May 2017. I asked for PP Amex specifically, and she told me that it is not possible to apply for this card anymore.

For UOB card application, as long as there is a need for human intervention (such as income verification, or at any other stages), the persons-in-charge will stop PP Amex from sending out.

Better luck to those applicants, whose account is “so clean” that their application won’t fall into the hands of a human being during the automated process of applying for PP Amex… Heng ah!

Yet I sent mine in on a paper form which must be processed by a human (unless their OCR is so advanced it can read my handwriting… Somehow doubt that), together with payslips etc. Approved and received 3mths ago.

Even if you get the card, nothing stops UOB to stop issuing 4mpd awards for dining next day. So why bother?

Hey Aaron, this is an interesting analysis. On a different note, are you aware of the new update in UOB Preferred Platinum Visa’s terms and conditions? Will you an update on that? It has become very restrictive apparently.

Not just the PP MC that got redesigned.

The Amex got redesigned too by removing the “sunshine” around the Amex logo

Is anyone get the PP Amex after applying in May/june 2017 ? I saw in Aaron FB that someone get PP Amex recently. How is the correct way to apply it ? already send 3 SMS and said witihin 10 days will receive but nothing come

There’s no correct way to apply it lah. I tried everything. Just don’t keep spamming call centre cos it doesn’t help. SMS, mail, just do as many as you can lol.

Chelsea is right. It’s pointless to ask “what’s the right method of applying”. It’s plain dumb luck

[…] can imagine the scare I got when my UOB PP MC came and my Amex didn’t, and I already committed a photo to Aaron for this post at that time. Malu […]

Interesting to note that looking at the photo of the PP MC card, not only the MC logo has been updated. There is a paywave (contactless) logo for the card as well (the three arcs).

Tried the SMS method and the error message was “Hi, this is an invalid keyword. Please contact our customer service officer at 1…..”

sorry marisa. nothing much anyone can do here to help you. at most you can keep trying.

Sms option dead…

A sad sad day

“Hi, this is an invalid keyword. Please contact our customer service officer at 1800-2222121 or visit uob.com.sg for any enquiry. Have a good day.”

Who are you! YOU ARE AMAZING. Please carry on writing such articles!

oh you.

I just got annual fee for the Mastercard but not the PPA Strangely, can I cancel the Mastercard and still keep the Amex?.

nope. the cards are part of a dual account and the annual fee (which covers both cards) is charged to one card, not 50-50. cancel the mastercard, cancel amex too

not sure if that’s entirely accurate – i just cancelled the mastercard and asked them specifically if my amex would be affected and they said no. Just checked online banking in a panic after reading your comment and can see that my amex is still there but mastercard is gone (phew!). My guess is i’ll still have to pay the full annual fee though, which I’m more than happy to do

I can second this too. Back in 2015, I had the PPMC sitting in my drawer since I realised it was the unwanted twin of the 4mpd dining offer. At the 1st year renewal, I got the annual fee “charged” in the form of auto-deduction of UNI$ from my account. So I called up UOB for waiver (which was promptly refunded in the following statement cycle), and at the same time to cancel the PPMC. This was also promptly done, and the PPAmex is still alive, kicking and earning miles to this date. I continue to get the PPAmex annual… Read more »

Oh NOOOOOOOOOOOOOOOOOOOO

the 4 miles per dollar is now CAPPED!!!!!!!

http://uob.com.sg/assets/pdfs/terms-and-conditions-for-preferred-platinum-american-express.pdf