Last month we ran a sign up campaign with SingSaver where new and existing cardholders could get cash gifts and vouchers when signing up for selected credit cards. Towards the end of July there were some issues with SingSaver’s website, but I understand that all affected parties have been contacted already and the relevant details gathered. If you applied last month through SingSaver for non-Citibank cards after 26 July, do have a read of this article and see if further action is needed from your side.

For the month of August, SingSaver is running an exclusive campaign for new and existing users who sign up for selected credit cards.

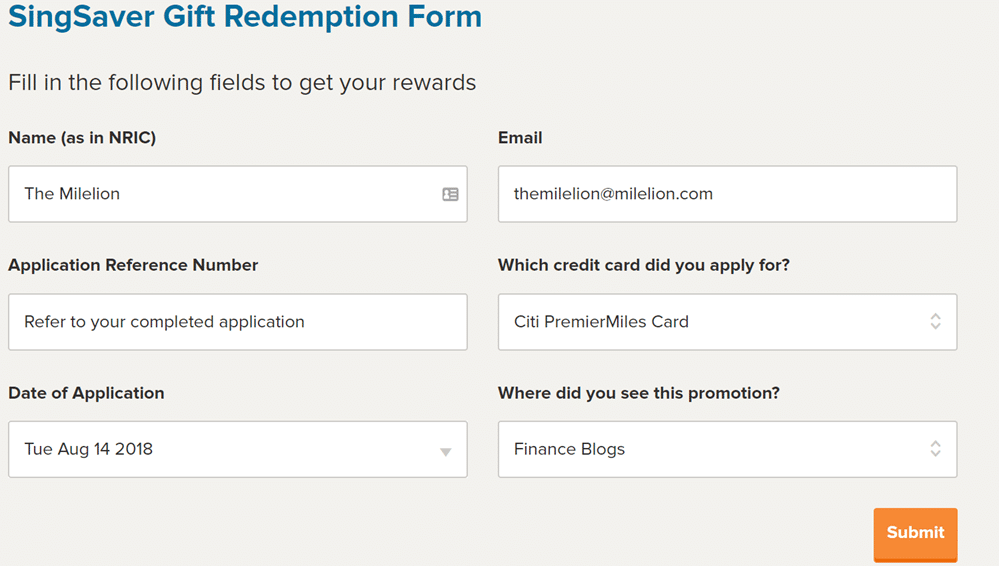

After you’ve signed up, be sure to click on this link to get to the gift redemption form, which will tell SingSaver how to send you your gift. Here’s a quick article showing you how to find your application reference number if you’re forgotten.

Here’s my analysis of what’s available for August:

AMEX KrisFlyer Ascend & KrisFlyer Blue

| New to Bank | Existing Customer | |

| AMEX KrisFlyer Blue | $150 | $150 |

| AMEX KrisFlyer Ascend | $150 | $150 |

Apply for the KrisFlyer Blue and KrisFlyer Ascend here

The AMEX KrisFlyer cobrand cards don’t have the highest miles earning rates out there (1.1/1.2 mpd local, 2.0 mpd overseas in June/Dec), but they have big sign up bonuses and should still be part of your plans if you’re new to the miles game. Every once in a while, they throw up some nice bonuses too.

The KrisFlyer Blue and Ascend earn 3.1 and 3.2 mpd respectively on Grab, capped at $200 per month. You also earn 2.0 mpd on transactions made on Singapore Airlines and Silk Air’s websites for both cards.

Currently, the KrisFlyer Blue is offering a spend $5,000 get 25,500 miles offer which is broken down as follows:

- 5,000 bonus miles on the first spend

- 6,000 bonus miles with $2,000 spent within 3 months of approval

- 9,000 bonus miles with a further $3,000 spent within 3 months of approval

- 5,500 base miles on the total $5,000 spent

The KrisFlyer Ascend is offering a spend $10,000 get 43,000 miles offer which is broken down as follows:

- 5,000 bonus miles on the first spend

- 13,000 bonus miles with $5,000 spent within 3 months of approval

- 13,000 bonus miles with a further $5,000 spent within 3 months of approval

- 12,000 base miles on the total $10,000 spend

Do remember the KrisFlyer Ascend also comes with Hilton Silver status and a complimentary night hotel stay voucher, four SATS/Plaza Premium lounge access vouchers and a fast track to KrisFlyer Elite Gold. However, the first year fee of S$337.05 cannot be waived.

You can only apply for either the Blue or the Ascend card. The first year annual fee is waived for the Blue but not the Ascend. This promotion is available for applications submitted by 31 Aug 2018.

AMEX Platinum and True Cashback Cards

| New to Bank | Existing Customer | |

| AMEX Platinum Credit Card | $100 | $100 |

| AMEX True Cashback | $150 | $150 |

Apply for the AMEX Platinum and True Cashback cards here

Not to be confused with the newly relaunched The Platinum Card, The AMEX Platinum Credit Card is positioned at the lower end of the market with a $50,000 annual income requirement.

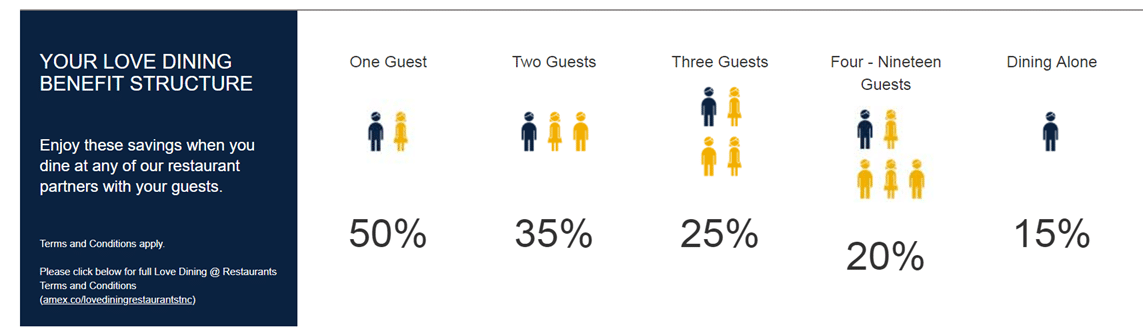

The AMEX Platinum card isn’t designed to rack up miles fast- it’s positioned more as a lifestyle and dining card. Card members get access to the Love Dining program, where you get up to 50% off at selected restaurants, as well as the restaurants at the Conrad, Marriott Tangs Plaza, St Regis Singapore and W Sentosa Cove.

Where the True Cashback card is concerned, I’m not the biggest proponent of cashback but you may find it useful in transactions where the miles cards you have are precluded from earning any points (eg parking transactions, school fee payments, charitable or non-profit payments). The AMEX True Cashback card offers a flat 1.5% cashback with no cap (you enjoy 3% cashback for the first 6 months capped at S$5,000 spend). The first year annual fee is waived.

SingSaver is offering $150 and $100 for successful True Cashback and Platinum Card applications respectively. This promotion is available for applications submitted by 31 Aug 2018.

Citi PremierMiles Visa & Citi Rewards Visa

| New to Bank | Existing Customer | |

| Citi Rewards Visa | $200 NTUC, Grab or Taka vouchers | N/A |

| Citi PremierMiles Visa | $200 NTUC, Grab or Taka vouchers | N/A |

Apply for the Citibank PremierMiles Card (New or Existing Customers)

Apply for the Citibank Rewards Card (New or Existing Customers)

SingSaver is offering an exclusive sign up gift for Milelion readers: if you’re a new-to-bank customer who successfully applies for the Citi Rewards or Citi PremierMiles Visa, you’ll get $200 worth of NTUC, Grab, or Taka vouchers instead of the regular $150. A new customer is defined as one who has not held a Citibank card within the past 12 months.

The amazing Apple Pay-Citibank 20X promotion may be over, but both cards are still useful for your miles earning strategy.

The Citi PremierMiles Visa earns 1.2 mpd locally and 2.0 mpd overseas (2.4 mpd from 4 October till 31 December), with up to 7 mpd on Expedia and 10 mpd on Kaligo. The card also comes with two complimentary lounge visits a year via Priority Pass (this will be changed to DragonPass in the future)

There’s currently an ongoing sign up bonus for the Citi PremierMiles card, where you get 30,000 miles in total with paying the annual fee and spending a minimum of $7,500 within the first 3 months. You’re still eligible for this bonus if you sign up via SingSaver.

The Citi Rewards earns 10X points (or 4 mpd) for spending on online shopping, department stores and anywhere which sells shoes, bags, or clothes, capped at $1,000 each month. It’s even known to earn 10X with some other merchants which technically don’t fall under these categories…join the Telegram Group or Milelion’s Den if you want to learn which ones.

Citibank points don’t pool, but the good news is they have the widest selection of partner airlines in Singapore. Two useful programs they partner with are Etihad Guest and British Airways Avios- refer to the links for some ideas how to spend those points.

The first year annual fee is waived on both cards, and this promotion is available for applications submitted by 31 Aug 2018.

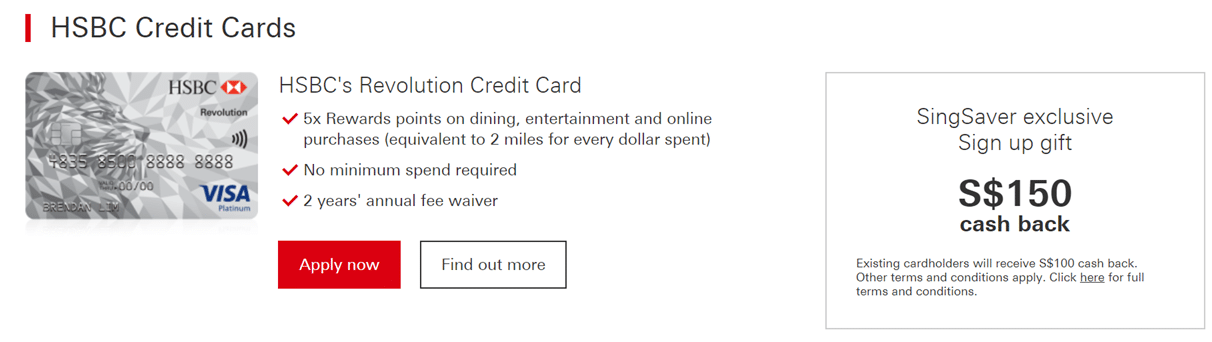

HSBC Revolution

| New to Bank | Existing Customer | |

| HSBC Revolution | $150 cashback | $100 cashback |

Apply for the HSBC Revolution card here

The HSBC Revolution is a useful backup card to have because it earns 2.0 mpd on online, local dining and local entertainment transactions. 2.0 mpd on dining is less than the Maybank Horizon Visa Signature’s 3.2 mpd, but HSBC’s definition of dining is broader. HSBC considers fast food to be part of dining, and explicitly states that spend at clubs, pubs, bars will get 2 mpd. There also is no minimum spend amount required to earn this.

Fun fact: you can pair the HSBC Revolution with your EZ-Reload service and earn 2 mpd on the first S$200 spent on EZ-link top ups each month. That’s more than the 1.4 mpd you’d earn by using your UOB PRVI Miles Mastercard with ABT.

Unlike the rest of the cards here, the HSBC sign up gift is in the form of cashback. That’s to say, it’s awarded by the bank, not SingSaver. If you applied normally through the HSBC website, you’d get $100 of cashback as a new customer. Applying through SingSaver gives you an additional $50 of cashback for a total of $150.

Existing cardholders will get $100 cashback when they sign up through SingSaver ($50 otherwise). Again, please refer to the T&C for the definition of new and existing cardholders.

To earn your cashback, you need to apply before 5 September 2018 and spend $600 within 30 days of card approval.

Standard Chartered Visa Infinite

| New to Bank | Existing Cardholder | |

| SCB Visa Infinite | S$150 | S$50 |

Apply for the SCB Visa Infinite here

The SCB Visa Infinite is part of the so-called “$120K” group of entry level prestige cards (although its income requirement technically is $150K). You earn 1.4 and 3.0 mpd on local and overseas spending respectively if you spend more than S$2K in a month, otherwise you’re looking at 1.0 mpd for everything.

The card has a non-waivable annual fee of $588.50, for which you get 35,000 welcome miles. That said, it does not have an unlimited Priority Pass (6 visits only) nor does it have airport limo service.

However, and this is a big however, think about it this way. If you’re new to bank, you get a S$150 cash gift from SingSaver. This lowers the cost of the annual fee to S$438.50, for which you get 35,000 miles. 1.25 cents per mile is a great price, and any other card benefits you get are just a bonus.

This promotion is available for applications submitted by 31 Aug 2018.

Summary

Any queries about the sign up gifts should be directed to info@singsaver.com.sg. If your application is successful, your SingSaver gift will be received within 1-2 months. You can find the full T&C for this promotion here.

By signing up with Singsaver, it’d mean there is now an intermediary with access to personal data, in exchange for the sign up gifts?

If I have the blue Krisflyer card, can I upgrade to the Ascend and still be eligible for the sign up gift?

you can try- if you are approved you will get the gift. remember you can only hold one or the other.

I applied and got the Ascend. I checked regarding the bonus miles and it seems that if you upgrade from the blue card, the 7000 miles first use bonus is not given.

Just like to check, if I sign up via MileLion and SingSaver for the Citi PM card and I choose the non-fee paying option, do I

1) Get $200 vouchers

2) Fee waiver

3) $120 cashback as a new Citi card holder?

I am asking about the 3rd one in particular as in Citi landing page (https://www.citibank.com.sg/gcb/credit_cards/premiermiles-visa-card.htm), new Citi card applicants who choose the non-fee paying get $120 cashback. But the landing page you direct us to have no mention of it, so just want to enquire about it.

Thanks!

Saw yr link. Applied ascend card. Bank call me back to offer something else with a lot less miles point and down $50 voucher after verifying information. So strange. I didn’t proceed because SingSaver promotion states otherwise. Any idea how to contact SingSaver and resolve this?

The singsaver team takes an awful long time to answer queries and when we enquired the status of the cash rewards after out cards were approved, they asked for additional questions such as date of application, date of approval, email address of application, card applied. All these despite us already filling up the form! The to and fro is ridiculous and probably my last time signing up with them.

In fact referral bonus from existing card members is better and I need not go through a 3rd party with lousy customer service.

Dear Kelvin,

I would like to sincerely apologize for the experience you had with us. Currently we are undergoing system maintenance and request your kind understanding on this.

I would like to resolve this immediately. Please drop an email to info@singsaver.com.sg and I will immediately look into this.

I understand this experience has been frustrating and rest assured we take every feedback seriously and are putting in the right tools and processes to avoid such delays.

Thanks,

Best Regards,

Shiva, SingSaver Customer Service.

Hi Aaron, I saw there’s a $250 sign up bonus for Standard Chartered card. I read the last date to sign up was on 31 August. Can’t see the link on the sign up page on your Singsaver page. Too many applications?

There is no sign up link on the sign up page for Amex, HSBC or Stanchart cards. Only the citibank cards have signup links. So what do we do if we want to apply for non-Citibank cards and get the bonuses?

There’s a weird browser issue going on, sometimes I see that too. Can you try opening in incognito mode and see if the sign up links appear?

Yes, the links appear for all cards in incognito mode.

Sorry bout that. Trying to get it fixed now.

The Apply buttons are still missing on the link below for AMEX, HSBC and SCB cards

https://www.singsaver.com.sg/credit-card/milelion-aug-promo?utm_source=milelion&utm_medium=affiliate&utm_campaign=augpromo

Also wanted to point out that your singsaver.link URLs for specific cards are not working either, opens in a new tab which immediately closes.

hi evan- the singsaver.link URLs are working for me, tried both on regular browser and incognito. which one in particular is giving you problems?

as for this link (https://www.singsaver.com.sg/credit-card/milelion-aug-promo?utm_source=milelion&utm_medium=affiliate&utm_campaign=augpromo) the only solution for now appears to be opening it in an incognito tab. that’s why i replaced the links below with links to individual cards, but if those aren’t working for you do let me know where the oddness is happening. many thanks!

I tried the link for Citi (new to bank) but both links don’t work across both IE, Chrome, incognito and normal.

The links work ok on my side, but getting them checked again.

Hi all,

I signed up for Amex Ascend cars and already rec the card one week ago. How would SingSaver credit the $150 to me? Any idea?

SingSaver has assigned a customer service representative to address all of your queries. If your haven’t submit your reward form to redeem your reward after applying to the credit card, please apply here –

https://www.singsaver.com.sg/rewards

For other queries please write an email to info@singsaver.com.sg to get a fast response with the following subject line: “Source: Milelion-Tele ” + Query description”

Thx Aaron