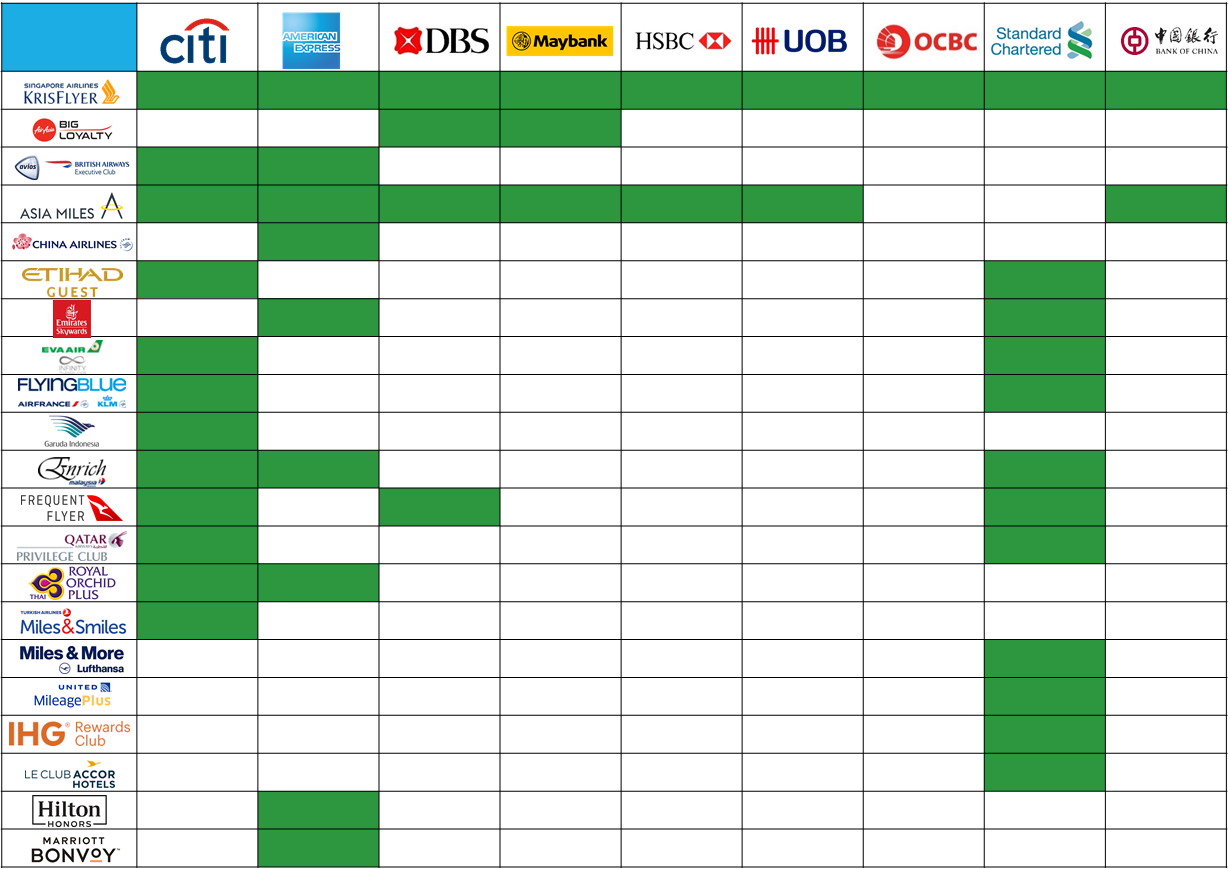

Although all the buzz so far regarding the Standard Chartered X Card has been about its 100,000 miles sign up bonus, an equally interesting development is the addition of 11 new transfer partners.

Previously, 360° Rewards Points could only be transferred to KrisFlyer. With the launch of the X Card, Standard Chartered has added nine more FFPs and two hotel loyalty programs to its lineup.

In a market like Singapore where KrisFlyer and Asia Miles are the order of the day, it’s always good to have additional options because certain FFPs may have great sweet spots, generous routing rules, or unique tricks that help you maximise your miles.

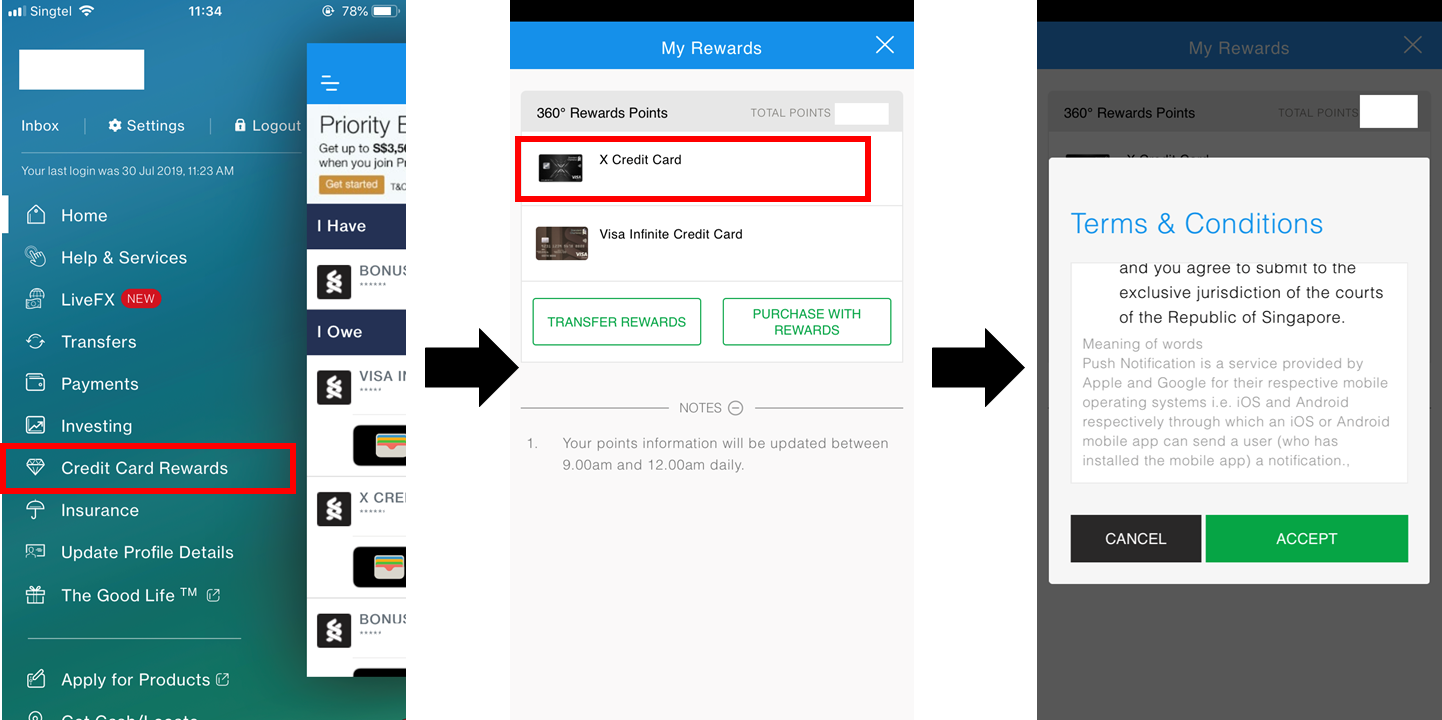

How do you access these new partners?

There’s a bit of confusion as to how to transfer 360° Rewards Points to these new partners. If you go to the SCB Rewards portal, all you’ll see is the usual KrisFlyer options.

To see the other 11 rewards programs, you’ll need to do the following.

If you’re on desktop, go to the SCB Internet banking website. Click on your X Card account–> Card Details–>View My Rewards–>Transfer Rewards

If you’re on the mobile app, go to Credit Card Rewards–> Select Card–>Transfer Rewards–> Accept

You’ll then see the full listing of partners and their respective transfer ratios

What are the transfer ratios to these new partners?

Although other banks in Singapore offer the same conversion rates to all airline partners (with the exception of Air Asia BIG, a revenue-based budget carrier scheme), Standard Chartered will apply a different ratio depending on the program.

This means that your 100,000 miles sign up bonus is only really 100,000 miles if you pick certain FFPs (KrisFlyer is one of them, don’t worry). Here’s the full summary of the X Card’s transfer partners, their conversion ratios, and what your equivalent MPD is should you decide to earn miles in that particular program.

| Airline Programs |

||||

| Loyalty Program | Conversion Ratio | Value of Sign up Bonus | Local Earn Rate | FCY Earn Rate |

| 2.5:1 | 100,000 | 1.2 | 2.0 | |

|

2.5:1 | 100,000 | 1.2 | 2.0 |

| 2.5:1 | 100,000 | 1.2 | 2.0 | |

| 2.5:1 | 100,000 | 1.2 | 2.0 | |

| 3:1 | 83,333 | 1.0 | 1.67 | |

| 3:1 | 83,333 | 1.0 | 1.67 | |

| 3:1 | 83,333 | 1.0 | 1.67 | |

| 3.5:1 | 71,429 | 0.86 | 1.43 | |

| 3.5:1 | 71,429 | 0.86 | 1.43 | |

|

3.5:1 | 71,429 | 0.86 | 1.43 |

| Hotel Programs | ||||

|

5:1 | 50,000 | 0.6 | 1.0 |

| 2.5:1 | 100,000 | 1.2 | 2.0 | |

The minimum transfer block for each program is the equivalent of 1,000 points or miles. For example, if you want to get Accor points (5:1), you’d have to transfer a minimum of 5,000 360° Rewards Points. If you want to get KrisFlyer miles (2.5:1), you’d have to transfer a minimum of 2,500 360° Rewards Points.

Of the 12 loyalty programs available through the X Card, this will be the first time it’s possible to earn United MileagePlus, Lufthansa Miles & More, and Accor points in Singapore through credit cards.

Let’s take a closer look at these three programs and see if there’s value to be had by transferring 360° Rewards Points.

Lufthansa Miles & More

Basic information

| Alliance | Miles Validity | Family Pooling? | Fuel Surcharges? |

| Star Alliance | 36 months | Yes (max 2 adults, 5 children) | Yes |

| Date Change Fee | Cancellation Fee | Need miles to search? | Redeem For |

| US$60 | US$60 | Yes, 7K min | Anyone |

Miles & More is the joint frequent flyer program of Lufthansa, Austrian Airlines, Brussels Airlines, Eurowings, SWISS, LOT Polish Airlines, Adria Airways, Croatia Airlines, Condor, and Luxair. In addition to redeeming flights on Star Alliance carriers, you can also redeem Miles & More miles for flights on:

|

|

Miles & More miles are valid for 36 months from the date they are earned, and can be redeemed for friends and family without restriction. Families can also create family pooling accounts with up to two adults and five children per pooled account.

Miles & More award tickets are subject to fuel surcharges, and there’s a US$60 fee to change or cancel an award ticket. Infants in arms do not require a separate award ticket- they only pay taxes, fees & fuel surcharges (unlike other carriers which charge 10% of the revenue fare).

Annoyingly, you cannot search for Miles & More award space unless you have a minimum of 7,000 miles in your account.

Sweet Spots

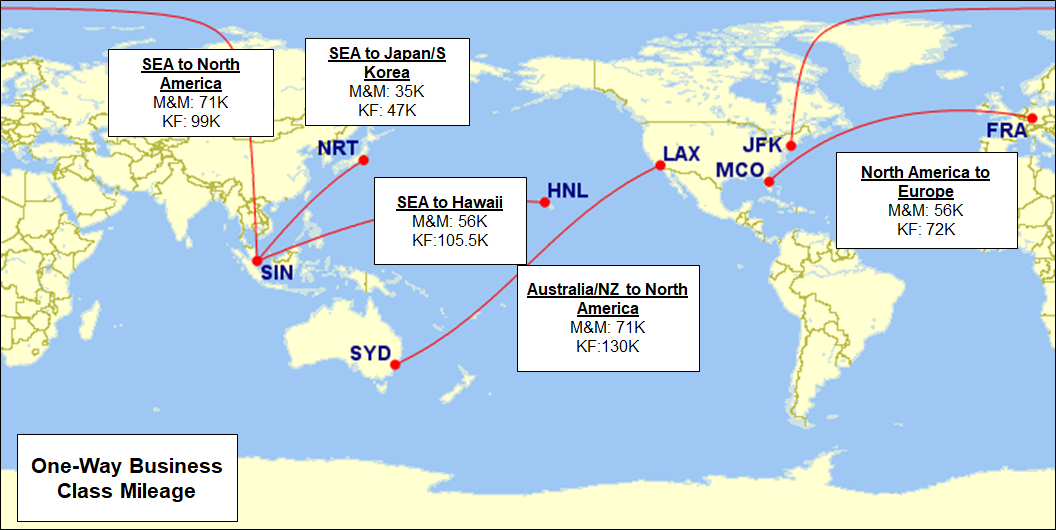

On first glance, the Miles & More award chart has numerous sweet spots compared to KrisFlyer.

However, we need to be careful about comparing those figures on a like-to-like basis, because X Card holders will earn Miles & More miles 30% slower than KrisFlyer miles, thanks to the conversion ratios at play.

In other words, these are the right figures to compare:

| One-way Business Class | KrisFlyer | Miles & More (Adjusted)* |

| SEA to North America | 95/99K | |

| SEA to Japan/S Korea | 47K | |

| SEA to Hawaii | 105.5K | |

| Australia/NZ to North America | 130K | |

| North America to Europe | 72K |

| *Adjusted refers to the equivalent number of KrisFlyer miles for a particular redemption. For example, A 56K Miles & More award earned at a 0.86 mpd rate would require the same spending as a 78.4K KrisFlyer award earned at a 1.2 mpd rate ($65.3K) |

Suddenly some of those savings don’t look so fantastic anymore, apart from perhaps Singapore to Hawaii and Australia to North America.

Mileage Bargains promotional tickets

Miles & More offers discounted award flights on Lufthansa through a promotion called “Mileage Bargains“. Conceptually, it’s pretty similar to KrisFlyer Spontaneous Escapes, only that the travel period isn’t restricted to the following month- these flights can be booked up to four months in advance. Mileage Bargains awards cannot be changed or cancelled once booked.

Here’s a sampling of round-trip Business Class prices from the current offers:

- Frankfurt to San Francisco/Toronto:

112,00055,000 - Frankfurt to Tehran/Cairo/Amman/Kuwait: 70,000

- Frankfurt to Qingdao:

142,00070,000 - Frankfurt to Vienna/Strasbourg/Seville:

50,00025,000

These deals are certainly impressive, but they’ve got very limited usefulness to someone based in Singapore. I don’t believe I’ve ever seen Mileage Bargains available on Lufthansa flights to/from Singapore.

Beware of fuel surcharges on Lufthansa flights

If you’re using Miles & More to redeem awards, try to avoid Lufthansa flights because they have awful fuel surcharges. How awful? Consider the following:

| Route | Cabin | Fuel Surcharge (Round Trip) |

| SIN-FRA/DUS/MUC | Business | S$784.40 |

| FRA-JFK | First | S$653.40 |

| MUC-HKG | Business | S$726.70 |

| FRA-LAX | First | S$714.50 |

| Learn how to check fuel surcharges using the ITA Matrix here |

Granted, if you booked these Lufthansa flights through KrisFlyer, you’d be subject to the same fuel surcharges too, but it just means that Lufthansa awards are best booked not through Miles & More. Instead, consider a no fuel surcharge program like United MileagePlus (see below) or LifeMiles.

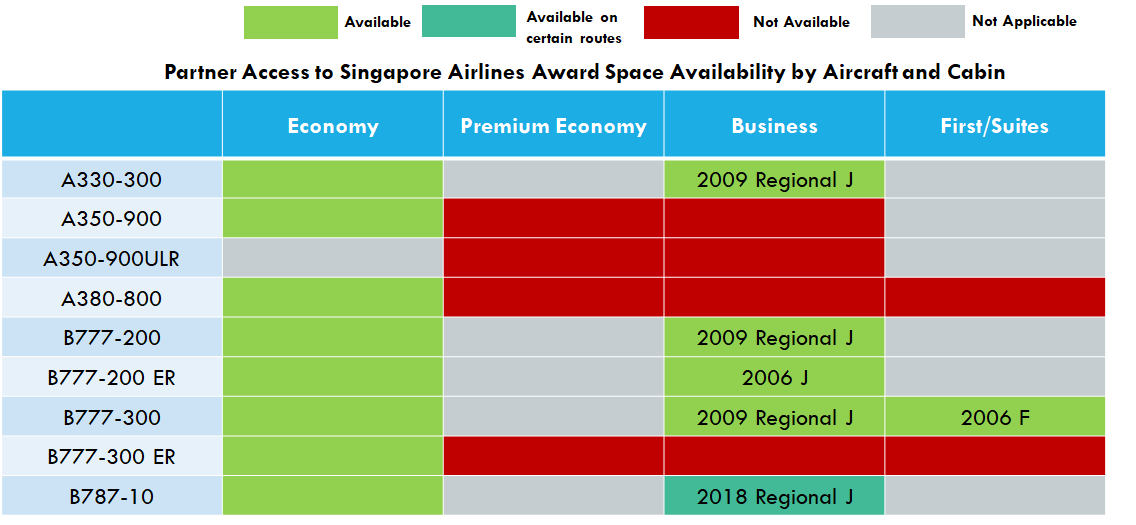

Access to Singapore Airlines premium cabins

Most people should know by now that Singapore Airlines zealously guards its First and Business Class awards for its own KrisFlyer members, only releasing these on selected routes to partner airlines.

Although there will be the odd instance where partner programs are able to see award space in “forbidden cabins”, these are the exception rather than the rule. That’s why I don’t advise people to buy LifeMiles with the expectation that they can redeem Singapore Airlines First & Business Class, for example.

However, Miles & More is the exception to this general rule. It’s been well-documented that Miles & More members can see Singapore Airlines premium cabin award space that other partner programs cannot.

I’m on the fence as to whether this is actually useful, given that we in Singapore can easily access Singapore Airlines premium cabin space through KrisFlyer anyway.

I think where this can work is if you want to redeem a combination award on Singapore Airlines plus a non-Star Alliance carrier like Air Dolomiti or Air Malta.

For example, you might want to fly SIN-FRA-VCE, with SIN-FRA on Singapore Airlines and FRA-VCE on Air Dolomiti. This routing would not be possible through KrisFlyer (since Air Dolomiti isn’t part of Star Alliance, you can’t use KrisFlyer miles to book it), but can be done through Miles & More.

I’m assuming of course that there isn’t Star Alliance space available on FRA-VCE, because I could otherwise book the whole thing as a Star Alliance award ticket via KrisFlyer for 92K miles, below the Miles & More equivalent of 99.4K.

| tl;dr: Miles & More |

| Miles & More would have been a useful program if the value hadn’t been neutered by the X Card’s inferior transfer ratio. At 2.5:1, the program has potential value. At 3.5:1, it’s marginal at best |

United MileagePlus

Basic information

| Alliance | Miles Validity | Family Pooling? | Fuel Surcharges? |

| Star Alliance | 18 months from last activity | No | No |

| Date Change Fee | Cancellation Fee | Need miles to search? | Redeem For |

| US$75 (61 or more days to departure) US$125 (60 days or less to departure) |

US$75 (61 or more days to departure) US$125 (60 days or less to departure) |

No | Anyone |

United MileagePlus is the frequent flyer program of United Airlines, a member of Star Alliance. In addition to Star Alliance carriers, you can redeem United MileagePlus miles for flights on:

|

|

MileagePlus uses an activity-based expiry policy, and so long as you have at least one activity in your account every 18 months, your miles will not expire.

The best thing about MileagePlus is that there are no fuel surcharges on awards. This means you could potentially use the program to book airlines with notoriously expensive YQ (Lufthansa) and come out ahead.

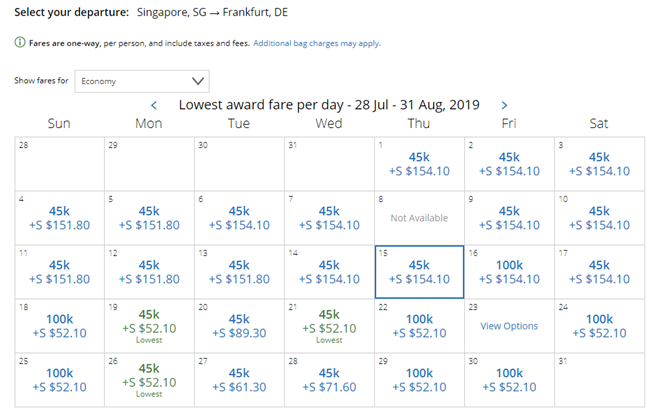

There’s no need to have any miles in your MileagePlus account before searching- in fact, that’s why I recommend it as one of the ways of searching for Star Alliance award space. The MileagePlus website is much faster than Singapore Airlines’, and you can view a 30 day award calendar (versus a mere 7 days for SQ).

Sweet spots

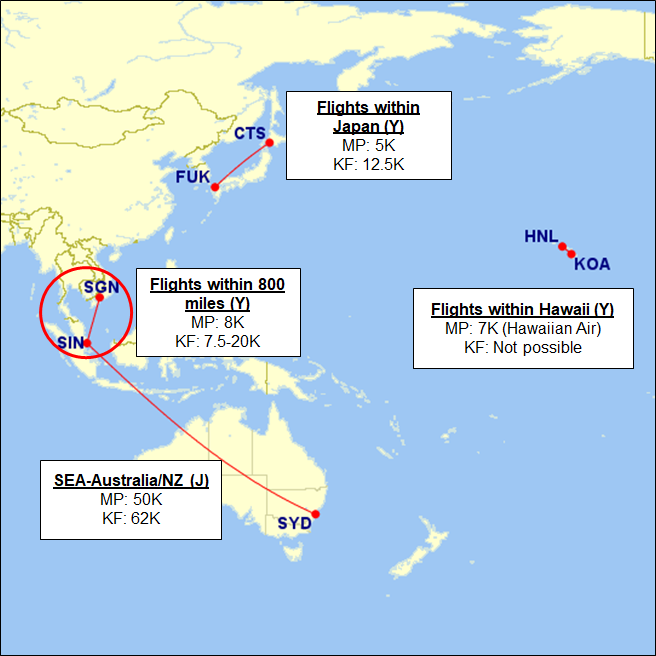

Although United does not impose fuel surcharges, its award pricing is generally higher than most other FFPs. This limits the sweet spot opportunities, although some still exist.

Remember, the amounts above should be adjusted to reflect the slower rate at which MileagePlus miles are earned vis-à-vis KrisFlyer.

| One way prices | KrisFlyer | MileagePlus (Adjusted) |

| SEA to Australia/NZ (J) | 62K | |

| Flights within 800 miles (Y) | 7.5-20K | |

| Flights within Hawaii (Y) | Not possible | |

| Flights within Japan (Y) | 12.5K |

Even after the adjustments, there’s some potentially good value in MileagePlus for short-haul Economy flights.

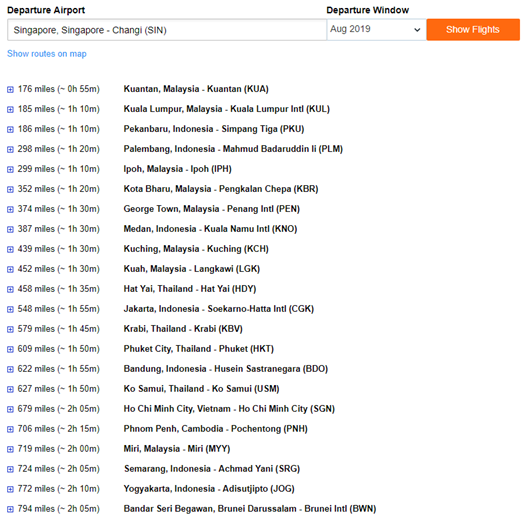

For example, you can redeem any Economy Class flight within 800 miles for 8,000 MileagePlus miles, provided the routing is outside North America. This works great for Singapore to Ho Chi Minh (8K on United vs 12.5K on KrisFlyer, plus you end up flying on Singapore Airlines anyway), as well as hops within Europe. Kayak has a useful tool that helps you identify an 800 mile radius around a given airport.

You can also get domestic Japan flights on ANA for only 5,000 miles, and flights within Hawaii on Hawaiian Airlines for only 7,000 miles.. True, short haul flights can also be redeemed through Avios for 4,000-9,000 Avios, but this gives you additional options if oneworld flights aren’t available.

Excursionist perk

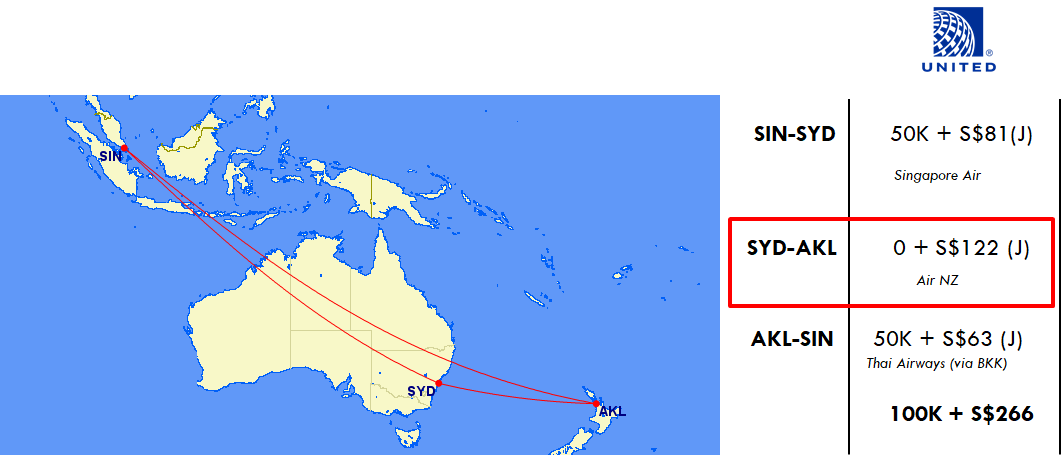

Another cool trick that United MileagePlus offers is called the “Excursionist Perk“. It’s a bit complicated to explain in full here, but the gist is that you get a free one-way flight on a round-trip itinerary.

For example, I could fly from Singapore to Sydney, spend a few days there, get a free flight (just pay taxes) from Sydney to Auckland, spend a few days there, then fly home from Auckland. I’d spend exactly the same as I would on a regular round-trip itinerary, but the perk is I get a free flight to explore a second place.

We cover the Excursionist perk in greater detail including worked examples and creative routings during the Alternative Frequent Flyer program workshops.

| tl;dr: MileagePlus |

| Even with the reduced transfer ratio, MileagePlus still has potential use in some very limited circumstances; namely short haul Economy flights. The Excursionist Perk could also save you quite a few miles, especially if you unlock its full potential. |

Le Club Accor Hotels

Basic information

| Participating Hotels | Validity | Family Pooling? | Award Chart? |

| Raffles, Banyan Tree, Fairmont, Sofitel, M Gallery, Pullman, Swissotel, Angsana, Grand Mercure, Novotel, Mercure, ibis, and others | 12 months from last activity | No | No, 2,000 points= 40 Euros |

I’m not a big fan of the Accor Hotels loyalty program, because it’s basically a glorified cashback scheme where 2,000 points = 40 Euros (this is set to change at the end of the year when Accor relaunches Le Club as “Accor Live Limitless”, complete with a proper award chart).

However, this does allow us to quantify the value of the X Card’s sign up bonus should you opt for Accor points. Your 250,000 360° Rewards Points would be worth 50,000 Accor points, or 1,000 Euros (S$1,527).

Once you adjust for the $695.50 annual fee, you’ve basically earned about $831.50 on $6,000 of spending, or a rebate of 14%. I realise that’s significantly below the $1,104 you’d get with KrisFlyer miles (100,000 miles @ 1.8 cents each less $695.50), but you’re trading off something you can earn fairly easy (free flights) with something that’s difficult to earn in Singapore (free hotels).

| tl;dr: Le Club Accor Hotels |

| Rule #1 of hotel points in Singapore is: you don’t earn hotel points in Singapore. Rule #2 of hotel points in Singapore is: you don’t earn hotel points in Singapore. The X Card’s sign up bonus presents a one-time opportunity to save ~$840 on a hotel stay, which might be useful to some people, but I certainly wouldn’t use the card to regularly earn Accor points. |

Conclusion

Of the rest of the X Card’s transfer partners, my opinion is that there’s only value to be had in KrisFlyer, and Etihad Guest (thanks to its potpourri of redemption partners).

My brief thoughts on the rest:

| Program | Thoughts |

| Unpredictable, revenue-based redemption program where award prices change dynamically with ticket prices. Can lead to nonsensical pricing at times. | |

| One of the worst FFPs thanks to unannounced devaluations and ridiculous fuel surcharges. Has the audacity to charge a “redemption booking fee” on top of all that, which can be as much as US$75 per sector (or US$300 on a round-trip flight via DOH) | |

|

High fuel surcharges and very poor award chart value, with the odd exception here and there. |

| Another airline that loves to play games with fuel surcharges. Even though Qantas no longer impose fuel surcharges on revenue fares, they still include them on award tickets…because they can. By the way, big changes are coming to Qantas Frequent Flyer, and they won’t be good for those wanting to redeem premium cabins | |

|

There’s very little you can book with Infinity MileageLands that you wouldn’t be able to book for less with KrisFlyer |

| As far as hotel rewards programs come, IHG is decent enough. However, be warned that the program is eliminating award charts and moving towards dynamic award pricing |

Long story short: if I were you, I’d probably transfer my X Card’s sign up bonus to KrisFlyer. There are use cases for some of the other transfer partners, but they’re highly situation specific and may not apply to you at all.

Remember that your X Card’s points never expire, so there’s no rush to transfer them immediately. At the same time, remember that award programs devalue every few years (and we may be seeing more frequent KrisFlyer devaluations going forward), so you shouldn’t be hoarding your points forever.

Which loyalty program do you intend to transfer your X Card sign up bonus to?

Hi Aaron,

While it’s true that the X Card’s points don’t expire, we should keep in mind that unless SCB offers a very good retention bonus to justify the $695 annual fee, many of us could be cancelling our X Card this time next year. Then the 3-year countdown starts for all except PPS Club members.

Absolutely true. So unless they add some amazing feature, your x card points are “effectively” valid for 1 year 🙂

Good overview, Aaron….. as always.

I was doing the same to find other potential sweet spots that might be possible in other FFPs. Found one! EVA Air’s InfinityMileage Lands accrue miles at the same rate as Krisflyer. EVA Air’s “SE Asia – Europe” business only costs 80k vs. SQ’s 92k.

I’ve checked their routes and found that EVA Air flies to three destinations direct from Bangkok. So, it would take us a short positioning to Bangkok, to get a 12k miles discount for a Biz trip to Europe.

Check it out!

EVA Air’s InfinityMileage Lands from SIN to Japan or Tokyo (via TPE), one way business class at 25k miles. I think is better than SQ also.

Eh, with SQ offering IST for 49k you could also put your positioning flight to the end and save 31k miles 🙂

Jason: SIN to Japan is 40k miles on EVA business class, vs 47k miles on SQ business class. So yes, that’s a sweet spot. I am looking at SIN to Hokkaido, which can be done at the same 40k…. vs having to pay for a second flight that departs fromTokyo.

Dave: well, that’s true. we could position at IST instead

You need to remember though that unless you can book SQ j via Eva (unclear if possible), then you’ll have to content with fuel surcharges which may offset the 7k miles difference. Of course if you can book it through Eva then yes you just save 7k miles straight out

I just received that card. It came in a box which shoots lights. Its pretty over the top, but considering I’m paying $600 for it…. Now what am I going to do with the box? The card is heavy, likely metal.

Was it couriered to you or came via mail? Still waiting for my card.

Infinity Mileage can offer 50k SIN-TPE-SIN against Krisflyer which is 61k!