Here’s a thought experiment.

You’re walking down the street when someone comes up to you and says “hey buddy, I’ll sell you 30,000 miles for 700 bucks, whaddya say?”

You pause and do some mental sums. That’s more than 2.3 cents per mile. Given what you know about the landscape for buying miles in Singapore, it’s a poor deal. You politely decline and walk away.

“Come on guy, I’ll sweeten the deal,” he says. “Two free lounge visits every year!”

You scoff because you know you can get that with free cards like the DBS Altitude or the Citi PremierMiles Visa. You start walking faster.

“Fullerton dining benefits! Complimentary travel insurance! Redeem your miles for statement credit at 1 cent each!” he shouts after you.

You disappear around the corner, just as he says, almost pleadingly, “Instant digital card?”

No more sign up bonus on the SCB X Card

Now here’s something that’s not so hypothetical.

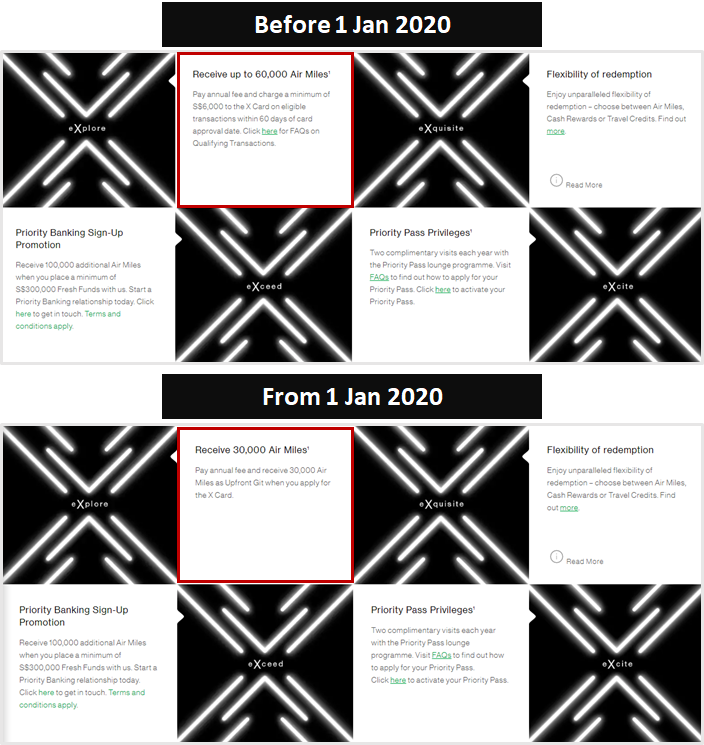

Until 31 December 2019, the SCB X Card offered 30,000 miles upon paying the S$695.50 annual fee, and a further 30,000 miles upon spending S$6,000 in 60 days.

Effective 1 January 2020, the sign up bonus is gone. Cardholders will simply receive 30,000 miles for paying the annual fee.

| Nomenclature clarification: I consider a sign up bonus to be “spend $X in Y days to get Z miles”. If the card gives you miles upon the payment of the annual fee, that’s a welcome/renewal gift, not a sign up bonus. |

The landing page has been updated to reflect this change.

In other words, your S$695.50 annual fee now gets you:

- 30,000 miles

- 2 lounge visits

And that’s it. Yes, there’s complimentary travel insurance and hotel dining benefits, but these are things you could get from many other credit cards at much lower price points (e.g Love Dining with the basic AMEX Platinum).

Although the previous 60,000 miles sign up offer was nowhere as good as the 100,000 miles launch promotion, I could still justify getting the X Card if I were going to spend S$6,000 anyway. With the S$695.50 annual fee, I’d be paying 1.16 cents per mile- a pretty decent price.

But without the sign up bonus, there’s really no reason to have it. The SCB X Card’s earn rate of 1.2/2.0 mpd on local/overseas spending is easily outdone by other entry-level cards like the BOC Elite Miles (1.5/3.0) and the UOB PRVI Miles (1.4/2.4).

Come to think of it, without the sign up bonus the SCB X Card is basically a Citi PremierMiles Visa or DBS Altitude Visa, only that you pay ~S$500 more for 20,000 additional miles.

| Earn Rates (Local/FCY) | Lounge Visits | Annual Fee | Miles with AF | |

SCB X Card SCB X Card |

1.2/2.0 | 2 | S$695.50 | 30,000 |

Citi PremierMiles Visa Citi PremierMiles Visa |

1.2/2.0 | 2 | S$192.60 | 10,000 |

DBS Altitude Visa DBS Altitude Visa |

1.2/2.0 | 2 | S$192.60 | 10,000 |

Keep in mind, the SCB X Card has a 3.5% FCY fee, so it’s slightly more expensive to use overseas than the Citi PremierMiles & DBS Altitude (3.25%).

Are there uses for the SCB X Card?

Well, if you really, really wanted to earn some exotic airline currencies, then the X Card at least offers some programs that no other bank has, like United MileagePlus, Lufthansa Miles&More and Le Club Accor.

The problem is, the transfer ratios are extremely unfavorable. The annual fee’s 30,000 miles and the 1.2/2.0 mpd earn rates only apply if you pick Singapore Airlines KrisFlyer or certain other programs; otherwise, it’s much lower.

Here’s the full listing of the SCB X Card’s hotel and airline transfer partners:

| Airline Programs |

||||

| Loyalty Program | Conversion Ratio | Value of “30,000” miles | Local Earn Rate | FCY Earn Rate |

| 2.5:1 | 30,000 | 1.2 | 2.0 | |

|

2.5:1 | 30,000 | 1.2 | 2.0 |

| 2.5:1 | 30,000 | 1.2 | 2.0 | |

| 2.5:1 | 30,000 | 1.2 | 2.0 | |

| 3:1 | 25,000 | 1.0 | 1.67 | |

| 3:1 | 25,000 | 1.0 | 1.67 | |

| 3:1 | 25,000 | 1.0 | 1.67 | |

| 3.5:1 | 21,430 | 0.86 | 1.43 | |

| 3.5:1 | 21,430 | 0.86 | 1.43 | |

|

3.5:1 | 21,430 | 0.86 | 1.43 |

| Hotel Programs | ||||

|

5:1 | 15,000 | 0.6 | 1.0 |

| 2.5:1 | 30,000 | 1.2 | 2.0 | |

You can view a summary of bank transfer partners here.

Otherwise, well…

Of course, the X Card’s utility as a paperweight only applies if you have the metal version. As it stands, new cardholders are still receiving plastic cards while SCB sorts out its metal cardstock shortage.

Conclusion

For a product that started so brightly, the SCB X Card has certainly lost its way. The only thing it had going for it was its sign up bonus, and now that it’s gone, who’s going to shell out ~S$700 for a very dubious return?

With the first batch of renewals coming in just over 6 months time, the X Card team has a big job on their hands if they want to retain customers. Let’s keep our fingers crossed and hope for good news soon.

If not, a lot of people will be sporting new paperweights come July.

So mean…

Honest…

but so mean…

🤣

I agree that the paperweight showdown “infographic” is somewhat of a low blow. There is really no need to make fun of a card like this, however useless you may deem a card to be. Whatever happened behind the scenes, you can (and should) take the high road, MileLion.

X card product manager spotted…

you know we tease hard around these parts 🙂 but it’s always at the product, never at anyone in particular.

@Bayle Quek, Please don’t “agree with me that Aaron’s article is somewhat of a low blow” because I neither said nor suggested it in any way or form. Thanks.

So what, we got POHA now for these little cards who may be feeling harassed? You gotta Bayle, bro.

I found a great use for this card! I got the 100K miles first up, but now I’ll never actually use it again, but I keep in my wallet because it’s metal it keeps my other cards straight so they don’t bend and crack when I sit down with the wallet in my back pocket. It’s ideal for that!

more likely it will spoil your wallet first. 🙂

Retention might not be their kpi

if it’s not, then this must be the most expensive acquisition ever. give 100,000 miles and get a 1 year tenure? doesn’t sound like a receipe for success…

Maybe the product manager need something on the cv… “so in my first card launch, I broke the std chat sign up rate by 500% in 2 months! … now I’m looking for a new challenge…”

Hi Aaron, I noticed that even though I don’t own the X card, StanChart app gives me access to the other airline partner programs (my card is the VI Priority). I’ve never tried a redemption, so I do not know if it would go through. Have you tried?

yes, it’s possible. you can redeem your VI points for the new airline partners too.

It’s good to know. Thanks, Aaron!

I’ve never laughed so hard at a blog!!

On my way home yesterday evening, acting on a whim, I dropped by the SCB PB branch next to my office to apply for the SCB PB VI (the one you can’t apply online, the one with the 24x Priority Pass lounge access). I know I could have contacted my RM, but given that I don’t buy any of the higher fee products the bank peddles, I preferred not to (I think the paper application process is a guise for the RM to get facetime with the client to tell them all about the newly launched [fill in the blank]… Read more »

i’ve heard rumours about the SCB VI being discontinued, but your anecdote makes me feel they’re more than rumours…