Here’s The MileLion’s review of the Citi ULTIMA Card, which safe to say you won’t be seeing at a friendly roadshow near you anytime soon.

This is Citibank’s most elite card offering, available only to the upper crust of society, the types of people who sport double-barrelled surnames and think a banana costs $10. Membership is as tightly guarded as the pearly gates, and no, I don’t think you should delay your application until SingSaver offers a sign-up gift.

No prizes for guessing that such exclusivity doesn’t come cheap- you’ll be out of pocket ~S$4,200 just to get a foot in the door.

But if a 420-banana annual fee doesn’t deter you, what lies in store?

|

|

| Citi ULTIMA Card | |

| 🦁 MileLion Verdict* | |

| If you live the kind of lifestyle that the Citi ULTIMA Card implicitly assumes, its main drawbacks probably won’t even cross your mind. | |

| 👍 The good | 👎 The bad |

|

|

| *I won’t be assigning my usual Take It/Take It or Leave It/Leave It ratings to cards in the $500K segment, because the service experience, which is a huge factor in a segment like this, is unknown to me as a non-cardholder |

|

| 💳 Full List of Credit Card Reviews | |

Citi ULTIMA Card Basics

Citi ULTIMA Card Citi ULTIMA Card |

|||

| Apply Here | |||

| Income Req. | S$500K p.a. | Points Validity | No Expiry |

| Annual Fee | S$4,199 |

Min. Transfer |

25,000 TY points (10,000 miles) |

| Miles with Annual Fee |

150,000 | Transfer Partners |

|

| FCY Fee | 3.25% | Transfer Fee | N/A |

| Local Earn | 1.6 mpd | Points Pool? | No |

| FCY Earn | 2 mpd | Lounge Access? | Yes |

| Special Earn | N/A | Airport Limo? | Yes |

| Cardholder Terms and Conditions | |||

The Citi ULTIMA Card was originally issued on the Visa network as a Visa Infinite. However, as part of Citi’s 2015 agreement to migrate all its non-cobrand cards to the Mastercard network, the ULTIMA was relaunched in August 2023 as a World Elite Mastercard.

Existing Citi ULTIMA Visa Cards will continue to be valid and can be renewed, but all new ULTIMA Cards will only be issued on the Mastercard network. Holders of ULTIMA Visa Cards can request to be switched to the Mastercard version if they wish.

| 💬 Updates from an ULTIMA Cardholder… |

|

If you currently hold an ULTIMA Visa and wish to switch to Mastercard, you should do it during the renewal month. It is not possible to cancel the Visa midway through your membership year and have the remaining annual fee applied towards the Mastercard. Do remember that Citi cards do not pool points, so you will need to empty out the points on the Visa before closing the account. When switching from Visa to Mastercard, no updated income documents are required if the credit limit remains unchanged. |

Is there any difference between the Visa and Mastercard versions? I put that question across during the media briefing, and Citi officials, presumably reluctant to be seen taking sides, demurred to answer.

According to them, the CVP remains the same. That’s true- if you only look at the Citi side. However, the network benefits are different, and for what it’s worth, I would much prefer to hold a Mastercard World Elite over a Visa Infinite (more on that later).

Some useful links:

How much must I earn to qualify for a Citi ULTIMA Card?

The Citi ULTIMA Card is by invitation only, with no published qualification criteria.

That said, we do know that applicants tend to:

- Earn annual incomes of at least S$500,000

- Be Citigold Private Client (min AUM: S$1.5M) or Citi Private Banking (min AUM: US$10M) customers

- Spend at least S$20,000 per month on their cards

These are just general guidelines, and I imagine there’s flexibility to consider other high-profile individuals, like captains of industry, celebrities, and Instagram influencers with 41,400 followers (that, I suppose, entitles them, in their estimation, to be a celebrity).

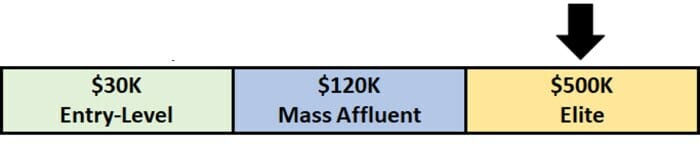

These requirements would put the ULTIMA in the so-called “S$500K segment”, which also includes the:

- American Express Centurion Card

- DBS Insignia Card

- UOB Reserve Card

Cardholders in this segment can expect invitations to Illuminati-esque events and “who do you want killed” concierge services, along with eye-popping annual fees.

How much is the Citi ULTIMA Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$4,199.04 | First 2 free, 3rd onwards S$1,080 |

| Subsequent |

It should come as no surprise that the Citi ULTIMA Card won’t be cheap. It’s a card targeting individuals with a minimum AUM of S$1.5 million, after all. Did you really expect a first year fee waiver?

Principal cardholders will pay S$4,199.04 in 2023, and S$4,237.92 from 2024 onwards once the GST increases to 9% (just the sort of thing the GST Voucher Scheme had in mind, I’m sure).

Two supplementary cards are free for life, the third onwards will cost S$1,080 in 2023 and S$1,090 from 2024 onwards.

And before you ask, no. It doesn’t matter if you cured cancer. It doesn’t matter if your pronouns are “his” and “majesty”. It doesn’t matter if you were the head of a major insurance company and now spend your time on Facebook commenting on pretty girls. There is no annual fee waiver, period.

Cardholders receive 375,000 ThankYou points (150,000 miles) each year the annual fee is paid, which works out to a cost of 2.8 cents per mile. Of course, that working assumes you place no value on the rest of the card’s benefits, which as we’ll see in a bit are substantial.

In terms of annual fees, the ULTIMA is the second most expensive card in the $500K segment, though it does offer the lowest cost per mile (again I want to emphasise that pure CPM comparisons don’t make much sense at this level, since cards pack so many other benefits- I mean if CPM were your only metric, no one would want an AMEX Centurion!).

| 💳 Annual Fees, Miles and CPM for Elite Cards (income req.: S$500K) |

|||

| Cards | Annual Fee | Miles | CPM |

AMEX Centurion AMEX Centurion |

S$7,560 | N/A | N/A |

Citi ULTIMA Citi ULTIMA |

S$4,199 | 150K | 2.80 |

DBS Insignia DBS Insignia |

S$3,240 | 100K | 3.24 |

UOB Reserve UOB Reserve |

S$3,888 | 100K | 3.88 |

Sign-up bonus

Customers who apply for a Citi ULTIMA Mastercard from now till 31 January 2024 are eligible to earn 125,000 bonus ThankYou points (50,000 miles) when they:

- Receive approval within 30 days of application

- Pay the S$4,199.04 annual fee (which increases to S$4,237.92 if you’re approved from 1 January 2024)

- Spend at least S$25,000 within the qualifying period

The qualifying period is defined as the month of approval plus three full calendar months after that. For example, a cardholder approved on 15 September 2023 will have till 31 December 2023 to meet the minimum spend.

Eligible cardholders will receive the bonus within three months from the end of the qualifying period. For avoidance of doubt, this sign-up bonus is on top of the usual 375,000 ThankYou points (150,000 miles) that cardholders receive each year for paying the annual fee.

For the definitions of qualifying spend and other T&Cs, refer to this document.

How many miles do I earn?

| 🇸🇬 SGD Spending | 🌎 FCY Spending | ⭐ Bonus Spending |

| 1.6 mpd | 2 mpd | – |

SGD/FCY Spending

Citi ULTIMA Cardmembers earn:

- 4 ThankYou points per S$1 spent in Singapore Dollars (SGD)

- 5 ThankYou points for every S$1 spent in foreign currency (FCY)

1 ThankYou point is worth 0.4 airline miles, so that’s an equivalent earn rate of 1.6 mpd for local spending, and 2.0 mpd for FCY spending.

These rates put it ahead of the AMEX Centurion (which never competed on earn rates anyway) and on par with the DBS Insignia. The UOB Reserve Card still wins on an overall basis, though its rounding policies are more punitive (although my guess is that the average transaction size placed on these cards rather negates the effects of rounding!).

| 💳 Earn Rates for Elite Cards (income req.: S$500K) |

||

| Cards | Local Spend | FCY Spend |

AMEX Centurion AMEX Centurion |

0.98 mpd | 0.98 mpd |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | 2 mpd |

DBS Insignia DBS Insignia |

1.6 mpd | 2 mpd |

UOB Reserve UOB Reserve |

1.6 mpd | 2.4 mpd |

All foreign currency transactions are subject to a 3.25% fee, so using your Citi ULTIMA Card overseas represents buying miles at 1.63 cents each. And yes, if you have the ULTIMA Mastercard, you can pair it with Amaze to enjoy 1.6 mpd on all transactions with reduced FCY fees.

A debit card backed by an ULTIMA. If there’s a bigger flex out there, I don’t know what it is.

When are ThankYou points credited?

ThankYou points are credited when your transaction posts, which generally takes 1-3 working days.

How are ThankYou points calculated?

Here’s how you can work out the ThankYou points earned on your Citi ULTIMA Card.

| Local Spend | Round down transaction to nearest S$1, then multiply by 4 |

| FCY Spend |

Round down transaction to nearest S$1, then multiply by 5 |

This means the minimum spend required to earn miles is S$1.

Because of this rounding policy, the Citi ULTIMA Card is actually the highest earning card for local spend, beating the DBS Insignia and UOB Reserve (and of course the AMEX Centurion). To illustrate:

Citi ULTIMA Citi ULTIMAEarn rate: 1.6 mpd |

UOB Reserve UOB ReserveEarn rate: 1.6 mpd |

|

| S$5 | 8 miles | 8 miles |

| S$9.99 | 14.4 miles | 8 miles |

| S$15 | 24 miles | 24 miles |

| S$19.99 | 30.4 miles | 24 miles |

| S$25 | 40 miles | 40 miles |

| S$29.99 | 46.4 miles | 40 miles |

| S$35 | 56 miles | 56 miles |

| S$39.99 | 62.4 miles | 56 miles |

If you’re an Excel geek, here’s the formulas you need to calculate:

| Local Spend | =ROUNDDOWN(X,0)*4 |

| FCY Spend |

=ROUNDDOWN(X,0)*5 |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for ThankYou points?

The full list of ineligible transactions to earn ThankYou points can be found in the Citi rewards T&Cs.

I’ve highlighted a few noteworthy categories below:

- Educational Institutions (MCC 8211-8299)

- Donations (MCC 8398)

- Government Services (MCC 9000-9999)

- Insurance (MCC 6300)

- Professional Services and Membership Organizations (MCC 8651-8661)

- Quasi cash transactions (MCC 6529-6540)

- Real Estate Agents and Managers (MCC 6513)

- Top-ups to prepaid accounts like YouTrip and GrabPay

- Utilities payments (MCC 4900)

For the avoidance of doubt, Citi ULTIMA Cardholders will earn rewards for CardUp transactions- though they will almost certainly prefer to use Citi PayAll instead (see below).

There is also no restriction on points for hospital transactions, making Citi cards one of the few remaining options for spending on this category.

What do I need to know about ThankYou points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| No Expiry | No | Free |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 25,000 TY Points (10,000 miles) |

11 | 24-48 hours (for KF) |

Expiry

ThankYou points earned on the Citi ULTIMA Card do not expire.

Pooling

Citibank has a policy of not pooling points across cards.

If you have 12,000 ThankYou points on the Citi ULTIMA Card and 30,000 ThankYou points on the Citi Rewards Mastercard, you will have to pay two separate conversion fees. This also means that you’ll need to transfer all your points out before cancelling the card, or else forfeit them.

Transfer Partners & Fee

Citibank has the widest variety of transfer partners in Singapore, with 11 airline and hotel programmes to choose from. This gives you access to some great sweet spots, like with British Airways Executive Club, Etihad Guest, and Turkish Miles&Smiles.

Points transfer at a 5:2 ratio, with a minimum transfer block of 10,000 miles.

| Frequent Flyer Programme | Conversion Ratio (ThankYou Points: Partner) |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

|

25,000: 10,000 |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

|

25,000: 10,000 |

| 25,000: 10,000 |

The usual S$27 admin fee for conversions is waived for Citi ULTIMA Cardholders.

Transfer Times

Citibank tells customers that points transfers will take 14 business days, but in reality it’s usually 24-48 hours for KrisFlyer, or 2-4 working days for other programmes.

If you need your points credited instantly, you can move them via Kris+ at a rate of 10,000 TY points = 3,400 KrisPay miles. KrisPay miles can then be instantly converted to KrisFlyer miles at a 1:1 ratio.

|

| S$5 for new Kris+ Users |

| Get S$5 (in the form of 750 KrisPay miles) when you sign-up with code W644363 and make your first transaction |

There are pros and cons to this:

Pros

- Minimum conversion block is reduced to 10,000 TY points, versus 25,000 TY points if converting via Citibank’s rewards portal

- Transfers from Citi to Kris+ and Kris+ to KrisFlyer are instant

Cons

- Those 10,000 TY points would normally be worth 4,000 KrisFlyer miles, so a 15% haircut is incurred

Should you choose to take this option, do note that it’s a two-step process. The first transfer is from Citi to Kris+, the second is from Kris+ to KrisFlyer. A big button will pop up after the first step prompting you to take the second.

If you do not convert within seven days, or spend any of the transferred miles, the balance will be “stuck” in Kris+, where they expire after six months, and are worth a mere 0.67 cents apiece.

Other card perks

Buy miles with Citi PayAll

|

| Citi PayAll |

While this isn’t unique to the Citi ULTIMA Card, one of the best perks of holding a Citibank card is access to Citi PayAll.

Citi ULTIMA Cardholders can pay various bills with their card and earn 1.6 mpd, in exchange for a 2.2% service fee. 23 different categories of payment are currently supported:

| 💰 Citi PayAll: Supported Payments | |

| Category | Monthly Cap |

|

S$200,000 |

|

S$100,000 |

|

S$30,000 |

|

S$30,000 |

|

S$30,000 |

|

S$30,000 (combined) |

The cost per mile works out to 1.38 cents apiece (2.2% admin fee divided by 1.6 mpd), though Citi runs periodic promotions that upsize the miles or discount the admin fee. The most recent offer (which ended on 20 August 2023) boosted the earn rate to 2.2 mpd across most Citi cards including the ULTIMA, lowering the cost to 1 cent per mile.

Citi PayAll transactions will count towards the minimum spend for welcome offers and other promotions, provided the service fee is paid.

I’ve written a comprehensive guide to Citi PayAll, so be sure to check out the article below.

Three unlimited-visit Priority Pass cards

Principal Citi ULTIMA Cardholders (plus two supplementary cardholders) receive an unlimited-visit Priority Pass. No guests are included, however, and the standard US$32 guest fee will apply.

As an interesting counterpoint, the relatively-plebeian Citi Prestige only grants the principal cardholder an unlimited-visit Priority Pass, but it comes with a guest entitlement. This means there’s more flexibility with the Citi Prestige as your traveling partner can change each time. With the Citi ULTIMA, the only way to bring a “guest” is to give that guest a supplementary card- feasible for a spouse, not so much for a colleague.

Compared to other S$500K cards, the Citi ULTIMA outperforms only the DBS Insignia. Both the AMEX Centurion and UOB Reserve offer superior lounge access benefits.

| Card | Lounge Network | Free Visits (Per Year) |

|

| Principal | Supp. | ||

DBS Insignia DBS Insignia |

Priority Pass | ∞ | N/A |

Citi ULTIMA Citi ULTIMA |

Priority Pass | ∞ | ∞* |

UOB Reserve UOB Reserve |

Priority Pass | ∞ + 1 guest | ∞ |

AMEX Centurion AMEX Centurion |

Priority Pass, Plaza Premium, AMEX & Centurion Lounges, and others | ∞ + 1-2 guests | ∞ + 1-2 guests |

| *For up to two supplementary cards |

|||

Then again, if you’re regularly flying in First or Business Class (as ULTIMA believes its cardholders will be), then a lounge membership isn’t all that important.

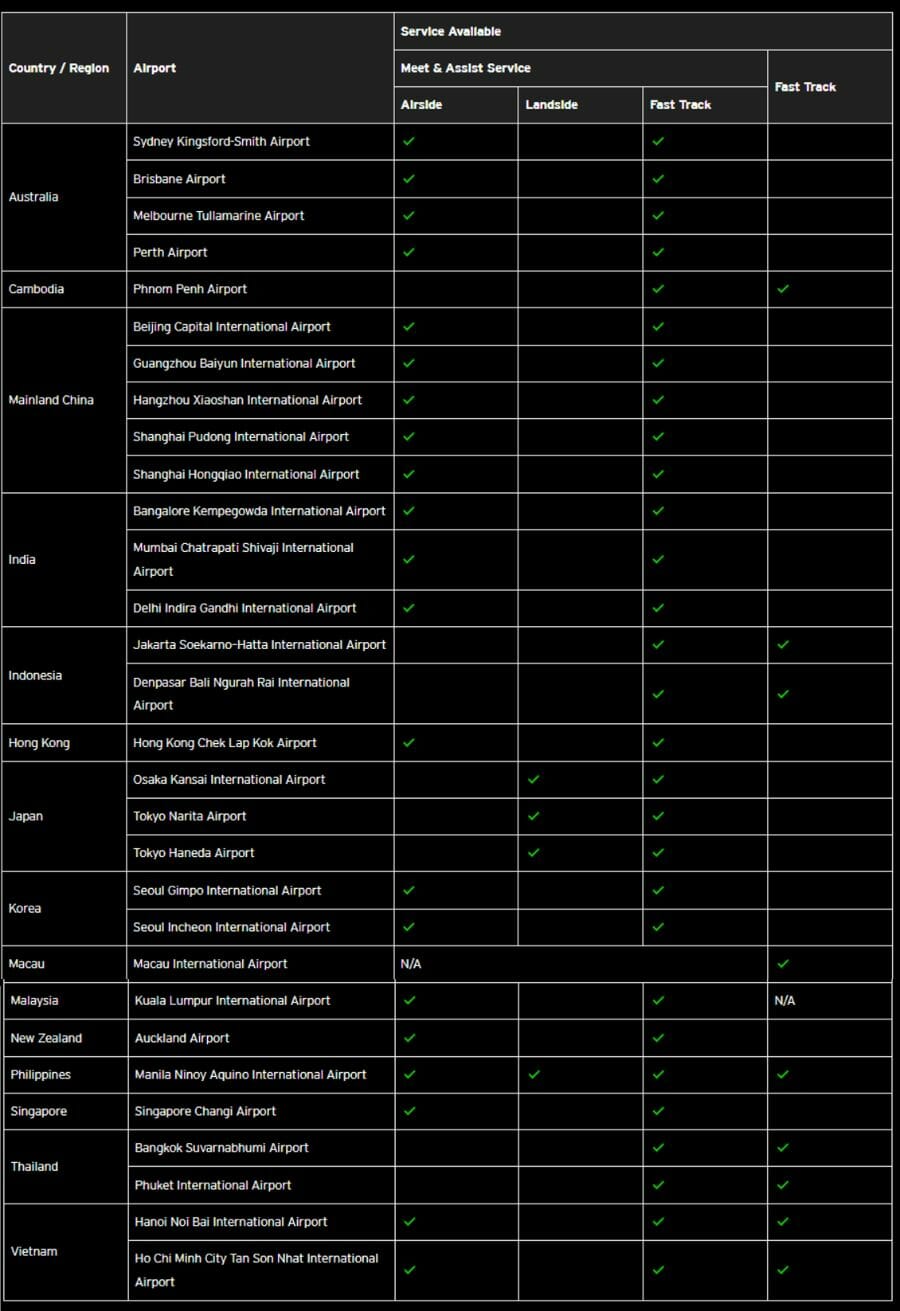

Complimentary airport limo transfers & fast track immigration

Principal Citi ULTIMA Cardholders who purchase a First or Business Class ticket using their card will be entitled to a complimentary one-way airport limo transfer, and fast track immigration services where available.

This benefit only applies when you travel on a full-service carrier; budget carriers are ineligible. No mention is made of private jets.

A few points to note:

- The air ticket must originate from Singapore

- The air ticket can be either one-way or return

- The one-way limo transfer either be used in Singapore or overseas

- No cap on the maximum usage

- No complimentary limo ride if you redeem a First or Business Class ticket with miles, even if you pay for the taxes and surcharges with your Citi ULTIMA Card

- Bookings must be made at least 72 hours prior

- Cancellations must be made at least 48 hours prior

It surprises me that the airport limo benefits offered on these supposedly elite cards are substantially weaker than what you’d find on cheaper ones. Heck, the UOB PRVI Miles AMEX (income requirement: S$30,000) offers two complimentary limo rides for spending just S$1,000 overseas in a calendar quarter!

So it seems awfully restrictive that Citi ULTIMA Cardholders must buy a First or Business Class ticket to enjoy a free airport limo transfer, but then again, it’s par the course for the S$500K segment. Forget a generic spending requirement; these cards want you to perform very specific actions to unlock those limo rides.

| Card | Limo Benefit | Remarks |

AMEX Centurion AMEX Centurion |

Purchase First or Business Class ticket via Centurion Concierge | Round-trip transfer within Singapore, and on arrival at selected airports overseas |

Citi ULTIMA Citi ULTIMA |

Purchase First or Business Class ticket with card | One-way transfer in Singapore or overseas |

DBS Insignia DBS Insignia |

N/A* | |

UOB Reserve UOB Reserve |

Make dining, cruise, staycation or flight booking via UOB Travel Concierge | Capped at 4X uses per year |

| *The DBS Insignia does not offer any airport limo benefit that I’m aware of, but if you get the card by virtue of being an Treasures Private Client then you enjoy unlimited airport transfers anyway | ||

However, it should be noted that if you happen to be a Citigold Private Client (and presumably a Citi Private Bank client), you will be entitled to complimentary airport limo transfers as follows:

| AUM | Limo Entitlements (from 1 June to 31 May) |

| ≥S$5m | Unlimited |

| S$1.5M≥ and <S$5m | 8 |

| <S$1.5M | 0 |

Complimentary hotel night programme

Principal Citi ULTIMA Cardholders will receive one free night with a minimum of two consecutive nights, for hotel stays outside of Singapore booked through the ULTIMA concierge.

Depending on which version of the ULTIMA you hold, your stay will either be booked through the Visa Infinite Luxury Hotels Collection or the Mastercard Luxury Hotels & Resorts Collection.

|

|

| Citi ULTIMA Visa | Citi ULTIMA Mastercard |

|

|

As you can see from the table above, standard benefits include complimentary daily breakfast for two guests, room upgrades (subject to availability), and a hotel credit of up to US$100. I don’t think there’s too much to separate the two in terms of perks, although I believe the Mastercard Luxury Hotels & Resorts Collection is much larger (note: not all of the properties will be eligible for ULTIMA bookings).

A few points to note:

- Bookings can only be made for stays completed within six months from booking date, and no later than 72 hours before check-in

- Maximum two complimentary nights per outbound trip from Singapore (how they enforce this I’m not quite sure- it’s not like they’re tracking your movements, right (right?))

- Maximum one complimentary night per booking (although in practice, this doesn’t seem to be enforced)

- The cardholder must be one of the staying guests

The cost of the complimentary night will be computed as the average nightly rate for the entire stay, so if one night costs S$300 and the other S$500, you’ll get a S$400 rebate. You’ll still be responsible for taxes and surcharges on the “free” night.

Companion airfare programme

Principal Citi ULTIMA Cardholders receive a complimentary companion ticket when they purchase a First or Business Class ticket on the following eight carriers:

- American Airlines

- British Airways

- Delta

- Etihad Airways

- Japan Airlines

- Lufthansa

- Qantas

- Qatar Airways

Here’s the catch: you need to buy a full-fare ticket, and you’re still on the hook for taxes and surcharges.

Citi provides the following illustration:

| ✈️ Illustration from Citibank (SIN-JFK) |

|||

| ULTIMA Member | Companion | Total | |

| Airfare | S$9,800 | S$0 | S$9,800 |

| Taxes & Surcharges | S$1,579 | S$1,579 | S$3,158 |

| Ticket Issuance Fee* | S$80 | S$80 | S$160 |

| Total | S$11,459 | S$1,659 | S$13,118 (43% savings) |

| *Charged as US$60, non-refundable |

|||

Since you’re still paying the taxes, surcharges, and ticket issuance fee, your savings here are about 43%. But that savings figure is inflated, because it assumes you’d have paid full-fare prices in the first place. If you benchmark this against booking discounted premium cabin fares, your savings will probably be more in the region of 20-30%.

Sadly, Singapore Airlines is excluded from this programme, not just because it’s the most convenient option for a Singapore-based cardholder, but because it’s one of the few airlines that folds fuel surcharges into the airfare, which would mean greater savings were it bookable.

A few points to note:

- Bookings must be for travel dates within six months of booking date, and at least 72 hours before departure

- All travel must start and end in Singapore

- A maximum of one complimentary companion ticket is permitted per booking

- The cardholder must be one of the travellers

- The complimentary companion ticket is based on the lowest available fare booking class

In addition to the companion airfare discount, principal Citi ULTIMA Cardholders also enjoy “up to 15%” savings on non-promotional First or Business Class airfares on the aforementioned eight carriers. Once again, the discount only applies to the airfare component, so you’ll still pay the full amount of taxes and surcharges.

This perk used to be a lot better in the days when booking discounted fare classes was allowed…

Complimentary APEC Business Travel Card

Citi ULTIMA Cardholders are eligible for reimbursement of the application costs for an APEC Business Travel Card (ABTC).

An ABTC allows you to skip the regular immigration lines in participating countries, which can either be a mild convenience or a complete lifesaver.

| 🌎 Countries accepting ABTC | |

|

|

| ❓ Can I bring a companion? | |

| The rules on companions are fuzzy, and it sometimes boils down to the immigration officer’s mood. Some places officially allow for a guest, others will insist on “one card one person”. |

|

Having been an ABTC cardholder for a few years, I can tell you it’s amazing. Even if you’re a regular First or Business Class traveller, some airports don’t have priority lines for premium cabin passengers. But they will have a separate ABTC lane, which can save you hours at less efficient airports.

Full guide: Applying for an APEC Business Travel Card (ABTC) in Singapore

The ABTC has an application fee of S$100, which Citi will refund…provided you spend at least S$200,000 on the ULTIMA in the 12 months prior!

Yes, that’s right. To get a S$100 statement credit, you need to spend S$200,000. Given that cardholders are forking over more than S$4,000 in annual fees, that just seems needlessly stingy.

Dining benefits

The Citi ULTIMA Card doesn’t come with any dining vouchers or memberships (that I’m aware of), but cardmembers can expect periodic invitations to (paid) events featuring celebrity chefs as part of its partnership with MICHELIN Singapore.

Otherwise, the following dining discounts apply:

| 🍽️ Citi ULTIMA Dining Privileges |

|

| Dining discounts may only apply to certain days and menu items; refer to T&Cs for full details |

None of these are particularly impressive to me, quite frankly. The list was much more extensive a couple years ago, including restaurants at Shangri-La Singapore, W Singapore, Esquina and Zafferano.

Moreover, you could save more at Fairmont Singapore with AMEX Love Dining or Accor Plus, and similar discounts at The Fullerton Hotel/Fullerton Bay Hotel are available to UOB cardholders- no four-digit annual fees required.

Complimentary golf games

Principal Citi ULTIMA Cardholders enjoy:

- Complimentary green fees and buggy at participating golf clubs for themselves and one guest

- Complimentary green fees up to three times per calendar year at participating golf clubs

- Two complimentary green fees per quarter at Sentosa Golf Club, Singapore with a minimum spend of S$25,000 per quarter

I don’t golf, so I can’t really speak to the value of this benefit. All I’ll say is that most golf benefits on elite cards usually require you to bring a paying guest, and I don’t see any such requirement here.

Complimentary travel insurance

| Coverage | Amount |

| Accidental Death | S$1,000,000 |

| Medical Benefits | S$500,000 |

| Travel Inconvenience |

|

| Policy Wording | |

Citi ULTIMA Cardholders who purchase a round-trip airfare or pay for the taxes and surcharges on an award ticket with their card will receive complimentary travel insurance underwritten by HL Assurance.

| ✈️ Coverage for award tickets |

| Coverage for award tickets only applies if “the travel ticket has been acquired with points earned by a rewards program associated only with the CITI ULTIMA card”. |

As you might expect, this policy offers the highest coverage available to any Citi cardholder, including S$1,000,000 for accidental death and permanent disablement, S$500,000 for medical expenses, S$100,000 for emergency medical evacuation, and coverage for travel inconveniences like lost or delayed luggage.

COVID-19 medical expenses and hospital allowance are also provided for, as is rental car excess. Coverage is provided for accompanying spouse and children, with lower limits.

I reckon this would be sufficient coverage to save you from having to buy a separate stand-alone policy, but then again, I can’t claim to know the risk appetite of people earning more than S$500,000 a year. More kidnap insurance, perhaps?

Mastercard World Elite benefits

As I mentioned at the start of this post, there are certain benefits that only Citi ULTIMA Mastercard cardholders will enjoy, by virtue of the World Elite badge. This includes:

- Instant Avis President’s Club status (also available to Visa Infinite cardholders)

- Instant GHA DISCOVERY Titanium status

- Instant Wyndham Diamond status

- Held Tables at more than 600 fine dining restaurants worldwide

- Additional travel insurance and purchase protection

- Mastercard Priceless Experiences platform (just use an adblocker to remove the lightbox overlay if you don’t have a ULTIMA card like me and want to kaypoh; it seems that these can be booked by any Mastercard cardholder though)

I for one am glad to see another World Elite Mastercard on the market, even if it’s hopelessly out of reach. Prior to this, UHNWIs had to apply for a Citi Prestige Card (the horror!) just to get World Elite benefits.

Visa Infinite is not without its perks, but on the balance I’d much rather have a World Elite Mastercard than a Visa Infinite (particularly since the latter is relatively common in Singapore- you can get the CIMB Visa Infinite with a perpetual annual fee waiver).

Miscellaneous benefits

Some odds and ends to round up the Citi ULTIMA Card perks:

- Birthday treat at TWG Tea (whole cake, weekday dinner set for two, or tea gift set)

- Upgrade to MBS Sands Rewards Elite tier for three months

- Complimentary 1-year subscription to The Peak and ICON magazine

- Complimentary 12-month HoteLux Elite Plus membership (with 1,500 bonus points for Visa, 2,000 for Mastercard)

There’s also the ULTIMA concierge, which I presume provides the sort of white glove service you’d expect at this level. At the media briefing, mention was made of an RM who chartered a private jet to rescue a cardholder stuck overseas when COVID hit and commercial flights were cancelled.

That’s probably table stakes for cards in this segment, really.

Terms & Conditions

Conclusion

|

|

| Citi ULTIMA Card |

Here’s the thing: the Citi ULTIMA Card assumes a certain kind of lifestyle.

It assumes that flying in First or Business Class is a foregone conclusion. It assumes you don’t bat an eyelid about booking a suite at the Park Hyatt Tokyo for a week. It assumes that a meal out at Les Amis is otherwise known as “Tuesday”.

If that describes you, then none of the ULTIMA’s drawbacks will even cross your mind. No guest privileges for Priority Pass? Why would I even visit a contract lounge, when The Private Room awaits? S$200,000 spend for an ABTC reimbursement? Well, I’m buying a couple of Pateks next week anyway. Airport limo ride requires a paid First or Business Class ticket? Er, how else would I fly there?

On the other hand, if you’re the sort who worries about Saver space opening up, buys points to stay in the Maldives, and changes hotel every night just to enjoy multiple hotel credits, may I gently suggest that this card really wasn’t created for you.

But don’t worry- there’s always money in the banana stand.

Nice review. If we value miles at 1.8 cents each then that’s $2700 down leaving $1460. The hotel benefit is up to 2 nights so I usually get 4 nights for about the price of 2.4 which is about right for a short trip. Staying at the Mandarin Oriental in Tokyo or the Peninsula in Hong Kong or the Four Seasons in Paris or the Bulgari in Milan usually pays for the $1460 in one trip – I typically get upgraded to a suite on these stays with the usual Amex-type benefits such as property credit breakfast etc. I use… Read more »

Absolutely- there are people who will be able to milk tons of value out of the hotel stays… although it’s contingent on being willing to pay for that calibre of hotel in the first place. E.g even if you get 1 night free at the mo Tokyo you’re still going to be out of pocket a fair penny- so the question is whether you’re even willing to pay that.

If yes, then this could be right for you

I agree with you. And I think it is reasonable to say that the majority of cardholders in this category (a level or two below owning jets and holiday villas) will value choice and convenience, then savings if possible. Miles wouldn’t be the goal but rather the side-perk for having these cards. For many in this bracket, time is probably worth more than money (not just in terms of earning power per hour but also how much time an older person has remaining……. yes morbid I know but something the 1% consider important when they hit their 50’s and the… Read more »

Super well stated… All banks/ cards should be looked at as a ‘tool shed’ and there’s no such thing as one Swiss Army Knife that does it all.. Not everyone can make use of it, but if you can, Amex’s EXTRA Partners are unrivaled for 7.8mpd up to $16k p.a. and thereafter 3.9mpd to no limit.. And as you’ve pointed out.. either UOB Reserve or Citi Ultima or DBS Insignia.. depending on how much credit limit they give (no one knows how individual banks work this out), even for these ‘ultra’ cards, can be as low as under100k to.. well..… Read more »

Oops sorry double post by mistake….. I agree with you. And I think it is reasonable to say that the majority of cardholders in this category (a level or two below owning jets and holiday villas) will value choice and convenience, then savings if possible. Miles wouldn’t be the goal but rather the side-perk for having these cards. For many in this bracket, time is probably worth more than money (not just in terms of earning power per hour but also how much time an older person has remaining……. yes morbid I know but something the 1% consider important when… Read more »

For hotel booked by citi ultima, can you also get points and stay credit if stay in hyatt or Marriott? Thanks

Yes to both

I have both the Ultima and Amex and I use them to great effect. I charge my workplace rent and personal Income Tax to CitiPayall and that gives me lots of Thank You points that can be converted to miles (5:2 ratio). Redeem Business tickets for travel on almost all airlines ( Citibank ), then use the Buy 1, get 1 night free for the hotel stay ( unfortunately, they usually don’t upgrade the room, and so the Amex hotel privileges of Hilton and Shang may help ). Apply for APEC card as a Singaporean and you will breeze thru… Read more »

Looks like you’re getting value on the Ultima with workplace rent. Wish I had something like that to charge too. I prefer SCB IRAS instead for the GIRO and better mpd but that’s another annual fee (balanced by GIRO savings). Totally agree on the hotel bonus and the APEC card though. Got upgraded a few times (once double upgrade to corner suite during sakura season) so I think it just depends on the room situation and asking at check-in. Better deal than FHR IMHO. Also totally agree on the Amex 50% on dining. Centurion’s better on hard to book places… Read more »

the APEC card is fantastic, but doesn’t it strike you as a bit stingy that citi only refunds the fee if you spend a buttload with them? for the AF you pay, you’d think they could throw in a $100 application fee rebate for free

HK version is better, with lots of local offer restaurants.

can you sg version to enjoy hk benefit?

The golf perks plus the ability to get the Conceirge to book games for u is an understated perk

I enjoyed the AD quote at the end. Am considering biting down on this banana for the hotel benefit, but it really comes down to the service level offered – Amex Plat is relatively disappointing (told me to queue for my own Coldplay tickets)

In this category would love to see a NetJets type benefit where they offer paid spare capacity on frequently flown regional routes. Ends up costing similar to flying F for a large family

Haha amex plat concierge is a peashooter compared to the 500k segment- or so I’m told!

btw, you can switch from visa to mastercard and citi will manually reallocate the points and refund annual fee if already paid

This really should be compared against the Centurion concierge, not the Plat’s.

ultima concerige is also so-so.. quite some unpleasant experiences already in a year. including no response and missing hotel notice for additional charges

Having used it for 2 years. Yup ultima concierge is rubbish, they can’t do anything except the regular hotel bookings and restaurant bookings.

Everything else, no response, “we value your feedback”, general robot answers.

I’m not sure this is for me, but I’ve just pulled the trigger and applied for it nonetheless. For 2 reasons. 1) I have a ~25k expense coming up (hello baby #2) so I can maximise Year 1 as much as I can and then potentially get out. And 2) Wife has an Amex Plat Charge, and not many cards left to earn a boatload for large expenses so have to only go up.

Nervous though, never thought I’d pay 4.2k for a credit card. That’s 6x my rent when I first moved to SG 🙂

Just received the card – looks dope! Anyone know if there’s a telegram group for this card?

is it possible to get this card without being a citigold client? or having a salary of 500K? who do you even contact to see if you are eligible? I dont even have a citi account

Call in and i think if you leave your email or number, they will reach out. im their citi credit card holder and did exactly that, they did send someone to reach out on the Ultima product

I tried calling in but they don’t even seem interested in getting someone to call me back, instead kept reciting “invitation only”. Is it because in their system I’m nowhere close to being their real “customer”?

yes you can

I have this card and cannot overstate the value of the two nights hotel free. I have done multiple personal trips recently, and getting 2 free nights each time say at an average of $400 per night is easily going to cover the card fee less the welcome miles. I also received (or will receive) $800 mbs vouchers for spending x amount in the first x months (perhaps now replaced with the additional miles) so I consider my fee to be 3400. I can easily save 2k on hotels in a year so I’m taking 150k miles at $1400. So… Read more »

It’s possible to have both the VI Ultima and the World Elite Prestige to benefit from both networks. The free nights work differently in a complementary fashion.

2x annual fee

Sometimes the average trip length can be 8 nights. That could possibly leave enough time to switch hotels. Or something else..

Like this card. Total bill for Aman Tokyo Grand Suite is US$7534 instead of US$12452. Worth the AF for almost 2 years. I couldn’t get a better rate anywhere else but would love to learn if anyone else knows how to stay for less. I used classictravel before but this is better.

Had to call in to cancel a fraudulent charge yesterday. Credit has been issued for the fraudulent charge. Got a replacement card by courier this afternoon even though it’s a public holiday today. Faster than the expected delivery which was originally scheduled for the next working day which would have been tomorrow. Grateful for the satisfactory service.