Unlike co-brand cards, which automatically convert your spending into miles or points with a given program, non co-brand cards allow you to choose from a range of hotel and airline loyalty programs.

But not all banks are equal in this regard. While some have only 1-2 partners, others offer their customers a much wider variety to choose from. This is especially useful in the current climate, where having more transfer partners hedges you against one particular airline going bust, or devaluing its frequent flyer program.

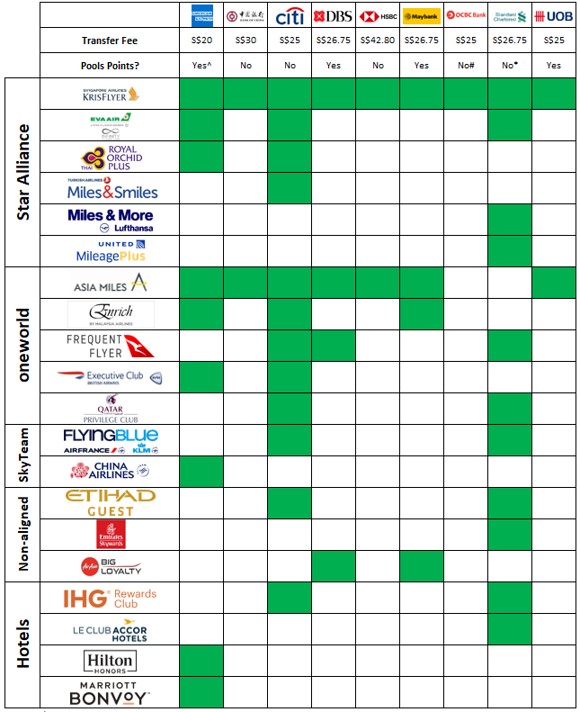

Where can you transfer your points?

Here’s a summary of the airline and hotel transfer partners that each bank has. Also take note of the conversion fee (which, with the exception of BOC, applies regardless of how many points are transferred), and whether or not points from multiple cards are pooled together.

With so many partners to choose from, just how do you decide where to put your points? Here’s how I go about it.

Think about partner redemptions

When an airline is part of an alliance, its frequent flyer miles can be used to redeem awards on any of its alliance partners. For example, Singapore Airlines is part of the Star Alliance, so KrisFlyer miles can be used to redeem flights on THAI Airways and United Airlines.

| There are limited exceptions, e.g SWISS First Class awards can only be redeemed by Miles&More HON Circle members, and certain Singapore Airlines First and Business Class cabins can only be redeemed by KrisFlyer members |

There are three major airline alliances in the world: Star Alliance, oneworld, and SkyTeam. Below is a listing of the members of each alliance.

Just because an airline isn’t part of alliance doesn’t mean its miles are less valuable, however. Airlines may also negotiate their own bilateral partnerships that allow for mutual redemptions. For example, Etihad Airways isn’t part of any alliance, but has its own bilateral partnerships with Air Serbia, Bangkok Airways, Royal Air Maroc and many more.

Do note that redemptions may not be possible on all routes. For example, Asia Miles can be redeemed on Air Canada, but only on domestic legs. Furthermore, it may not be possible to see all partner space online- a call to customer service may be required.

| Learn how to search for Star Alliance and oneworld award space here. If you’re determined to go deeper, buy the KVSTool and familiarize yourself with its search features |

Think sweet spots

It’s all good and well if a given frequent flyer program has tons of partners, but that counts for nothing if the redemption rates are off the charts.

This means you’ll want to familiarize yourself with sweet spots- routes or destinations where outsized value can be had. For example, KrisFlyer charges 184,000 miles for a Singapore Airlines round-trip Business Class award between Singapore and Zurich. Cathay Pacific, on the other hand, charges just 130,000 miles!

Keep in mind that sweet spots may also lie outside a particular program’s native carrier. For example, Etihad Guest miles aren’t great value for redemptions on Etihad, but they can be fantastic for trips from Singapore to Koh Samui. A round-trip Business Class ticket would cost just 20,000 miles.

Here’s a few sweet spots worth exploring, off the top of my head. The list below isn’t exhaustive by any means, so keep exploring and sharing:

For further reading, check out these articles:

Think fuel surcharges

If you visited a restaurant and were asked to pay an “ingredient surcharge”, you’d feel outraged, and rightly so. So why is it acceptable for airlines to impose “fuel surcharges”?

Heck if I know, but that’s the hand we’ve been dealt. Fuel surcharges (sometimes euphemistically termed “carrier-imposed surcharges”) are junk fees that airlines tack on to award tickets, simply to increase the cash co-pay on a “free flight”.

| If you ever needed a reminder how gratuitous fuel surcharges are, consider Qantas. In 2015, they removed fuel surcharges from revenue tickets, but left them on award tickets…because they could. |

Fuel surcharges have the potential to wreck otherwise fantastic sweet spots. Take Turkish Airlines, for example, which charges only 90,000 miles for a round-trip Business Class ticket from Singapore to Paris (less than half the price of KrisFlyer). The catch? You’ll pay S$745 of fuel surcharges, on top of the regular airport taxes.

So ideally, you want to avoid frequent flyer programs with fuel surcharges. The good news is that Singapore Airlines stopped imposing fuel surcharges in 2017, and Cathay Pacific will cease the practice from May 2020. That said, both programs will still pass them on where imposed by partner airlines, so be careful.

| Fuel Surcharges |

||

| On Own Flights | On Partner Flights | |

| ✖ | ✔ | |

|

✔ | ✔ |

|

✔ | ✔ |

|

✔ | ✔ |

| ✔ | ✔ | |

| ✖ | ✖ | |

| ✖ From 1 May 2020 |

✔ | |

| ✖ Because it’s a revenue-based redemption scheme (bad) |

✔ | |

| ✔ | ✔ | |

| ✔ | ✔ | |

| ✔ | ✔ | |

| ✔ | ✔ | |

| ✔ | ✔ | |

| ✔ | ✔ | |

|

✔ | ✔ |

The presence of fuel surcharges also means that you can’t compare mileage requirements on a 1:1 basis, even if the transfer ratio (see below) is the same. After all, 50,000 KrisFlyer miles is a better deal than 50,000 Qantas miles, when you consider the fact the latter still has fuel surcharges.

Think transfer ratios

In general, all banks transfer points at the same ratio to all their partners. That’s to say that 1 DBS point will be worth 2 miles, whether you choose Asia Miles, KrisFlyer, or Qantas Frequent Flyer.

However, some exceptions apply:

- Transfer ratios to Air Asia BIG are different, because it’s a budget carrier and runs a fundamentally different type of program

- Transfer ratios to hotel programs with AMEX Membership Rewards are different from airlines

- SCB has three different transfer ratios, depending on program

| Bank | Transfer Ratio (Bank: Partner) |

Exceptions |

|

400:250 (Plat Charge) 450:250 (All others) |

Hilton- 1,000: 1,250 Marriott- 1,000: 1,000 |

|

3:1 | |

| 5:2 (ThankYou) 1:1 (Citi Miles) |

||

| 1:2 | Air Asia BIG- 1:3 | |

| 5:2 | ||

|

5:2 | Air Asia BIG- 2:1 |

| 5:2 (OCBC$) 1:1 (VOYAGE & Travel$) |

||

| 5:2* | Qatar, Etihad- 3:1 United, Lufthansa, Emirates- 3.5:1 |

|

| 1:2 | ||

| *For Visa Infinite cards. Non Visa Infinite cards can only transfer to KrisFlyer, at a 3,500: 1,015 ratio | ||

The difference in ratios can sometimes lead to confusion when quoting earning rates. For example, the SCB X Card earns 1.2 mpd locally and 2.0 mpd overseas- if you’re transferring points to Singapore Airlines, EVA Air, FlyingBlue, or Qantas. If you’re transferring points to Qatar or Etihad, the rates are 1.0 mpd/1.67 mpd, and if you’re transferring points to United or Lufthansa, the ratio is 0.86 mpd/1.43 mpd.

Fortunately, you only really need to worry about this with SCB cards.

Which programs would I definitely avoid?

While I don’t want to say that any program is completely useless, I’d certainly keep my distance from the following:

| Program | Thoughts |

| Unpredictable, revenue-based redemption program where award prices change dynamically with ticket prices. Can lead to nonsensical pricing at times. | |

| One of the worst FFPs thanks to unannounced devaluations and high fuel surcharges. Has the audacity to charge a “redemption booking fee” on top of all that, which can be as much as US$75 per sector (or US$300 on a round-trip flight via DOH) | |

|

High fuel surcharges and very poor award chart value, with the odd exception here and there. SCB’s recent transfer bonus might have made sense for some people though |

| Like FlyingBlue, also operates a dynamic award system where the mileage requirements proportionately increase with price |

Conclusion

When I first started collecting miles, I thought that KrisFlyer was the be-all and end-all, and there was no point spending the time to read up on anything else. But bit by bit, I discovered situations where it made much more sense to use other frequent flyer programs, which cued me in to how valuable points flexibility was.

So it pays to familiarize yourself with programs other than KrisFlyer, and learning how they can help you stretch your points. It could well be the difference between flying one person in Business Class or two!