Insurance premiums, tuition fees, income tax, rent, and utilities are a regular part of life. However, they often can’t be paid with a credit card, or even if they can, they’re usually excluded from earning rewards.

But if you’re willing to accept a small admin fee, platforms like CardUp allow you to earn miles when paying those bills. Whether this makes sense ultimately boils down to your valuation of a mile, though with the right cards and promo codes, the cost can be attractive.

In this post, I’ll answer some common questions about CardUp, as well as which cards and promo codes help you achieve the lowest cost per mile.

| 💰 Guide: Best Card for CardUp |

What is CardUp?

|

| CardUp Pricing |

| Enjoy a 1.79% admin fee on your first payment of up to S$5,000 with the promo code MILELION. For Visa cards only. |

CardUp is a platform that allows users to pay bills with their credit card and earn rewards, in exchange for an admin fee.

Here’s how it works:

- You submit a payment request to CardUp

- CardUp charges your credit card for the amount due, plus an admin fee

- CardUp makes a bank transfer to the receiving party on your behalf. The receiving party need not be registered with CardUp

To put some figures into the illustration:

- John submits a payment request to CardUp for a S$1,000 insurance premium

- CardUp charges John’s DBS Vantage Card for S$1,023.50 (insurance premium + 2.35% admin fee)

- John earns ~1,535 miles from his DBS Vantage Card (ignoring rounding)

- His cost per mile is ~1.53 cents (S$23.50 / 1,535 miles)

Aside from the obvious benefit of earning credit card rewards, CardUp also allows you to stretch your cashflow. Had you used a GIRO arrangement or PayNow to settle your bill, the funds would be deducted from your account immediately. But when you pay with a credit card, you enjoy an interest-free period of up to 55 days, depending on the bank and when your statement cycle ends.

What payments does CardUp support?

CardUp currently supports the following payments:

| 💳 CardUp Supported Payments | |

|

|

|

|

| *Payment for the provision of goods and services, agent fees, and other categories subject to CardUp’s approval | |

Most of those categories are self-explanatory, though some could use further elaboration.

Renovation includes any payments for home furnishing, painting, flooring, plumbing, carpentry, interior design, and other expenses incurred in the process.

Miscellaneous includes post-paid purchases of goods and services, event services, food catering, accounting fees, legal fees and school bus fees. Other payments may also be processed, subject to approval. An official tax invoice with the recipient’s UEN and bank account details must be submitted.

What MCC does CardUp code as?

CardUp transactions code as MCC 7399 (Business Services Not Elsewhere Classified).

MCC 6513 (Real Estate Agents and Managers) was historically used, but my understanding is that it’s been discontinued following DBS’s move to exclude this MCC in December 2025.

Do CardUp transactions earn credit card rewards?

Um, yes. That’s kind of the whole point of this!

CardUp transactions are eligible to earn rewards with all cards on the market, with the exception of the following:

- BOC cards do not earn rewards on CardUp transactions, ever since July 2025

- HSBC cards do not earn rewards on CardUp transactions, ever since July 2020

- The UOB One Credit Card no longer offers cash rebates on CardUp transactions, ever since August 2022

- Because of internal compliance restrictions, the AMEX HighFlyer Card cannot be used with CardUp

Unfortunately, bank CSOs sometimes misinform customers that CardUp transactions aren’t eligible to earn rewards. This usually happens because the customer asks something like “will insurance paid through CardUp earn rewards?”

Odds are, the CSO has never even heard of CardUp in their life and has no idea what it does. All they hear is “insurance”, and once that trigger word is spoken, the answer will almost certainly be no!

Does CardUp count towards minimum spend?

CardUp also counts towards the minimum spend for welcome offers and other card benefits, though again some exceptions apply:

- For DBS/POSB, CardUp transactions will not count towards the minimum spend for welcome offers, even though they still earn base rewards

- CIMB does not include CardUp transactions in the computation of the minimum spend for bonus cashback

Otherwise, CardUp transactions are normally treated like regular retail spend. For example, a StanChart Visa Infinite Cardholder who spends at least S$2,000 on CardUp in a statement month will earn 1.4 mpd on local currency transactions, instead of the regular 1 mpd.

What’s the best card to use with CardUp?

Since CardUp is basically a way of buying miles, the best card to use for CardUp is the one that gives the lowest cost per mile.

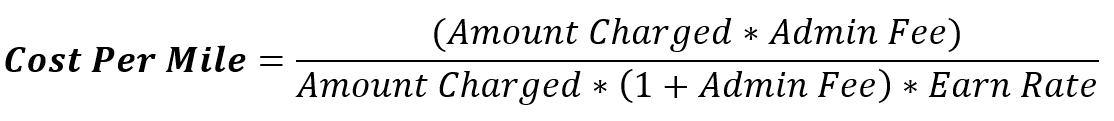

|

Two things to note about the above formula:

- Both the amount charged and the CardUp admin fee are eligible to earn miles. For example, if I charge S$1,000 to CardUp with a 2.6% admin fee, the full S$1,026 amount will earn miles

- The formula does not take into account the impact of rounding. For example, if I charge a S$1,026 CardUp transaction to a UOB card, I will only earn miles based on S$1,025 (because UOB rounds all transactions down to the nearest S$5). However, the impact of rounding becomes less significant as the amount charged increases

What this formula shows is that we can lower the cost per mile by:

- Maximising the earn rate

- Minimising the admin fee

Or both!

Maximising the earn rate

While CardUp transactions are technically online, they do not qualify for online spending bonuses with the likes of the Citi Rewards Card or DBS Woman’s World Card.

Therefore, you should stick to general spending cards for CardUp, and use the highest-earning general spending card you have.

Minimising the admin fee

As important as earn rates are, they’re just part of the picture because the admin fee also dictates the final cost per mile.

CardUp’s standard admin fee is 2.6% for locally-issued American Express, Mastercard and Visa cards. However, with the promo code OFF235 (valid for all payments except tax), this is effectively discounted to 2.35%.

Here’s the list of current promotions at the time of publishing.

| Code | Payment | Cards |

| 3HOME26R 1.77% Exp 30 Jun 26 |

Mortgage, Car Loan, Car Leasing, Condo MCST, Education, Rent, Renovation, Season Parking, Property Tax, Helper Salary New Existing |

Visa |

| MILELION 1.79% Exp 31 Dec 26 |

Any Payment New |

Visa |

| 18VTAX26 1.8% Exp 25 Mar 26 |

Recurring income tax New Existing |

Visa |

| 18TAX26 1.8% Exp 31 Mar 26 |

Property Tax, Stamp Duty New Existing |

Visa |

| RENT183 1.83% Exp 31 Jan 27 |

Rent New Existing |

Visa |

| REC185 1.85% Exp 31 Jan 27 |

Recurring Payments New Existing |

Visa |

| GLOBE185 1.85% Exp 31 Jan 27 |

Overseas Payments New Existing |

Visa |

| RENO26ONE 2.1% Exp 30 Jun 26 |

Renovation New Existing |

Visa |

| OFF235 2.35% Exp 31 Jan 27 |

Any Payment ex. Tax New Existing |

AMEX, Visa, MC |

If you’re an OCBC cardholder, there are some additional codes that you can use.

| Code | Payment | Cards |

| OCBC90N155 1.55% Exp 31 Mar 26 |

Any Payment New |

OCBC 90°N Visa & MC |

| OCBC155 1.55% Exp 31 Mar 26 |

Any Payment New |

OCBC VOYAGE & Premier VI |

| OCBCTAX173 1.73% Exp 20 Mar 26 |

Income Tax New Existing |

OCBC VOYAGE & Premier VI |

| OCBC18 1.8% Exp 31 Mar 26 |

Recurring Payments New Existing |

OCBC VOYAGE & Premier VI |

| OCBC195 1.95% Exp 31 Mar 26 |

Any Payment New Existing |

OCBC VOYAGE & Premier VI |

| OCBC90NV 2% Exp 31 Mar 26 |

Any Payment New Existing |

OCBC 90°N Visa |

| OCBC90NMC 2% Exp 31 Mar 26 |

Any Payment New Existing |

OCBC 90°N MC |

For the full details of these codes including minimum spends and caps, refer to the article below.

What’s the cost per mile?

For the mathematically challenged, I’ve taken the liberty of putting together a series of tables that show the cost per mile, depending on the earn rate of your card and the CardUp fee payable.

1.77% fee (3HOME26R)

| Cards | Earn Rate | Cost Per Mile (1.77% fee) |

|

1.6 mpd | 1.09¢ |

|

1.5 mpd | 1.16¢ |

|

1.4 mpd | 1.24¢ |

|

1.3 mpd | 1.34¢ |

|

1.28 mpd | 1.36¢ |

|

1.2 mpd | 1.45¢ |

1.79% fee (MILELION)

| Cards | Earn Rate | Cost Per Mile (1.79% fee) |

|

1.6 mpd | 1.10¢ |

|

1.5 mpd | 1.17¢ |

|

1.4 mpd | 1.26¢ |

|

1.3 mpd | 1.35¢ |

|

1.28 mpd | 1.37¢ |

|

1.2 mpd | 1.47¢ |

1.8% fee (18VTAX26, 18TAX26)

| Cards | Earn Rate | Cost Per Mile (1.8% fee) |

|

1.6 mpd | 1.11¢ |

|

1.5 mpd | 1.18¢ |

|

1.4 mpd | 1.26¢ |

|

1.3 mpd | 1.36¢ |

|

1.28 mpd | 1.38¢ |

|

1.2 mpd | 1.47¢ |

1.83% fee (RENT183)

| Cards | Earn Rate | Cost Per Mile (1.83% fee) |

|

1.6 mpd | 1.12¢ |

|

1.5 mpd | 1.20¢ |

|

1.4 mpd | 1.28¢ |

|

1.3 mpd | 1.38¢ |

|

1.28 mpd | 1.40¢ |

|

1.2 mpd | 1.50¢ |

1.85% fee (REC185, GLOBE185)

| Cards | Earn Rate | Cost Per Mile (1.85% fee) |

|

1.6 mpd | 1.14¢ |

|

1.5 mpd | 1.21¢ |

|

1.4 mpd | 1.30¢ |

|

1.3 mpd | 1.40¢ |

|

1.28 mpd | 1.42¢ |

|

1.2 mpd | 1.51¢ |

2.1% fee (RENO26ONE)

| Cards | Earn Rate | Cost Per Mile (2.1% fee) |

|

1.6 mpd | 1.29¢ |

|

1.5 mpd | 1.37¢ |

|

1.4 mpd | 1.47¢ |

|

1.3 mpd | 1.58¢ |

|

1.28 mpd | 1.61¢ |

|

1.2 mpd | 1.71¢ |

2.35% fee (OFF235)

| Cards | Earn Rate | Cost Per Mile (2.35% fee) |

|

2 mpd | 1.15¢ |

|

1.6 mpd | 1.44¢ |

|

1.5 mpd | 1.53¢ |

|

1.4 mpd | 1.64¢ |

|

1.3 mpd | 1.77¢ |

|

1.28 mpd | 1.79¢ |

|

1.2 mpd | 1.91¢ |

|

1.1 mpd | 2.09¢ |

Are there any restrictions on the types of payments I can make?

While most credit cards do not have any restrictions on CardUp payments, there are a couple of exceptions.

Due to internal restrictions, American Express and Citi cards cannot be used for car loan or mortgage payments. Personal American Express cards (including those issued by DBS and UOB) can only be used to pay the following CardUp expenses:

- Rental payments

- Rental deposits

- Income tax, property tax, stamp duty

- Tuition and school fees (to Singapore-based schools/education centres)

- Condo maintenance fees

- Insurance premiums

- Season parking

- Property agent fee

Personal American Express cards cannot be used for the following:

- Car loans

- Electricity

- Helper salary

- Miscellaneous

- Mortgage

- Payroll

- Renovation

- Supplier

- International payments

- Car rentals and leasing

More details can be found in the article below.

Conclusion

|

| CardUp Pricing |

| Enjoy a 1.79% admin fee on your first payment of up to S$5,000 with the promo code MILELION. For Visa cards only. |

If you want to earn miles on your bill payments and don’t mind paying a small fee for the privilege, then CardUp would be one way of doing so. Of course, you’ll want to compare the cost per mile with what you could get through alternative platforms like Citi PayAll, and pick whichever is lower.

The idea is to keep the cost per mile as low as possible, which we do by using the highest-earning general spending card we have, and paying the lowest possible admin fee with promo codes.

CardUp transactions are eligible to earn rewards with all cards on the market except BOC, HSBC and the UOB One Card, so there are plenty of options.

Probably good to clarify that other UOB cards will only award Based points for cardup transaction.

Tested with EVOL, not recognised as “online” category.

Evol will still contribute to the online spend category if your aim is just to meet the min $600 just that it doesn’t count as a spend

Hello, does Cardup count towards $500 spend for bonus interest for UOB One Account?

This is only relevant if you are spending exactly $250 on online and exactly $250 on contactless for EVOL, and are adding exactly $100 on CardUp per month to meet the minimum spend.

Seems impossible to execute in real life.

CardUp = 2.25% fee -> 1.84 cpm

(Miles awarded include fees)

Citi PayAll = 2.2% fee -> 1.83 cpm

(Miles awarded exclude fees)

Ever since Citi PayAll increases the fee from 2% to 2.2%, It is clear that I will be using CardUp in the future as miles awarded do include fees on CardUp. (To add on: Income tax = 1.75% fee using VISA cards)

Forget about the Citi PayAll 2.2 mpd promo – I can never hit the $8k spend on Citi PayAll payments!

Edit: Just realised CardUp doesn’t support payments to SP group for electricity and utility bills. Oh well, back to using Citi PayAll for those payments! 🙁

Will be using CardUp for the upcoming income tax though for the cheaper 1.75% fee.

Citi payall offering 1.8mpd with 2.2% fee. Works out to be 1.22 cpm

Citi-PayAll 1.8 mpd with 2.2% fee promo requires $8k spend on Citi-PayAll payments, which is not for the majority of the users who do not have such big payments to make.

Could you please confirm that it is still correct? Thank you very much!

read on google review that many users complain about customer service as being a big issue if anything were to go wrong. does anyone have any experience on this?

some users say paying the extra for citipayall is worth it because of CS and security

Tried to pay for income tax with VTAX23 but system showed error saying fully redeemed…

For HSBC, it was mentioned it does not recognise Cardup trxn for “regular rewards”.

However, you do not mention whether HSBC does / does not recognise Cardup trxn for “sign-up rewards”. Can help to clarify?

Will the DBS Altitude AMEX card for cardup earn miles and can I use the promo code 18AMEX for new user?

Hi! i wanted to ask if i were to setup cardup for my AIA insurance payments, do i need to cancel my recurring payments in AIA portal first? then set it up in Card up?

I saw there’s a spending cap under MCC for cardup using Credit Card in Malaysia to earn bonus reward mile. Is it just a bonus point and still earn unlimited regular reward for the spendings?

Hi, wanted to check if anyone has the experience of using CardUp with UOB Krisflyer Credit Card? If you have fulfilled the SIA-related transaction criteria, does CardUp still earn 1.3mpd, or 3mpd for general spending? Thank you!

Hi I wanted to check this as well! Do we get the full 3mpd if the SIA-transaction is met?

3mpd is for a specific list of MCC transactions, not all spend.

I’ve been using CardUp for about a month with my uob Krisflyer credit card but I have not received any miles yet… Is this normal how long does it usually take I’ve paid more than 1k in fees already and I’m worried I won’t get miles. Pleaseeee help? Should I call the bank?

UOB KF credit card award the miles based on your spending directly to your Krisflyer account every month 5th

From what i understand after hitting the criteria the bonus miles will only reflect end of membership year.

But same time i would like to check does any payment using card up does it entitle the bonus spending?

Did you manage to get the miles in the end?

Maybe it’s just me, I couldn’t add my Citi Prestige in Cardup.

Has anyone successfully paid tax and car loans with cardup paired with DCS Ultimate 2% cashback ?

would like to know this also, Cardup is not specifically mentioned in exclusion list, so by right it should count

But cardup fee 2.6% cashback 2% why would you link this? You will pay extra 0.6%?

if i want to pay for reno contractor may i use krisflyer UOB if I have spent the 800 criteria

Is chocolate visa or uob prvi miles better for Cardup?

Can I link Chocolate visa to heymax and then pay Cardup using Chocolate visa?

I tried using UOB Priv miles card to pay for my reno deposit using cardup but the transaction only earned me 0.7mpd. seems like MCC 7399 does not count.

sounds like you’re confusing UNI$ and miles. 1 UNI$ = 2 miles

Hi. Does Citi SMRT earn the 5% online spend category at CardUp?

Does Vantage offer reward points for rent payments on cardup?

hi aaron, i just had a look at Maybanks Treats T&C effective 1 Dec 25. Under clause 2.2G Cardup payments are excluded from earning rewards. Would this change make Maybank Visa infinite ineligible for Cardup trxns now?

I think you might have spotted something- check out the latest post.

The promo code 3HOME26R is for the Home Bundle Promotion. It offers a tiered discounted fee on up to three new recurring home payment categories, including car loans.

To be eligible, you need to be a CardUp Personal account user with a Singapore-issued Visa credit card. The recurring series must be set up on or before December 26, 2025, 6 PM SGT, and the payment due date must be on or before December 31, 2025.