Here’s The MileLion’s review of the OCBC VOYAGE Card, which became OCBC’s first-ever miles card when it launched in 2015.

That’s right. It might surprise you to know that unlike other banks, which launched mass-market miles cards before going premium, OCBC did things the other way round. In fact, it wasn’t until six years later that the bank entered the mass-market miles segment with the 90°N Card.

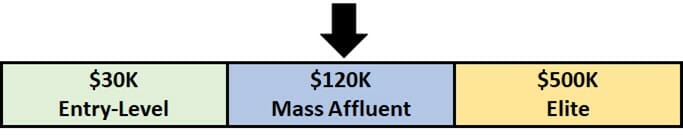

While it may be OCBC’s flagship product, the VOYAGE is actually the most affordable S$120K card with an annual fee of S$498. So does that make it a bargain compared to the competition?

OCBC VOYAGE Card OCBC VOYAGE Card |

|

| 🦁 MileLion Verdict | |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? |

|

| The OCBC VOYAGE offers the cheapest entry point into the $120K segment, but needs more of an X-factor to truly stand out. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: OCBC VOYAGE Card

Let’s start this review by looking at the key features of the OCBC VOYAGE Card.

|

|||

| Apply | |||

| Income Req. | S$120,000 p.a. | Points Validity | No expiry |

| Annual Fee | S$498 |

Min. Transfer |

1 VOYAGE Mile (1 mile) |

| Miles with Annual Fee |

15,000 | Transfer Partners |

9 |

| FCY Fee | 3.25% | Transfer Fee | S$25 |

| Local Earn | 1.3 mpd | Points Pool? | No |

| FCY Earn | 2.2 mpd |

Lounge Access? | Yes |

| Special Earn | N/A | Airport Limo? | Yes |

| Cardholder Terms and Conditions | |||

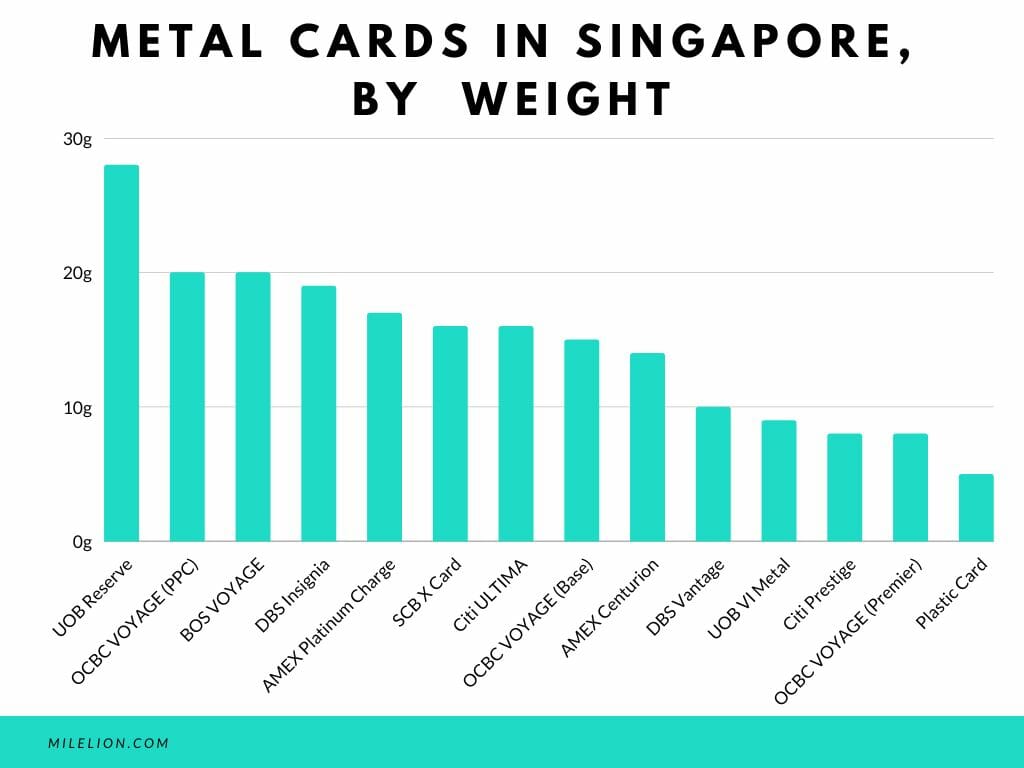

The OCBC VOYAGE comes in metal card stock, duralumin to be precise. Duralumin is a strong, hard and lightweight aluminium alloy that contains copper, manganese, iron, and silicon, and is resistant to acid and seawater corrosion. I suppose that means you can go swimming with your VOYAGE Card (because why wouldn’t you?).

The current version of the VOYAGE Card weighs in between 8-20g.

Why the range of weights? Because there’s actually four versions of the VOYAGE. In addition to the basic OCBC VOYAGE, you have:

- OCBC Premier VOYAGE, for clients of OCBC Premier (min. AUM S$350K)

- OCBC PPC VOYAGE, for clients of OCBC Premier Private Client (min. AUM S$1.5M)

- BOS VOYAGE, for clients of Bank of Singapore (min. AUM US$5M)

| 💳 OCBC VOYAGE Cards |

|||

| Card | Annual Fee | Local | FCY |

OCBC VOYAGE OCBC VOYAGE |

S$498 | 1.3 mpd | 2.2 mpd |

OCBC Premier VOYAGE OCBC Premier VOYAGE |

S$498 | 1.6 mpd | 2.3 mpd |

OCBC PPC VOYAGE OCBC PPC VOYAGE |

Waived | 1.6 mpd* | 2.3 mpd* |

BOS VOYAGE BOS VOYAGE |

S$498 | 1.6 mpd | 2.3 mpd |

| *2.3 mpd for local and overseas dining | |||

It may seem odd that the OCBC PPC VOYAGE has an annual fee waiver, when the supposedly more high-end BOS VOYAGE does not, but that’s indeed accurate. Each business unit makes their own decision as to whether to absorb or charge the fees.

The OCBC PPC and BOS VOYAGE Cards used to have access to the members-only Tower Club, but that ended in July 2024. Now the (published) benefits of all four VOYAGE Cards are largely identical- with one big exception: PPC customers get unlimited complimentary airport limo rides, with no minimum spend required.

In this review, I’ll mostly focus on the basic version of the OCBC VOYAGE Card.

How much must I earn to qualify for an OCBC VOYAGE?

The OCBC VOYAGE has a minimum income requirement of S$120,000 p.a., which puts it in the so-called mass affluent segment alongside the Citi Prestige and DBS Vantage.

If you fall short of that mark but are otherwise asset rich, you can deposit funds to get Premier, PPC or BOS status, which would allow you to get the respective VOYAGE cards with a minimum income of just S$30,000 p.a., the MAS-mandated minimum.

How much is the OCBC VOYAGE’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$498 | Free for first 2 3rd onwards: S$191 |

| Subsequent | S$498 | S$191 |

The OCBC VOYAGE has an annual fee of S$498. Up to two supplementary cards are free for the first year, with an annual fee of S$191 subsequently.

Cardholders who spend at least S$60,000 in a membership year (S$30,000 for the OCBC Premier VOYAGE) will receive an annual fee waiver.

15,000 VOYAGE Miles will be awarded for paying the annual fee each year, which works out to about 3.32 cents per mile. Alternatively, cardholders can opt to pay an “upgraded ASF” for additional miles:

- S$3,270 for 150,000 VOYAGE Miles

- S$10,200 for 500,000 VOYAGE Miles

This reduces the fee to 2.18 cents per mile (for the 150,000 miles option) or 2.04 cents per mile (for the 500,000 miles option). My opinion is that neither is great, but if you’re the sort who regularly buys paid Business Class tickets, you might find it worthwhile.

OCBC 90°N & VOYAGE Card annual service fee option: Should you upgrade for more miles?

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.3 mpd | 2.2 mpd | N/A |

SGD/FCY Spend

OCBC VOYAGE cardholders earn:

- 1.3 VOYAGE Miles for every S$1 spent in Singapore Dollars (1.3 mpd)

- 2.2 VOYAGE Miles for every S$1 spent in FCY (2.2 mpd)

These are fairly competitive rates compared to other cards in the $120K segment, although OCBC’s punitive rounding policy (discussed later in this article) will result in a lower average mpd on smaller transactions.

| 💳 Earn Rates for S$120K Cards (sorted by sum of local and FCY earn rate) |

||

| Card | Local | FCY |

StanChart Visa Infinite StanChart Visa InfiniteApply |

1.4 mpd# | 3 mpd# |

Maybank Visa Infinite Maybank Visa InfiniteApply |

1.2 mpd | 3.2 mpd@ |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal CardApply |

1.4 mpd | 2.4 mpd |

DBS Vantage Card DBS Vantage CardApply |

1.5 mpd | 2.2 mpd |

OCBC VOYAGE OCBC VOYAGEApply |

1.3 mpd | 2.2 mpd |

Citi Prestige Card Citi Prestige CardApply |

1.3 mpd^ | 2 mpd^ |

HSBC Visa Infinite HSBC Visa Infinite |

1 mpd | 2 mpd |

AMEX Platinum Reserve AMEX Platinum ReserveApply |

0.69 mpd | 0.69 mpd |

| #With minimum S$2K spend per statement month. Otherwise 1 mpd for both @With minimum S$4K spend per calendar month. Otherwise 2 mpd ^Additional 0.02 to 0.12 mpd awarded based on tenure with bank |

||

All FCY transactions are subject to a 3.25% fee, which is on par with the rest of the market.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

With a 3.25% FCY fee, using your OCBC VOYAGE Card overseas represents buying miles at 1.48 cents each.

Bonus Spend

The OCBC VOYAGE does not have a bonus spend category (though the OCBC PPC VOYAGE earns 2.3 mpd on local and overseas dining).

That’s kind of a bummer, because it makes it really hard to rack up VOYAGE Miles in any significant quantity, unless you’re a big spender, or use CardUp for bill payments.

When are VOYAGE Miles credited?

VOYAGE Miles are credited when your transaction posts, which generally takes 1-3 working days.

How are VOYAGE Miles calculated?

Here’s how you can work out the VOYAGE Miles earned on your OCBC VOYAGE.

| Local Spend | Round down transaction to nearest S$5, divide by 5, multiply by 6.5. Round to the nearest whole number |

| FCY Spend |

Round down transaction to nearest S$5, divide by 5, multiply by 11. Round to the nearest whole number |

One annoying thing about the VOYAGE (and all OCBC cards for that matter) is that transactions are rounded down to the nearest S$5. That means a S$14.90 transaction earns the same number of miles as a S$10 transaction, and a S$4.99 transaction earns no miles at all!

This rounding policy means that even though the OCBC VOYAGE may have the same headline earn rate as a competitor, the actual number of miles earned will be smaller. Below is a comparison with the Citi Prestige, which also offers 1.3 mpd on local spending.

OCBC VOYAGE OCBC VOYAGE1.3 mpd |

Citi Prestige Citi Prestige1.3 mpd |

|

| S$5 | 7 miles | 6.4 miles |

| S$9.99 | 7 miles | 11.6 miles |

| S$15 | 20 miles | 19.6 miles |

| S$19.99 | 20 miles | 24.8 miles |

| S$25 | 33 miles | 32.4 miles |

| S$29.99 | 33 miles | 37.6 miles |

If you’re an Excel geek, here are the formulas you need to calculate points:

| Local Spend | =ROUND (ROUNDDOWN(X/5,0)*6.5,0) |

| FCY Spend |

=ROUND (ROUNDDOWN(X/5,0)*11,0) |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for VOYAGE Miles?

A full list of ineligible transactions to earn VOYAGE Miles can be found in the OCBC VOYAGE T&Cs under section 1.4.

I’ve highlighted a few noteworthy categories below:

- Charitable donations

- Education

- Government services

- Public hospitals

- Insurance premiums

- Prepaid account top-ups (e.g. GrabPay, YouTrip)

- Real estate agents & managers

- SimplyGo (Bus/MRT transactions)

- Utilities

For the avoidance of doubt, OCBC VOYAGE Cardholders will still earn miles for payments to private hospitals, including Mount Elizabeth, Mount Alvernia, Farrer Park, Gleneagles, Thomson Medical Centre, Parkway East and Raffles Hospital.

OCBC VOYAGE Cardholders will also earn miles with CardUp, and there’s an ongoing tie-up (see below) that gives a discount on the admin fee.

What do I need to know about VOYAGE Miles?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| No expiry | No | S$25 |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| Varies | 9 | Varies |

Expiry

VOYAGE Miles earned on the OCBC VOYAGE do not expire, so long as the card remains active.

Pooling

VOYAGE Miles are a unique currency earned only on the OCBC VOYAGE, and since you can only hold one VOYAGE Card at a time, there’s no question of pooling. VOYAGE Miles cannot be combined with 90°N Miles or OCBC$ for redemptions.

You must redeem all your VOYAGE Miles before cancelling the OCBC VOYAGE, or else forfeit them.

Transfer Fees, Partners & Times

OCBC cardholders can convert their points to nine airline and hotel partners.

| Frequent Flyer Programme | Conversion Ratio (VOYAGE Miles: Partner) |

| 1:1 | |

| 1,000 : 1,000 | |

| 1,000 : 1,000 | |

| 1,000 : 1,000 | |

| 1,000 : 900 | |

| 1,000 : 900 | |

| 1,000 : 750 | |

| 1,000 : 700 | |

| 1,000 : 500 |

Unfortunately, the ratios are poor for partners other than KrisFlyer or Flying Blue.

I would at the very least have expected Asia Miles to enjoy the same conversion ratio as KrisFlyer. That’s the way it is for every other bank on the market, and it effectively eliminates Asia Miles as a viable transfer partner. After all, why on earth would you take a 25% haircut on the value of your OCBC points (and therefore your card spending rebate) when no other bank forces you to do that?

Likewise, it’s disappointing to see that there’s a 10% haircut for British Airways Executive Club and Etihad Guest, when Citibank and HSBC offer transfers to both at the same ratio as KrisFlyer.

As for hotel partners, the ratios for IHG and Marriott Bonvoy aren’t that appealing when you factor in the opportunity cost- you’re basically forgoing 1 KrisFlyer mile (~1.5 SG cents) for every IHG (~0.5 US cents/0.65 SG cents) or Bonvoy (~0.7 US cents/0.92 SG cents)

The only non-KrisFlyer programmes I might consider would be Air France-KLM Flying Blue and Accor Live Limitless. With Accor, 2,000 points = €40, so there is an opportunity cost of 1.5 cents per KrisFlyer mile, roughly what I’d deem acceptable.

For what it’s worth, OCBC does offer occasional transfer bonuses. Some recent offers include:

- November 2024: 75% bonus to IHG One Rewards

- November 2024: 62% bonus to Cathay Pacific Asia Miles

- July 2024: 70% bonus to Marriott Bonvoy

- June 2024: 15% bonus to British Airways Executive Club

However, given that the baseline rates are so poor, all these bonuses do is to bring the rates in line with other cards, or add a small premium at best.

In terms of minimum conversions:

- Conversions to KrisFlyer require a minimum of just 1 VOYAGE Mile (1 KrisFlyer mile)

- Conversions to other programmes require a minimum of 1,000 VOYAGE Miles (500-1,000 partner points)

Transfers to KrisFlyer should be completed within 24 hours, while other programmes are more or less instant. A fee of S$25 per transfer applies.

Other card perks

Redeem VOYAGE Miles for any flight

One of the most unique features of the OCBC VOYAGE is the ability to redeem VOYAGE Miles for any seat, on any flight, to any destination. This is basically using VOYAGE Miles like cash.

To be clear, redeeming VOYAGE miles is not the same as redeeming KrisFlyer miles.

| Redeem VOYAGE Miles | Redeem KrisFlyer miles | |

| Airline | Any airline | Any KrisFlyer partner |

| Seat Availability | Any seat available for sale | Award inventory only |

| Miles Required | Depends on cost of ticket |

Fixed based on award chart |

| Taxes & Surcharges | Can be covered by miles | Paid in cash |

| Earn Miles & Status Credits | Yes | No |

VOYAGE Miles can be redeemed for any airline available through the VOYAGE Exchange (which would include every major carrier worldwide). KrisFlyer miles can be redeemed for Singapore Airlines or any of its Star Alliance/non-Star Alliance partners (which totals 30 at last count).

When you redeem VOYAGE Miles, you have access to any seat available for sale. When you redeem KrisFlyer miles, you’re limited to the space that airlines have set aside for awards.

The number of VOYAGE Miles required depends on the cost of the ticket. If the ticket is more expensive, you’ll need more VOYAGE Miles. If the ticket is cheaper, fewer VOYAGE Miles. With KrisFlyer, the number of miles is fixed according to the award chart.

VOYAGE Miles can be used to pay taxes and surcharges for tickets, but if you redeem KrisFlyer miles, you’ll need to pay for these with cash.

| ⚠️ You can, but shouldn’t! |

|

While you can use your VOYAGE Miles to pay for taxes and surcharges, you probably shouldn’t. OCBC uses a different valuation for VOYAGE Miles when used for fares, as compared to taxes and surcharges, and the rate used for the latter is very poor (presumably because they’re non-commissionable). Always opt to pay these in cash. |

Since tickets purchased through the VOYAGE Exchange are basically the same as a cash ticket, you’ll earn miles and elite status credits (e.g. PPS Value) as per the fare class. KrisFlyer redemption tickets do not earn miles or elite status credits.

Long story short, each route has its own advantages. If you use VOYAGE Miles, you enjoy better availability and miles/elite status accrual, but lower value on a per mile basis. If you use KrisFlyer miles, you have less availability and no miles/elite status accrual, but higher value on a per mile basis.

So the question then becomes: what’s the value of a VOYAGE Mile when redeemed through VOYAGE Exchange?

Unfortunately, less than before. Once upon a time, cardholders could enjoy a valuation of about 2.2-2.3 cents per VOYAGE Mile, when redeemed for Business Class flights. In August 2023, the value was cut to 1.72 cents, with even lower value for Economy Class.

| Cabin | Value per VM |

| First Class | 1.72 cents |

| Business Class | 1.72 cents |

| Premium Economy Class | 1.03 cents |

| Economy Class | 0.92 cents |

Complimentary airport limo rides

Principal OCBC VOYAGE Cardholders who spend at least S$12,000 per calendar quarter will receive two complimentary limo rides, capped at two rides per quarter and eight per calendar year.

This ties it with Citi Prestige as the most expensive limo ride on the market at S$6,000 per ride. However, Citi Prestige Cardholders can rely on Citi PayAll to meet the minimum spend, or even charitable donations, education expenses, insurance premiums and utility bills (these won’t earn rewards, but will count towards the minimum spending requirement). VOYAGE Cardholders have no such alternative.

| 💳 Airport Limo Benefits (income req.: S$120K) |

||

| Card | Qualifying Spend | Cap |

HSBC Visa Infinite HSBC Visa Infinite |

S$2K per month for 1 ride* |

24 per year |

Maybank Visa Infinite Maybank Visa InfiniteApply |

S$3K per month for 1 ride | 8 per year |

Citi Prestige Card Citi Prestige CardApply |

S$12K per quarter for 2 rides | 2 per quarter |

OCBC VOYAGE OCBC VOYAGEApply |

S$12K per quarter for 2 rides | 2 per quarter |

AMEX Platinum Reserve AMEX Platinum ReserveApply |

N/A | N/A |

DBS Vantage Card DBS Vantage CardApply |

N/A | N/A |

StanChart Visa Infinite StanChart Visa InfiniteApply |

N/A | N/A |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal CardApply |

N/A | N/A |

| *First 2 (Regular customer) or 4 (HSBC Premier) per year are free | ||

OCBC VOYAGE limo rides used to be valid for trips to any authorised point of departure and entry into Singapore, including cruise centres, ferry terminals, bus terminals and even land checkpoints– you could book a limo to the Woodlands checkpoint if you were so inclined!

Unfortunately, that’s no longer the case from 24 November 2025, and limo rides are now only valid for trips to and from Changi and Seletar airports.

Unlimited complimentary lounge visits

OCBC VOYAGE Cardholders enjoy lounge access through DragonPass, with the following entitlements.

- Principal cardholder: Unlimited visits

- All supplementary cardholders: 2x visits per calendar year

The two visits that supplementary cardholders receive cannot be shared, and any accompanying guest will incur a US$32 fee.

| 💳 Airport Lounge Benefits (Income Req.: S$120K) |

|||

| Card | Lounge Network | Free Visits (Per Year) |

|

| Main | Supp. | ||

HSBC Visa Infinite HSBC Visa Infinite |

LoungeKey | ∞ | ∞ Up to 5 supp. cards |

OCBC VOYAGE OCBC VOYAGEApply |

DragonPass Lounge only |

∞ | 2 |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal CardApply |

DragonPass | ∞ + 1 guest* | N/A |

Citi Prestige Card Citi Prestige CardApply |

Priority Pass | 12 Multi Guests |

N/A |

DBS Vantage Card DBS Vantage CardApply |

Priority Pass | 10 Multi Guests |

N/A |

StanChart Visa Infinite StanChart Visa InfiniteApply |

Priority Pass | 6 1x Guest |

N/A |

Maybank Visa Infinite Maybank Visa InfiniteApply |

Priority Pass | 4 | N/A |

AMEX Platinum Reserve AMEX Platinum ReserveApply |

N/A | N/A | N/A |

| *Will be reduced to 12 visits per calendar year from 1 June 2026 |

|||

One big drawback is that the DragonPass issued by OCBC VOYAGE does not cover airport restaurants, and most non-lounge experiences like spas, capsule hotels, nap pods and video game lounges (though there are a handful of exceptions).

Discounted CardUp admin fee

OCBC VOYAGE and OCBC Premier Visa Infinite Cardholders enjoy a discounted admin fee of 1.55% (new) or 1.8% (existing) with CardUp, which reduces the cost per mile to as low as 0.95 cents.

| Card | Earn Rate |

Cost Per Mile (1.55% fee) |

Cost Per Mile (1.8% fee) |

OCBC VOYAGE OCBC VOYAGE (Premier, PPC, BOS) |

1.6 mpd | 0.95¢ | 1.11¢ |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd | 1.17¢ | 1.36¢ |

OCBC Premier Visa Infinite OCBC Premier Visa Infinite |

1.28 mpd | 1.19¢ | 1.38¢ |

New CardUp users (defined as those who have yet to make a first payment on the platform) can use the code OCBC155 to enjoy a 1.55% admin fee on their first payment of any kind.

| 💳 New-to-CardUp Customers | |

| Code | OCBC155 |

| Card Type | OCBC VOYAGE & Premier Visa Infinite |

| Limit | No cap on total redemptions, but max 1x per user |

| Admin Fee | 1.55% |

| Min. Spend | None |

| Cap | S$20,000 |

| Schedule By | 31 March 2026, 6 p.m SGT |

| Due Date By | 3 April 2026 |

| Payment Type | One-off payment, or first payment of a recurring series |

| OCBC155 T&Cs | |

The payment must be scheduled on CardUp by 31 March 2026, 6 p.m (SGT), with a due date on or before 3 April 2026.

No minimum payment is required, but the maximum payment is capped at S$20,000. The prevailing 2.6% fee will apply to any portion of the payment that exceeds S$20,000.

Existing CardUp users can use the code OCBC18 to enjoy a 1.8% admin fee on any CardUp payment.

| 💳 Existing CardUp customers | |

| Code | OCBC18 |

| Card Type | OCBC VOYAGE & Premier Visa Infinite |

| Limit | No limit on redemptions |

| Admin Fee | 1.8% |

| Min. Spend | None |

| Cap | None |

| Schedule By | 31 March 2026, 6 p.m SGT |

| Due Date By | 3 April 2026 |

| Payment Type | Recurring |

| OCBC18 T&Cs | |

The payment must be scheduled on CardUp by 31 March 2026, 6 p.m (SGT), with a due date on or before 3 April 2026.

No minimum payment is required, nor is there any maximum. There is no limit on the number of times each account can use this code.

1-for-1 dining offers

OCBC VOYAGE Cardholders receive periodic 1-for-1 offers and discounts at fine dining restaurants (such as QIN and Fico), through the VOYAGE Gourmet Experiences platform.

The 1-for-1 offers are first-come-first-serve, and get sold out very quickly. To improve your chances of snagging a slot, subscribe to the OCBC VOYAGE Telegram Group, where news about these offers breaks first.

Upgrade to Sands Lifestyle Prestige tier

OCBC VOYAGE Cardholders can enjoy a complimentary 3-month membership upgrade to the MBS Sands Lifestyle Prestige tier. They can renew their membership for a further 9-month period by spending at least S$1,500 within the initial 3-month period, failing which they will be downgraded to the entry-level Lifestyle tier.

To upgrade their status, cardholders must visit one of the following locations in person

- Lobby, Hotel Tower 1

Daily: 10am – 10.30pm - The Shoppes, B1 (above Sampan Rides)

Daily: 10am – 11pm - The Shoppes, B2 (near Digital Light Canvas)

Daily: 10am – 11pm

Sands Lifestyle Prestige members enjoy perks such as:

- Up to 20% instant Resort Dollars at over 250 outlets

- 10% savings on hotel room rate

- Preferential earning of up to 10% instant Resort Dollars at selected restaurants

- $4 Resort Dollar parking (with same-day spend)

- Complimentary tickets to Marina Bay Sands attractions (up to two tickets per day per attraction, capped at two per month)

- Digital Light Canvas

- Sampan rides

- SkyPark Observation Deck

- 1-for-1 ArtScience Museum exhibition tickets (up to four tickets per month)

The full list of perks can be found here.

If you’re an OCBC PPC or BOS VOYAGE Cardholder, you’ll be upgraded to the Sands Lifestyle Elite tier instead.

HoteLux membership

|

| Benefit details |

HoteLux is a hotel booking app that allows users to book travel advisor rates such as Hyatt Prive, Marriott STARS, Rosewood Elite, Shangri-La Luxury Circle and Virtuoso at more than 4,000 luxury hotels worldwide. These rates typically include extra perks such as:

- Complimentary daily breakfast for two

- Room upgrades (subject to availability)

- Early check-in (subject to availability)

- Late check-out (subject to availability)

- Welcome amenity

- US$100 hotel credit

A membership is required to use the app, and OCBC VOYAGE Cardholders receive a complimentary 12-month Elite membership and 1,000 points (worth US$100).

OCBC Premier, PPC and BOS VOYAGE Cardholders receive a complimentary 12-month Elite Plus membership and 2,000 points (worth US$200).

It should be mentioned that these travel advisor rates can also be booked for free through many travel agencies (e.g. Classic Travel), but the vast majority of these operate over the phone or email only. An app is a big convenience in that respect.

Do note that you can also get a free HoteLux membership with a World or World Elite Mastercard.

Visa Infinite benefits

OCBC VOYAGE Cardholders enjoy the following additional perks, provided by Visa.

| 🏨 Hotel Elite Status | |

| 🚗 Rental Car Elite Status | |

| 👍Other Perks |

For more information on how these perks work, refer to the post below.

Terms & Conditions

Summary Review: OCBC VOYAGE Card

|

|||

| Apply | |||

| 🦁 MileLion Verdict | |||

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

The OCBC VOYAGE Card has a lot going for it on paper: unlimited lounge access, airport limo rides, numerous transfer partners and the ability to redeem VOYAGE Miles for any seat on any flight.

However, a lot of those perks come with caveats attached.

- Only the principal cardholder gets unlimited lounge access, and it doesn’t cover restaurants

- The airport limo rides require a hefty minimum spend of S$12,000 per quarter and unlike the Citi Prestige, there’s no Citi PayAll to help meet the threshold

- Many of the transfer partners have poor value transfer ratios that makes them virtually irrelevant

- The value of VOYAGE Miles for offsetting commercial tickets been cut significantly

It’s certainly not the weakest player in the $120K segment, and given its relatively low annual fee (and the possibility of waiving it through annual spend), I can understand why this could be the card of choice for some. Still, I think the VOYAGE could do with a refresh, in order to stay competitive with the rest of the pack.

So that’s my review of the OCBC VOYAGE Card. What do you think?

Might be important to note that TravelwithOCBC is operated by Ascenda and different from Voyage Exchange.

This is a great point, thanks for sharing!

Hi – does Voyage Exchange (presumably the concierge) offer a better redemption rate than TravelwithOCBC?

Doesn’t seem so in my experience but that was back when we could get 2.3 cents/VM

So, a hard-to-earn dynamic pricing currency that is based on non-transparent rates, what’s not to like?

if you use voyage miles to redeem a business class ticket with SIA do you get PPS value?

Yes

Questions

1) Does VOYAGE Payment Facility transfers count towards the annual $60,000 spent?

2) Does it make sense to use the above (1) to get the annual fee waiver

3) Is it better to pay annual fees for the 15,000 miles since it has no expiry date

Am considering between OCBC VOYAGE for its 30,000 bonus miles or should I go for OCBC Premier VOYAGE straight?

Thank you in advance for your view 😉

Do note that OCBC deems a Toyota Alphard / Vellfire to be similar to a Toyota Noah… Surprised at the downgrade.

Minor correction: BOS minimum is USD3m not SGD5m

fixed, thank you!

This card has no paywave. What card in this era does not have paywave ?I know I can add to apple of Google pay but is really silly

The newer version has paywave. Can ask ocbc to replace it for you

Does the airport transfers , work for Sub card holders? As in they can take the transfers without the main cardholder?

Reading the T&Cs, it seem to indicate that you need to meet the minimum spend before taking the limo ride. 2.8.1 If a Cardmember charges at least S$12,000 (or its equivalent in foreign currency) on his/her Card within a quarter in the eligible spend categories detailed in section 1 of these Terms and Conditions, the Principal Cardmember will be awarded with two complimentary one-way Service. A maximum of two complimentary one-way Service may be awarded to a Principal Cardmember in a quarter . A “quarter” refers to each of the 4 quarters in a calendar year i.e. January to March,… Read more »

they nerfed me…

i have a 100k 365 card limit

i took the PREMIER version, and only got 10k on it

called them, they upped to 20k

i played along and deposited 30k inside to swipe a 50k bill..

it went back to 10k limit at statement date…

think they scared of giving MPD

I think we now need 8000 miles in addition to the 12k min spend per quarter for 1 limo booking. Absurd.

Is it worth it to use Cardup and pay 1.5% fee for Voyage miles?

Limo can now be redeemed online at stack

No mentioning of lack of restaurant with Dragon Pass?

Oh yes this is a good point. I will add that. In.

Is the card up payment counted as the 60k minimal spend for annual fee waiver? If it is counted, then use cardup to pay for house loan will be very easy to waive the annual fee to make the Voyage as a free card😄

Voyage card is only useful if you’re using the Premier or PPC version.

If you use it with cardup to pay income tax, that should cover your 30K minimum spend or a big chunk of it to make it a free card. Anyway, RM will most likely waive for you each year.

PPC has unlimited free limo rides to airport. Note, only to airport, and not on the way back, you’ll have to use your limo rides for that.

This is really just the card to put your luxury items on. Better cards for everything else.

thanks for the reminder of the PPC voyage limo benefit. have added a note

to be very Singaporean, technically as PPC you get a free birthday cake each year too. Ritz Carlton, 1kg cake is like 80-90 bucks 🙂

Hi, do you know if the limo ride can be booked for a different quarter than the validity period? (i.e. I have limo rides expiring end of Dec, can I use it to book for limo rides to be used for next year?)

Yes you can. For instance, if you earned the limo ride and it expires in Feb 2025, you can use it to book a limo ride in Aug 2025.

OCBC DragonPass lounge pass is valid for 2hours stay vs citi’s 3 hours for the same lounge. 🫠

Can I ise a mix of cash and voyage miles to pay for an air ticket?

I saw on Ocbc website stating that the annual fee cannot be waived at all. Did it just change recently?

I have the OCBC PPC voyage card and my RM telks me that local dining earns only 1.6 mpd and not 2.3 mpd as advertised.

Is OCBC premium voyage card is metal card?