Here’s The MileLion’s review of the DBS yuu Card, which shows that even “aunty cards” can be pretty darn exciting.

When it first launched in late 2022, this was a convoluted mess, with a confusing system of tiered rebates, headline earn rates that couldn’t actually be achieved in real life, and way too much PCK.

But to DBS’s credit, they read the room and made the necessary changes. In April 2023, the earning structure was dramatically simplified to offer an incredible (and actually-achievable) 18% rebate. yuu then launched a partnership with KrisFlyer in September 2024 which enabled cardholders to turn that 18% rebate into a whopping 10 mpd instead.

Fast forward to October 2025, and the third iteration of the card has arrived. This update further increases the bonus cap, though it also adds some extra cognitive load in the form of a higher minimum spend, and the need to transact with at least four merchants per month.

In fairness though, this is still a hugely rewarding card, which can earn enough miles for a First Class flight to Dubai each year. How many aunty cards can claim that?

DBS yuu Card DBS yuu Card |

|

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? |

|

| The DBS yuu Card offers an unbeatable 18% rebate or 10 mpd for yuu merchant spending, but it does require a bit of micromanagement to get right. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: DBS yuu Card

Let’s start this review by looking at the key features of the DBS yuu Card:

|

|||

| Apply (AMEX) | |||

| Apply (Visa) | |||

| Link your card to the yuu app with code TMCYRWM5 for 2,000 bonus yuu Points |

|||

| Income Req. | S$30,000 p.a. | Points Validity | 2 years |

| Annual Fee | S$196.20 (First Year Free) |

Min. Transfer |

200 yuu Points (56 miles) |

| Miles with Annual Fee |

N/A | Transfer Partners |

1 |

| FCY Fee | 3% (AMEX) 3.25% (Visa) |

Transfer Fee | Free |

| Local Earn | 0.14 mpd | Points Pool? | Yes |

| FCY Earn | 0.14 mpd | Lounge Access? | No |

| Special Earn | 10 mpd at yuu merchants & SimplyGo | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The DBS yuu Card comes in two flavours: American Express, and Visa. The earn rates and benefits of the two are almost identical, but there are some key differences.

- AMEX has a lower FCY fee of 3% versus 3.25% for Visa (not that you should be using either card for overseas spending, mind you)

- AMEX occasionally gets to participate in AMEX Offers such as Shop Small

- AMEX does not earn 18% rebates/10 mpd at Charge+ or Mandai Wildlife Group

- AMEX is not accepted at 7-Eleven

There’s nothing stopping you from applying for both cards. In fact, you might want to do this if you’re a big spender, since each card has its own bonus cap.

How much must I earn to qualify for a DBS yuu Card?

The DBS yuu Card has a minimum income requirement of S$30,000 per year.

If you don’t meet the minimum income requirement, you can place a S$10,000 fixed deposit with DBS and get a secured version of the card. Visit any DBS branch for further information.

How much is the DBS yuu Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | Free | Free |

| Subsequent | S$196.20 | S$98.10 |

The DBS yuu Card has an annual fee of S$196.20 for the principal cardholder, and a S$98.10 fee for each supplementary card.

The first year’s fee is waived. While DBS does not publish a specific minimum spend to waive the second and subsequent year’s fees, based on my personal experience it’s not too difficult to do.

What welcome offers are available?

The DBS yuu Card is currently offering the following welcome offers.

| Card | New | Existing |

DBS yuu AMEX DBS yuu AMEXApply |

S$300 Code: YUU300 |

N/A |

DBS yuu Visa DBS yuu VisaApply |

S$300 Code: YUU300 |

N/A |

New customers are defined as those who do not:

- currently hold a principal DBS or POSB credit card, and

- have not cancelled a principal DBS or POSB credit card in the past 12 months

All other applicants are considered existing customers.

New customers who spend at least S$800 within the first 60 days of card approval and maintain a valid DBS Pay Lah! account will receive S$300 cashback.

These offers are valid for applications submitted by 28 February 2026. The T&Cs can be found here.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 0.14 mpd | 0.14 mpd | 10 mpd on yuu merchants and SimplyGo |

non-yuu merchant spend

DBS yuu Cardholders earn an uncapped 0.5 yuu Point for every S$1 spent (0.25% rebate/0.14 mpd) in Singapore Dollars or foreign currency at non-yuu merchants. Needless to say, you should not be using this card for non-yuu spend!

All overseas transactions on the DBS yuu Card are subject to a 3% (AMEX) and 3.25% (Visa) FCY fee respectively. But since this card only awards bonus points for local yuu merchants, there’s no reason to use it overseas.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

yuu merchant & SimplyGo spend

The DBS yuu Card earns a total of 36 yuu Points per S$1 (18% rebate/10 mpd) on transactions with yuu merchants and SimplyGo, broken down as follows.

| Reward | Min. Spend | Cap |

| Base Reward 1x point per S$1* 0.5% rebate 0.28 mpd |

N/A | N/A |

| Bonus Reward 1 9x points per S$1* 4.5% rebate 2.5 mpd |

N/A | 28,800 points (S$822.86) |

| Bonus Reward 2 26x points per S$1 13% rebate 7.22 mpd |

S$800 Spend at 4x merchants |

|

| Note: For SimplyGo, Base Reward = 0.5x points per S$1, Bonus Reward 1= 9.5x points per S$1 |

||

There is no minimum spend required for the Base Reward, and Bonus Reward 1.

Bonus Reward 2 requires that cardholders meet a minimum spend of S$800 per calendar month, and transact with 4x participating merchants each calendar month.

Bonus cap

Bonus Reward 1 and Bonus Reward 2 have a combined cap of 28,800 points per calendar month, equivalent to S$822.86 of spending.

In other words, the sweet spot is to spend between S$800 and S$822.86 each month.

Remember, the bonus cap applies per card. If you have a DBS yuu AMEX and DBS yuu Visa, you can earn 10 mpd on up to S$1,645.72 per calendar month, subject to meeting a minimum spend of S$800 on each card.

The full list of yuu merchants can be found below.

| Participating Merchant | Consists Of |

| 🏪 7-Eleven |

|

| 🍵 CHAGEE |

|

| ⚡Charge+ Visa only |

|

| 🛒 Cold Storage |

|

| 🍽️ foodpanda |

|

| 🛒 Giant |

|

| 💊 Guardian |

|

| 🚕 Gojek |

|

| 📱 Singtel |

|

| 🚆 SimplyGo* |

|

| *SimplyGo is not a yuu merchant per se, but is still eligible for the bonus earn rate |

|

4x participating merchants

Bonus Reward 2 requires that DBS yuu Cardholders spend at four different Participating Merchants per calendar month.

For example, you could meet the requirement by spending with SimplyGo, Cold Storage, Giant and Guardian. However, if you were to spend at Cold Storage, CS Fresh and Jasons Deli, it would only count as one merchant (since they’re collectively under the “Cold Storage” heading).

Having to spend at four different merchants each month will present some cognitive load, but one of them can be SimplyGo, and if you’re using the yuu Card, you’re almost certainly spending with at least one yuu merchant already.

There is no minimum spend required per merchant, so you could just as easily buy one plastic bag at Cold Storage and Giant’s self check-out stations.

Regardless of whether you prefer rebates or miles, a reward of this magnitude is almost too good to be true, and you should enjoy it while it lasts!

| ❓ Isn’t the Bonus Reward supposed to end on XXX? |

|

On the yuu app, you might notice that the 36X points/18% rebates promotion is scheduled to finish at the end of the current month.

This is a placeholder date that is consistently extended by another month once the deadline comes. At the moment, the promotion is evergreen until further notice. My guess is that they want to create a sense of urgency, or to avoid overcommitting while retaining the ability to review the promotion each month. |

Can the minimum spend include non-yuu merchants?

The S$800 minimum spend can be met by any spending that is not on DBS’s general exclusions list, such as charitable donations, education, government services and utilities (see the section below on What transactions aren’t eligible for yuu Points?).

It can also include spending at non-yuu merchants, but a better question is: why would you even want to spend at non-yuu merchants in the first place?

Non-yuu transactions only earn 0.5 yuu Point per S$1, which would drag your weighted average down like a stone. Even if you’re short of the minimum spend, it would be preferable to buy grocery vouchers and spend them the following month rather than making transactions outside the yuu ecosystem.

Transaction date or posting date?

The bonus cap and minimum spend on the DBS yuu Card is enforced based on transaction date, not posting date. For example, making a transaction on 31 January 2025 will still be counted under January 2025’s bonus cap, even though the posting will likely happen in February 2025.

Which cards track spending by transaction date vs posting date?

When are yuu Points credited?

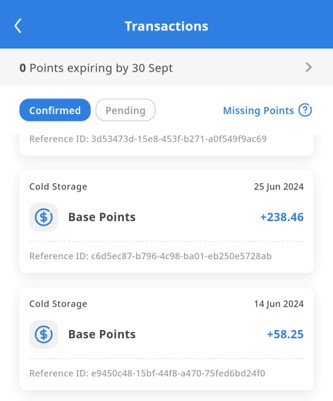

The Base Reward is credited as follows:

- yuu merchants (1x point per S$1): Same day

- SimplyGo and non-yuu merchants (0.5x points per S$1): 60 working days after the end of each calendar month

Bonus Reward 1 & 2 will be credited within 60 working days after the end of each calendar month.

How are yuu Points calculated?

Here’s how you can work out the yuu Points earned on your DBS yuu Card.

| Base Reward (1 pt per S$1) |

Multiply transaction by 1 Remember: you must present the yuu app for scanning, or link your yuu ID |

| Bonus Reward 1 (9 pts per S$1) |

Multiply transaction by 9 |

| Bonus Reward 2 (26 pts per S$1) |

Multiply transaction by 26 |

For the avoidance of doubt, there is no rounding up or down of points, and fractional points are awarded. You can see this on your yuu app, where all earnings are shown to two decimal points.

This means a transaction as small as S$0.01 would earn yuu Points!

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for yuu Points?

A full list of transactions that do not earn yuu Points can be found at point 9 of the T&Cs.

I’ve highlighted a few noteworthy categories below:

- Charitable donations

- Education

- Government institutions and services

- Hospitals

- Insurance

- Top-ups of prepaid accounts e.g. GrabPay and YouTrip

- Utilities bills

Base Rewards will also not be offered for certain items like DFI vouchers, Stage 1 milk powder and plastic bags. The full list can be found in the appendix of the T&Cs. However, you can still earn Bonus Rewards 1 & 2 on such purchases.

What do I need to know about yuu Points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| 2 years | Yes | Free |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 200 yuu Points | 1 | Instant |

Expiry

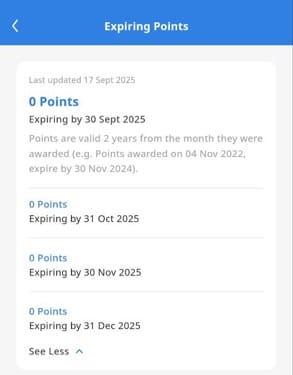

yuu Points expire two years from the date the points are awarded.

You can track the expiry of yuu Points in the yuu app, which will display how many points are expiring in the current month and following three months.

Pooling

yuu Points earned on the AMEX and Visa cards are pooled together automatically in your yuu account.

Cancelling a DBS yuu Card has no impact on the points already in your yuu account.

Partners and transfer fee

yuu Points can be transferred to Singapore Airlines KrisFlyer at the following ratio.

| Frequent Flyer Programme | Conversion Ratio (yuu Points: Miles) |

|

3.6:1 |

A minimum conversion of 200 yuu Points (56 miles) is required, but subsequent conversions can be in blocks as small as 1 mile.

All conversions are free of charge.

Transfer times

Conversions from yuu Points to KrisFlyer miles are processed instantly. This makes it a quick and easy way of topping up a KrisFlyer account, should you spot a redemption you’re keen on.

Should you opt for rebates, or miles?

With the DBS yuu Card, you’re basically choosing between 10 mpd or 18% rebates for yuu merchant spending.

On the surface, this appears to be simple maths: the cost per mile is 1.8 cents (18/10). That’s decent, though it might be on the high side for most people’s purchasing thresholds.

That’s not quite correct. It would be correct if you were dealing with a cashback card, where the rebate is offset against your monthly bill. But the yuu Card is not a cashback card. It’s a rewards card, where the points need to be offset against future spending.

Here’s a simple illustration. Suppose you spend S$800 on your yuu Card and earn 28,800 points. You now have a choice between:

- Using those points to offset S$144 of spend at a yuu merchant

- Converting those points to 8,000 KrisFlyer miles

Choosing option 1 implicitly means you forgo the opportunity to earn 1,440 miles on your next transaction at a yuu merchant (because your bill is reduced by S$144, at 10 mpd). Therefore, by choosing the S$144 offset, you’re giving up not 9,440 miles, but 6,560 miles. Based on this, the actual opportunity cost is 1.53 cents per mile.

You’ll have to decide for yourself whether that’s an acceptable price, but it’s just about my threshold where I’m equally happy to burn yuu Points as cash or convert them to miles.

Other card perks

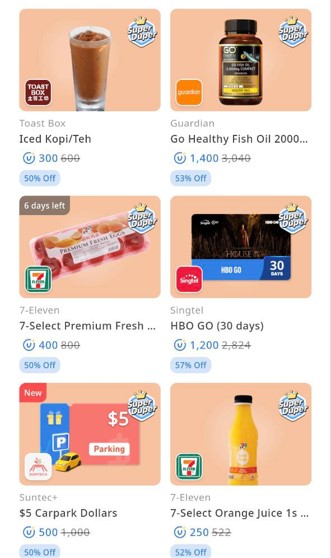

“Super Duper” redemptions

While KrisFlyer miles or paying at yuu merchants will be the primary usage of yuu Points, don’t discount the yuu catalogue entirely.

yuu releases a limited quantity of “Super Duper” rewards, which offer outsized value for your points. Recent examples include:

- S$5 Gojek voucher for 500 points

- 7-day Sports Plus for 1,000 points

- 30-day HBO Max for 1,400 points

Some of these boost the value of a yuu Point significantly; for example, the S$5 gojek voucher represents 1 cent per point, or double the usual value. I personally find the 7-day Sports Plus packages to be great value, redeeming them during tennis tournaments I want to watch instead of buying a subscription.

Refer to the article below for more on spending yuu Points.

Terms and Conditions

Summary Review: DBS yuu Card

|

|||

| Apply (AMEX) | |||

| Apply (Visa) | |||

| Link your card to the yuu app with code TMCYRWM5 for 2,000 bonus yuu Points |

|||

| 🦁 MileLion Verdict | |||

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

The DBS yuu Card offers an unbeatable 18% rebate or 10 mpd at yuu merchants, which makes it simply unthinkable to use any other card for such transactions. While you will have to hit the minimum spend each month, it should be achievable for most given the range of everyday spending categories covered: groceries, food delivery, ride-hailing etc.

Of course, the entire product is designed to draw and keep you within the yuu ecosystem, such that you default to Cold Storage for groceries, Foodpanda for food delivery, gojek for ride-hailing, Singtel for mobile connectivity, and BreadTalk for freshly-prepared soya milk. That’s a feature, not a bug, and if the reward is good enough, I think most people would be willing to change their habits.

While it’s true that the minimum spend has been hiked by 33% from S$600 to S$800, the bonus cap has also been boosted. And with many other specialised spending cards cutting their earning capacity (e.g. DBS Woman’s World Card, UOB Lady’s Solitaire Card), any extra boost is always welcome.

The upshot is that this card now has the potential to earn you ~8,223 miles per month, or 98,743 miles per year (double, if you max out both the AMEX and Visa). Just how long the gravy train continues is anyone’s guess. yuu, as you probably know by now, is bankrolled by Temasek, and sooner or later they’re going to switch the focus from acquisition to profitability. The party will end eventually, but until then, make hay and enjoy the ride.

So that’s my review of the DBS yuu Card. What do you think?

My only additional comment to this article is that if you intend to make the bulk of your purchases via the CS app, the app doesnt allow you to pay via AMEX.

Same for most Singtel kiosks. That increased sign up bonus for the AmEx comes at a cost.

If i get supp card,

Can the $600 be hit by both? or is only one counted?

Does the $600 min spend have to be within the ecosystem too or can u use it outside of Yuu merchants?

Would like to know too. Based on the website, does seem like the non-Yuu merchant spend also contributes to the $600.

https://www.dbs.com.sg/personal/cards/credit-cards/dbs-yuu-cards (see “How to earn yuu Points”).

Would like to check with anybody here that is in the know… is the S$600 target per calendar month, based on transaction date or post date?

Following to learn the same

transaction, based on the T&C

How do u link the yuu to foodpanda?

Where do you find the dbs yuu spend tracker bar?

In the yuu App, go to the “brands” tab from the bottom navigation bar.

In the brands screen, select DBS.

On the DBS screen, you can find the spend tracker

One key thing to note is, if you’re using this card for foodpanda, and you’ve used any kind of voucher/discount/pandabox, or even just been a pandapro member, you’ll not get the bonus point at all and it won’t count towards the $600 spending at yuu merchant…

oh my god. that’s why i only got base points for my foodpanda order? do you have any source for this? thanks!

Last page of their tnc:

https://www.dbs.com.sg/iwov-resources/media/pdf/cards/promotions/dbs-yuu-cards/dbs-yuu-card-promotion-tncs.pdf

Should I cancel my pandapro member then if I am already one?

Hi Aaron, apparently the base point of 10yuu points per $1 using DBS Yuu is also capped at 600. Thereafter, it will only be 2pts, 1 from yuu, 1 from DBS.

no, that’s definitely not the case. if you have missing points you should contact customer service. 5% base rebates are uncapped.

I had applied both yuu visa and Amex

I already link my yuu visa to my yuu app

How should I deal with my new yuu Amex?

Link it to another yuu account?

Every time spending with Amex , need to scan with 2nd yuu account app?

Did you figure out how that work?

link both cards to same account

What’s the capped to spend for this card?

It’s 600 which was already mentioned in the review!

Hi I cannot convert Yuu point to KF.. I wonder how. I managed to so last weekend. Do you know why?

I cant find the option to convert yuu points to KF. Can you advise where it should be?

For the term “transaction date”, please take note that it is not based on the “real transaction time in Singapore”, my transaction was done on 1st May, but in the DBS app shows 30th Apr; DBS reply as follow: Allow us to share that transactions are automatically tracked based on the time zone merchant settles transaction. and this will be counted into Apr min spending. DBS has adjusted this to May for me, but said no exception in the future, so guys, please be careful of the first and last calendar day.

I wonder why there is a time zone effect? aren’t most, if not all the vendors in SG? unless you were clocking spend for other purposes.

I used foodpanda app(this app was downloaded in SG, my apple ID is also in SG) at around 8am on 1st May in Singapore, but this weird thing happened -_-

Can I still spend on DFI vouchers and gain 35 points now?

For SimplyGo, just tapping my DBS yuu card (either physical card or Apple Pay) is enough? There is no scanning yuu QR code at the MRT like at Cold Storage and I don’t see my MRT fares reflected in the transaction list on yuu app

Same question for me. Does just tapping on bus or MRT qualify? Checking my statement for other cards there is no mention of SimplyGo on the statement when I do this. Just says “bus/mrt”.

just tap and go. nothing more to it.

Does paying my singtel bill using the card count as a transaction?

i would like to know this too. example, will my monthly broadband bill count towards the spend?

Has anyone managed to get a data point for this yet? Cheers

Doesn’t work

There seems to be some bug with the DBS app on yuu card, all the giant transactions are coded as cold storage, not sure if this will affect the 4 merchant categories

Datapoint: my transaction date was 30 Nov but posting date was 01 Dec. Per Yuu terms, eligibility is based on transaction date. But per DBS terms, bonus eligibility are based on posting date. Hence, I missed out on the 36X.

Can anyone confirm Paragon CS Fresh is a yuu merchant? On the statement, it says Paragon Market Place.

Please note that if you are using the Charge+ app and topping up credits, the default behaviour of the app is to redeem your yuu points first. You need to manually deactivate it time you top up credits.