Life would be much simpler if you could rely solely on blacklist cards, which reward you based on how you spend (i.e. mode of payment). There’s no greater joy than mindlessly tapping your UOB Preferred Platinum Visa everywhere, knowing you’re earning 4 mpd regardless (general exclusions aside).

But their limited bonus caps mean that most people will have to incorporate whitelist cards to some degree, which reward you based on what you spend on (i.e. merchant category).

| 💳 Blacklist Cards (Rewards based on mode of payment) |

💳 Whitelist Cards (Rewards based on category) |

|

|

| General rule: Bonuses awarded if MCC is not on exclusion list | General rule: Bonuses awarded if MCC is on the inclusion list |

If you’re choosing a whitelist card, I imagine you’d want to pick the one that covers the most bonus categories- which is what we’ll cover in this post.

Which card covers the most MCCs?

| Card | Bonus MCCs | Bonus Rate (Cap) |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

54 | 4 mpd S$600 per c. month* |

HSBC Revolution HSBC RevolutionApply |

51 | 4 mpd S$1.5K per c. month^ |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit CardApply |

33 | 2.4 mpd No cap% |

Maybank XL Rewards Maybank XL RewardsApply |

27 | 4 mpd S$1K per c. month@ |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

5-18 | 4 mpd S$750 per c. month# |

OCBC Rewards Card OCBC Rewards CardApply |

13 | 4 mpd S$1.1K per c. month |

Citi Rewards Card Citi Rewards CardApply |

11 | 4 mpd S$1K per s. month |

StanChart Journey Card StanChart Journey CardApply |

11 | 3 mpd S$1K per s. month |

UOB Lady’s Card UOB Lady’s CardApply |

2-10 | 4 mpd S$1K per c. month |

| *A separate cap of S$600 per c. month for offline mobile contactless payments applies ^Reduced to S$1,000 per c. month from 1 March 2026 %Min. spend of S$1K per membership year on SIA Group @Min. spend of S$500 per c. month #Two bonus categories capped at S$750 per c. month each |

||

In the table above, I’ve listed the most popular rewards cards in Singapore, and the number of MCCs on their whitelists. And yes, I know it’s probably a little oversimplistic to just compare the sheer quantity of MCCs, so I’ll also be looking at coverage for specific categories like dining and shopping later.

A few things before we get started.

First, it may surprise you to see the Citi Rewards and UOB Preferred Platinum Visa in the table, since they’re often referred to as blacklist cards. But that’s only the case if you’re spending in a specific mode (online for Citi Rewards, offline via mobile contactless for the UOB Preferred Platinum Visa). For other modes of spending, these cards switch to whitelist mode, and only award bonuses on specific MCCs.

|

|

|

| Citi Rewards | UOB Pref. Plat. Visa | |

| Blacklist Mode | Online | Offline via mobile contactless |

| Whitelist Mode | Offline | Online |

Second, the table will understate the usefulness of the OCBC Rewards and KrisFlyer UOB Credit Card, which also award bonuses for the following merchants. These bonuses are awarded based on merchant name, not MCC.

|

|

| OCBC Rewards | KrisFlyer UOB |

|

|

| ^Amazon and Mustafa Centre transactions under MCC 5411 are not eligible to earn any OCBC$ *Shopee Pay transactions under MCC 5262 are not eligible to earn any OCBC$ |

|

Third, it gets a bit tricky counting MCCs for airlines, hotels and car rentals, because certain companies have their own MCCs, while others fall under a catch-all MCC.

- Airlines code as 3000 to 3350 (individual companies), or 4511 (others)

- Car rentals code as 3351 to 3500 (individual companies), or 7512 (others)

- Hotels code as 3501 to 3999 (individual companies), or 7011 (others)

Since counting individual company MCCs would overstate the coverage (as other MCCs cover multiple companies, not just one), I’ve decided to consider these ranges as just one MCC. For example, if a card covers 3000-3350, I will count the entire range as one. If it covers 3000-3350 and 4511, I will count it as two.

Fourth, it’s worth noting that the StanChart Journey Card only earns bonuses on whitelisted MCCs if transactions are made online, in SGD, while the KrisFlyer UOB Credit Card will only award bonuses for shopping MCCs if they’re transacted online.

Fifth, where the UOB Lady’s Cards are concerned, MCC coverage depends on which bonus categories you choose.

| Category | No. of MCCs |

| Beauty | 6 |

| Dining | 4 |

| Entertainment | 3 |

| Family | 2 |

| Fashion | 10 |

| Transport | 5 |

| Travel | 8 (Not explicitly listed in the T&Cs, but I previously managed to confirm it) |

Therefore, a UOB Lady’s Cardholder (1x bonus category) could cover 2-10 MCCs, while a UOB Lady’s Solitaire Cardholder (2x bonus categories) could cover 5-18 MCCs.

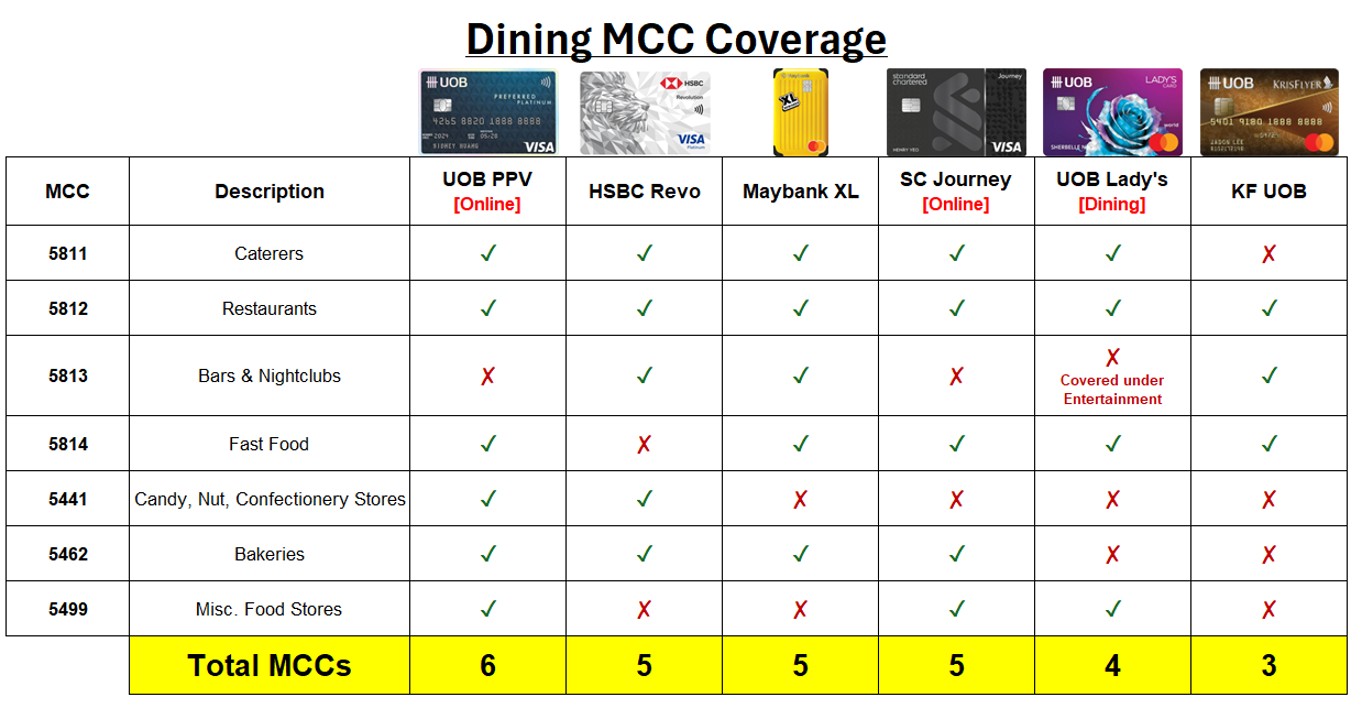

Dining

Within the Dining category, the UOB Preferred Platinum Visa has the widest MCC coverage (and remember, if you’re spending offline then it becomes a blacklist card).

Joint second are the HSBC Revolution, Maybank XL Rewards Card and StanChart Journey, and while they’re tied on MCCs, they differ in important ways. The HSBC Revolution excludes MCC 5814 Fast Food, and even if you don’t care for Burger King, KFC or McDonald’s, 5814 can be used by non-fast food restaurants like Cafe Nesuto and Baker & Cook. It’s also used by food delivery platforms like Grab and Deliveroo.

While the Maybank XL Rewards Card does cover 5814, it also requires a minimum spend of S$500 a month for bonuses to be triggered (versus no minimum spend for the Revolution), with a lower monthly bonus cap of S$1,000 (versus S$1,500 for the Revolution).

Shopping

For the shopping category, the HSBC Revolution and UOB Preferred Platinum Visa offer the most MCC coverage by far (it’s somewhat ironic that despite being marketed as shopping cards, the OCBC Rewards, Citi Rewards and UOB Lady’s Card have scant coverage of this category!).

While shopping encompasses a wide range of MCCs, the most useful one is arguably 5311, which is whitelisted by all seven cards. This is how HeyMax gift card purchases code, which means you can use it as an “MCC switcher”. For example, Deliveroo would normally code as MCC 5814 for transactions made directly, but buying a gift card via HeyMax switches it to 5311, effectively letting you use a shopping card for dining.

|

|

| Sign up here | |

|

|

Another important MCC is 5947, which is used by gift card retailer Wogi. Wogi stocks eCapitaVouchers, so if your card awards bonuses for MCC 5947, it can effectively earn bonuses at any voucher-accepting shop within a CapitaLand Mall.

|

|

|

|

5947 is whitelisted by the HSBC Revolution, UOB Preferred Platinum Visa and KrisFlyer UOB Credit Card.

Finally, don’t forget MCC 5999, which is used by Atome. Atome doesn’t just help with cashflow, it also allows you to break up larger transactions into smaller amounts that better utilise your bonus caps, while standardising the MCC. Just like 5947, 5999 is whitelisted by the HSBC Revolution, UOB Preferred Platinum Visa and KrisFlyer UOB Credit Card.

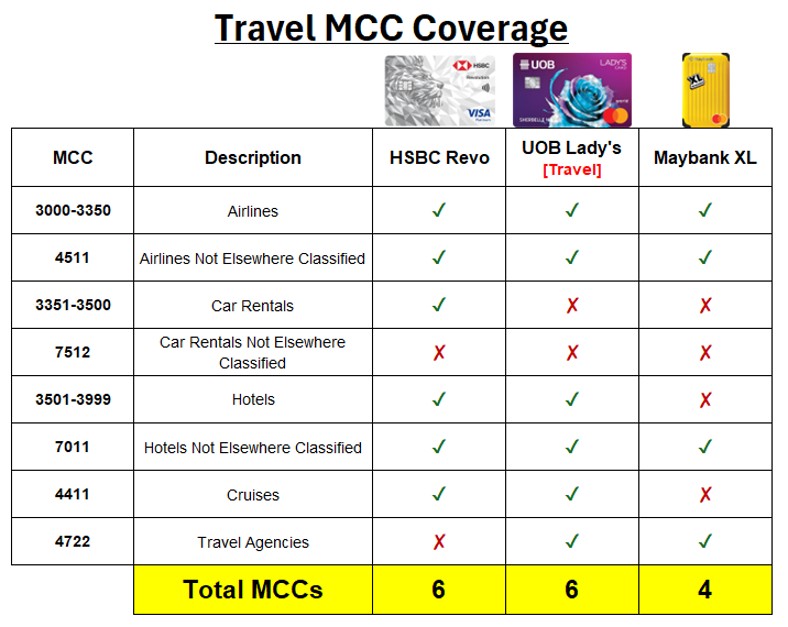

Travel

When it comes to travel, I’d say the HSBC Revolution wins this category, with coverage for airlines, car rentals, hotels, and cruises. The key thing missing here is travel agencies, which rules out Agoda, Hotels.com, Expedia, Klook, Pelago, Trip.com etc. (but there is some potential here for MCC switching via HeyMax and Wogi, as mentioned in the Shopping section).

Do remember that this is only a temporary state of affairs, however. The bonuses for travel-related and in-person contactless spending are currently set to lapse on 28 February 2026 (though a further extension isn’t out of the question).

If you don’t rent cars, however, then the UOB Lady’s Card with the Travel category selected would get the job done. The main issue here would be its relatively low bonus cap of S$1,000 per month, which may not be enough to cover big-ticket travel purchases.

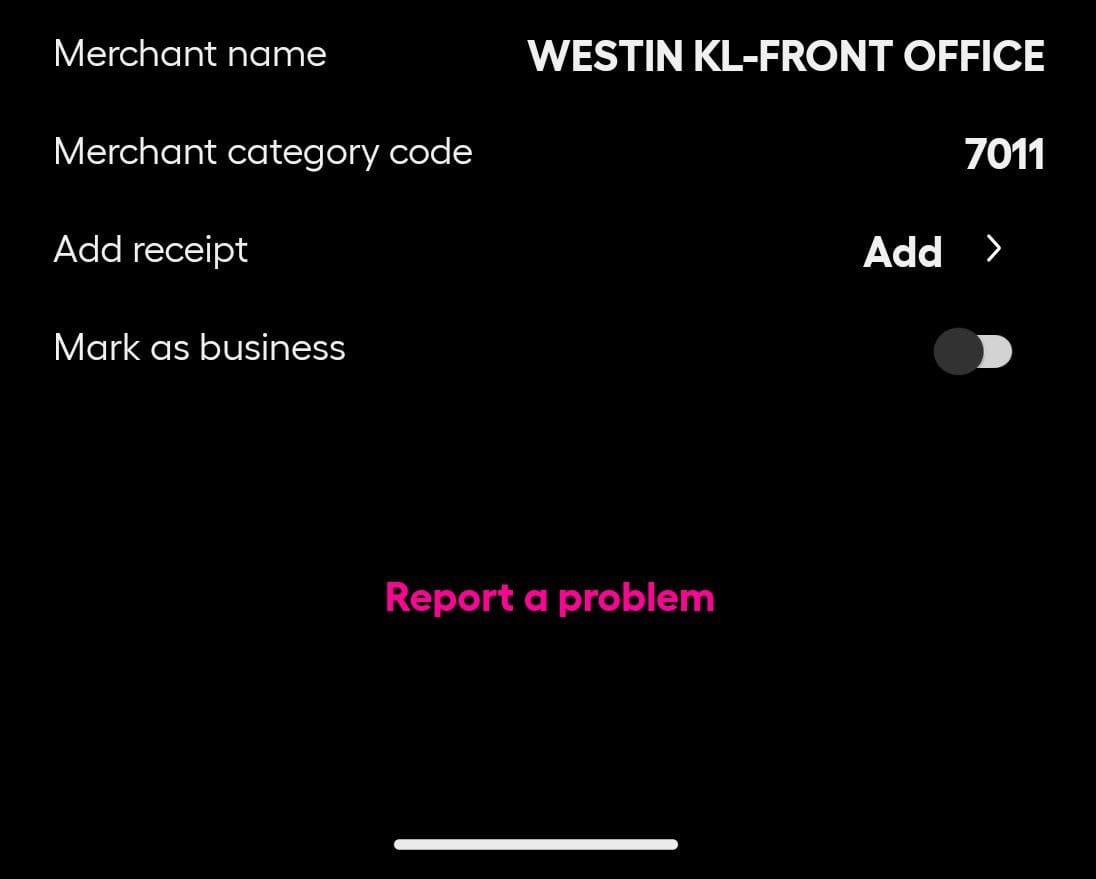

Is the Maybank XL Rewards Card’s omission of the hotel MCC range a dealbreaker? Perhaps not. Just because a hotel is part of a chain doesn’t guarantee it will code under the chain’s corresponding MCC in the 3501-3999 range. As shown in the screenshot below from the Westin Kuala Lumpur, it’s possible for chain hotels to code as 7011. In fact, I’ve seen this happening more often than not, so 7011 is arguably more useful to include.

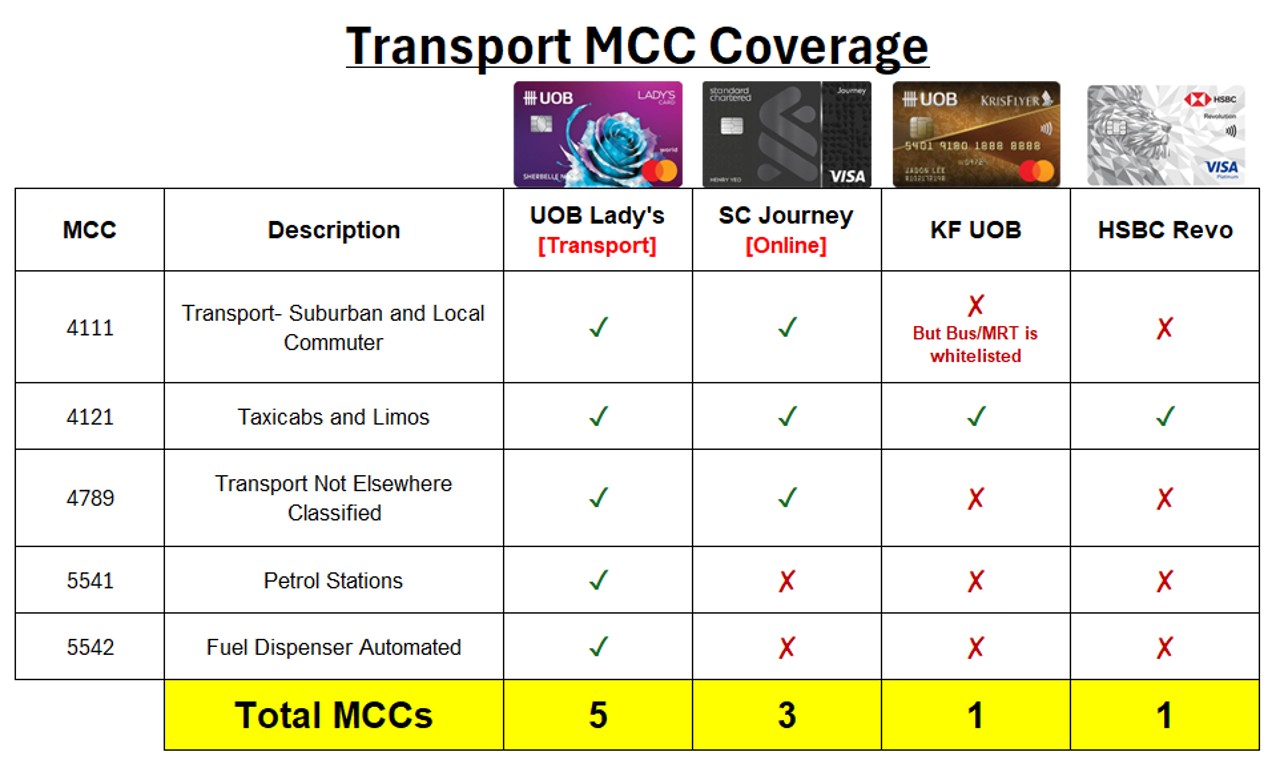

Transport

The UOB Lady’s Card (with the Transport category selected) offers the widest coverage for transportation-related expenses, including both public transport and private car petrol.

Otherwise, all four cards whitelist MCC 4121, which means that at the very least, you’ll earn bonuses for taxis, Grab, Gojek, and other ridehailing apps.

SimplyGo Bus and MRT rides are also a reliable bonus category for all but the HSBC Revolution. While the KrisFlyer UOB Credit Card does not explicitly whitelist MCC 4111, it does whitelist the Bus/MRT transaction description (which is how SimplyGo rides code). However, if you’re riding public transport in another country, you won’t earn any bonuses.

As an aside, I’m slightly surprised that electric vehicle charging (MCC 5552) has yet to become a common bonus category. The only two cards which actively reward this are the StanChart Smart Card and DBS yuu Card (only for Charge+).

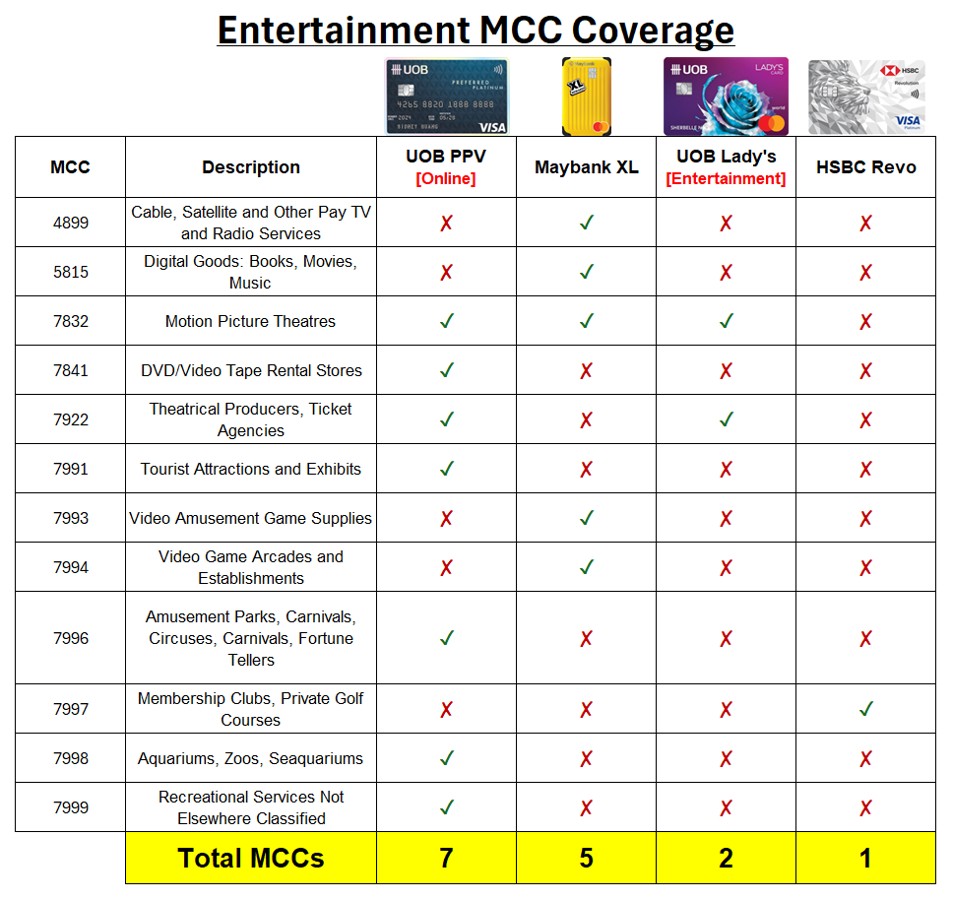

Entertainment

The UOB Preferred Platinum Visa comes out tops in the entertainment category, with bonuses for cinemas, theatres, and tourist attractions of various kinds.

A close second is the Maybank XL Rewards Card, which also covers streaming subscription services like Amazon Prime, Netflix, Disney+ under MCC 4899.

While the HSBC Revolution doesn’t have much coverage here, don’t underestimate the usefulness of MCC 7997. This is the MCC used for gyms like Anytime Fitness, Fitness First, and BFT. It’s also the MCC used for ALL Accor+ Explorer membership purchases.

Which MCCs are the most important to cover?

While I realise this is a very subjective question, my preference would be that my card covers the following MCCs.

- MCC 5812, 5814, 5499: For dining out and food delivery

- MCC 5311: For HeyMax vouchers

- MCC 5947: For Wogi gift cards

- MCC 5999: For Atome purchases

Anything more is just a bonus. With 5311/5947 alone, I can already cover many dining, travel, shopping, entertainment, grocery, transport and petrol merchants, to the extent they sell gift cards on HeyMax or Wogi.

Conclusion

In an ideal world, you’d just stick to blacklist cards for everything, but if you’re looking for the widest MCC coverage, then the HSBC Revolution and UOB Preferred Platinum Visa (for online spend) would be good choices.

Of course, not all MCCs are equally useful, so it’s not just about quantity. It’s a good idea to analyse your most common spend categories, and get a card with good coverage for those MCCs.

Which MCCs do you think are the most important to cover?

Just wondering, why wasn’t the DBS woman’s card taken into consideration?

because it has no “whitelist mode”.

Why UOB vs is not mentioned here?

again- no whitelist mode, save for petrol

There is no more foodpanda vouchers for purchase on HeyMax 🙁

I think SC Journey whitelists mcc 5462 and 5499 as well for online dining

have corrected that, thanks

Taobao apps – MCC code is 5999