Here’s The MileLion’s review of the Standard Chartered Visa Infinite, which not too long ago was destined for the scrap heap of history. Marketing was discontinued, applications were closed, and rumours said that the X Card would now become the bank’s flagship offering.

-dramatic pause-

Well, we all know how that turned out. Barely one year later, applications reopened and the Standard Chartered Visa Infinite slid back into the portfolio like nothing ever happened. And, in a stroke of delicious irony, it was the X Card which got sent to the junk pile instead.

Here’s the thing though: the Standard Chartered Visa Infinite may have won the internal battle for card supreme, but on the industry level, it’s far from a winner.

Standard Chartered Visa Infinite Standard Chartered Visa Infinite |

|

| 🦁 MileLion Verdict | |

| ☐ Take It ☐ Take It Or Leave It ☑ Leave It |

|

| What do these ratings mean? |

|

| Tax payment facility and overseas spending aside, there’s not many reasons to hold a Standard Chartered Visa Infinite. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: Standard Chartered Visa Infinite

Let’s start this review by looking at the key features of the Standard Chartered Visa Infinite.

|

|||

| Apply Here | |||

| Income Req. | S$150,000 p.a. | Points Validity | No expiry |

| Annual Fee | S$594 |

Min. Transfer |

25,000 points (10,000 miles)* |

| Miles with Annual Fee |

35,000 (first year only) |

Transfer Partners |

|

| FCY Fee | 3.5% | Transfer Fee | S$27 |

| Local Earn | Up to 1.4 mpd | Points Pool? | Yes |

| FCY Earn | Up to 3 mpd |

Lounge Access? | Yes : 6x Priority Pass |

| Special Earn | N/A | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

| *For KrisFlyer; for other programmes 1,000 miles/points |

|||

Standard Chartered actually has two different Visa Infinite cards: a brown card for the general public and priority banking customers, and a blue card for priority banking customers only.

The brown Visa Infinite card, which is the focus of this review, offers better earn rates. However, the blue Priority Visa Infinite card offers as many as 12 lounge visits per year (and until recently it was 24!), provided the cardholder meets the minimum AUM.

Surprisingly for a $120K card, the Visa Infinite comes in standard plastic cardstock. No reassuring metal clang here!

How much must I earn to qualify for a Standard Chartered Visa Infinite?

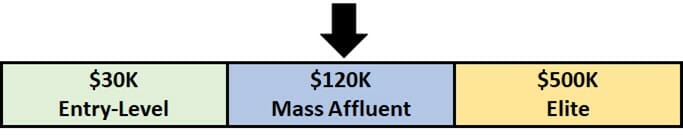

The Standard Chartered Visa Infinite has a S$150,000 p.a. income requirement, which is 25% higher than the usual S$120,000 you’d expect for cards in its weight class. It’s not clear how strictly Standard Chartered enforces this requirement, though I have heard anecdotal reports that they’ll let in anyone pulling at least S$80,000 per year.

The income requirement is reduced to just S$30,000 p.a. if you’re a StanChart Priority Banking customer. This requires a minimum AUM of S$250,000.

How much is the Standard Chartered Visa Infinite’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$594 | Up to five cards free |

| Subsequent | S$594 | Up to five cards free |

The Standard Chartered Visa Infinite has an annual fee of S$594, which will increase to S$599.50 from 1 January 2024 due to the GST hike. Up to five supplementary cards are free for life.

No fee waivers are offered for this card, regardless of how much you spend per year.

Cardholders receive a welcome gift of 35,000 miles, but this only applies in the first year. Officially, there are no miles offered for renewal. I say “officially” because I’ve read reports that those who call in to appeal are sometimes placated with 25,000 miles. That wouldn’t be enough to retain me, quite frankly, but at least it’s something.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| Up to 1.4 mpd | Up to 3 mpd | N/A |

SGD/FCY Spend

Standard Chartered Visa Infinite Cardholders normally earn:

- 2.5 points for every S$1 spent in Singapore Dollars

- 2.5 points for every S$1 spent in foreign currency (FCY)

5 points are worth 2 airline miles, so that’s an equivalent earn rate of 1 mpd for local and overseas spend. Needless to say, that’s extremely underwhelming- even the much-maligned BOC Elite Miles Card does better!

The picture improves if cardholders spend at least S$2,000 per statement month. In that case, they’ll earn:

- 3.5 points for every S$1 spent in Singapore Dollars

- 7.5 points for every S$1 spent in foreign currency (FCY)

This works out to 1.4 mpd for local and 3 mpd for overseas spend. For avoidance of doubt, this applies to all spend from the first S$1 onwards, not just the incremental spend above S$2,000.

Provided you’re consistently able to meet the minimum spend, this would be the highest-earning card in the $120K segment.

| 💳 Earn Rates for General Spending Cards (income req.: S$120K) |

||

| Card | Local Spend | FCY Spend |

SCB Visa Infinite SCB Visa Infinite |

Up to 1.4 mpd* |

Up to 3 mpd* |

DBS Vantage DBS Vantage |

1.5 mpd | 2.2 mpd |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd | 2.2 mpd |

HSBC Visa Infinite HSBC Visa Infinite |

Up to 1.25 mpd^ |

Up to 2.25 mpd^ |

UOB VI Metal Card UOB VI Metal Card |

1.4 mpd | 2.4 mpd |

Citi Prestige Citi Prestige |

1.3 mpd | 2 mpd |

Maybank Visa Infinite Maybank Visa Infinite |

1.2 mpd | 2 mpd |

AMEX Plat. Reserve AMEX Plat. Reserve |

0.69 mpd | 0.69 mpd |

| *Min. S$2,000 spend per statement month, otherwise 1 mpd for both SGD and FCY ^From second year onwards, with min S$50,000 spend in the previous membership year, otherwise (or if first year) 1 mpd (SGD) and 2 mpd (FCY) |

||

Is that reason enough to get a Standard Chartered Visa Infinite? Well, if you staunchly insist on using one card for everything and spend big on FCY transactions, maybe. But keep in mind that its star attraction — 3 mpd for overseas spend — comes with a hefty 3.5% FCY fee, the highest in the market.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

Considering you could earn 4-6 mpd on overseas spend by pairing the right card with Amaze and paying an implicit FCY fee of ~2%, it’s harder to swallow.

But what if you’re a big spender and regularly bust the 4-6 mpd caps? Even so, I’d argue the Maybank Horizon Visa Signature Card is a better option. Cardholders can earn an uncapped 3.2 mpd on FCY spend:

- Until 31 January 2024, if your card was approved before 1 November 2023

- For the month of approval + 3 full calendar months, if your card was approved from 1 November 2023 to 31 March 2024

The earn rate drops to 2.8 mpd after that, but given the FCY fee of 3.25%, it’s still a better option than the StanChart Visa Infinite in my book.

|

|

|

| SCB VI | MB Horizon | |

| FCY Earn | 3 mpd | 2.8mpd /3.2 mpd |

| Min. Spend | S$2,000 per s. month | S$800 per c. month |

| FCY Fee | 3.5% | 3.25% |

| Cost Per Mile | 1.17 | 1.16/1.02 |

When are 360° Rewards Points credited?

Points are credited when your transaction posts, which generally takes 1-3 working days.

How are 360° Rewards Points calculated?

Here’s how you can work out the 360° Rewards Points earned on your Standard Chartered Visa Infinite Card:

Regular rate (Monthly spend <S$2K)

| Local Spend (2.5x) | Multiply transaction by 2.5, then round to nearest whole number |

| FCY Spend (5x) |

Multiply transaction by 2.5, then round to nearest whole number |

The minimum spend to earn points would be S$0.20 (local & FCY).

Regular rate (Monthly spend ≥S$2K)

| Local Spend (3.5x) | Multiply transaction by 2.5, then round to nearest whole number. Multiply transaction by 1, then round to nearest whole number. Add both numbers |

| FCY Spend (7.5x) |

Multiply transaction by 2.5, then round to nearest whole number. Multiply transaction by 5, then round to nearest whole number. Add both numbers |

The minimum spend to earn points would be S$0.20 (local) and S$0.10 (FCY).

For what it’s worth, Standard Chartered has a more forgiving rounding policy than banks like OCBC and UOB, which enables the Standard Chartered Visa Infinite Card to outperform ostensibly higher-earning cards for smaller transactions- even if you’re on the regular rate!

An illustration is provided below.

If you’re an Excel geek, here’s the formulas you need to calculate points:

Regular rate

| Local Spend | =ROUND(X*2.5,0) |

| FCY Spend |

=ROUND(X*2.5,0) |

| Where X= Amount Spent |

|

Step-up rate

| Local Spend | =ROUND(X*2.5,0) + ROUND(X*1,0) |

| FCY Spend |

=ROUND(X*2.5,0) + ROUND(X*5,0) |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for 360° Rewards Points?

A full list of transactions that do not earn transactions can be found in the T&Cs at point 6.

I’ve highlighted a few noteworthy categories below:

- Charitable Donations

- Education

- Government Services

- GrabPay and YouTrip top-ups

- Insurance Premiums

For avoidance of doubt, CardUp transactions will earn points. Standard Chartered is also one of the rare few banks which still offers points for utilities payments, so enjoy it while it lasts.

What do I need to know about 360° Rewards Points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| No expiry | Yes (but it’s complicated) |

S$27 (per conversion) |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| Varies | 10 | 1-3 working days (for KF) |

Expiry

360° Rewards Points earned on the SCB Visa Infinite Card never expire, so long as the card account remains active.

Pooling

This is complicated, so bear with me.

If you are converting points to any programme other than KrisFlyer, 360° Rewards Points pool, end of story.

If you are converting points to KrisFlyer:

- Points earned Visa Infinite cards and the Journey card pool

- Points earned on non-Visa Infinite cards pool

In case you’re wondering why the Journey gets to party with the Visa Infinite cards, it’s purely a legacy reason. Remember, the former X Card was a Visa Infinite, so Standard Chartered could hardly “downgrade” all legacy X Card points by putting them on the same scheme as the non-Visa Infinite.

It used to be the case that all Standard Chartered points pooled, so a cardmember with a non-Visa Infinite card could apply for a Visa Infinite card to “enhance” the value of his non-Visa Infinite points (they enjoy a favourable conversion ratio, as you’ll see below). That is no longer possible.

Transfer Partners & Fees

Standard Chartered has 10 different airline and hotel transfer partners, one of the widest ranges in Singapore.

| Frequent Flyer Programme |

Conversion Ratio (SC Points: Partner) |

|

| Visa Infinite & Journey | Non-Visa Infinite | |

|

25,000 : 10,000 | 34,500 : 10,000 |

| 2,500 : 1,000 |

||

| 2,500 : 1,000 |

||

| 2,500 : 1,000 |

||

| 2,500 : 1,000 |

||

| 3,000 : 1,000 |

||

| 3,500 : 1,000 |

||

| 3,500 : 1,000 |

||

|

3,500 : 1,000 |

|

| 5,000 : 1,000 |

||

Transfers cost S$27 each, regardless of the number of points transferred.

While I appreciate the transfer partner variety, the transfer ratios for Etihad Guest, Qatar Privilege Club, United MileagePlus and Emirates Skywards are not very attractive. Using Emirates as an example, your effective earn rate would be just 0.71 mpd on local spend (assuming the S$2,000 minimum spend is not met).

That’s not the only problem. Standard Chartered has the most confusing rewards redemption system of any bank in Singapore, period. Yes, I’d go so far as to say that even Bank of China has it better.

Standard Chartered’s 360° Rewards & EasyRewards: A hot steaming mess

Because of the way the system is set up, some people go away thinking:

- StanChart no longer offers transfers to KrisFlyer, or

- StanChart no longer offers transfers to anything but KrisFlyer

What’s going on is that StanChart has two different rewards portals:

- SC 360° Rewards (for KrisFlyer only)

- SC EasyRewards (for all other partners)

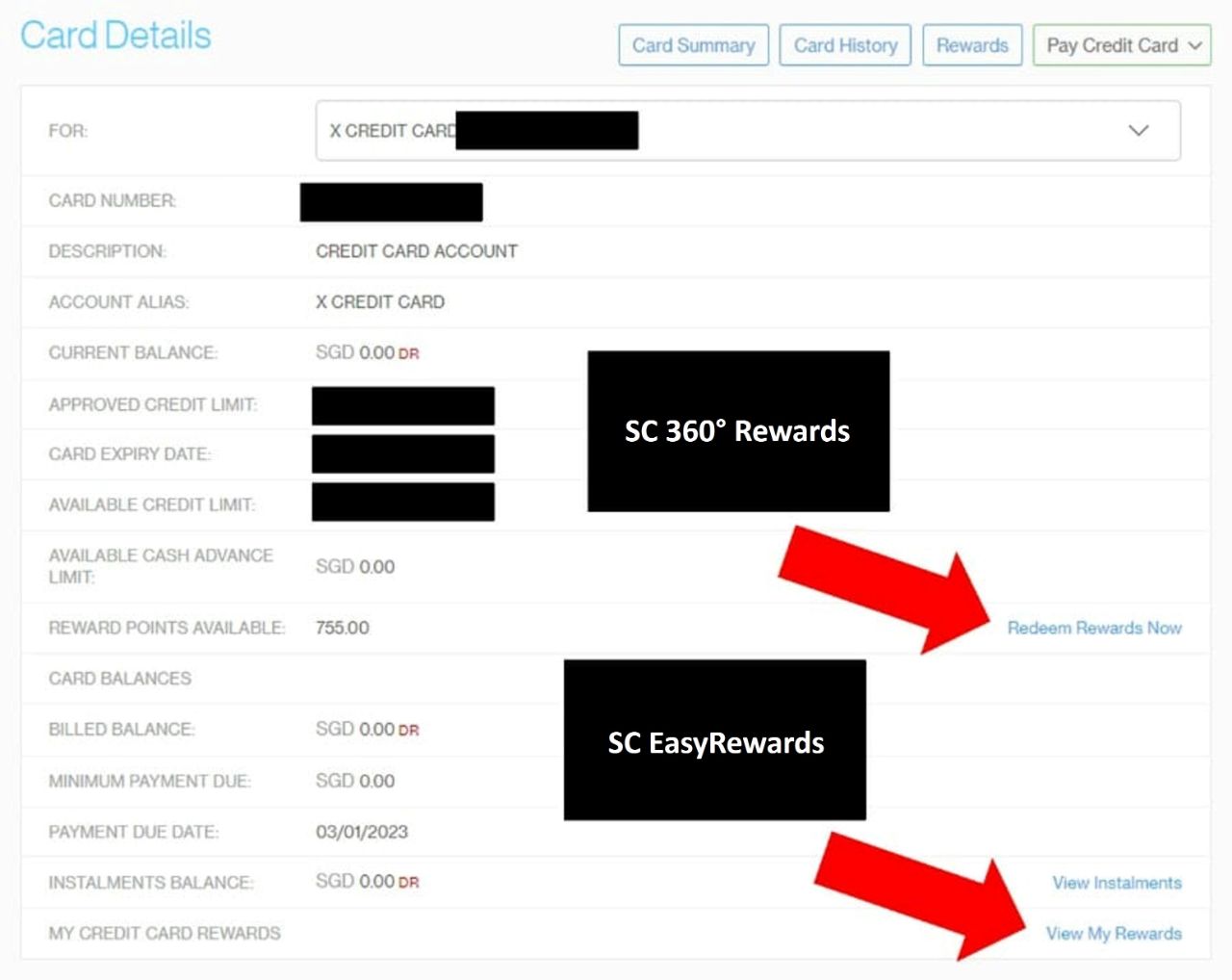

Both portals can be accessed through the desktop online banking platform.

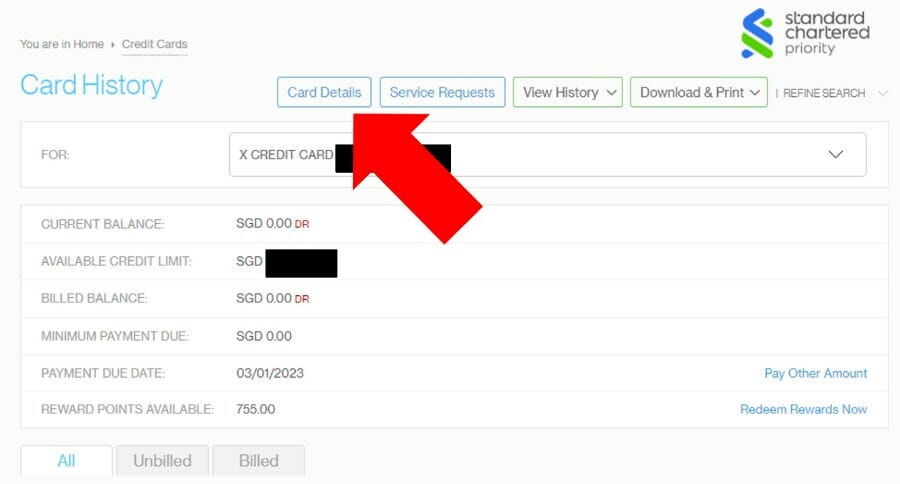

First, navigate to your credit card and click on the ‘Card Details’ button.

You’ll then see two options:

- Redeem Rewards Now (which brings you to SC 360° Rewards)

- View My Rewards (which brings you to SC EasyRewards)

You don’t need to tell me this is confusing. If you must use two different rewards portals, why not change the labels to make it clearer what’s found where?

Ah, StanChart. Never change.

Transfer Time

Conversions to KrisFlyer miles are generally completed within 1-3 working days.

Other programmes should be completed instantly or within a day, except for Accor Live Limitless, where you will need to wait up to 5 working days.

Other card perks

Six complimentary lounge visits

|

| Registration |

Standard Chartered Visa Infinite Card cardholders enjoy six complimentary lounge visits per membership year, courtesy of Priority Pass. A guest fee of US$35 applies after the free visits have been exhausted, and this benefit is only available to the principal cardholder.

As far as cards in the $120K segment go, this is woefully uncompetitive. In fact, it would be the second worst option, if not for the Maybank Visa Infinite’s decision to set the bar even lower!

| 💳 Airport Lounge Benefits (income req.: S$120K) |

|||

| Card | Lounge Network | Free Visits (Per Year) |

|

| Main | Supp. | ||

HSBC Visa Infinite HSBC Visa Infinite |

LoungeKey | ∞ | ∞ |

OCBC VOYAGE OCBC VOYAGE |

Plaza Premium | ∞ | ∞ |

Citi Prestige Citi Prestige |

Priority Pass | ∞ + 1 guest | N/A |

UOB VI Metal Card UOB VI Metal Card |

Dragon Pass | ∞ + 1 guest | N/A |

DBS Vantage DBS Vantage |

Priority Pass | 10 | N/A |

SCB Visa Infinite SCB Visa Infinite |

Priority Pass | 6 | N/A |

Maybank Visa Infinite Maybank Visa Infinite |

Priority Pass | 4 | N/A |

AMEX Plat. Reserve AMEX Plat. Reserve |

N/A | N/A | N/A |

For what it’s worth, lounge visits can be shared with guests, so if a cardholder always brings a +1, he/she would be able to visit the lounge three times in total.

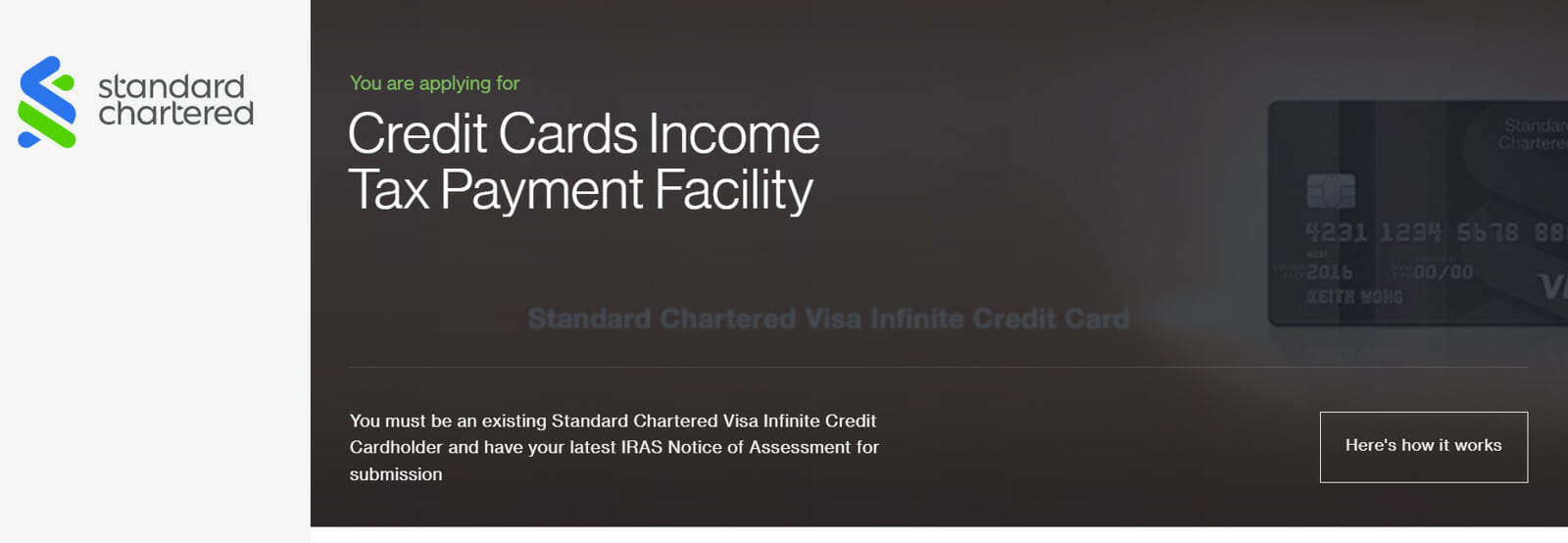

Tax payment facility

|

| Tax Payment Facility |

| The tax payment facility is not available to SC Priority Banking Visa Infinite, SC Journey or SC X Cardholders |

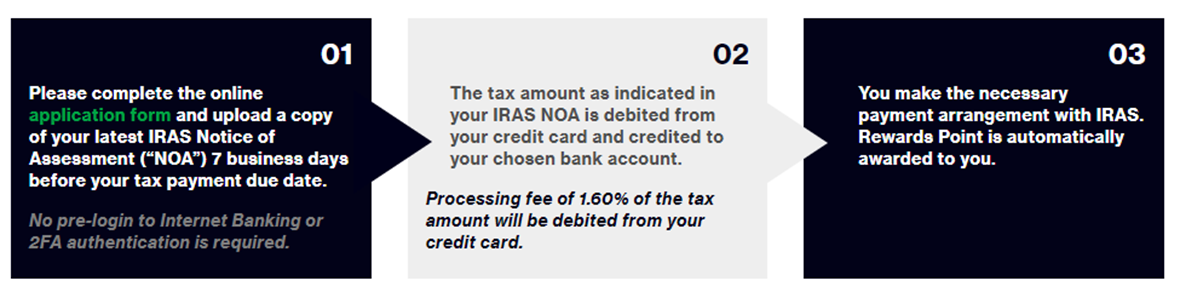

For a card so short on benefits, the income tax payment facility is arguably the Standard Chartered Visa Infinite’s ace in the hole.

Here’s an illustration of how it works, for a cardholder with a S$10,000 tax bill:

- Cardholder completes an online application form and uploads a copy of their IRAS NOA

- S$10,160 is charged to his Standard Chartered Visa Infinite Card (S$10,000 tax due + S$160 admin fee @ 1.6%)

- S$10,000 will be deposited into his designated bank account within seven business days

- He uses the funds to pay IRAS

Now step (4) is obviously optional. Whether or not you pay IRAS with those funds credited in step 3 is your business. You’re perfectly at liberty to keep your current GIRO payment plan, or even use another bill payment platform like Citi PayAll or CardUp to buy more miles while paying IRAS.

Given a 1.6% admin fee and a 1.4 mpd earn rate, you’re paying 1.14 cents per mile. I’ve confirmed with a Standard Chartered spokesperson that any amounts charged to the tax payment facility will count towards the S$2,000 minimum spend required to trigger the 1.4 mpd earn rate.

This is an excellent price; the catch is that you’re limited by the amount stated on your NOA. In our example of a taxpayer with a S$10,000 bill, the maximum miles he can buy is 14,000 (@ 1.4 mpd). Even if you’re more of a whale, a S$50,000 tax bill would yield 70,000 miles- not even enough for a one-way Business Class ticket to Europe!

For what it’s worth, you can’t pay someone else’s tax bill, but supplementary cardholders are also allowed to use the same tax payment facility.

FAQs for the tax payment facility can be found here.

Complimentary travel insurance

| Accidental Death | S$1,000,000 |

| Medical Expenses | S$50,000 |

| Others | Delayed Luggage: S$1,000 Lost Luggage: S$5,000 |

| Policy Wording | |

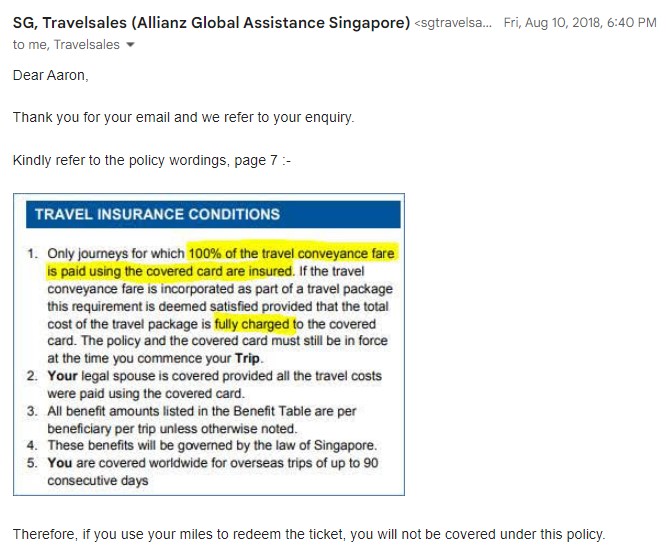

Standard Chartered Visa Infinite Cardholders enjoy complimentary travel insurance underwritten by Allianz.

This includes up to S$1,000,000 coverage for death and total permanent disability, S$100,000 emergency medical evacuation, S$50,000 overseas medical expenses, S$5,000 for lost baggage and S$1,000 for delayed baggage.

Do note there is no coverage for trip cancellation and disruption, delayed flights, rental car excess, or personal liability. I personally would not feel comfortable without this, so I’d recommend you purchase additional coverage regardless.

Coverage is automatically activated when the full airfare is charged to the card. Allianz has previously clarified that coverage does not apply to award tickets, unfortunately.

Visa Infinite benefits

Standard Chartered Visa Infinite cardholders enjoy the following additional perks, provided by Visa:

- Avis President’s Club status

- 50% off weekday golf at 50 participating golf clubs across Southeast Asia

- 50% off weekday golf at Sentosa Golf Club

- Visa Luxury Hotel Collection

Terms & Conditions

Summary Review: Standard Chartered Visa Infinite

|

|||

| Apply Here |

The way I see it, the Standard Chartered Visa Infinite has two things going for it:

- Its 3 mpd FCY earn rate

- Its tax payment facility

(1) is only attractive if you’ve maxed out the 4-6 mpd possibilities with other cards, and don’t mind paying a higher-than-average 3.5% FCY fee. Even so, I think the Maybank Horizon Visa Signature is a better option, given its lower 3.25% FCY fee and three-year fee waiver.

(2) is one of the lowest cost ways of earning miles, but you’re effectively capped by your NOA.

Since the rest of the benefits are so lacklustre, this is really a “buy miles” kind of card. Outside the first year and its 35,000 miles welcome bonus, I’m not sure whether you could generate enough miles to justify the S$594 annual fee.

And even if you wanted to buy miles, then the Citi Prestige and its PayAll facility may be more your speed, with regular promotions that bring down the cost of miles significantly.

Maybe the X Card should have won, eh?

Aaron, Which priority banking in Singapore that you think offer the best travel and miles benefit?

Hi. I have this card. Can’t say its for everyone but it’s a keeper for me. Anyway, I get 50,000 points i.e. 20,000 miles automatically every year on renewal. I called once long ago and was told it was automatic. Since then I haven’t called and just check the points after my renewal month. Has always been credited without fail every year. Just got the annual points again about 2 months ago – I didn’t call in. I believe it is the same for some other card holders.

The article is not very accurate. For me the annual fee was waived easily through mobile banking recently. The supplementary cards are not free contrary to the article. At least that’s what the RM told me a few months ago.

the website states very clearly: This annual fee is strictly non-waivable.

if your personal experience is different, that’s great. but it’s certainly not official policy, and people can’t expect the same to happen for them.

likewise, the website states that up to five supplementary cards are provided free (https://www.sc.com/sg/pricing-guide/#table-content-610040-8)

It is possible that John might be referring to the Priority Banking SCB VI card (blue card) since he has an RM – unless he specifically asked for the non-PB version of the VI card. The blue card has a waivable $324/$327 AF for a year but the supplementary cards are chargeable thereafter (so his RM is correct). I’ve heard that some PB clients get waived subsequent years on request and maybe with some minimum AUM/spend criteria but I’ve never bothered with this version anyway since it earns 1mpd, doesn’t have the IRAS facility and I get free lounge entries… Read more »

yup- if you can get guaranteed renewal miles each year, then someone with a high enough NOA could potentially generate enough miles to make it worthwhile. keep in mind, however, that we’re talking a very sizeable NOA, well in excess of an income of $150k per year.

You’re right. The only effort needed is to remember to do the 5-minute online IRAS facility once a year. I just do it when I see my online NOA. All the IRAS miles for NOA>84K will generate value at 0.36 cpm (at 1.5cpm redemption value). No other card has a simple non-promotion uncapped value like this (except maybe the 2 cards with bonus free hotel nights).

Do you also a priority private client with significant credit card spending so they offer fee waiver?

Hi Aaron, thank you for the wonderful information. I am new to the Miles game and would like to seek your advise on which cc to use for furniture purchases (Aircon/fridge/Sofa) at Harvey Norman, Courts, Gain City as well as Shopee/Lazada. Many thanks in advance!