Unless you’ve been hiding under a rock of some sort, you’ll know that Citibank is running quite the promotion right now with Apple Pay, which lets you earn 8 mpd with the Citibank Rewards, Citibank Prestige and Citibank Ultima cards until 31 July 2018. With no cap.

How they’re paying for this promotion is a mystery to me, but I believe it was Wordsworth who said “screw that, get me an iPhone”. Make hay while the sun shines and all that, and the interweb is positively abuzz with people figuring out how they can front load their spending before 31 July 2018. I’ve been receiving many questions about this, so I thought I’d come up with an article.

Can I just say one thing before we start? As with all promotions, this should not be an enticement for you to spend money you do not have. Sure, front load some of your expenditure if you can, but spending money you don’t have for the sake of chasing miles is dumb. If you choose to go down the buying gift cards route, remember also the opportunity cost in terms of foregone interest. Do your homework, be smart and come to your own conclusion based on your circumstances.

Clear? Ok, let’s go. Many thanks to the good folks in The Milelion’s Telegram Group for freely sharing their ideas!

Grocery Vouchers

This is a fairly obvious one. You can buy NTUC vouchers or Dairy Farm vouchers (which can be used at Cold Storage, Giant, Jasons, Guardian and 7-Eleven) with Apple Pay, and gradually use them over the course of a year.

I believe NTUC vouchers are valid for 2 years upon issuance, and you can buy a maximum of $5,000 at one go (nothing stopping you from breaking this up into more transactions of course).

I suspect some people will be buying to liquidate, and on Carousell I see NTUC vouchers going for about a 5% discount. That’s still decent-ish for the seller, insofar as it means buying miles at 0.63 cents each. You can expect to see a glut of grocery vouchers hitting reseller sites very soon, so even if you couldn’t care less about miles (go away) you might well be a beneficiary of this externality.

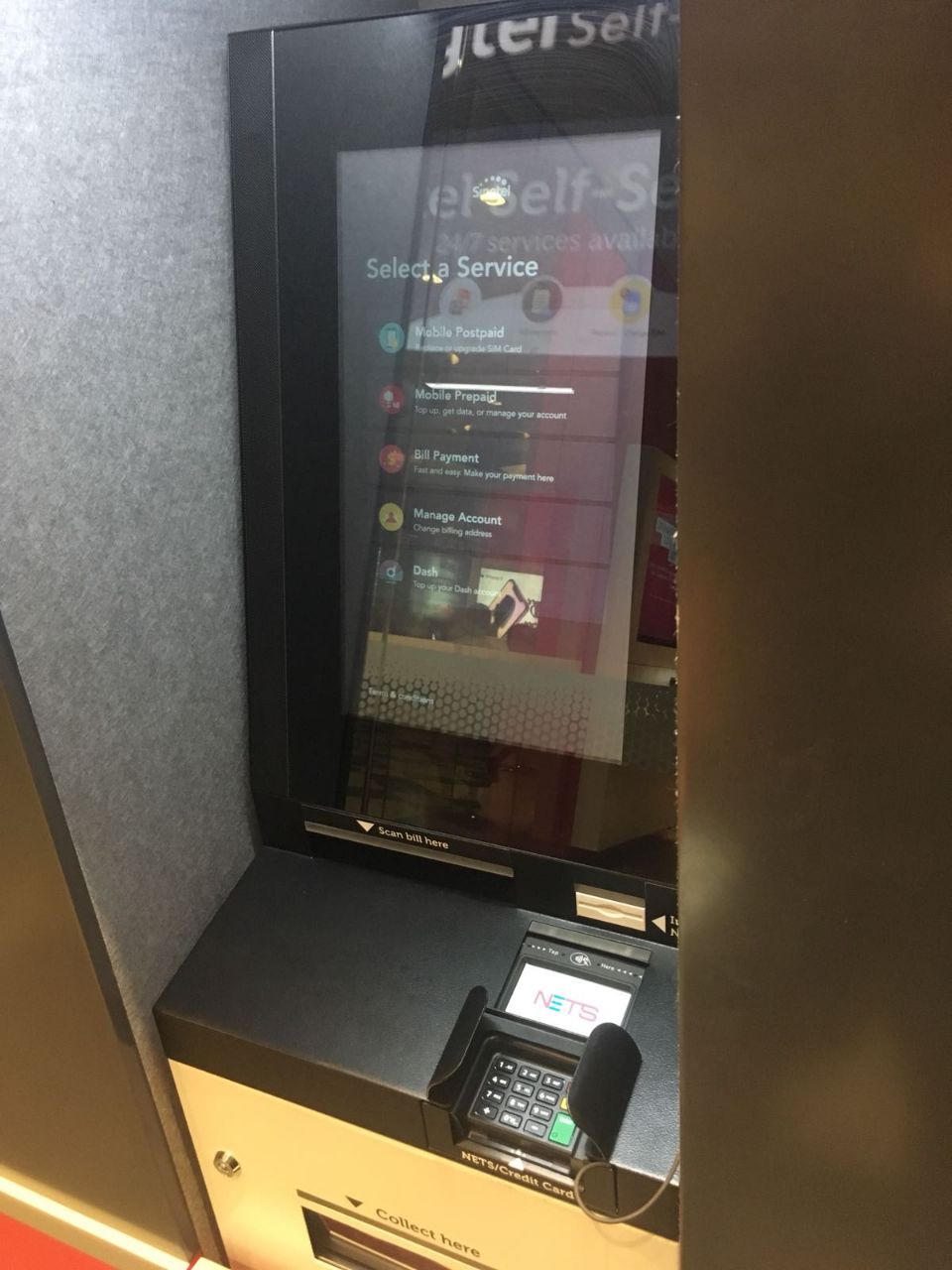

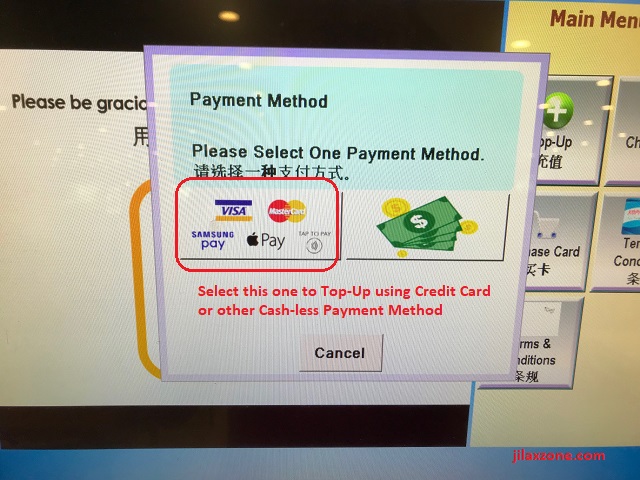

Prepay your Singtel bill

Through the Telegram group, we’ve learned that there are these newfangled Singtel Kiosks at selected Singtel shops which allow people to pay their bill through credit card. More importantly, Apple Pay is one of the options available. These kiosks have been spotted at Bugis, Jurong Point, Causeway Point and Comm Centre, although I’m sure there must be more out there.

This means you could prepay your Singtel bill for however many months you see fit, and then gradually draw it down. You could even cash out some of it through Singtel Dash (although the maximum top up for Dash is $200 a month).

M1 apparently has similar kiosks and people in the group are in the process of testing if this earns 20X too. Stay tuned. No love for Starhub so far.

Buy Qoo10 gift cards

If you shop often on Qoo10, you can buy Qoo10 gift cards at 7-Eleven and load up your account.

Now, people are reporting different degrees of success with this. Some 7-Elevens insist that gift cards are cash only. Others accept cards including Apple Pay. So YMMV, but thanks to Joanne on the Telegram Group we have some verified evidence of at least one outlet accepting Apple Pay…

Top up your Suica Card for travel to Japan

Those of you who go to Japan regularly will know the Suica card is as good as having cash. You can use it for transport, you can use it to pay for food, you can use it to shop etc.

The Suica card can be topped up via Apple Pay, once it’s been added to your wallet. For those of you who plan to head to Japan on a trip in the future, this could be a viable option for you. To use Suica with Apple Pay, you need an iPhone X, iPhone 8, iPhone 8 Plus, or Apple Watch Series 3. You can also use an iPhone 7, iPhone 7 Plus, or Apple Watch Series 2 that was purchased in Japan.

A reminder that this only works for the Rewards card. The Ultima and Prestige will not earn 20X on foreign currency spending.

Top up your Kopitiam card

Another way of maximizing your 20X is by loading up your Kopitiam card with Apple Pay for a 2% admin fee. Full instructions can be found in this very helpful article, and it seems the maximum top up you can do at one time is $50. I believe the card is capable of holding more than $50, but the exact amount eludes me.

Do note that despite the image above, it appears that Visa is temporarily not accepted at these top up stations so this method will currently only work for Mastercards (i.e. Citibank Prestige, Citibank Rewards MC)

Buy IKEA Gift cards

If you missed out on the amazing 12 mpd promotion that OCBC ran with its Titanium Rewards card back in March, here’s another chance for you to load up on furniture you totally know how to assemble.

IKEA gift cards are valid for 2 years.

Pre-paying tuition fees

I’m not going to be able to give you a play by play of which institutions do and do not support Apple Pay, but we’ve had reports that The Learning Lab does. It doesn’t hurt to check if your child’s tuition centre takes card payments, and if so I’m sure they won’t mind some additional working capital.

Conclusion: All roads lead to Rome…

If nothing else, this 20X promotion must be doing wonders for the cashflow of major retailers who sell gift vouchers. Remember that if you have any sort of big ticket spending coming up, you should definitely be checking if the merchant accepts contactless payments. Hotel wedding banquets, home renovations (for the furniture component at least), and car repairs are some things that come to mind.

It’s going to be hard to go back to “just” 4 mpd after this…

Do you have any other ideas of things you can pre-pay for with Apple Pay? Feel free to shout out below.

[credit_card_shortcode cc_id=”21829″]

[credit_card_shortcode cc_id=”21824″]

If you are using $0.02 as a value of a mile to calculate the expense to Citibank, of course it makes no sense. But that’s what the end user values it. In reality, the cost of a mile to banks are much lower than $0.02. The other thing is with every campaign, the bank sets aside a marketing budget, which is an expense that is projected to yield future returns. Just think about those people who forget to change their default card from the Rewards Card after the promo and goes back to earning 0.4 miles per dollar. And while… Read more »

nah, i’m well aware that banks buy much lower than 2 cents. but i know for a fact that 4 mpd rates are loss leaders, which makes me wonder how 8 mpd with no cap can be sustainable. and how do you set aside a marketing budget when there’s no cap?

Wont be surprised if Apple is contributing a bit of its marketing budget as well. After all, Apple will be equally benefiting from this campaign if not more than Citi.

How about Robinsons, Tang and Takashimaya?

10x only

Wrong, Aaron. 10x for Citi Rewards. Still a 20x for Citi Prestige

I am interested if possible.. Wanna Wack something ex at taka

Is that Singtel kiosk good for OCBC Titanium via Samsung Pay?

Will topping up Suica be in SGD or JPY?

Will I still get my 8mpd if it’s charged in Foreign currency?

For rewards card, yes

IKEA gift card can be purchased with Apple Pay? For ocbc promotion, have to pay at counter without Paywave. Top up at checkout is no longer allowed when I tried, though the 1st top up went through.

What about in-app purchase of air tickets?

There is still an irritating problem with the max transaction size with apple pay at $100…

Not sure about Citibank, but when I made payment for a more than $100 transaction on my OCBC credit card through Apple Pay, it requested me for the pin code, after that the transaction went through, somehow now the cap is higher?

that depends upon the merchant, not apply pay or citibank. plenty of merchants allow more than $100.

1. Apple Pay/ Samsung Pay limit is YOUR card’s limit.

2. It’s not the merchant.. it’s the terminal type that the merchant has.. some older ones limit to $100.. others as per your card’s limit

3. I’ve personally charged S$XX,XXX.00 by Samsung Pay in SG before, via my Samsung S3 watch.. I got a kick out of it.. only regret was not taking a pic when the amount flashed on watch face..

4. See no. 1

TOP u your Starbucks card, pay using Apple Pay at the counter

That’s a lot of coffee! Hahaha..

This is interesting though… as far as I can see the site hasn’t mentioned anything about Citi Rebate for Apple Pay thus far (unlike citi/samsung pay where they explicitly state that it’ll be credited within 3 working days). Been triple-dipping Citi Rebate + points + starbucks card stars at sbux all this while 😛

Would hate to miss out on the 10%, but hmm, 10% in exchange for 8mpd seems like a decent tradeoff, at least till july

I was recently instructed on this on the Telegram grp – there’s a FAQ document on the Citi website that specifically states that Citi Rebate is earned while using Apple Pay (credited 3 days later), though you’ll need to redeem using physical credit card.

In short, you can continue triple dipping!

Do you get 8mpd for buying capital mall vouchers ? Is it considered a retail transaction?

For now, only cash or payment via the CapitaLand Amex card is accepted for purchase of CapitaLand vouchers.

You can pay via PayWave on EZ Link top up kiosks at MRT stations – will using Apple Pay on it get 8mpd as well?

and get refund at Ticket Counter. Sadly no rewards for EZ Link top up.

Confirmed! Hotel booking through Expedia website, using Safari browser gets you 20x using Rewards. Do note it’s Expedia.com, not Expedia.com.sg, and the apple pay option will show.

Similarly I have done so on the hotels.com app which you need to change settings to the USA and USD

I managed to pay via Apple Pay on the Agoda app as well! Their rooms are much cheaper on the Agoda app as compared to Expedia or Hotel.com!

Hi Mandy,

Need to set to usd?

Hi Gary, I thot the promo specifically excludes non-SGD transactions? Thanks

That’s a good point! Anyone able to confirm if they did get the 20x points when not using a sg site?

confirmed. I used Citi Rewards VISA.

Hello All,

Do you know home renovation that accept apple pay? Thanks!

Hi, anyone can confirmed you get bonus points for payment at Singtel Kiosk?

Yes, I paid $900 at one go and got 18000 points

Anyone knows if this works for paying for petrol with apple pay at Esso and Shell?

Esso does not accept contactless payment.

Esso accepts Apple Pay at pump, but not inside.

pay at SPC and earned 20x

Not sure if it helps, but Caltex accepts Apple Pay.

Caltex accepts Apple Pay, but really REALLY poor discount rate of 5% for Citi cards..

For NSmen, you would probably have a year of free SAFRA membership. That entitles you to 14% discount at Caltex so can use it together with Citi Apple Pay.

Thanks for the info, but I’m way too old for SAFRA, especially when I don’t golf.. but apprentice the info, and good for those with SAFRA membership.. ??

Finnair APP bookings can also be paid using Apple Pay and therefore earn 20X Rewards.

nice find!

>>It’s going to be hard to go back to “just” 4 mpd after this…

Hold on. After Jul it will be 4mp$ regardless type of transaction, like OCBC Titanium?

I think Aaron meant 4mpd for selected categories of transactions. There’s no indication of 4mpd for all classes of transactions.

Singtel Kiosk does not accept bill payment if the bill is for corporate mobile phone. Tried yesterday and got message ‘account does not exist’. Was told by staff that I need to go to AXS or Singpost to pay it.

Does anybody know if paying Singtel bill from the app using WWMC earn 4mp$?

Anyone tried this:

https://www.alternativeairlines.com/why-use-us

Have ~20k SGD in airline bookings coming up but never heard from the site before….

Lol, i had the same dilemma before i used other options. As per the Telegram group, trip.com allows apple pay.

I think it’s only Trip.com app, not on Trip.com itself. I tried the webpage but no apple pay option.

The website is legit, it is a UK based online flight search. Accepts Apple Pay, PayPal and many other international payment methods

Is anyone experience problems using Apple Pay on the Singapore Airlines App? After a few successful transactions, I’m finding the ‘apple pay button’ to be inactive for some reason on the payment page…Am I the only one experiencing this problem? (I have been repeatedly trying for the last 4 days – and pending customer service response)

Did you pay for revenue tickets in past or it was taxes/fees payment for redemption tickets?

Also, did you add your KF card into apple wallet? And what IOS app version are you running?

Only attempted on Revenue tickets, KF card is in Apple Wallet and phone running on iOS 11.4.

I actually had 2 successful transactions prior to incurring this error – so not sure what is happening here…

Agree. made a purchase via SQ app on Tuesday 26 June with Apple Pay and it went through. Unable to do so since then. Saw Apple Pay replaced with Union pay button today.

hi, am newbie yet. I’ve been trying in vain using applepay on SQ app too. Sent them email and also commented on their FB page, SQ did respond and said technical issue which they are still fixing and they’re unable to gimme an estimate when it will be resolved. Sigh, was trying to use appleplay for the silkair biz class promo which ended yesterday, so no choice but switch to WMC instead

I’m sure a lot of you new have heard TW and citi$ situation….

M1 can pay via apple pay thru the sales personnel over the counter. $100 limit.

The limit is $200. I paid at bugis store.

[…] These two cards earn 4 and 8 mpd respectively when used with Apple Pay from now till 31 July 2018. If you’re only finding out about the amazing Apple Pay promo now, you’re kind of late to the game, but I guess better late than never? […]

[…] obvious answer was to find stores of value which could be paid for with Apple Pay. I provided some ideas: NTUC and Dairy Farm vouchers, Qoo10 gift cards, Suica contactless cards, pre-paying Singtel bills, […]