Here’s The MileLion’s review of the OCBC Rewards Card, formerly known as the Titanium Rewards Card.

For years, this was a staple in the wallets of many miles chasers, and what a run it had. Who can forget the glorious days of 4 mpd on all mobile payments, 12 mpd on public transport, 12 mpd on IKEA, and 8 mpd on online shopping during the pandemic?

But in November 2023 came a major devaluation: bonus categories like electronics, IKEA and Courts were removed, and the 4 mpd bonus cap was changed from S$13,335 per year to S$1,110 per month. Losing the bonus categories was painful enough, but the switch to a monthly cap was the real blow, since it limited the ability to use this card for big-ticket purchases.

To make matters worse, early 2024 saw a rebrand that ditched the “Titanium” label and dual colour scheme in favour of a single card, named (somewhat generically) “OCBC Rewards”. No, I don’t care about aesthetics or monikers. What I do care about is that this removed the possibility of doubling the bonus cap by holding both the Pink and Blue versions!

Thankfully, there’s been more to cheer recently, with the introduction of a quarterly 6 mpd promotion. This started off weak, but later gained momentum thanks to the inclusion of MCC 5311 (Department Stores)— and the concurrent rise of HeyMax.

HeyMax allows you to convert diverse categories like dining, groceries, ride-hailing, electronics and petrol into 5311, expanding the scope of OCBC Rewards Card’s otherwise-limited bonus whitelist. In fact, OCBC should really be sending a Christmas card to HeyMax for single-handedly revitalising this card’s fortunes!

OCBC Rewards Card OCBC Rewards Card |

|

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? |

|

| The OCBC Rewards Card has a limited bonus whitelist, but the fact that HeyMax is one of the bonus categories — plus a quarterly 6 mpd promo — saves the day. | |

| 👍 The good | 👎 The bad |

|

|

Overview: OCBC Rewards Card

Let’s start this review by looking at the key features of the OCBC Rewards Card.

|

|||

| Apply | |||

| Income Req. | S$30,000 p.a. | Points Validity | 2 years |

| Annual Fee | S$196.20 (2 Years Free) |

Min. Transfer |

25,000 OCBC$* (10,000 miles) |

| Miles with AF | None | Transfer Partners | 9 |

| FCY Fee | 3.25% | Transfer Fee | S$25 |

| Local Earn | 0.4 mpd | Points Pool? | Yes |

| FCY Earn | 0.4 mpd | Lounge Access? | No |

| Special Earn | 4 mpd on online and offline shopping | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

First, some legacy matters to address.

Back when the OCBC Rewards Card was known as the OCBC Titanium Rewards Card, both a blue and pink version were available. Both cards were identical in every way except colour, and each card had its own bonus points cap. Customers were perfectly at liberty to hold both cards, if they wished (and many did).

In contrast, there is only a single OCBC Rewards Card. If you’re holding on to both the blue and pink Titanium Rewards Cards, you can enjoy double the bonus cap until they expire. After that, you’ll only receive a single OCBC Rewards Card as a replacement, and therefore no more double bonus cap.

How much must I earn to qualify for an OCBC Rewards Card?

The OCBC Rewards card has a minimum income requirement of just S$30,000 p.a.

If you do not meet the minimum income requirement, it’s possible to get a secured version of the card by depositing S$10,000 in a fixed deposit with OCBC. Visit any OCBC branch to do the necessary paperwork.

What welcome gifts are available?

|

|||

| Apply |

New-to-bank customers who apply for an OCBC Rewards Card through the links in this post can enjoy welcome gifts from SingSaver, including:

- Apple AirPods 4

- Stryv Airflex 2.0

- S$200 Shopee voucher

- S$160 cash

Cardholders must make at least one transaction of any amount within 30 days of card approval.

New-to-bank customers are defined as those who do not currently hold a principal OCBC credit card, and have not cancelled one in the past 12 months.

How much is the OCBC Rewards Card’s annual fee?

| Principal Card | Supp. Card | |

| First 2 Years | Free | Free |

| Subsequent | S$196.20 | S$98.10 |

The OCBC Rewards Card has an annual fee of S$196.20 for the principal cardholder, and S$98.10 for each supplementary card. These fees are waived for the first two years.

In subsequent years, a fee waiver will be automatically granted if you spend at least S$10,000 in a membership year, though based on personal experience, OCBC is not very strict about this requirement.

No points are awarded for the payment of the annual fee.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 0.4 mpd | 0.4 mpd | 4 mpd on selected online and offline shopping |

SGD/FCY Spend

OCBC Rewards Cardmembers earn a base rate of 5 OCBC$ for every S$5 spent (0.4 mpd) in Singapore Dollars or FCY.

All transactions in FCY attract an FCY fee of 3.25%.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

Needless to say, you don’t want to be using the OCBC Rewards Card as a general spending card!

Online and Offline Shopping

OCBC Rewards Cardmembers earn a total of 50 OCBC$ for every S$5 spent (4 mpd) on shopping.

This applies to both offline and online transactions, whether in SGD and FCY, and is capped at 10,000 bonus OCBC$ per calendar month (equivalent to S$1,110 of spending).

Prior to 1 November 2023, the bonus cap was based on membership year, allowing cardholders to utilise their entire 4 mpd cap on a single big ticket purchase of up to S$13,335. Unfortunately, that’s no longer possible, and you’ll need to consistently spend each month to extract the most value from this card.

OCBC defines shopping as purchases made at any merchant with the following MCCs:

| 💳 OCBC Rewards Bonus Whitelist (Based on MCC) |

|

| MCC | Examples (non-exhaustive) |

| MCC 5309 Duty-Free Shops |

Lotte Duty Free, King Power Duty Free, The Shilla Duty Free |

| MCC 5311 Departmental Stores |

Takashimaya, TANGS, Isetan, OG, Metro, BHG, Marks & Spencer |

| MCC 5611 Men’s and Boys’ Clothing and Accessories Stores |

Benjamin Barker, Timberland, Edit Suits, Berluti |

| MCC 5621 Women’s Ready to Wear Stores |

Zara, H&M, Mothercare |

| MCC 5631 Women’s Accessory and Speciality Stores |

Tory Burch, Love Bonito, Pandora |

| MCC 5641 Children’s and Infants’ Wear Stores |

Kiddy Palace, Mummys Market, Pupsik, Motherswork |

| MCC 5651 Family Clothing Stores |

Uniqlo, ASOS, Club 21, Burberry, Yoox |

| MCC 5655 Sports and Riding Apparel |

Nike, Lululemon, Adidas |

| MCC 5661 Shoe Stores |

Skechers, Charles & Keith, Bata, Foot Locker, Pazzion |

| MCC 5691 Men’s and Women’s Clothing Stores |

Ezbuy, Zalora, Farfetch |

| MCC 5699 Miscellaneous Apparel and Accessory Shops |

Qoo10, Cotton On, Reebonz |

| MCC 5941 Sporting Goods Stores |

Decathlon, Fila, New Balance |

| MCC 5948 Luggage or Leather Goods Stores |

Louis Vuitton, Coach, Rimowa |

While the list of bonus-eligible MCCs may seem rather brief (and it is!), one big plus is the inclusion of department stores (MCC 5311). Why? Because of HeyMax.

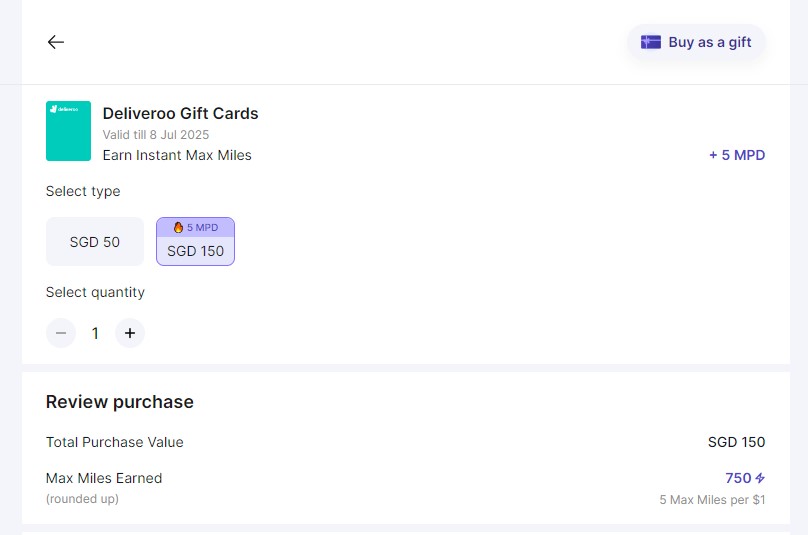

HeyMax sells vouchers for numerous merchants across different categories.

|

|

| 👍 250 Max Miles joining bonus |

|

| Sign up for a HeyMax account and get up to 250 Max Miles as a welcome bonus |

|

| 250 bonus Max Miles |

|

|

|

Transactions made directly at these merchants would code under a wide range of MCCs, most of which would not be eligible for bonuses with the OCBC Rewards Card.

But if you buy vouchers from HeyMax, the MCC gets standardised to 5311. I hope you see where I’m going here. Whether you’re buying electronics or furniture, booking activities, taking a Grab or gojek, ordering food delivery, buying eSIMs or shopping online, you can use HeyMax to turn that into a 4 mpd opportunity for the OCBC Rewards Card.

The sheer variety of HeyMax voucher coverage means you should be easily maxing out the bonus cap each month. To sweeten the deal even further, you can earn Max Miles from voucher purchases on top of your credit card miles, convertible to 28 different airline and hotel programmes at a 1:1 ratio.

In addition to the MCC whitelist, transactions at the following merchants are also eligible for 4 mpd.

| 💳 OCBC Rewards Bonus Whitelist (Based on Merchant Name) |

|

|

|

| ^Amazon and Mustafa Centre transactions under MCC 5411 are not eligible to earn any OCBC$ *Shopee Pay transactions under MCC 5262 are not eligible to earn any OCBC$ |

|

Can I use Amaze?

If you’re spending in FCY, you might be thinking of pairing the OCBC Rewards Card with Amaze for better FX rates.

You will still earn 4 mpd in situations where bonuses are awarded based on MCC, e.g. shopping at Harrod’s (MCC 5311), as Amaze does not change the MCC.

You will not earn 4 mpd in situations where bonuses are awarded based on merchant name, e.g. AliExpress. This is because Amaze modifies the merchant name to Amaze*Merchant, which messes up tracking.

Quarterly 6 mpd promotion

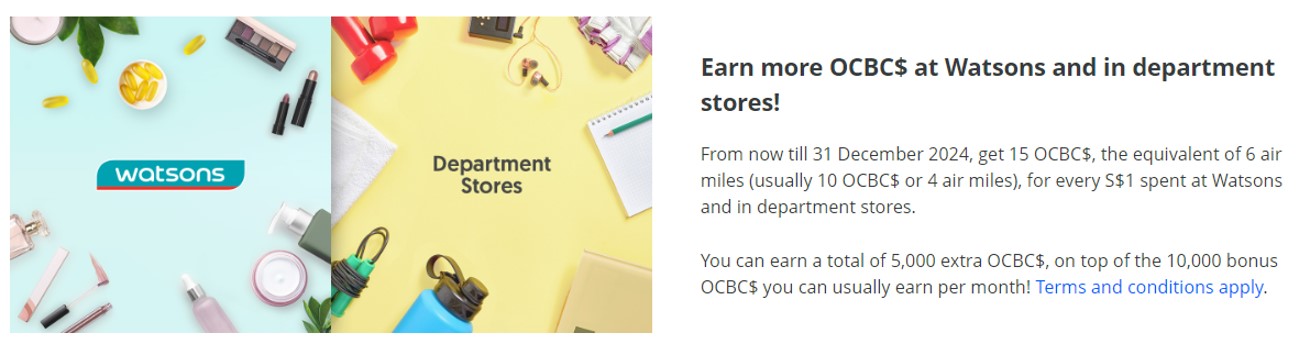

Since January 2024, the OCBC Rewards Card has been running a quarterly promotion that offers 6 mpd at selected merchants, such as duty-free and departmental stores.

- Q1 2024: TANGS & SHEIN

- Q2 2024: Duty-free shopping, department stores and Watsons

- Q3/4 2024: Department stores and Watsons

- Q1/2 2025: Department stores and Watsons

- Q3/4 2025: Shopee, Lazada, TikTok Shop, Taobao and Watsons

No registration is required, and the 6 mpd earn rate is capped at S$1,000 per calendar month. Any spending above this threshold will earn the usual 4 mpd up till S$1,110, and 0.4 mpd after that.

| Component | Monthly Cap (OCBC$) |

Monthly Cap (S$) |

| Base: 5 OCBC$ per S$5 (0.4 mpd) |

N/A | N/A |

| Regular Bonus: 45 OCBC$ per S$5 (3.6 mpd) |

10,000 OCBC$ | S$1,110* |

| Special Bonus: 25 OCBC$ per S$5 (2 mpd) |

5,000 OCBC$ | S$1,000 |

| *Really S$1,111, but remember that OCBC only awards points in blocks of S$5 |

||

What was particularly amazing about this promotion is that from 1 April 2024 to 30 June 2025, MCC 5311 was eligible to earn 6 mpd, making the previously-mentioned HeyMax option even more lucrative.

The current promotion no longer includes 5311, but does cover Shopee, Lazada, TikTok Shop, Taobao and Watsons. Some of these platforms also sell vouchers for other merchants, though the coverage is not as wide as HeyMax, and some vouchers are sold above face value.

When are OCBC$ credited?

Base points will be awarded when the transaction posts (typically in 1-3 working days).

Bonus points will be received by the end of the next calendar month. If you’re earning points under the limited-time quarterly 6 mpd promotion, the extra 5X points (2 mpd) will also be credited by the end of the next calendar month.

| Base Points (1X) | Credited when transaction posts |

| Bonus Points (9X) | Credited by the end of the next calendar month |

OCBC does not have a fixed crediting date, but based on previous data points, you can expect to receive the bonus between the 15th to the 21st.

How are OCBC$ calculated?

Here’s how you can work out the OCBC$ earned on your OCBC Rewards Card:

| Base Points (1X) | Round down transaction to nearest S$5, then divide by 5 and multiply by 5 |

| Bonus Points (9X) |

Round down transaction to nearest S$5, then divide by 5 and multiply 45 |

On 1 June 2020, OCBC started awarding credit card points in blocks of S$5. This means you’ll be penalised should your transaction not be in a block of S$5. For example, a S$9.90 transaction will earn the same number of points as a S$5 transaction, and a S$4.99 transaction will earn zero points. In other words, the minimum transaction to earn points is S$5.

Here’s how this policy affects the miles you earn on the OCBC Rewards Card, compared to another 4 mpd card like the Citi Rewards.

OCBC Rewards OCBC RewardsEarn Rate: 4 mpd |

Citi Rewards Citi RewardsEarn Rate: 4 mpd |

|

| S$5 | 20 miles | 20 miles |

| S$9.99 | 20 miles | 36 miles |

| S$15 | 60 miles | 60 miles |

| S$19.99 | 60 miles | 76 miles |

| S$25 | 100 miles | 100 miles |

| S$29.99 | 100 miles | 116 miles |

If you’re an Excel geek, here’s the formulas you need to calculate points:

| Base Points (1X) | =ROUNDDOWN (X/5,0)*5 |

| Bonus Points (9X) |

=ROUNDDOWN (X/5,0)*45 |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

OCBC provides a breakdown of points earned, though this is somewhat poorly executed since reference numbers are used for tracking, instead of merchant names. You’ll need to cross reference with your card statement to figure out which transaction is which.

Full instructions are provided below.

What transactions aren’t eligible for OCBC$?

A full list of transactions that do not earn OCBC$ can be found in the T&Cs.

I’ve highlighted a few noteworthy categories below:

- Charitable Donations

- Education

- GrabPay Top-Ups

- Government Services

- Insurance Premiums

- Non-Profit and Government Hospitals

- Real Estate Agents & Managers

The OCBC Rewards will not earn 4 mpd on platforms like CardUp, ipaymy and RentHero.

You can earn points on bus/MRT rides with SimplyGo, but there’s no reason to settle for 0.4 mpd when much better options exist.

What do I need to know about OCBC$?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| 2 years | Yes |

S$25 (per conversion) |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 10,000 OCBC$ (4,000 miles) |

9 | KrisFlyer: <24 hours Others: Instant |

Expiry

OCBC$ earned on the OCBC Rewards Card expire after 2 years.

For example, OCBC$ earned from 1-30 November 2023 will expire on 30 November 2025.

Pooling

OCBC uses three different rewards currencies:

- OCBC$

- 90°N Miles

- VOYAGE Miles

Similar rewards currencies are pooled. For example, if you have 20,000 OCBC$ on the OCBC Rewards Card, and 10,000 OCBC$ on the OCBC Premier Visa Infinite, you can redeem 30,000 OCBC$ at one shot and pay a single conversion fee. However, you cannot combine 90°N/VOYAGE Miles together with OCBC$ in a single redemption.

Since OCBC$ pool, you do not need to transfer them out before cancelling your OCBC Rewards Card, assuming it’s not your last OCBC$-earning card.

Transfer Partners & Fee

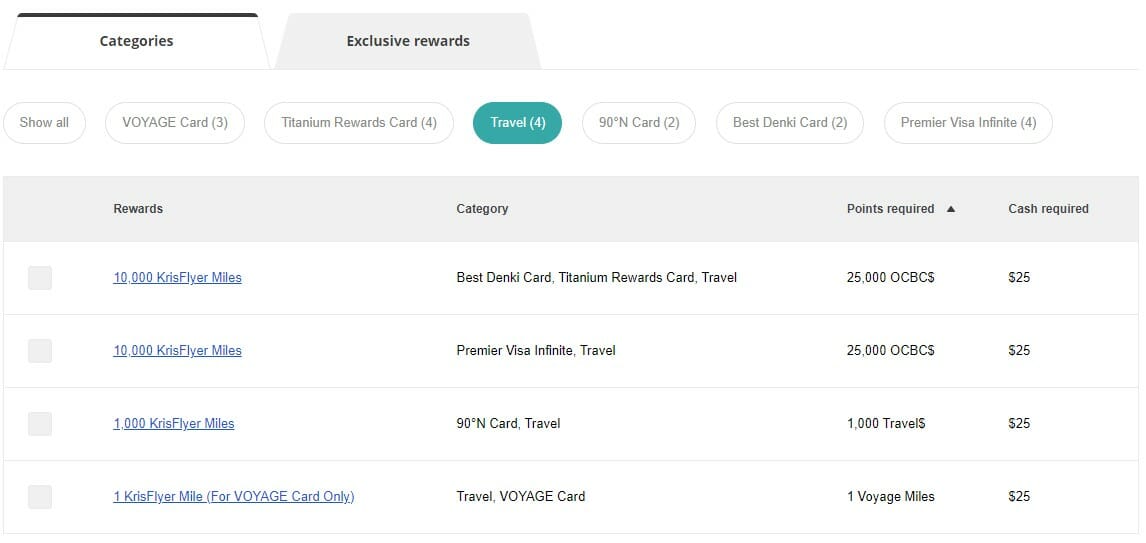

OCBC has a total of nine airline and hotel transfer partners.

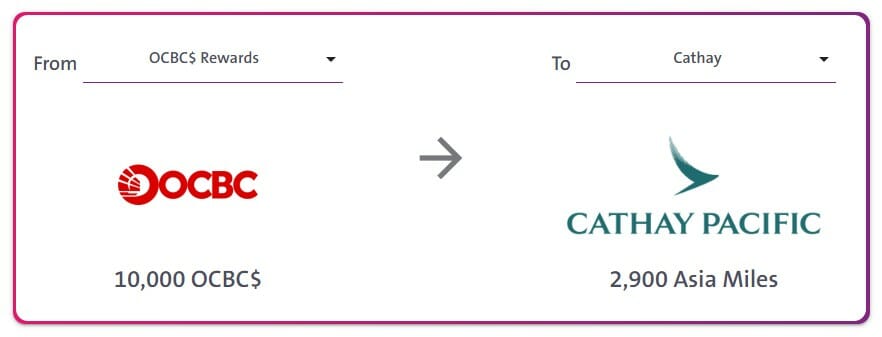

| Frequent Flyer Programme | Conversion Ratio (OCBC$ : Miles) |

| 25,000 : 10,000 |

|

| 10,000 : 4,000 | |

| 10,000 : 4,000 | |

| 10,000 : 4,000 | |

| 10,000 : 3,600 | |

| 10,000 : 3,600 | |

| 10,000 : 2,900 | |

| 10,000 : 2,800 | |

| 10,000 : 2,000 |

Sadly, the conversion ratios of most partners are disappointing.

I would at the very least have expected Asia Miles to enjoy the same conversion ratio as KrisFlyer. That’s the way it is for every other bank on the market, and it effectively eliminates Asia Miles as a viable transfer partner. After all, why on earth would you take a 25% haircut on the value of your OCBC points (and therefore your card spending rebate) when no other bank forces you to do that?

Likewise, it’s disappointing to see that there’s a 10% haircut for British Airways Executive Club and Etihad Guest, when Citibank and the HSBC TravelOne Card offer transfers to both at the same ratio as KrisFlyer.

As for hotel partners, the ratios for IHG and Marriott Bonvoy aren’t that appealing when you factor in the opportunity cost- you’re basically forgoing 1 KrisFlyer mile (~1.5 SG cents) for every IHG (~0.5 US cents/0.67 SG cents) or Bonvoy (~0.7 US cents/0.94 SG cents)

The only non-KrisFlyer programmes I might consider would be Air France-KLM Flying Blue and Accor Live Limitless. With Accor, 2,000 points = €40, so there is an opportunity cost of 1.5 cents per KrisFlyer mile, roughly what I’d deem acceptable.

OCBC, to its credit, does offer periodic transfer bonuses which can improve the ratios:

- November 2024: ~20% transfer bonus to Asia Miles

- July 2024: 70% transfer bonus to Marriott Bonvoy

- June 2024: 15% transfer bonus to British Airways Executive Club

- November 2023: 15% transfer bonus to Asia Miles

- October 2023: 20% transfer bonus to Flying Blue

- October 2023: 50% transfer bonus to IHG One Rewards

Regarding minimum conversion blocks:

- Transfers for KrisFlyer miles must be in blocks of 25,000 OCBC$ (10,000 miles)

- Transfers for all other programmes must be a minimum of 10,000 OCBC$ (2,000-4,000 miles/points), but subsequent conversions can be in blocks of 1,000 OCBC$ (200-400 miles/points).

A S$25 fee applies to all conversions.

Transfer Times

OCBC splits its partners across two different platforms:

- Transfers for KrisFlyer miles are done via the OCBC Rewards portal, and are usually processed within 24 hours

- Transfers for the other programmes are done via the STACK Rewards portal, under the Points Exchange tab. Transfers should be instantaneous, because they’re powered by Ascenda Loyalty which has a direct API linkage with the programmes.

Other card perks

Bonus interest with OCBC 360 account

Spending at least S$500 per month on the OCBC Rewards Card will qualify for the Spend bonus on the OCBC 360 Account.

Here’s the OCBC 360 Account’s current interest rate structure, which is valid till 31 July 2025.

| 🏦 Current OCBC 360 Structure (Till 31 Jul 25) |

||

| First S$75K | Next S$25K | |

| Salary | 1.6% | 3.2% |

| Save | 0.6% | 1.2% |

| Spend | 0.5% | 0.5% |

| Wealth (Insure) | 1.2% | 2.4% |

| Wealth (Invest) | 1.2% | 2.4% |

| Base Interest | 0.05% | |

| Max EIR | 6.30% | |

| Additional Grow bonus of 2.2% p.a. available if minimum ADB at least S$250,000 | ||

From 1 August 2025, the interest rate structure will be revised as follows.

| 🏦 Revised OCBC 360 Structure (From 1 Aug 25) |

||

| First S$75K | Next S$25K | |

| Salary | 1.2% | 2.4% |

| Save | 0.4% | 0.8% |

| Spend | 0.4% | 0.4% |

| Wealth (Insure) | 1.2% | 2.4% |

| Wealth (Invest) | 1.2% | 2.4% |

| Base Interest | 0.05% | |

| Max EIR | 5.45% | |

| Additional Grow bonus of 2% p.a. available if minimum ADB at least S$250,000 | ||

Assuming you keep the full S$100,000 inside, that works out to an additional S$400 per year in interest.

Terms and Conditions

- OCBC Rewards Terms and Conditions

- OCBC Rewards 6 mpd promotion

- OCBC$ Rewards Programme Terms and Conditions

Summary Review: OCBC Rewards Card

|

|

| Apply | |

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

On its own, the OCBC Rewards Card is of limited use because of its restrictive bonus whitelist. There are many other specialised spending cards out there which reward a wider range of spending.

But HeyMax changes everything. With HeyMax, the OCBC Rewards Card can earn 4 mpd on food delivery, groceries, activities, electronics, furniture, and petrol — basically anything you can buy a voucher for. And while it’s unfortunate that the quarterly 6 mpd promotion no longer covers HeyMax, major merchants like Lazada, Shopee and Watsons are still included.

OCBC also offers a decent variety of transfer partners, though given the ratios, only KrisFlyer, Flying Blue and Accor are really of any value.

That said, if my spending were more modest, I wouldn’t prioritise getting an OCBC Rewards Card. I would instead focus on using (in this order) the Citi Rewards Card, DBS Woman’s World Card, UOB Lady’s Card and HSBC Revolution Card before bringing the OCBC Rewards Card into the picture. Both the Citi Rewards and DBS Woman’s World Card offer 4 mpd on almost all online spending, without the need for the HeyMax layer.

So that’s my review of the OCBC Rewards Card. What do you think?

Overall a solid card. I think it would be 4.5* if OCBC had a greater range of transfer partners.

Was careful to rate it a step below wwmc, because of xfer partners + More restricted 4 mpd

Personally, I feel that they cater to different use cases, although I see where you’re coming from. This would be the card I use if I had a purchase costing more than $2K.

“For example, if you have 20,000 OCBC$ on both the Blue and Pink versions of the OCBC Titanium Rewards Card, you can redeem 40,000 OCBC$ at one shot and pay a single conversion fee.” I think the example is slightly misleading as you cannot redeem 40,000 OCBC$ at one shot since you must convert in multiples of 25,000 OCBC$. Also, it seems from OCBC rewards redemption website that it is possible to transfer OCBC$ from one principal cardholder to another principal cardholder for 2,300 OCBC$ which may be useful if you have less than 25,000 OCBC$ and wish… Read more »

transfer to KF needs 25000 blocks, but transfer to other does not.

so the article is correct.

Hi, anyone knows if there’s a way to track how much I’ve spent in the membership year?

I had to call them to check and confirm. Other way is pretty manual i.e. going through the statements (can do on their app) but only for up to 180 days

Does this work when you link the card to the Amaze card?

Think it does. But unsure how it will work overseas, cos now cannot find the MCC of merchants easily, let alone overseas.

Let’s say I’m going to Uk/France, any tips on finding out whether I can get 4mpd on shops like Primark or even boutiques like Chanel/LV?

Recently used the OCBC Titanium Rewards card at Goyard in Paris and was suprised to learn that the MCC for Goyard is 7631 – Clock, Jewellery and Watch Repair from the OCBC CSO so no bonus points. I did point out to the CSO that the MCC doesn’t seem correct because Goyard does not sell clocks, jewellery or watches? Anyway, it doesn’t seem to make any difference for the bonus. I wished there were a comprehensive list/warning list which stores (local & overseas) will not get bonus with OCBC Titanium Rewards but also it would be great if OCBC would… Read more »

All’s good until they refuse to waive off annual fee…

exactly. ocbc gives 0 customer leeway.

Just to clarify that we won’t get the bonus points if we buy airline tickets such as Singapore Airlines, or buy cruise packages with this card since no related MCC could be found in the T&C?

Can’t recall the annual spending requirements for wavier but mine seems to get have annual fee waived off automatically so it’s been a no brained for me to keep this card.

@aaron do you put annual fee cost and waivers into rating consideration

due to the MCC issue, Was not given bonus point last i swiped it in LV store in MBS, learnt the lesson hardway

wow must be painful! what was LV’s MCC?

Based on data points, LV should be 5948 – uggage and leather goods. Would be good if there is a crowd source consolidated list of data point for shopping boutiques

but you don’t need to guess anymore….

https://milelion.com/2022/10/08/how-to-check-merchant-category-codes-mccs-before-spending/

Big purchase coming up, car downpayment of at least 12k, but dont think this card earn any bonus points at car dealers?

Do you know if we’re getting the bonus if we shop on Amzon fresh?

for the 9x bonus points, it will be eligible if I buy something from Apple online store or Courts online store via apple pay using OCBC titanium credit card?

Hello, i am new to the miles game so trying to understand all the benefits/limitations. I have a question for points validity. I am someone who intends to keep my points/miles to hopefully redeem an upgrade for a flight in the future – i can see that the citipremier miles has no expiry so for this purpose it would be good, but it is 1.2 mpd. Does that mean that, for this purpose (keep points for future flight upgrade), cards that have points expiry (e.g. womans card that is 4mpd but validity of 1 year) will not be of use… Read more »

Effective timeline for your exame would be 1 year as reward points + 3 years (assuming krisflyer) as frequent flyer points after transfer

Does anyone know if Shopee pay top ups are eligible for bonus OCBC$? Thanks!

could you kindly try top up a bit and see how it goes? Kindly share with us here!

@Aaron Wong, do you know of any card that gives 4mpd for watch purchases in boutique shops? Seems like they fall under MCC5944, which does not fall under the OCBC titanium or Citi Rewards shopping categories? Amaze would only cover the first 1K…

@Aaron: I assume this card is no good for Airline ticket purchase (eg: Business class to Europe). I struugle currently with monthly spending caps of Citi Rewards and HSBC Revo when I have to buy business class tickets

you can use the DBS altitude visa for 3mpd capped at $5k per month

i Have gotten the card approved on 19 Jan 2023 for exiting card holder and made the $100 spending within 30 days but the Product Manager mentioned to the service agent that my application is not tagged along the promotion and I am wondering what kind of tag they are referring.

Limited MCCs…

Is there any CC worth using for say, Rimowa luggage purchase over 2K SGD? Or is it just local general spending being the only way?

This card is it good for payment for Rimowa luggage?

Should be “Shopee Pay transactions under MCC 5262 are not eligible to earn any OCBC$” instead of 5626, at least according to TnC governing OCBC Titanium Rewards Programme with effect from 1 Mar 2023

Hi all, anyone knows if Chanel qualify in any of the mcc categories for ocbc titanium card?

Starting from 01 Nov2023, MCC 5732 Electronics Stores, MCC 5045 Computers, Peripherals, and Software will be excluded from the bonus. How sad

Hi! Where did you get this info? I am planning to purchase a Mac Mini at the Apple Store soon. Will this be affected?

https://milelion.com/2023/10/01/nerf-ocbc-titanium-rewards-to-cap-bonus-ocbc-by-month-remove-bonus-for-electronics/

Thanks Aaron. I’m fairly new with this whole thing of cards mile game and learned most of it from your milelion. Actually i’ve just received my Titanium, Citi Rew, HSBC Revo and DBS Womans this month.

somehow with this nerfing of the OCBC card, it diminished its value prop especially with my intention purchasing big electronics items , ~8k. Any advice or work around on this? Appreciate your patience on a noob like me.

Hello Aaron, I’m confused by the below 2 paragraphs: “For avoidance of doubt, Amaze does not change the MCC of a transaction, so all the abovementioned transactions will still earn bonuses when you pair the OCBC Titanium rewards Card with Amaze. This could come in useful when shopping at overseas factory outlet stores, for example. ” And then in a later paragraph: “Do note that bonuses are awarded based on specific merchant name, so if you use a card that modifies the name of the merchant (e.g. Amaze), you will not earn the bonus.” So would using Amaze get the… Read more »

the two statements can be true at the same time.

100% agree. Leave it. Most useles bank and useless card in Singapore.

Does the 4mpd work when you use FavePay to buy vouchers in HeyMax as I can’t seem to use credit card to purchase vouchers in HeyMax as it returns an error

I believe FavePay has different MCC for different merchants. You should test the MCC using Amaze/DBS to make sure it’s in the OCBC whitelist.

heymax has always used favepay; the naked credit card options are new. the website says it’s 5311 regardless.

The naked credit card option on HeyMax does not work for me

this card + heymax + amazon prime deal was an epic combination

This card cheats at least from my one-time experience. I bought a dress at a women’s clothing store at Orchard Central, the MCC assigned was for book store, therefore no bonus points

sorry to hear that, but your gripe isn’t with ocbc- it’s with the merchant. ocbc has no control over how mcc are assigned.

I don’t think so. The merchant is a well-known brand, it’s not likely it has any foul play involved on MCC and I also checked MCC through the Instarem App. It clearly shows as 5621(clothing) instead of 5942 for the bookstore.

I bought $100 of foodpanda vouchers on heymax using favepay and OCBC Rewards card, i got back exactly 100 OCBC$, there is no bonus at all.

Is this page updated?

Facing the same issue here – what’s up?

<deleted>

OCBC has refused to waive off the annual fee for my Rewards credit card. First time I encountered this from a bank. It’s not even a ‘special’ card, so it’s funny OCBC is behaving all high and snooty!

This is OCBC. Even worse than UOB. I’ve long ago decided not to use credit cards from these 2 banks. No need to beg or hope for ‘charity’ dependent on their whims. I choose cards where the delivered benefit is clearly stated. And sometimes they overdeliver by volunteering waivers or gifts even when I never asked for any.

Does anyone knows if ocbc rewards card offer the bonus OCBC$ for shopee and Lazada orders overseas/non-Singapore?

I am thinking of the same question.