Here’s The MileLion’s review of the DBS Altitude Card, which once upon a time was a very solid general spending card.

True, its local/overseas earn rates of 1.2/2 mpd weren’t very exciting, but cardholders could earn 3 mpd on air tickets and hotel bookings, for up to S$5,000 per month. And unlike its competitors, you weren’t forced to book on special OTA portals with inflated pricing and limited selections. Cardholders could book any airline or hotel, any way they wished.

Unfortunately, that all changed in August 2023, when DBS gave a chicken wing by boosting the local/overseas earn rates to 1.3/2.2 mpd, then took back the whole chicken by removing the 3 mpd on air tickets and hotels (not to mention the way they did so left a lot to be desired). In April 2024, DBS also removed the 6 mpd on Expedia flights and hotels and 10 mpd on Kaligo hotels, and since then the Altitude has slipped into a sort of ennui.

It’s not great, not terrible— and while the occasional overseas spending promotion does spice things up, it’s otherwise a rather staid offering.

DBS Altitude Card DBS Altitude Card |

|

| 🦁 MileLion Verdict | |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? |

|

| Two free lounge visits and occasional overseas spending promos are welcome, but the DBS Altitude Card has little else to offer year-round. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: DBS Altitude Card

Let’s start this review by looking at the key features of the DBS Altitude Card:

|

|||

| Apply (AMEX) | |||

| Apply (Visa) | |||

| Income Req. | S$30,000 p.a. | Points Validity | No Expiry |

| Annual Fee | S$196.20 (First Year Free) |

Min. Transfer |

5,000 DBS Points (10,000 miles) |

| Miles with Annual Fee |

10,000 | Transfer Partners |

4 |

| FCY Fee | 3% (AMEX) 3.25% (Visa) |

Transfer Fee | S$27.25 |

| Local Earn | 1.3 mpd | Points Pool? | Yes |

| FCY Earn | 2.2 mpd | Lounge Access? | Yes (Visa) |

| Special Earn | N/A | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The DBS Altitude comes in two varieties: American Express, and Visa. The fees, earn rates and benefits of the two are almost identical, though historically speaking, the American Express had a more generous welcome offer than the Visa (at the time of writing, there’s no such differentiation).

The main advantage the Visa has is two airport lounge visits per year, which the American Express version lacks.

How much must I earn to qualify for a DBS Altitude Card?

The DBS Altitude has a minimum income requirement of S$30,000 per year, the MAS-mandated minimum.

If you don’t meet the minimum income requirement, you can place a S$10,000 fixed deposit with DBS and get a secured version of the card. Visit any DBS branch for further information.

| 🤓 History Lesson |

|

The DBS Altitude Card can probably take credit for democratising the miles game, because once upon a time, the minimum income requirement for any miles card was S$80,000, well beyond the reach of most fresh graduates. Then in 2016, DBS became the first bank in Singapore to offer a miles card at the MAS-mandated minimum of S$30,000. This put pressure on the rest of the market, and eventually the Citi PremierMiles and UOB PRVI Miles Cards reduced their income requirements to S$30,000 as well. |

How much is the DBS Altitude Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | Free | Free |

| Subsequent | S$196.20 | S$98.10 |

The DBS Altitude Card has an annual fee of S$196.20 for the principal cardholder, and a S$98.10 fee per supplementary card.

The first year’s fee is waived. Subsequent years’ fees are automatically waived if you spend at least S$25,000 in a membership year, though based on personal experience, it is possible to get a fee waiver even if you don’t meet the minimum spend.

Cardholders will receive 10,000 miles (in the form of 5,000 DBS Points) every year they pay the principal card’s annual fee, which is equivalent to buying miles at 1.96 cents each.

If the annual fee is subsequently waived, these DBS Points will be clawed back. Should you have an insufficient balance (because you already redeemed those points), then you’ll be charged S$0.0388 per DBS Point.

What welcome offers are available?

DBS Altitude Card DBS Altitude Card |

||

| Apply |

||

| Promo Code | ALT38 | ALTW28 |

| Bonus Miles | 28,000 miles | |

| Base Miles From S$800 Spend (1.3 mpd local, 2.2 mpd FCY) |

1,040 – 1,760 miles | |

| Miles From S$196.20 Annual Fee | 10,000 miles | Fee waived |

| Total Miles | 39,040- 39,760 miles | 29,040- 29,760 miles |

DBS is currently offering a 28,000 miles welcome bonus for new-to-DBS cardholders, defined as those who:

- do not currently hold any principal DBS/POSB credit cards, and

- have not cancelled any principal DBS/POSB credit cards in the past 12 months

Customers must apply for a DBS Altitude Card between 1 March and 31 August 2025, and receive approval by 14 September 2025. They must also spend at least S$800 within 60 days of approval, which will earn:

- 28,000 bonus miles

- 1,040 to 1,760 base miles, depending on how the S$800 spend is split between SGD/FCY

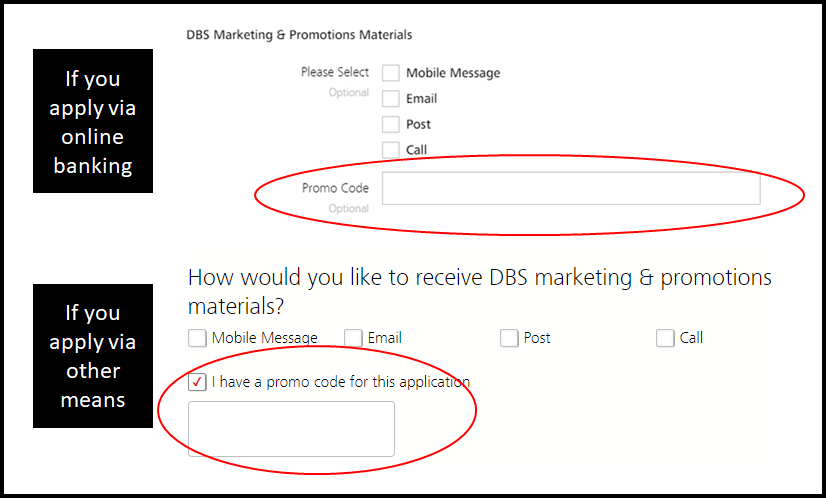

On top of this, there is the option of paying the first year’s S$196.20 annual fee for an extra 10,000 miles. This needs to be indicated at the time of application via a promo code:

- ALT38: If you wish to pay the first year’s annual fee

- ALTW28: If you wish to have a first year fee waiver

Make sure to enter one code or the other. No code, no bonus!

There’s nothing stopping you from signing up for both the DBS Altitude AMEX and DBS Altitude Visa cards. However, you will only enjoy the new-to-bank bonus on the first card that’s approved.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.3 mpd | 2.2 mpd | N/A |

SGD/FCY Spend

DBS Altitude Card members earn:

- 3.25 DBS Points for every S$5 spent in Singapore Dollars (SGD)

- 5.5 DBS Points for every S$5 spent in foreign currency (FCY)

1 DBS Point is worth 2 airline miles, so that’s an equivalent earn rate of 1.3 mpd for SGD spending, and 2.2 mpd for FCY spending. These are acceptable rates for a general spending card, though certainly not market-leading.

| 💳 Earn Rates for General Spending Cards (income req.: S$30K) |

||

| Cards | Local Spend | FCY Spend |

UOB PRVI Miles Card UOB PRVI Miles Card |

1.4 mpd | 3 mpd IDR, MR, THB, VND 2.4 mpd All Others |

HSBC TravelOne Card HSBC TravelOne Card |

1.2 mpd | 2.4 mpd |

DBS Altitude Card DBS Altitude Card |

1.3 mpd | 2.2 mpd |

OCBC 90°N Card OCBC 90°N Card |

1.3 mpd | 2.1 mpd |

Citi PremierMiles Card Citi PremierMiles Card |

1.2 mpd | 2 mpd |

StanChart Journey Card StanChart Journey Card |

1.2 mpd | 2 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd | 1.2 mpd |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd | 1.1 mpd |

BOC Elite Miles Card BOC Elite Miles Card |

1 mpd | 2 mpd |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

1.2 mpd | 1.2 mpd |

All foreign currency transactions on the DBS Altitude AMEX and Visa Cards are subject to a 3% and 3.25% FCY fee respectively. Therefore, using your DBS Altitude Card overseas represents buying miles at 1.36 cents (AMEX) and 1.48 cents (Visa).

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

When are DBS Points credited?

DBS Points for local and overseas spending will be credited when your transaction posts, which generally takes 1-3 working days.

How are DBS Points calculated?

Some people get anxious when they read in the T&Cs that DBS Points are awarded in S$5 blocks. That’s understandable, given how UOB’s S$5 earning blocks result in a lot of lost miles from rounding, especially for small transactions.

But DBS’s calculations aren’t nearly as penalising. Here’s how the DBS Points on your DBS Altitude Card are calculated:

| Local Spend | Divide transaction by 5 and multiply by 3.25. Round down to the nearest whole number |

| FCY Spend |

Divide transaction by 5 and multiply by 5.5. Round down to the nearest whole number |

Notice how the transaction is not rounded down to the nearest S$5; instead, it’s divided by 5 straight away. This means the minimum spend to earn points is not S$5, but rather:

- SGD spend: S$1.54

- FCY spend: S$0.91

To illustrate the point, here’s how the DBS Altitude compares to the UOB PRVI Miles. Note how it outperforms the ostensibly higher-earning PRVI Miles (1.4 mpd) on certain transaction sizes.

DBS Altitude DBS AltitudeEarn rate: 1.3 mpd |

UOB PRVI Miles UOB PRVI MilesEarn rate: 1.4 mpd |

|

| S$5 | 6 miles | 6 miles |

| S$9.99 | 12 miles | 6 miles |

| S$15 | 18 miles | 20 miles |

| S$19.99 | 24 miles | 20 miles |

| S$25 | 32 miles | 34 miles |

| S$29.99 | 38 miles | 34 miles |

If you’re an Excel geek, here’s the formulas you need to calculate points:

| Local Spend | =ROUNDDOWN ((X/5)*3.25,0) |

| FCY Spend |

=ROUNDDOWN ((X/5)*5.5,0) |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, refer to these articles:

What transactions aren’t eligible for DBS Points?

The DBS Altitude Card will not earn points on the following transactions:

- Amaze transactions (not that it matters here, because only Mastercards can be paired with Amaze)

- Charitable donations

- Education

- Government institutions and services

- Hospitals

- Insurance

- Top-ups of prepaid accounts e.g. GrabPay

- Utilities bills

A full list of transactions that do not earn DBS Points can be found at point 2.6 of the DBS Rewards Programme’s T&Cs.

All CardUp transactions are eligible to earn DBS Points. However, when it comes to qualifying spend for the purposes of welcome offers, only CardUp rental transactions which code under MCC 6513 (Real Estate Agents and Managers) will count.

If you plan to use CardUp to meet the qualifying spend for a welcome offer, do read the article below for greater clarity.

ipaymy transactions are explicitly excluded from counting towards qualifying spend.

What do I need to know about DBS Points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| No expiry | Yes | S$27.25 (per conversion) or S$43.60 (per year) |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 5,000 DBS Points (10,000 miles) |

4 | 1-3 working days (for KF) |

Expiry

DBS Points normally expire after one year, but points earned on the DBS Altitude Card never expire.

Pooling

DBS Points pool across cards for the purposes of redemption. If you have 10,000 DBS Points on the DBS Altitude Card and 5,000 DBS Points on the DBS Woman’s World Card, you can redeem 15,000 DBS Points at one shot and pay a single conversion fee.

However, DBS Points are not pooled when it comes to card cancellations. If I have a DBS Altitude Card and DBS Woman’s World Card and decide to cancel the former, I’ll need to transfer my points out before cancelling, or else forfeit them.

Partners and Transfer Fee

DBS partners with four frequent flyer programmes, though it’s arguably three because Air Asia Rewards offers such poor value it might as well not exist.

| Frequent Flyer Programme | Conversion Ratio (DBS Points: Miles) |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 500: 1,500 |

For KrisFlyer specifically, DBS offers an alternative “Auto Conversion programme”. This charges a flat fee of S$43.60 per membership year, and automatically converts DBS Points to KrisFlyer miles each calendar quarter in blocks of 500 DBS Points.

How does the DBS KrisFlyer Miles Auto Conversion Programme work?

This reduces the minimum transfer block from 10,000 miles to 1,000 miles, but has the downside of starting the three-year expiry on your KrisFlyer miles early.

Whether the Auto Conversion programme makes sense depends on your miles transfer patterns. If you make only one transfer to KrisFlyer per year, the “per transfer” model of S$27.25 would make more sense. However, if you find yourself making two or more transfers, the Auto Conversion programme would be better.

Cardholders enrolled in the Auto Conversion scheme can make ad-hoc conversions from DBS Points to KrisFlyer miles without paying the usual S$27.25 fee, but the usual minimum block of 5,000 DBS Points applies.

| 💡Protip: Alternative to miles? |

| While I normally would advise against redeeming DBS Points for anything other than miles, the bank runs a monthly promotion that offers extra value for selected voucher redemptions. You can usually get around 1.8 cents per mile, which might interest you if you have orphan points. |

Transfer Times

DBS quotes a points conversion time of 1-2 weeks, but in reality it usually takes about 1-3 working days at the very most for KrisFlyer (transfer times to other programmes may be longer).

If you need your points credited instantly, you can do so via Kris+. 100 DBS Points can be instantly transferred to 170 KrisPay miles, which can then be converted to KrisFlyer miles at a 1:1 ratio with no fees.

|

| S$5 for new Kris+ Users |

| Get S$5 (in the form of 750 KrisPay miles) when you sign-up with code W644363 and make your first transaction |

However, those 100 DBS Points would normally have earned you 200 KrisFlyer miles, so you effectively take a 15% haircut. Therefore, I wouldn’t recommend taking this option, unless you need a small top-up to redeem a flight, or have an orphan DBS Points balance (<5,000 points).

If you choose to do so nonetheless, do remember that it’s a two-step process:

- Transfer DBS Points to KrisPay miles

- Transfer KrisPay miles to KrisFlyer miles

Do not forget the second step! If you wait more than 21 days, or spend any of the converted KrisPay miles via Kris+, the entire balance will be stuck in the Kris+ app. KrisPay miles expire after six months, and can only be spent at a poor ratio of 150 miles = S$1.

Other card perks

Two free lounge visits (DBS Altitude Visa only)

|

| Registration |

Principal DBS Altitude Visa Cardholders enjoy two free Priority Pass lounge visits per membership year.

The two visit allowance is tracked by membership year, based on when they applied for their Priority Pass. Lounge entitlements can be shared with a guest, but once you exhaust your free visits you’ll be charged US$32 per additional visit.

Here’s how this compares to other cards in its segment.

| Card | Network | Free Lounge Visits (per year) |

HSBC TravelOne Card HSBC TravelOne Card |

DragonPass | 4X* Share |

UOB PRVI Miles Card UOB PRVI Miles Card |

Priority Pass | 4X* |

Citi PremierMiles Card Citi PremierMiles Card |

Priority Pass | 2X* Share |

DBS Altitude Visa DBS Altitude Visa |

Priority Pass | 2X Share |

StanChart Journey Card StanChart Journey Card |

Priority Pass | 2X Share |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

N/A | N/A |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

N/A | N/A |

BOC Elite Miles Card BOC Elite Miles Card |

N/A | N/A |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

N/A | N/A |

OCBC 90°N Card OCBC 90°N Card |

N/A | N/A |

| *Allowance tracked based on calendar year |

||

Overseas spending promotions

The DBS Altitude Card usually offers two overseas spending promotions each year, to cover the June and December peak travel periods. You can usually expect to see a boosted overseas spend rate of 5 mpd, subject to meeting a certain minimum spend and with an overall earning cap.

Unfortunately, the most recent promotion (which ends on 30 June 2025) was rather weak, offering 5 mpd on in-store FCY spend made in the following countries:

- 🇦🇺 Australia

- 🇯🇵 Japan

- 🇲🇾 Malaysia

- 🇹🇭 Thailand

Cardholders had to spend at least S$2,000 per calendar month to be eligible, and the bonus was capped at S$1,200 of in-store FCY spend.

Past promotions were significantly more generous, with 5 mpd offered without any geographical restrictions, a lower minimum spend of S$1,000 per calendar month, and a higher bonus cap of S$2,000 per calendar month.

Income tax payment facility

DBS Altitude Cardholders can pay their income tax via DBS Payment Plans, earning 1.5 mpd (instead of the usual 1.3 mpd) with a 2.5% fee. The cost per mile works out to 1.67 cents each. This is decent, but you could buy miles for less through a service like CardUp.

The article below summarises the lowest-cost way of paying taxes with your DBS Altitude Card and other credit cards.

2025 Edition: How to earn credit card miles on IRAS income tax

Terms and Conditions

Summary Review: DBS Altitude Card

|

|||

| Apply (AMEX) | |||

| Apply (Visa) | |||

| 🦁 MileLion Verdict | |||

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

With the loss of its bonus categories, the DBS Altitude Card is a pure vanilla general spending card, and while there are situations which call for that, most of the time you’ll want to keep your spending on 4 mpd alternatives.

The two lounge visits offered by the Visa version are useful, especially if you’re trying to rack up free visits without paying annual fees, but otherwise I don’t see much here to get excited about.

Since I’m never going to be new-to-bank for DBS anyway (I value my DBS Woman’s World Card too much to go one year without it), I do keep the Altitude handy, if only to wait for its bi-annual 5 mpd overseas spending promotions.

So that’s my review of the DBS Altitude Card. What do you think?

Thank you, especially for the bit on crabhey bobups. Hope it stays that way. Could you kindly include in your reviews how these cards function for transport e.g. special rates, total transport fare pools for the month or not etc.

they earn the regular miles-earning rate for simplygo, i.e 1.2 mpd.

Reading all these reviews makes me wonder: what card are you going to use for your general spending once the AMEX Plat Charge and BOC EM offers end? It seems like you’ve gravitated towards the Citi PM.

Well I’ll be using gpmc for as much as 1k allows, then uob ppv wherever possible. That leaves a v narrow range of situations when I’ll have to use a general spending card.

1k limit of CRV you mean?

yup

Makes sense. Make hay while the sun shines.

On the bonus miles for hotel, noted that providing card details doesnt count towards the bonus miles. I have a booking which I reserved refundable online but subsequently emailed the hotel to switch to DBS altitude card and provided my card details. Really hoping this still works but need your advice!

so long as the booking is not charged ONLINE, you don’t get any bonus miles. if your booking is refundable, it sounds like they will charge you only at check out.

The DBS Priority Pass link is not dead. Just don’t put a slash “/” behind.

https://www.prioritypass.com/altitudevisa

https://www.prioritypass.com/altitudevisacard

Ah brilliant, thank you

On the point that DBS points are not pooled when it comes to card cancellation, may I ask if this is also applicable to OCBC Titanium cards? If I’m holding on to both the blue and pink, will I forfeit the OCBC$ earned on the blue in the event I decide to cancel it? Thanks

no, ocbc$ are pooled for redemption and cancellation. you’ll retain your points

Thanks

Hi, Aaron,

I have just been informed by DBS (confirmed twice with different customer services staff) that MCC 7399 will not be considered eligible spend for miles rewards. That includes anything from GrabPay top ups to ipaymy tax payments. If true, that’s a real nasty piece of work by them.

It’s really odd, because as far as I can see anywhere, it doesn’t explicitly exclude this code nor mention GrabPay in their exclusions.

In the meantime, I will try to post a small amount to test it out.

well, customer service will say one thing.

in reality, however…

Hi Aaron, I have a question. Alt’s DBS Points doesn’t expire whereas WWMC’s DBS Points does after 1 year. DBS Points are pooled together. Therefore if I have both cards, does it mean that Points earned through WWMC will not expire after pooling with Alt’s points? If not, does the monthly bank statement state the expiry of certain amount of points like how UOB does it?

Nope. They still keep their original expiry. So if you go to Dbs rewards portal you’ll see your altitude points listed separately from wwmc.

They are pooled for the purposes of redemption

does airbnb count as online hotel transaction?

Hi guys, got a question:

I have a big family of 6-9 pax (parents/inlaws) and each time my air travel expenses for a holiday can rack up to ~$10k since I am offering to purchase the tickets on their behalf.

does it then make sense for me to get and utilize both dbs attitude visa and amex cards as each card bonus spend is limited to $5k only?

hi all! would anyone know if installment plan (of eligible category) will be eligible for the miles? or are they treated differently? thanks!

Does anyone know if we get more miles for booking cruises? Does that fall into hotel spend category?

Nope it doesn’t. It is still 1.2mpd. The MCC is coded as 4411 Cruise Lines.

I previously used it before on Royal Caribbean and Genting Dream / World Dream last time.

Prices on the DBS Expedia link are much higher, no wonder they are giving 6mpd

What cards are good for GrabPay top-ups then?

My DBS points have not being credited in more than 4 working days after transactions done. Does it happen to anyone?

anyone knows if the priority pass membership have an expiry?

“Cardholders need to apply for their Priority Pass via this link. Their two visit allowance is tracked by membership year, based on when they applied for their Priority Pass.”

Hi, does Airbnb count under the bonus 3 MPD for DBS Altitude card for online hotel spend?

yes

I think they also started S$5 earning blocks

If i link DBS Altitude Amex to Atome pay for gym fee. Is this eligible for the 2k spending?

It sounds more like a definite “Leave it” card. Wonder why it’s not rated as such.

Hi Aaron, may I know if you have any recommended miles credit cards to be used in purchasing luxuries overseas like engagement rings, jewellery, bags, watches, etc. those are SGD 3k and above? I am thinking UOB PRVI and DBS Altitude which do not have cap but not sure if there is any other considerations like conversion rate and refunds. Thanks in advance for your advice!

PS: I excluded UOB KrisFlyer as I might not spend over SGD 800 for the criteria.

Well Well, there was supposed to be an anticipated change at the start of the year (2024) which did not happen at all. I wonder where it all went, they just quietly took it away from their website.

Thought to update you instead of US$32, “28. A fee of US$35 per person per visit will be charged to Cardmember’s DBS Altitude Visa Signature Card for additional visits in excess of the 2 complimentary lounge visits within each 12-month membership period.” taken from https://www.dbs.com.sg/iwov-resources/pdf/cards/altitude-card-tnc.pdf Last Updated: 1 January 2024

Can I check if homepay is eligible for the sign-up bonus?

I see what you did there with the chicken wing analogy ^^ My favourite chicken lady

Thank you for the review! Wanted to check if the calculation of altitude miles in the table might be a little outdated or am I doing something wrongly, my calculation returned the following: $5 – 3 miles, $9.99 – 6 miles, $15 – 9 miles and so on.. is that right?

you’re calculating dbs points, not miles. 1 dbs point = 2 miles