Pharmacies are an important category of everyday spend for a lot of people, whether it’s antihistamines, or wellness items which may or may not vibrate.

While there are credit cards that earn as much as 10 mpd on this category, the best card boils down to which particular chain you’re patronising, and whether you’re spending online or offline.

| 💳 What’s the Best Card for… | ||

| ❓ Overall Guide |

||

| ✈️ Air Tickets |

🌎 Amaze | 🛍️ Atome |

| 💰 CardUp | 🚗 Car Rental | 💗 Charity |

| 🍽️ Dining | 🏫 Education | ⚡ EV Charging |

| 🥡 Food Delivery | 🏨 Hotels | ☂️ Insurance |

| 📱 Kris+ | ⚕️ Medical | 🏖️ Overseas |

| 💊 Pharmacies | ⛽ Petrol | 🚍 Public Transport |

| 🛒 Supermarkets | 🚰 Utilities | 💒 Weddings |

How do pharmacies code?

Most pharmacy transactions code as MCC 5912 Pharmacies or Drug Stores. This covers the vast majority of stand-alone pharmacies you’re likely to encounter, such as Guardian, Unity, or Watsons.

However, purchases from SingHealth Pharmacy or NHG Pharmacy code as MCC 9399 (Government Services), which is ineligible for rewards with almost all cards. One possible workaround is to pay via HealthHub, which codes as the rewards-eligible MCC 8099 (Medical Services Not Elsewhere Classified) — though read this post before spending! — but that’s not possible for regular retail purchases.

Similarly, if you buy from hospital-based pharmacies, your transaction may be coded as MCC 8062 (Hospitals), which also usually doesn’t qualify for rewards.

For a complete picture, I recommend reading this article alongside the one linked below.

In case you’re uncertain about the MCC, there are three ways of looking it up before making a purchase:

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

| Note: “Ease of use” and “reliability” are all relative. HeyMax already provides a solid baseline for reliability, and the DBS digibot is still simple enough to use, despite requiring more steps than the other two methods. | ||

What’s the best card to use?

I’m going to divide this into two scenarios: offline and online purchases, because not everyone’s cool enough to waltz up to the cashier with a bottle of Rogaine and a box of extra petite condoms (or as I call it, Friday night).

Offline

| 💊 Best Cards for Pharmacies (Offline) |

||

| Card | Earn Rate | Remarks |

DBS yuu Card DBS yuu CardApply |

10 mpd | Guardian only. Min. S$600, max S$600 spend per c. month Review |

OCBC Rewards Card OCBC Rewards CardApply |

6 mpd | Watsons only. 4 mpd for Guardian and Unity. Max S$1.1K per c. month Review |

HSBC Revolution Card HSBC Revolution CardApply |

4 mpd | Max S$1.5K per c. month* Review |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | Max S$1K per c. month. Must choose Beauty & Wellness as bonus category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd | Max S$750 per c. month. Must choose Beauty & Wellness as bonus category Review |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd^ |

Max S$1.1K per c. month Review |

UOB Visa Signature UOB Visa SignatureApply |

4 mpd^ |

Min S$1K, max S$1.2K per s. month Review |

| C. Month= Calendar Month | S. Month= Statement Month *Until 31 October 2025, after which no more bonuses for offline spend, and bonus cap reverts to S$1,000 per calendar month ^Must tap phone to pay (Preferred Platinum Visa) or tap phone/physical card (Visa Signature) |

||

Online

| 💊 Best Cards for Pharmacies (Online) |

||

| Card | Earn Rate | Remarks |

DBS yuu Card DBS yuu CardApply |

10 mpd | Guardian only. Min. S$600, max S$600 spend per c. month Review |

OCBC Rewards Card OCBC Rewards CardApply |

6 mpd | Watsons only. 4 mpd for Guardian and Unity. Max S$1.1K per c. month Review |

Citi Rewards Card Citi Rewards CardApply |

4 mpd | Max $1K per s. month Review |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd |

Max S$1K per c. month Review |

HSBC Revolution HSBC RevolutionApply |

4 mpd |

Max S$1.5K per c. month* Review |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | Max S$1K per c. month. Must choose Beauty & Wellness as bonus category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd | Max S$750 per c. month. Must choose Beauty & Wellness as bonus category Review |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd |

Max S$1.1K per c. month Review |

KrisFlyer UOB Card KrisFlyer UOB CardApply |

2.4 mpd |

No cap. Min S$1K spend on SIA Group in m. year Review |

| C. Month= Calendar Month | S. Month= Statement Month | M. Year= Membership Year *Until 31 October 2025, after which bonus cap reverts to S$1,000 per month |

||

Be sure to read the explanatory notes below.

DBS yuu Card

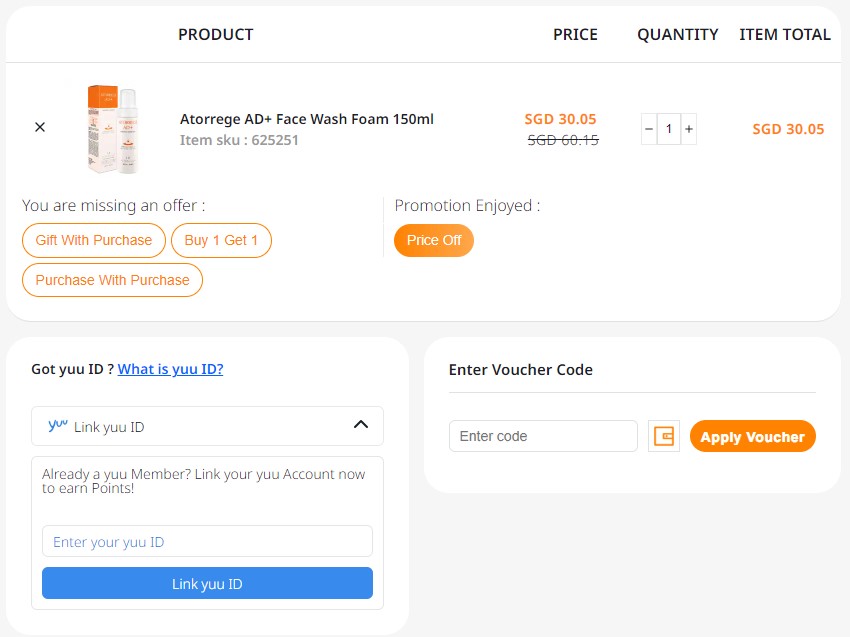

The DBS yuu Card will earn 10 mpd at Guardian, whether offline or online. However, if you purchase online, you’ll need to link your yuu ID to your payment to earn the full number of points. Don’t forget this step!

OCBC Rewards Card

The OCBC Rewards Card’s bonus whitelist does not feature MCC 5912. Instead, it specifically includes Guardian, Unity and Watsons, and while that should cover most of the brick-and-mortar segment in Singapore, it’s not quite all-encompassing.

Incidentally, OCBC has informed me that the Watsons bonus applies whether you’re buying in Singapore or overseas. If you’re doing the latter, the transaction description must start with Watsons, so avoid using any e-wallets which may change the description (e.g. Amaze).

Be careful with apps!

If you’re making a purchase through the Guardian or Watsons app, these purchases code as MCC 5499 and not MCC 5912.

Stick to a card that offers bonuses for general online spending, such as the Citi Rewards or DBS Woman’s World Card.

HeyMax workaround

In the unlikely event you don’t have any of the cards mentioned above, there’s one more possibility: the Maybank XL Rewards Card, paired with HeyMax.

|

|

| Sign up here | |

|

|

| All voucher purchases code as MCC 5311 (Department Stores) | |

All HeyMax gift card purchases code as MCC 5311, which is a whitelisted bonus category for the Maybank XL Rewards Card. Therefore, you could purchase NTUC FairPrice gift cards, redeem them at Unity pharmacies, and earn 4 mpd.

You’ll also earn some additional Max Miles from your purchase, though the current rate is a rather negligible 0.1 mpd.

Conclusion

There’s no shortage of cards that earn bonus miles at pharmacies, but you do need to be careful as the ideal card will depend on whether you’re buying online or offline, as well as whether you’re at a stand-alone pharmacy, or one which is part of a hospital.

Given that pharmacies are a whitelist category for several cards, I feel it’s a bit of a waste to use the more flexible caps of the DBS Woman’s World Card or UOB Preferred Platinum Visa here, unless of course you’re not in danger of busting those in the first place.

Hi Aaron, you have written separately on the recent exclusion of hospital bills by Standard Chartered, HSBC Visa Infinite and UOB premium cards. These nerfs do not seem to be have been updated in your general article on Best Credit Cards for Medical Expenses.

Maybank Family & Friends MC – 8%, if Pharmacy category selected

Thanks, but need to have a monthly spend of at least S$800 on the card in order to get 8% cashback (with a monthly cap of S$25) from the Pharmacy category.

We can also buy from pharmacies (e.g. Guardian, Watsons, SingHealth Pharmacare, NHG Pharmacy) that are in Shopee app and/or Lazada app, and earn 10X reward points for online transactions offered by cards such as Citi Rewards Card, HSBC Revolution and DBS Woman’s World Card.

For spending using the DBS yuu Cards at Guardian’s physical stores, besides earning bonus yuu points, there are free “My Rewards” digital vouchers in the yuu app available for use to reduce expenses on selected product categories (e.g. body wash, facial, oral) from time to time.

Watsons online store also 5499 so I can use UOB Lady’s Card that’s on dining category?

I confirm the above with dining category able to get the 9x bonus as of Nov 2025