One of the more annoying things about playing the miles game is keeping track of bonus caps.

For example, the HSBC Revolution Card offers 4 mpd on the first S$1,500 spent at bonus merchants each month. But go even S$1 above that limit, and the rate plunges into 0.4 mpd territory, meaning you’d have been better off using a general spending card instead!

To add to the frustration, internet banking often displays transactions by statement period, even if the card tracks bonuses by calendar month. This mismatch makes it hard to calculate remaining bonus caps on the fly.

But thankfully, there’s a tool which can make life a lot easier— at least for certain cards.

HeyMax Card Maximiser

|

| Get a HeyMax account |

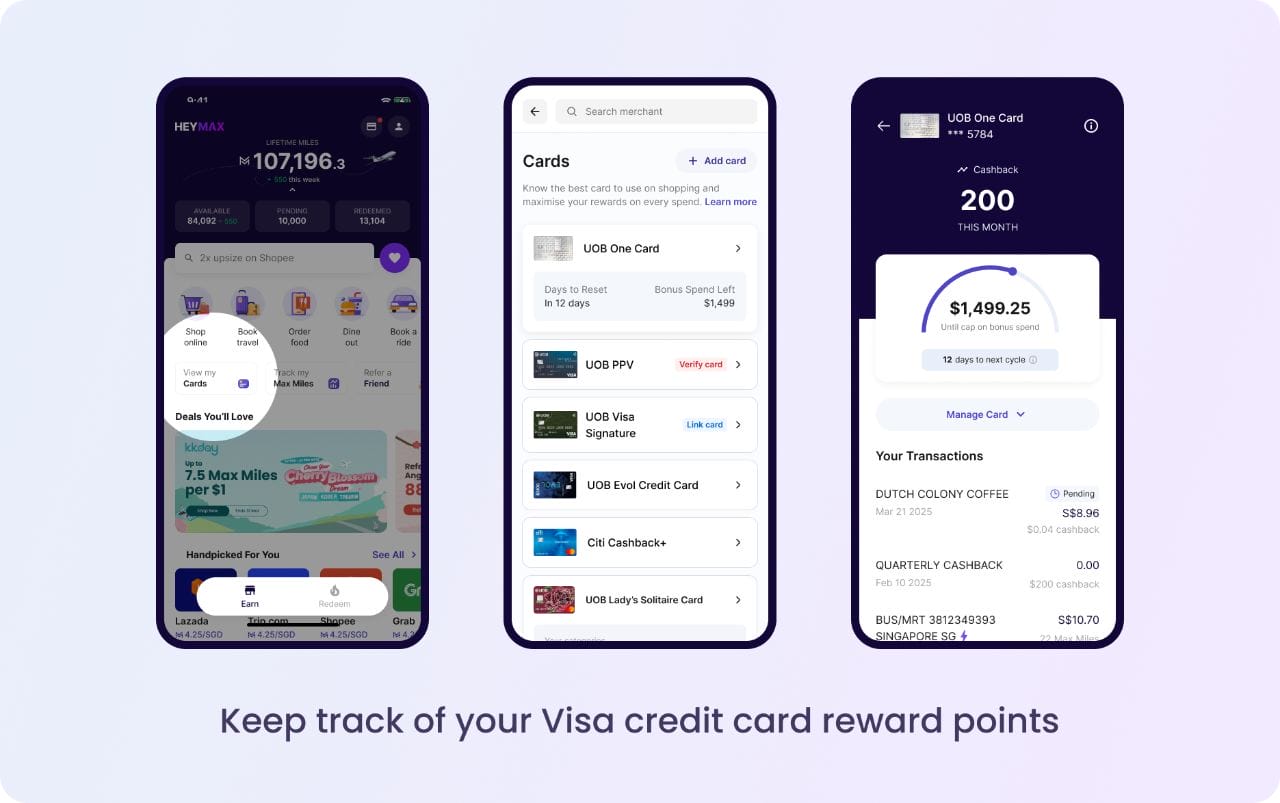

The HeyMax Card Maximiser allows you to automatically track your expenditure, points earned and remaining bonus cap for selected Visa cards.

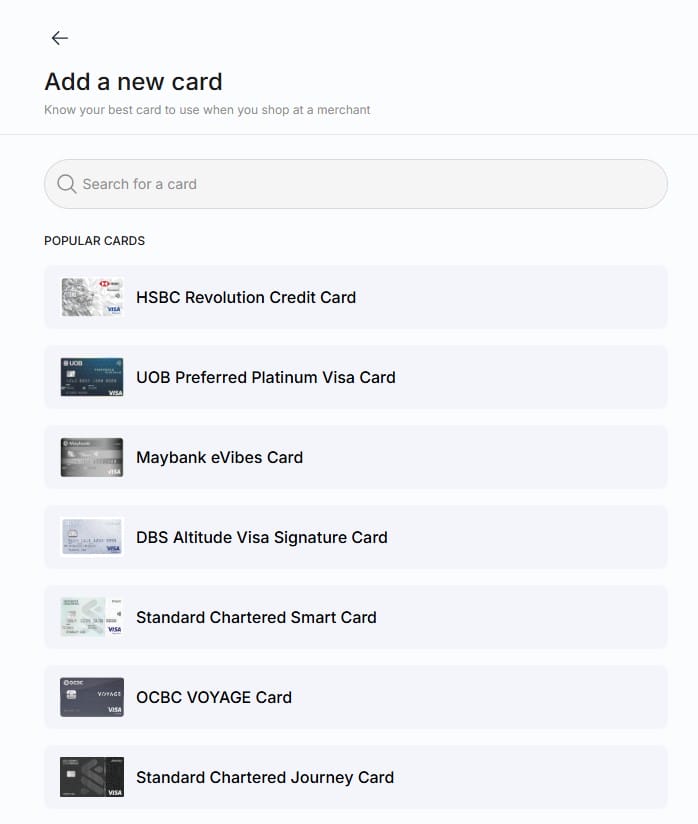

To use the Card Maximiser, you need to first pair your card with your HeyMax account.

- Login to your HeyMax account

- Navigate to Your Cards

- Click on Add Card, then follow the instructions

A test transaction of S$0.01 (or S$1, depending on the card) will be charged and later refunded. This is very similar to ShopBack GO or Qatar’s Card Linked Offers, both of which rely on the transaction feed that Visa provides to track and reward card spending.

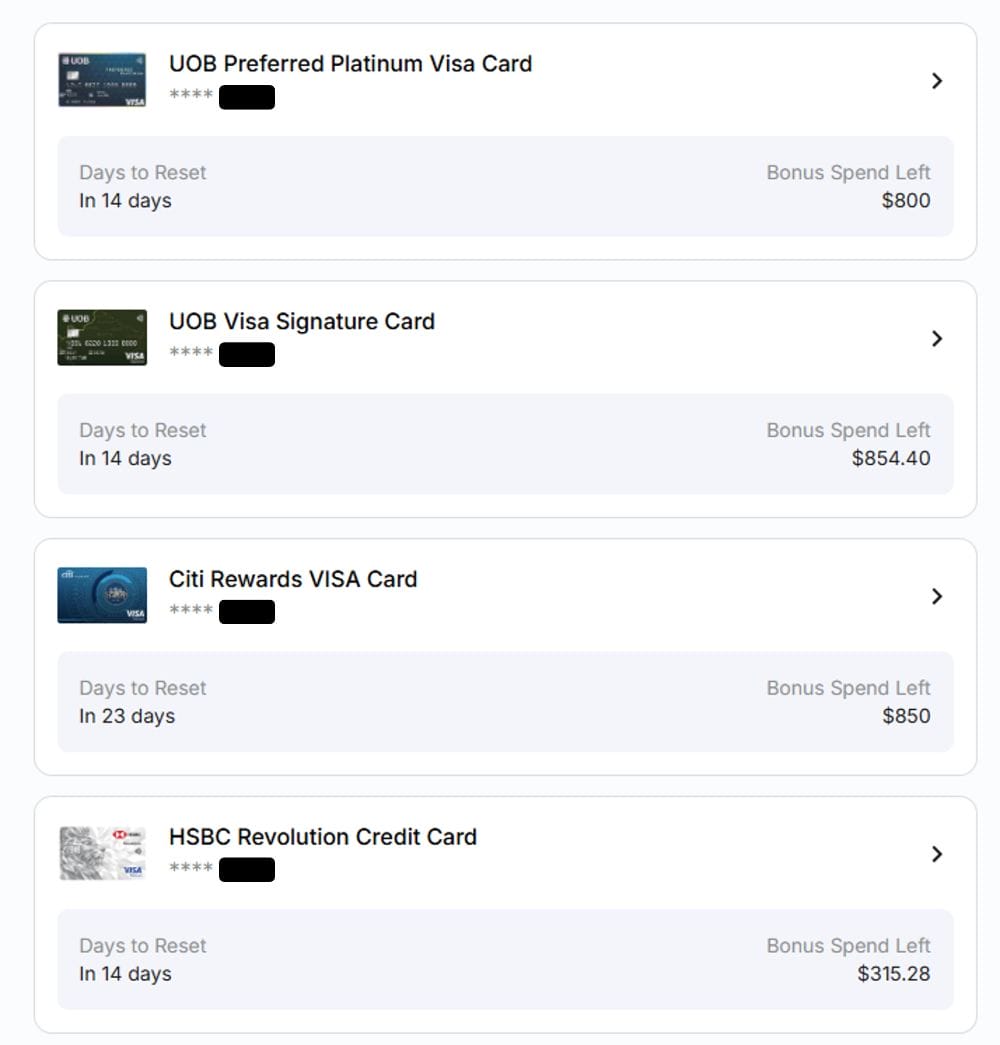

Once the linking is completed, HeyMax will start tracking how much you’ve spent on each card, and deduct it from the bonus cap accordingly.

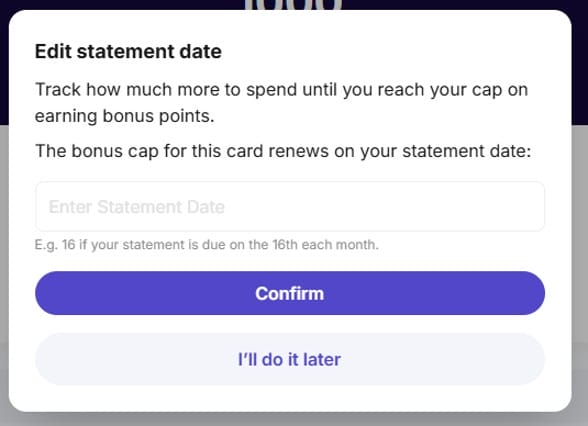

In the case of the Citi Rewards Visa, StanChart Journey Card and UOB Visa Signature, where bonus caps are tracked by statement month, you’ll be prompted to enter the last day of your statement date so the system knows when to reset your cap.

While the Card Maximiser supports transaction tracking for (almost) every Visa card, the calculation of points earned and remaining bonus caps is only supported for the following Visa cards.

| 💳 HeyMax Card Maximiser Supported cards for points and bonus cap tracking |

||

| Card | Earn Rate | Bonus Cap |

Chocolate Visa Debit Card Chocolate Visa Debit CardApply |

1 mpd | S$1K per c. month |

Citi PremierMiles Visa Citi PremierMiles Visa |

1.2 mpd (SGD) 2.2 mpd (FCY) |

N/A |

Citi Rewards Visa Citi Rewards Visa |

4 mpd | S$1K per s. month |

DBS Altitude Visa DBS Altitude VisaApply |

1.3 mpd (SGD) 2.2 mpd (FCY) |

N/A |

DBS Vantage Card DBS Vantage CardApply |

1.5 mpd (SGD) 2.2 mpd (FCY) |

N/A |

HSBC Revolution HSBC RevolutionApply |

4 mpd | S$1.5K per c. month |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

2.8 mpd | S$10K per c. month (for air tickets) |

StanChart Journey Card StanChart Journey CardApply |

3 mpd | S$1K per s. month |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd | S$1.1K per c. month* |

UOB Visa Signature UOB Visa SignatureApply |

4 mpd | S$2.4K per s. month (2x sub-cap of S$1.2K) |

| *From 1 Oct 2025, the bonus cap will be split into S$600 for mobile contactless, and S$600 for selected online transactions | ||

Do note bonus tracking for the UOB Visa Signature is currently broken, following the introduction of bonus sub-caps which HeyMax does not yet support.

What are the limitations?

Tracking not supported for all Visa cards

The HeyMax Card Maximiser does not support points calculations and bonus cap tracking for all Visa cards.

The key ones I’d like to see added are:

- DBS yuu Visa: 10 mpd rate has a minimum spend and cap (currently S$600, will be S$800 from 1 October 2025)

- StanChart Visa Infinite: To help track progress towards the S$2,000 minimum spend required to trigger 1.4/3 mpd on SGD/FCY

- Maybank Visa Infinite: To help track progress towards the S$4,000 minimum spend required to trigger 3.2 mpd on FCY

No support for Mastercard

As mentioned, the HeyMax Card Maximiser only supports Visa cards, so you won’t be able to track the bonus caps on any kind of Mastercard (mind you, it’s not that they don’t want to, but rather because Mastercard does not provide the API which makes the Card Maximiser possible).

That’s a shame, because I could think of numerous Mastercards which would benefit from this feature.

| Card | Earn Rate | Bonus Cap |

Citi Rewards Card Citi Rewards CardApply |

4 mpd | S$1K per s. month |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd | S$1K per c. month |

Maybank XL Rewards Maybank XL RewardsApply |

4 mpd | S$1K per c. month (with min. S$500 spend per c. month) |

OCBC Rewards Card OCBC Rewards CardApply |

4 mpd | S$1.1K per c. month |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd | S$1.5K per c. month (2x sub-cap of S$750) |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | S$1K per c. month |

No support for sub-caps

UOB has recently started introducing sub-caps across most of its rewards cards, which require cardholders to spend across two separate bonus categories in order to max out the card’s monthly bonus cap.

For example, the UOB Visa Signature’s bonus cap is now split into:

- 4 mpd for overseas spending, with a minimum spend of S$1,000 and capped at S$1,200 per statement month

- 4 mpd for local contactless and petrol spending, with a minimum spend of S$1,000 and capped at S$1,200 per statement month

The Card Maximiser does not categorise your spending based on category, so you won’t be able to see which of the sub-caps your transaction counts towards, or how much bonus cap remains in each sub-category.

This will also become an issue for the UOB Preferred Platinum Visa from 1 October 2025, when it will split its bonus cap into:

- 4 mpd for mobile contactless, capped at S$600 per calendar month

- 4 mpd for selected online transactions, capped at S$600 per calendar month

Hopefully, HeyMax will add support for sub-caps soon, because they’re going to be very frustrating to track manually.

Points may not tally with the back end

While certain cards like the Citi Rewards Visa and UOB Preferred Platinum Visa award base and bonus points together, other cards may award base points upfront, and bonus points the following month.

For example, I made a transaction with Atome using my HSBC Revolution, and HeyMax shows that I’ve earned 2,340 HSBC points (936 miles).

That’s not strictly speaking correct. What I have earned is 234 points (S$234.35 @ 1 point per S$1, adjusted for rounding). The remaining 2,106 points (S$234.35 @ 9 points per S$1, adjusted for rounding) will be credited the following month, so if I didn’t know better and went to check my HSBC points balance now, I might get confused.

Still, I think this is the best way of showing information, because if the Card Maximiser showed 234 points I bet HeyMax would get a lot of panicky emails…

For more details on when bonus points are posted, refer to the article below.

Conclusion

The HeyMax Card Maximiser is a useful tool for keeping tabs on how much you’re spending, and how much bonus cap remains on your Visa card. All that’s required is a one-time linkage and transactions will be tracked automatically, taking some cognitive load off your mind.

The main limitations now are the absence of support for the DBS yuu Visa and all Mastercards, as well as the inability to handle UOB’s new sub-caps. If those could be sorted out, then the Card Maximiser would become practically essential.

does it track and reflect only the spend eligible for miles on the card?

Not that sophisticated, it’s very simple counter

Are we sure they are still in business? Support tickets arw ignored for weeks these days?