Here’s The MileLion’s review of the Citi Prestige Card, Citibank’s second most exclusive credit card (after the invite-only Citi ULTIMA).

Even though this card has been discontinued elsewhere, it’s still going strong in Singapore, rewarding cardholders with travel benefits, gourmet promotions, and various lifestyle offers. But with a non-waivable annual fee of S$540, a Citi Prestige Card is certainly going to make a dent in your wallet.

Here’s a detailed look at what’s in store for cardholders who take the plunge.

Citi Prestige Citi Prestige |

|

| 🦁 MileLion Verdict | |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? |

|

| While some of its benefits have been chipped away, the Citi Prestige Card remains one of the more competitive cards in the $120K segment. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Review Changelog

|

Date: 11 September 2023

|

Overview: Citi Prestige Card

Let’s start this review by looking at the key features of the Citi Prestige Card.

|

|||

| Apply Here | |||

| Income Req. | S$120,000 p.a. | Points Validity | No expiry |

| Annual Fee | S$540 |

Min. Transfer |

25,000 TY points (10,000 miles) |

| Miles with Annual Fee |

25,000 | Transfer Partners |

|

| FCY Fee | 3.25% | Transfer Fee | S$27 |

| Local Earn | 1.3 mpd | Points Pool? | No |

| FCY Earn | 2.0 mpd |

Lounge Access? | Yes |

| Special Earn | N/A | Airport Limo? | Yes |

| Cardholder Terms and Conditions | |||

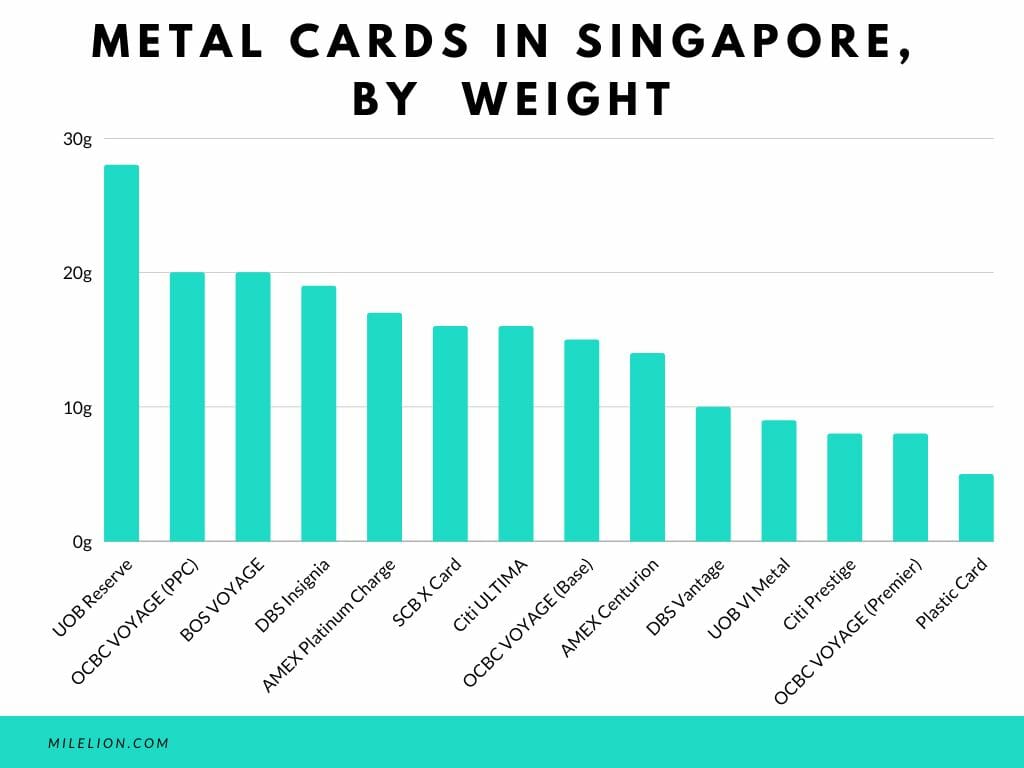

The Citi Prestige comes in metal cardstock, but it’s actually one of the lightest metal cards on the market. In fact, it’s more of a hybrid, weighing in at 8 grams, just a hair over the standard plastic card’s 5 grams.

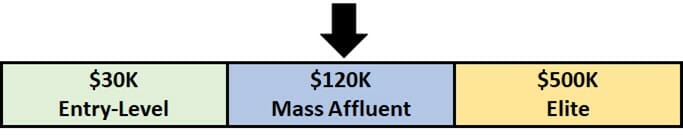

How much must I earn to qualify for a Citi Prestige?

The Citi Prestige has a S$120,000 p.a. income requirement, although it is also available to Citigold customers (min AUM: S$250K) who earn at least S$30,000 p.a.

If you don’t meet the income criteria, it may be possible to get the Citi Prestige as a secured credit card, with a deposit of at least S$15,000. Visit a Citi branch to make enquiries.

How much is the Citi Prestige Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$540 | Free |

| Subsequent | S$540 | Free |

The Citi Prestige has an annual fee of S$540, which will increase to S$545 from 1 January 2024 due to the increase in GST from 8% to 9%. Supplementary cards are free for life.

Annual fee waivers are not available for the Citi Prestige, so don’t even think about asking (Citigold has run acquisition promotions which waive the first year’s fee, but there’s nothing going on now to my knowledge).

Cardholders receive 25,000 miles for paying the annual fee each year, which works out to about 2.16 cents per mile. That’s a relatively high cost to pay, but remember, we need to look at the benefits in totality.

What sign-up bonus or gifts are available?

The Citi Prestige is currently offering 71,000 bonus miles for cardholders who apply online for a Citi Prestige Card and receive approval within 30 days of application.

Cardholders will earn:

- 25,000 miles for paying the S$540 annual fee

- 23,000 miles for spending S$1,000 in local currency

- 23,000 miles for spending S$1,000 in foreign currency

The minimum spend for local and foreign currency must be met by the end of the second calendar month following the month of approval. For example, those approved from 1-31 August 2023 have until 31 October 2023 to meet the minimum spend. Depending on when your approval comes in, you have anywhere from 2-3 months to meet the minimum spend.

This offer is open to individuals who have not cancelled a Citi Prestige Card in the 12 months prior to application. Existing Citi principal cardholders are eligible.

The full details can be found below:

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.3 mpd | 2 mpd | N/A |

SGD/FCY Spend

Citi Prestige members earn:

- 3.25 ThankYou points for every S$1 spent in Singapore Dollars

- 5 ThankYou points for every S$1 spent in foreign currency (FCY)

5 ThankYou points are worth 2 airline miles, so that’s an equivalent earn rate of 1.3 mpd for local spend, and 2.0 mpd for FCY spend.

| 👫 Relationship Bonus | ||||||||

|

The Citi Prestige Card features a “relationship bonus” which awards 5-30% more points depending on your tenure with Citibank, and whether you have Citigold status. Contrary to popular belief, a 5% bonus does not mean you earn 1.3 * 1.05 = 1.365 mpd. Instead, the relationship bonus percentage is applied to your overall dollar spend amount to derive bonus points. For example, if you spend S$10,000 in a year with a 5% bonus, you get 5% * 10,000= 500 bonus points, or a paltry 200 miles. The bump in mpd is a mere 0.02! Here’s how much you can earn on local/overseas spending with the relationship bonus:

|

Truth be told, these earn rates could certainly be much better. In terms of miles earning potential, the Citi Prestige Card ranks towards the bottom of the $120K pack.

However, the picture changes if you look at the base earn rates, without minimum spend requirements. In that case, the Citi Prestige ranks more respectably- and perhaps slightly better, once you factor in its rounding policy (see below).

When are ThankYou points credited?

ThankYou points are credited when your transaction posts, which generally takes 1-3 working days.

How are ThankYou points calculated?

Here’s how you can work out the ThankYou points earned on your Citi Prestige Card.

| Local Spend | Round down transaction to nearest S$1, then multiply by 3.25. Round to nearest whole number |

| FCY Spend |

Round down transaction to nearest S$1, then multiply by 5. Round to nearest whole number |

Unlike some cards which award points for every S$5 spent (such as the OCBC VOYAGE and UOB Visa Infinite Metal Card), the Citi Prestige awards points for every S$1 spent.

This means you lose fewer points through rounding, which can make a big difference on smaller transactions. For example, the Citi Prestige Card can outperform the ostensibly higher-earning UOB Visa Infinite Metal on certain transactions, as illustrated below.

If you’re an Excel geek, here’s the formulas you need to calculate points:

| Local Spend | =ROUND (ROUNDDOWN(X,0)*3.25,0) |

| FCY Spend |

=ROUND (ROUNDDOWN(X,0)*5,0) |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for ThankYou points?

A full list of ineligible transactions to earn ThankYou points can be found in the Citi rewards T&Cs.

I’ve highlighted a few noteworthy categories below:

- Educational Institutions (MCC 8211-8299)

- Donations (MCC 8398)

- Government Services (MCC 9000-9999)

- Insurance (MCC 6300)

- Professional Services and Membership Organizations (MCC 8651-8661)

- Quasi cash transactions (MCC 6529-6540)

- Real Estate Agents and Managers (MCC 6513)

- Top-ups to prepaid accounts like YouTrip and GrabPay

- Utilities payments (MCC 4900)

For avoidance of doubt, the Citi Prestige Card still earns points for CardUp and hospital spend.

What do I need to know about ThankYou points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| No Expiry | No | S$27 |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 25,000 TY Points (10,000 miles) |

11 | 24-48 hours (for KF) |

Expiry

ThankYou points earned on the Citi Prestige Card do not expire.

Pooling

Citibank has a policy of not pooling points across cards.

If you have 12,000 ThankYou points on the Citi Prestige Card and 30,000 ThankYou points on the Citi Rewards Mastercard, you will have to pay two separate conversion fees. This also means that you’ll need to transfer all your points out before cancelling the card, or else forfeit them.

Transfer Partners & Fee

Citibank has the widest variety of transfer partners in Singapore, with 11 airline and hotel programmes to choose from. This gives you access to some great sweet spots, like with British Airways Executive Club, Etihad Guest, and Turkish Miles&Smiles.

More importantly, all three airline alliances are represented: Star (KrisFlyer, EVA, THAI, Turkish), oneworld (Asia Miles, BA, Qantas, Qatar), and SkyTeam (Flying Blue). This means your points are intrinsically more valuable, since you’re hedged against any one particular programme carrying out a devaluation.

Points transfer at a 5:2 ratio, with a minimum transfer block of 10,000 miles.

| Frequent Flyer Programme | Conversion Ratio (ThankYou Points: Partner) |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

|

25,000: 10,000 |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

|

25,000: 10,000 |

| 25,000: 10,000 |

An admin fee of S$27 applies to all transfers.

Transfer Times

Citibank tells customers that points transfers will take 14 business days, but in reality it’s usually 24-48 hours for KrisFlyer, or 2-4 working days for other programmes.

If you need your points credited instantly, you can move them via Kris+ at a rate of 10,000 TY points = 3,400 KrisPay miles. KrisPay miles can then be instantly converted to KrisFlyer miles at a 1:1 ratio.

|

| S$5 for new Kris+ Users |

| Get S$5 (in the form of 750 KrisPay miles) when you sign-up with code W644363 and make your first transaction |

There are pros and cons to this:

Pros

- Minimum conversion block is reduced to 10,000 TY points, versus 25,000 TY points if converting via Citibank’s rewards portal

- Transfers from Citi to Kris+ and Kris+ to KrisFlyer are instant

Cons

- Those 10,000 TY points would normally be worth 4,000 KrisFlyer miles, so a 15% haircut is incurred

Should you choose to take this option, do note that it’s a two-step process. The first transfer is from Citi to Kris+, the second is from Kris+ to KrisFlyer. A big button will pop up after the first step prompting you to take the second.

If you do not convert within seven days, or spend any of the transferred miles, the balance will be “stuck” in Kris+, where they expire after six months, and are worth a mere 0.67 cents apiece.

Other card perks

4th Night Free on hotel stays

One of the biggest draws of the Citi Prestige is the 4th Night Free benefit, which allows cardholders to stay four nights at a hotel for the cost of three.

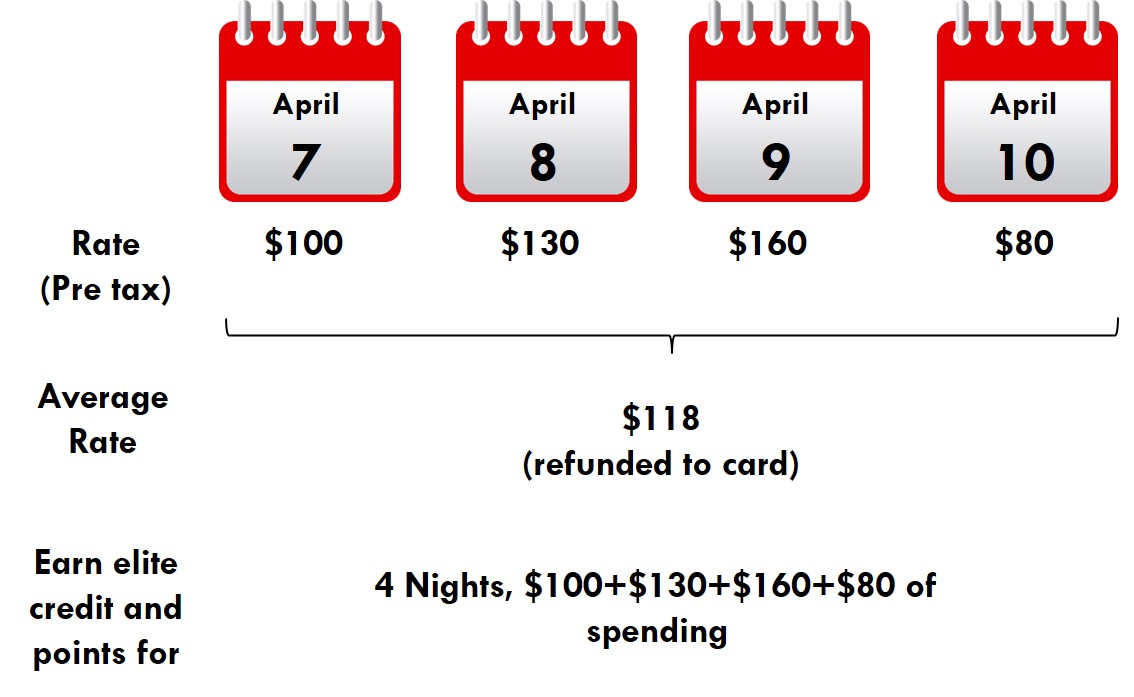

Here’s how it works: Citi Prestige Cardholders make a hotel booking through the Citi Prestige concierge of at least four nights. The average pre-tax rate of the first four nights will be refunded within two billing cycles (up to 90 days) from completion of full payment, which must be made at the time of booking.

In the example above, the cardholder receives a refund of S$118 (the average of S$100, S$130, S$160 and S$80). Since the refund is on the Citi side, elite credit and hotel points (if applicable) are earned on the full amount of spending.

A maximum of one free night can be enjoyed per stay, back to back stays will not be honoured. Back to back stays are defined as consecutive stays:

- In the same hotel, same city

- In a different hotel, in the same city

Consecutive stays are defined as any stay in which the check-in date is less than seven days from the previous check-out date.

Only the principal cardholder is entitled to this benefit, and he/she must be staying at the hotel. The following stays are excluded:

- Full and half board room stays

- Single and multi-room suites

- Home & farm stays

- Serviced apartments

- Villas

- Packaged stay and member rates, such as air and hotel, hotel and car rental, hotel and meals bundled promotions

This means the concierge will not let you book an all-suites or all-villa hotel, even though I believe that wasn’t the original intention of the exclusions.

Only prepaid rates that are available on the hotel’s website (excluding member’s rates) or Expedia can be booked.

As you can see, Citi has slapped a whole lot of restrictions on this benefit, so much so that existing cardholders complain it’s dying the death of a thousand cuts. You can still save money, sure, but you might drive yourself a little crazy trying to do it.

Complimentary airport limo

Once upon a time, spending just S$1,500 per quarter in foreign currency would unlock four free airport limo rides on the Citi Prestige Card. But in April 2019, Citi hiked the spending to S$20,000 per quarter while reducing the rides to two. That was an outrageous change, and the bank’s attempts to spin it as an “enhancement” didn’t help.

In February 2020, Citi walked back the changes somewhat. The minimum spend was reduced to S$12,000 per quarter, where it’s remained ever since.

Quarters are defined as:

- Q1: 1 Jan to 31 Mar

- Q2: 1 Apr to 30 Jun

- Q3: 1 Jul to 30 Sep

- Q4: 1 Oct to 31 Dec

For avoidance of doubt, Citi PayAll spending will count towards the S$12,000 qualifying spend, provided the 2.2% service fee is paid.

Rides must be booked in the same quarter they are earned, although the ride date can be outside the earning quarter. For example, on 3 May 2023 I charge S$12,000 in qualifying spend to my Citi Prestige Card. This earns me two complimentary limo rides, which I must book by 30 June 2023. The actual utilisation date can be beyond 30 June 2023.

Remember, limo rides are charged at the time of booking (not utilisation), so all that matters is the charge is reflected in the correct quarter.

Reimbursement for limo rides will take place in the following quarter. All bookings must be done via the Citi Prestige concierge at least 48 hours prior to pickup time.

Unlimited complimentary lounge visits

Citi Prestige Cardholders enjoy unlimited lounge visits via Priority Pass, along with one guest. This benefit only applies to the principal cardholder; supplementary cardholders do not receive access.

As far as cards in the $120K segment go, this is pretty competitive.

Registration is required, and instructions can be found here.

Prestige Guest Chef Dining

Citi Prestige Cardholders receive periodic invitations to specially-curated dining experiences under the Prestige Guest Chef Dining programme.

These aren’t free, obviously, but can sometimes represent a small discount to the public price.

| 🍽️ Sample Event: Four Hands Dining – Iggy’s |

|

This September, prepare to indulge in a culinary symphony as two masterful chefs, Chef Darren Chin of 1-Michelin starred DC Restaurant by Darren Chin, and Head Chef Jake Lee of 1 Michelin-starred Iggy’s, unite their creative prowess in a captivating Four Hands dinner collaboration. Chef Darren’s exquisite mastery, a fusion of classic French techniques and delicate Japanese nuances, intertwines harmoniously with Chef Jake’s artful curation of a seasonal menu that resonates with the flavors of Singapore, Southeast Asia, and contemporary European gastronomy trends. This exceptional collaboration promises an evening of transcendent flavours, where two distinct culinary realms converge to craft an unforgettable dining experience that celebrates innovation, cultural diversity, and the art of culinary storytelling. |

| Price: S$415.80 for 2 pax. |

Buy cheap miles via Citi PayAll

|

| Citi PayAll |

While this isn’t unique to the Citi Prestige Card, one of the best perks of holding a Citibank card is access to Citi PayAll.

Citi Prestige Cardholders can pay various bills with their card and earn 1.3 mpd, in exchange for a 2.2% service fee.

23 different categories of payment are currently supported:

| 💰 Citi PayAll: Supported Payments | |

| Category | Monthly Cap |

|

S$200,000 |

|

S$100,000 |

|

S$30,000 |

|

S$30,000 |

|

S$30,000 |

|

S$30,000 (each category) |

Here’s a simple example:

- Set up a S$10,000 insurance premium payment via Citi PayAll

- Citi PayAll will charge your Citi Prestige Card S$10,220 (S$10,000 + 2.2% admin fee)

- Citi Prestige Card will earn 13,000 miles (S$10,000 @ 1.3 mpd; no miles for admin fee)

- Cost per mile= 1.69 cents (S$220 admin fee / 13,000 miles)

Citi runs periodic promotions that upsize the miles or discount the admin fee. The most recent offer (which ended on 20 August 2023) boosted the earn rate to 2.2 mpd across most Citi cards including the Prestige, lowering the cost to 1 cent per mile.

Citi PayAll transactions will count towards the minimum spend for welcome offers, limo spend and other promotions, provided the service fee is paid.

I’ve written a comprehensive guide to Citi PayAll, so be sure to check out the article below.

Complimentary golf games

|

| Golf Bookings |

Citi Prestige Cardholders enjoy complimentary golf games at the following clubs.

| Club | Benefit |

|

|

|

|

| ^There is a requirement of one minimum accompanying paying guest per cardholder for Sentosa Golf Club. No accompanying paying guest is required for Sembawang Country Club, Marina Bay Golf Course and Regional Golf Clubs. *Mission Hills Golf Club requires a minimum one-night stay for every tee time booking |

|

Cardholders enjoy complimentary green fee rounds at three local and three regional golf clubs per calendar year. The benefit can be used at the same club multiple times, e.g. they could book three rounds at Marina Bay Golf Course.

Complimentary travel insurance

Citi Prestige Cardholders enjoy two different insurance travel insurance policies- one from Citibank, and one from Mastercard.

From Citibank

| Accidental Death | S$5,000,000 |

| Medical Expenses | S$50,000 |

| Travel Inconvenience | Flight Delay: S$400 Baggage Delay: S$400 Lost Baggage: S$1,000 |

| Policy Wording | |

Citi Prestige Cardholders receive complimentary travel insurance when they charge their round-trip air ticket to their card. For avoidance of doubt, this includes situations where tickets are redeemed with miles, and the taxes/surcharges paid with the Citi Prestige Card.

However, the miles must be from one of Citi Singapore’s airline transfer partners. At the time of making a claim, you will need to show that the miles transferred from Citi are the same or more than the miles used to redeem the award ticket.

Cardholders are covered for up to S$5,000,000 for accidental death or dismemberment while traveling on a scheduled public conveyance, with S$50,000 coverage for medical expenses and S$100,000 for emergency medical evacuation.

Flight delays, baggage delays and lost baggage are also covered.

Coverage includes the cardholder, spouse, and up to three children.

From Mastercard

| Accidental Death | US$500,000 |

| Medical Expenses | US$500,000 |

| Travel Inconvenience | Flight Delay: US$500 Baggage Delay: US$500 Lost Baggage: US$3,000 |

| Policy Wording | |

On top of the protection provided by Citibank, Citi Prestige Cardholders also enjoy additional coverage from Mastercard by virtue of World Elite Mastercard status. Like Citibank, Mastercard coverage is activated when you use your card to pay for your airfare (or taxes on an award ticket).

This features US$500,000 coverage for accidental death, US$500,000 coverage for medical expenses, plus US$7,500 for trip cancellation or curtailment.

Coverage includes the cardholder, spouse, and up to three children.

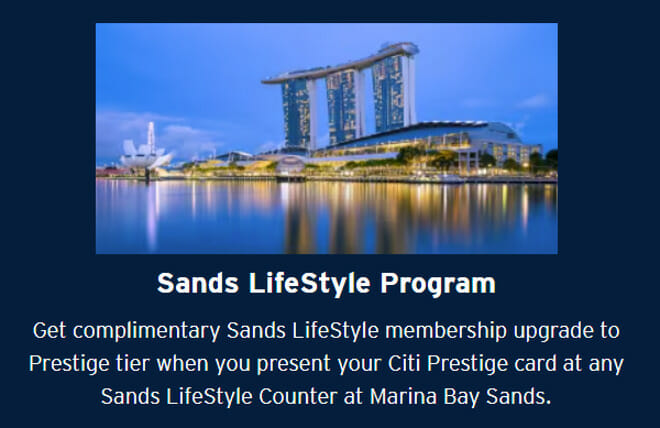

Sands Lifestyle Prestige

|

| T&Cs |

Citi Prestige Cardholders can enjoy a complimentary upgrade to the Prestige tier of Sands Lifestyle, Marina Bay Sand’s loyalty programme.

| Sign-up Period | Free Membership | Renewal Criteria |

| 15 Aug to 30 Nov 23 | 12 months | Spend S$5,000 within 12 months |

| 1 Dec 23 to 30 Apr 24 | 3 months | Spend S$1,500 within 3 months |

Cardholders who sign up from 15 August to 30 November 2023 will enjoy a 12-month membership. They can renew their membership for a second 12-month period by spending at least S$5,000 within the initial 12-month period, failing which they will be downgraded to the Lifestyle tier.

Cardholders who sign up from 1 December 2023 to 30 April 2024 will enjoy a 3-month membership. They can renew their membership for a second 9-month period by spending at least S$1,500 within the initial 3-month period, failing which they will be downgraded to the Lifestyle tier.

Sands Lifestyle Prestige members enjoy perks such as:

- Up to 20% instant Resort Dollars at over 250 outlets

- 10% savings on hotel room rate

- Preferential earning of up to 10% instant Resort Dollars at selected restaurants

- $4 Resort Dollar parking (with same-day spend)

- Complimentary tickets to Marina Bay Sands attractions (up to two tickets per day per attraction, capped at two per month)

- Digital Light Canvas

- Sampan rides

- SkyPark Observation Deck

- 1-for-1 ArtScience Museum exhibition tickets (up to four tickets per month)

The full list of perks can be found here.

To upgrade their status, Citi Prestige Cardholders must visit one of the following locations in person

- Lobby, Hotel Tower 1

Daily: 10am – 10.30pm - The Shoppes, B1 (above Sampan Rides)

Daily: 10am – 11pm - The Shoppes, B2 (near Digital Light Canvas)

Daily: 10am – 11pm

World Elite Mastercard benefits

As a World Elite Mastercard, Citi Prestige cardholders enjoy the following perks:

- Avis President’s Club status

- Complimentary fast-track to GHA Discovery Titanium status

- Complimentary 12-month HoteLux Elite Plus membership + US$200 in points

- US$20,000 annual purchase protection

- US$1,000 annual e-commerce purchase protection

- Held Tables for reservations at >600 dining venues worldwide

- Mastercard Priceless offers

For what it’s worth, I think the World Elite Mastercard perks are much better than their Visa Infinite counterparts.

Terms & Conditions

Summary Review: Citi Prestige Card

|

|||

| Apply Here |

The Citi Prestige Card can certainly be useful to frequent travellers.

Those who stay in one place long enough to utilise the 4th night free benefit will find that a handful of bookings can help them recover the annual fee. Likewise, the unlimited lounge visits will be useful for the times you don’t fly First or Business Class, or if you just want to grab a meal at an airport restaurant (unlike AMEX cards, Citi does not exclude these “non-lounge experiences”). And since a guest is included, you can travel with a different person every time.

Citi PayAll continues to be hands down the cheapest way of buying miles on the market, and given Citi’s wide range of transfer partners, you can expand your horizons beyond the usual KrisFlyer and Asia Miles options. PayAll spend also counts towards the complimentary airport limo rides, which can be the icing on the cake.

However, the Citi Prestige Card is certainly weaker than it used to be a few years ago. The 4th night free benefit has become more and more frustrating to use, given the additional terms that Citi has slapped on, and there’s no more free Boingo inflight Wi-Fi or CDW coverage for rental cars.

All things considered, however, the Citi Prestige still offers the easiest path to annual fee recovery among cards in the $120K segment (especially once you factor in the 25,000 annual miles), and if the rarefied air of the ULTIMA is out of reach, this might be a good consolation prize.

StanChart Visa Infinite

StanChart Visa Infinite DBS Vantage

DBS Vantage OCBC VOYAGE

OCBC VOYAGE HSBC Visa Infinite

HSBC Visa Infinite

Relationship bonus rates for Citigold are lower than non-Citigold?

i swapped them around. fixed!

Is the 4th night free applicable for stays in Singapore?

I don’t have personal experience, but reports in Citi Prestige Tele chat say yes

That’s new, will check it out thx Aaron

it does. i used before

Quite a sizeable chunk of points with KF, so any recommendations on transfer options for Citi? Or does it make sense to just renew and wait it out?

I can take the premium for $ per miles paid during renewal as storage maintenance fee for the points since they don’t expire. There’s the devaluation risk but I guess that’s a separate discussion since everyone is basically stuck in sg

yeah you could view it that way…although i still think it’s quite expensive storage.

How about the 3 free greenfees at SG golf clubs?

just read about this, seems to have been added on 20 august. no interest to me, but i’ll add something in the post for those who enjoy golf

These have been around for many years, it used to be three in SG plus three overseas. After the arrival of covid it actually got changed to six rounds in SG, as people could not travel overseas. Not sure whether it has reverted to 3+3 more recently. I’ve been able to secure two rounds this year at MBGC so far.

Thanks so much for the detailed review. I’ve been a member for one year now but this article was a nice recap for me. Due to the lost benefits under COVID situation I was thinking of canceling the membership but I somehow missed the renewal month so I’ll continue to be a member for another year. lol

One stupid question – is this card really metal? I thought the metal card feels heavier and colder but I don’t feel any difference from othe plastic cards…

thin metal glued to thin plastic. it comes apart with time. just like amex platinum card. plastic for paywave. metal cards like insignia and ultima don’t have plastic and are obviously heavier in the hand. some amusing articles actually compare card weights – older ritzcarlton card was the champ if I remember.

what met said- it’s a hybrid card. and one of the lightest metal cards on the market; there are some complaining about build quality.

Fantastic in-depth review! Just wondering, is the Singapore version of this card like the US where it is a metallic card?

yup! however the build quality isn’t great, and it’s only a few grams heavier than a pure plastic card

Hi Aaron, first time commenting here. I was actually looking at this after i saw the benefits you got from your GHA black membership that comes with a World Elite Mastercard (which this card is). With these World Elite Mastercard benefits (I only see 2 on the site, 1 of which is by invite only), do you think it will boost your rating or do you think it doesn’t move the needle much? (Specifically after your Capitol Kempinski Hotel glowing review :))

well i don’t think it’s possible to get GHA black anymore with world elite mastercard, which his why i didn’t mention it. the last successful data point posted was from january 2020, and the landing page is gone: https://www.discoveryloyalty.com/Discovery-Member-News/2018-09/You-re-Invited-To-Black-Status-with-DISCOVERY

if indeed gha black is still possible, then yes it does move the needle a bit. but as always it depends where you stay- some hotels like kempinski treat gha black well, others may not really care.

I attempted to cancel my card (near end Nov) as they would not waive the fees despite almost no opportunity to travel this year and potentially next year. The cancellation process is a nightmare – you have to wait for their retention team to call you, then they will repeat the same refusal to waive fees (ya I get the point) and then read an ultra long terms and conditions that you would indemnify them against any claims (like who will even bother??) and then take their own sweet time to remove the card (1-2 weeks) from your account. Make… Read more »

I’m wondering if there is any regulation or requirement in T&C on how to cancel a card. If not, just inform them and keep a record, then say bye-bye

Has Boingo benefit been removed?

Seems to be the case. Verified eligibility on mastercard website, and result is negative.

where can I find the link to the Prestige Concierge to book travels/hotels? Tried google without success.

Yes, where is this website? Have applied for the card and it’s taking ages to come. Wrote in to Citi for the URL and they asked me to call the ‘Aspire hotline’ on the back of the card. It’s like some heavily guarded trade secret lol smh

Yes, call the Aspire Hotline number (Prestige cardholders can call 63386911). It’s a long wait though.

The 4th night free restrictions are an absolute killer

The 4th night free MUST NOT ONLY be a prepaid, non cancellable/refundable rate

But ALSO be a non discounted rate. Meaning if you book a hotel with an advanced booking discount, that rate is not eligible for the benefit even if the rate is entirely public

And booking through the so-called Travel Concierge is basically you going to the websites, doing your own research, and THEN going back to the Concierge to get them to book it for you.

Absolutely gawd awful benefit. Ridiculous.

Same thing for car rental – I asked how do they do it…they said they’d take my requests and go to 1 of 2 websites…i’d thought concierge means they’d go find the best value option….

Yeah agree.

The difference in prices for member rates could reduce the savings by using the prestige to around 9%.

And the difficulty in calling the concierge…God makes me want to cancel the card

4NF can be refundable, there is no such restriction as long as it is fully prepaid.

That’s right – it just needs to be prepaid. Expedia has a paynow but refundable option – the concierge will typically use that option.

Thanks for the review ! Do agree the 4th night stay is a great way to recoup the AF but in all likelihood my travel profile means i will stay typically a few nights rather than an extended period of time. However, with the 48000 miles bonus offer, it seems quite enticing to get the card at just around approx. 1.1 cents/mile? Although in all likelihood may end up canceling the card just before renewal, with my current spends optimized around on 4 mile/dollar cards. Currently only holding a Citi PM card since 2008 (does that qualify as non-citigold relationship… Read more »

4th night free only available for prepaid rates or some nonsense like that – for W Singapore, I couldn’t get the concierge to book the rooms through the Marriott website because no prepaid rate was available at that time, so they had to use some OTA.

Even though I got the 4th night free, I couldn’t get the nights to count towards status :/

Was pretty much done with the card after that.

How do the current sign up promotions fare in comparison to that 1-2 year back?

I need some advice here. I’m thinking of using this Citi Prestige as my “charge everything” Mastercard. I can use the Citi PayAll to pay for insurance, etc. Strangely, AIA only accepts Mastercard. And I will be earning 1.3 mpd, better nothing at all. PremierMiles earns 1.2 mpd. So I thought this is a better deal.

I have a DBS Vantage that earns 1.5 mpd on Visa spends. Is this a good idea to maximise my mpd? Or should I go for other MasterCards?

Thanks in advance.

If you are looking to maximise mpd dumping all your expenditure on these cards should be the last thing you ever do.

I use the Prestige card as my ‘charge when I don’t have a 4 MPD card’.

Sometimes saving time is worth more than optimizing for miles (I realize some will attack me for this heresy).

Also, Citi Prestige miles convert to Turkish and other programs that often have much lower mileage requirements than Krisflyer.

So while you might earn fewer miles per dollar, the miles you get are worth more IMO.

Joke of the day.

Asked prestige concierge to book an intercontinental club room as was told because it comes with club lounge access hence it’s counted as a package stay.

Not going to renew the card for next year…

that is hilarious indeed. citi CSOs have never been known for competency, but this is special indeed.

Thanks for a great article and an amazing website overall! Does anyone know if the complimentary green fees extend to supplementary card holders?

Was wondering about the limo ride, if I hit the 12k spend in Dec but the payment is 30 Dec, do I get the 2 rides? It can’t be that they expect usage on 31 Dec if it can’t be carried over to next quarter or calendar year right?

Just realised the Kaligo special Earn ended lasg month. Should we expect renewal of that programme?

May I know when I pay the annual fee to renew for the 2nd year, do I get 25000 TY points? Or renewals don’t come with any points at all?

Hey Aaron!

i’m looking for Milelion’s Verdict

will be updating this review in the next few months…stay tuned!

Would appreciate if its before promo period ser

For the 4th night free benefit, how is it booked at chain hotels? Can I ask the concierge to book at the official website and quote my membership number for the booking? Because, sometimes, the website offers members’ price and public price which is higher than members’. If the concierge can accommodate us by booking prepaid member’s prices, then that is still worth the trouble I think.

Can book through hotel website and may be able to link membership (works for IHG but other chains may leave it as a note), but can only book the public non-member rate.

Thanks for sharing the experience. Were you holding the phone line until the booking is finished?

Based on 11Sep’23 updated article, may I confirm if Citi PayAll enables one to receive miles when used for Income Tax payment? Thanks. (my apologies if I had missed it somewhere….)

Yes, only reason I have kept this card. Not renewing next year, will get the Rewards card which still gives access to Citi Payall at a lower cost (for the card)

I keep this card to pay rent and school fees on payall- the nice side benefit is the limo rides. The advantage of the Citi ones is that can be used from Changi and also get a maxicab- saves $60+ each time. They also do random spend promotions (I received a $400 restaurant voucher last month)

the insurance coverage is $5mil or $500k?

Hi aaron,

To confirm, i can use citi payall to pay for donations via giving.sg and this donation will qualify as a valid spending for the welcome gift of max of 71k miles?

Thks

Manage to utilised the 4th night free thrice recently due to my travel plans. A few things to take note: 1) You can ask Citi to book the hotel at no discount rate and your stay will be eligible for hotel membership status 2) You can ask Citi to get cheapest rate (about 5% price difference to booking.com) but then your stay will not be eligible for hotel membership status 3) When calling Citi for 4th night stay, it is better to confirm the hotel booking while on the call. DO not ask them to follow up via email for… Read more »

Hello, grateful for any data points on whether the Marriott Bonvoy hotels will honor the membership status benefits (e.g Platinum benefits) when booking a hotel stay through Citi using the 4th Night free benefit?

Used the card for 12 months, here is the review. – redemption – best redemption offers will come from retailers, like Tangs, however, be prepared to receive pile of vouchers form Citi, which you have to tear up and sign, each voucher is 50$. If you do it for 1000$+ it takes some time. online redemption rates are extremely off. I had some sign up bonus to be charged, that was charged in time, no issues. usage of bonus points a bit of a hassle. – for lounge access, Citi usesi priority pass, which either gives you access to the… Read more »