Food delivery has become an essential part of everyday life, and if you’re going to spend on it anyway, you might as well earn some miles while you’re at it.

In this guide, we’ll look at how food delivery platforms typically code, which cards offer the highest earn rates, and how to stack additional rewards through platforms like HeyMax and ShopBack.

| 💳 What’s the Best Card for… | ||

| ❓ Overall Guide |

||

| ✈️ Air Tickets |

🌎 Amaze | 🛍️ Atome |

| 💰 CardUp | 🚗 Car Rental | 💗 Charity |

| 🍽️ Dining | 🏫 Education | ⚡ EV Charging |

| 🥡 Food Delivery | 🏨 Hotels | ☂️ Insurance |

| 📱 Kris+ | ⚕️ Medical | 🏖️ Overseas |

| 💊 Pharmacies | ⛽ Petrol | 🚍 Public Transport |

| 🛒 Supermarkets | 🚰 Utilities | 💒 Weddings |

What MCC does food delivery code as?

Transactions on food delivery platforms code as online spend, usually under MCC 5812 or 5814.

| Platform | MCC |

| Deliveroo | 5812, 5814 |

| foodpanda | 5812, 5814 |

| GrabFood | 5812, 5814 |

| Oddle Eats | 5812 |

| WhyQ | 5499 |

In case you’re uncertain about the MCC, there are three ways of looking it up before making a purchase:

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem App | ●● | ●● |

| 🤖 DBS Digibot | ● |

●●● |

| Note: “Ease of use” and “reliability” are all relative. HeyMax already provides a solid baseline for reliability, and the DBS digibot is still simple enough to use, despite requiring more steps than the other two methods. | ||

What cards should I use for food delivery?

The simplest cards to use for food delivery are the ones which offer 4 mpd on all online transactions (aka blacklist cards). This way, you don’t need to worry about specific MCCs.

However, if you prefer to conserve their bonus caps for other types of spending, there are also cards which specifically reward food delivery.

| 🥡 Best Cards for Food Delivery |

||

| Card | Earn Rate | Remarks |

DBS yuu Card DBS yuu CardApply |

10 mpd | Foodpanda only. Min. S$600 Max. S$600 per c. month Review |

Citi Rewards Citi RewardsApply |

4 mpd | Max S$1K per s. month Review |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd | Max S$1.5K per c. month* Review |

HSBC Revolution HSBC RevolutionApply |

4 mpd | Excludes 5814. Max S$1.5K per c. month# Review |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | Max S$1K per c. month. Must choose dining as bonus category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd | Max S$2K per c. month^. Must choose dining as bonus category Review |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd | Max S$1.1K per c. month Review |

StanChart Journey Card StanChart Journey CardApply |

3 mpd | Max S$1K per s. month Review |

KrisFlyer UOB Card KrisFlyer UOB CardApply |

2.4 mpd | No cap. Min S$1K spend on SIA Group in m. year Review |

AMEX KrisFlyer Ascend AMEX KrisFlyer AscendApply |

2 mpd |

GrabFood only. Max S$200 per c. month Review |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit CardApply |

2 mpd |

GrabFood only. Max S$200 per c. month Review |

| C. Month= Calendar Month | S. Month= Statement Month *Reduced to S$1,000 per calendar month from 1 August 2025 ^Reduced to S$750 per category per calendar month from 1 August 2025 #Monthly cap has been temporarily upsized, and will revert to S$1,000 per calendar month from 1 November 2025 |

||

A few important points to note.

First, you need to exercise a lot of caution with the HSBC Revolution, since MCC 5814 is no longer on the bonus whitelist. Given that food delivery platforms switch between 5812/5814, you’re basically playing roulette unless you want to take the effort to check the MCC every time. I would avoid using this, for the sake of sanity (if you want to use this card nonetheless, read below for a workaround).

Second, when using the Citi Rewards with food delivery apps, always pay with the card directly, and not through an intermediary like Apple or Google Pay. The Citi Rewards does not earn 4 mpd for in-app mobile wallet transactions (in-person mobile wallet transactions, however, are fine).

Third, the DBS yuu Card only earns bonuses for foodpanda (but at 10 mpd, who’s complaining?), while the AMEX KrisFlyer Ascend and AMEX KrisFlyer Credit Card only earn bonuses with GrabFood.

Additional stacking opportunities

|

| 👍 250 Max Miles joining bonus |

| Sign up for a HeyMax account and get up to 250 Max Miles as a welcome bonus |

| 250 bonus Max Miles |

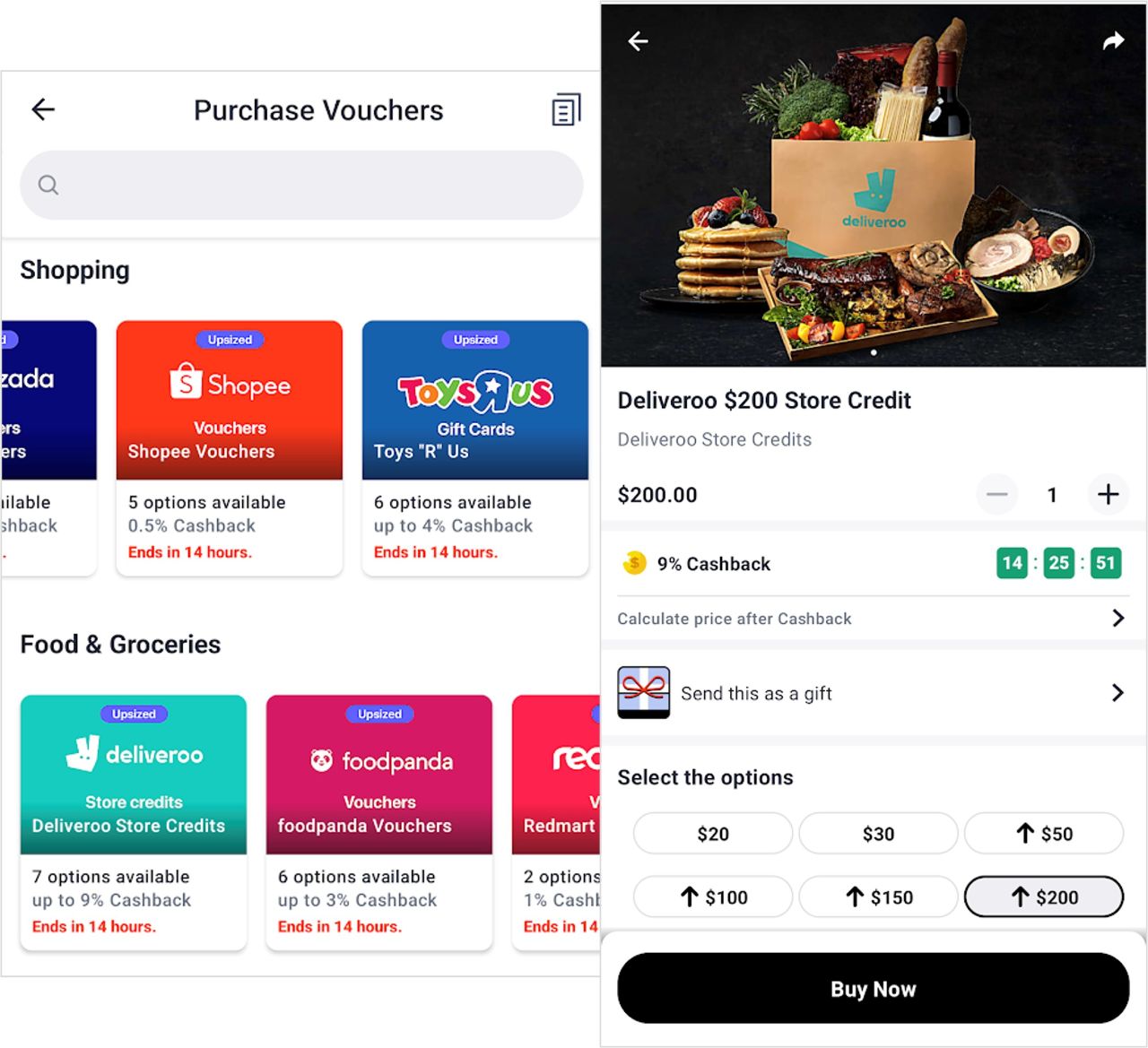

Instead of spending directly on the food delivery platform, you could buy vouchers through HeyMax to earn additional Max Miles on your purchase (earn rates are subject to change).

- Deliveroo (2.25 Max Miles per S$1)

- foodpanda (0.5 Max Miles per S$1)

- GrabFood (2.5 Max Miles per S$1)

- Oddle Eats (1.9 Max Miles per S$1)

However, do note that purchases of vouchers via HeyMax code as MCC 5311.

That might actually be a good thing, because it allows you to use the HSBC Revolution without worrying about the possibility of a transaction coding as MCC 5814. You can also use the OCBC Rewards Card, as well as the previously-mentioned Citi Rewards, DBS Woman’s World Card, UOB Preferred Platinum Visa and KrisFlyer UOB Credit Card (if you’re using the UOB Lady’s Card, you’ll need to choose Fashion as your bonus category rather than Dining).

Alternatively, you can also buy Deliveroo and foodpanda vouchers on the ShopBack mobile app to earn 3-9% cashback.

The problem is that the MCC is less reliable here, as MCC 4215, 5814 and 7299 have all been reported. To be safe, use a card that earns bonuses for general online spending, like the Citi Rewards or DBS Woman’s World Card.

Conclusion

By using the correct credit cards, you can earn up to 10 mpd on food delivery (or 4 mpd, if foodpanda isn’t your preferred platform), with further stacking opportunities by buying vouchers from HeyMax and ShopBack.

Since this is a fairly common bonus category, my advice is that bigger spenders shouldn’t be using the Citi Rewards or DBS Woman’s World Card here. Instead, save their more flexible caps for other types of transactions instead.

My Citibank rewards MC doesn’t give me 10X points for Foodpanda, Deliveroo and Redmart. Every month I have to call and argue with the CSO for point adjustments even though they have already done it many times before. And the bank says they can’t fix this because for some reason the online apps MCC are not Online. Really frustrating for me, I’m considering to cancel this card. Anyone else experiencing the same issue?

ah yes, the Citi rewards MC problems. i’d better put in something to point that out.

does it still have this issue?

I’d counter with “Don’t pay the food delivery company directly”.

My way to go:

Shopback (1-4%) -> Shopee -> Foodpanda 12% off (or Grab 15% off but their delivery fees are all over the place) -> 4mpd CC (=7.2%)

Vouchers are issued instantly for a total of 20-25% off. Works with the OCBC card for 8mpd as well, but I haven’t pulled the trigger yet 🙂

That’s exactly what I did for most of the time unless there is a good discount voucher to use.

thanks for the tip!

nice!

I have been using the shopee > Grabfood voucher for 8mpd. You can also use this for Grab rides. Since using your ocbc titanium card on Grab directly won’t earn you 8mpd.

You get a bigger discount on Shopback for food delivery vouchers 8-10%

How about the unicorn card?

Anyone has experience paying for online delivery via the Getzpay mode? Is it considered an online transaction? Thinking of using Dbs women world

Aaron, if there is a problem with Citi Rewards MC for deliveroo, food panda, etc. in getting 4 miles per dollar, does it happen to DBS WWMC too since it is also a MC version?

no, it doesn’t. hence the confusion.

Based on DBS virtual assistant, I found out the following (as of 8 July 2020) with WWMC:

Deliveroo & Grabfood – MCC 5814

Foodpanda – MCC 5812

My recent transactions on Grabfood & Foodpanda earned 10x on CRMC. Seems like there are different outcomes for different people using CRMC for these merchants.

For Odddle, would DBS Womens card get 4mpd, as it is processed via stripe online or would HSBC Revo be the better one?

both should be fine (caveat: haven’t tested)

I’m not sure if there has been changes to the MCC recently, but WWMC does not award 4mpd for WhyQ. The CSO claims that it is under professional services.

that’s…odd. let me see what i can find out about this.

so i asked DBS about this, and they said that WhyQ should be coded under dining MCC. if that doesn’t happen, you can ask the CSO to file an appeal and they will take a look at the case.

Thanks for checking. The last I used was in Aug 2020. Prior to that, I had to appeal every month and finally in Sep 2020, they claimed it was coded under Professional Services and refused my appeal. From then on, I stopped using WWMC for WhyQ.

What about HSBC revolution?

OCBC 365 is now processing orders placed via Oddle via MCC 5734 and no longer under the MCC of that particular restaurant (usually 5812). This means cardholders no longer qualify for dining rebates.

Anyone experience similar issues with Oddle transactions?

I just gotten the same response from Citibank. A recent Sept Oddle transaction is processed as MCC 5734 and no longer counted as dining.

Do take note of the above!

Hi, just sharing that my ShopBack vouchers for Deliveroo displayed 7299 for the mcc instead of 5812.

I got “MISCELLANEOUS PERSONAL SERVICES” using DBS digibot method. Could not identify the MCC from Citi’s MCC list but the description seems to fit 7XXX MCC more than 5XXX

Sorry just wondering isn’t 18% of $600 going to be $108? $78 is the extra 13% bonus in addition to the usual 5% bonus?

“This requires a minimum spend of S$600 (which can be on any retail transactions, not just foodpanda), and the 18% rebate is capped at S$78 per calendar month”

yup that’s right, have fixed.

Hi Aaron, would be quite interested to read a “What’s the best card for..” article for car rentals. Reason for that is it can be quite a big chunk of overseas spending, and as far as I know, there are no 4mpd Amaze options for this category, so this would fall under the foreign currency or gen spend card + Amaze? Thanks!