Do you believe in resurrections? If you have a HSBC Revolution Card, you very well might.

2024 was a brutal year for cardholders, no two ways about it. No more bonuses for airlines, car rental, cruise liners, hotels, travel agencies, supermarkets, food delivery or fast food. No more bonuses for any transactions made offline. And if that wasn’t bad enough, 2025 started with the devaluation of KrisFlyer miles conversions, and the removal of complimentary travel insurance.

But the faithful have been rewarded, because in July 2025, the HSBC Revolution announced its comeback in style. Bonuses were reinstated for travel-related and contactless spending, and the monthly bonus cap was raised by 50% from S$1,000 to S$1,500 per month. This enhancement, originally set to run till 31 October 2025, was then further extended to 28 February 2026.

It’s not quite a return to the glory days, because certain former bonus categories like fast food, supermarkets and travel agencies have not been restored. That said, these enhancements – in particular the increase in bonus cap – come at a much-needed time.

With rival cards cutting bonus caps, adding nitpicky sub-caps, or just throwing in the towel altogether, any extra 4 mpd capacity is a precious commodity. And if you don’t need the “m” in mpd to be KrisFlyer, then this could very well be the best miles card on the market right now.

HSBC Revolution Card HSBC Revolution Card |

|

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

|

| With the reinstatement of bonuses for travel and contactless spending, plus an enhanced bonus cap, the HSBC Revolution is back. |

|

| 👍 The good | 👎 The bad |

|

|

| Full List of Credit Card Reviews | |

Overview: HSBC Revolution

Let’s start this review by looking at the key features of the HSBC Revolution.

|

|||

| Apply | |||

| Income Req. |

S$30,000 p.a. |

Points Validity |

37 months |

| Annual Fee |

None | Min. Transfer |

25,000 HSBC points (10,000 miles) |

| Miles with Annual Fee | None | Transfer Partners | 20 |

| FCY Fee | 3.25% | Transfer Fee | None |

| Local Earn | 0.4 mpd | Points Pool? | Yes |

| FCY Earn | 0.4 mpd | Lounge Access? | No |

| Special Earn | 4 mpd on dining, shopping, transport & membership clubs, travel | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

How much must I earn to qualify for a HSBC Revolution?

The HSBC Revolution has an income requirement of at least S$30,000 per year, the MAS-mandated minimum.

If you do not meet the minimum annual income, you can place a S$10,000 fixed deposit with HSBC to get a secured version of the card, with a credit limit equivalent to 100% of the deposit amount. More information can be found in this form.

How much is the HSBC Revolution’s annual fee?

| Principal Card | Supp. Card | |

| First Year | Free | Free |

| Subsequent | Free | Free |

The HSBC Revolution’s S$160.50 annual fee was removed on 1 August 2020, and both principal and supplementary cards are now free for life.

You’ll never again have to call up the bank for a fee waiver!

What welcome offers are available?

HSBC Revolution Card HSBC Revolution Card |

| Apply (HSBC) |

| Apply (SingSaver) |

If you don’t have a HSBC Revolution Card yet, you might be eligible for a welcome offer either with HSBC or SingSaver.

| Min. Spend | HSBC | SingSaver |

| S$500 |

|

|

| Further S$500 (i.e. S$1,000 total) |

|

– |

| T&Cs | Link | Link |

Both offers require you to be a new-to-HSBC cardholder, defined as anyone who:

- Does not currently hold any existing principal HSBC credit card, and

- Has not cancelled a principal HSBC credit card in the past 12 months before application

You must also consent to receive marketing and promotional materials at the time of application, and do not revoke that consent until the gift is fulfilled.

If you’re an existing HSBC cardholder, you may be eligible for S$50 cashback with a minimum spend of S$500. This requires that:

- Your most recent principal HSBC credit card was issued more than 12 months ago, and

- You have not cancelled a principal HSBC credit card in the past 12 months before application

HSBC’s eligibility criteria is unique, and rather confusing. While most banks define an existing cardholder as “anyone who is not a new cardholder”, HSBC says that not only must you not have cancelled a principal HSBC credit card within the past 12 months, the principal HSBC credit card you currently hold must have been issued at least 12 months ago.

Therefore, when it comes to HSBC, it’s possible to be neither new nor existing, in which case there’s no welcome offer for you!

For the avoidance of doubt, you cannot stack the HSBC and SingSaver offers; you must pick one or the other.

How many miles do I earn?

| 🇸🇬 SGD Spending | 🌎 FCY Spending | ⭐ Bonus Spending |

| 0.4 mpd | 0.4 mpd | 4 mpd on dining, shopping, transport & membership clubs, and travel |

Regular SGD/FCY Spending

The HSBC Revolution Card usually earns 1 HSBC point for every S$1 spent (0.4 mpd) in Singapore Dollars or foreign currency (FCY).

All foreign currency transactions are subject to a 3.25% fee.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

Bonus Spending

The HSBC Revolution Card earns 10X HSBC points per S$1 (4 mpd) on dining, shopping, travel, transportation and membership clubs, split into:

- A base reward of 1x HSBC points per S$1 (0.4 mpd)

- A bonus reward of 9x HSBC points per S$1 (3.6 mpd)

The bonus reward is usually capped at 9,000 points per calendar month, equivalent to S$1,000 of spending. However, from 1 July 2025 to 28 February 2026, the bonus cap has been increased to 13,500 bonus points per calendar month, equivalent to S$1,500 of spending.

| Regular | Promo Period (1 Jul 25 to 28 Feb 26) |

|

| Monthly Bonus Point Cap | 9,000 points | 13,500 points |

| Equivalent Spending | S$1,000 | S$1,500 |

Any spend in excess of the bonus cap will only earn the base reward of 1x HSBC point per S$1 (0.4 mpd).

The bonus reward is normally available for online transactions only. However, from 1 July 2025 to 28 February 2026, in-person contactless payments will also be eligible for the bonus.

Contactless payments refer to transactions made via Visa payWave (i.e. tapping the physical card), Apple Pay or Google Pay. Payments made by swiping the magnetic stripe and/or using the chip will not be eligible for bonuses.

Here’s a quick summary of how the HSBC Revolution normally works, and how it works during the special 1 July 2025 to 28 February 2026 period.

|

|

|

| Regular | 1 Jul 25 to 28 Feb 26 | |

| Dining | 4 mpd Online |

4 mpd Online Contactless |

| Shopping | 4 mpd Online |

4 mpd Online Contactless |

| Transport & Member Clubs | 4 mpd Online |

4 mpd Online Contactless |

| Travel | N/A | 4 mpd Online Contactless |

| Bonus Cap | S$1,000 per c. month | S$1,500 per c. month |

As you can see, the HSBC Revolution adopts a whitelist policy, which means that transactions don’t earn bonuses unless they’re explicitly included in the T&Cs. This is more restrictive than a blacklist policy, where transactions earn bonuses unless they’re explicitly excluded in the T&Cs (e.g. Citi Rewards Card, DBS Woman’s World Card).

Blacklist vs whitelist cards: How I optimise miles between both

Dining

| MCC | Description |

| 5441 | Candy, Nut and Confectionery Stores |

| 5462 | Bakeries |

| 5811 | Caterers |

| 5812 | Eating Places and Restaurants |

| 5813 | Bars, Cocktail Lounges, Discotheques, Nightclubs and Taverns– Drinking Places (Alcoholic Beverages) |

The HSBC Revolution earns 4 mpd for both online and in-person dining transactions at restaurants, bakeries and bars.

However it does not include MCC 5814 (Fast Food Restaurants), so this is the wrong card to use at Burger King, KFC, McDonald’s, Starbucks or Ya Kun. It might surprise you that even certain sit-down establishments like Shin Katsu, PS Cafe and Marche can code as MCC 5814, so if in doubt, always check the MCC!

Furthermore, food delivery platforms like GrabFood, Foodpanda and Deliveroo can switch between MCC 5812 or MCC 5814 with no apparent rhyme or reason. That makes the HSBC Revolution a risky card to use here, and my advice would be to purchase gift cards for these platforms as a workaround (refer to next section on Department Stores & Retail).

It also does not include MCC 5499 (Misc. Food Stores), which is used by Bee Cheng Hiang, 7-Eleven, Family Mart, Famous Amos, and iHerb, among others.

Department Stores & Retail

| MCC | Description |

| 4816 | Computer Network/Information Services |

| 5045 | Computers, Computer Peripheral Equipment, Software |

| 5262 | Marketplaces |

| 5309 | Duty Free Stores |

| 5310 | Discount Stores |

| 5311 | Department Stores |

| 5331 | Variety Stores |

| 5399 | Miscellaneous General Merchandise Stores |

| 5611 | Men’s and Boys’ Clothing and Accessories Stores |

| 5621 | Women’s Ready to Wear Stores |

| 5631 | Women’s Accessory and Specialty Stores |

| 5641 | Children’s and Infants’ Wear Stores |

| 5651 | Family Clothing Stores |

| 5655 | Sports Apparel and Riding Apparel Stores |

| 5661 | Shoe Stores |

| 5691 | Men’s and Women’s Clothing Stores |

| 5699 | Accessory and Apparel Stores–Miscellaneous |

| 5732 | Electronics Sales |

| 5733 | Music Stores–Musical Instruments, Pianos and Sheet Music |

| 5734 | Computer Software Stores |

| 5735 | Record Shops |

| 5912 | Drug Stores and Pharmacies |

| 5942 | Book Stores |

| 5944 | Clock, Jewelry, Watch and Silverware Stores |

| 5945 | Game, Toy and Hobby Shops |

| 5946 | Camera and Photographic Supply Stores |

| 5947 | Card, Gift, Novelty and Souvenir Shops |

| 5948 | Leather Goods and Luggage Stores |

| 5949 | Fabric, Needlework, Piece Goods and Sewing Stores |

| 5964 | Direct Marketing–Catalog Merchants |

| 5965 | Direct Marketing–Combination Catalog and Retail Merchant |

| 5966 | Direct Marketing–Outbound Telemarketing Merchants |

| 5967 | Direct Marketing–Inbound Telemarketing Merchants |

| 5968 | Direct Marketing–Continuity/Subscription Merchants |

| 5969 | Direct Marketing–Other Direct Marketers–Not Elsewhere Classified |

| 5970 | Artist Supply Stores, Craft Shops |

| 5992 | Florists |

| 5999 | Miscellaneous and Specialty Retail Stores |

The HSBC Revolution earns 4 mpd for both online and in-person transactions at department and retail stores.

There are two crucial MCCs here: 5311, and 5999.

MCC 5311 is used for department stores, but it also belongs to HeyMax, which sells vouchers for a wide range of online and brick-and-mortar merchants including Amazon, Best Denki, Courts, IKEA, NTUC FairPrice and Pelago.

|

|

| Sign up here | |

|

|

| All voucher purchases code as MCC 5311 (Department Stores) | |

These would normally code under a wide range of MCCs, but when purchased as vouchers through HeyMax, will universally code as MCC 5311.

I hope you see where I’m going here. Maybe you want to order food delivery, but are worried that it codes as MCC 5814. No problem, buy a Deliveroo or GrabFood gift card. Maybe you want to book tours and attractions, but Klook and Pelago code as MCC 4722. No worries, buy their gift cards instead. Basically, every merchant selling gift cards on HeyMax can be turned into a 4 mpd opportunity for the HSBC Revolution.

To sweeten the deal further, HeyMax also awards Max Miles based on the value of your purchase, which can be transferred to more than two dozen airline and hotel partners at a 1:1 ratio with no conversion fees.

Max-imum Fun: The best sweet spots for Max Miles redemptions

MCC 5999 is used for Atome, which partners with Agoda, Cathay Pacific, EU Holidays, KKday and Trip.com, among others.

Again, Atome is a way of turning a diverse range of MCCs into 4 mpd opportunities with the HSBC Revolution Card, while optimising your bonus caps and double dipping on Atome+ points too.

Transport & Membership Clubs

| MCC | Description |

| 4121 | Taxicabs and Limousines |

| 7997 | Clubs–Country Clubs, Membership (Athletic, Recreation, Sports), Private Golf Courses |

The HSBC Revolution earns 4 mpd on MCC 4121, which includes Gojek, Grab, TADA and Ryde, as well as in-taxi payments where cards are accepted. However, it does not award 4 mpd for SimplyGo or petrol.

Cardholders can also earn 4 mpd on MCC 7997, which would cover Anytime Fitness, Fitness First, BFT and most other gyms.

Travel

| MCC | Description |

| 3000 to 3350, 4511 | Airlines |

| 3351 to 3500 | Car Rental Agencies |

| 3501 to 3999, 7011 | Lodging- Hotels , Motels, Resorts |

| 4411 | Cruise Lines |

The HSBC Revolution Card previously removed bonuses for travel-related expenditure on 1 January 2025.

But from 1 July 2025 to 28 February 2026, this bonus category has been restored temporarily, allowing cardholders to earn 4 mpd on airline, car rental, hotels and cruise line transactions.

Do note that MCC 4722 is not included, so online travel agencies like Airbnb, Expedia, Hotels.com, Pelago, Klook, KKday and Trip.com will not be eligible for the bonus.

| 🏖️ MCC 4722 (Travel Agencies & Tour Operators) (non-exhaustive) 🚫 Not eligible for 4 mpd with HSBC Revolution! |

|

|

|

Transaction date or posting date?

The bonus cap on the HSBC Revolution is enforced based on posting date, not transaction date.

For example, if you made a transaction on 31 January 2025 and it posts on 2 February 2025, that amount will count towards February 2025’s bonus cap.

Therefore, you should exercise caution when spending towards the end of the calendar month, in case transactions “leak” into the following period.

Which cards track spending by transaction date vs posting date?

When are HSBC points credited?

| Base Points (1X) | Credited when transaction posts |

| Bonus Points (9X) |

Credited around the middle of the following calendar month |

The base 1X HSBC points are credited when the transaction posts, usually within 1-3 working days.

The bonus 9X HSBC points will be credited as a lump sum in following calendar month. While HSBC does not follow a fixed crediting date, historical data points suggest it typically falls between the 9th and 19th of the month.

How are HSBC points calculated?

Here’s how you can work out the HSBC points earned on your HSBC Revolution.

| Base Points (1X) | Round transaction to the nearest S$1, then multiply by 1 |

| Bonus Points (9X) |

Sum all eligible transactions (including cents) and multiply by 9. Round down transaction to the whole number |

This rounding policy gives the HSBC Revolution a slight advantage compared to some other specialised spending cards on the market, like the UOB Preferred Platinum Visa. Consider the following illustration:

HSBC Revolution HSBC Revolution |

UOB Pref. Plat Visa UOB Pref. Plat Visa |

|

| S$5 | 20 miles | 20 miles |

| S$9.99 | 39.6 miles | 20 miles |

| S$15 | 60 miles | 60 miles |

| S$19.99 | 79.6 miles | 60 miles |

| S$25 | 100 miles | 100 miles |

| S$29.99 | 119.6 miles | 100 miles |

Of course, the UOB Preferred Platinum Visa has a much wider list of bonus categories than the HSBC Revolution, but assuming you were spending at a merchant that’s eligible for bonuses on both cards, then the HSBC Revolution would win.

If you’re an Excel geek, here’s the formulas you need to calculate your points:

| Base Points (1X) | =ROUND (X,0)*1 |

| Bonus Points (9X) |

=ROUNDDOWN (Y,0)*9 |

| Where X= Amount Spent, Y= Sum of all eligible transactions |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for HSBC points?

The following transactions are not eligible for HSBC points.

| ❌ HSBC Revolution Exclusion List |

|

Let me highlight a few points in particular:

- Foreign exchange transactions does not refer to foreign currency transactions. Foreign exchange refers to trading foreign currencies on platforms like Forex.com

- The HSBC Tax Payment Facility was terminated in January 2023, but HSBC has never bothered to update its T&Cs so the clause remains there

- HSBC has a blanket exclusion on bill payment services like CardUp, ipaymy and RentHero

- While PayPal is on the exclusion list, this refers to peer-to-peer money transfers between personal PayPal accounts. Payments to business PayPal accounts, the sort which e-commerce merchants will use, will still earn rewards

Otherwise, the list of exclusions here is fairly standard: charitable donations, education, government services GrabPay top-ups, insurance, professional services providers, and utilities.

What do I need to know about HSBC points?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| 37 months | Yes | Free |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 25,000 HSBC points (10,000 miles) |

20 | Instant* |

| *Except JAL Mileage Bank and Hainan Air Fortune Wings Club | ||

Expiry

All HSBC points expire at the end of a 37-month period which commences from the month subsequent to the month in which the points were earned.

For example:

| Points earned in the period of | Expiry date |

| 1-31 August 2023 | 30 September 2026 |

| 1-30 September 2023 | 31 October 2026 |

| 1-31 October 2023 | 30 November 2026 |

Pooling

HSBC points have been pooled ever since 1 May 2024, which means that if you have 10,000 HSBC points with the HSBC Revolution, and 15,000 HSBC points with the HSBC TravelOne Card, you can make a single redemption of 25,000 HSBC points.

However, do note that cancelling a HSBC card will lead to the forfeiture of points earned on that card, so you’ll need to convert them before cancelling.

Partners and transfer fee

HSBC points can be transferred to 20 airline and hotel loyalty programmes at the following ratios.

| ✈️ HSBC Airline Partners | |

| Frequent Flyer Programme | Conversion Ratio (HSBC Points : Partner) |

| 50,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 30,000 : 10,000 |

|

|

30,000 : 10,000 |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 |

|

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

|

25,000 : 10,000 |

| 🏨 HSBC Hotel Partners | |

| Hotel Programme | Conversion Ratio (HSBC Points : Partner) |

|

30,000 : 10,000 |

| 25,000 : 5,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

A minimum conversion block of 10,000 miles/points (5,000 points in the case of ALL) applies, but subsequent conversions can be as little as 2 miles/points. For example, you could opt to convert 25,100 HSBC points into 10,040 Asia Miles, or 183,750 HSBC points into 52,500 Aeroplan points.

One important thing to highlight is that not all partners share the same transfer ratio, and the partner you choose affects the earn rate on your HSBC cards.

The 4 mpd rates we’ve been referring to only apply if you pick a partner with a 25,000 pts = 10,000 miles ratio. If you want to use the HSBC Revolution to earn KrisFlyer miles (30,000 pts = 10,000 miles), your effective earn rate is 3.33 mpd at best, and if you pick JAL Mileage Bank (50,000 pts = 10,000 miles), it’s 2 mpd.

| Transfer Ratio (Points : Miles) |

HSBC Revolution (Bonus Categories)* |

| 25,000 : 10,000 (8x partners) |

4 mpd |

| 30,000 : 10,000 (2x partners) |

3.33 mpd |

| 35,000 : 10,000 (5x partners) |

2.86 mpd |

| 50,000 : 10,000 (1x partner) |

2 mpd |

| *10 points per S$1 on bonus categories | |

It’s beyond the scope of this review to discuss which frequent flyer programmes you should be transferring points to, but I do want to highlight that under no circumstances should you opt for Qatar Privilege Club.

Here’s why: the transfer ratio to Qatar Privilege Club is 35,000 HSBC points = 10,000 Avios. However, you can achieve a much better value by transferring 25,000 HSBC points to British Airways Executive Club for 10,000 Avios, then transferring those Avios to Qatar Privilege Club at a 1:1 ratio.

I’m also going to say that if you want to earn Singapore Airlines KrisFlyer miles, this is the wrong card for you. There are plenty of other specialised spending cards on the market which will earn you 4 mpd, so there’s no reason to resort to a 3.33 mpd rate.

Transfer time

All points transfers are completed instantly, with the exception of JAL Mileage Bank (10 working days) and Hainan Fortune Wings Club (5 working days).

Other perks

Free Entertainer subscription

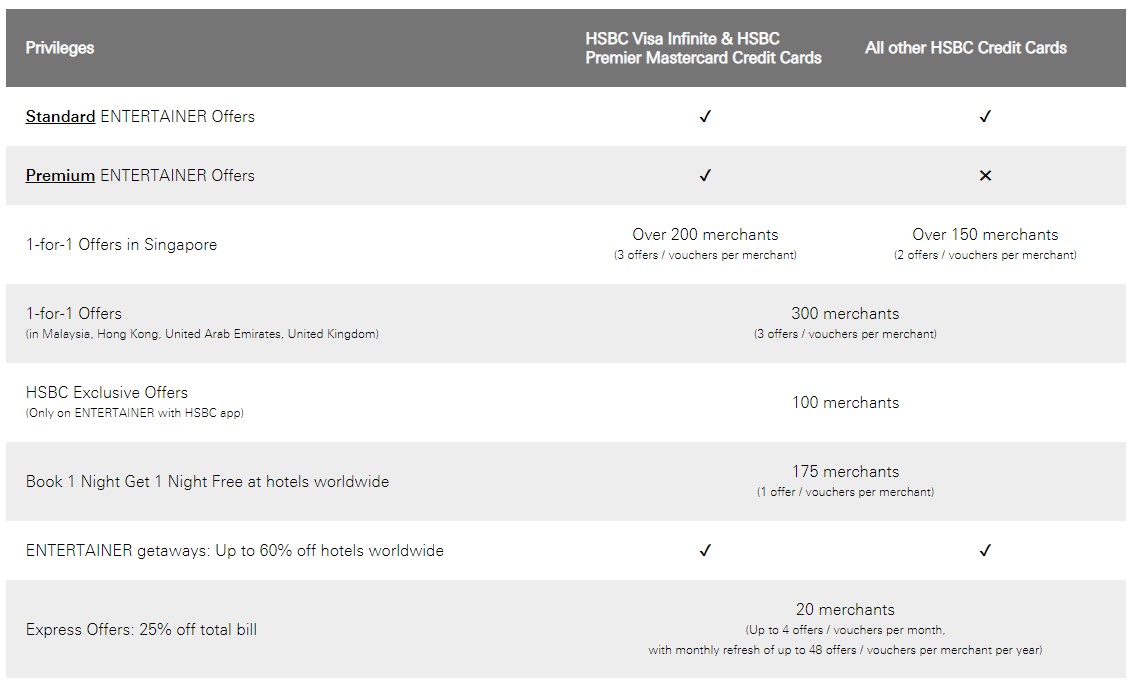

All principal HSBC cardholders receive a complimentary copy of The Entertainer, which offers more than 1,000 1-for-1 offers for dining, entertainment and travel.

Since the Revolution is not a “premium” card, you won’t get nearly as many offers as HSBC Visa Infinite & HSBC Premier Cardholders. That said, you’ll still have access to the standard Entertainer offers at more than 150 merchants in Singapore, as well as the same overseas and travel offers that higher tier cards have.

An Entertainer membership usually retails at S$85.

Terms and Conditions

- HSBC Revolution 10X Points Terms & Conditions

- HSBC Revo Up campaign (1 Jul 25 to 28 Feb 26)

- HSBC Rewards Terms & Conditions

Summary Review: HSBC Revolution

|

|

| Apply | |

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

For some people, the HSBC Revolution will be a “leave it” card for the simple reason that it has an inferior transfer ratio to KrisFlyer. Why bother with a finicky whitelist card, when the DBS Woman’s World Card, Citi Rewards and UOB Preferred Platinum Visa offer higher earn rates with less effort?

But there’s a big world beyond KrisFlyer, and if you want to build balances with alternative programmes like EVA Air Infinity MileageLands, Flying Blue and British Airways Executive Club, then this card would be perfect.

In fact, with the limited-time enhancements, this is now the specialised spending card with the highest unified bonus cap in Singapore. Let that sink in. No other card on the market offers 4 mpd on more than S$1,500 of spending (except the UOB Lady’s Solitaire Metal Card, if you want to be pedantic), which either says a lot about how much the Revolution has improved, or how much the rest of the pack has declined.

Once you factor in the highly flexible points, with 20 transfer partners, instant conversions, small conversion blocks, and waived admin fees, I reckon this is one card you should give a second chance.

So that’s my review of the HSBC Revolution. What do you think?

4mpd for simplygo?

nope. 4111 not included

Do you get the base points (1point = $1) for using SimplyGo? It only says you don’t get the bonus points. But how about the base points?

why would you want to earn only 0.4 mpd with simply go though?

Better than earning 0.0mpd

Use other cards like UOB PRVI visa or mastercard

get an sc smart card in that case strictly for simplygo. 5.6mpd, or 6% cashback if you don’t like orphan miles and you got yourself a solid beginner 2 card set-up.

Use UOBKF for SimplyGo – 3mpd

Hi if I use fave pay, does it count as contact less payment?

Don’t users get 4mpd also for contactless dining with the UOB Preferred Platinum VISA?

sure, but it’s not a specialized dining card. and amazingly, some places still don’t have paywave

But HSBC Revolution also requires dining payments to be contactless. So, how’s that different?

I have both cards and I see it as an additional card to fully maximize my 4mpd earnings per month for my dining expenditure.

Does ‘contactless’ include waving physical card at PayWave terminals unlike UOB PPV ? Incidentally, Do fuel purchases fall under the transportation or retail category ?

Yes. It counts when you tap the card contactless or via Apple Pay

Fuel purchases not sure. Gotta ask the drivers here.

Hey Aaron

Just so you know, when I went to apply the HSBC website asks me to download their app and apply via that. Which is fine but I am not sure whether you’re getting any affiliate bonus that way – I see the affiliate code from your link but because sign-up is via app I don’t see how you get any credit (if indeed you were expecting that).

Also sign-up via app is very frustrating…

thanks for the heads up! quite frankly, i have no idea how it works too…all i know is that signing up via mobile browser is supposed to be the best because they dont ask you to download, sign, scan and email a form.

It’s a shame we can only use this card for up to $1,000 a month

They should bump it up to a higher number, and I’m sure the additional usage over the first $1K will shoot thru the roof

So any spend above $1k in that month will not earn the bonus miles?

… any thoughts on HSBC Infinite card vs Revolution or other HSBC cards. I’m looking to drop my Infinite card?

Didn’t see hospital in the exclusion list, does this mean 4mpd for contactless payment at both public/private hospitals?

HSBC Revolution’s 4mpd goes by MCC whitelist approach as mentioned in the article, and as far as I see hospital MCCs aren’t included.

Aaron, does it earn 4mpd on Favepay transactions? Favepay offers a rebate that can be used to a subsequent transaction at the same merchant and would be great if bonus miles are earned!

Any idea if topping up topping up ShopeePay entitles you to the bonus miles? Went to Whatcard and it only shows Shopee as MCC5331 but doesn’t say anything about ShopeePay.

Between HSBC Revolution and Citi Premiermiles, which one is better on average? Considering that we are able to pay for insurance using Citi Payall to accumulate miles..

“The only caveat I’d add is that if your monthly spending is very low (maybe in the $500-1,000 range), it may not make sense to spread your points across another bank. In that case the UOB PRVI Miles + UOB Preferred Platinum Visa combination might work better. ”

Hi Aaron, I currently fall under this category of low spending. Are you able to share more about the UOB PRVI Miles + UOB Preferred Platinum Visa combination?

Would contactless payments overseas in the same categories qualify for 4mpd as well?

yes, so long as the MCCs are on the list.

I’m trying to use this card to make an online purchase on a local website that sells cookies. Will it quality for 4mpd?

Hi

I’m planning some purchases at Mustafa. Does anyone know for sure the MCC for Mustafa Centre in at Syed Alwi Road? I’ve checked Whatcard and the Visa Supplier Locator – seems to be either 5331 or 5311? And what about the MCC for Mustafa Online? Should we use the HSBC Revo?

Thanks in advance

Is WhatCard.com updated for this? It still lists the Revolution as 2 mpd for dining.

whatcard has not been updated for a while already.

Thanks for the useful review as usual! Which rate applies if the transaction is both online AND in FCY, 0.4mpd or 4mpd? Thanks

4 mpd if eligible category

Hey, I just got this card with the latest biggest promo! Thanks for these articles.

Wanted to ask about this –>

“Instead of charging a fee per conversion, HSBC instead charges cardholders an annual S$42.80 Mileage Program fee, which covers unlimited conversions for a 12-month period.”

Will I get billed for this immediately or when I first want to transfer my miles? Thanks in Advance!

Upon your first transfer and then valid for 12 months.

based on my experience and info from HSBC’s CS, the bonus points are awarded the following month from the statement date, contrary to what it seems to be on the t&c

ie. if a transaction made on 18th Apr is captured in a 14Apr-13May statement, the bonus points will only be awarded end of June.

How about MCC for Shopee and Shopee supermarket?

Would it make sense to pair this with the Amaze card? Say for restaurants that don’t use contactless?

Amaze works for mastercard only. This aint

Is there a card that you gave 5 star rating to it? would be useful if there is a list of cards with the ratings next to it

I’d encourage people not to get too hung up about the star ratings. In fact I thought about removing them. They don’t really tell you much to the extent that there’s a false accuracy in saying a 5 star card is definitively better than a 4.5 one. In fact, I think I’d rather change ratings to simply recommend vs don’t recommend.

How do I get The Entertainer? I have the card for nearly half a year now and maxing out each month, but have never received anything.

Contact HSBC customer support for the Entertainer VIP code and it should give you access!

Thanks Guy!

Hmm… Any idea which day of the week is the cutoff for miles transfer? I did my transfer on Thu but seems like it’s still pending. 😡

Opps! Wrong emoticon. 🙁

any idea if the 4mpd will stack for supplementary card holders?

Is Harvey Norman eligible for 4mpd? I remembered checking the MCC once, seems like it’s not on the whitelist?

Anybody else having difficulty applying for this card? I applied for it in May and still haven’t heard anything from HSBC. I called a few times to inquire – sometimes they tell me they can’t find my application and at other times they tell me they sent a message to expedite my application. I received 4 credit cards from other banks in the meantime, so clearly it’s not an issue on my end.

Their systems cock up, my application can even went missing for 3 weeks. Finally got the card after 7 weeks!

Good to know. I called them like 4 times and got a different reason every time (missing document, can’t find application, “due to overwhelming demand…”). Such a mess!

Their system quite bad. I also kena slow. needed to call and chase a few times.

I am quite disappointed with this card. I spent it at IKEA Jem using Google Pay and online at Pet Lovers Centre. Both were not eligible for the extra 9x points. I asked HSBC and they said the merchant code didn’t qualify for the 9x points. I am totally confused.

the bonus points are earned specifically on certain MCC codes which you can refer in the T&C link below. IKEA spend probably best would be OCBC Titanium or UOB PP Visa via contactless payment?

https://www.hsbc.com.sg/content/dam/hsbc/sg/documents/credit-cards/revolution/offers/10x-reward-points-terms-and-conditions.pdf

is there a way to check how many HSBC points did they award me for each transaction and the corresponding bonus points (if transaction is eligible)? Thank you 🙂

Well, I recently talked to HSBC via online chat on their online banking as I had the same query. This is what they told me. “We understand you have an enquiry with regards to 10x reward points transactions. We regret to share that we do not have access to check for eligible transactions via the system or through online banking. You may refer based on the transaction category under Eligibile transactions and reflect on monthly statement.” If they can be like Citi/UOB/DBS and allow customer to check on the online banking site, life would be easier and I think perhaps… Read more »

Will there be contactless payments abroad if not then there are much better cards with better offers.

Article written 2 years ago and updated this year, yet the most important question of how long it takes for miles to be credited into Krisflyer is not mentioned or answered. Having data point on this would be useful.

I havent receive any bonus miles since my first usage in June 2022. I’ve spent at Harvey Norman and contactless dining areas. This is really strange, any one facing the same issue?

Application processing takes 3-5 days.

Apporval after processing another 7-14 days.

Absoloute rubbish when competitors have immdediate approval and some even lets you use virtual card while physcial card is sending over. But I guess this is the price to pay for a good miles card with good sign-up bonus.

Hi, it was previously mentioned that need to physically tap the card. This is no longer needed?

Isn’t this card better than the UOB Preferred Platinum which is graded 5 stars while this is 4.5 stars? It seems to be almost identical except that the points do not count in blocks of $5. The HSBC Revolution card also has no annual fee and 11 months longer points validity. Only downside is that points conversion is twice the amount ($42.80 vs $25) but that is a small fixed cost to pay given the missed miles with UOB’s $5 blocks.

Hi Aaron, been a long time reader of your site, thanks for your excellent work, it has enabled my family to fly on a number of business class tickets (something we thought impossible previously). I just wanted to leave a quick comment on the MCC for Courts. I paid with this card (contactless) in the physical store but did not get the 9x points. I called in and was told that Courts coded as 5712 (Furniture, Home Furnishings, and Equipment Stores, Except Appliances). Not sure if it is accurate. I did not buy any furniture though, bought an iron actually.… Read more »

hi, does 4mpd applies to iCloud and Google Drive storage?

Thanks for the detailed article! Wanted to check if the $1,000 max cap for 4mpd is shared between Principal and Supplementary cards? Or does each card get a separate limit?

shared cap.

The HSBC points earned from supplementary cards will be stacked together with principle card?

Hi Aaron.. I’m curious, since there are no annual fee, does that mean we have to payS$42.80 Mileage Programme fee annually instead?

I’m pretty sure it’s not required to pay until you are ready to redeem the points into miles, so if it were me I would accumulate for like 35 months (before the points expires) and then pay the fee to get my points out. The 1 year free transfer timeframe from that day on is just a bonus (and expensive!)

Would we still earn the 4mpd if we pay for petrol via the CaltexGO app

Hi do dinning in restaurants is eligible for 10 X HSBC points? Thanks.

Yes, Provided contactless.

Milelion, you seems to forget one segment of your readers. Those who recently retired and do not have the official $30,000, though most CPF have more than 1million. 🙂

Read again.

“If you do not meet the minimum annual income, you can place a S$10,000 fixed deposit with HSBC to get a secured version of the card, with a credit limit equivalent to 100% of the deposit amount. More information can be found in this form.”

Does anyone know whether iherb considered as online retail spending

Telegram DP codes it as 5499 which makes it an eligible MCC

Thanks Bent 🙂

YMMV for Expedia since it is an aggregator – I booked a car rental via Expedia and it was coded as 7512 which is not an eligible MCC.

HSBC didn’t even reply my email requesting for an appeal.

Is the 4 mpd given for the following? Google Pay (mcdonald’s app, fairprice app, ), favepay and xnap? Thanks

just to double check the 1k capping is per month but not per statements. therefore we need to calculate it ourselves if the statement date is not at the end of the month? thanks.

Calendar month and post date.

Bonus reward w b credited a month later.

Thanks. 🙂

The qualifying spend is $1000 for the Samsonite luggage

thanks! have fixed that. $500 was the previous offer.

Hi Aaron, do you happend to have the tnc for previous offer ? Signed up around 14 Feb. But they credit me with cashback instead of luggage. Definitely selected luggage as option as i was planning to use it for my overseas trip.

Have you ever encountered this issue? I’m thinking of filing an appeal

hello! just to check, why would you not condone using it everywhere?

The bonus spending capped at S$1,000 per calendar month, is based on transaction date or when the transaction was posted?

Post Date

Hi Aaron, I just want to point out that the single Mileage Programme fee does not apply anymore. I have both a HSBC Revolution (thanks to recommendation from you) and HSBC VI. I had the HSBC Revo, applied for the mileage programme for the Revo, then signed up for HSBC VI later. I called the CSO today, they confirmed that each card need to have their own mileage programme sign up. meaning i will have to be charged twice for 2 mileage programmes. apparently the 2nd mileage programme fee is non-waivable, but we’ll see.

The CSO is wrong. The fee only needs to be paid once (this has been confirmed by HSBC’s corp comms team).

“The customer needs to only pay for the fee once as the mileage enrollment fee is charged at customer level.”