Here’s The MileLion’s review of the Standard Chartered X Card, which launched with great fanfare in 2019, only to peter out into virtual irrelevance before the year was up.

In a way, it’s the sad story of a card which you had every reason to get, but little reason to keep. What was supposed to be the bank’s shiny new flagship has instead become a punchline, a case study of what happens when you put all your budget into customer acquisition and none into retention.

In pictorial form, the story looks something like this:

I don’t know whether Standard Chartered has a rescue plan in store, but it’d take something incredible to save the X Card from the scrap heap.

Standard Chartered X Card Standard Chartered X Card |

|

| ★ |

|

| With a hefty annual fee and close to zero benefits, the Standard Chartered X Card could be the most expensive paperweight you ever buy. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: SCB X Card

Let’s start this review by looking at the key features of the Standard Chartered X Card.

Apply Here Apply Here |

|||

| Income Req. | S$80,000 p.a. | Points Validity | No expiry |

| Annual Fee (Including GST) |

S$695.50 |

Min. Transfer |

2,500 points (1,000 miles) |

| Welcome Gift | 30,000 miles | Transfer Partners |

|

| FCY Fee | 3.5% | Transfer Fee | S$26.75 |

| Local Earn | 1.2 mpd | Points Pool? | Yes |

| FCY Earn | 2.0 mpd | Lounge Access? | Yes |

| Special Earn | N/A | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The Standard Chartered X Card comes in metal card stock, and if there’s nothing else in its favour (and there isn’t (I’m kidding (but not really))), it’s significantly heftier than other metal cards on the market. At 16g, it’s double the weight of Citi Prestige, and 60% heavier than the DBS Vantage and OCBC VOYAGE. You know, if that sort of thing is important to you.

The Standard Chartered X Card belongs to the Visa Infinite tier, but it’s important not to confuse it with the Standard Chartered Visa Infinite, which is a different product altogether (fun fact: at one point the X Card was supposed to replace the Visa Infinite, until someone got cold feet).

How much must I earn to qualify for a SCB X Card?

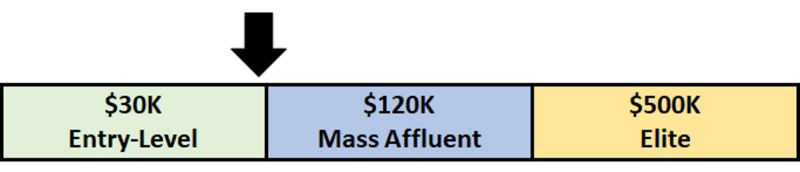

The Standard Chartered X Card occupies a bit of an odd position with its S$80,000 p.a. income requirement. That’s not quite the rarefied air of the S$120,000 mass affluent segment, nor is it among the unwashed masses of the S$30,000-50,000 entry-level cards.

In fact, the income requirement is a throwback to 5-10 years ago, where miles cards like the DBS Altitude, Citi PremierMiles and UOB PRVI Miles all had S$80,000 requirements, presumably to give them an air of prestige (even though any income requirement above S$30,000 is essentially arbitrary).

If you have an SC Priority or Private Banking relationship, the minimum income requirement will be lowered to S$30,000 p.a.

How much is the SCB X Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$695.50 |

S$107 |

| Subsequent | S$650 |

Free |

The Standard Chartered X Card has an annual fee of S$695.50 for the main card, and S$107 for supplementary cardholders. Annual fees are strictly non-waivable.

It’s OK, you can laugh now.

As it turns out, “strictly” has a very different meaning in the SCB lexicon, since the annual fee has been “exceptionally” waived each year since inception (aside from the first year’s upfront fee).

It happened in 2020, it happened in 2021, and it happened again in 2022 (only that SCB didn’t bother sending out an SMS this time, it just did so quietly on the back end).

At this point I almost want to say that the Standard Chartered X Card has a perpetual annual fee waiver, but some customers were indeed charged the subsequent years’ annual fees for reasons that are not quite clear. I personally haven’t put a single dollar of spend on this card ever since the sign-up bonus ended, and still got a fee waiver.

Cardholders receive 30,000 miles for paying the first year’s annual fee, but nothing official from the second year onwards. Those who were charged the subsequent year’s annual fee said they were offered 25,000 miles (and only upon complaining), which would represent a cost of 2.78 cents per mile– much too high, in my opinion.

What sign-up bonus or gifts are available?

You can’t talk about the Standard Chartered X Card without bringing up its launch offer: a 100,000 miles sign-up bonus. This was simply unprecedented in Singapore, and received so ravenously it had to be pulled after only a few days.

The sign-up bonus was then toned down to 60,000 miles, and eventually removed altogether. Cardholders now receive 30,000 miles for paying the first year’s annual fee (mentioned in the previous section), and nothing more.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ➕ Bonus Spend |

| 1.2 mpd | 2.0 mpd | N/A |

SGD/FCY Spend

Standard Chartered X Card cardholders will earn:

- 3 360° Rewards Points per S$1 spent locally (equivalent to 1.2 mpd)

- 5 360° Rewards Points per S$1 spent overseas (equivalent to 2 mpd)

Those are very average rates for the premium card segment in which the X Card hopes to compete.

| 💳 Earn Rates for Premium Cards |

||

| Card | SGD | FCY |

DBS Vantage DBS Vantage |

1.5 mpd | 2.2 mpd |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd |

2.2 mpd |

UOB VI Metal Card UOB VI Metal Card |

1.4 mpd | 2.0 mpd |

Citi Prestige Citi Prestige |

1.3 mpd | 2.0 mpd |

Maybank VI Maybank VI |

1.2 mpd | 2.0 mpd |

SCB X Card SCB X Card |

1.2 mpd | 2.0 mpd |

HSBC VI HSBC VI |

1.0 mpd (Enhanced: 1.25 mpd)^ |

2.0 mpd (Enhanced: 2.25 mpd)^ |

SCB VI SCB VI |

1.0 mpd (Enhanced: 1.4 mpd)* |

1.0 mpd (Enhanced: 3.0 mpd)* |

AMEX Plat. Reserve AMEX Plat. Reserve |

0.69 mpd | 0.69 mpd |

| ^With min. S$50,000 spend in previous membership year *With min. S$2,000 spend per statement month |

||

To add insult to injury, Standard Chartered has the highest foreign currency transaction fee in the market at 3.5% (other banks max out at 3.25%). This means that using your card overseas represents buying miles at a hefty 1.75 cents each.

Bonus Spend

No bonus earn rate is available for the Standard Chartered X Card.

When are 360° Rewards Points credited?

360° Rewards Points are credited when your transaction posts, which generally takes 1-3 working days.

How are 360° Rewards Points calculated?

Here’s how you can work out the 360° Rewards Points earned on your Standard Chartered X Card.

Regular rate

| Local Spend | Multiply transaction by 3, then round to nearest whole number |

| FCY Spend |

Multiply transaction by 3, then round to nearest whole number. Multiply transaction by 2, then round to the nearest whole number. Add the two figures. |

This means the minimum spend required to earn points is S$0.17, whether in local or foreign currency.

For what it’s worth, SCB has a more forgiving rounding policy than banks like OCBC and UOB, which enables the Standard Chartered X Card to outperform ostensibly higher-earning cards for smaller transactions. An illustration is provided below.

If you’re an Excel geek, here’s the formulas you need to calculate points:

Regular rate

| Local Spend | =ROUND(X*3,0) |

| FCY Spend |

=ROUND(X*3,0) + ROUND(X*2,0) |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for 360° Rewards Points?

A full list of transactions that do not earn transactions can be found in the T&Cs. I’ve highlighted a few noteworthy categories below:

- Charitable Donations

- Education

- Government Services

- GrabPay top-ups

- Insurance

Standard Chartered is one of the rare few banks which still offers points for utilities payments, so enjoy it while it lasts.

What do I need to know about 360° Rewards Points?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| No expiry | Yes | S$26.75 |

Expiry

360° Rewards Points earned on the Standard Chartered X Card never expire, so long as the card account remains active.

Pooling

360° Rewards Points pool across cards, so if you have 10,000 360° Rewards Points on the Standard Chartered X Card, and 15,000 360° Rewards Points on the Standard Chartered Rewards+, for example, you can combine the two when making a redemption.

SCB offers an enhanced KrisFlyer conversion rate for both Standard Chartered X Card and Standard Chartered Visa Infinite cardholders (see below). Since points pool together, you can redeem your entire balance at the enhanced rate, regardless of which card the points were actually earned on.

Transfer Partners & Fees

Let me just state this outright: Standard Chartered has the most confusing rewards redemption system of any bank in Singapore, period. Yes, I’d go so far as to say that even Bank of China has it better.

The way the system is set up seems designed to confuse customers, so much so that some people believe:

- SCB no longer offers transfers to KrisFlyer

- SCB has devalued the rate for KrisFlyer transfers

- SCB makes you pay multiple fees when converting points to miles

Thankfully, all three are absolutely untrue (there’s some truth in the third, but not the way you think), though I can understand how they’d come to that conclusion.

Transfers to KrisFlyer

If you try to redeem KrisFlyer miles via the SC mobile app, you won’t see it listed as a partner-which leads some to think that SCB points can no longer be transferred to KrisFlyer.

Not true. If you want to redeem KrisFlyer miles, you must do so via the desktop rewards portal. Be careful to select Air Miles (Visa Infinite) and not Air Miles (Other Credit Cards), because the latter has inferior transfer rates (which leads some to think that SCB has devalued the rate for KrisFlyer transfers- sensing a trend here?).

This will bring up five different KrisFlyer redemption options:

- Rewards Code SIA 11: 2,500 points (1,000 miles)

- Rewards Code SIA 12: 25,000 points (10,000 miles)

- Rewards Code SIA 13: 75,000 points (30,000 miles)

- Rewards Code SIA 14:125,000 points (50,000 miles)

- Rewards Code SIA 15: 250,000 points (100,000 miles)

A maximum of 99 of each rewards code can be redeemed in a single transaction, and each unique rewards code attracts a transfer fee of S$26.75. For example:

- If you transfer 20 x SIA 11, you’ll pay S$26.75

- If you transfer 10 x SIA 11 and 1 x SIA 12, you’ll pay S$26.75 x 2= S$53.50

The problem with this system is that you may have to pay multiple conversion fees when cashing out a large number of miles. Suppose you have 262,500 points in your account, for example. Your options are to redeem:

- 99x SIA 11 in one transaction, and then 6x SIA 11 in another transaction (S$26.75 x 2)

- 2x SIA 14 and 5x SIA11 in another transaction (S$26.75 x 2, since you’re redeeming two different rewards codes)

That’s frustrating indeed, since it seems to arise because the system is incapable of handling three-digit redemption quantities.

Transfers to all other transfer partners

If you want to redeem other transfer partner miles or points, you must go via the SC mobile app (Menu > Credit Card Rewards) or online banking platform (Click on X Card > Card Details > View My Rewards > Transfer Rewards).

You can then transfer points to the following nine partners:

| Frequent Flyer Programme | Conversion Ratio (SC Points: Partner) |

| 2,500: 1,000 |

|

| 2,500: 1,000 | |

| 2,500: 1,000 | |

| 2,500: 1,000 | |

| 3,000: 1,000 | |

| 3,500: 1,000 | |

| 3,500: 1,000 | |

|

3,500: 1,000 |

| 5,000: 1,000 |

Transfers cost S$26.75 each, regardless of the number of points transferred.

Other card perks

OK, fine.

Two complimentary lounge visits

Standard Chartered X Card cardholders enjoy two complimentary lounge visits per membership year, courtesy of Priority Pass. A guest fee of US$32 applies after the free visits have been exhausted, and this benefit is only available to the principal cardholder.

Compared to other cards in its price segment, this is, well, far from adequate.

| Card | Lounge Network | Free Visits (Per Year) |

|

| Main | Supp. | ||

HSBC VI HSBC VI |

LoungeKey | ∞ | ∞ |

OCBC VOYAGE OCBC VOYAGE |

Plaza Premium | ∞ | ∞ |

Citi Prestige Citi Prestige |

Priority Pass | ∞ + 1 guest | N/A |

Maybank Visa Infinite Maybank Visa Infinite |

Priority Pass | ∞ | N/A |

DBS Vantage DBS Vantage |

Priority Pass | 10 | N/A |

SCB VI SCB VI |

Priority Pass | 6 | N/A |

UOB VI Metal Card UOB VI Metal Card |

Dragon Pass | 4 | N/A |

SCB X Card SCB X Card |

Priority Pass | 2 | N/A |

AMEX Plat. Reserve AMEX Plat. Reserve |

N/A | N/A | N/A |

SC EasyBill

This isn’t a unique feature of the Standard Chartered X Card per se, but all SCB cardholders can use SC EasyBill to pay income tax, rent, education expenses and insurance premiums with a fee of 1.9% (sometimes lowered for targeted customers).

Given the X Card’s earn rate of 1.2 mpd, you’re effectively paying 1.58 cents per mile. It’s not terrible, but Citi PayAll blows all other payment services out of the water both in terms of scope (it also supports utilities bills, condo management fees, and charitable donations), and price (witness the recent 2.5 mpd promotion which lowered the cost per mile to 0.8 cents).

Marina Bay Sands dining discounts

Standard Chartered X Card and Standard Chartered Visa Infinite cardholders enjoy the following discounts at Marina Bay Sands restaurants:

- RISE: 30% off

- Black Tap: 20% off with min. S$200 spend

- Bread Street Kitchen: 20% off with min. S$200 spend

- CUT by Wolfgang Puck: 20% off with min. S$250 spend

- db Bistro & Oyster Bar: 20% off with min. S$200 spend

- LAVO Italian Restaurant & Rooftop Bar: 20% off with min. S$200 spend

- Spago Bar & Lounge: 20% off with min. S$250 spend

This offer is available till 31 January 2023.

Complimentary travel insurance

| Accidental Death | S$1 million |

| Medical Expenses | S$50,000 |

| Others | Delayed Luggage: S$1,000 Lost Luggage: S$5,000 |

| Policy Wording | |

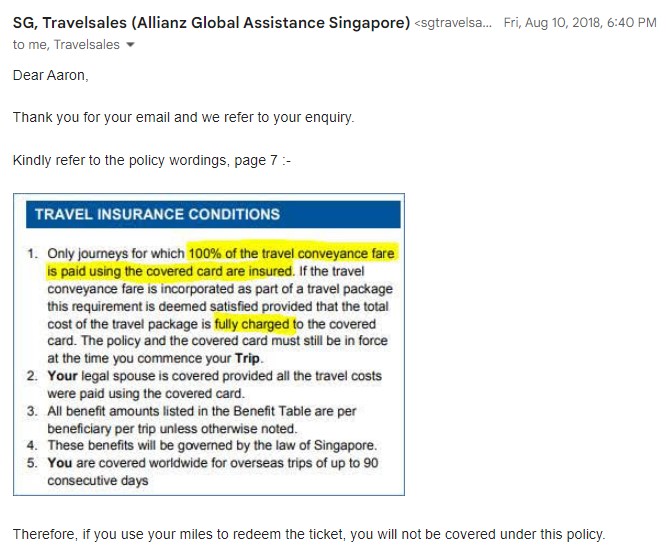

Standard Chartered X Card cardholders enjoy complimentary travel insurance underwritten by Allianz, which is automatically activated when the full airfare is charged to the card. Allianz has previously clarified that coverage does not apply to award tickets, unfortunately.

This policy provides:

- S$1 million for accidental death, or permanent total disablement

- S$100,000 for emergency medical evacuation (including COVID-19)

- S$50,000 for medical expenses (including COVID-19)

- S$5,000 for lost baggage

- S$1,000 for delayed baggage

Do note there is no coverage for trip cancellation and disruption, delayed flights, rental car excess, or personal liability. I personally would not feel comfortable without this, so I’d recommend you purchase additional coverage regardless.

Summary Review: SCB X Card

|

| Apply Here |

I wanted the SCB X Card to be a hit. I really did. How can you not get behind a card with a 100,000 miles sign-up bonus?

And yet, the neglect that Standard Chartered has shown this product borders on criminal. From day one, there’s been no visible attempt to improve its core value proposition. Yes, there have been a few transfer bonuses, and yes, you might find the Marina Bay Sands dining discount useful (though neither promotion was/is exclusive to this card, mind you). But asking S$695.50 for 30,000 miles (first year only) plus two lounge visits is just insane. It’d almost be comical, if the price weren’t so high.

There’s simply no reason to spend that amount of money when you could get a much better $120K card for a few hundred dollars cheaper. I don’t think “paperweight” has ever been a more apt assessment.

So that’s my review of the Standard Chartered X Card. What do you think?

| Overall Score | |

| ★ | |

| Ratings Guide | |

| 5 Stars ★★★★★ |

An essential card for miles chasers, with few viable alternatives |

| 4 Stars ★★★★ |

A very good card, although other equally good alternatives may exist |

| 3 Stars ★★★ |

A decent card to round out your collection, but not absolutely essential |

| 2 Stars ★★ |

Very limited use cases, and outperformed by most other cards |

| 1 Star ★ |

Paperweight. Use for picking teeth or ninja stars |

At least at 16g, it does its job as a paperweight really well 😉

Thanks for sharing your review! So will you be keeping or binning this card (even) with the 2022 waiver?

still keeping, if only so i can enjoy the inevitable revival.

there is a revival, right?

Would probably need some Lazarus level revival miracle. Perks and benefits are mediocre at best. Maybe they could induce loyalty if the annual fee comes with over the top miles bonus for staying on.

With SCB having some decent NTB promos this year, I’m out. Should have done so a year ago, but I shared the same hopes as the boss.

Wonder if you could do a comparison between the best cards in SG vs the best available in say, the US (heard it’s Amex Platinum and Chase Sapphire Reserve). I am wondering how poorly SG cards compare…

That would be beneficial for whom exactly?

whats the point for that ?

Actually, some of my friends who are based in Singapore hold US credit cards. I do not think that they use those cards to earn miles because of FCY, US dollar appreciation and wire transfer costs, but it seems that the perks are better. From what I’ve read on OMAAT, Lucky holds most of his credit cards just for the perks. The tricky part is how to apply without an actual US address, phone number, SSN and credit history. Anyone?

Work in the US for a few years

Not impossible without SSN/ITIN. I went the HSBC international remote bank account opening route. Whole lotta forms, but got approved for their US cards. Problem is…well I can’t retrieve my credit history file (I have one) because no SSN lol

How about you do up this pointless comparison and share it with the rest of us?

From the perspective of an American/Green card holder in SG Pros of SG cards: Earnings on unbonused local spend are fairly good although Capital One Venture X is comparable Miles for renewal on cards like Citi prestige are better than similar travel credits in US Better local/promotional offers (like the Citi Payall) at least for Citibank SG versus Citibank US Pros of US cards Much better sign up bonuses A lot more quality cards especially for hotels/airlines No foreign transaction fees on vast majority of travel cards Transferring miles doesn’t require a fee and can be done in blocks of… Read more »

Did they confirm to anyone that the 2022 annual fee is officially waived?

Just to be sure that they don’t bill it after X months with the explanation they “forgot” to charge it.

Yup don’t think i receive any waiver notice too and there is so far no charge. Anyone receive notice it’s waived?

$200 minimum spend at the MBS burger joint selling $22 mains?

Great perk, signing up now!

Got a few thousand orphaned points. Is there anything I can do with those other than (a) paying SGD26.75 to transfer to an airline or (b) forfeiting them? Am cancelling the card so in 1-year I can be eligible for some new cardholder sign-up bonuses…held onto this beast for too long.

i guess you could browse through the scb rewards catalogue and see if any of the vouchers catch your eye.

can anyone teach me how to activate the priority pass for this card? Card center ask me to do online…end up is priority banking staff calling me instead. Also, which card still give points etc for insurance and singtel fees? Thank you and gong xi fatt choy