Every 12 months, AMEX Platinum Charge cardholders have to confront the annual “keep or cancel” question, which this year has hit an all-time-high of S$1,744 thanks to the GST hike on 1 January 2024.

For many people, this is the most they’ll ever pay for a credit card. And since no one gets an AMEX Platinum Charge for its miles-earning potential (unless perhaps you spend big at 10Xcelerator merchants), the only way the math works out is if you make full use of all the benefits on offer.

That’s why I perform an annual audit of my AMEX Platinum Charge each year to get a sense of how much I value I managed to get out of my card. I’d strongly encourage you to do the same, if you’re considering whether to renew!

Summary: AMEX Platinum Charge 2023/24

Below is a summary of my AMEX Platinum Charge usage for the 2023/24 membership year, which in my case runs from October to September.

My 2023/24 Membership Year My 2023/24 Membership YearApply |

|

| Perk | Value |

| Platinum Statement Credits | S$1,094 |

| Comoclub C4 Vouchers | S$390 |

| 1-Night Hotel Stay | S$420 |

| Dining Vouchers | S$250 |

| Airport Lounge Access | S$450 |

| Hilton Gold Status | S$300 |

| 2-night Frasers Hospitality Voucher | S$430 |

| Love Dining & Chillax | S$800 |

| Retention Offer (20K points) | S$188 |

| Wine Vouchers | S$140 |

| Total | S$4,462 |

Caveats

Before we go into the analysis, some caveats apply.

Renewal vs first-time

This article is written from the perspective of a renewing AMEX Platinum Charge cardholder.

A first-time cardholder would get even more value because of:

- the welcome bonus

- the ability to use two sets of Platinum Statement Credits in the first membership year

Welcome bonus

With regards to the welcome bonus, American Express is now running a welcome offer that’s valid for approvals received by 2 December 2024.

This offer effectively discounts the first year’s annual fee by more than 50% with S$900 worth of statement credits and a Samsonite luggage (turning the S$1,744 question into a S$844 question, even if you don’t put any value on the luggage itself).

|

||

| Apply | ||

| Offer 1 | Offer 2 |

|

| Pay S$1,744 Annual Fee | – | – |

| Spend S$8,000 (First 180 days) |

S$900 credits + Samsonite luggage | 88,000 MR points + S$100 credits + Samsonite luggage |

| Base Points from S$8,000 (@ 2 pts/S$1.60) |

10,000 MR points | 10,000 MR points |

| Total Spend | S$8,000 | S$8,000 |

| Total Return | 10,000 MR points + S$900 credits + Samsonite luggage | 98,000 MR points + S$100 credits + Samsonite luggage |

This offer is valid for anyone who hasn’t cancelled an AMEX Platinum Charge in the past 24 months. You are eligible for the offer even if you currently hold other AMEX cards.

Platinum Statement Credits

With regards to Platinum Statement Credits, the key thing to remember is that they’re issued by calendar year, not membership year. This means a new cardholder can enjoy two sets in their first membership year, enhancing their value significantly.

For example, if a cardholder is approved in November 2024, he gets 1x S$200 local dining credit to use by 31 December 2024, and then on 1 January 2025, another 1x S$200 local dining credit to use by 31 December 2025. Using the second year’s credit has no impact on his ability to cancel his card the following November before the second year’s annual fee comes due, if he wishes to.

For more information, refer to the post below.

AMEX Platinum Reserve benefits

Historically speaking, AMEX Platinum Charge cardholders enjoyed a perpetual fee waiver for the AMEX Platinum Reserve, which came with additional perks such as:

- A 1-night stay at selected Fraser Hospitality properties worldwide (reduced from 2 nights)

- S$100 Tower Club voucher (discontinued from 1 January 2024)

- 2x complimentary bottles of wine from Grand Cru (no purchase required)

- 1x complimentary bottle of wine from Napoleon (no purchase required)

- S$150/S$190 nett stays at Hotel Fort Canning, M Social, Rendezvous Hotel and Outpost Hotel under the Near Away staycation programme

However, the fee waiver no longer applies to anyone approved for an AMEX Platinum Charge from 1 November 2022 onwards. Those who were approved prior to this date will continue to enjoy the benefit so long as they hold the AMEX Platinum Charge.

I’m part of the batch that was grandfathered in, but if you’re not, you’ll need to adjust your figures accordingly.

Value is subjective!

Finally, the most important caveat: valuation is inherently subjective, and what you get out of the AMEX Platinum Charge will depend on your individual preferences, travel patterns and lifestyle. For example, a teetotaller wouldn’t find much value in Chillax or the wine vouchers, and someone who always flies First or Business Class may not value a lounge membership.

The same goes for the rest of the vouchers and statement credits, where your valuation should take into account whether these are the kinds of places you’d normally be spending money at. And if not, then some sort of haircut is in order.

How much of a haircut should that be? Only you can say. Ultimately, I don’t know your lifestyle patterns and preferences, so I can’t speak to your particular situation. What I do know is that you shouldn’t take my figures wholesale. Make adjustments as needed!

tl;dr: The AMEX Platinum Charge is big money investment, and you should only be taking the plunge if you’re confident you can get a lot more out of it than you put in.

Now, on to the main event…

Platinum Statement Credits: S$1,094

The annual Platinum Statement Credits are key to recovering the value of your annual fee, so much so I’ve written a separate guide covering each of these in full detail.

Guide: AMEX Platinum Charge annual S$1,354 statement credits

Airline credit: S$200

| ✈️ Airline Credit | |

| ❓What’s this? | AMEX Platinum Charge cardholders receive a S$200 airline credit every calendar year that can be used at Singapore Airlines or Scoot, with a minimum spend of S$600 in one or more transactions. |

I maxed out the S$200 airline credit simply by using the AMEX Platinum Charge to pay for the taxes and surcharges on my KrisFlyer award tickets.

This comes with the added benefit of fairly comprehensive complimentary travel insurance which covers myself, the MileLioness and the MileCub, saving me from having to buy a separate policy to cover them.

Dining credit (local): S$200

| 🍽️ Local Dining Credit | |

| ❓What’s this? | AMEX Platinum Charge cardholders receive a S$200 local dining credit every calendar year that can be used at participating restaurants in Singapore. No minimum spend is required. |

I used last year’s S$200 local dining credit during what I call the “Basilico Bonanza”, when a couple of well-timed AMEX Offers created a fantastic stacking opportunity at Basilico in the Conrad Orchard Singapore.

In short, cardholders could stack:

- A S$105 Conrad statement credit with a minimum spend of S$350

- A S$60 Hilton statement credit with a minimum spend of S$300

- 25% discount on F&B for Hilton Gold/Diamond members

- S$200 local dining credits

That was sensational, to say the least, and I made some people very happy by treating them to the lunch buffet.

Dining credit (overseas): S$200

| 🍽️ Overseas Dining Credit | |

| ❓What’s this? | AMEX Platinum Charge cardholders receive a S$200 overseas dining credit every calendar year that can be used at more than 1,400 participating restaurants worldwide. No minimum spend is required. |

This year’s S$200 overseas dining credit was spent at Mido Omakase, a small omakase place located in Eight Thong Lo in Bangkok. The lunch set started from 2,900++ THB (~S$113++), so we only had to top up a little extra for two people.

The quality? Superb. I’d say it was as good as anything I’ve had in Tokyo, and I’d probably come back even without the dining credit.

Entertainment credit: S$204

| 📺 Entertainment Credit | |

| ❓What’s this? | AMEX Platinum Charge cardholders receive a S$17 entertainment credit every calendar month that can be used at Audible, Eventbrite, Disney+, Netflix Singapore, SPH Media, and Ticketmaster. No minimum spend is required. |

I’ve been spending the S$17/monthly entertainment on a Netflix subscription (which requires an additional top-up since I’m on the premium plan that costs S$25.98 a month).

Fashion credit: S$150

| 👒 Fashion Credit | |

| ❓What’s this? | AMEX Platinum Charge cardholders receive a S$150 fashion credit, disbursed as two bi-annual credits of S$75 each (1 Jan to 30 Jun, 1 Jul to 31 Dec) and usable at NET-A-PORTER & MR PORTER |

Every year I keep telling myself that this is the year I do something more interesting with my Fashion Credit, that I overhaul my wardrobe and get myself a snazzy pair of shoes or a stylish hat that makes my wife think I’m having an affair.

Every year I end up getting more Aesop. I get two bottles each half-year period (which cost about S$100 total), and add the code mrp10pmx to remove the shipping costs.

Don’t forget that NET-A-PORTER and MR PORTER are both on ShopBack, so you can earn extra cashback on your order too (though that may be affected if you use the free shipping promo code; I’m not sure).

Lifestyle credit: S$340

| 🍷 Lifestyle Credit | |

| ❓What’s this? | AMEX Platinum Charge cardholders receive a S$400 lifestyle credit every calendar year that can be used at Adeva Spa, Follicle at Adeva, Spa Rael, The Ultima, The Spa by The Ultimate, and Grand Cru Wine Concierge with a minimum spend of S$600 in a single transaction. |

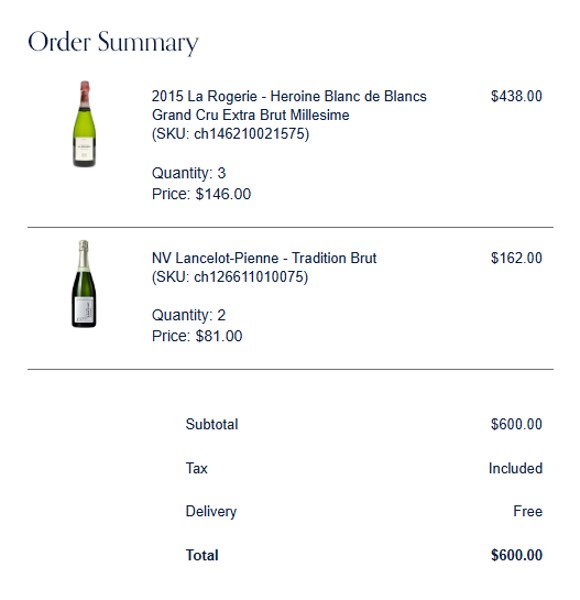

Since I have little interest in spa treatments or grooming, I always default to using my lifestyle credit with Grand Cru Wines. I managed to hit S$600 on the dot this year with this order.

However, the prices on the Platinum portal are sometimes (but not always) higher than the public website, so I think it’s prudent to take a 15% haircut on the value of this credit.

Comoclub C4 membership: S$390

|

| AMEX x COMO |

AMEX Platinum Charge cardholders enjoy a complimentary 12-month Comoclub C5 membership, bypassing the usual S$50,000 minimum spending requirement.

This comes with various discounts throughout the Como Group, but the real highlight are the birthday perks:

- S$200 shopping vouchers at Club21 Singapore, Kids21 Singapore and Dover Street Market Singapore

- S$40 dining voucher at COMO Dempsey

- S$20 grocery voucher for SuperNature Singapore and glow cafe

- COMO Shambhala birthday gift

- DrHair deep cleansing scalp treatment

- Corkage waiver at COMO Dempsey

I didn’t spend enough to maintain the C5 membership, so I’ve dropped down to C4. But that’s still decent, because I get:

- S$100 shopping vouchers at Club21 Singapore, Kids21 Singapore and Dover Street Market Singapore

- S$20 dining voucher at COMO Dempsey

- S$10 grocery voucher for SuperNature Singapore and glow cafe

- COMO Shambhala birthday gift

- DrHair deep cleansing scalp treatment

That’s S$130 worth of vouchers (all of which have no minimum spend), and since the benefit also applies to supplementary cardholders, I get a total of S$390 across three cards.

1-Night Hotel Stay: S$420

AMEX Platinum Charge members receive a voucher for a complimentary hotel night each year, currently valid for stays at the following properties:

|

|

I redeemed this year’s voucher at the Mandarin Oriental Kuala Lumpur, which was a solid stay, all things considered. The hotel completed a renovation in 2018, so it’s not as run down as some of the other Mandarin Orientals I’ve seen.

Breakfast was included, and a similar rate for the dates of my stay would have cost me S$420.

Platinum dining vouchers: S$250

The AMEX Platinum Charge includes numerous dining vouchers in its membership pack, but this year I ignored all but two.

- S$100 Tower Club voucher (+S$100 more from AMEX Platinum Reserve- remember, this has since been discontinued)

- 30% off Wan Hao restaurant

For the Tower Club vouchers, I normally take a 10% haircut because AMEX Platinum Charge and other affiliate members need to pay a 10% surcharge on orders.

However, because I find the food at Tower Club to be very mediocre, I used this year’s vouchers to buy wine instead. Tower Club has periodic wine sales where they get rid of excess inventory, and you can pop in (no reservation needed) to purchase what you like. The 10% surcharge does not apply to list prices, so I’m taking the full S$200 value here (the prices were generally the same or better than what I could find online).

If you plan to do the same, be advised that Tower Club has a one voucher per unique card per day policy, so those with the AMEX Platinum Charge and AMEX Platinum Reserve vouchers should bring down both cards. Also, you’re limited to a maximum of one voucher per transaction, so you’ll need to pay for whatever exceeds S$100.

Given that Wan Hao is already on Love Dining, does the 30% off voucher have any use? Three things to remember:

- Love Dining privileges don’t apply to drinks, while the 30% off voucher does

- Love Dining privileges don’t apply to the dim sum menu, while the 30% off voucher does

- Love Dining offers 50% off for parties of two, but the 30% off voucher is valid regardless of party size

Based on my bill, I got roughly S$50 worth of savings.

As for the rest of the vouchers:

- S$100 Restaurant JAG voucher: I never got around to visiting JAG, and in any case the cheapest menu, if you don’t want to go vegetarian, would cost S$210

- S$100 Wooloomoolooo voucher: This requires a minimum spend of S$250 and does not stack with Love Dining, and in any case I don’t feel the food quality warrants that kind of money

- 2x S$50 JAAN vouchers: I already gave JAAN a try a couple of years ago, and while it’s decent, I can think of a hundred other places that would give me as good or better a meal at the fraction of the price

- $50 Crossroads Buffet voucher: This requires a minimum spend of S$100, and makes no sense at all because you’d almost always save more with the Love Dining discount instead

- S$50 Mikuni voucher: I was looking forward to do the S$50 melon hack (where you order a single piece of musk melon that costs, you guessed it, S$50), but Mikuni has now changed its policy to disallow it

- 50% off Asian Market Cafe: Never crossed my mind to visit, and in any case, you don’t even need the voucher to enjoy the discount because it’s offered for free to DBS, OCBC and UOB cardholders

I’ll put it bluntly: the AMEX Platinum Charge’s dining vouchers have been steadily devalued over the years. Gone are the days where cardholders could look forward to S$200 of St. Regis dining vouchers, with no minimum spend and stackable with Love Dining.

The dining vouchers now come with significant restrictions, and you’re likely to have to pay a significant amount out of pocket when using them (which I believe is the idea).

Airport lounge access: S$450

AMEX Platinum Charge cardholders receive access to the following lounges:

- Centurion Lounges (+2 guests)

- Delta Sky Clubs

- Lufthansa Lounges

- International American Express Lounges (+2 guests)

- Priority Pass (+1 guest)

- Plaza Premium Lounges (+1 guests)

These benefits are equally applicable to all supplementary cardholders, although only the first supplementary cardholder will enjoy a Priority Pass membership.

The main thing that has changed from previous years is that the number of guests for Plaza Premium Lounges has been reduced from two to one.

I generally try to redeem Business Class tickets wherever possible, but there’s some trips where there’s no award space, or where it simply doesn’t make sense (e.g. Kuala Lumpur to Singapore). In those cases, I rely on my AMEX Platinum Charge for access.

Of all the lounges I visited, the highlight was the AMEX Centurion Lounge in Los Angeles, where I had one of my best-ever meals in an airport lounge. I know that reads like a punchline, but the Nancy Silverton curated menu featured a surprisingly decent pasta with roasted Brussel sprouts I’m still dreaming about.

My travel frequency, and that of my two supplementary cardholders, increased significantly over the past year, so I’m ballparking the benefits slightly higher at S$150 per cardholder, or S$450 total.

Of course, the value here boils down to how frequently and in what cabins you fly, and how much you’d have spent on airport F&B otherwise.

Hilton Gold status: S$300

AMEX Platinum Charge members receive complimentary status with several programmes including Marriott Bonvoy and Radisson Rewards, but the truly useful one is Hilton Gold.

Hilton Gold means free breakfast, which can easily save S$100 or more per couple per day at high cost locations. It’s why I’ve been gravitating towards Hilton properties over the past 12 months: Conrad London St James, Hilton Tokyo, Roku Kyoto, Conrad Osaka, Hilton Milan, Conrad New York Midtown and Conrad New York Downtown to name a few.

Like I mentioned last year, I already hold Hilton Diamond status, so Gold offers no incremental benefit for me. However, my supplementary cardholders also enjoy Hilton Gold status, which I estimate to be worth about S$300, based on the cost of savings on breakfast on their stays.

2-night Fraser Hospitality voucher: S$430

The AMEX Platinum Reserve comes with a 2-night Fraser Hospitality voucher, which can redeemed at more than 40 properties worldwide.

I used my voucher at Capri by Fraser Barcelona, which was always going to be a step down coming from the impeccable Cotton House Hotel the night before, but was still much better than expected. The voucher booked into a studio deluxe room, which was spacious enough for us to do all our repacking. Some recent reviews cited issued with a sewage smell coming from the bathroom and ventilation system, and while I did catch a faint whiff of it here and there, we were largely spared.

A two night stay for the dates we were there would have cost S$430.

Unfortunately, any vouchers issued from 1 January 2024 onwards will be valid for just one night instead of two, so expect the value of this perk to be cut in next year’s article.

Love Dining & Chillax: S$800

American Express Love Dining isn’t an exclusive privilege of the AMEX Platinum Charge (it’s offered on the AMEX Platinum Credit Card and Reserve too), but it can help save a fair chunk on dining nonetheless.

Here’s the current list of participating restaurants and hotels.

|

|

| Restaurants (27) | |

|

|

| T&Cs | |

| Hotels (33) | |

|

|

| T&Cs | |

| *No Love Dining @ Hotels savings available; cardholders instead enjoy 20% off total bill | |

2024 was the year that Love Dining got rejuvenated, with 16 new joiners (including the short-lived Burger & Lobster- what a disaster that turned out to be!).

I was delighted to see Tapas24 join the programme, as I consider it to be one of the better Spanish places in Singapore (Binomio, Esquina and FOC are great too, but have price tags to match).

Elsewhere, 15 Stamford has rejoined Love Dining after a lengthy absence, and while Alvin Leung is no longer associated with the restaurant, it still serves up high quality cuisine that becomes excellent value at 50% off.

Les Bouchons is a solid option for steak frites, Entrepot serves up innovative East meets West cuisine, and protip: Paradox and Pullman offer 50% off the food bill on Mondays even for single diners!

So, me and my supplementary cardholders did a lot more Love Dining this year than the year before, and saved more than S$800.

Retention offer: S$188

When my annual fee is charged, I always make a point of calling up customer service to ask about a retention offer (you’ll need to do it after your annual fee has been billed to your statement; the CSO won’t be able to assist you before that).

American Express usually offers cardholders bonus points upon renewal, but they’re not automatically awarded; if you don’t ask, you don’t get. This year, like previous years, I received 20,000 MR points (12,500 miles) for renewing. At 1.5 cents per mile, this is worth ~S$188.

Bigger spenders have reported receiving up to 40,000 MR points (25,000 miles), so it’s really a YMMV situation.

Platinum wine vouchers: S$140

AMEX Platinum Charge cardholders get two complimentary wine vouchers, with an additional five from the AMEX Platinum Reserve, redeemable at the following outlets:

| From | Voucher | Conditions |

AMEX Plat. Charge AMEX Plat. Charge |

2x vouchers for wine (or cake) at Fairmont Hotel & Swissotel The Stamford | At least 1 dine-in item, max 1 voucher per visit |

AMEX Plat. Reserve AMEX Plat. Reserve |

2x vouchers for wine (or cake) at Fairmont Hotel & Swissotel The Stamford | At least 1 dine-in item, max 1 voucher per visit |

| 2x vouchers for Grand Cru Wines | N/A | |

| 1x voucher for Napoleon | N/A |

The Grand Cru Wines and Napoleon vouchers are absolute no-brainers. No minimum spend is required; just show up and collect your bottles. Don’t feel bad, you’re not the first to do this, and you won’t be the last.

The Fairmont Hotel & Swissotel The Stamford vouchers require a minimum order of one dine-in item. I usually get around this by ordering a coffee or dessert and redeeming two wine vouchers each time.

Unfortunately, the rules were recently tightened, and now:

- You must order a main to utilise a voucher

- You can redeem a maximum of two vouchers per visit (example: if you visit Mikuni, you can redeem 1x S$50 voucher + 1x wine/cake voucher)

Fortunately, I managed to redeem my vouchers before the new rules came into play, but it’s certainly going to affect my valuation next year.

As for the quality of the wines, they’re not going to win any awards. Think of them as better used for daytime drinking or cooking.

Depending on available stock, you may receive any of the following:

- La Minga Sauvignon Blanc 2022

- Mâcon Uchizy 2015

- Triennes Merlot 2014

- L’Autantique Sauvignon 2020

- Karku Nocturno Sauvignon Blanc 2020

- Karku Nocturno Merlot 2020

- Famille Perrin Ventoux 2019

I use a S$20 value for each bottle, for a total of S$140.

Other perks

I’ve not given a value to any of the perks below, but thought I’d mention them for completeness’ sake.

AMEX Fine Hotels & Resorts

|

| AMEX Fine Hotels & Resorts |

AMEX Platinum Charge members can book Fine Hotels & Resorts (FHR) rates at luxury hotels worldwide, which include perks such as:

- Room upgrade

- Daily breakfast for two

- US$100 hotel credit

- 12 p.m check-in (subject to availability)

- 4 p.m check-out (guaranteed)

- Complimentary Wi-Fi

FHR rates price the same as the hotel’s best flexible rate, and are eligible to earn hotel points and elite status credits.

Over the past year I’ve booked FHR stays at the Crown Perth, Langham Hong Kong and Ritz-Carlton Perth, and on all occasions I’ve received at least a one-category upgrade, some very nice breakfasts, as well as the opportunity to try restaurants and spa treatments with the hotel credits.

A special mention for the Ritz-Carlton Perth, where I got upgraded to an amazing suite with killer views of the Elizabeth Quay waterfront. This 104 sqm room had acres of space for the MileCub to run around, and probably ranks among my best FHR upgrades.

However, I’m not including this in the valuation because you can book similar luxury agent rates through a free platform like HoteLux.

Spa vouchers

AMEX Platinum Charge members receive the following spa vouchers:

- S$100 credit at Aveda Spa (min. S$180 spend)

- S$100 credit at Spa Rael (min. S$180 spend)

- S$130 credit at The Ultimate Spa (min. S$180 spend)

I might have given these a token value back when the treatments were completely free, but now that they have minimum spends I just ignore them completely.

Complimentary travel insurance

|

| Policy Wording |

AMEX Platinum Charge cardholders receive complimentary travel insurance when they pay for air tickets (or taxes and surcharges on award tickets) with their card.

This is a fairly comprehensive policy, which includes:

- S$1 million for death or total permanent disability

- S$1 million of medical expense coverage

- S$10,000 trip cancellation and postponement

- S$4,000 of emergency dental treatment

- S$1,500 for lost personal belongings

- S$400 for flight or baggage delays

- S$150 hospital cash allowance

However, it does not cover the loss of airline miles (e.g. you redeem a Spontaneous Escapes ticket and can’t travel because of illness), so that’s something to take note of.

Because I value miles and points coverage, I purchase a separate Singlife insurance plan and use that as my primary coverage.

Regional Golf Programme

|

| Regional Golf Programme |

AMEX Platinum Charge, Platinum Reserve and Platinum Credit Card members enjoy complimentary green fees when they bring along one paying guest on weekdays, and two paying guests on weekends under the Regional Golf Programme,

This features Orchid Country Club, Sembawang Country Club and Warren Golf & Country Club in Singapore, along with courses in Cambodia, Indonesia, Japan, Malaysia, Philippines, Thailand and Vietnam.

I don’t golf, so I don’t assign this any value.

Great World Parking

|

| Great World Parking |

AMEX Platinum Charge cardholders enjoy complimentary all-day parking at Great World City on Fridays, Saturdays and Sundays. This is capped at 50 redemptions per day, so you’ll need to come early if you want to take advantage of this (redemptions start from 10 a.m).

I’ve used this perk a handful of times, but not enough for me to assign it any real value.

AMEX Experiences

AMEX Platinum Charge cardholders can sign up for events in partnership with various lifestyle and F&B merchants. These are available via the AMEX Experiences app on a first-come-first-serve basis, and over the past year I’ve managed to register for: SABON Next Generation Body Scrub, Montblanc Archive Roadshow, The Breitling Heritage Exhibition, Panerai Watches & Wonders, La Labo Scent Discovery Journey, Guerlain L’Art & La Matiere Fragrance Masterclass, Chopard Day of Happiness, and Moschino Spring Summer 2024.

These events are all free to attend, and while I’m sure they’d appreciate it if you made a purchase, it’s not expected. You can generally expect light bites, champagne, and possibly a goody bag.

It’s not something I’d assign a specific value to, but nice if you can find the time.

Conclusion

|

| Apply |

There’s only space in my wallet for one “benefits card” (a card you hold not for earning miles, but rather lifestyle and travel perks), and since 2018 that’s been occupied by the AMEX Platinum Charge.

For sure, the card has lost some lustre from the early days, where the dining vouchers were less stingy, NOOK was available as a private working space, and there was Platinum af’FAIR to look forward to every year. But I still see a clear way of getting more out of my annual fee than I put in, and given my returns for the 2023/24 membership year, I’m happy to continue.

But at the risk of belabouring the point, value is subjective. The way you value the perks may be different from mine, so you’ll need to look at your travel and lifestyle patterns and decide whether the AMEX Platinum Charge is still a good fit, or whether a $120K card (with annual fees of around S$500-600) could work just as well for your needs.

What other AMEX Platinum Charge perks did you make use of?

Hi, where did you get the free shipping code mrp10pmx? it does not work for me

I had the same problem.

Aaron, is the discount code for Mr Porter, mrp10pmx, one time use only? I tried it and it didn’t work for me.

i’ve used it multiple times with no issue. no reports of issues from the amex plat chat on telegram either (https://t.me/amexplatinumsg)

on my end too does not work sadly

Read that the promo codes cannot be stacked. Either SINGLES 25% or Free Shipping using MRP10PMX. But if spend is >GBP200, shipping is free.

Had it cancelled first year into covid, no flights. Seems like the bar options (chillax) are reducing significantly now than before, and NOOK was conveniently located and never crowded when I was there. Been thinking if I should get back on it again. If only they can up the miles per dollar spent ratio.

i can safely say that amex will never enhance the earn rate on this card. there’s simply no need to- and you shouldn’t be using this as a general spending card anyway. i only ever spend on it for 10xcelerator merchants, love dining, amex offers and when i want free travel insurance

the net a porter free shipping code doesn’t work

Does travel insurance apply or not apply for bookings made with airline miles (with taxes and surcharges paid by the plat card)? There is a contradiction here:

AMEX Platinum Charge cardholders receive complimentary travel insurance when they pay for air tickets (or taxes and surcharges on award tickets) with their card.

However, it does not cover bookings made with airline miles (e.g. you redeem a Spontaneous Escapes ticket and can’t travel because of illness), so that’s something to take note of.

the complimentary travel insurance is triggered when you pay for an award flight with miles. however, the insurance does not cover the loss of miles and points. will edit for clarity.

Thanks Aaron, yet again an insightful piece. What do you spend the Club21 vouchers on if you’re not getting those snazzy hats or stylish shoes that make your wife think you’re having, erm, a snazzy or stylish time?

overpriced clothes and toys for the milecub at kids21.

i’m wholesome that way.

$200 doesn’t go far when a brand-name T-shirt is >$100 and a scooter is >$300. Probably C6 for the $500 voucher to be really useful. Miss the CPC benefit from before.

c5 also has a discount of 15% that stretches your credit a bit further. over the years I’ve bought things like a rocking horse, a life jacket, some baby sunglasses and a swimming costume, all without overshooting much.

It is interesting to see that for SG market, the card seems to have a really heavy (~200 to 400 sgd) “brand / status symbol tax”. If you compare to some other markets such Hong Kong or the US, the ratio “credits + face value of vouchers” / fees is higher (quite close to 100% imo), making it almost an easy no brainer if you match the income requirements, while SG one only seems to break even if : you factor in insurances + lounge accesses supplementary cards potential extra cards (e.g : Reserve) acquired before the fee scheme change.… Read more »

Hi Aaron,

On amex website the lounge benefit is written as such:

“Escape the chaos with unlimited complimentary lounge access for you, one Supplementary Card Member and one guest each.”

Just want to clarify as what I understand is that only PP is limited to 1 supp card.

The other lounges, plaza premium, etc should be available for all supp cards?

Seems like the Amex website is wrong?

PP for principal and ONE supp. Need to show the PP card

Principal and BOTH supp get all non-PP-related lounge e.g. centurion and plaza premium, only need to show the Amex card.

Personally, the statement credits and complimentary travel insurance also provided good value. for example, they just provided a offer of $100 credit for $500 spent at sookee, translating to a discount off market value for Gold which me and my Sup card each made purchase, thats $200 back already. Of course, this is a purchase We were going to make in any case. For the travel Insurance, it applied to my whole family of 5 for 15 days, a few hundreds of savings there. last but not least, lesser valued is the extended warranty.Example, an iphone extended warranty costs $230… Read more »

Hi Aaron, after the first membership year is over, upon paying the second annual fee, do you get another set of statement credits and vouchers (that come in the grey box)? Or do you only get the retention offer that you had requested

Hi Aaron, with the Platinum Statement Credits issued by calendar year, not membership year. Do you typically recommend a certain period of the year to apply for the card and have sufficient time to enjoy the best of both years? Also what does the set comprises of which are issued for both calendar years? Thank you.

well mathematically speaking that would be the middle of the year. but…you also have to see what the welcome offers are. a better welcome offer might be worth the trade-off of having less time to spend one set of credits.

Is it just me or is anyone still facing the issue of not being able to apply discount code mrp10pmx for Mr Porter and Net-a-porter?

hint: incognito.

Still doesnt work in incognito mode too!!