Another year has gone by in a flash, and once again I’m facing the S$1,712 question: keep or cancel my AMEX Platinum Charge?

The past 12 months have been…unusual, to say the least. My membership year runs from from October to September, so it’s a bit of a strange hybrid where 5 out of 12 months were “normal”, and the other 7 were the “new normal” (I’m using March as the dividing line, when the MOH issued its advisory against all non-essential travel abroad).

Given how many of the AMEX Platinum Charge’s benefits are travel and lifestyle-related, a lockdown can really negate their usefulness. That said, I went through my statements and did some calculations, and this is my rough valuation of the perks I’ve enjoyed over the previous 12 months:

| Value | |

| Hotel Vouchers |

S$840 |

| Travel Credit | S$800 |

| Love Dining* | S$655 |

| “Everyday Essentials” Statement Credit | S$500 |

| Dining Vouchers | S$400 |

| Free Drinks at NOOK | S$260 |

| Hotel Elite Status | S$245 |

| 3 x Spa Vouchers^ | S$150 |

| Bonus MR Points During Double Points Campaign# | S$140 |

| Lounge Access | S$100 |

| Total | S$4,090 |

| *Also available on the AMEX Platinum Credit Card (AF: S$321) ^Based on the price I’d have otherwise been willing to pay (not retail price) #Based on 1.5 cents per mile (reduced from my usual 1.8 cents to reflect the current situation) |

|

A quick word about valuation: it’s inherently subjective, so it helps if you do your own calculations too. For example, the complimentary spa treatments have a list price in the hundreds of dollars, but there’s no way I’d have paid that much in the first place. Hence, I use a S$50 valuation for each of the three (the maximum out of pocket price I’d be willing to pay). You may feel different if you’re a hardcore spa fanatic, however.

Likewise, I normally get lounge access by virtue of redeeming Business or First Class tickets, so the actual value I derived from the unlimited lounge pass will be lower than someone who regularly flies Economy without elite status.

I’ll talk about how I valued each of these perks in more detail below:

Free Hotel Stays

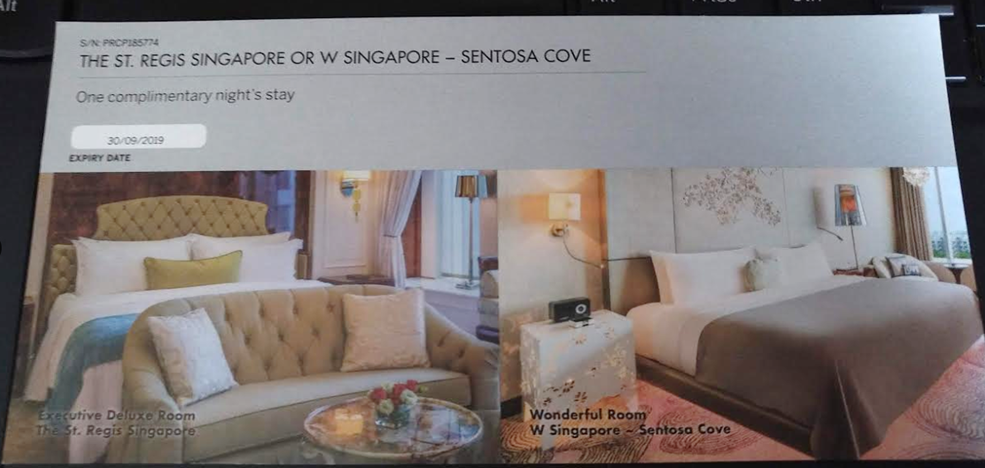

The AMEX Platinum Charge gives you a complimentary night at the St Regis Singapore or W Sentosa each year of renewal. Last year I used the free hotel night at the W Sentosa (I went on National Day weekend- never again); this year I opted to try the St Regis instead.

I stayed in January, amidst the halcyon days before COVID-19. We ate at buffets. There were no restrictions on the pool and gym. I sneezed in public and wasn’t subject to summary execution. What a world.

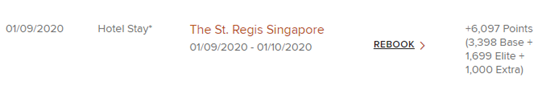

It helped that I was still a Marriott Platinum back then, which got me an upgrade from an Executive Deluxe base room to a Penthouse room overlooking the Botanical Gardens. Despite the impressive name, the Penthouse is actually a slightly larger room rather than a bona fide suite, but hey, who’s complaining?

Based on the dates I stayed, the cash rate would have been about S$380. In case you were wondering, the annual free night voucher does count towards your elite nights, and earns Marriott Bonvoy points too.

By the way, you may have noticed that your renewal voucher looks different. Earlier this year, American Express changed up the list of hotels where the annual free night stay can be used. Instead of two properties in Singapore, it’s now possible to redeem the voucher at 19 different hotels worldwide:

- Banyan Tree Chongqing Beibei (China)

- Banyan Tree Huangshang (China)

- Banyan Tree Yangshuo (China)

- Angsana Xian Lintong (China)

- Mandarin Oriental Jakarta (Indonesia)

- Angsana Maison Souvannaphoum (Laos)

- Banyan Tree Kuala Lumpur (Malaysia)

- Pavilion Hotel Kuala Lumpur (Malaysia)

- Banyan Tree Cabo Marques (Mexico)

- Banyan Tree Mayakoba (Mexico)

- Banyan Tree Tamouda Bay (Morocco)

- Angsana Riads Collection Marrakech (Morocco)

- Mandarin Oriental Singapore (Singapore)

- St Regis Singapore (Singapore)

- Mandarin Oriental Bangkok (Thailand)

- Banyan Tree Bangkok (Thailand)

- Angsana Laguna Phuket (Thailand)

- Banyan Tree Lang Co (Vietnam)

- Angsana Lang Co (Vietnam)

While there’s no more W Sentosa Cove, cardholders can now stay at the Mandarin Oriental Singapore instead.

AMEX Platinum Charge cardholders can also get an AMEX Platinum Reserve for free, which includes a two-night stay at selected Fraser Properties worldwide. I used my voucher for a stay at the Fraser Residence Nankai Osaka (superb location) back in September, which saved me about S$460.

The current year’s voucher will obviously be much more difficult to use, with the only local option being Capri by Fraser Changi City. Moreover, all voucher redemptions at this property have been fully exhausted for the year, so I’m waiting on AMEX to get back on an extension.

S$800 Travel Credit

With leisure travel indefinitely on hold, using the S$800 travel credit has obviously been a big problem this year. In fact, I’m now holding on to two year’s worth of air travel credits, thanks to my cancelled trip to Bangkok.

The good news is that American Express has been proactively extending these credits as and when their expiry comes due. That’s fair enough I suppose, although it does mean I’m currently S$1,200 “behind” in terms of value realization.

My guess is that leisure travel, when it resumes, will initially be regional in nature. That’s fine with me, insofar as I’d normally spend my travel credit on short haul flights anyway (for medium/long haul, I’d opt to redeem miles). Do note that you cannot combine two separate air travel credits in a single booking, but if you’re traveling with a companion, you can make two separate bookings and use one credit for each.

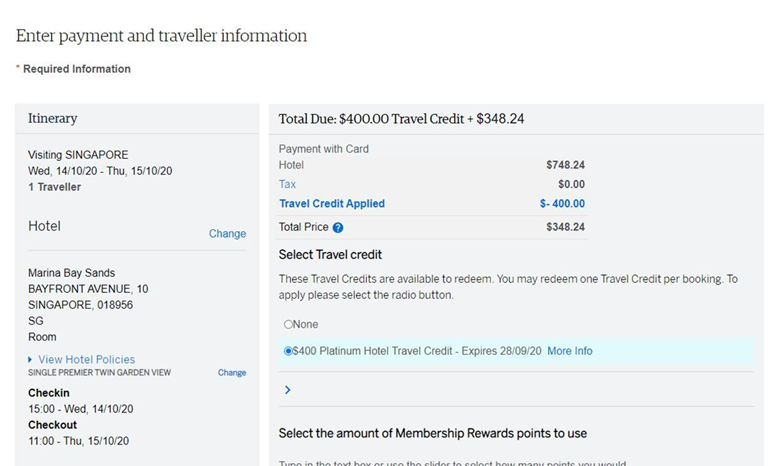

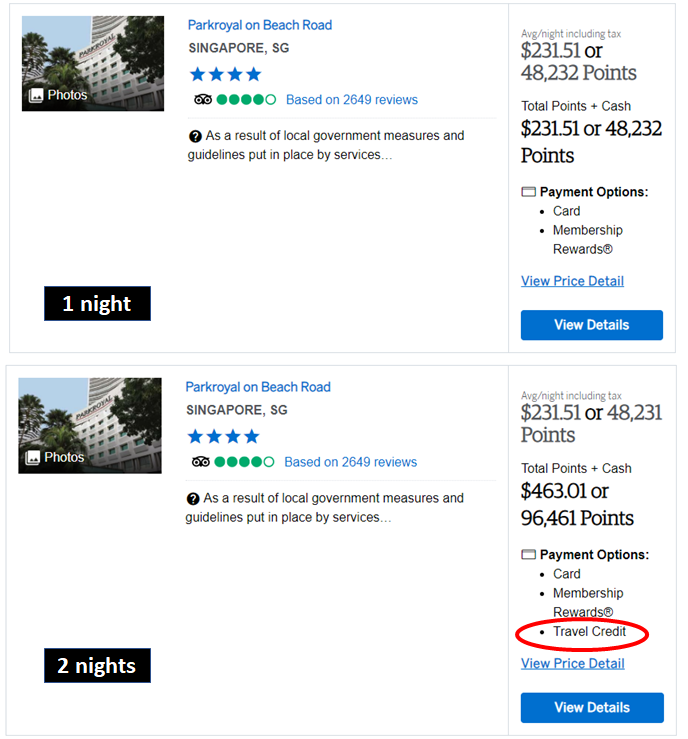

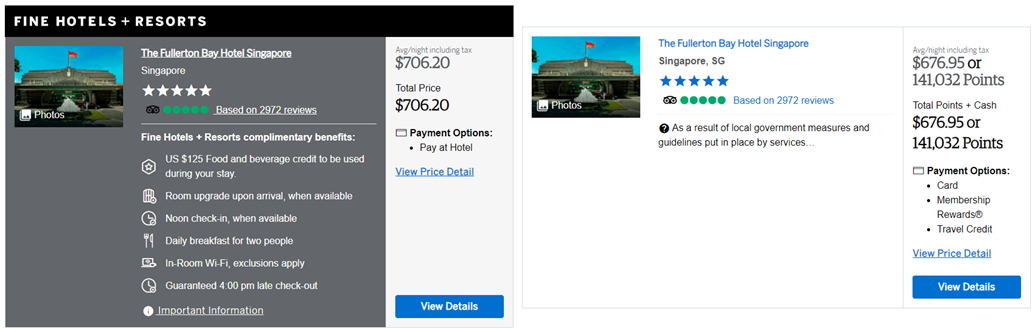

The hotel credit is relatively more straightforward to use. Contrary to popular belief, the S$400 Platinum Hotel credit can be used at hotels in Singapore- just a more restricted list. To see which hotels are eligible, you’ll need to login to the AMEX Travel Portal and run a search.

| ⚠️ Update: As per the official T&C of the travel credits, hotel credits can only be used for overseas bookings. In spite of that, it appears that it’s possible to use the credits for local hotels via the AMEX Travel Portal, although how long this lasts for is anyone’s guess. Anecdotally, quite a few people have been able to book and stay at local hotel with the credits. |

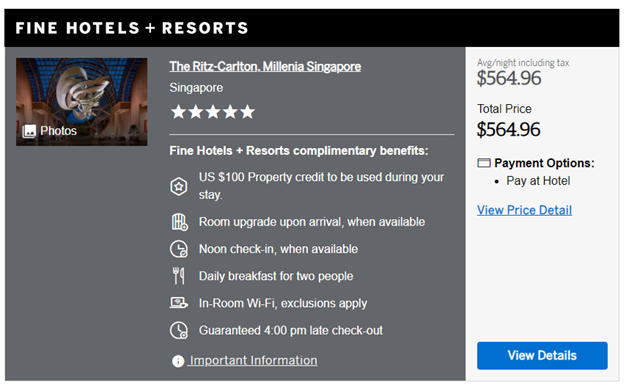

What annoys me is that since 2019, it’s not been possible to use the hotel credit on Fine Hotels & Resorts (FHR) or The Hotel Collection (THC) rates. This eliminates hotels like the Ritz-Carlton Millennia, Four Seasons, and Shangri-La, a policy I really dislike and have given feedback to AMEX about.

| ⚠️ Dual Listings |

|

Do note that a given hotel may appear twice under the AMEX Travel search results- once under the FHR/THC rate, once without. You’ll be able to use the travel credits to book the non-FHR/THC rate (although the question then becomes whether it’s worth doing so, given all the benefits you lose out on).

|

So what can you book? Based on a random search for October, I was able to use the travel credits at the following hotels (you may find other properties as well, depending on the dates you search):

| Bold= Approved for staycations | |

|

|

Once you’ve chosen your hotel, you’ll be able to apply the travel credit at the last step before payment:

If you don’t see “travel credit” appearing as a payment option on a non-FHR/THC rate, the most likely explanation is that your total cost <S$400. As the screenshot below shows, selecting multiple nights resolves this issue:

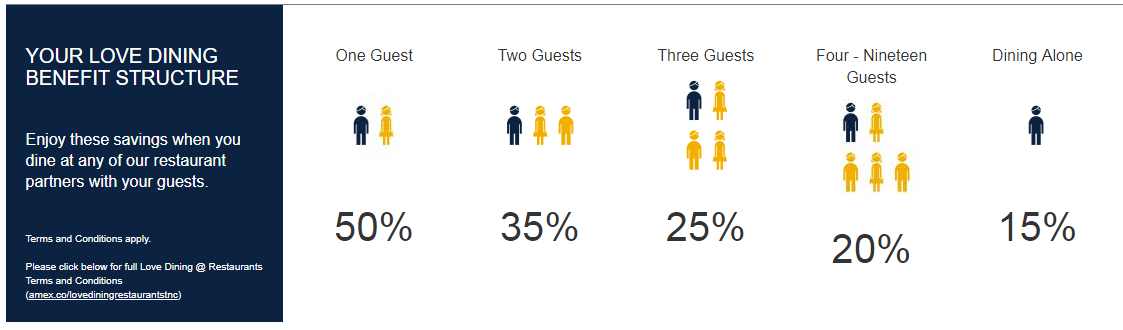

Love Dining

While Love Dining benefits aren’t exclusive to the AMEX Platinum Charge. I still consider them in my evaluation because I wouldn’t consider getting a stand-alone Platinum Credit Card or Platinum Reserve.

Over the course of my membership year, American Express added new Love Dining options in the form of six restaurants at The Capitol Kempinski, three at the Conrad Centennial (which previously left love dining in January 2019 before rejoining in July 2020), Le Fusion, and Paulaner Brauhaus.

While there’s a wide range of restaurants to choose from, it says a lot about how much I enjoy 15 Stamford that the bulk of my Love Dining discounts were used here.

50% off on food (not drinks though) is excellent value, and it’s even better than other programs like The Entertainer. The Entertainer gives you 1-for-1 main courses, but you pay full price for everything else. Plus, only the cheaper of the two items is free, so if one person goes expensive, the other feels obligated to follow suit.

Based on my statements, I saved roughly S$655 on dining over the past 12 months.

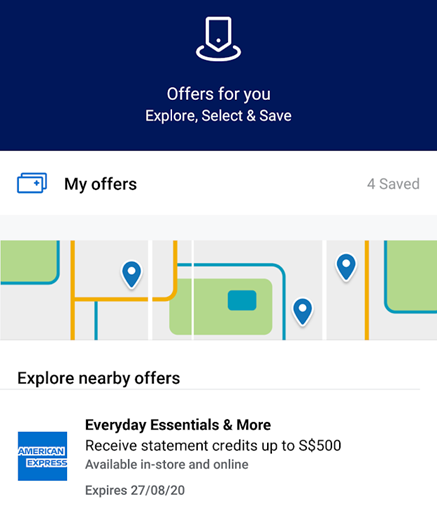

S$500 statement credit for “everyday essentials”

In May, American Express offered a one-time S$500 statement credit for “everyday essentials”.

This was valid at the following merchants:

- Club21

- Kids21

- Cold Storage

- Market Place

- Jasons

- Jasons Deli

- Giant

- Guardian

- Deliveroo

- Lazada

- FairPrice

- Unity

The inclusion of grocery stores effectively made this a S$500 discount off the annual fee, and was much appreciated at a time when people weren’t spending on much else.

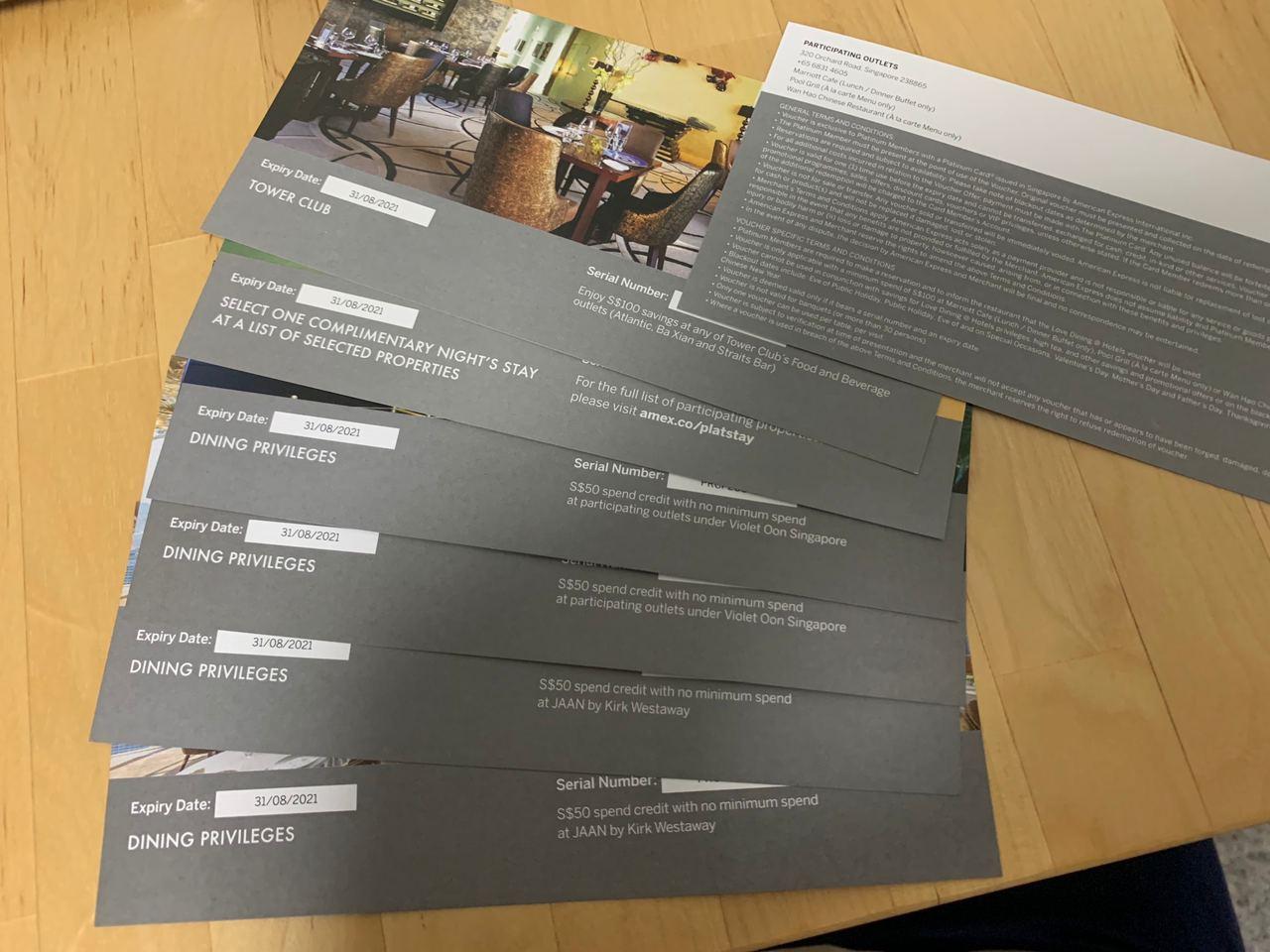

Dining Vouchers

I fully utilized the 4 x S$50 St Regis dining vouchers and the 2 x S$100 Tower Club vouchers (one from the AMEX Platinum Charge, another from the AMEX Platinum Reserve) for a total of S$400 in dining savings.

| 👍 50% off first, then vouchers |

| St Regis dining vouchers can be stacked with Love Dining benefits, and the 50% discount is taken before the vouchers are applied |

However, the outlook for next year is not so rosy. According to cardholders who renewed earlier this year, the 4 x S$50 St Regis dining vouchers have been replaced with 2 x S$50 Jaan and 2 x S$50 Violet Oon vouchers. These require a minimum of two diners, and only one voucher can be used per visit.

Needless to say, this is a significant downgrade, and I’ll have to adjust next year’s valuation accordingly.

NOOK by Platinum

In December 2019, American Express opened NOOK by Platinum, the replacement lounge for Platinum VIBES. Nestled in a corner of 15 Stamford, it’s a pleasant place to unwind with a complimentary glass of red or white wine.

I’ve even found NOOK to be a useful co-working space on weekday afternoons, when it’s practically deserted. Although most of the chairs are in a lounge configuration, there are four work desks with power ports, and the hotels’ Wi-Fi network is accessible to NOOK guests.

The lease was recently extended till the end of 2020, and NOOK is now operating with safe distancing measures in place. I’ve probably visited at least 20 times since it opened, and using a S$13 per glass of wine estimate gives ~S$260 in value.

Hotel Elite Status

The AMEX Platinum Charge comes with elite status in the following programs:

- Marriott Bonvoy Gold

- Radisson Rewards Gold

- Hilton Gold

- Shangri-La Golden Circle Jade

In September last year, another perk was added: Ascott Star Rewards Platinum. This is the highest tier of Ascott’s newly-launched loyalty program, and while I’ve yet to make any stays, it can’t hurt to have it.

If you haven’t signed up yet, it’s still possible to do so- the Platinum offer is valid until 31 December 2020. You may need to contact ASR customer service to get your account manually upgraded (they’ll ask you to send a redacted copy of your Platinum Charge card as proof).

Otherwise, Hilton Gold proved useful once more (it really is the best mid-tier status out there) during our trip to Rome, where we received free breakfast at the Waldorf Astoria Rome Cavalieri. This would normally have cost 38 euros per person, so we saved about S$245 over two nights.

Spa Vouchers

The AMEX Platinum Charge comes with vouchers for three complimentary spa treatments at Adeva Spa, Spa Rael, and The Ultimate Spa. Although the list price for these is as high as S$400+ each, there’s no way I’d have paid that in the first place. Instead, I use a simple S$50 per treatment figure, or S$150 total, based on the amount I’d otherwise have been willing to pay.

Alas, there’s another nerf here. Going forward, the free spa treatments have been replaced with:

- S$100 credit at Aveda Spa (min S$180 spend)

- S$100 credit at Spa Rael (min S$180 spend)

- S$130 credit at The Ultimate Spa (min S$180 spend)

All this means my valuation of this benefit will drop to 0 from next year onwards.

Double points and double statement credits

Another AMEX initiative to offset the impact of COVID-19 was to offer all Platinum Charge cardholders double points and double statement credits from 21 April to 20 July 2020. This created an opportunity to earn a phenomenal 15.6 mpd (or 24% cashback) on EXTRA merchants, and for a period, the Platinum Charge became my default general spending card.

I didn’t spend an awful lot during this time, but I still earned just over 15,000 bonus points. I’ll value that at roughly S$140, with a lower valuation of 1.5 cents per mile to reflect the current circumstances.

While I didn’t think much of the double statement credit option at first, I eventually realised that a rate of S$9.60= 1,000 MR points could be a great way to indirectly fund my staycation reviews. That opportunity is sadly over, although AMEX is temporarily offering an upsized rate of S$6.50=1,000 MR points for charges at selected hotels.

Lounge Access

My KrisFlyer Elite Gold status is ancient history now, and I’ve been relying on the AMEX Platinum Charge for lounge access whenever I don’t redeem First or Business Class flights.

I haven’t had a chance to visit any new Centurion lounges over the past year, but the Priority Pass still proved useful in Kiev (when flying Ukraine International Airlines in Economy), Kuala Lumpur (flying Singapore Airlines in Economy), and New York (flying ANA in First Class- but they use the pretty abject British Airways lounge, and it was so bad I went over to the Alaska Club instead).

As always, I’ve been religiously visiting TGM every time I pass through Terminal 2, where you’ll find one the better lounge dining experiences at Changi (assuming you don’t have access to the Qatar Premium Lounge or the life-changing Qantas First Lounge).

I’ll guesstimate a blanket value of S$100 for all this.

Events

While it’s not possible to attach a value to this, I still want to briefly talk about the AMEX events, because they’re one of the highlights of membership for me. Sadly, COVID-19 has put a pause on these, and it’s almost certain there’ll be no Platinum af’FAIR for 2020 (AMEX’s signature event that’s really a massive carnival for adults).

But 2019 was a good year for events. In October, I attended an IWC showcase at The Atelier & Co. This was a wonderful evening with good food, free flowing champagne, and artisanal gelato. You could make your own flower bouquets, browse a selection of vintage watches, and even try your hand at disassembling and reassembling a watch movement.

Heck, they even had a poet-in-residence, who came up with this little ditty about my dog.

In December there was a TAG Heuer event (complete with F1 simulator) as well as a celebratory dinner at 15 Stamford to mark the launch of NOOK (tickets were available at a subsidized rate of S$120 nett).

Although AMEX has tried to do some online events in recent months, they’re just not the same. Here’s hoping these will return soon.

I’m renewing…but not paying cash

While everyone’s personal valuation of the perks will vary, I definitely feel I got my money’s worth. Although I couldn’t use some of the benefits due to COVID-19, the other promotions that AMEX rolled out helped to make up the difference.

Moreover, it helps a great deal that I don’t have to pay my annual fee in cash.

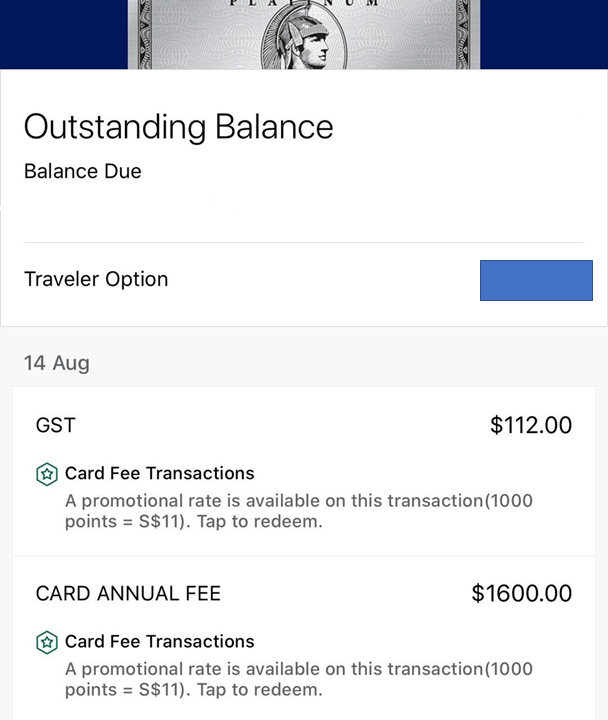

From now till 31 December 2020, American Express is allowing cardholders to use Membership Rewards points to offset their Platinum Charge annual fee at a rate of S$11= 1,000 points (for context, the regular statement credit rate is S$4.80=1,000 points).

To fully offset the S$1,712 annual fee, you’d need ~155,636 points. That’s a considerable amount to be sure, but to put it another way: 155,636 points are equivalent to 97,273 miles, so it’s as if you’re getting a value of 1.8 cents per mile. That’s about the threshold I’d deem to be acceptable in the current climate.

| 💳 How many Membership Rewards points for renewal? |

| American Express typically offers some bonus Membership Rewards points upon Platinum Charge renewal, but you’ll need to call up after your annual fee has been billed to find out what your offer is. My fee is only due in mid-October, so I’ll update this when I get my offer. However, based on my rather bush league spending of S$24,527 in the previous year, I’m pretty sure I’ll get the standard offer of 20,000 MR points. Better than nothing, I suppose. |

Conclusion

The AMEX Platinum Charge doesn’t come cheap, but all in all, I think I got good value out of it over the past 12 months.

While there’s no doubt been some chipping away of benefits (such as the new dining and spa vouchers), the core value proposition remains strong enough to overlook this. I also feel reassured that American Express is willing to help out its cardholders during this period (certainly more than other premium cards, at least), as evidenced by the double points/statement credit promotion, S$500 “discount” on the annual fee, and extension of vouchers and travel credit that can’t be used right now.

Get 40,000 bonus MR points with the AMEX Platinum Charge

So it looks like I’ll be taking the plunge for another year. Do remember that if you’re interested in applying for an AMEX Platinum Charge card too, you’ll get 40,000 bonus Membership Rewards points when you use the link above.

AMEX Platinum Charge cardholders: how did your year go?

The make hay while the sunshine days are over.. i rejected an offer for a discount off the annual fee as i think the perks have been watered down, i am not travelling anytime soon and the service is atrocious! Btw $50-$80++ mains before a 50% off do not really represent savings since you are really paying a high premium in the first place and it is possible to get similar discounts without this card from time to time.

interesting you mentioned service as a downside. my experiences have all been way superior to any other bank (and not just me I’m sure). care to share what went wrong?

re: love dining discount, i’m sure there are other ways to secure discounts, but i find this the most fuss free option, and it’s allowed me to eat at places i normally wouldn’t consider going to because of price.

I agree with Aaron on Amex service. Not just for platinum only. I had a basic KF card >10 years ago when I started work and service was pretty good for me back then too. But Klep is not all wrong about the love dining discount either. Some places are good and others are not. I have my favorites on the list. Nevertheless quality of food has to take priority over discounts. 50% discount on pigswill is 100% loss. Klep, if you’re still following this thread and value is important to you, may I enquire whether you consider 50% discount… Read more »

Unfortunately, I have to agree with Klep. The customer service I have been receiving is extremely poor. I spend 6 digits/year on the American Express platinum charge card. In 2020, I have not used any travel/hotel credits or the free night at W/St Regis. They refuse to extend the vouchers (I had actually asked for an automatic credit). The W hotel has been saying they are unable to accommodate American Express free stay vouchers since October. It’s been 3 weeks with promises of a call back/resolution and I am on the brink of cancelling my card (just that I have… Read more »

Don’t mind if I ask how much yout reduced AF is? I’m about to renew my card and amex hasn’t been that generous to me over the years even when I spend in the mid 5 digits

Just want to point out to all readers that although I am keeping my own Platinum card this year, all the popular reviewers of Amex cards in Singapore have generally failed to mention one great reason they keep the card: they all get MGM rewards when readers click on their links. All it takes is one or two MGM bonuses (25K miles at 1.8cpm = $450 value per referral) to make the annual fee worthwhile. I’m pretty sure I’ve counted more than a few readers in the comments of various Amex articles who have used a reviewer’s MGM link. Not… Read more »

Sure. Can’t attack the argument, so attack the person. Stay classy

Dear Thad, I’m not attacking anyone, least of all Aaron. But thanks for attacking – it’s nice to know you’re classy since you can’t attack my point. Maybe you didn’t read in the first line that I said I am also keeping my Platinum card since I agree with Aaron that it’s worth keeping. Just pointing out to fence-sitters that MGM and Citi referral program, whether for better or worse, will encourage recommendations whether by word-of-mouth or via readership. Buyer/Reader Beware. I’ll take back my original observation if any reviewer removes their MGM or Citi referral link from their article… Read more »

MGM is a great program indeed, but I hope that people who read the site enough know that I only recommend cards/products I really believe in. Heck, most of the uob cards that i talk about the most don’t even pay anything for apps.

stay safe and take care! hopefully we’ll be able to use some of those plat benefits in the near future.

Aaron, how did you get invited to the IWC and Tag Heuer events? Even the NOOK opening dinner … I spent quite a lot using the AMEX Plat and got nothing in terms of invitation !?!

eh, make sure you’re on the edm mailing list? these were sent out to the amex plat community at large (unless you’ve selected the do not contact option)

Who should I email to check that I’m on the mailing list?

FYI. ASR customer service rejected my request to upgrade my ASR status under AMEX offer as I am registering under my current account. The offer is valid for new ASR account sign up only.

Nice review! This is probably the best card in SG in terms of privileges (apart from Centurion of course). Looks like the benefits way outshine the $500k cards.

seems like there isnt any more free 1N stay at Regis Singapore or W Sentosa for new sign ups?

this is still part of the welcome and renewal pack.

W Sentosa replaced by Mandarin Oriental Singapore. So choice of St Regis or Mandarin Oriental from 2020

What’s the unofficial minimum income to get approved for Platinum Charge? The AMEX site says the official minimum is 200k but milelion says 150k. Mine is between 150k and 200k and I got rejected on the application. Any ideas?

Hmmm….when I got my Plat 2 years ago, I was also $150k to $200k. I clicked on the link on MileLion site, submitted the application and got the heavy box with card in a few days. Honestly, not sure what criteria Amex has for the Amex Plat.

Hi Aaron I am seriously considering applying for the card now as I have an impending spend of $20k. In your opinion, how has the value proposition change from the time of this article and now? Is it still worth paying $1712 for 134k in miles? I still don’t see any chance of travel in 2021 despite taking the vaccine.

well, you’ll need to go in with both eyes open, if you know what i mean. if you were to get the card today, for example, you’d waste the lounge benefits from now till whenever we’re able to travel again. the travel credit, hotel vouchers, dining vouchers etc you can still use, although there has been some nerfing of the dining vouchers in recent times (Swapped from st regis to jaan with limit 1 per visit and min 2 diners). i dont think the sign up bonus or mgm bonus will go away anytime soon, so if you’re on the… Read more »

Thanks, Aaron. Appreciate your kind advice. I can only defer the $20k payment till June (car collection) – hopefully things would improve by then. Otherwise, will have to try to split the $20k to UOB visa signature and ppv ($3k), citi rv and master ($2k – not sure on 4mpd), HSBC revolution ($1k – not sure on 4mpd), local spend on other cards (1.4mpd). The car dealership will probably hate me. 🙂

Hi DK, may I ask if you are using the card to pay for the deposit or for the remaining balance? My experience has been that the deposit is exempt from any fee whereas to pay in full they usually charge about 2%. Thanks

Hi I had an agreement with them and paid my deposit with cash so that I can pay portion of the remainder ($20k) with card(s). I guess mile hunters go all out to get their miles :))

any upcoming 80k bonus mgm? holding back my application .

not that i’m aware of!

any nice upcoming sign up promo that you are aware of , for this card =)

still on the fence. need something to tilt my over the fence

wow wow wow – just noticed that AMEX is throwing in massage chair (worth $3480) plus 87500 miles plus 1 night in mandarin oriental (worth $100++ in my opinion). Basically trading 46500 miles (based on previous promo) for the massage chair. I am extremely tempted now. Any comments?