Here’s the MileLion’s review of the UOB Visa Infinite Metal Card, the spiritual successor to the original UOB Visa Infinite Card, which became the first-ever Visa Infinite card to launch in Singapore back in September 2003.

While the OG Visa Infinite was labelled “an exceedingly-exclusive card for the mega-rich”, the Visa Infinite Metal Card has a decidedly broader appeal, available to anyone who earns a mere S$120,000. And before you call me out of touch, remember— the OG Visa Infinite had a minimum income requirement of S$350,000, which would be equivalent to S$540,000 today after adjusting for inflation!

The UOB Visa Infinite Metal Card was initially underwhelming, charging one of the highest annual fees in the S$120K segment but relatively few benefits. But UOB revamped the card in June 2023, dramatically improving the value position by adding unlimited lounge visits for the cardholder plus a guest, boosting the overseas earn rate, and throwing in a very generous welcome offer.

Unfortunately, recent times have been less kind. The welcome offer and some key benefits have been nerfed, and while the card remains competitive for its segment, this is largely due to declining value among its rivals, rather than any recent improvements of its own.

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

|

| 🦁 MileLion Verdict | |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? |

|

| The UOB Visa Infinite Metal Card can be a good anchor for a UOB-centric card strategy, though the quietly-added cooldown policy on lounge visits will be annoying. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: UOB Visa Infinite Metal Card

Let’s start this review by looking at the key features of the UOB Visa Infinite Metal Card

|

|||

| Apply | |||

| Income Req. |

S$120,000 p.a. |

Points Validity |

2 years |

| Annual Fee |

S$654 |

Min. Transfer |

5,000 UNI$ (10,000 miles) |

| Miles with AF | 25,000 | Transfer Partners | 3 |

| FCY Fee | 3.25% | Transfer Fee | Waived |

| Local Earn | 1.4 mpd | Points Pool? | Yes |

| FCY Earn | 2.4 mpd | Lounge Access? | Yes |

| Special Earn | N/A | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

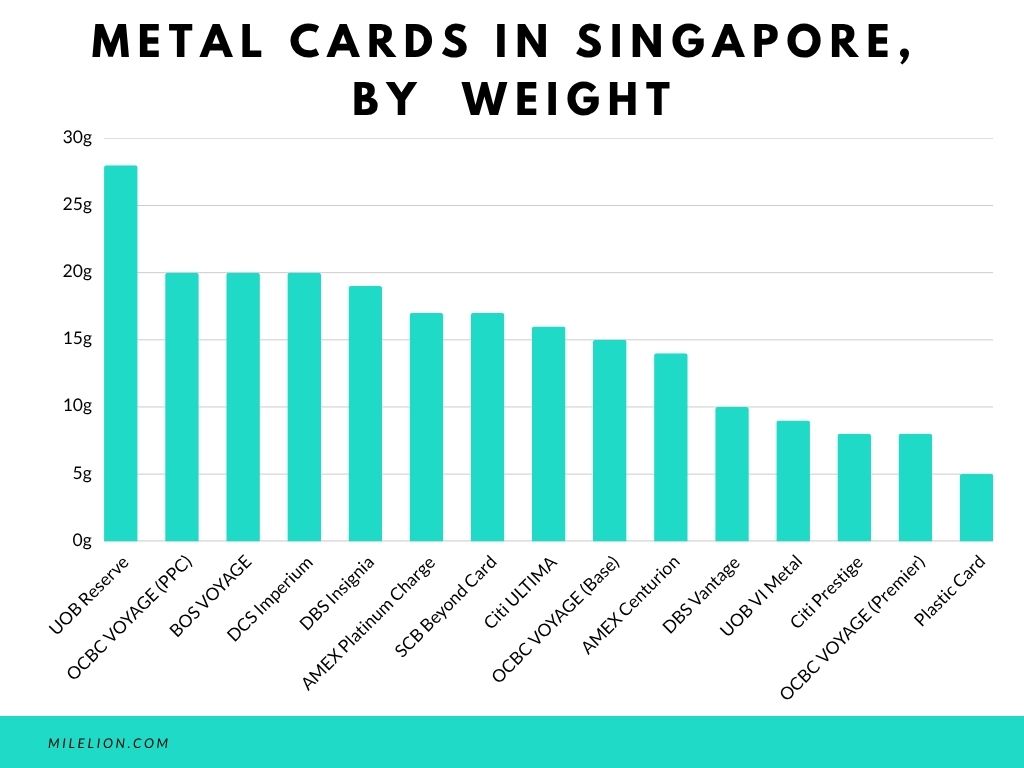

The UOB Visa Infinite Metal Card, as the name proudly reminds you, is made out of metal. However, it’s one of the lighter metal cards on the market, and only marginally heavier than a standard plastic card.

Despite this, you should be aware that UOB is the only bank (other than OCBC) to charge for replacement metal cards. Should you lose your UOB Visa Infinite Metal Card, you’ll pay a S$150 replacement fee.

UOB issues a total of five Visa Infinite cards, which are easy to confuse with each other. Refer to this article for a detailed rundown of the differences among the cards.

| Card | Description |

UOB Reserve Diamond Card UOB Reserve Diamond CardT&Cs |

|

UOB Reserve UOB ReserveT&Cs |

|

UOB Privilege Banking Card UOB Privilege Banking CardT&Cs |

|

UOB Visa Infinite UOB Visa InfiniteT&Cs |

|

UOB Visa Infinite Metal Card UOB Visa Infinite Metal CardT&Cs |

|

How much must I earn to qualify for a UOB Visa Infinite Metal Card?

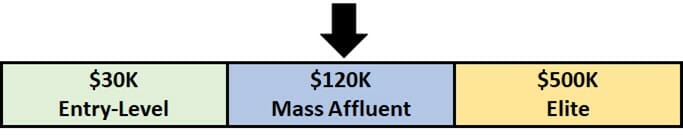

The UOB Visa Infinite Metal Card has a minimum income requirement of S$120,000 p.a., which means it competes in the so-called $120K segment.

As far as I know, it’s not possible to apply for a secured version of this card. If you’re asset rich but income poor, you might be directed to the UOB Privilege Banking Visa Infinite instead (minimum AUM S$350,000).

How much is the UOB Visa Infinite Metal Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$654 | 1st card free, 2nd onwards S$293.38 |

| Subsequent |

The UOB Visa Infinite Metal Card has an annual fee of S$654, which is strictly non-waivable. The first supplementary card is free for life; the second card onwards costs S$293.38 per year.

Cardholders receive 25,000 miles each year the annual fee is paid. That’s a fairly unattractive 2.61 cents per mile, but remember, we need to factor in the value of the other card benefits as well.

What sign-up bonus or gifts are available?

From now till 30 June 2025, new UOB Visa Infinite Metal Cardholders who pay the S$654 annual fee and spend at least S$4,000 within 30 days of approval will receive:

| New customers | Existing customers | |

| Pay S$654 annual fee | 25,000 miles | 25,000 miles |

| Spend S$4,000 within 30 days of approval | 55,000 miles | 15,000 miles |

| Total | 80,000 miles | 40,000 miles |

Unlike most UOB sign-up offers, there is no cap on the number of eligible applicants.

New customers are defined as those who:

- do not currently hold any principal UOB credit cards, and

- have not cancelled a principal UOB credit card in the past six months prior to the commencement of the promotion period

Given the S$654 annual fee, you’re basically paying 0.82 cents (new) or 1.64 cents (existing) per mile. Back when S$200 Grab vouchers were thrown into the mix, the value was even better, but now I’d only consider it if I met the new customer criteria.

Bonus miles are awarded on top of the regular base miles, so if you spent the entire S$4,000 on local spend at 1.4 mpd, you’ll have a total of 85,600 miles (new-to-bank) or 45,600 miles (existing).

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.4 mpd | 2.4 mpd | None |

SGD/FCY Spending

The UOB Visa Infinite Metal Card earns:

- UNI$3.5 for every S$5 spent in Singapore Dollars (1.4 mpd)

- UNI$6 for every S$5 spent in foreign currency (FCY) (2.4 mpd)

Compared to the rest of the $120K pack, these are very solid earn rates. However, UOB has S$5 earning blocks, which means your actual earn rate could be lower, especially on small transactions (see below for details).

| 💳 Earn Rates for S$120K Cards (sorted by sum of local and FCY earn rate) |

||

| Card | Local | FCY |

StanChart Visa Infinite StanChart Visa Infinite |

1.4 mpd# | 3 mpd# |

UOB VI Metal Card UOB VI Metal Card |

1.4 mpd | 2.4 mpd |

DBS Vantage Card DBS Vantage Card |

1.5 mpd | 2.2 mpd |

OCBC VOYAGE Card OCBC VOYAGE Card |

1.3 mpd | 2.2 mpd |

Citi Prestige Card Citi Prestige Card |

1.3 mpd^ | 2 mpd^ |

Maybank Visa Infinite Maybank Visa Infinite |

1.2 mpd | 2 mpd |

HSBC Visa Infinite HSBC Visa Infinite |

1 mpd | 2 mpd |

AMEX Plat. Reserve AMEX Plat. Reserve |

0.69 mpd | 0.69 mpd |

| ^Additional 0.02 to 0.12 mpd awarded based on tenure with bank #With minimum S$2K spend per statement month. Otherwise 1 mpd for both |

||

All overseas transactions are subject to a 3.25% fee, so using your UOB Visa Infinite Metal Card overseas represents buying miles at 1.35 cents each.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

Unfortunately, there’s another UOB quirk here. While other banks define overseas transactions simply as those charged in currencies other than Singapore Dollars, UOB further requires that the payment gateway be overseas. As per the T&Cs:

For the avoidance of doubt, card transactions made overseas but effected/charged in Singapore dollars and online transactions effected in Singapore dollars or in foreign currencies at merchants with payment gateway in Singapore will not be treated as overseas transactions and will earn UNI$3.5 per S$5 spend

In other words, if you’re shopping on an online website which bills you US$100 (~S$140), but processes the payment within Singapore (Hotels.com is an example), you’ll earn miles at the local spending rate of 1.4 mpd.

For what it’s worth, this will only be an issue with online transactions; if you’re spending at brick-and-mortar stores overseas, you can rest assured you’ll receive the FCY earn rate so long as you’re not charged in SGD (watch out for DCC!).

To find out where a merchant’s payment gateway is located, follow the steps in the guide below.

When are UNI$ credited?

UNI$ are credited when your transaction posts, which generally takes 1-3 working days.

How are UNI$ calculated?

Here’s how you can work out the UNI$ earned on your UOB Visa Infinite Metal Card

| Local Spend | Round down transaction to nearest S$5, then divide by 5 and multiply by 3.5. Round down to the nearest whole number |

| FCY Spend |

Round down transaction to nearest S$5, then divide by 5 and multiply by 6. Round down to the nearest whole number |

Unfortunately, UOB has one of the most punitive rounding policies in the game, which can adversely affect your earn rates especially on smaller transactions.

UOB first rounds your transaction down to the nearest S$5, divides it by 5, then multiplies the amount by 3.5 UNI$ (assuming it’s a Singapore Dollar transaction). This UNI$ figure is then rounded down again to the nearest whole number.

So imagine you spent S$9.99 on your UOB Visa Infinite Metal Card. You might figure that’s 14 miles (S$9.99 @ 1.4 mpd), but…

- The S$9.99 is rounded down to S$5

- S$5 is awarded 3.5 UNI$

- 3.5 UNI$ is rounded down to 3 UNI$

You actually earn 3 UNI$ (6 miles), an effective rate of just 0.6 mpd!

This is an extreme example, of course, and the effect of rounding gets smaller as your transaction size increases. But it’s exactly why you should think twice about using your UOB Visa Infinite Metal Card for small transactions that aren’t in S$5 blocks. In fact, the minimum spend required to earn miles is S$5.

| 🚆 What about SimplyGo? |

|

If the minimum transaction to earn miles is S$5, then what’s the point of using the UOB Visa Infinite Metal Card with SimplyGo? Don’t worry: for Visa, UNI$ are awarded based on the accumulated SimplyGo spending per calendar month. So with the exception of extreme circumstances (e.g. where you take just 1-2 rides a month), you’ll definitely earn some miles. |

This means that despite having a higher headline rate, you may earn fewer miles on the UOB Visa Infinite Metal Card than the Citi Prestige Card depending on transaction size. Consider the following:

UOB VI Metal UOB VI Metal Earn Rate: 1.4 mpd |

Citi Prestige Citi PrestigeEarn Rate: 1.3 mpd |

|

| S$5 | 6 miles | 6.4 miles |

| S$9.99 | 6 miles | 11.6 miles |

| S$15 | 20 miles | 19.6 miles |

| S$19.99 | 20 miles | 24.8 miles |

| S$25 | 34 miles | 32.4 miles |

| S$29.99 | 34 miles | 37.6 miles |

If you’re an excel geek, here’s the formulas you need to calculate points:

| Local Spend | =ROUNDDOWN (ROUNDDOWN (X/5,0) * 3.5,0) |

| FCY Spend |

=ROUNDDOWN (ROUNDDOWN (X/5,0) * 6,0) |

| Where X= Amount Spent |

|

Don’t forget that UOB makes it easy to check your points breakdown thanks to the TMRW app, which will show transaction-level points for the UOB Visa Infinite Metal Card.

UOB TMRW: Get transaction-level credit card rewards points breakdowns

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for UNI$?

A full list of transactions that do not earn UNI$ can be found at point 1.5 of the T&Cs.

I’ve highlighted a few noteworthy categories below:

- Amaze (not that it matters in this case, as it was never possible to pair Visa cards with Amaze in the first place)

- Charitable Donations

- Government Services

- Hospitals

- ipaymy

- Prepaid account top-ups (e.g. GrabPay, YouTrip)

- Real Estate Agents & Managers

- Utilities

However, the UOB Visa Infinite Metal Card is somewhat unique among UOB cards in that it does not exclude education-related expenses from earning points. This alone could be a big selling point, since it’s almost impossible to find a decent miles-earning card for schools and tuition fees.

For avoidance of doubt, CardUp transactions will also earn miles with the UOB Visa Infinite Metal Card, even though ipaymy does not.

What do I need to know about UNI$?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| 2 years | Yes | Waived |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 5,000 UNI$ (10,000 miles) |

3 | 48 hours (KF) |

Expiry

UNI$ expire 2 years from the last day of each periodic quarter in which the UNI$ was earned.

For example, if any UNI$ earned in January 2024 will expire on 31 March 2026. This means that the validity could technically be up to 2 years 3 months in some cases, but it’s probably better to think of it as 2 years to avoid confusion.

Pooling

UNI$ pool across cards. If you have 10,000 UNI$ on the UOB Lady’s Card, and 5,000 UNI$ on the UOB Visa Infinite Metal Card, you can redeem 15,000 UNI$ in a single transaction.

It also means that you don’t need to transfer your UNI$ out before cancelling the UOB Visa Infinite Metal Card, assuming it’s not your last UNI$-earning card.

Transfer Partners & Fees

UNI$ can be transferred to three frequent flyer programmes (though it’s really two, because converting points to AirAsia is like throwing them away) at the following ratio:

| Frequent Flyer Programme | Conversion Ratio (UNI$: Partner) |

| 5,000 : 10,000 | |

| 5,000 : 10,000 | |

| 2,500 : 4,500 |

UOB Visa Infinite Metal Cardholders enjoy a waiver of the usual S$25 conversion fee. And since UNI$ pool, you can use the Visa Infinite Metal Card as a conduit to convert UNI$ earned on other UOB cards for free too.

Transfer Times

UOB transfers to KrisFlyer are typically completed within 48 hours.

If you need your points credited instantly, you can move them via Kris+ at a rate of 1,000 UNI$ = 1,700 KrisPay miles. KrisPay miles can then be instantly converted to KrisFlyer miles at a 1:1 ratio.

|

| S$5 for new Kris+ Users |

| Get S$5 (in the form of 750 KrisPay miles) when you sign-up with code W644363 and make your first transaction |

However, those 1,000 UNI$ would normally have earned you 2,000 KrisFlyer miles, so you effectively take a 15% haircut. Therefore I wouldn’t recommend taking this option, unless you need a small top-up to redeem a flight, or have an orphan UNI$ balance (<5,000 points).

If you choose to do so nonetheless, do remember that it’s a two-step process:

- Transfer UNI$ to KrisPay miles

- Transfer KrisPay miles to KrisFlyer miles

Do not forget the second step! If you wait more than 21 days, or spend any of the converted KrisPay miles via Kris+, the entire balance will be stuck in the Kris+ app. KrisPay miles expire after six months, and can only be spent at a poor ratio of 150 miles = S$1.

Other card perks

Unlimited lounge visits (+1 guest)

At the time of launch, UOB Visa Infinite Metal Cardholders received a measly four free lounge visits per membership year. That was woefully inadequate, considering other cards in its segment were offering unlimited visits.

Thankfully, that’s now been rectified, and cardholders now receive unlimited visits (+1 guest) to DragonPass lounges worldwide.

| 💳 Airport Lounge Benefits (Income Req.: S$120K) |

|||

| Card | Lounge Network | Free Visits (Per Year) |

|

| Main | Supp. | ||

HSBC Visa Infinite HSBC Visa Infinite |

LoungeKey | ∞ | ∞ Up to 5 supp. cards |

OCBC VOYAGE Card OCBC VOYAGE Card |

Dragon Pass Excludes restaurants |

∞ | 2 |

Citi Prestige Card Citi Prestige Card |

Priority Pass | ∞ + 1 guest (12 visits from 1 Jul 25) |

N/A |

UOB VI Metal Card UOB VI Metal Card |

Dragon Pass | ∞ + 1 guest | N/A |

DBS Vantage Card DBS Vantage Card |

Priority Pass | 10 | N/A |

StanChart Visa Infinite StanChart Visa Infinite |

Priority Pass | 6 | N/A |

Maybank Visa Infinite Maybank Visa Infinite |

Priority Pass | 4 | N/A |

AMEX Plat. Reserve AMEX Plat. Reserve |

N/A | N/A | N/A |

There’s a hitch though. DragonPass has a “fair use policy” which sets the following restrictions on airport lounge and restaurant visits:

- A maximum of one lounge visit every two hours

- A maximum of one set meal every five hours (except for cards using the Mastercard Travel Pass, where the limit is two hours)

As recently as January 2025, the two entitlements did not interact, in the sense that you could redeem a set meal, finish it quickly, then head to a lounge and redeem a lounge visit. However, following an unannounced policy change, redeeming a set meal now triggers the cooldown period for lounge visits as well (and vice versa).

That’s not all. In April 2025, UOB quietly added a minimum four-hour cooldown period between redemptions.

| Visit #1 | Visit #2 | Cooldown |

| Lounge | Lounge | 4 hours |

| Lounge | Set meal | 4 hours |

| Set meal | Lounge | 4 hours |

| Set meal | Set meal | 5 hours |

This means that short of arriving at the airport well ahead of departure, it will be impossible to utilise more than one visit per flight (I suppose you could try to redeem something on landing though, if the lounge or restaurant allows you).

It’s no secret that lounge pass abuse has become rampant, prompting the Citi Prestige to reduce its benefit from unlimited lounge visits to just 12 per year. While the introduction of a cooldown period may not be well-received, I believe most people would still prefer it over an outright reduction in lounge visits.

While this is still some time in the future, it’s worth highlighting that from 1 June 2026, the UOB Visa Infinite Metal Card will cap free lounge visits at 12x per 12-month membership period. Any additional visits will be charged at US$28 each.

Dining discounts

UOB Visa Infinite Metal Cardholders enjoy up to 30% off a la carte food orders at the following restaurants.

- Pan Pacific Singapore (20% off)

Edge | Hai Tien Lo | Keyaki - PARKROYAL COLLECTION Marina Bay (30% off)

Peach Blossoms | Peppermint (buffet only) | Portman’s Bar | Skyline Bar - PARKROYAL COLLECTION Pickering (30% off)

Lime Restaurant (buffet only) - PARKROYAL on Beach Road (30% off)

Club 5 | Ginger (buffet only) | Si Chuan Dou Hua Restaurant | Tian Fu Tea Room - Top of UOB Plaza (30% off)

Si Chuan Dou Hua Restaurant - The Fullerton Hotel Singapore (30% off)

Jade: Lunch (Mondays to Thursdays) | Dinner (Mondays to Sundays)

Town Restaurant: Lunch (Mondays to Saturdays) | Dinner (Mondays to Sundays)

The Courtyard: Afternoon Tea (Mondays to Thursdays) - The Fullerton Bay Hotel Singapore (30% off)

La Brasserie: Lunch (Mondays to Thursdays) | Dinner (Mondays to Sundays)

The Landing Point: Lunch and Afternoon Tea

Lantern: All-day Dining - The Ritz-Carlton, Millenia Singapore (30% off)

Republic: Afternoon Tea

Colony (15% off) : Lunch and Afternoon Tea (Mondays to Fridays) | Dinner (Mondays to Thursdays) - Sheraton Towers Singapore (30% off)

The Dining Room: All-day Dining

Lobby Bar: All-day Dining

Li Bai: Dinner (Sundays to Thursdays) - Grand Hyatt Singapore Pete’s Place (15% off)

UOB Visa Infinite Metal Cardholders also enjoy the Infinite Dining programme, which offers specially-curated menus from celebrity chefs.

15,000 miles loyalty bonus

UOB Visa Infinite Metal Cardholders who spend at least S$100,000 in a membership year will receive 15,000 bonus miles when they renew their card for the following membership year. This is on top of the usual 25,000 miles awarded each year the annual fee is paid.

The bonus miles will be awarded two months after the annual fee is posted.

While extra miles are always good, 15,000 bonus miles for S$100,000 spend is not much of an incremental return. There’s really no reason why you should be putting so much spend on a general spending card in the first place (unless perhaps you’re charging school fees?).

Bonus miles with KrisFlyer UOB Account

UOB Visa Infinite Metal Cardholders can earn bonus miles on their spending with a KrisFlyer UOB Account.

For example, if I spend on my UOB Visa Infinite Metal Card AMEX in SGD, I will earn:

- A base reward of 1.4 mpd from my UOB Visa Infinite Metal Card

- A bonus reward of 5-6 mpd from my KrisFlyer UOB Account

| Without Salary Crediting | With Salary Crediting | |

| UOB VI Metal Card | 1.4 mpd | 1.4 mpd |

| KrisFlyer UOB Account | 5 mpd | 6 mpd |

| Total | 6.4 mpd | 7.4 mpd |

| To unlock the salary crediting bonus, you must credit a minimum salary of S$1,600 to the KrisFlyer UOB Account |

||

However, I’d strongly advise against this, because the opportunity cost of the funds you need to deposit in the account would almost certainly outweigh the value of any miles earned. That’s mainly because the maximum miles you can earn each month are capped at 5% of your Monthly Average Balance (MAB).

For example, if your MAB is S$1,000 (the minimum required to earn miles), you can earn at most 50 miles (5% of S$1,000) from the KrisFlyer UOB Account each month. Assuming you don’t credit a salary (5 mpd), the account would stop rewarding you after spending just S$10 (50/5 mpd) on your cards!

To learn more about the KrisFlyer UOB Account, and why it’s such a raw deal, refer to the post below.

Complimentary health screening

Both principal and supplementary UOB Visa Infinite Metal Cardholders enjoy a one-time complimentary health screening, which covers haematology, lipid/cardiac risk profile, diabetic panel, kidney function test, liver function test, and urine/stool analysis. Any additional tests will be given a 10% discount.

The name of the provider is not stated on the website, but according to the community it’s Ardennes Health.

This benefit must be used by 31 December 2026.

Complimentary travel insurance

| Accidental Death | US$1,000,000 |

| Medical Expenses | N/A |

| Travel Inconvenience | Flight Delay: S$400 Baggage Delay: S$500 Lost Baggage: S$1,000 |

| Policy Wording | |

The UOB Visa Infinite Metal Card offers complimentary travel insurance, which covers up to US$1,000,000 for accidental death or dismemberment while traveling on a scheduled public conveyance, with further coverage also for travel inconvenience like lost luggage or flight delays. However, there is no coverage for medical expenses or evacuation, so you’ll definitely want to get separate protection there.

It is unclear from the policy wording whether coverage applies in the case where an airline ticket is redeemed with miles and the UOB Visa Infinite Metal Card is used to pay for taxes and surcharges.

Buy miles with UOB Payment Facility

|

| UOB Payment Facility |

UOB Visa Infinite Metal Card members have access to a “no questions asked” Payment Facility that lets them buy unlimited miles at 2.2 cents each, subject to their credit limit.

How it works is that cardholders fill out an online form and specify how much they’d like to charge to the facility, e.g. S$5,000. UOB will then:

- Deposit S$5,000 into their designated bank account

- Charge S$5,110 to their card (S$5,000 + 2.2% fee)

- Award UNI$ at a rate of UNI$2.5 per S$5, or 2,500 UNI$ in total (5,000 miles; the payment facility fee doesn’t earn miles)

Cardholders are then out of pocket S$110, for which they purchased 5,000 miles. This works out to 2.2 cents per mile

Frankly speaking, 2.2 cents per mile is way above what you should be paying, when you can find cheaper alternatives with services like CardUp and Citi PayAll. The only situation where the UOB Payment Facility would make sense is to top off your UNI$ balance to the next 5,000 UNI$ block needed for a transfer.

That said, UOB runs periodic promotions for the UOB Payment Facility which reduce the fee for UOB Visa Infinite Metal Cardholders. The current offer (which runs till 31 August 2025) lowers the price to 2 cents per mile.

Generic Visa Infinite benefits

UOB Visa Infinite Metal Cardholders enjoy the following additional perks, provided by Visa:

| 🏨 Hotel Elite Status | |

| 🚗 Rental Car Elite Status | |

| 👍Other Perks |

For more information on how these perks work, refer to the post below.

Summary Review: UOB Visa Infinite Metal Card

|

| Apply |

| 🦁 MileLion Verdict |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

The UOB Visa Infinite Metal Card offers competitive earn rates for a $120K card, and remains one of the few options for earning miles on education-related expenses.

Moreover, if you’re a heavy user of other UOB cards such as the UOB Lady’s Card, UOB Preferred Platinum Visa and UOB Visa Signature, then the UOB Visa Infinite Metal Card can anchor this strategy by providing a general spending option and free UNI$ conversions.

Yes, the newly-introduced 4-hour cooldown between lounge visits is frustrating, but it’s still preferable to the outright lounge access cuts enacted by the AMEX Platinum Charge, Citi Prestige, and SC Priority Private this year. Plus, DragonPass access continues to include airport restaurants, unlike the OCBC VOYAGE.

On the flip side, the dining discounts have been devalued over the years, and the monthly Grab vouchers removed. Points are no longer awarded for hospital transactions, and lost points due to UOB’s S$5 rounding policy continue to be a bugbear. Unless you qualify for the 80,000 miles welcome offer, I’d take a serious look at other $120K cards before deciding to pull the trigger.

So that’s my review of the UOB Visa Infinite Metal Card. What do you think?

Hi,

can you confirm if owning this card waives the transfer fee to Krisflyer?

i did transfer the miles to krisflyer yet I m still charged $25

i was under the impression that uob waives all transfer fees for visa infinite cards, based on this: https://www.uob.com.sg/assets/pdfs/personal/cards/rewardsplus_tnc.pdf Each transfer by the Eligible Person to his/her designated airline’s frequent flyer programme is subject to a S$25 conversion fee (or a conversion fee of such other amount as UOB may determine in its discretion), with the exception of UOB Reserve, UOB Visa Infinite and UOB Privilege Banking Cardmembers; and must be to a frequent flyer account bearing his/her own name. Each transfer must be in block of 10,000 miles It’d be strange if they waived it for the classic Visa… Read more »

Ok let me call the bank and update you,

also to let you know that owning this card entitles you to have access to privilege banking lounge i,e, privilege banking in Raffles Place etc.

i tried and was granted access

i am also thinking whether to keep this card coming renewal in sept. Just used this card to pay my income tax via card up haha, will have a few more months to think about it.

Just don’t care about the 25 dollar, just transfer and dump the card lah, after reading so much from this article, still want to hold it?

Haha yeah signed up impulsively last year. Coz there was some bonus miles for few k spending. But the promotion is over already. They gave free privilege banking lounge to try out as well.

when its up for renewal, may not keep it anymore ..

I used to hold this useless card. It is a really pretty card but that’s really all about it. I never used the useless Gourmet Collection once because I have The Entertainer and Amex Love Dining programme also offers far better discounts. The free transfer as per the terms that Aaron had quoted, do not apply for this card unfortunately.

thanks Raymond. have updated the post.

Hi Aaron, love the addition of the tl;dr and star rating sections to your credit card reviews! It would be awesome if you could add a page or table somewhere with the grouping of cards by star rating!

thanks christian! i need to figure out how to do that, will keep it in mind (as usual i’m hopeless with the tech side of things)

https://milelion.com/tag/card-review/

here’s where you can see all card ratings at a glance

Isn’t the SCB VI the highest earning $120K card? No longer issued, but still

all style, no substance

Thanks for another great analysis. Was contemplating to renew or cancel. Now it’s clear.

This is a very good article. Excellently written. Well done.

Hey Aaron, have you noticed that UOB has taken away the gourmet collection benefit from this card? I was checking this card just now but can’t find anything about this benefit any more, have you heard about anything about the changes of this card?

Thanks!

Hi Aaron, they’re now offering 3 nights stay with Accor as an alternative sign up benefit to the 25k miles. Do you think it’s worth the annual fee?

https://milelion.com/2022/01/12/uob-visa-infinite-metal-card-offering-accor-plus-membership-with-3-free-nights/

Seems there’s some updates to the benefits? There’s some golfing benefits now.

Seems like refuelling at shell also award uni$. I thought fuel station dont reward uni$ as it is stated clearly on shell website. Also if I remember correctly other cards dont award uni$ on phone bills but this card does, maybe I remember wrongly, Anyway, these could be additional perks for this UOB visa infinite card.

yes, shell transactions earn UNI$ despite what the T&Cs say (confirmed on other UOB cards too like the PPV, lady’s)

I currently have the UOB Metal Infinite Visa as my main credit card. I was thinking of canceling the metal card and switching to the UOB KrisFlyer Mastercard. However, I am aware that I won’t benefit from any new to bank sign up bonus. I will be using my card for every possible daily expense, shopping, dining, travel, etc. I travel every month via SQ. Would it make sense to keep both cards? Or just stick to one. If so, which card?

Hi,

do we know if the Dragon Pass benefit extends to sub card holders?

I also would like to know

No, only applies to main cardholders

UOB$ is UOB’s card-wide cashback programme and includes Cold Storage, Crystal Jade, Giant, Guardian, Starbucks and Toast Box, among others. For the full list, refer to this link.

the above link appears to be broken

will get that fixed, thank you!

UOB VI Metal excludes hospital bills wef 01 Oct 2024

See page 2 of

https://www.uob.com.sg/personal/cards/credit/visa-infinite/pdf/VI-Metal-Pdt-TnC.pdf

8062 Hospitals (wef 1 Oct 2024)

Thanks HST.

Oh man, one more reason to drop this card..

I just tried to cancel this card after holding it for about 6 months, but I was told by the CSO that there’s a minimum holding period of 12 months!

Anyone with the same experience? I looked through the T&C and can’t find any such clause.

CardUp can be used for qualifying spend?

Would like to know this as well. Also, can we pair with Kris+ app?

+1 same Q

iPaymy does have UOB Infinite crad as an option

If you do clock $100,000 on this card, you get additional 15,000 miles. This means overall a 1.55 (1.4 + 0.15) mpd, not too bad. If i have $100,000 of cardup expenses, other than this uob vim that gives 1.55 mpd, which card is a better option?

Confused over what is meant by lounge visit misuse.

Coming from someone who makes maybe only 2 flights out of Sg in a year.

It’s getting worst off, their insurance also useless, they make it almost impossible to claim, drop this card, it’s a no go for me if they decide to reduce to 12 complimentary passes, sounds terrific way to end this card

I hold secured uob credit cards, and was told to top up my fixed deposit to $30k to be able to get this card.

there’s another data point out there saying $50k min.

Hi Aaron, Just like to clarify on the write up of “Thankfully, that’s now been rectified, and cardholders now receive unlimited visits (+1 guest) to DragonPass lounges worldwide.” In fact, the benefit is provided by Airport Companion Program by Dragon Pass. The list of airport lounge in the Airport Companion App is different from that offered in Dragon Pass list of lounges. The list of lounges in Airport Companion App is limited and of poor experience. One example is Sapporo airport. It is not listed in the Airport Companion App while the Dragon Pass site shows there are two lounges… Read more »

Can this card be used for insurance premiums like how citi can utilise citipayall?