Here’s The MileLion’s review of the StanChart Journey Card, which will forever stand as a monument to the bank’s ill-fated attempt to capture the affluent millennial market.

Launched in 2019 as the StanChart X Card with an unprecedented 100,000 miles sign-up bonus (the largest welcome offer in Singapore credit card history), this metal card attracted applicants in droves.

There was just one small problem: it couldn’t retain any of them. After the dizzy highs of the first year welcome offer, the only benefit it had to offer from the second year onwards was two lounge visits— hardly the kind of thing you pay S$695.50 a year for. The bank ended up having to offer an “exceptional” annual fee waiver each year to prevent a mass exodus, even as its website kept insisting that the annual fee was “strictly non-waivable”.

After several years of wandering in the wilderness, Standard Chartered finally put the card out of its misery by rebranding it as the (plastic) Journey Card. It’s a fascinating story of corporate hubris fading into disillusionment fading into abandonware — and you can read about it below— but it’s not the focus of this article.

Instead, the question before us is much simpler: should you get a StanChart Journey Card?

StanChart Journey Card StanChart Journey Card |

|

| 🦁 MileLion Verdict | |

| First Year | Recurring |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

☐ Take It ☑Take It Or Leave It ☐ Leave It |

| What do these ratings mean? |

|

| The StanChart Journey Card offers excellent first-year value with its stackable welcome offers. However, like its X Card predecessor, renewals aren’t strictly essential. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: StanChart Journey Card

Let’s start this review by looking at the key features of the Standard Chartered Journey Card.

|

|||

| Apply (Fee Waiver) | |||

| Apply (Fee Paying) | |||

| Annual Fee |

S$196.20 |

Min. Transfer | 25,000 points (10,000 miles)* |

| Miles with Annual Fee | 10,000 |

Transfer Partners |

2 |

| FCY Fee | 3.5% | Transfer Fee | S$27.25 |

| Local Earn | 1.2 mpd | Points Pool? | Yes |

| FCY Earn | 2 mpd | Lounge Access? | Yes |

| Special Earn | 3 mpd on online groceries, food delivery, transport (SGD) | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The StanChart Journey Card is a direct replacement for the X Card, so even if you still hold a physical X Card, all earn rates, benefits and fees will follow the Journey Card from 19 May 2023.

In other words, the StanChart X Card, as we know it, no longer exists. However, for posterity’s sake, I’ve preserved the legacy review, just in case future generations need a case study on how not to manage a credit card.

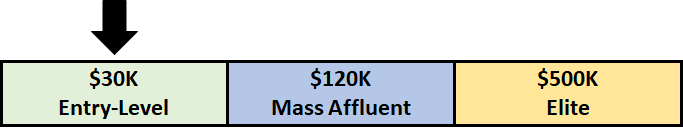

How much must I earn to qualify for a StanChart Journey Card?

How the mighty have fallen. Back when this was the X Card, a minimum income of S$80,000 p.a. was required.

Now as the Journey, all you need is the MAS-mandated minimum of S$30,000 p.a.

How much is the StanChart Journey Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$196.20 (FYF option) |

Free |

| Subsequent | S$196.20 | Free |

The Standard Chartered Journey Card has an annual fee of S$196.20 for principal cardholders. You can either opt for a first year fee waiver, or pay the first year’s fee for an extra 10,000 miles (see next section).

While annual fee waivers from the second year onwards are technically possible, data points in the MileChat suggest that StanChart is taking a strict approach to this, so don’t be surprised if your request is rejected. You will receive 10,000 miles for paying the annual fee, but I’m not convinced that’s worth renewing, in and of itself.

The annual fee is waived for up to five supplementary cards (it’s not clear what the fee is for the sixth onwards, but why would you need so many anyway?).

What welcome offers are available?

New-to-bank customers who apply for a StanChart Journey Card through the links in this article will receive both Standard Chartered’s public welcome offer and additional SingSaver gifts.

| ❓ New-to-bank definition |

|

New-to-bank customers are defined as those who:

|

Standard Chartered public welcome offer

New-to-bank customers who apply for a StanChart Journey Card by 30 September 2025 can choose between the following options.

| Pay Annual Fee | Annual Fee Waiver | |

| Miles from S$196.20 annual fee |

10,000 miles | – |

| Spend S$800 in first 60 days of approval | 20,000 miles | 20,000 miles |

| Total | 30,000 miles | 20,000 miles |

Cardholders who want a first year fee waiver will receive 20,000 bonus miles when they spend S$800 in the first 60 days of approval.

Cardholders who pay the annual fee will receive 10,000 bonus miles, and a further 20,000 bonus miles when they spend S$800 in the first 60 days of approval.

Bonus miles are in addition to StanChart Journey Card’s regular earn rates of 1.2-3 mpd, so assuming you spend the full S$800 on local, non-bonused transactions, you’re looking at an additional 960 miles (S$800 @ 1.2 mpd), for an overall haul of 30,960 miles.

SingSaver gifts

|

|||

| Apply (Fee Waiver) | |||

| Apply (Fee Paying) |

New-to-bank customers who apply for a StanChart Journey Card via the SingSaver links in this article can choose from one of the following gifts:

- Samsonite Straren Spinner 67/24

- 7,000 Max Miles

- S$200 Grab voucher

- S$180 cash

These offers are available regardless of whether you choose the fee paying or fee waiver option.

A minimum spend of S$800 within the first 60 days of approval is required, and this amount will count towards the attainment of both Standard Chartered’s public welcome offer and the SingSaver gifts.

As SingSaver gifts regularly change, be sure to refer to the T&Cs for the most current offer (you’ll also see it reflected on the application landing page).

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.2 mpd | 2 mpd | 3 mpd on online groceries, food delivery, transport (SGD) |

SGD/FCY Spend

Standard Chartered Journey Cardholders will earn:

- 3 SC Rewards Points per S$1 spent in SGD (1.2 mpd)

- 5 SC Rewards Points per S$1 spent in FCY (2 mpd)

These were once respectable rates for its segment, but many other cards now offer superior returns.

| 💳 Earn Rates for General Spending Cards (Income Req: S$30K) |

||

| Cards | Local Spend | FCY Spend |

UOB PRVI Miles Card UOB PRVI Miles CardApply |

1.4 mpd | 3 mpd IDR, MYR, THB, VND 2.4 mpd All Others |

BOC Elite Miles Card BOC Elite Miles CardApply |

1.4 mpd | 2.8 mpd |

HSBC TravelOne Card HSBC TravelOne CardApply |

1.2 mpd | 2.4 mpd |

DBS Altitude Card DBS Altitude CardApply |

1.3 mpd | 2.2 mpd |

OCBC 90°N Card OCBC 90°N CardApply |

1.3 mpd | 2.1 mpd |

Citi PremierMiles Card Citi PremierMiles CardApply |

1.2 mpd | 2.2 mpd |

StanChart Journey Card StanChart Journey CardApply |

1.2 mpd | 2 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer AscendApply |

1.2 mpd | 1.2 mpd |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit CardApply |

1.2 mpd | 1.2 mpd |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit CardApply |

1.1 mpd | 1.1 mpd |

All FCY transactions are subject to a 3.5% fee, which is the highest in the market (other banks max out at 3.25%).

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

This means that using your StanChart Journey Card overseas represents buying miles at a relatively unattractive rate of 1.75 cents each.

Bonus Spend

StanChart Journey Cardholders will earn 7.5 SC Rewards Points per S$1 spent (3 mpd) on transactions with the following MCCs.

| Category | Examples (non-exhaustive) |

| Groceries MCC 5411 |

NTUC FairPrice Online, Redmart, Shopee Supermarket |

| Bakeries MCC 5462 |

Bengawan Solo, BreadTalk, Four Leaves |

| Misc. Food Stores MCC 5499 |

Bottles and Bottles, Famous Amos, Irvins Salted Egg |

| Liquor, Wine or Beer Stores MCC 5921 |

1855 The Bottle Shop, The Oaks Cellars, Grand Cru |

| Food Delivery MCC 5811 MCC 5812 MCC 5814 |

GrabFood, Deliveroo, Foodpanda |

| Transport MCC 4111 MCC 4121 MCC 4789 |

Grab rides, CDG, gojek |

| Cruise Liners MCC 4411 |

Royal Caribbean, Princess Cruises, Norwegian Cruise |

No minimum spend is required, but the bonus is subject to the following conditions:

- the transaction must be made online

- the transaction must be made in SGD

- a cap of S$1,000 per statement month applies; any spending beyond the cap will earn the regular base rate of 1.2 mpd

A few important things to note:

- While Standard Chartered uses the term “food delivery”, the bonus would also be granted in situations where a restaurant has online ordering for dine-in (e.g. in-app ordering or scan a QR code and pay online before receiving your food), provided the MCC codes as 5811/5812/5814

- Even though SimplyGo’s MCC is 4111, you won’t earn 3 mpd on bus and MRT rides because they don’t satisfy the “online” criteria

Truth be told, however, 3 mpd is not a big draw in and of itself, since you could easily earn 4 mpd on these categories with other cards. However, it’s rare to see a general spending card offering bonus categories, so we’ll have to give Standard Chartered some credit for that.

Transaction date or posting date?

The bonus cap on the StanChart Journey Card is enforced based on posting date, not transaction date.

For example, if your statement month ends on the 15th, and you make a transaction on 14 June that posts on 16 June, it will count towards the following statement month’s bonus cap.

Therefore, you should exercise caution when spending towards the end of the statement month, in case transactions “leak” into the following period.

Which cards track spending by transaction date vs posting date?

When are SC Rewards Points credited?

The base 3/5 SC Rewards Points for local/overseas spend are credited when your transaction posts, which generally takes 1-3 working days.

The bonus 4.5 SC Rewards Points for local grocery, food delivery, and transport will be credited at the start of the following statement period.

How are SC Rewards Points calculated?

Here’s how you can work out the SC Rewards Points earned on your Standard Chartered Journey Card.

| Local Spend (3x) | Multiply transaction by 3, then round to nearest whole number |

| FCY Spend (5x) |

Multiply transaction by 3, then round to nearest whole number. Multiply transaction by 2, then round to the nearest whole number. Add the two figures. |

This means the minimum spend required to earn points is S$0.17, whether in local or foreign currency.

For what it’s worth, Standard Chartered has a more forgiving rounding policy than banks like OCBC and UOB, which enables the StanChart Journey Card to outperform ostensibly higher-earning cards for smaller transactions. An illustration is provided below.

StanChart Journey Card StanChart Journey CardEarn Rate: 1.2 mpd |

UOB PRVI Miles Card UOB PRVI Miles CardEarn Rate: 1.4 mpd |

|

| S$5 | 6 miles | 6 miles |

| S$9.99 | 12 miles | 6 miles |

| S$15 | 18 miles | 20 miles |

| S$19.99 | 24 miles | 20 miles |

| S$25 | 30 miles | 34 miles |

| S$29.99 | 36 miles | 34 miles |

If you’re an Excel geek, here’s the formulas you need to calculate points:

| Local Spend | =ROUND(X*3,0) |

| FCY Spend |

=ROUND(X*3,0) + ROUND(X*2,0) |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for SC Rewards Points?

A full list of transactions that do not earn rewards can be found here.

I’ve highlighted a few noteworthy categories below:

- Charitable donations

- Education

- Government services

- GrabPay and YouTrip top-ups

- Hospitals

- Insurance premiums

- Utilities

For the avoidance of doubt, CardUp transactions will earn points, and also count towards the minimum spend for welcome offers.

What do I need to know about SC Rewards Points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| No expiry | Yes |

S$27.25 (per conversion) |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 10,000 miles | 2 | 1-3 working days (for KF) |

Expiry

SC Rewards Points earned on the StanChart Journey Card never expire, so long as the card account remains active.

Pooling

Standard Chartered divides its credit cards into two tiers:

- Tier 1: Beyond, Journey, Visa Infinite, Priority Visa Infinite

- Tier 2: All other cards

Points pool within tiers, but not across tiers (so you can’t combine Tier 1 and 2 points in a single redemption, for example).

In case you’re wondering why the Journey gets to party with the Visa Infinite cards, it’s purely a legacy reason. Remember, the former X Card was a Visa Infinite, so Standard Chartered could hardly “downgrade” all previously-earned X Card points by putting them on the same scheme as the non-Visa Infinite (they’re not BOC, after all!).

Transfer Partners & Fees

Standard Chartered used to have 10 different airline and hotel transfer partners, one of the widest ranges in Singapore.

Unfortunately, that all changed in March 2024, when nine of them were unceremoniously dumped. Cathay Pacific Asia Miles was added, but the overall line-up is a lot thinner than before.

| Frequent Flyer Programme |

Conversion Ratio (SC Points: Partner) |

|

| Tier 1 | Tier 2 | |

|

25,000 : 10,000 | 34,500 : 10,000 |

|

25,000 : 10,000 | 34,500 : 10,000 |

| Tier 1: Beyond, Journey, Visa Infinite, Priority Visa Infinite Tier 2: All others |

||

Transfers cost S$27.25 each, regardless of the number of points transferred.

Transfer Time

Conversions to KrisFlyer miles are generally completed within 1-3 working days.

Other card perks

Two complimentary lounge visits

|

| Registration |

Principal Standard Chartered Journey Cardholders enjoy two complimentary Priority Pass visits per membership year. You can either visit a lounge twice, or bring a guest and consume both visits at once. A fee of US$35 applies to all additional visits after the complimentary allowance has been utilised.

Here’s how this compares to other cards in its segment:

| Card | Network | Free Lounge Visits (per membership year) |

HSBC TravelOne Card HSBC TravelOne Card |

DragonPass | 4X* Share |

UOB PRVI Miles Card UOB PRVI Miles Card |

Priority Pass | 4X* |

Citi PremierMiles Card Citi PremierMiles Card |

Priority Pass | 2X* Share |

DBS Altitude Visa DBS Altitude Visa |

Priority Pass | 2X Share |

StanChart Journey Card StanChart Journey Card |

Priority Pass | 2X Share |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

N/A | N/A |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

N/A | N/A |

BOC Elite Miles Card BOC Elite Miles Card |

N/A | N/A |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

N/A | N/A |

OCBC 90°N Card OCBC 90°N Card |

N/A | N/A |

| *Allowance tracked based on calendar year |

||

SC EasyBill

|

| SC EasyBill |

Standard Chartered offers a bill payment platform called SC EasyBill, which allows cardholders to earn rewards when paying the following bills.

| Category | Examples |

| Tax Payments |

|

| Education |

|

| Insurance |

|

| Rent |

|

An admin fee of 1.9% applies, though this is sometimes lowered for targeted customers.

To illustrate, suppose you have a S$10,000 income tax bill to make:

- Your Journey Card will be charged S$10,190 (S$10,000 +1.9% admin fee)

- Standard Chartered will pay S$10,000 to IRAS on your behalf

- You will earn 12,000 miles (S$10,000 @ 1.2 mpd; the admin fee does not earn miles)

- The out of pocket cost is S$190 for 12,000 miles, or 1.58 cents apiece.

1.58 cents per mile is neither great nor terrible, but Citi PayAll can offer better rates during its regular promos, as well as a wider scope of payments.

Guide: Buying miles with Standard Chartered’s SC EasyBill service

Complimentary Travel Insurance

| Accidental Death | S$500,000 |

| Medical Expenses | S$50,000 |

| Others | Delayed Luggage: S$1,000 Lost Luggage: S$5,000 |

| Policy Wording | |

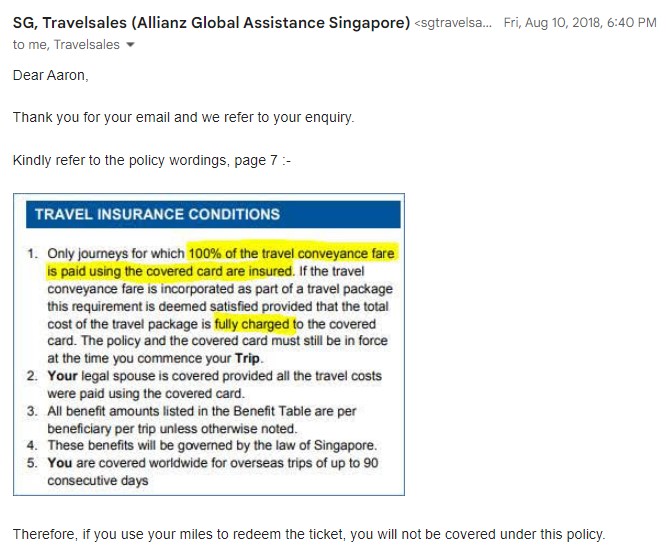

StanChart Journey Card cardholders enjoy complimentary travel insurance underwritten by Allianz, which is automatically activated when the full airfare is charged to the card. Allianz has previously clarified that coverage does not apply to award tickets, unfortunately.

Do note there is no coverage for trip cancellation and disruption, delayed flights, rental car excess, or personal liability. I personally would not feel comfortable without this, so I’d recommend you purchase additional coverage regardless.

Summary Review: StanChart Journey Card

|

|||

| Apply (Fee Waiver) | |||

| Apply (Fee Paying) | |||

| 🦁 MileLion Verdict | |||

| First Year | Recurring | ||

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

☐ Take It ☑Take It Or Leave It ☐ Leave It |

||

| What do these ratings mean? |

|||

The StanChart Journey Card offers a compelling first-year value proposition, with a 30,000 miles welcome offer that’s further stackable with SingSaver gifts. Together with the two free lounge visits, it’s almost impossible to lose.

But come the second year onwards, you’ll have a tougher decision on your hands. Because StanChart lacks the kind of specialised spending cards that DBS and UOB offer, after the initial welcome bonus it can be difficult to accumulate a critical mass of points from day to day spending. True, there is a 3 mpd bonus on online groceries, food delivery and transport, but keep in mind that superior 4 mpd alternatives exist so there’s some opportunity cost involved.

It’s also unfortunate that StanChart has discarded nine of its transfer partners, which were a unique differentiating factor given how many banks default to just KrisFlyer and Asia Miles.

So that’s my review of the StanChart Journey Card. What do you think?

The Zero FCY fee is looking lucrative for my upcoming trip! Do you know if there are any other cards offering the same?

However, if you’re a new-to-bank customer, you can stack it with the extra 5 mpd offered during the first 30 days for a total of 8 mpd.

>> where is the 5 mpd found in the offer?

this is a leftover from a previous sign-up offer. will get it updated, thanks!

one more question – it states “transactions made and posted” . my hotel check out is 31st October which i will pay on that day. will this qualify or no?

it is impossible to tell when a transaction will be posted, so depends on your luck

Is the first year free waiver applicable to existing SC customers too? Not very clear from the T&Cs but it seems only for new customers

I have applied for SC Journey and wanted to go for the 35k miles signup offer with minimum $3k spend. Used CardUp to pay my income tax to reach to $3k minimum spend but the transaction was deemed invalid unfortunately. SC agent themselves are unclear with the requirement, I checked with them to clarify that I did indeed meet the requirements, which they have confirmed, but to be met with disappointment when the miles did not arrive at the promised date

contact cardup for assistance.

see this post: https://t.me/milelion/875466

did you get it in the end?

I have one question about sign-up gift (which is still being offered in 2024). If I did cancel a SC credit card previously ~10 years ago and I did enjoy sign-up gift then (I recalled is $200 cash) – if I sign-up SC Journey card now, will I get the full welcome miles or will be knocked off by previous $200 cash (in equivalent form of miles/points)? My understanding is if today the welcome gift is $300 cash, then only $100 will be credited after offsetting $200 previous gift. But I am not sure how it works when the welcome… Read more »

No utilities, no hospitals, no annual fee waiver, bye SCB Journey.

totally agree. just cancel and get NCB bonus

If I was in two minds about keeping or not, the nightmare that is the SCB phone system made it clear to cancel…

You can cancel directly in the app

Can I sign up for this card and swipe 3k on mortgage/ insurance premiums through cardup to qualify for welcome miles?

I signed up for the card in February but did not receive the bonus miles even though i hit the $3k min spend. When I called SC CS, they mentioned that as I locked my card temporarily when I went overseas, I will not be eligible for the bonus miles. There was no way to appeal as they said it was stated in their T&C, which I felt was pretty unfair.

recently applied 1 of this card thru singsaver when i read your article that gift are stackable. How do i know if i can be qualify for the $3000 spend for bonus miles? It mentioned in your page that gift are stackable with singsaver, however from the terms and condition, it mentioned card application gift is only valid if the application is submitted to Standard Chartered Bank (Singapore) Limited (“Standard Chartered” or the “Bank”) either through https://www.sc.com/sg/ or any of SC appointed sales agents at the Bank’s roadshow booths.

Hi I have followed your article and applied through singsaver as it mentioned in your article: The StanChart Journey Card offers a compelling first-year value proposition, with a 45,000 miles welcome offer that’s further stackable with SingSaver gifts. I did not receive the annual feel charge and I clarify with standard chartered chatbot, I was inform i applied through singsaver and I am not entitled to the promotion of 45,000 miles as I did not applied through SC website. And the annual fee will be wavied for 1st year…. is there some kind of error pls, can you pls advise… Read more »

the offers are stackable, as mentioned in the singsaver T&Cs. do contact singsaver for further assistance with your case.

Somehow cannot add to CardUp now. Not sure it’s a special case or policy change

I successfully added my to CardUp a few days back. Two transactions also went through without fail. You might want to try again!

Hi Aaron, thanks for sharing! Will existing SCB customers still get the 10,000 miles for paying the annual fee of $196.20 in the first year?

I have gotten this card since the metal days. Cancelled it recently as SC do not even entertain fee waiver.