Here’s The MileLion’s review of the Maybank World Mastercard, which largely flew under the radar until September 2024, when it introduced an uncapped 3.2 mpd on foreign currency (FCY) spend.

Combined with its existing 4 mpd on petrol, specialty retail & dining — also uncapped — this is an excellent choice for anyone who finds the bonus caps of competing cards too restrictive. It even awards miles for commonly-excluded transactions like education, hospitals and utilities (all the better if they’re in FCY).

The catch is that a minimum spend of S$4,000 is required to unlock the 3.2 mpd earn rate. However, cardholders can still earn an uncapped 2.8 mpd with a minimum spend of S$800, and if the uncapped earning potential appeals to you, then a minimum spend is unlikely to be a major hurdle.

Maybank World Mastercard Maybank World Mastercard |

|

| 🦁 MileLion Verdict | |

| ☑Take It ☐ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? |

|

| With an uncapped 3.2 mpd on FCY spend and 4 mpd on petrol, the Maybank World Mastercard is the ideal choice for big spenders. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: Maybank World Mastercard

Let’s start this review by looking at the key features of the Maybank World Mastercard.

|

|||

| Apply | |||

| Income Req. | S$80,000 p.a. | Points Validity | No expiry |

| Annual Fee | S$261.60 (FYF) |

Min. Transfer |

25,000 points (10,000 miles)* |

| Miles with Annual Fee |

N/A | Transfer Partners |

4 |

| FCY Fee | 3.25% | Transfer Fee | S$27.25 |

| Local Earn | 0.4 mpd | Points Pool? | Yes |

| FCY Earn | Up to 3.2 mpd |

Lounge Access? | No |

| Special Earn | 4 mpd on petrol and specialty retail & dining | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

| *For KrisFlyer; 5,000 miles for Cathay and Malaysia Airlines, 2,000 points for AirAsia |

|||

How much must I earn to qualify for a Maybank World Mastercard?

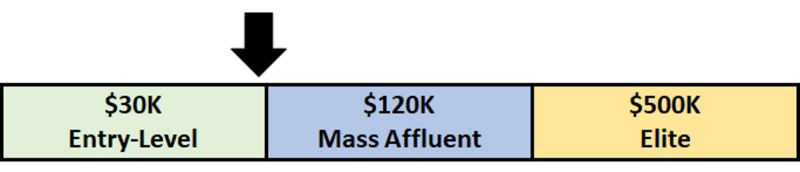

The Maybank World Mastercard has a minimum income requirement of S$80,000 p.a., which is an odd middle ground. It’s not quite as exclusive as the S$120,000 mass affluent segment, nor is it as accessible as the S$30,000 entry-level segment.

In fact, the income requirement is a throwback to 5-10 years ago, where miles cards like the DBS Altitude, Citi PremierMiles and UOB PRVI Miles all had S$80,000 income requirements, presumably to give them an air of prestige (even though any requirement above S$30,000 is essentially arbitrary).

That said, Maybank does not enforce this requirement strictly, and it’s not difficult to get approved even if you don’t meet the threshold.

How much is the Maybank World Mastercard’s annual fee?

| Principal Card | Supp. Card | |

| First Year | Waived | Free |

| Subsequent | S$261.60 | Free |

The Maybank World Mastercard has an annual fee of S$261.60, which is waived for the first year.

While the official policy requires a minimum spend of S$24,000 per membership year for a fee waiver in subsequent years, this rule does not appear to be strictly enforced. Many cardholders report receiving fee waivers even without meeting the spending requirement.

All supplementary cards are free for life.

What welcome offers are available?

|

| Apply |

New-to-bank customers who apply for a Maybank World Mastercard will receive a Samsonite INTERLACE Spinner 67/24 EXP luggage (worth S$520).

A minimum spend of S$1,300 within the first two months of approval is required.

New-to-bank customers are defined as those who:

- Do not currently hold a principal Maybank credit card or CreditAble account

- Have not cancelled a principal Maybank credit card or CreditAble account in the past nine months

The T&Cs of this offer can be found here.

In my experience, Maybank is extremely fast with the gift fulfilment, and I received mine within days of meeting the minimum spend.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 0.4 mpd | 3.2 mpd | 4 mpd on petrol and selected dining & retail |

SGD/FCY Spend

Maybank World Mastercard cardholders earn miles according to the table below.

| Spend (per calendar month) |

SGD* | FCY |

| <S$800 | 0.4 mpd | 0.4 mpd |

| S$800 to S$3,999 | 0.4 mpd | 2.8 mpd |

| ≥S$4,000 | 0.4 mpd | 3.2 mpd |

| *4 mpd for petrol, specialty retail & dining | ||

The local earn rate is fixed at 0.4 mpd, with exceptions for certain categories like petrol, specialty retail & dining (see below).

The overseas earn rate is usually 0.4 mpd, but:

- Cardholders who spend at least S$800 per calendar month earn 2.8 mpd

- Cardholders who spend at least S$4,000 per calendar month earn 3.2 mpd

The minimum spend can be in SGD, FCY, or any combination of the two. Upsized earn rates apply from the very first S$1 of spend, and not just the incremental spending. For example:

- A cardholder who spends S$1,000 in FCY would earn 2,800 miles (S$1,000 @ 2.8 mpd)

- A cardholder who spends S$5,000 in FCY would earn 16,000 miles (S$5,000 @ 3.2 mpd)

There is no cap on the maximum miles that can be earned.

While the Maybank Horizon Visa Signature has offered an uncapped 3.2 mpd on FCY spend on a promotional basis, the Maybank World Mastercard offers this as a permanent feature. This makes it one of the best general spending cards for FCY on the market.

| 💳 FCY Earn Rates by Card (For cards with uncapped earn rates only) |

||

| Card | Earn Rate | Remarks |

DCS Imperium Card DCS Imperium CardApply |

4 mpd | By invite only. Min. S$4K FCY spend per c. month Review |

Maybank World Mastercard Maybank World MastercardApply |

3.2 mpd | Min. S$4K spend per c. month. 2.8 mpd with min. S$800 spend per c. month |

Maybank Visa Infinite Maybank Visa InfiniteApply |

3.2 mpd | Min. S$4K spend per c. month Review |

StanChart Visa Infinite StanChart Visa InfiniteApply |

3 mpd | Min. S$2K spend per s. month Review |

BOC Elite Miles Card BOC Elite Miles CardApply |

2.8 mpd | No min. spend Review |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

2.8 mpd | Min. S$800 spend per c. month Review |

HSBC Premier Mastercard HSBC Premier MastercardApply |

2.76 mpd | No min. spend. Requires HSBC Premier relationship (min. S$200K AUM) |

UOB PRVI Miles Card UOB PRVI Miles CardApply |

2.4 mpd | No min. spend. 3 mpd for IDR, MYR, THB, VND Review |

HSBC TravelOne Card HSBC TravelOne CardApply |

2.4 mpd | No min. spend Review |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal CardApply |

2.4 mpd | No min. spend Review |

| All other options earn below 2.4 mpd | ||

I should point out that you can earn 4 mpd on FCY spending with the Maybank XL Rewards Card, UOB Visa Signature, and other specialised spending cards. However, these earn rates will either be capped, or only apply to specific MCCs. Read the article below for more information.

https://milelion.com/2025/02/04/best-cards-for-overseas-spending/

The Maybank World Mastercard has an FCY fee of 3.25%, so using it overseas represents buying miles at around 1.02 cents (3.2 mpd) or 1.16 cents (2.8 mpd) each, which is very decent in my book.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

Petrol

The Maybank World Mastercard earns an uncapped 4 mpd on offline petrol transactions, made in SGD under MCC 5541. In other words, you cannot earn this bonus if you pay through apps like Kris+ (available at Esso) or CaltexGo.

No minimum spend is necessary. FCY spending on petrol will be eligible for 2.8/3.2 mpd, under the FCY earning bonus.

Maybank World Mastercard cardholders can apply for a free Corporate Fuel Card, which gives a 15% upfront discount at Shell, on top of credit card rewards. Despite the name, there is no need to be a registered business entity to use it; it’s also available to individuals.

Specialty Retail & Dining

The Maybank World Mastercard earns an uncapped 4 mpd (except at Luxury Galleria at RWS, where a 20,000 miles/month cap applies) on offline transactions made at specialty retail & dining merchants.

These are defined in the table below.

| Group | Brands |

| Imperial Treasure |

|

| Les Amis Group |

|

| Valiram Group |

|

| Luxury Galleria at Resorts World Sentosa (capped at 50,000 Treats Points per calendar month) |

|

| Leonian |

|

| The Par Club SG |

|

| Aparo Golf |

|

| KGOLF |

|

No minimum spend is necessary.

What counts towards the S$800/S$4,000 minimum spend?

All SGD and FCY transactions that are eligible to earn TREATS Points will also count towards the minimum spend required to trigger the 2.8/3.2 mpd on FCY spend.

Principal and supplementary cardholder spending is pooled for the purposes of this calculation (e.g. if the sum of spending across both cards is S$4,000, then both principal and supplementary cardholders will earn 3.2 mpd on FCY spend).

Transaction date or posting date?

Technically speaking, Maybank tracks minimum spend and bonus caps by posting date, not transaction date.

In practice, however, all transactions charged in a given month and posted by the 7th of the following month are considered to be part of the month in which they were charged.

| 💳 Maybank World Mastercard |

||

| Transaction Date | Posting Date | Counts Towards |

| Month X | By the 7th of Month X+1 | Month X |

| Month X+1 | By the 7th of Month X+2 | Month X+1 |

In other words, you can comfortably spend up till the last calendar day of the month, and not have to worry about transactions “leaking” into the following month (it’s not impossible, but six days should be more than enough time for even the slowest of merchants to post).

Which cards track spending by transaction date vs posting date?

When are TREATS Points credited?

For FCY spend, base TREATS Points are credited when the transaction posts, which usually takes 1-3 working days. Bonus TREATS Points are credited on the 8th of the following month.

For petrol and specialty retail & dining, base and bonus TREATS Points are credited when the transaction posts.

How are TREATS Points calculated?

Here’s how you can work out the TREATS Points earned on your Maybank World Mastercard.

For FCY spend

Spend <S$800 per calendar month

| Base Points (1X) | Round down transaction to the nearest S$5, divide by 5, then multiply by 5 |

Spend S$800 to S$3,999 per calendar month

| Base Points (1X) | Round down transaction to the nearest S$5, divide by 5, then multiply by 5 |

| Bonus Points (6X) |

Sum up all eligible transactions. Divide by 5, then multiply by 30. Round to the nearest whole number |

Spend ≥S$4,000 per calendar month

| Base Points (1X) | Round down transaction to the nearest S$5, divide by 5, then multiply by 5 |

| Bonus Points (7X) |

Sum up all eligible transactions. Divide by 5, then multiply by 35. Round to the nearest whole number |

For petrol and specialty retail & dining

| Base Points (1X) | Round down transaction to the nearest S$5, divide by 5, then multiply by 5 |

| Bonus Points (9X) |

Round down transaction to the nearest S$5, divide by 5, then multiply by 45 |

Maybank cards do have minimum earn blocks of S$5, which means a S$9.99 transaction earns the same amount of points as a S$5 transaction, and a <S$5 transaction earns no points at all.

The impact will be more acute on petrol and specialty dining & retail, since base and bonus points are awarded on a transaction level. It’s relatively more muted for FCY spending, because all eligible transactions are summed up to compute the bonus points, without rounding.

If you’re an Excel geek, here’s the formulas you need to calculate points:

For FCY spend

Spend <S$800 per calendar month

| Base Points (1X) | =ROUND (ROUNDDOWN(X/5,0)*5,0) |

| Where X= Amount Spent |

|

Spend S$800 to S$3,999 per calendar month

| Base Points (1X) | =ROUND (ROUNDDOWN(X/5,0)*5,0) |

| Bonus Points (6X) |

=ROUND(Y/5*30,0) |

| Where X= Amount Spent, Y= Sum of all eligible transactions |

|

Spend ≥S$4,000 per calendar month

| Base Points (1X) | =ROUND (ROUNDDOWN(X/5,0)*5,0) |

| Bonus Points (7X) |

=ROUND(Y/5*35,0) |

| Where X= Amount Spent, Y= Sum of all eligible transactions |

|

For petrol and specialty dining & retail

| Base Points (1X) | =ROUND (ROUNDDOWN(X/5,0)*5,0) |

| Bonus Points (9X) | =ROUND (ROUNDDOWN(X/5,0)*45,0) |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

Maybank’s 5 million point cap

While this won’t be an issue for 99.9% of cardholders, it’s worth noting that Maybank limits cardholders to accumulating a maximum of 5,000,000 TREATS points (2,000,000 miles) at any time. This cap applies across all Maybank cards.

You would need to spend a lot — and I really mean a lot — to breach this cap, but it’s not outside the realm of possibility. Still, even if your spending was high enough to reach the limit, it’s just a simple matter of transferring some points out before spending more.

This clause can be found at point 2.8 of the general TREATS T&Cs.

What transactions aren’t eligible for TREATS Points?

A full list of transactions that do not earn points can be found in the general TREATS T&Cs at point 2.2.

I’ve highlighted a few noteworthy categories below:

- Betting and gambling transactions

- Brokerage and securities transactions

- Charitable donations

- Government services

- Insurance premiums

- Prepaid account top-ups, e.g. GrabPay and YouTrip

For the avoidance of doubt, you will earn points on commonly-excluded transactions such as education, hospitals and utilities.

These will earn just 0.4 mpd if charged in SGD, but if you spend in FCY, you could be earning as much as 3.2 mpd on university fees or medical treatments.

What do I need to know about TREATS Points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| No expiry | Yes |

S$27.25 |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| Varies | 4 | 1-2 working days (to KF) |

Expiry

While TREATS Points normally expire after 12-15 months, Maybank World Mastercard cardholders are automatically enrolled into the Rewards Infinite programme. This means their TREATS Points never expire.

Pooling

TREATS Points pool with other Maybank cards. If you have 20,000 TREATS Points on the Maybank World Mastercard, and 5,000 TREATS Points on the Maybank Horizon Visa Signature, you can redeem 25,000 TREATS Points in a single conversion.

This also means that if you cancel your Maybank World Mastercard Card, you won’t lose your accumulated TREATS Points unless it happens to be your very last TREATS-earning card.

Transfer Partners & Fees

TREATS Points can be transferred to four airline partners at the following ratios.

| Frequent Flyer Programme | Conversion Ratio (TREATS Points: Partner) |

| 25,000 : 10,000* | |

| 12,500 : 5,000 | |

|

12,500 : 5,000 |

| 4,000 : 2,000 |

Malaysia Airlines Enrich and airasia rewards are close to worthless in my opinion, so that leaves Asia Miles and KrisFlyer as the only realistic options.

Unfortunately, Maybank no longer waives the points conversion fee for Maybank World Mastercard and Maybank Visa Infinite Cardholders, ever since April 2025. Cardholders will pay a S$27.25 fee per conversion.

Transfer Time

Conversions to KrisFlyer miles are generally completed within 1-2 working days.

Other card perks

Golf benefits

The Maybank Regional Golf programme offers principal Maybank World Mastercard cardholders complimentary green fees at more than 100 participating golf clubs across 19 countries.

Cardholders must spend at least S$2,000 in the previous calendar month to enjoy this benefit, and can book a maximum of two flights per month per cardholder. In Singapore, the participating clubs are:

- Sembawang Country Club

- Warren Golf & Country Club

- Orchid Country Club

- 1 additional participating club (not named)

Golf perks offered by other credit cards normally require a paying guest, but no such requirement exists for Maybank World Mastercard cardholders who book clubs in Singapore, Malaysia, Indonesia and the Philippines.

The T&Cs of the Maybank Regional Golf programme can be found here.

Complimentary travel insurance

| Accidental Death | S$1,000,000 |

| Medical Expenses | N/A |

| Others | Missed Connection: S$400 Luggage Delay: S$400 Lost Luggage: S$1,000 |

| Policy Wording | |

Maybank World Mastercard cardholders receive complimentary travel insurance when they charge their full travel fares to their card. Unfortunately, coverage will not apply in situations where you redeem miles for an award ticket, and charge the taxes and fees to your Maybank World Mastercard.

This features up to S$1,000,000 coverage for accidental death or total permanent disablement, S$400 for luggage delays or missed connections, and S$1,000 for luggage loss.

However, there is no coverage for medical expenses or emergency medical evacuation. Because of this, I highly advise that you purchase comprehensive travel insurance elsewhere.

Terms & Conditions

Summary Review: Maybank World Mastercard

Maybank World Mastercard Maybank World Mastercard |

|

| 🦁 MileLion Verdict | |

| ☑Take It ☐ Take It Or Leave It ☐ Leave It |

If you consistently find yourself exceeding the bonus caps with other credit cards, then the Maybank World Mastercard might be the ideal solution.

With an uncapped 4 mpd on petrol, specialty retail & dining, and an uncapped 3.2 mpd on FCY spend (including education, hospitals and utilities), this would really let you rack up the points quickly. Points don’t expire, though it’s a shame that free conversions are no longer available.

Even if you’re a smaller spender, you can still earn a respectable uncapped 2.8 mpd on all FCY spend, with a minimum spend of just S$800. The 4 mpd on petrol, specialty retail & dining also has no minimum spend requirement.

So that’s my review of the Maybank World Mastercard. What do you think?

Very troublesome to require payslip

Maybank pls revise your policies !!!

I’m not sure where this card fits into the usually well-defined matrix of Singaporean credit cards. By and large, excluding co-brand and Amex-issued cards (because the latter is way too hard for me to categorise), there are four categories of miles cards in Singapore. Specialised (DBS Woman’s World, Citi Rewards, UOB PPV/VS/Lady’s, plus the now-crippled HSBC Revolution) General $30k (Citi PremierMiles, DBS Altitude, UOB PRVI Miles, most SCB cards) General $120k (Citi Prestige, DBS Vantage, HSBC/Maybank/SCB Visa Infinite) $500k (Citi ULTIMA, DBS Insignia, UOB Reserve) Perhaps the Maybank World Mastercard is a category all unto its own, because this is… Read more »

I’m actually surprised if banks want to fit all their cards into a category such that it goes head on with other cards.

Better approach would be to find their own niche.

Any idea if the categories under exclusion for treat points, such as insurance, can count towards the min spend for the welcome gift?

I don’t see any rewards on donations, education, hospital bills and utilities. Am I missing something?

Yeah, same. I got this card. Spent on those categories – got zero treats points. Feels like a waste of time.

I don’t see exclusions on Donation, Education, Hospital and Utility… but Insurance is clearly excluded on all Maybank cards except Horizon Visa Signature.

I should have read the T&Cs myself because I paid for insurance last month with the World Mastercard thinking I’ll earn accelerated points on FX during my trip later in the month. But now realise it’s all for nothing.

for insurance, the only 2 cards that grant points are maybank horizon and maybank visa infinite.

Hey Aaron, refer to T&Cs clause 2.3. there seems to be a hard cap which is subjective to individuals… Not sure how this hard cap works. Is it based on per transaction or per month basis ? Meaning if I split my extremely large bill into multiple txn within my personal credit limit, would that award me the points ?

“In addition to the list stated in clause 2.2, TREATS Points will not be awarded for amounts that

exceed the approved credit limit of the Cardmember.”

Maybank site states: Complimentary Plaza Premium airport lounge access. New Perk?

https://www.maybank2u.com.sg/en/personal/cards/credit/maybank-world-mastercard.page

2x free visits. good spot. will update my post on lounge access.

Charge a minimum of S$1,000 in a single retail transaction to your Maybank Premier World Mastercard or Maybank World Mastercard to enjoy one complimentary Plaza Premium Lounge access, within 3 months from transaction date.

Maybank Premier World Mastercard enjoy complimentary access to Plaza Premium Lounge twice a calendar year with no spending requirement. To enjoy the complimentary lounge access, simply present your Premier World Mastercard at Plaza Premium Lounge. Subsequent access will be based on minimum spend of S$1,000 in a single retail transaction.

So is there free lounge access? The summary table still says ‘no’.

this is not a benefit of the maybank world mastercard. it is a benefit of the maybank premier world mastercard (different product)

$4000 per calendar month spending to receive 3.2mpd has to be maintained across all months? All can be for that particular month only to receive 3.2mpd?

Does the redemption program for Krisflyer through Maybank World Mastercard goes through Maybank TREATS Points Redemption Form?

Or through the TREATS app itself?

How about online FCY payment ?

e.g ebay, amazon, etc ?

curious too if the 3.2mpd for FCY transactions (with min 4k spend) applies to both online and offline transactions?

No mention of online vs offline in the terms. Just retail transactions so I’d take it online works for this FCY earn.

https://www.maybank2u.com.sg/iwov-resources/sg/pdf/cards/maybank-world-mastercard-tnc.pdf

Hi, is the minimum spending per month calculated based on transaction date or posting date?

See the terms. A bit more complex. Posted before 7th day of the following month counts towards the previous calendar month.

https://www.maybank2u.com.sg/iwov-resources/sg/pdf/cards/maybank-world-mastercard-tnc.pdf

Looks like they’ve recently excluded charitable contributions from points eligibility.

Continued nerfing underway:

https://www.maybank2u.com.sg/en/personal/about_us/important-notices/2025/revision-maybank-tp-rewards-programme-general-tnc.page

“With effect from 1 April 2025, Maybank TREATS Points Rewards Programme General Terms and Conditions will be revised. The key revisions are summarised below:

You are also allowed to sign up for the Diamond Sky Fuel Card with Caltex – probably the best discounts for petrol!

Card doesn’t support google pay. Only apple and Samsung. Also cannot change statement date. Otherwise good FCY card as mentioned in article

Apparently, there is a requirement to call the bank to whitelist the country that you are going to (they allowed a whitelisting period of max one month), otherwise they will block your transaction. I just went through that experience, It is pretty tedious (and frustrating) to keep doing that. Anyone had the same experience?

I called them earlier and the CS rep mentioned having to call every day because the whitelist is only available for 24 hours. Extremely inconvenient when in a different timezone and defeats the purpose of having this card

Sounds insane. The cost of the call (can we whatsapp call a landline?) and the cognitive load while on vacation…..