Here’s The MileLion’s review of the StanChart Beyond Card, Standard Chartered Bank’s flagship card.

With a minimum income requirement of S$200,000 and a hefty S$1,635 annual fee, it’s clearly not the kind of thing you rush into. And yet, this is a tricky card to review, because its earn rates and benefits come in three different configurations, depending on your status with Standard Chartered.

When it first launched in November 2024, I thought it was somewhat overpriced and only suitable for very big spenders, as evidenced by the S$20,000 minimum spend for its 100,000 miles welcome offer (a requirement that remains in place till today).

But the landscape has changed significantly since then. The days when you could enjoy unlimited lounge visits on a cheaper S$120K card like the Citi Prestige or UOB Visa Infinite Metal Card are slowly drawing to an end. The continued nerfs to specialised spending cards mean a bigger role for general spending cards. And the Beyond now boasts an 80,000 miles renewal bonus — 80% of the first year’s welcome offer.

So is the StanChart Beyond Card a better deal today? Read on and we’ll find out.

Standard Chartered Beyond Card Standard Chartered Beyond Card |

|

| 🦁 MileLion Verdict |

|

| Priority Private | |

| First Year | Recurring |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

☐ Take It ☑ Take It Or Leave It ☐ Leave It |

| Priority Banking | |

| First Year | Recurring |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

☐ Take It ☑ Take It Or Leave It ☐ Leave It |

| Regular | |

| First Year | Recurring |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

☐ Take It ☐ Take It Or Leave It ☑ Leave It |

| What do these ratings mean? |

|

| The value of the StanChart Beyond Card depends heavily on your status with the bank, with Priority Private and Priority Banking customers getting the best deal. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: StanChart Beyond Card

Let’s start this review by looking at the key features of the StanChart Beyond Card.

|

|||

| Apply | |||

| Income Req. | S$200,000 p.a. | Points Validity | No expiry |

| Annual Fee | S$1,635 |

Min. Transfer |

10,000 miles |

| Miles with Annual Fee |

N/A | Transfer Partners |

2 |

| FCY Fee | 3.5% | Transfer Fee | S$27.25 |

| Local Earn | 1.5-2 mpd | Points Pool? | Yes |

| FCY Earn | 3-4 mpd |

Lounge Access? | Yes |

| Special Earn | PP only: 8 mpd on FCY dining | Airport Limo? | Yes |

| Cardholder Terms and Conditions | |||

As I mentioned at the start, the StanChart Beyond Card is one product, with three tiers. Your tier depends on your banking status with Standard Chartered.

- Regular: No minimum AUM required

- Priority Banking (PB): Minimum AUM S$200,000 (or S$1.5M housing loan)

- Priority Private (PP): Minimum AUM S$1,500,000

AUM includes the total balance of your savings accounts, investments (including shares in brokerage account) and insurance with the bank.

All three tiers pay the same S$1,635 annual fee, but the benefits are different.

| Regular | Priority Banking | Priority Private | |

| Welcome Offer | 100,000 miles |

||

| Renewal Offer | – | 80,000 miles |

|

| Local Earn | 1.5 mpd | 2 mpd | 2 mpd |

| FCY Earn | 3 mpd | 3.5 mpd | 4 mpd |

| FCY Dining | 8 mpd | ||

| Birthday Meal | 1x | ||

| Business Class Upgrades | 2x | ||

| Airport Lounge | ∞ + 6 guests (Principal & 4x Supp.) |

||

| Airport Limo | – | 2x | 2x^ |

| ALL Accor+ Explorer | – | – | Yes |

| Mastercard Tier | World Elite Mastercard |

||

| ^Standard Chartered advertises this as 10x rides, but this includes the 8x complimentary limo rides that Priority Private customers already enjoy without the Beyond Card | |||

It should be no surprise that the benefits get better as your status with Standard Chartered goes higher. After all, a key goal of the Beyond is to drive the acquisition of PB and PP clients, something the now-discontinued X Card failed to do.

Oh, and in case you were wondering, yes. The Beyond Card is made of metal, and weighs in at 17g, about the same weight as the AMEX Platinum Charge.

How much must I earn to qualify for a StanChart Beyond Card?

The StanChart Beyond Card has a minimum income requirement of S$200,000 p.a.

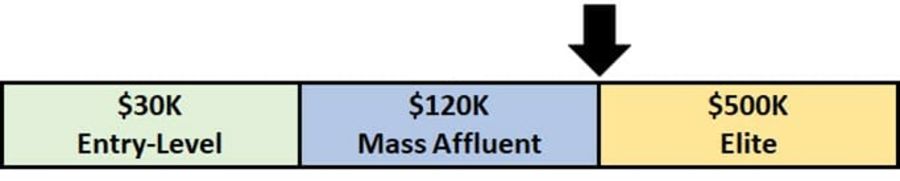

This doesn’t fit neatly into any existing segment, and I think that’s intentional. Standard Chartered is trying to carve out a whole new niche with the Beyond, one that sits above the accessibility of the increasingly-crowded S$120K segment, but below the white glove service of the S$500K segment.

For the moment it does seem that they are strictly enforcing the income requirement, though you should be able to get approved with a lower income if you’re a PB or PP customer. Remember: any income requirement above the MAS-mandated S$30,000 is essentially arbitrary, so it’s really up to the bank whether they want to approve you.

How much is the StanChart Beyond Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$1,635 | Up to 4x cards free |

| Subsequent | S$1,635 | Up to 4x cards free |

The StanChart Beyond Card has an annual fee of S$1,635. No fee waivers are offered for this card, regardless of how much you spend per year.

Yes, I know. One of the running jokes about the X Card was that Standard Chartered kept insisting the annual fee was strictly not waivable— then ended up waiving it every renewal year on an “exceptional” basis. But I wouldn’t count on the same happening with the Beyond, given the enhanced level of benefits on offer.

Up to four supplementary cards are offered free for life, and you’re going to want to max this out, since each of them enjoys an unlimited-visit Priority Pass (more on that later).

Cardholders will receive 80,000 bonus miles for renewing their card, provided they maintain at least S$200,000 AUM by the end of the month following renewal. For example, if your StanChart Beyond Card is due for renewal in November 2025, you will need to maintain at least S$200,000 in AUM as of 31 December 2025.

I would assume you’re already doing this if you’re a Priority Banking (min AUM: S$200,000) or Priority Private customer (min AUM: S$1.5M), but otherwise, it’s worth noting that you only need to maintain the S$200,000 as of the last day of the month. I see nothing in the T&Cs that prevents you from withdrawing it after that.

It’s notable that Standard Chartered is positioning this as a limited-time promotion until 31 December 2026, rather than an evergreen feature. In other words, they’re not committing to offer 80,000 miles for renewing every year, though I suppose we can worry about that when the time comes.

What welcome offers are available?

|

|||

| Apply |

The StanChart Beyond Card is currently offering a 100,000 miles welcome offer for applications submitted by 31 March 2026, broken down as follows.

| Reward | Criteria |

| 60,000 miles | Pay S$1,635 annual fee |

| 40,000 miles | Spend at least S$20,000 within 90 days of approval (or S$10,000 if you’re a StanChart employee) |

60,000 miles for paying the annual fee will be credited (in the form of 150,000 SC Rewards Points) within 60 working days of approval.

40,000 miles for meeting the minimum spend will be credited (in the form of 100,000 SC Rewards Points) within 60 working days after the 90-day spending period ends.

This offer is valid for both new and existing Standard Chartered cardholders, and the T&Cs can be found here.

Who is the Beyond’s comparison set?

Coming up with a comparison set for the StanChart Beyond Card is a tricky exercise, because its income requirement and annual fee put it in a unique segment.

The most obvious rival is the AMEX Platinum Charge, given its proximate S$1,744 annual fee. Once upon a time, this card also had a S$200,000 income requirement, though that was later dropped to S$150,000 and eventually removed altogether, with all applications “subject to internal approval”.

I’d also consider the OCBC Premier VOYAGE/HSBC Premier Mastercard and OCBC Premier Private Client (PPC) VOYAGE to be pacing challengers for the PB and PP versions of the Beyond respectively.

Granted, neither is an exact match for AUM or fees:

- OCBC Premier Banking requires higher minimum AUM than StanChart PB (S$350K vs S$200K), and the accompanying OCBC Premier VOYAGE has a much lower annual fee (S$498 vs S$1,635)

- The AUM for OCBC PPC is on par with StanChart PP at S$1.5M, but the PPC VOYAGE has no annual fee

Still, both are targeting a similar segment of customer as their StanChart equivalents, so I think they’re worth including.

I’m also going to include the Citi Prestige, which I believe to be the best of the S$120K bunch, to expand the competitor set a little further. Wait a minute— didn’t you just say that the StanChart Beyond Card was above the riff-raff of S$120K? Yes, and that’s the point. Because the StanChart Beyond Card costs much more than a S$120K card, you should expect it to perform at a much higher level too. If the comparisons show that you could get similar benefits for less, then that’d be a big argument against getting a Beyond.

| 💳 Beyond Comparison Set |

||

| Card | Income Req. | Annual Fee |

StanChart Beyond StanChart Beyond |

S$200,000 | S$1,635 |

AMEX Platinum Charge AMEX Platinum Charge |

Not stated | S$1,744 |

Citi Prestige Citi Prestige |

S$120,000 | S$651.82 |

HSBC Premier Mastercard HSBC Premier Mastercard |

Min. AUM S$200K | Free |

OCBC Premier VOYAGE OCBC Premier VOYAGE |

Min. AUM S$350K | S$498 |

OCBC PPC VOYAGE OCBC PPC VOYAGE |

Min. AUM S$1.5M | Waived |

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| Regular: 1.5 mpd PB/PP: 2 mpd |

Regular: 3 mpd PB: 3.5 mpd PP: 4 mpd |

PP: 8 mpd on overseas dining |

SGD/FCY Spend

The earn rates for the StanChart Beyond Card range from 1.5 to 8 mpd, depending on your status and what you’re spending on.

| Regular | PB | PP | |

| Local Earn | 1.5 mpd | 2 mpd | 2 mpd |

| FCY Earn | 3 mpd | 3.5 mpd | 4 mpd |

| FCY Dining* | 8 mpd | ||

| *Dining is defined as transactions made at MCC 5811 (Caterers), 5812 (Restaurants), 5813 (Pubs & Bars) and 5814 (Fast Food Restaurants) | |||

There is no minimum spend required, nor cap on the maximum miles that can be earned. While we have seen cards offering uncapped 4 mpd earn rates on a promotional basis, this is the first time we’ve seen an uncapped 8 mpd (well, apart from the legendary Citi x Apple Pay offer), let alone as an evergreen feature.

No question about it— the StanChart Beyond Card wipes out the competition when it comes to local earn rates. An uncapped 2 mpd is far above the competition, and can be especially useful for buying miles through CardUp or SC EasyBill (more on that below).

The FCY earn rates are also impressive, but unlike local spending, the advantage over the market is not so clear cut here. That’s because Maybank has been stepping up their game too:

- The Maybank World Mastercard earns 3.2 mpd on all FCY spend, subject to a minimum spend of S$4,000 per calendar month (or 2.8 mpd with a minimum spend of S$800 per calendar month)

- The Maybank Visa Infinite earns 3.2 mpd on all FCY spend, subject to a minimum spend of S$4,000 per calendar month

- The Maybank Horizon Visa Signature earns 2.8 mpd on all FCY spend, subject to a minimum spend of S$800 per calendar month

Those minimum spends are a hurdle to be crossed, but if an uncapped earn rate is what attracts you, then it’s unlikely a minimum spend requirement is going to be an impediment anyway.

StanChart also has the highest FCY transaction fee in the market at 3.5%, compared to Maybank’s 3.25%, which in turn affects your cost per mile (CPM).

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

Here’s my analysis:

| Card | FCY Earn | FCY Fee | CPM |

StanChart Beyond StanChart Beyond (PP) |

8 mpd Dining |

3.5% | 0.44¢ |

| 4 mpd | 3.5% | 0.88¢ | |

StanChart Beyond StanChart Beyond (PB) |

3.5 mpd | 3.5% | 1.00¢ |

Maybank Visa Infinite Maybank Visa Infinite Maybank World MC Maybank World MC |

3.2 mpd | 3.25% | 1.02¢ |

Maybank Horizon Visa Signature Maybank Horizon Visa Signature |

2.8 mpd | 3.25% | 1.16¢ |

StanChart Beyond StanChart Beyond (Regular) |

3 mpd | 3.5% | 1.17¢ |

If you’re a Regular StanChart Beyond Cardholder, Maybank cards are the superior option for FCY spend.

If you’re a PB StanChart Beyond Cardholder, Maybank Cards are marginally more expensive, but that difference is surely erased once you consider the annual fees. The Maybank Horizon has a S$196.20 fee, waived for three years, and the Maybank World Mastercard has a S$261.60 fee, waived for one year. The annual fee for both cards can still be waived beyond the free period, unlike the Beyond.

If you’re a PP StanChart Beyond Cardholder, it’s hard to argue with an uncapped 4 or 8 mpd. I mean, if you’re a globetrotter who regularly entertains clients overseas on a company-bankrolled expense account, then this card becomes a no-brainer.

When are SC Rewards Points credited?

Cardholders will initially receive the regular rate of 1.5/3 mpd on local/FCY spending when the transaction posts.

The additional miles for PB and PP customers will be awarded the following statement cycle, provided you maintain the minimum AUM at month-end.

| Customer | When trxn posts | Next statement cycle | Total |

| Regular | 1.5 mpd 3 mpd | – | 1.5 mpd 3 mpd |

| PB | 0.5 mpd 0.5 mpd | 2 mpd 3.5 mpd | |

| PP | 0.5 mpd 1 mpd | 2 mpd 4 mpd |

If the minimum AUM is not met at month-end, PB and PP customers will earn the same rates as Regular customers.

How are SC Rewards Points calculated?

Here’s how you can work out the SC Rewards Points earned on your StanChart Beyond Card:

Regular rate

| Local Spend (3.75x) | Multiply transaction by 3.75, then round to nearest whole number |

| FCY Spend (7.5x) |

Multiply transaction by 7.5, then round to nearest whole number |

The minimum spend to earn points would be S$0.14 (local) or S$0.07 (FCY).

Bonus (PB)

| Local Spend (1.25x) | Multiply transaction by 1.25, then round to nearest whole number |

| FCY Spend (1.25x) |

Multiply transaction by 1.25, then round to nearest whole number |

Bonus (PP)

| Local Spend (1.25x) | Multiply transaction by 1.25, then round to nearest whole number |

| FCY Spend (2.5x) |

Multiply transaction by 2.5, then round to nearest whole number |

| FCY Dining (12.5x) | Multiply transaction by 12.5, then round to nearest whole number |

The other advantage of Standard Chartered cards is that their rounding policy is more favourable than banks like DBS, OCBC and UOB, allowing the StanChart Beyond to outperform even an equivalent-earning card like the DBS Vantage.

An illustration is provided below.

StanChart Beyond StanChart Beyond1.5 mpd |

DBS Vantage DBS Vantage1.5 mpd |

|

| S$5 | 7.6 miles | 6 miles |

| S$9.99 | 14.8 miles | 14 miles |

| S$15 | 22.4 miles | 22 miles |

| S$19.99 | 30 miles | 28 miles |

| S$25 | 37.6 miles | 36 miles |

| S$29.99 | 44.8 miles | 44 miles |

If you’re an Excel geek, here’s the formulas you need to calculate points:

Regular rate

| Local Spend (3.75x) | =ROUND(X*3.75,0) |

| FCY Spend (7.5x) |

=ROUND(X*7.5,0) |

| Where X= Amount Spent |

|

Bonus (PB)

| Local Spend (1.25x) | =ROUND(X*1.25,0) |

| FCY Spend (1.25x) |

=ROUND(X*1.25,0) |

| Where X= Amount Spent |

|

Bonus (PP)

| Local Spend (1.25x) | =ROUND(X*1.25,0) |

| FCY Spend (2.5x) |

=ROUND(X*2.5,0) |

| FCY Dining (12.5x) | =ROUND(X*12.5,0) |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for SC Rewards Points?

A full list of transactions that do not earn points can be found here.

I’ve highlighted a few noteworthy categories below:

- Charitable donations

- Education

- Government services

- GrabPay and YouTrip top-ups

- Hospitals

- Insurance premiums

- Utilities

For the avoidance of doubt, CardUp transactions will earn points, and do count towards the minimum spend for welcome offers.

What do I need to know about SC Rewards Points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| No expiry | Yes |

S$27.25 (per conversion) |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 10,000 miles | 2 | 3 working days (for KF) |

Expiry

Points earned on the StanChart Beyond Card never expire, so long as the card account remains active.

Pooling

Standard Chartered divides its credit cards into two tiers:

- Tier 1: Beyond, Journey, Visa Infinite, Priority Banking Visa Infinite

- Tier 2: All other cards

Points pool within tiers, but not across tiers (so you can’t combine Tier 1 and 2 points in a single redemption, for example).

Transfer Partners & Fees

Standard Chartered used to have 10 different airline and hotel transfer partners, one of the widest ranges in Singapore.

Unfortunately, that all changed in March 2024, when nine of them were unceremoniously dumped. Cathay Pacific Asia Miles was added, but the overall lineup is a lot thinner than before.

| Frequent Flyer Programme |

Conversion Ratio (SC Points: Partner) |

|

| Tier 1 | Tier 2 | |

|

25,000 : 10,000 | 34,500 : 10,000 |

|

25,000 : 10,000 | 34,500 : 10,000 |

Transfers cost S$27.25 each, regardless of the number of points transferred.

Transfer Time

Conversions to KrisFlyer miles are generally completed within three working days.

Other card perks

Unlimited complimentary lounge visits

The StanChart Beyond Card offers the principal and up to four supplementary cardholders unlimited Priority Pass lounge visits. This also includes non-lounge experiences such as restaurants, spa treatments and rest pods.

Access is through the physical Beyond Card, as part of the AoPC programme. There is no need to show a separate Priority Pass membership card.

As for guests:

- A total of six guests can be brought per calendar year

- This quota is shared between the principal and all supplementary cardholders

- You can bring multiple guests in a single visit For example, the principal cardholder could take along three guests and consume a total of three guest entitlements

- A guest fee of US$35 applies after the free visits have been utilised

Here’s how the lounge benefit measures up to the competition.

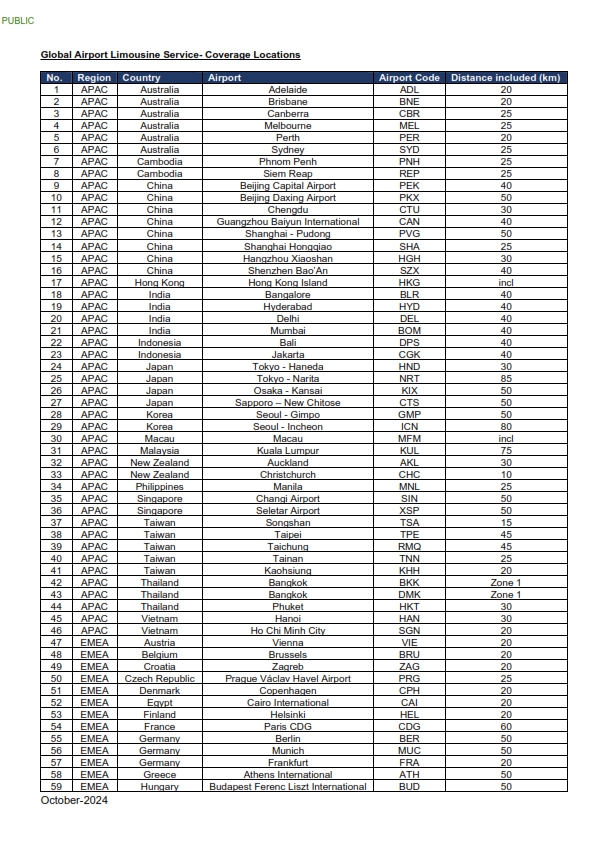

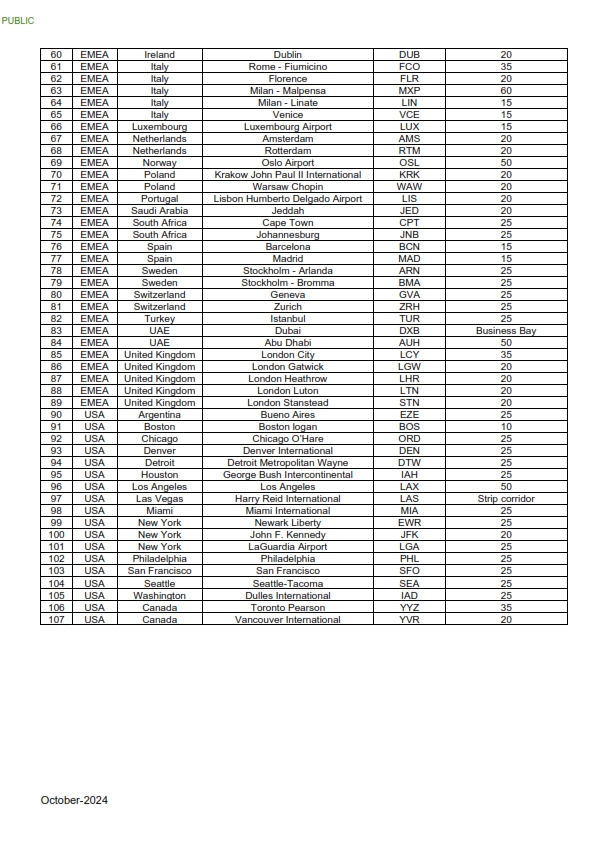

Airport limo rides

Principal StanChart Beyond Cardholders belonging to the PB and PP tiers enjoy two complimentary airport limo rides per calendar year. There is no airport limo benefit for regular Beyond Cardholders.

Wait a minute. Isn’t it 10 limo rides for PP customers? Well, here’s where Standard Chartered’s marketing is misleading. PP clients already enjoy 8x limo rides per calendar year by virtue of their status, without the need to get the Beyond Card. Therefore, the incremental benefit of the Beyond Card is really just 2x rides.

No minimum spend is required to unlock this benefit. Upon approval, you will receive a redemption code that can be used to book rides via the Teleport portal.

Limo rides can be used both in Singapore and more than 100 destinations overseas. However, there’s a catch: depending on city and vehicle chosen, a one-way trip may consume more than 1x entitlement.

List of cities and included distance

I know that’s a bit confusing, so think of your ride entitlements like a currency. Some cities will require you to spend 2x or more ride entitlements for a single journey. I did some searching on the portal and found the following:

- Bangkok (1x entitlement)

- Kuala Lumpur (2x entitlements)

- London Heathrow (4x entitlements)

- Osaka (5x entitlements)

- San Francisco (6x entitlements)

- Seoul (3x entitlements)

- Sydney (3x entitlements)

- Tokyo Narita (4x entitlements)

Additional surcharges apply in the following scenarios:

| ⚠️ Additional surcharge for limo rides |

|

Also note that blackout dates apply, so you might not be able to book the airport limo during popular periods.

ALL Accor+ Explorer membership

Principal StanChart Beyond Cardholders belonging to the PP tier enjoy a complimentary ALL Accor+ Explorer membership (formerly known as Accor Plus).

Member benefits include the following:

- 2 Stay Plus free nights across Asia Pacific (2x buy 1 night, get 1 night free)

- Up to 50% off member exclusive room rates with Red Hot Room offers

- 15% off Accor hotel stays worldwide

- 30% off dining across Asia Pacific for up to 10 pax

- 15% off drinks across Asia Pacific

- 30 status nights each year

| ⚠️ Important Note |

|

Standard Chartered’s website describes the benefit as “4x Stay Plus Free Nights”. This is somewhat misleading. It’s true that during the transition from Accor Plus to ALL Accor+ Explorer, all unredeemed legacy Stay Plus certificates were converted into 2x new Stay Plus certificates. Since the Accor Plus Explorer Plus tier that the Beyond Card provides came with 2x legacy Stay Plus certificates, it’s correct that those who had yet to redeem them would end up with 4x new Stay Plus certificates.

However, if you redeemed your complimentary membership after the transition (1 October 2025), or if you already redeemed a legacy Stay Plus certificate, then you will only receive 2x new Stay Plus certificates, each redeemable for a 1-for-1 night. |

The big draw here are the two Stay Plus free night certificates, each of which needs to be redeemed in conjunction with a single paid night (the more expensive of the two nights will be free).

The 30 status nights are sufficient for Gold status, though you need to moderate your expectations because most of its benefits — including room upgrades, early check-in and late check-out — are subject to availability.

Given all the changes that have happened during the transition from Accor Plus to ALL Accor+ Explorer, I would strongly encourage you to read the article below to get up to speed.

Business Class upgrades

Principal StanChart Beyond Cardholders enjoy two complimentary Business Class upgrades per year.

When this benefit first launched, it was close to useless. Cardholders had to purchase a minimum of two Business Class tickets in order to upgrade up to two Premium Economy Class tickets. Because this mechanic required a minimum purchase of three tickets, it was impossible to use for couples!

Standard Chartered eventually made some changes from 22 November 2025, allowing cardholders to upgrade one Premium Economy Class ticket for every one Business Class ticket purchased.

However, the benefit is still of dubious value, because other restrictions remain:

- You can’t use the benefit if you’re travelling on an airline that does not offer a Premium Economy product (e.g. Etihad Airways, Qatar Airways, Turkish Airlines)

- You can’t use the benefit if you’re travelling on a route where Premium Economy is not offered (e.g. Singapore Airlines flights to Adelaide, Maldives, Perth, Seoul)

- The Premium Economy Class ticket must be in the most expensive fare class, otherwise known as unrestricted tickets, while the upgrade can only be to the least expensive Business Class fare, otherwise known as restricted tickets

- Depending on airline, restricted Business Class fares can come with additional limitations, such as no advance seat selection or lounge access

Unrestricted Premium Economy Class tickets can be very expensive, and in some cases even more expensive than restricted Business Class tickets. If so, then this benefit is effectively worthless!

Complimentary travel insurance

| Accidental Death | US$500,000 |

| Medical Expenses | US$500,000 |

| Personal Liability | US$500,000 |

| Others | Trip Cancellation: US$7,500 Trip Postponement: US$7,500 Trip Curtailment: US$7,500 Trip Delay: US$500 Delayed Luggage: US$500 Lost Luggage: US$3,000 |

| Policy Wording | |

Standard Chartered Beyond Cardholders enjoy complimentary travel insurance, though it should be noted that this is the standard insurance available to all World Elite Mastercard customers.

This includes up to US$500,000 coverage for accidental death and total permanent disability, US$500,000 for emergency medical evacuation, medical expenses and personal liability, and US$7,500 for trip cancellation, postponement or curtailment.

This is a fairly comprehensive policy, but do note the absence of coverage for rental car excess, so be sure to get separate coverage if you’re renting a car.

Coverage is automatically activated when the full airfare is charged to the card, or when a ticket is redeemed with airline miles and the taxes and surcharges paid with the card.

World Elite benefits

Principal and supplementary StanChart Beyond Cardholders enjoy standard World Elite Mastercard benefits, including:

| 🏨 Hotel Elite Status |

|

| 🚗 Rental Car Elite Status | |

| 👍Other Perks |

It’s an excellent list of perks for sure, but it’s worth remembering that these are generic World Elite privileges, available to any World Elite cardholder. Some World Elite cards even come with a perpetual fee waiver!

| Card | Annual Fee | Qualification Req. |

Citi Prestige Card Citi Prestige Card |

S$651.82 | Income ≥ S$120K |

Citi Private Client Debit Card Citi Private Client Debit Card |

N/A | Min. AUM S$1.5M |

Citi ULTIMA Card Citi ULTIMA Card |

S$4,237.92 | Income ≥ S$500K |

DCS Imperium Card DCS Imperium Card |

S$1,294.92 | Unknown |

HSBC Premier Mastercard HSBC Premier Mastercard |

N/A* |

Min. AUM S$200K |

HSBC Prive Card HSBC Prive Card |

S$5,327.92 | HSBC Global Private Banking relationship |

OCBC Premier Debit Card OCBC Premier Debit Card |

N/A | Min. AUM S$350K |

OCBC PPC Debit Card OCBC PPC Debit Card |

N/A | Min. AUM S$1.5M |

StanChart Beyond Card StanChart Beyond Card |

S$1,635 | Income ≥ S$200K |

UOB Lady’s Solitaire Metal Card UOB Lady’s Solitaire Metal Card |

S$598.99 | Spend S$45K in 3-month period on UOB Lady’s Solitaire Card |

| *Waived if min. AUM is maintained, otherwise S$708.50 |

||

SC EasyBill

|

| SC EasyBill |

SC EasyBill allows StanChart customers to earn rewards when paying selected bills with their credit cards, in exchange for a 1.9% admin fee.

| Category | Examples |

| Tax Payments |

|

| Education |

|

| Insurance |

|

| Rent (capped at S$10K) |

|

This can be particularly lucrative if you have the PB/PP version of the StanChart Beyond Card, as the cost per mile is reduced to just 0.95 cents.

| Card | Earn Rate | Cost Per Mile (1.9% admin fee) |

StanChart Beyond Card StanChart Beyond Card(PB & PP) |

2 mpd | 0.95¢ |

StanChart Beyond Card StanChart Beyond Card(Regular) |

1.5 mpd | 1.27¢ |

Unfortunately, Standard Chartered quietly nerfed EasyBill in December 2025 by imposing a limit of one payment per category per month.

7. The Qualified Cardholder is limited to 1 SC EasyBill application per payment type (as defined in Clause 2 above) every calendar month.

-Standard Chartered

For example, in the same month, you won’t be able to pay:

- Rent for more than one property

- Life and medical insurance

- Fees for more than one enrichment class

- Income tax and property tax

This effectively limits the number of miles you can buy through this facility.

Important: Investment and/or deposit requirement

It’s clear that Beyond is part of a big push by Standard Chartered for PB and PP customers.

But not just any PB or PP customers. In addition to the requirement to fully fund your account each month with the requisite AUM to enjoy the higher earn rates, there’s another clause in the T&Cs which states that you must carry out at least one eligible investment or eligible deposit each year to retain your benefits.

|

7. In order for a Beyond principal cardholder to continue to be eligible for the programmes, or part thereof, that are specially offered to Beyond principal cardholders who have a Priority Banking, Priority Private or Private Banking relationship with the Bank, i.e. the programmes listed under Clauses 1.1, 1.4, 1.7, the Beyond principal cardholder must carry out at least one (1) Eligible Investment or Eligible Deposit with the Bank within 12 months after the first renewal of the Beyond Card and yearly thereafter. Further details of this requirement will be provided in due course. This requirement will not apply for the first 12 months after the Beyond Card is issued to you. |

This requirement is waived for the first year.

I can’t find the definition of an Eligible Investment or Eligible Deposit in the Beyond Card’s T&Cs, but from what I understand, eligible investments refer to unit trusts, bonds, structured notes or equities. It excludes insurance policies, foreign currency exchange transactions and investments using the Central Provident Fund Investment Scheme / Supplementary Retirement Scheme.

If you fail to meet this requirement, you will not be eligible for the additional benefits accruing to PB or PP customers, namely:

- (PB & PP) The upsized earn rates

- (PB & PP) Airport limo rides

- (PP) Accor Plus Explorer Plus membership

Terms & Conditions

Summary Review: Standard Chartered Beyond Card

Standard Chartered Beyond Card Standard Chartered Beyond Card |

|

| 🦁 MileLion Verdict |

|

| Priority Private | |

| First Year | Recurring |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

☐ Take It ☑ Take It Or Leave It ☐ Leave It |

| Priority Banking | |

| First Year | Recurring |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

☐ Take It ☑ Take It Or Leave It ☐ Leave It |

| Regular | |

| First Year | Recurring |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

☐ Take It ☐ Take It Or Leave It ☑ Leave It |

Should you get a StanChart Beyond Card? Let’s lay out the scenarios.

If you’re a regular customer

If you’re a regular StanChart customer, the Beyond Card offers you:

- 100,000 miles welcome offer

- An uncapped 1.5/3 mpd earn rate

- Birthday meal

- Business Class upgrades

- Unlimited Priority Pass visits for principal cardholder, and up to four supplementary cardholders, plus 6x guests

- Generic World Elite Mastercard benefits

The 100,000 miles could certainly go some way towards covering the first year’s fee, but the S$20,000 minimum spend is a big barrier. If you’re eligible for welcome offers with other banks, that spending could potentially generate a higher return, with lower fees.

The uncapped earn rates are impressive, but they can be equalled by competitors like the DBS Vantage for SGD spend, and bested by Maybank cards where FCY spend is concerned.

If you had a big family, then the four unlimited Priority Pass memberships may be appealing, but you could also get the same with the HSBC Premier Mastercard, which has no annual fee provided you maintain a S$200K AUM.

I personally wouldn’t put much value on the Business Class upgrades, given how restrictive the terms are, and while the birthday meal is nice, it wouldn’t be something that sways my decision either.

So I’ll put it as a Take It Or Leave It, with a * saying that maybe if you don’t qualify for welcome offers with other cards, and maybe if you had a big family, then maybe this would be worth a one-year punt. I’m aware that doesn’t sound like a ringing endorsement, and that’s the point.

If you’re a Priority Banking customer

If you’re a StanChart PB customer, the Beyond Card offers you:

- 100,000 miles welcome offer

- 80,000 miles renewal offer

- An uncapped 2/3.5 mpd earn rate

- Birthday meal

- Business Class upgrades

- Unlimited Priority Pass visits for principal cardholder, and up to four supplementary cardholders, plus 6x guests

- Generic World Elite Mastercard benefits

- 2x airport limo rides

The incremental benefits over the regular version are improved earn rates, 2x airport limo rides, and 80,000 renewal miles.

Where earn rates are concerned, an uncapped 2 mpd on SGD spending beats any other competitor, but you’d have to spend a lot in order to generate sufficient miles to put a dent in the annual fee. And keep in mind, the Maybank cards could still be better for FCY spending, when you factor in their lower FCY transaction fee, and waivable annual fees.

So again, I don’t consider it a slam dunk by any means, unless you’re a big spender who doesn’t have any problem hitting the minimum spend for the welcome offer, and spends enough in SGD to make that 2 mpd count. That said, the 80,000 renewal miles provide a stronger basis for renewal, compared to the regular version.

If you’re a Priority Private customer

If you’re a StanChart PP customer, the Beyond Card offers you:

- 100,000 miles welcome offer

- 80,000 miles renewal offer

- An uncapped 2/4 mpd earn rate, with 8 mpd for dining

- Birthday meal

- Business Class upgrades

- Unlimited Priority Pass visits for principal cardholder, and up to four supplementary cardholders, plus 6x guests

- Generic World Elite Mastercard benefits

- 2x airport limo rides

- ALL Accor+ Explorer membership

The incremental benefits over the PB version are improved earn rates, and ALL Accor+ Explorer membership.

It used to be that PP members received an unlimited Priority Pass membership with one guest each time, but that was nerfed in June 2025 to 24 visits. No doubt that was intended to incentivise PP customers to take up the Beyond!

The earn rates for PP customers are head and shoulders above the competition, so if you’re the sort who spends big, especially overseas, then go ahead and get this card. You’ll be minting miles with those uncapped 4/8 mpd rates, though remember you’ll need to keep your AUM above S$1.5M every month!

So that’s my review of the StanChart Beyond Card. What do you think?

What SC gives in card benefits for PP and PB customers, it will claw back through low interest rates for deposits or high fees for investments. Not worth considering.

Invest in shares with your SCB funds if you really want PP/PB. No custody charges and brokerage fees similar to other banks I think. Sure there’s some capital risk but for example between cash in a local bank FD or shares of a local bank…..

Can’t believe I read through this junk. 😂

birthday meals and limo rides, how i wish Amex Plat Charge also learn from banks instead of being a overglorified coupon booklet.

weren’t u the one perpetually singing the over glorified praises of the amex charge in every other article comments section?

Doesn’t the SCB team think they are scamming their SCB customers with this type of card?

That is the point!

I am wondering that will I receive credit card point for my kids School fees in “other countries” since I am not currently residing in Singapore?

Will this be categorized as “Foreign spending” or “School fees” which in exclusion list?

Hi, does Cardup payment for income tax qualify for the 20k spending requirement for the welcome offer?

Does the 8 mpd stack with Kris+ when using it to pay for overseas dining?

it all boils down to MCC.

Is it worth signing up for this card to pay for income tax and get miles in return?

I applied online and got instantly approved. Check my credit limit, 0.7 my monthly salary, not expected 4x. This card makes sense for me, I am replacing Citi Prestige (no golf, no staying in hotel more than 2 days in a hotel, going on HelloBike to Changi – so no use of the limousine, and do it frequently, so 12 PP free visits is not enough) I spend quite a lot, my income is not only my regular salary, but with such credit limit it does not make sense to me. This card, if you are not in special relationship… Read more »

If you require a higher credit limit, you can simply request your RM to pledge the fixed deposit as collateral, amounting to the credit you need. It’s a straightforward process, and even foreigners like me are permitted to do so.

Does annual fee count towards 20k spend for welcome 40k miles

Nope

No Priority Pass card issued. Does that means benefit will be limited to lounge access only?

Non-lounge airport experiences also not available?

I want to highlight one disadvantage of SCB, for regular consumers. While not PP/PB the card makes sense to me given expected spending and complicated travel itineraries for which unlimited PP would be highly beneficial. In that I assumed that getting supplementary card would be an easy step, at least 5 weeks would be enough. It happen not to be the case. First thing, correct me if I am wrong there is no option to include the sup card holder at the point of application for the primary card. But with certainty for some weird reasons there is no way… Read more »

I did not get my free birthday meal and called in the PP hotline x 3, was told each time the RM would get in touch immediately but it never happened. Finally upon requesting change of RM, she finally called me and said she would look into it. That was a week ago and still havent heard back…SC really needs to work on their customer service…

Limo rides are now tied to your active investment with SCB PP, so you may not be entitled to the full entitlement. So I see this card as a means to overcome this. Incidentally, my qn is… aren’t these rides stacked on top of what I get as a SCB PP?

correct. the sc beyond card offers 2 limo rides, which stack with whatever you have from PP (8 rides)

Just to clarify further, the PP benefit of 8 comes in quarters, 2 for every quarter. Not sure when the additional 2 fro the Beyond card arrives though

Unfortunately Beyond is a Mastercard and all the promo rates offered by CardUp are for Visa cards only. 2mpd paired with 2.6% fee is actually worse than 1.5/1.6 mpd paired with 1.75% fee for the likes of DBS Vantage/OCBC VOYAGE Visa cards

why not use easybill?

Hi, any idea if I change status from PP to PB while holding the Beyond card – will i get the PB benefits for the same membership year? To me, the key is 2mpd for 1.9% fee from easybill – I got tons of education/insurance/rental bills to pay and 0.95 cpm is a definite plus point.

Revolut Metal – 17g

I just got the card a few days ago. I am a PB customer bordering on PP. Made the mistake of trying to pay rent without activating my card. Transaction got rejected and was counted as 1 rental transaction. Contacted live chat and they insisted that it is 1 application a month – regardless of whether it is rejected or not. Sounds illogical but that’s SCB for you. Reached out to my RM and still pending over the weekend. Will probably not bother to be PB.