Aside from insurance premiums, government services are probably the toughest category for earning credit card rewards in Singapore.

For as long as I can remember, most credit cards have excluded these transactions from earning points or miles. There used to be a few workarounds, but those have largely been nerfed over time (RIP GrabPay!).

That said, it’s not completely hopeless, and in this post we’ll cover the (limited) alternatives.

| 💳 What’s the Best Card for… | ||

| ❓ Overall Guide |

||

| ✈️ Air Tickets |

🌎 Amaze | 🛍️ Atome |

| 💰 CardUp | 🚗 Car Rental | 💗 Charity |

| 🍽️ Dining | 🏫 Education | ⚡ EV Charging |

| 🥡 Food Delivery | 🗳️ Govt Services | 🏨 Hotels |

| ☂️ Insurance | 📱 Kris+ | ⚕️ Medical |

| 🏖️ Overseas | 💊 Pharmacies | ⛽ Petrol |

| 🚍 Public Transport | 🛒 Supermarkets | 🚰 Utilities |

| 💒 Weddings | ||

What MCC do government services code as?

While government services technically use the entire MCC range from 9000 to 9999, the one you’ll encounter the most frequently is MCC 9399 Government Services (Not Elsewhere Classified).

Some examples of where you might encounter this include:

- ActiveSG bookings

- Bali tourism levy

- Certain tourist attractions run by government agencies (e.g. Palace of Versailles Paris)

- HealthHub and Health Buddy (though only for selected cards)

- HDB season parking

- OneMotoring road tax

- National parks passes

- SAFRA

- Singapore Management University school fees (other universities in Singapore code under the education MCC range)

- SingHealth and NHG pharmacy

- Visa or Electronic Travel Authorisation fees

Needless to say, all your usual government agencies like ACRA, ICA, LTA, NEA, NPB etc. will almost certainly code as 9399 too.

If you need to check the MCC of a particular merchant, there are three ways of looking it up before making a transaction:

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

Merchants in this MCC range typically pay below-average processing fees, which makes these transactions less profitable for banks, and hence more likely to be excluded from rewards.

| ❓ What about taxes? |

| IRAS does not accept credit card payments. If you want to learn about how to earn miles on your tax payments, refer to this post. |

Which credit cards earn rewards for government services?

As mentioned at the start, the vast majority of banks now exclude government services from earning points. Here’s a snapshot of each bank’s policy:

| Card Issuer | Awards Points for Government Services? |

| ✓ | |

| ✕ | |

|

✓ |

| ✕ | |

| ✕ | |

| ✕ | |

| ✕ | |

| ✕ | |

| ✕ | |

| ✕ |

This really only leaves the following cards as viable options.

| 🗳️ Best Cards For Government Services | |

| Card | Earn Rate |

AMEX Solitaire PPS Credit Card AMEX Solitaire PPS Credit CardApply |

1.3 mpd |

AMEX PPS Credit Card AMEX PPS Credit CardApply |

1.3 mpd |

AMEX HighFlyer Card AMEX HighFlyer CardApply |

1.2 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer AscendApply |

1.2 mpd |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit CardApply |

1.1 mpd |

Chocolate Visa Card Chocolate Visa CardApply |

1 mpd (Capped at 100 Max Miles per calendar month) |

AMEX Centurion AMEX CenturionApply |

0.98 mpd |

AMEX Platinum Charge AMEX Platinum ChargeApply |

0.78 mpd |

AMEX Platinum Reserve AMEX Platinum ReserveApply |

0.69 mpd |

AMEX Platinum Credit Card AMEX Platinum Credit CardApply |

0.69 mpd |

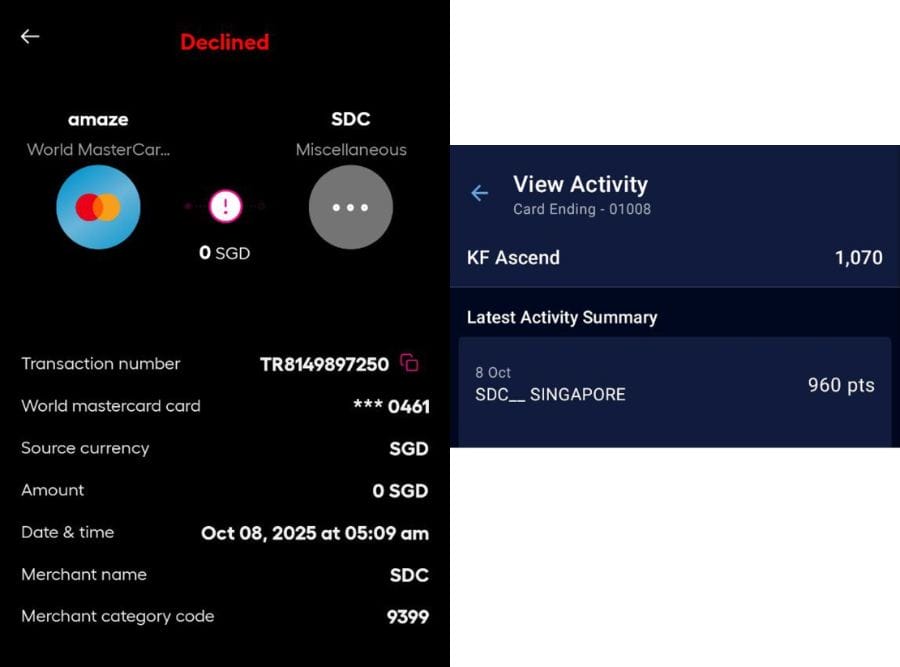

For what it’s worth, I’ve personally tested and verified that American Express cards do indeed earn points for government services. I used my AMEX KrisFlyer Ascend to pay for my Australia ETA and the MileLioness’ registration with Singapore Dental Council, and in both cases earned rewards.

The bigger problem is that American Express acceptance is far from universal. I should also state that HealthHub transactions do not earn rewards with American Express cards (presumably they’re excluded based on merchant name rather than MCC).

If American Express isn’t accepted, then the only remaining option is really the Chocolate Visa Debit Card, which will earn 1 Max Mile per S$1, though capped at a mere 100 Max Miles per calendar month (a cap that is shared with all other so-called “bill payments”).

Other ways to earn points on government services

If you really want to earn miles on government services, and don’t mind paying an admin fee, then you can consider using bill payment platforms like AXS Pay+Earn, CardUp, and Citi PayAll.

How it works is that your card is charged for the amount due plus an admin fee, and a bank transfer made in your name to the relevant agency. That said, not every government agency is available through these platforms. AXS probably has the widest range, including HDB, URA, town councils, and public hospitals.

Whether it’s “worth it” to buy miles at this price all boils down to how much you value a mile. The gold standard is of course to earn miles for free, but if you don’t have any of the abovementioned cards, then this is really the only option left.

Conclusion

Government services are notoriously difficult to earn rewards for, but if it so happens that American Express cards are accepted, then that’s really your only option (Chocolate Visa and its paltry cap aside).

Otherwise, you’ll have to pay an admin fee to earn miles through a platform like AXS Pay+Earn or CardUp— assuming the agency even accepts payments this way.

The 2.25% promo code now specifically excludes taxes

that’s because there’s an even cheaper code for paying taxes (not sure if it’s stil lvalid)

The 2.25% is the only one applicable for Mastercard. The rest are all for Visa (and UnionPay)