The AMEX Platinum Charge has launched a new welcome bonus for existing AMEX cardholders, which offers 98,250 bonus MR points with a minimum spend of S$3,000.

This is almost double the previous offer of 50,000 bonus MR points, and the best offer (based on the MR points to spend ratio) in more than two years. Surprisingly, it’s even more lucrative than the bonus for new-to-AMEX customers, who receive 110,000 bonus MR points with a minimum spend of S$8,000. While new customers receive 12% more MR points, their spending requirement is 267% higher!

Perhaps that’s just as well, given that last year AMEX significantly tightened its eligibility for sign-up bonuses. As it stands, even current and recently-cancelled supplementary cardholders are excluded from the new-to-AMEX definition.

However — and this changes the picture significantly — American Express will also be devaluing Membership Rewards transfers to airline miles on 23 February 2026. If you don’t receive your bonus before this date, you’ll receive 20% fewer miles— so it’s crucial to meet the minimum spend as quickly as possible.

AMEX Platinum Charge 98,250 bonus MR points welcome offer

AMEX Platinum Charge AMEX Platinum Charge |

|

| Apply |

|

| Existing AMEX customers | |

| Annual Fee | S$1,744 (must be paid) |

| Spend | S$3,000 |

| Spend Period | 90 days |

| Base Points | 3,750 MR points |

| Bonus Points | 98,250 MR points |

| Total Points | 102,000 MR points |

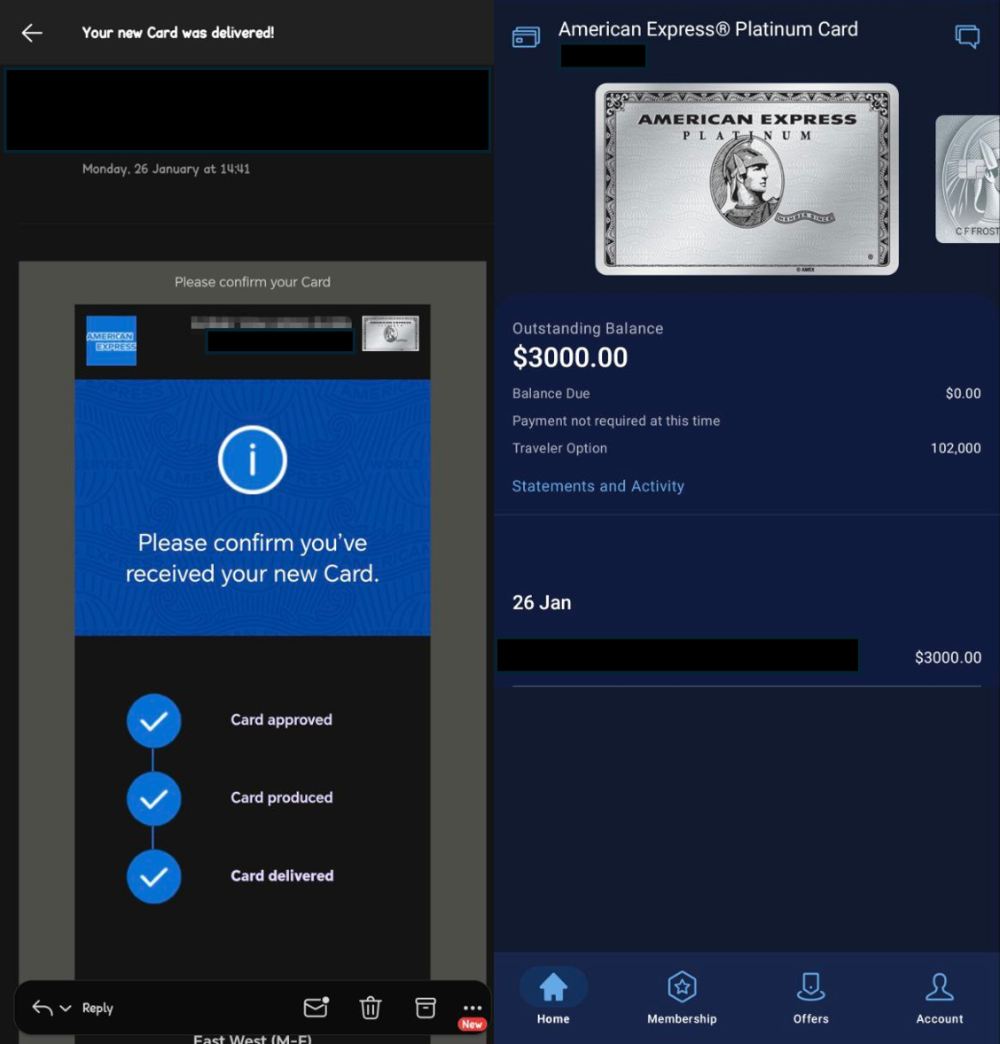

Existing AMEX customers who apply for an AMEX Platinum Charge and receive approval by 11 March 2026 will earn 102,000 MR points for spending S$3,000 within the first 90 days of approval.

This consists of:

- A welcome bonus of 98,250 MR points for meeting the minimum spend of S$3,000

- The regular 3,750 MR points for spending S$3,000

This offer is available to anyone who has not cancelled a principal AMEX Platinum Charge in the past 12 months prior to application. To be clear: you’re still eligible if you currently hold another AMEX Platinum card, such as the AMEX Platinum Credit Card or AMEX Platinum Reserve.

What counts as qualifying spend?

Qualifying spend refers to all online and offline retail purchases, whether in Singapore dollars or foreign currency, excluding the following transactions:

| ❌ Qualifying Spend Exclusions |

|

a) Charges processed and billed prior to the Enrolment Date or charges prepaid on any Card Account prior to the first billing statement for that Card Account following the Enrolment Date; |

For the avoidance of doubt, CardUp, private and non-profit hospital bills, charitable donations, education, and anything else not explicitly stated in the exclusion list will count as eligible spend. While American Express added charitable donations and education to its exclusions list on 1 October 2023, an exception was carved out for the AMEX Platinum Charge.

However, if you plan to use CardUp to meet the minimum spend, do note that there are certain restrictions on the type of payments that can be made with an AMEX card.

Spending by both principal and supplementary cardholders will be combined when determining whether the minimum spend threshold has been met.

When will bonus MR points be credited?

Officially, bonus MR points will be awarded within 12 weeks of meeting the minimum spend threshold.

Unofficially, however, there are numerous reports from recent applicants that their bonus points were credited much sooner, usually within one day of meeting the minimum spend.

This is crucial because of the upcoming Membership Rewards devaluation, which kicks in on 23 February 2026. On that date, the transfer ratios will be devalued for all eight frequent flyer programmes.

| Frequent Flyer Programme | Conversion Ratio (AMEX: Partner) |

|

| Plat Charge Centurion |

Others | |

|

500 : 250 |

550 : 250 |

500 : 250 |

550 : 250 |

|

500 : 250 |

550 : 250 |

|

|

600 : 250 |

650 : 250 |

|

500 : 250 |

550 : 250 |

|

500 : 250 |

550 : 250 |

500 : 250 |

550 : 250 |

|

|

500 : 250 |

550 : 250 |

Here’s how the size of your welcome offer will differ, depending on when you complete the minimum spend and get your points.

| 💳 Existing Customer Welcome Offer | ||

| Before 22 Feb 2026 | From 23 Feb 2026 | |

| Bonus Points | 98,250 MR points (61,406 miles) |

98,250 MR points (49,125 miles) |

For existing customers, your bonus will either be 61,406 miles (pre-devaluation) or 49,125 miles (post-devaluation).

So tl;dr: if you plan to sign up for this offer, make sure you beat the clock. If all else fails, consider using CardUp, which is offering a 2.35% admin fee for AMEX cards with the code OFF235.

Terms & Conditions

How does this compare to previous offers?

For the sake of comparison, here’s a summary of the recent welcome offers we’ve seen for the AMEX Platinum Charge.

| 💳 AMEX Platinum Charge Welcome Offers (Existing AMEX customer) |

||

| Date | Min. Spend | Bonus MR Points & Gifts |

| Current | S$3,000 | 98,250 |

| 1 Oct to 7 Jan 26 | S$3,000 | 50,000 |

| 31 Jul to 30 Sep 25 | S$3,000 | 45,000 |

| 29 May to 30 Jul 25 | S$4,000 | 95,000 + FCY spend bonus |

| S$8,000 | 150,000 + S$50 | |

| 17 Feb to 28 May 25 | S$8,000 | 150,000 + S$100 |

| 3 Dec 24 to 16 Feb 25 | S$8,000 | 88,000 + 2x Samsonite luggage or S$800 + 2x Samsonite luggage |

| 1 Oct to 2 Dec 24 | S$8,000 | 88,000 + Samsonite luggage + S$100 or Samsonite luggage + S$900 |

| 6-30 Sep 24 | S$8,000 | 120,000 + S$100 eCV |

| 24 Jul – 5 Sep 24 | S$8,000 | 120,000 |

| 1-23 Jul 24 | S$8,000 | 93,000 |

| 30 May-30 Jun 24 | S$6,000 | 85,000 |

| 5 Apr-29 May 24 | S$6,000 | 127,500 |

| 29 Feb – 4 Apr 24 | S$6,000 | 80,000 |

| 29 Jan – 28 Feb 24 | S$6,000 | 85,000 |

| 12-26 Sep 23 | S$8,000 | 60,000 |

| 5-11 Sep 23 | S$8,000 | 60,000 |

| Spending time periods may not be the same across all offers; refer to the respective articles for the full details | ||

For existing AMEX cardholders, this is the most generous welcome offer in more than two years (based on a the MR points to spend ratio).

AMEX Platinum Charge: Key benefits

AMEX Platinum Charge cardholders can enjoy benefits such as:

- S$800 of dining, lifestyle, and travel credits each calendar year

- 6x free meals for two diners each year under the Table for Two programme

- COMO Club C5 membership (no birthday benefits for newly fast-tracked members)

- Unlimited airport lounge access for the cardholder + 1 guest

- Priority Pass Lounges

- Centurion Lounges (2 guests allowed)

- Plaza Premium Lounges

- One complimentary hotel night every membership year

- Tower Club access

- Tower Club & assorted dining vouchers

- Access to the American Express Fine Hotels + Resorts programme, which offers perks such as free breakfast, room upgrades (subject to availability), a US$100 experience credit and guaranteed late check-out

- Hilton Honors Gold status, Marriott Bonvoy Gold Elite status, Pan Pacific DISCOVERY Platinum status & Radisson Rewards Premium status

- American Express Love Dining

- American Express Chillax

- Platinum Golf privileges

Conclusion

AMEX Platinum Charge AMEX Platinum Charge |

||

| Apply |

American Express is now offering existing AMEX cardholders up to 98,250 bonus MR points as a welcome gift, which given the S$3,000 minimum spend is actually not too bad a deal.

You’ll of course want to make sure you can extract more than S$1,744 worth of value from the card however, so be sure to read my updated guides for 2026, which cover changes to the Platinum Statement Credits and the new Table for Two benefit.

If you’ve decided to pull the trigger, be sure to meet the minimum spend ASAP so your points can arrive before the devaluation takes place!

Now swaying me back to applying for one since I’m still considered an existing Amex customer. Hmmmmmmm

I hold a highflyer card. Does that make me an existing customer?

If I was a plat charge supplementary cardholder but my main card holder cancelled recently, am I eligible to be an existing customer for this promo?

existing customer definition: You do not previously hold a basic Platinum Card from American Express that was terminated or otherwise cancelled in the last twelve (12) months prior to the application.

basic= principal.

AMEX really screwed up on this… I was a really happy customer until I had to renew my Plat charge card and when they nerfed the benefits and excluded me as an ‘existing’ cardholder even when I was willing to spend to at least make it more worthwhile – I don’t golf and some of the other benefits I just don’t use,so I had to cancel and endure some really useless conversations… then now this… what?!

Now i am a bit swayed lol

I canceled the charge card last year Jan.

So if i reapply this month, I will be excluded from the existing card holder offer…

Guess will wait till next month or March…..

If I am new to Amex customer, can i apply for another AMEX card, then apply for this 1 week later to take advantage of both promotions?

must the min spend be one off or can it be multiple purchase and add up to 3000?

multiple is fine