The AMEX Platinum Charge has launched a new welcome bonus worth up to 230,000 bonus MR points, available to new-to-AMEX customers who make a minimum spend of S$8,000.

While this is significantly higher than the previous welcome offer, it’s important to understand how it’s structured. Only 110,000 bonus MR points will be awarded in the first year. The remaining 120,000 bonus MR points will be awarded in the 15th month after approval, i.e. the second year of membership. American Express is basically promising a retention bonus for keeping the card beyond the first year.

There is no change to the welcome offer for existing AMEX customers, which remains at 98,250 bonus MR points with a minimum spend of S$3,000. This is arguably the better of the two offers, given the much lower spending requirement and the fact that you receive the full points in the first year, rather than having to commit to a second year of membership.

Now, here’s the really interesting thing. Your bonus, in terms of miles, will depend on how fast you act, because of the upcoming Membership Rewards devaluation on 23 February 2026. If you can “beat the clock”, the welcome bonus for new and existing customers is 128,750 miles/61,406 miles. If you can’t, it’s 115,000 miles/49,125 miles.

So if you do intend to pull the trigger, you should also have a game plan to hit the minimum spend as soon as possible, whether it’s a big ticket purchase or CardUp.

AMEX Platinum Charge welcome offers

AMEX Platinum Charge AMEX Platinum Charge |

||

| Apply (New) |

||

| Apply (Existing) | ||

| New | Existing | |

| Annual Fee | S$1,744 (must be paid) |

S$1,744 (must be paid) |

| Spend | S$8,000 | S$3,000 |

| Spend Period | 90 days | 90 days |

| Base Points | 10,000 MR points |

3,750 MR points |

| Bonus Points #1 | 110,000 MR points |

98,250 MR points |

| Bonus Points #2 (awarded in 15th month) |

120,000 MR points |

N/A |

| Total Points | 240,000 MR points |

102,000 MR points |

New-to-AMEX customers

| ⚠️ Eligibility Criteria |

|

New-to-AMEX customers who apply for an AMEX Platinum Charge and receive approval by 11 March 2026 will earn 240,000 MR points for spending S$8,000 within the first 90 days of approval.

This consists of:

- A welcome bonus of 110,000 MR points for meeting the minimum spend of S$8,000

- The regular 10,000 MR points for spending S$8,000

- A further bonus of 120,000 MR points for making a spend of any amount in the 15th month of card membership

This is the first time I’ve seen a welcome offer structured this way. American Express is basically giving a 110,000 MR points welcome offer, plus a 120,000 MR points retention offer. If you want the full number of points, you’re implicitly undertaking to hold the card for at least two years, which means paying the S$1,744 annual fee twice.

As an aside, I do wonder what this means for the unofficial renewal offers. It’s an open secret that if you call up AMEX, you can usually get at least 20,000 MR points for renewing your card, or even more depending on your annual spending. But with this new mechanic, they could very well argue that you’re already getting a renewal bonus. We’ll have to see, I guess.

Existing AMEX customers

| ⚠️ Eligibility Criteria |

|

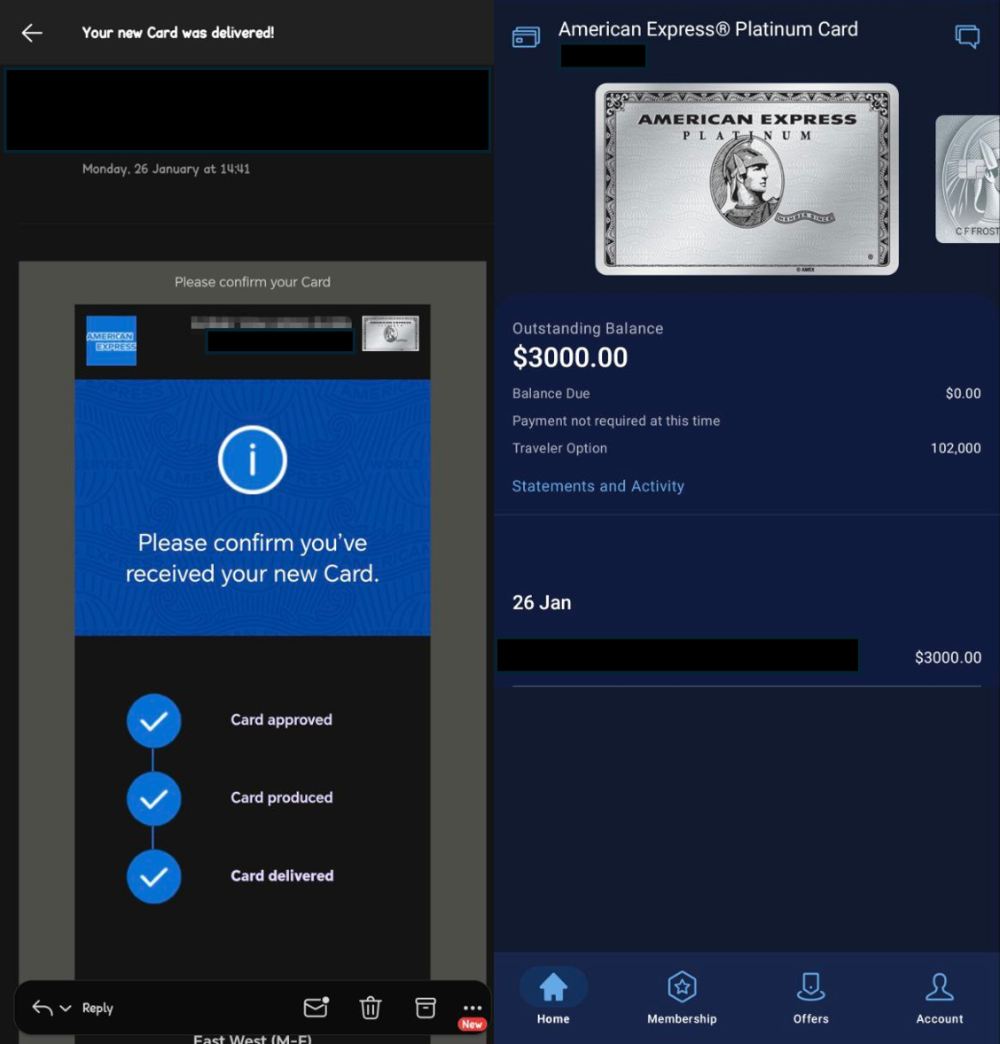

Existing customers who apply for an AMEX Platinum Charge and receive approval by 31 March 2026 will earn 102,000 MR points for spending S$3,000 within the first 90 days of approval.

This consists of:

- A welcome bonus of 98,250 MR points for meeting the minimum spend of S$3,000

- The regular 3,750 MR points for spending S$3,000

Surprisingly, this feels like the superior offer, given that the minimum spend is 37.5% of the new customer offer, and you don’t need to commit to a second year of membership.

What counts as qualifying spend?

Qualifying spend refers to all online and offline retail purchases, whether in Singapore dollars or foreign currency, excluding the following transactions:

| ❌ Qualifying Spend Exclusions |

|

a) Charges processed and billed prior to the Enrolment Date or charges prepaid on any Card Account prior to the first billing statement for that Card Account following the Enrolment Date; |

For the avoidance of doubt, CardUp, private and non-profit hospital bills, charitable donations, education, and anything else not explicitly stated in the exclusion list will count as eligible spend. While American Express added charitable donations and education to its exclusions list on 1 October 2023, an exception was carved out for the AMEX Platinum Charge.

However, if you plan to use CardUp to meet the minimum spend, do note that there are certain restrictions on the type of payments that can be made with an AMEX card.

Spending by both principal and supplementary cardholders will be combined when determining whether the minimum spend threshold has been met.

When will bonus MR points be credited?

Officially, bonus MR points will be awarded within 12 weeks of meeting the minimum spend threshold.

Unofficially, however, there are numerous reports from recent applicants that their bonus points were credited much sooner, usually within one day of meeting the minimum spend.

This is crucial because of the upcoming Membership Rewards devaluation, which kicks in on 23 February 2026. On that date, the transfer ratios will be devalued for all eight frequent flyer programmes.

| Frequent Flyer Programme | Conversion Ratio (AMEX: Partner) |

|

| Plat Charge Centurion |

Others | |

|

500 : 250 |

550 : 250 |

500 : 250 |

550 : 250 |

|

500 : 250 |

550 : 250 |

|

|

600 : 250 |

650 : 250 |

|

500 : 250 |

550 : 250 |

|

500 : 250 |

550 : 250 |

500 : 250 |

550 : 250 |

|

|

500 : 250 |

550 : 250 |

Here’s how the size of your welcome offer will differ, depending on when you complete the minimum spend and get your points.

| 💳 New Customer Welcome Offer | ||

| Before 22 Feb 2026 | From 23 Feb 2026 | |

| Bonus Points #1 | 110,000 MR points (68,750 miles) |

110,000 MR points (55,000 miles) |

| Bonus Points #2 | 120,000 MR points (60,000 miles) |

|

| Total | 230,000 MR points (128,750 miles) |

230,000 MR points (115,000 miles) |

For new customers, your bonus will either be 128,750 miles (pre-devaluation), or 115,000 miles (post-devaluation). Note that there is no avoiding the devaluation on the second component of the offer, as it will be credited 15 months down the road, long after the devaluation has come into effect.

| 💳 Existing Customer Welcome Offer | ||

| Before 22 Feb 2026 | From 23 Feb 2026 | |

| Bonus Points | 98,250 MR points (61,406 miles) |

98,250 MR points (49,125 miles) |

For existing customers, your bonus will either be 61,406 miles (pre-devaluation) or 49,125 miles (post-devaluation).

So tl;dr: if you plan to sign up for this offer, make sure you beat the clock. If all else fails, consider using CardUp, which is offering a 2.35% admin fee for AMEX cards with the code OFF235.

Terms & Conditions

How does this compare to previous offers?

For the sake of comparison, here’s a summary of the recent welcome offers we’ve seen for the AMEX Platinum Charge.

The new-to-AMEX offer is difficult to compare with prior periods, given the way it’s structured, but the existing customer offer is the most generous welcome offer in more than two years (based on the MR points to spend ratio).

New-to-AMEX customers

| 💳 AMEX Platinum Charge Welcome Offers (New-to-AMEX) |

||

| Date | Min. Spend | Bonus MR Points & Gifts |

| Current | S$8,000 | 230,000 |

| 13 Nov 25 to 27 Jan 26 | S$8,000 | 110,000 |

| 1 Oct to 12 Nov 25 | S$8,000 | 100,000 |

| 31 Jul to 30 Sep 25 | S$8,000 | 80,000 |

| 29 May to 30 Jul 25 |

S$4,000 | 95,000 + FCY spend bonus |

| S$8,000 | 150,000 + S$50 | |

| 17 Feb to 28 May 25 | S$8,000 | 150,000 + S$100 |

| 3 Dec 24 to 16 Feb 25 | S$8,000 | 88,000 + 2x Samsonite luggage or S$800 + 2x Samsonite luggage |

| 1 Oct to 2 Dec 24 | S$8,000 | 88,000 + Samsonite luggage + S$100 or Samsonite luggage + S$900 |

| 6-30 Sep 24 | S$8,000 | 131,000 + S$100 eCV |

| 24 Jul – 5 Sep 24 | S$8,000 | 131,000 |

| 1-23 Jul 24 | S$8,000 | 93,000 |

| 30 May-30 Jun 24 | S$6,000 | 132,500 |

| 9-29 May 24 | S$6,000 | 127,500 + S$350 voucher or Samsonite luggage |

| 1 Apr-8 May 24 | S$10,000 | 137,500 |

| 1-31 Mar 24 | S$6,000 | 127,500 + RC stay |

| 29 Jan – 28 Feb 24 | S$6,000 | 132,500 + S$200 voucher |

| 27 Sep 23- 28 Jan 24 | S$6,000 | 132,500 |

| 12-26 Sep 23 | S$8,000 | 60,000 + Samsonite luggage |

| 5-11 Sep 23 | S$10,000 | 100,000 |

| Spending time periods may not be the same across all offers; refer to the respective articles for the full details |

||

Existing customers

| 💳 AMEX Platinum Charge Welcome Offers (Existing AMEX customer) |

||

| Date | Min. Spend | Bonus MR Points & Gifts |

| Current | S$3,000 | 98,250 |

| 1 Oct to 7 Jan 26 | S$3,000 | 50,000 |

| 31 Jul to 30 Sep 25 | S$3,000 | 45,000 |

| 29 May to 30 Jul 25 | S$4,000 | 95,000 + FCY spend bonus |

| S$8,000 | 150,000 + S$50 | |

| 17 Feb to 28 May 25 | S$8,000 | 150,000 + S$100 |

| 3 Dec 24 to 16 Feb 25 | S$8,000 | 88,000 + 2x Samsonite luggage or S$800 + 2x Samsonite luggage |

| 1 Oct to 2 Dec 24 | S$8,000 | 88,000 + Samsonite luggage + S$100 or Samsonite luggage + S$900 |

| 6-30 Sep 24 | S$8,000 | 120,000 + S$100 eCV |

| 24 Jul – 5 Sep 24 | S$8,000 | 120,000 |

| 1-23 Jul 24 | S$8,000 | 93,000 |

| 30 May-30 Jun 24 | S$6,000 | 85,000 |

| 5 Apr-29 May 24 | S$6,000 | 127,500 |

| 29 Feb – 4 Apr 24 | S$6,000 | 80,000 |

| 29 Jan – 28 Feb 24 | S$6,000 | 85,000 |

| 12-26 Sep 23 | S$8,000 | 60,000 |

| 5-11 Sep 23 | S$8,000 | 60,000 |

| Spending time periods may not be the same across all offers; refer to the respective articles for the full details | ||

AMEX Platinum Charge: Key benefits

AMEX Platinum Charge cardholders can enjoy benefits such as:

- S$800 of dining, lifestyle, and travel credits each calendar year

- 6x free meals for two diners each year under the Table for Two programme

- COMO Club C5 membership (no birthday benefits for newly fast-tracked members)

- Unlimited airport lounge access for the cardholder + 1 guest

- Priority Pass Lounges

- Centurion Lounges (2 guests allowed)

- Plaza Premium Lounges

- One complimentary hotel night every membership year

- Tower Club access

- Tower Club & assorted dining vouchers

- Access to the American Express Fine Hotels + Resorts programme, which offers perks such as free breakfast, room upgrades (subject to availability), a US$100 experience credit and guaranteed late check-out

- Instant Hilton Honors Gold, Marriott Bonvoy Gold Elite, Pan Pacific DISCOVERY Platinum & Radisson Rewards Premium

- American Express Love Dining

- American Express Chillax

- Platinum Golf privileges

Conclusion

AMEX Platinum Charge AMEX Platinum Charge |

||

| Apply |

American Express has launched a new welcome offer worth up to 230,000 bonus MR points for new-to-AMEX customers who meet a minimum spend of S$8,000. The catch is that only 110,000 MR points are awarded in the first year. The remaining 120,000 MR points will be credited in the 15th month after approval, which forces you to hold the card for at least two years.

If you ask me, the offer for existing AMEX cardholders is more lucrative, with up to 98,250 bonus MR points with a minimum spend of just S$3,000.

Regardless of which offer you choose, it’s crucial that you meet the minimum spend as soon as possible, because MR points will be devalued on 23 February 2026. While AMEX officially quotes a lead time of 12 weeks for fulfillment, in practice the actual fulfillment appears to be much quicker.

You’ll of course want to make sure you can extract more than S$1,744 worth of value from the card, so be sure to read my updated guides for 2026, which cover changes to the Platinum Statement Credits and the new Table for Two benefit.

is it fair to say i can use this card for my wedding to rack up miles each time it launches miles offer for existing customer?

Hi Aaron GXFC,

I am an existing Plat holder and due for renewal (with only 30k renewal benefits), I tried apply thru your link but was rejected by AMEX stating I have submitted too many applications. Pls advice should I cancel my current card then apply thru your link, or any other ways. Thanks.