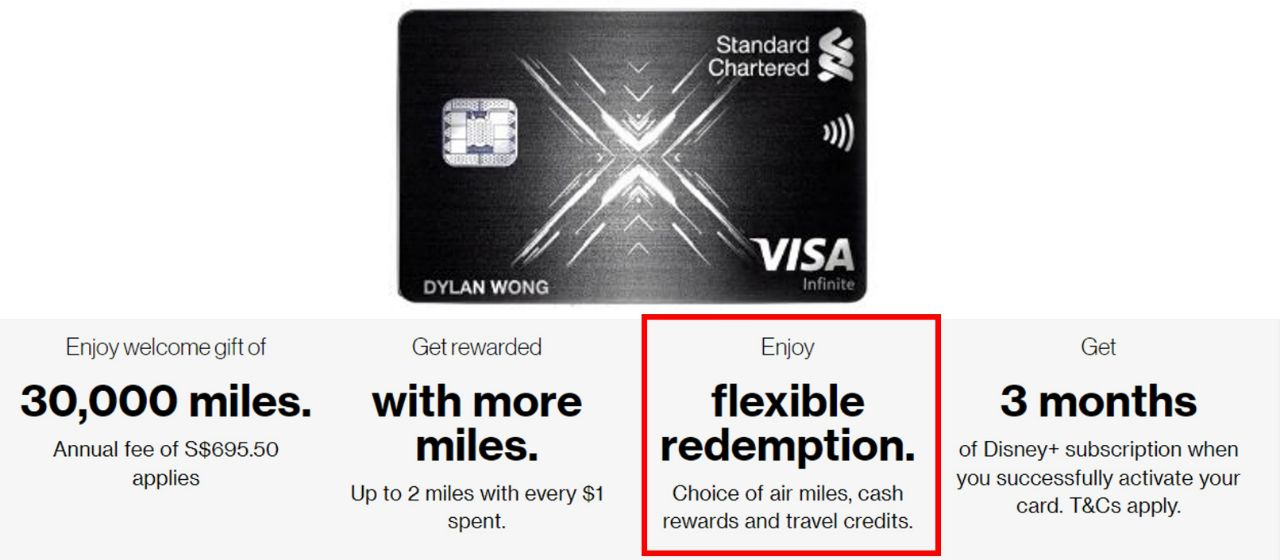

Is it just me, or is there something about the Standard Chartered X Card that automatically makes people assume the worst?

That would explain the frequent emails I get asking whether Standard Chartered no longer partners with KrisFlyer, or whether Standard Chartered has devalued its points transfer rate, or whether Standard Chartered is forcing customers to cough up multiple conversion fees (no to all, though their awful IT setup is partially to blame).

No, SCB hasn’t removed KrisFlyer miles transfers (and other misconceptions)

And now, there’s a new communique from Standard Chartered that’s causing some additional distress. Yesterday, the following SMS went out to SCB X Card customers:

Dear X Cardholder, please be informed that redemption of Rewards Points to offset Travel Purchase Qualifying Transactions will temporarily be unavailable from 25 April 2022 until further notice. Please visit StanChart website under Visa Infinite X Credit Card for more information. Thank you.

Does this mean that Standard Chartered rewards points can no longer be used for miles redemptions?

If you answered “no, of course not, why would you even think that”, then gold star for you. Close your browser (don’t forget to clear your search history) and head out for some fresh, maskless air.

For everyone else, read on…

SCB X Card suspends travel credit option

From 25 April 2022, SCB X Card members will no longer be able to offset qualifying travel purchases with their rewards points until further notice.

This doesn’t mean that you can’t transfer rewards points to airline miles or hotel loyalty programmes. Transfers continue as before, at the same ratios and with the same fees.

What this refers to is the travel credit feature, which allowed SCB X Card customers to offset the following transactions with rewards points:

|

|

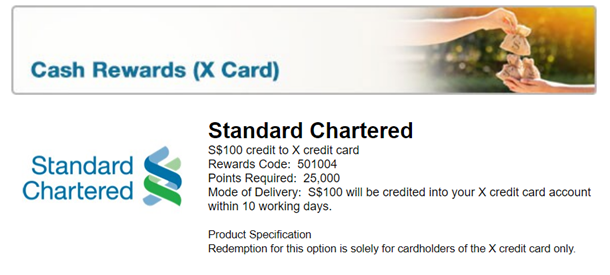

The rate on offer was 250 rewards points= S$1, so to illustrate, a customer could use 2,500 rewards points to offset S$10 from a S$500 air ticket purchase. Since rewards points can be redeemed for miles at a 5:2 ratio (it’s slightly worse for some airlines), customers are implicitly accepting a value of 1 cent per mile.

Leaving aside the miserable value, this feature is close to useless, because the rate is identical to what you can get when converting rewards points to unrestricted cashback. For example, an SCB X Card customer can redeem 25,000 rewards points for a S$100 statement credit that can be used to offset any kind of transaction.

The most you can say about the travel credit option is that it breaks up the minimum block, allowing cash outs of smaller amounts.

But really, if your goal was to save cash on travel, you’d be much better off using a card like the UOB Absolute Cashback and earning 1.7% cashback from the get go.

The SCB X Card earns 3 rewards points per S$1 on local currency spending (1.2 mpd), so your effective rebate is only 1.2%! Sure, it earns 5 rewards points per S$1 on foreign currency spending (2 mpd), but that 2% rebate is more than offset by the hefty 3.5% FCY fee you’ll pay.

So tl;dr:

What’s the future of the SCB X Card?

In all my time writing about miles, I’ve never seen a product quite as strange as the SCB X Card.

The X Card launched with a mega 100,000 miles sign-up bonus, the likes of which we’d never seen in Singapore. The offer proved so popular the bank had to pull it after just six days, and it was clear that Standard Chartered had badly underestimated demand, so much so that it had to suspend new applications, At one point, the X Card had been closed for applications twice as long as it was open!

But having gone through all that expense of acquiring customers, you’d think they’d be keen to retain them. After all, the big draw of the X Card was its sign-up bonus; take that away and it was hopelessly mediocre, offering just two free lounge visits and, um, complimentary travel insurance.

And yet, no significant enhancements have been made to the X Card since launch. Is it no wonder then, that every year around July (when the bulk of existing cardholders signed up) the recurring question that’s asked is whether to keep or cancel it?

The X Card now feels like an abandoned project, a mass exodus only forestalled by waiving its “strictly non-waivable” S$695.50 annual fee (first in 2020, then in 2021). I’m quite certain it wasn’t cheap for to develop or launch this product, so what’s the game plan here?

No one knows.

Probably not even Standard Chartered.

Conclusion

SCB X Card customers will soon be unable to redeem rewards points for travel credit, a feature that absolutely no one should care about anyway. They can continue to transfer their rewards points to Standard Chartered’s seven airline and two hotel partners, and that’s really all that matters.

July’s coming soon…

I forgot I still own the card until that SMS arrived.

Meaning you don’t get weekly calls for personal loans?

I had to block that number, those agents are relentless

Why SC just cancel the visa infinite card and put X cards same benefit as Visa infinite.

*Why not

it’s interesting you mention this, because at one point that might very well have been the plan. and then they revived the VI unexpectedly: https://milelion.com/2021/01/17/back-from-the-dead-standard-chartered-visa-infinite-returns-with-35000-welcome-miles/

Why is X Card?

Because it is metal card

This card is still alive…. Goodness gracious……

I never owned a metal card but I’d they added more benefits, I won’t mind applying