Welcome to the 2024 edition of the $120K Credit Card Showdown, my annual look at the finest pieces of plastic (or metal) that money can buy.

$120K cards come with hefty annual fees that are generally non-waivable, so before you hop onboard, you’ll want to have a game plan for extracting maximum value. In the seventh iteration of this guide, I’ll walk through all the important aspects to see which $120K card (if any!) is right for you.

What is the $120K segment?

The credit card market in Singapore can be broadly segmented into three tiers, which I’ve illustrated below with helpful band descriptors.

At the bottom are entry-level cards like the Citi PremierMiles, DBS Altitude and HSBC Revolution. The income requirement here is the MAS-mandated minimum of S$30,000, and benefits are limited to a few free lounge visits or generic bank discounts.

At the top are invitation-only cards like the AMEX Centurion, Citi ULTIMA, DBS Insignia, and UOB Reserve. Income requirements here are well in excess of S$500,000; benefits include who-do-you-want-killed concierge services, and invitations to events on Epstein-esque private islands.

In between those two you’ll find the mass-affluent tier, otherwise known as the $120K segment (note that despite the name, income requirements actually range from S$120,000 to S$150,000).

This, arguably, is the sweet spot. While nowhere as glamorous as the $500K segment, annual fees are ~80% lower and perks still include unlimited lounge access, complimentary airport transfers and exclusive hotel offers. Some sport metal cardstock too, for that extra premium feel.

The $120K candidates

| 💳 $120K Candidates | |

|

|

| AMEX Platinum Reserve Plastic |

Citi Prestige Metal |

|

|

| DBS Vantage Metal |

HSBC Visa Infinite Plastic |

|

|

| Maybank Visa Infinite Plastic |

OCBC VOYAGE Metal |

|

|

| SCB Visa Infinite Plastic |

UOB VI Metal Card Metal |

There is no change to the $120K card lineup for 2024, featuring the same eight faces that contested the 2023 edition. No $120K cards have been added to the market since last year, although there is a new look for the AMEX Platinum Reserve.

To address some common questions:

- The AMEX Platinum Charge is not featured because its annual fee is 3X that of the $120K segment, making a fair comparison close to impossible

- I don’t include $120K cards like the Bank of China Visa Infinite and CIMB Visa Infinite, because they earn cashback instead of points

- The UOB Lady’s Solitaire Card is not included because it’s less of a general spending card and more of a specialised spending option

What’s changed since last year?

Here’s a quick snapshot of what’s changed since the previous $120K showdown in June 2023.

AMEX Plat. Reserve AMEX Plat. Reserve |

|

| 👍 Improvements | 👎 Devaluations |

|

|

Citi Prestige Citi Prestige |

|

| 👍 Improvements | 👎 Devaluations |

|

|

DBS Vantage DBS Vantage |

|

| 👍 Improvements | 👎 Devaluations |

|

|

HSBC Visa Infinite HSBC Visa Infinite |

|

| 👍 Improvements | 👎 Devaluations |

|

|

Maybank Visa Infinite Maybank Visa Infinite |

|

| 👍 Improvements | 👎 Devaluations |

|

|

OCBC VOYAGE OCBC VOYAGE |

|

| 👍 Improvements | 👎 Devaluations |

|

|

SCB Visa Infinite SCB Visa Infinite |

|

| 👍 Improvements | 👎 Devaluations |

|

|

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

|

| 👍 Improvements | 👎 Devaluations |

|

|

And now, the head to head!

Annual fees and welcome/renewal gifts

| Card | Annual Fee | Welcome Gift |

AMEX Plat. Reserve AMEX Plat. Reserve |

S$545 | 1N stay at Fraser properties + dining & lifestyle vouchers 🔁 Recurring |

Citi Prestige Citi Prestige🥇 Winner 🥇 |

S$545 | 25,000 miles 🔁 Recurring |

DBS Vantage DBS Vantage |

S$599.50 | 25,000 miles 🔁 Recurring |

HSBC Visa Infinite HSBC Visa Infinite |

S$662.15 (S$497.12 for HSBC Premier) |

35,000 miles |

Maybank Visa Infinite Maybank Visa Infinite |

S$654 (1st yr. free) |

None |

OCBC VOYAGE OCBC VOYAGE |

S$498 |

15,000 miles 🔁 Recurring |

SCB Visa Infinite SCB Visa Infinite |

S$599.50 | 35,000 miles |

UOB VI Metal Card UOB VI Metal Card |

S$654 | 25,000 miles 🔁 Recurring |

If you want to join the $120K club, you’d better get used to the idea of paying annual fees, and not insignificant ones. The annual fee for a $120K card ranges from $498 to S$662, and fees have increased for the past two consecutive years owing to the GST hike from 7% to 9%.

| 💸 Annual Fee Waiver? |

|

While $120K cards generally don’t provide annual fee waivers, there are a few exceptions:

|

On the bright side, most $120K cards cushion the blow by offering miles in exchange for the annual fee.

- The Citi Prestige, DBS Vantage, OCBC VOYAGE, and UOB VI Metal Card offer bonus miles each year the annual fee is paid

- The HSBC Visa Infinite and StanChart Visa Infinite offer bonus miles only in the first year, as a one-time welcome gift. No miles are officially given upon renewal, but unofficially, customers who call up and complain are sometimes placated with 20,000-25,000 miles (YMMV)

- The AMEX Platinum Reserve does not offer miles with the annual fee, but renewing members receive another 1N Fraser Hospitality voucher upon renewal, plus other dining and spa vouchers

- The Maybank Visa Infinite does not offer miles with the annual fee, but waives the first year’s fee

If we’re just looking at the first year, the winner would be the HSBC Visa Infinite. Cardholders receive 35,000 miles in exchange for a S$497.12 annual fee, which works out to 1.42 cents per mile.

However, this only applies if you’re a HSBC Premier customer (min. AUM: S$200,000). For regular customers, the annual fee is a much higher S$662.15, or 1.89 cents per mile. In that case, the Standard Chartered Visa Infinite would offer cheaper miles at 1.71 cents per mile.

But my opinion is that we should look at this on an recurring basis, and in that case the Citi Prestige offers the best deal: S$545 for 25,000 miles each year, or 2.18 cents each.

2.18 cents per mile may sound expensive, but remember: you’re not just buying miles with the annual fee, you’re buying other benefits like lounge access that need to be factored into the equation as well.

Sign-up bonus

While renewing certain $120K cards may be a marginal proposition, the first year of membership can be considerably more lucrative thanks to sign-up bonuses.

At the time of writing, sign-up bonuses are offered by the AMEX Platinum Reserve, Citi Prestige, DBS Vantage, OCBC VOYAGE and UOB VI Metal Card.

| ❓ Sign-up bonus vs welcome/renewal gift |

|

Sign-up bonuses are different from welcome/renewal gifts. Sign-up bonuses refer to bonus miles awarded for meeting a certain minimum spend within a certain period of approval. Welcome/renewal gifts are bonus miles awarded for simply paying the annual fee, without any spend necessary. |

When comparing sign-up bonuses, there’s two things to consider:

- Is the bonus available to both new-to-bank and existing customers?

- What’s the payoff ratio (in terms of miles to spend)?

Based on this, the Citi Prestige would be the winner. Its welcome offer is available to both new and existing Citi cardholders, with a payoff ratio of 25. Keep in mind, it used to be even better- from August 2023 to February 2024, the welcome offer was 71,000 miles with the same S$2,000 minimum spend!

In second place — assuming you’re a new-to-bank customer— is the DBS Vantage, which is now offering its best-ever sign-up bonus of 85,000 miles for S$4,000 minimum spend. For comparison, when the card first launched, the offer was 80,000 miles for S$8,000 spend.

The UOB VI Metal Card offers something for both new and existing customers, but with a more payoff ratio of 10 (existing) or 20 (new). Since its annual fee is higher than the Vantage, this puts it in third for me.

Next is the OCBC VOYAGE, which in a policy change from 2023, now requires that applicants be new-to-bank, and only awards 40,000 miles for S$3,500 of spending.

And finally, the AMEX Platinum Reserve, which has a hefty minimum spend of S$10,000 for which you only get 22,222 bonus miles.

| ⚠️ Overlap with previous section |

| Sign-up bonus figures include the welcome miles from the previous section. For example, new-to-bank customers who apply for a DBS Vantage Card enjoy 85,000 miles, of which 25,000 miles come from paying the annual fee. |

Earn rates

| Card | Local | FCY | Min. Spend for Points |

AMEX Plat. Reserve AMEX Plat. Reserve |

0.69 mpd | 0.69 mpd | S$1.60 |

Citi Prestige Citi Prestige |

1.3 mpd^ | 2 mpd^ | S$1 |

DBS Vantage DBS Vantage |

1.5 mpd | 2.2 mpd | S$1.34 (SGD) S$0.91 (FCY) |

HSBC Visa Infinite HSBC Visa Infinite |

1 mpd | 2 mpd | S$0.20 |

Maybank Visa Infinite Maybank Visa Infinite |

1.2 mpd | 2 mpd | S$5 |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd |

2.2 mpd | S$5 |

SCB Visa Infinite SCB Visa Infinite🥇 Winner 🥇 |

1.4 mpd# | 3 mpd# | S$0.20 |

UOB VI Metal Card UOB VI Metal Card |

1.4 mpd | 2.4 mpd | S$5 |

| ^Additional 0.02 to 0.12 mpd awarded based on tenure with bank #With minimum S$2K spend per statement month. Otherwise 1 mpd for both |

|||

For the record: you shouldn’t be spending a lot on your $120K card, because of the opportunity cost involved. Think about it: every dollar you put on your $120K card is a dollar that doesn’t go towards a specialised spending card, and with specialised spending cards earning 4 mpd, that is a lot of foregone miles.

But for argument’s sake, we’ll take the perspective of someone who does spend regularly on their $120K card (maybe you’re such a big spender you’ve busted your bonus caps already).

If that describes you, then the StanChart Visa Infinite would be the best bet with its 1.4/3 mpd earn rates for local/overseas spend. However, we need to put a big asterisk on that because those rates only apply if you spend at least S$2,000 per statement month. Fail to do so, and it’s a pitiful 1 mpd across the board.

If you don’t want to bother with minimum spends, the next best would be the UOB VI Metal Card, which since June 2023 has earned 1.4/2.4 mpd for local/overseas spend.

| 💳 OCBC Premier VOYAGE |

| It’s worth mentioning that if you qualify for an OCBC Premier VOYAGE (min AUM: S$200,000), you’ll enjoy earn rates of 1.6/2.3 mpd for local/overseas spend. |

But the UOB VI Metal Card has UOB’s annoying S$5 earning blocks. That means miles lost due to rounding, especially if the typical transaction size on your $120K card is <S$50.

Should that be a problem, consider the DBS Vantage Card as an alternative. You can earn 1.5/2.2 mpd on local/overseas spend, with smaller earning blocks than UOB.

Elsewhere, things aren’t shaping up very well for the HSBC Visa Infinite, which lost its Step-Up Earn Rates of 1.25/2.25 mpd in May 2024. The revised earn rates 1/2 mpd are simply not competitive enough, especially when it’s the most expensive $120K card on the market!

It’s a double whammy because the HSBC Visa Infinite has also lost its ace in the hole- from 2 May 2024, the extra 1% cashback from the Everyday Global Account is limited to spending on the HSBC Everyday Global Debit Card, with HSBC credit cards no longer eligible.

I suppose you can’t get worse than the AMEX Platinum Reserve though, which offers an anaemic 0.69 mpd on local and overseas spending. Spending at 10Xcelerator partners does qualify for 3.47 mpd, for what it’s worth.

Points flexibility and expiry

Quantity of points is one thing; quality is another. All things equal, credit card points are more valuable if they:

- don’t expire

- can be transferred to multiple airline partners

- don’t incur conversion fees

- have smaller minimum transfer blocks

- pool with other cards

There’s a new winner this year, with the HSBC Visa Infinite taking the crown from the AMEX Platinum Reserve.

From 28 May 2024, points earned across all HSBC credit cards will be pooled together, allowing cardholders to redeem their combined stash for 21 airline and hotel partners.

Conversion fees are waived till at least 31 January 2025, and while the minimum conversion block of 10,000 miles could be lower, the subsequent conversion block is just 2 miles (e.g. you could convert 10,408 miles or 20,948 miles).

Keep in mind, the AMEX Platinum Reserve is still a formidable competitor, since Membership Rewards points don’t expire, have no conversion fees, and can be converted to a wide range of partners with a minimum block of just 250 miles. The bigger problem is that the earn rates are so miserly, it’d take you a long time to earn a critical mass of points.

In third place is the Citi Prestige. ThankYou points never expire and can be transferred to 11 different partners, and you can accumulate additional points via the PayAll feature (though a lot more pricey than before, with the recent fee hike!). The drawback here is that points don’t pool, and you have to pay a S$27 conversion fee.

As for the rest, the UOB VI Metal Card can help anchor a UOB portfolio since conversions are free and UNI$ pool. Therefore, you can use it as a conduit to cash out UNI$ earned on other cards like the UOB Preferred Platinum Visa, UOB Lady’s Card and UOB Visa Signature for free. The main catch is the 2-year expiry of UNI$.

The StanChart Visa Infinite lost nine airline and hotel partners this year, though it did add Asia Miles. It’s certainly a lot less interesting than before.

The OCBC VOYAGE finally debuted its eight new airline and hotel partners in 2023, but sadly the conversion ratios are rather bad. For example, conversions to British Airways Avios and Asia Miles entail a 10% and 25% haircut respectively compared to KrisFlyer, when other banks offer conversions to these programmes at the same ratio as KrisFlyer.

Miles purchase facilities

| Card | Buy Miles From | Limit |

AMEX Plat. Reserve AMEX Plat. Reserve |

N/A | N/A |

Citi Prestige Citi Prestige🥇 Winner 🥇 |

2 cpm* (PayAll) |

Actual bill amount |

DBS Vantage DBS Vantage |

1.67 cpm (Tax payment) |

Actual tax amount |

HSBC Visa Infinite HSBC Visa Infinite |

N/A | N/A |

Maybank Visa Infinite Maybank Visa Infinite |

N/A | N/A |

OCBC VOYAGE OCBC VOYAGE |

1.9-1.95 cpm (VOYAGE Pay) |

Actual tax amount |

SCB Visa Infinite SCB Visa Infinite |

1.36 cpm (SC EasyBill) |

Actual bill amount |

UOB VI Metal Card UOB VI Metal Card |

2.2 cpm^ (UOB Payment Facility) |

None |

| *Temporarily lowered to 1.3-1.63 cpm till 31 July 2024 ^Temporarily lowered to 2 cpm till 30 June 2024 |

||

Most $120K cards offer a payment facility, which is basically a way of buying discounted miles.

To recap, there are two types of payment facilities:

- Those which let you buy as many miles as you want, no questions asked

- Those which let you buy miles provided you have a rental, tax, insurance or some other bill to pay

(1) is available to UOB VI Metal Cardholders, with miles priced at 2.2 cents each (temporarily reduced to 2 cents till 30 June 2024). This is certainly better than the US$40 per 1,000 miles that Singapore Airlines charges if you top-up while redeeming, though hardly cheap.

(2) is available to Citi Prestige, DBS Vantage, OCBC VOYAGE and StanChart Visa Infinite Cardholders, and the cost per mile can be significantly lower.

| ⚠️ VOYAGE Payment Facility now for taxes only |

| Historically speaking, the OCBC VOYAGE Payment Facility was a no-questions-asked option for buying miles. However, the rules have now changed, and VOYAGE Payment Facility applications will only be accepted for payment of income taxes. |

But perhaps not as low as before. At the start of 2024, the StanChart Visa Infinite hiked the fee for its tax payment facility from 1.6% to 1.9%, which increased the lowest possible cost per mile from 1.14 cents to 1.36 cents.

More recently, the Citi PayAll service fee also increased from 2.2% to 2.6%, which means that barring a promotion, the lowest cost per mile for a Citi Prestige cardholder has gone up from 1.69 cents to 2 cents. That’s temporarily offset by an ongoing promotion to buy miles from 1.3-1.63 cents, but that promotion will eventually end, while the increased service fee is here to stay.

Citi PayAll offer: 2 mpd on tax payments, 1.6 mpd on non-tax payments

All things considered, Citi PayAll still offers the widest range of bill payments, so I’m leaning towards giving it this category. It’s certainly not the slam dunk it was before in light of the service fee hike though, and I wouldn’t consider it outside of promotions.

In any case, one could argue that with services like CardUp, you don’t really need a bank to offer its own payment facility anymore.

Lounge access

It’s hard to pick a winner here, so I’m going to wuss out by picking three.

The way I see it, it’s a toss up among the Citi Prestige, HSBC Visa Infinite, and UOB VI Metal Card. All three offer unlimited visits, but…

…in terms of guests:

- Citi Prestige and UOB VI Metal Card both offer one free guest

- HSBC Visa Infinite does not have a guest benefit, but up to five supplementary cardholders enjoy an unlimited-visit LoungeKey

If you travel with different people all the time, the Citi Prestige and UOB VI Metal Card would be better, since your guest could be anyone.

If you travel with the same people (e.g. family), then the HSBC Visa Infinite would let you give each of them a supplementary card with the same lounge benefit you enjoy. This frees them from dependence on you, since they can access the lounge whether or not you’re travelling.

…in terms of network:

- Priority Pass and LoungeKey have the same owner, and their benefits are practically identical. Some unique things include dining credits, fast track immigration, video game lounges, capsule hotels and spa treatments

- Dragon Pass gets access to railways lounges in China, and even though they don’t offer dining credits, you can still redeem set menus at certain airport restaurants

It’s hard to say definitively which network is better, since there will be a lot of overlap.

What’s clear is that the rest of the $120K cards lag behind.

- The Maybank Visa Infinite had its unlimited Priority Pass cut to just four (!) visits

- The OCBC VOYAGE got a buff when its Plaza Premium lounge benefit was changed to DragonPass, but supplementary cardholders lost their lounge access in the process

The DBS Vantage and StanChart Visa Infinite remain the same, with 10 and six free visits a year.

Airport limo transfers

No changes here from last year, as the HSBC Visa Infinite continues to reign supreme.

By paying the annual fee, cardholders enjoy two complimentary airport transfers per calendar year (four if you’re a HSBC Premier customer), and up to 24 rides per year (including the free ones) can be unlocked with just S$2,000 spend each.

The Maybank Visa Infinite comes a close second, with S$3,000 spend needed per ride. It used to be even better than the HSBC Visa Infinite, mind you, as up till July 2023 it offered two rides per S$3,000 spend.

Everything after that is far from ideal. The Citi Prestige and OCBC VOYAGE both require S$12,000 per quarter for two rides, and the rest of the cards have no benefit at all!

Frankly speaking, those who want the best airport limo benefit should just get a lowly UOB PRVI Miles AMEX: all you need to spend is S$1,000 FCY in a calendar quarter to get two free rides.

Travel insurance

| Card | Accident | Medical | Travel Inconvenience |

AMEX Plat. Reserve AMEX Plat. ReservePolicy |

S$1M | N/A | Yes |

Citi Prestige Citi PrestigePolicy |

S$1M | S$50K |

Yes |

DBS Vantage DBS Vantage |

N/A | N/A | N/A |

HSBC Visa Infinite HSBC Visa InfinitePolicy 🥇 Winner 🥇 |

US$2M | S$100K |

Yes |

Maybank Visa Infinite Maybank Visa InfinitePolicy |

S$1M | N/A | Yes |

OCBC VOYAGE OCBC VOYAGE |

N/A | N/A | N/A |

SCB Visa Infinite SCB Visa InfinitePolicy |

S$1M | S$50K |

Yes |

UOB VI Metal Card UOB VI Metal CardPolicy |

US$1M | N/A | Yes |

While most $120K cards offer complimentary travel insurance, not all coverage is made equal.

In general, you’ll want to make sure your policy covers three things:

- Death and permanent disability: In case you perish or suffer permanent bodily damage while on your trip

- Medical expenses: In case you need to visit a doctor or a hospital overseas

- Travel inconvenience: Flight delays, lost and damaged luggage

If not, I’d highly advise you to buy a stand-alone insurance policy, because 1 or 2 out of 3 isn’t sufficient. And even if the policy covers all three, it’s your responsibility to make sure the coverage limits are sufficient for your needs.

We don’t have the space here to do a detailed analysis, but based on my cursory reading, the policy offered by the HSBC Visa Infinite has the highest coverage of all. Cardholders are covered for up to US$2 million for accidental death, with S$100,000 of overseas medical expenses (including COVID), S$10,000 of post medical expenses in Singapore, and S$250,000 for emergency medical evacuation.

In terms of travel inconvenience, there’s S$10,000 coverage for trip cancellation, S$5,000 coverage for lost luggage, as well as coverage for loss of travel documents, rental car excess, and personal liability. Coverage even extends to family members travelling on the same trip. If you ask me, this is as good as any stand-alone policy.

Private club access

Not much of a contest here, really.

The AMEX Platinum Reserve continues to be the only $120K card with private club access via Tower Club. Bookings can be made through the AMEX concierge, and access is limited to five cardholders per day. All expenses will incur a 10% surcharge, as is Tower Club’s policy for affiliate members.

Although the Straits Bar is a nice place to have a drink, I find the overall Tower Club experience a bit stuffy and overrated. It’s certainly not a decisive factor for choosing a $120K card.

Dining perks

| Card | Dining Perks |

AMEX Plat. Reserve AMEX Plat. Reserve🥇 Winner 🥇 |

|

Citi Prestige Citi Prestige |

|

DBS Vantage DBS Vantage |

|

HSBC Visa Infinite HSBC Visa Infinite |

|

Maybank Visa Infinite Maybank Visa Infinite |

|

OCBC VOYAGE OCBC VOYAGE |

|

SCB Visa Infinite SCB Visa Infinite |

|

UOB VI Metal Card UOB VI Metal Card |

|

The AMEX Platinum Reserve may not have a lot going for it, but it does offer a solid dining proposition.

Cardholders enjoy up to 50% off food with Love Dining, at a wide range of hotels and restaurants around Singapore.

There’s also Chillax, which gives 1-for-1 drinks at selected bars islandwide including Botanico, Lantern, The World is Flat and Tipsy Flamingo.

| 💡 Love Dining Alternative |

| You don’t actually need the AMEX Platinum Reserve to enjoy Love Dining and Chillax benefits, since these are also available on the entry-level AMEX Platinum Credit Card (AF: S$327). |

The key nerf here is that there’s no more S$100 Tower Club dining voucher, removed for renewals from January 2024 onwards.

I don’t think any other card matches up to this, though the HSBC Visa Infinite does a valiant job with its complimentary copy of The Entertainer, which includes 1-for-1 offers at more than 200 dining merchants across Singapore, plus additional deals for use overseas.

This covers a wider range of restaurants than Love Dining, though the savings for Love Dining will always be superior since it’s 50% off all food (whether appetisers, mains or desserts), while The Entertainer generally offers a 1-for-1 main course.

But the HSBC Visa Infinite has lost its other dining privileges- gone is the 50% off dining at Fairmont Singapore, Swissotel The Stamford, Marriott Tang Plaza and Goodwood Park Hotel that cardholders enjoyed in 2023.

DBS Vantage includes an Accor Plus membership that offers up to 50% off food at participating Accor hotel restaurants across Asia Pacific, as well as 15% off drinks. I realise it’s subjective, but I don’t think much of the Accor hotel restaurants in Singapore- most of them are middling at best, with Racines at Sofitel City Centre the only possible exception.

DBS Vantage also used to have a partnership with Dining City, but that was discontinued from 2024. Given how underwhelming those discounts were, their loss shouldn’t move the needle much.

The UOB VI Metal Card has seen its dining offers significantly downsized for 2024. Instead of 50% off weekday lunch at restaurants under the Pan Pacific Hotels Group, the discount is now just 30%. There’s also 30% off at Sheraton Towers and Fullerton Hotels .

Citi Prestige and OCBC VOYAGE offer periodic celebrity chef dining experiences, which are sometimes offered on a 1-for-1 basis (though the nett price still won’t be cheap).

Weight

What’s the point of having a $120K card if you can’t let the whole world know by dropping it casually on the counter with a fragile-masculinity-assuaging “plonk”?

That is, if your card is actually made of metal like the DBS Vantage, Citi Prestige, OCBC VOYAGE and UOB VI Metal Card. The judging criteria here is simple: VOYAGE wins because it weighs the most.

| Card | Weight |

AMEX Plat. Reserve AMEX Plat. Reserve |

~5g |

Citi Prestige Citi Prestige |

8g |

DBS Vantage DBS Vantage |

10g |

HSBC Visa Infinite HSBC Visa Infinite |

~5g |

Maybank Visa Infinite Maybank Visa Infinite |

~5g |

OCBC VOYAGE OCBC VOYAGE🥇 Winner 🥇 |

15g |

SCB Visa Infinite SCB Visa Infinite |

~5g |

UOB VI Metal Card UOB VI Metal Card |

9g |

Supp. cardholder benefits

While the best perks are reserved for principal cardholders, certain $120K cards show the love to supplementary cardholders too.

The HSBC Visa Infinite offers an unlimited-visit LoungeKey membership for up to five supplementary cardholders. This makes it the only $120K card with a lounge perk for supplementary cardholders, following the OCBC VOYAGE’s nerfing of the perk.

One could argue that that the Citi Prestige supplementary cardholders have better benefits, because they enjoy things like GHA Titanium status, a HoteLux Elite Plus membership, Avis President’s Club status and a 3GB FlexiRoam data package. That’s true, but those perks are provided by World Elite Mastercard and not Citi itself, and for that reason I’d give this title to the HSBC Visa Infinite.

Unique perks

In addition to the benefits above, some $120K cards have unique perks which are well worth discussing.

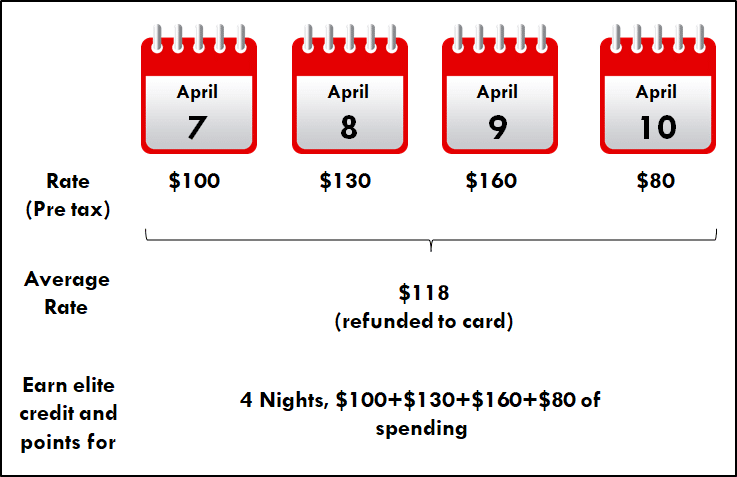

Citi Prestige: Fourth Night Free

The Citi Prestige Card’s ace in the hole is supposed to be its 4th Night Free (4NF) benefit, which, used judiciously, can help cardholders recover large chunks of their annual fee.

With 4NF, principal cardholders can book four nights at a hotel, and get one night refunded to their card (based on the average nightly pre-tax room rate). The refund is done on Citi’s side, so you’ll still earn hotel points and elite credit (where applicable) for four night’s worth of spending.

However, all bookings must be made through the Citi Prestige concierge, and Citi has been tightening the screws on this benefit:

- Only rates that appear on the hotel’s official website or Expedia can be booked

- All rates must be fully prepaid

- You can’t book suites or villas (even if that’s the lead-in category at a hotel)

- You can’t book half or full-board stays

- The rate must be “publicly available”. Even though it costs nothing to sign up for a Hilton/Marriott/Hyatt etc. membership, you won’t be able to enjoy the extra 10% or so they offer to their own members because it’s not a “publicly-available” rate

It’s an unpleasant number of hoops to jump through, but if you’re willing to play ball you can certainly save some money- and because Citi has not capped the 4NF benefit in Singapore (it has in a few other countries), frequent travellers should be able to make the math work.

Citi Prestige: GHA DISCOVERY Titanium

Citi Prestige Cardholders (both principal and supplementary) enjoy a complimentary upgrade to GHA DISCOVERY Titanium status.

GHA Titanium status normally requires 30 nights, or US$15K spend, or three brands to qualify for. As a reminder, here’s the benefits that DISCOVERY elites can look forward to.

| Gold | Platinum | Titanium | |

| Earn D$ | 5% | 6% | 7% |

| D$ Validity | 18 mo. | 24 mo. | 24 mo. |

| Room Upgrade | – | Single | Double |

| Early Check-in | – | – | From 11 a.m |

| Late Check-out | – | Till 3 p.m | Till 4 p.m |

| Welcome Amenity | – | Yes | Yes |

| Share Status | – | – | Yes* |

| Breakfast | – | – | Yes^ |

| Silver is the entry-level GHA tier, with 4% D$ and 6 mo. D$ validity *Status sharing only applies to members who earned their status through regular means, not fast-track promos ^Selected brands only |

|||

This benefit was briefly extended to Visa Infinite cardholders earlier in 2024, but was quickly pulled, presumably due to overwhelming demand.

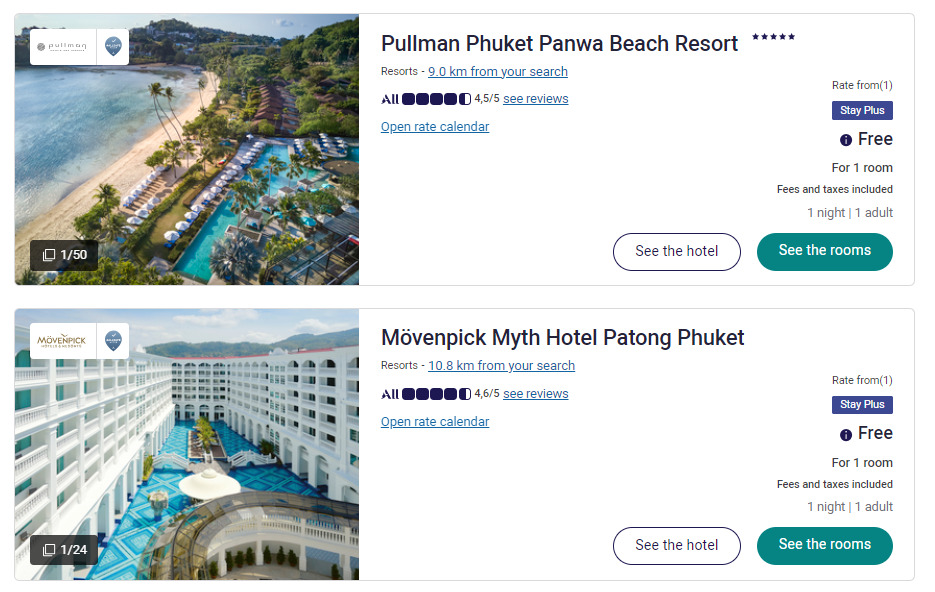

DBS Vantage: Accor Plus membership

DBS Vantage Cardholders receive a complimentary Accor Plus Explorer membership, which normally retails for S$418.

This includes perks at participating Accor hotels across Asia Pacific including:

- One complimentary hotel night per year

- Up to 50% off dining

- 15% off drinks bill in Asia

- 10% off the best available public rate

- Access to Red Hot Room sales with up to 50% off

- Accor Live Limitless Silver status

I’ve already discussed the dining benefits in a previous section, so let’s talk about the other big draw: the complimentary hotel night known as Stay Plus.

Stay Plus gives you a complimentary night at participating hotels across Asia Pacific. It is capacity controlled, however, which means you may not always get exactly the property you want, when you want it.

In my experience, it’s tough to book the Sofitels in Singapore, but you can book them elsewhere in Southeast Asia without too much difficulty. Over the years I’ve used my free nights at the Sofitel Sydney Darling Harbour, Pullman Kuala Lumpur, and Sofitel City Centre.

HSBC Visa Infinite: Priority immigration

HSBC Visa Infinite cardholders who spend at least S$2,000 in a calendar month receive complimentary fast-track immigration service at selected airports for themselves and a guest (in addition to the previously-mentioned free limo ride).

Just like the limo benefit, two complimentary uses are provided each year with no minimum spend (four if you’re a HSBC Premier customer).

Depending on the airport, fast-track immigration may also include meet and assist services, which escort you to/from the airplane.

Maybank Visa Infinite: JetQuay access

JetQuay is a private terminal at Changi for CIPs (commercially important people). You get dropped off at a private driveway, your check-in is handled by the terminal staff while you relax in the lounge, and the only time you mingle with the unwashed masses is en route to your flight in an electric buggy.

All that sounds great, but having tried it first hand, I can say it’s rather underwhelming. The JetQuay facility is dated, the food selection is poor, and although the service is excellent, there’s no reason why you should choose it over an airport lounge. Thank goodness there’s plans to transform JetQuay into a “premium travel hub” by 2025 with new interiors and private suites- it can’t happen soon enough!

The full-fledged JetQuay Quayside experience normally costs ~S$436, but Maybank Visa Infinite cardholders can get it for free. Spending S$3,000 a month unlocks a choice of either one limo ride or a single JetQuay use.

Take the limo ride.

OCBC VOYAGE: Redeem miles for any flight

A unique feature of OCBC VOYAGE is that VOYAGE Miles can be used to pay for any flight in any cabin on any airline. It’s conceptually the same as buying a commercial ticket, freeing you from the vagaries of award inventory and waitlisting, plus presenting the opportunity to earn miles and elite status credits on your flight.

The value of a VOYAGE Mile when redeemed for commercial airfares is opaque, but prior to August 2023, it was reliably around 2.3 cents. Unfortunately, OCBC carried out an unannounced 25% devaluation, which reduced the value to no more than 1.72 cents.

But that’s just the risk you bear when holding VOYAGE Miles. Since there’s no official value per mile, the value is whatever OCBC says it is!

Verdict: Which $120K card?

On the whole, I’d say the past 12 months have been more cruel than kind to the $120K segment, because for every enhancement, I can think of at least two devaluations. So the way I see it, 2024 is all about which card got nerfed the least, not so much which one had the best year per se.

To reap each category (and note that I don’t weigh each category the same):

🏆 Winner: Citi Prestige

In 2023’s $120K showdown, I declared the Citi Prestige and HSBC Visa Infinite to be the joint winners. But in 2024, the Citi Prestige has pulled ahead- and it’s more because the HSBC Visa Infinite has gotten worse.

While the HSBC Visa Infinite now enjoys points pooling with other HSBC cards (which adds more transfer partners and free conversions till January 2025), that’s tempered by:

- the loss of an extra 1% cashback with the EGA

- no more rewards for hospital transactions

- the lapse of 50% dining discounts with Fairmont, Swissotel, Marriott Tang Plaza and Goodwood Park

- the removal of the Step-up Earn Rate, leaving cardholders with just 1/2 mpd on local/FCY spend

Given that it’s the most expensive $120K card out there (if you’re a non-HSBC Premier customer), I just don’t think it’s good enough to be given equal billing with the Citi Prestige anymore.

Moreover, I don’t think any of the other $120K cards come close.

- The OCBC VOYAGE compounded 2023’s missteps even further by nerfing the supplementary cardholder lounge benefit and devaluing VOYAGE Miles, and many of its long-awaited new transfer partners are practically useless because of the conversion ratios

- After a great 2023, the UOB Visa Infinite Metal Card has backslid by nerfing its welcome offer, removing the monthly GrabGift vouchers and devaluing its dining benefits

- The DBS Vantage Card had a very quiet year, with an improved welcome offer the main development of note. It still feels underpowered compared to $120K rivals, with the Accor Plus membership the main tentpole

- The StanChart Visa Infinite and Maybank Visa Infinite are close to irrelevant from a benefits point of view

- Without a comprehensive reboot, the AMEX Platinum Reserve remains a niche card at best. I’m willing to bet that most readers only hold it because they have an AMEX Platinum Charge, and were grandfathered in on the “one annual fee” scheme. Few would be willing to pay the asking price based on its merits alone

And yet it’s not been all smooth sailing for the Citi Prestige. The hike in the Citi PayAll service fee has rendered it more or less useless outside of promotions, and from what I hear, the 4th Night Free restrictions are getting more ridiculous all the time (best story from the Citi Prestige Telegram Group is a CSO rejecting a booking because the room has an “ensuite bathroom”, and “suites cannot be booked under the T&Cs”).

Still, it offers the clearest path to annual fee recovery through the 4NF benefit, 25,000 renewal miles, unlimited lounge access and limo rides. Plus, as a World Elite Mastercard, it has some additional advantages over the rest of the Visa Infinite pack, such as GHA Titanium status, FlexiRoam packages, and Avis President’s Club status.

Conclusion

No one needs a $120K card to play the miles game. If your goal is simply to accumulate miles as quickly as possible, you’d be better off with the cards I recommend in my annual card strategy post, most of which are available with an annual income of just S$30,000.

But if you enjoy travelling, dining out, and sampling the nicer things in life, a $120K card can be a good companion- provided you make regular use of it!

Which $120K card do you fancy the most?

DBS Vantage

DBS Vantage

Other than the 30% discounts, UOB VI also has an Infinite Dining programme now. It seems.

I use my Citi prestige mainly for the lounge and the 4th night Free 🙂 It pays back the annual fee just by using these 2 perks when travelling with my friend or family.

Feel that the Citi Prestige’s World Elite Mastercard perks by itself should be considered in the analysis as well. While they are not exclusive to the card, I think this is a special case as it is by far the easiest World Elite Mastercard for an ‘average’ person to obtain (others require million dollar AUM, 500k income etc.)

yup, it’ll be more complete, to include the perks of World Elite MasterCard vs VISA Infinite cards.

this is the past Milelion post i found:

World Elite MasterCard

https://milelion.com/2024/01/29/what-are-the-perks-of-a-world-elite-mastercard/

VISA Infinite

https://milelion.com/2023/08/28/is-a-visa-infinite-card-still-worth-having/

Great comparison! Perhaps you could include some unique scenarios that could sway a person’s decision to sign for the card, for example earning miles on medical expenses, as well as education, enrichment and childcare.

To my knowledge (thanks to your blog (-:), only a handful of cards can do that, and one example is the UOB Visa Infinite Metal Card. Knowing this would definitely help young families boost their chances to achieve Business Class air tickets on a one-off big ticket spend (e.g. paying for birth-related expenses, enrichment classes etc.). Just my 2 cents worth 😀

Exactly, if you have a school fees to pay, the UOB VI metal card appears to be the best arrow to have in your quiver.

So when Aaron says you “don’t need to own a $120k card”, I’d say that some people could benefit a lot from having one, depending on what their “needs” are.

actually, if those school fees are FCY, then maybank horizon VS would get the job done with 3.2 mpd (upsized from 2.8 mpd) and no annual fee.

if we’re talking local school fees, then it boils down to how much you have to pay, and whether the miles earned from that payment + other UOB VI metal benefits can justify the annual fee. in first year with sign up bonus, probably. second year onwards would be more marginal

Is the Sands Prestige perk still available for Citi Prestige? According to the campaign it seems to have ended on 30 Apr 2024.

Prestige. For anyone who travels at least once a year and stays 4 nights. (1) Leisure travel once a year staying 4 nights in any city >$100 per night. $375 (25K miles at 1.5cpm) + $100 (4th night refund) + $70 (Lounge visit x2) = $545. That’s not counting the hotel points for the 4th night. Includes any hotel on Expedia not just boring chains – whether super luxury or hostelly motel types. Just one trip a year is enough. (2) Business travel when company requires employee to pay first and submit claim after return (my company doesn’t give us… Read more »

(1) That does not take into account the opportunity costs of not being able to use cheaper rates for the same room category, wanting to stay in anything other than a standard “room” and the opportunity cost of not earning e.g. 1/10th of a free night with hotels.com.

(2) This, however, is a genius idea, and one that had not crossed my mind so far. Thank you very much for sharing it, that makes a lot of sense!

Thanks. The renewal miles are worth $375 (more with J/F redemptions). With lounge access for 2 and 4NF, getting another $170 worth of benefit is easy for us even on personal travel. I check the OTA’s before calling Aspire, but 4NF with BRG & status upgrades has mostly been better for us while eliminating OTA booking screw-ups (ask Aspire to book directly with hotel). For employees who travel, this is the best card in the world (so good that 4NF is capped in USA). Better than 4mpd. Even better than Yuu since 4NF returns USD, not points/miles. On another note,… Read more »

Prestige 4N1F is more useful in Europe where room taxes are lower and 4N1F gives a bigger discount, and much less useful in APAC for same reason. But if you’re buying $500/night hotel rooms, you’ll make back the annual fee easily.

Maybank VI annual fee is $654, FYI

really? the website still shows $600. i would have thought they need to show gst inclusive fees.

Yup that’s what it showed on my recent statement

ANNUAL FEE 600.00

GST @ 9 % 54.00

updated, thanks.

My voyage card (the gold version) got replaced recently after it expired. It is actually lighter than the original one and does not feel very metallic. There’s no more metallic ‘clank’ when you drop it. The old one does not have a chip for contactless payments though; so maybe that’s why.

I highly doubt it is still the weightiest card.

It does not feel like metal, but neither is it feel like plastic plastic. It’s like some kind of composite material trying to mimic metal. My best description of it is waterproof cardboard.

I think the framework in this article is forced and not useful. These “$120k” cards have no similarity to each other except for the income requirement. They need to be analyzed one by one, not against each other. Citi Prestige is the “best” but only because if you have right hotel spend pattern, you can save money using their 4N1F privilege, then the PriorityPass lounge benefit is a good bonus. Vantage might look useless other than a slightly better general spend card compared to UOB PRVI Miles. But if you actually pay at least $60k (minimum for annual fee waiver)… Read more »

I agree, the recommendation should follow something like this:

Profile into different baskets. 🙂

A 2025 version coming soon?

Waiting for the 2025 edition too!