Here’s The MileLion’s review of the Citi Rewards Card, which once upon a time, was marketed as a card for shopaholics to earn bonus points on bags, shoes and clothes.

But those in the know understood that “bags, shoes and clothes” was just a suggestion. In reality, cardholders could earn 4 mpd on all manner of things, including Points.com purchases, ride-hailing and even GrabPay top-ups, for a time!

Citi finally dropped the pretense in March 2019 by officially expanding the bonus scope to cover almost all online transactions. This broad coverage, coupled with a wide variety of transfer partners, has made it a virtually essential card to have — despite annoyances like a lack of points pooling and the 1% admin fee now charged for domestic transactions when paired with Amaze.

|

|

| Citi Rewards Card |

|

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? | |

| An easy-to-earn 4 mpd and a wide variety of transfer partners make the Citi Rewards Card a no-brainer — despite annoyances like the lack of points pooling and 1% fee for local Amaze spend. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: Citi Rewards Card

|

|||

| Apply | |||

| Income Req. | S$30,000 p.a. | Points Validity | Up to 5 yrs. |

| Annual Fee | S$196.20 (FYF) |

Min. Transfer |

25,000 TY points (10,000 miles) |

| Miles with Annual Fee |

N/A | Transfer Partners |

11 |

| FCY Fee | 3.25% | Transfer Fee | S$27.25 |

| Local Earn | 0.4 mpd | Points Pool? | No |

| FCY Earn | 0.4 mpd | Lounge Access? | No |

| Special Earn | 4 mpd on online trxns. (except travel & in-app mobile wallet) | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The Citi Rewards Card was originally issued on the Visa network, but ever since 2020, all newly-issued Citi Rewards Cards have switched over to Mastercard.

Legacy Citi Rewards Visa Cards have thus far remained valid, which is great because the Mastercard and Visa each have their own 4 mpd bonus caps (we’ll talk about that later in this review). Unfortunately, Citi has announced that it will be discontinuing the Visa version at some point in 2026, so its days are numbered.

Both the Visa and Mastercard offer similar perks and benefits, though there are sometimes quirks in how bonuses are awarded (for example, the Visa does not earn bonus points with Atome, while the Mastercard does).

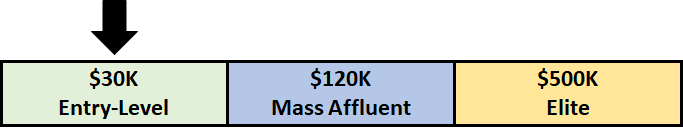

How much must I earn to qualify for a Citi Rewards Card?

The Citi Rewards Card has an income requirement of S$30,000 p.a., the MAS-mandated minimum for a credit card.

Applicants who don’t meet the minimum income requirement may be able to place a S$10,000 fixed deposit with Citibank to get a secured version of the card. Contact customer service for more information on this option.

How much is the Citi Rewards Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | Free | Free |

| Subsequent | S$196.20 | S$98.10 |

The Citi Rewards Card has an annual fee of S$196.20 for the principal cardholder, and a S$98.10 fee for supplementary cards. The first year’s fee is waived for both.

Annual fee waivers are at Citi’s discretion, but I’ve never had an issue getting one (with annual spending in the S$10-12K range). Refer to this guide for the steps to take to request a fee waiver.

Citibank does not award any bonus points for renewing the Citi Rewards Card.

What sign-up bonus or gifts are available?

|

| Apply |

New Citi Rewards Cardholders can currently enjoy a bonus of 40,000 ThankYou points (equivalent to 16,000 miles) when they:

- Apply online for a Citi Rewards Card

- Get approved within 30 days from application

- Spend at least S$800 on eligible transactions by the end of the second month after approval

This offer is open to those who do not currently hold a principal Citi card, and have not cancelled one in the 12 month period before application.

You can read the full details of this offer here.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 0.4 mpd | 0.4 mpd | 4 mpd on online trxns. (except travel and mobile wallet) |

SGD/FCY Spend

Citi Rewards Card members earn:

- 1 ThankYou point for every S$1 spent in Singapore Dollars

- 1 ThankYou point for every S$1 spent in foreign currency (FCY)

1 ThankYou point is worth 0.4 airline miles, so that’s equivalent to 0.4 mpd for both local and FCY spending.

All foreign currency transactions are subject to a 3.25% fee, which on par with the rest of the market.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DCS | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

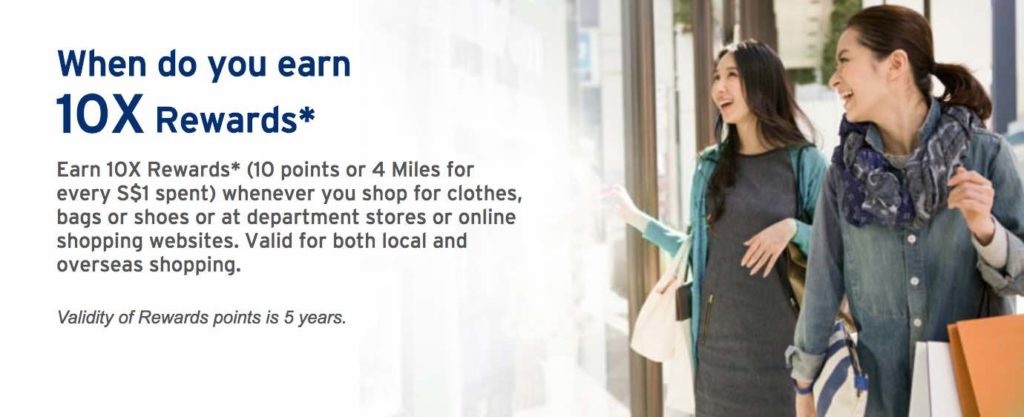

Bonus Spending

Citi Rewards Cardholders earn a total of 10 ThankYou points for every S$1 (4 mpd) for SGD and FCY transactions made:

- Online (except travel and in-app mobile wallet payments)

- At department stores, or shops selling bags, shoes and clothes

An overall cap of S$1,000 per statement month applies, shared between (1) and (2). Any spend in excess of the cap earns 0.4 mpd.

The Citi Rewards Mastercard and Citi Rewards Visa each have their own bonus cap, so if you have both cards, you can earn 4 mpd on up to S$2,000 per statement month.

| ⚠️ Calendar Month vs Statement Month |

|

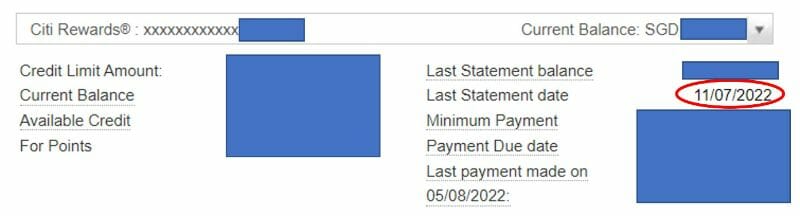

Calendar month is straightforward (e.g. 1-31 January), but statement month will vary from person to person. Log in to your Citi online banking and view your card details. You’ll see the statement date at the top.

For example, my statement month runs from the 12th to the 11th of the following month. This means my 4 mpd cap resets on the 12th of each month. |

(1) Online transactions

All online transactions will earn 4 mpd with the Citi Rewards Card, except for travel and in-app mobile wallet payments.

Travel

Citibank defines travel as any transactions with the following MCCs:

| ❌ Travel-Related Blacklist | |

| MCC | Description |

| MCC 3000 to 3350 MCC 4511 | Airlines |

| MCC 3351 to 3500 MCC 7512 | Car Rental Agencies |

| MCC 3501 to 3999 MCC 7011 | Lodging- Hotels Motels, Resorts |

| MCC 4111 MCC 4112 MCC 4789 | Passenger Transport and Railways |

| MCC 4411 | Cruise Lines |

| MCC 4722 MCC 4723 | Travel Agencies and Tour Operators |

| MCC 5962 | Direct Marketing- Travel Related Arrangement Services |

| MCC 7012 | Timeshares |

| 👎 Amaze won’t help |

| To pre-empt the inevitable question: No. Amaze won’t help you circumvent these restrictions, because it only changes the merchant description, not the MCC. |

This means you shouldn’t use the Citi Rewards Card for air tickets, cruises, hotels, rental cars, or booking activities with online travel agents like Klook and Pelago.

For more on this exclusion, refer to the article below.

Explained: Citi Rewards Card blacklist for “travel-related” transactions

In-app mobile wallet payments

In-app mobile wallet payments refer to using the Citi Rewards Card in conjunction with Apple Pay or Google Pay for online transactions.

To illustrate:

- you won’t earn 4 mpd when you use the Citi Rewards Card to make an in-app Apple or Google Pay transaction with Deliveroo

- you will earn 4 mpd when you use the Citi Rewards Card to make an in-app credit card transaction with Deliveroo

With most app-based payments, it’s a simple matter of choosing to pay directly with your credit card, instead of via Apple or Google Pay.

However, there are some apps (e.g. Kris+) which only allow you to pay with Apple or Google Pay, so don’t use the Citi Rewards Card here (pairing it with Amaze would help overcome the restriction, though be mindful of the new 1% fee for SGD transactions).

In-person mobile wallet payments (where you tap your phone to pay) will earn bonuses, to the extent the MCC falls under department stores, or shops selling bags, shoes and clothes (see next section).

For more on this exclusion, refer to the article below.

Aside from those two restrictions, all other online spend is fair game, which is pretty awesome if you think about it. You probably make dozens of online transactions each day without even realising it: hailing a Grab, ordering food delivery, buying groceries, paying for Netflix, shopping on Lazada or Shopee, booking movie tickets etc.

These bonuses can be extended to offline transactions too, via the Amaze Card.

|

||

| Apply | ||

| T&Cs | ||

| Use code 7HK2A2 for 225 bonus InstaPoints | ||

| 💳 tl;dr: Amaze Card | ||

|

That’s because the all Amaze transactions code as online spend, even if they were made physically in-store. This means you could dine in a restaurant or shop at a brick-and-mortar merchant, pay with the Amaze Card paired to a Citi Rewards Card, and earn 4 mpd on your spending!

Of course, there’s no knowing how long this will last, since it’s obviously not what Citibank had in mind when creating the Citi Rewards Card. In fact, there was an epic scare back in January 2024, when Amaze x Citi Rewards transactions were only earning 0.4 mpd instead of the usual 4 mpd. Fortunately, this was eventually resolved, though it should be obvious that this hack is living on borrowed time.

Moreover, ever since 10 March 2025, Amaze has imposed a 1% admin fee (min. S$0.50) for all SGD-denominated transactions. For example, if you were to use Amaze x Citi Rewards to pay for a S$100 meal in a restaurant in Singapore, you’d pay a S$1 fee.

It’s difficult to conclusively say whether it’s still “worth it” to use Amaze x Citi Rewards for local spending with the fee in the picture, but it’s definitely something to factor into your calculations.

Refer to the post below for a detailed discussion.

(2) Department stores, bags, shoes or clothes

Citi Rewards Cardholders will earn 4 mpd on all SGD or FCY transactions made online or offline at merchants with the following MCCs:

| MCC | Examples (non-exhaustive) |

| MCC 5311 Departmental Stores |

Takashimaya, TANGS, Isetan, OG, Metro, BHG, Marks & Spencer |

| MCC 5611 Men’s and Boys’ Clothing and Accessories Stores |

Benjamin Barker, Timberland, Edit Suits, Berluti |

| MCC 5621 Women’s Ready to Wear Stores |

Zara, H&M, Mothercare |

| MCC 5631 Women’s Accessory and Specialty Stores |

Tory Burch, Love Bonito, Pandora |

| MCC 5641 Children’s and Infants’ Wear Stores |

Kiddy Palace, Mummy’s Market, Pupsik, Motherswork |

| MCC 5651 Family Clothing Stores |

Uniqlo, ASOS, Club 21, Burberry, Yoox |

| MCC 5655 Sports and Riding Apparel |

Nike, Lululemon, Adidas |

| MCC 5661 Shoe Stores |

Skechers, Charles & Keith, Bata, Foot Locker, Pazzion |

| MCC 5691 Men’s and Women’s Clothing Stores |

Ezbuy, Zalora, Fartech |

| MCC 5699 Miscellaneous Apparel and Accessory Shops |

Cotton On, Reebonz |

| MCC 5948 Luggage or Leather Goods Stores |

Louis Vuitton, Coach, Rimowa |

In case you’re uncertain about the MCC, there are three ways of looking it up before making a purchase:

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

| Note: “Ease of use” and “reliability” are all relative. HeyMax already provides a solid baseline for reliability, and the DBS digibot is still simple enough to use, despite requiring more steps than the other two methods. | ||

For the avoidance of doubt, you will earn 4 mpd even if you digitise the Citi Rewards Card into Apple or Google Pay and use your mobile phone to pay at the merchant, as this is not considered an in-app mobile payment.

How does this compare to other specialised spending cards?

The Citi Rewards isn’t the only card that earns bonuses for online spending. However, it’s one of the best out there because the bonuses are awarded based on a blacklist system.

- Blacklist cards offer bonuses on all transactions, except explicitly-mentioned MCCs. (e.g. online spend for the Citi Rewards and DBS Woman’s World Card)

- Whitelist cards offer bonuses only on explicitly-mentioned MCCs (e.g. HSBC Revolution, UOB Lady’s Card)

With the Citi Rewards, so long as a payment is processed online and doesn’t fall into the travel, in-app mobile wallet or general exclusion categories, you’ll earn 4 mpd.

For more on blacklist vs whitelist cards, refer to the article below.

Blacklist vs whitelist cards: How I optimise miles between both

When are ThankYou points credited?

Base and bonus ThankYou points are credited when your transaction posts, which generally takes 1-3 working days.

How are ThankYou points calculated?

Here’s how you can work out the ThankYou points earned on your Citi Rewards Card.

| Base Points (1X) | Round down transaction to nearest S$1, then multiply by 1 |

| Bonus Points (9X) |

Round down transaction to nearest S$1, then multiply by 9 |

This means the minimum spend required to earn miles is S$1.

If you’re an Excel geek, here’s the formulas you need to calculate your points:

| Base Points (1X) | =ROUNDDOWN(X,0)*1 |

| Bonus Points (9X) |

=ROUNDDOWN(X,0)*9 |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for ThankYou points?

The full list of ineligible transactions to earn ThankYou points can be found in the Citi T&Cs.

I’ve highlighted a few noteworthy categories below:

- Educational Institutions (MCC 8211-8299)

- Donations (MCC 8398)

- Government Services (MCC 9000-9999)

- Insurance (MCC 6300)

- Professional Services and Membership Organizations (MCC 8651-8661)

- Quasi cash transactions including top-ups to GrabPay and YouTrip (MCC 6529-6540)

- Real Estate Agents and Managers (MCC 6513)

- Utilities Payments (MCC 4900)

Citi Rewards Cardholders will earn rewards for CardUp transactions, but because the earn rate is just 0.4 mpd, they will almost certainly prefer to use Citi PayAll instead.

What do I need to know about ThankYou points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| Up to 5 years | No | S$27.25 per conversion |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 25,000 TY Points (10,000 miles) |

11 | 24-48 hours (for KF) |

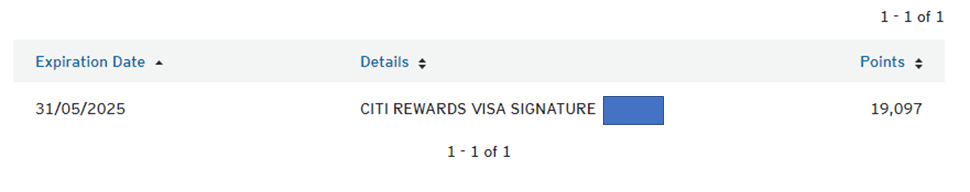

Expiry

A common misconception is that Citi ThankYou points earned on the Citi Rewards are valid for five years. Citibank has even said so on its website in the past!

But that’s not true. If you checked the expiry date of your points (which was possible back when the ThankYou rewards portal was still live), you’d see that they all expired on the same day.

What’s going on here is that all ThankYou points earned on the Citi Rewards expire every 5 years (+ 3 months grace) from the date of card approval/renewal, not from when points are earned.

To provide an illustration, suppose you’re approved for a Citi Rewards card on 15 October 2022.

- All points earned between 15 October 2022 to 31 October 2027 will be valid till 31 January 2028 (5 years + 3 months grace)

- On 1 November 2027, a new validity period will begin

- All points earned between 1 November 2027 to 31 October 2032 will be valid till 31 January 2033 (5 years + 3 months grace)

Therefore, Citi Rewards points are valid for up to 5 years + 3 months, and can be valid for as little as 3 months in some cases.

Pooling

Citibank does not pool points across cards.

If you have 12,000 ThankYou points on the Citi Rewards Visa and 30,000 ThankYou points on the Citi Rewards Mastercard, you will have to pay two separate conversion fees.

This also means that you’ll need to transfer all your points out before cancelling the card, or else forfeit them.

Transfer Partners & Fee

Citibank has the widest variety of transfer partners in Singapore, with 11 airline and hotel programmes to choose from.

Points transfer at a 5:2 ratio, with a minimum transfer block of 10,000 miles. I really appreciate that Citi uses the same transfer ratio for all its programmes, unlike HSBC and OCBC.

| Frequent Flyer Programme | Conversion Ratio (Citi: Partner) |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

|

25,000: 10,000 |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

|

25,000: 10,000 |

| 25,000: 10,000 |

Transfers cost S$27.25 each, regardless of how many points are converted.

Transfer Times

Citibank tells customers that points transfers will take 14 business days, but in reality it’s usually 24-48 hours for KrisFlyer, or 2-4 working days for other programmes.

If you need your points credited instantly, you can transfer them via Kris+ at a rate of 10,000 TY points = 3,400 KrisPay miles. KrisPay miles can then be instantly converted to KrisFlyer miles at a 1:1 ratio.

|

| S$5 for new Kris+ Users |

| Get S$5 when you sign-up with code W644363 and make your first transaction |

There are pros and cons to this:

Pros

- Minimum conversion block is reduced to 10,000 TY points, versus 25,000 TY points if converting via Citibank’s rewards portal

- Transfers from Citi to Kris+ and Kris+ to KrisFlyer are instant

Cons

- Those 10,000 TY points would normally be worth 4,000 KrisFlyer miles, so a 15% haircut is incurred

If you choose to do so nonetheless, do remember that it’s a two-step process:

- Transfer points to KrisPay miles

- Transfer KrisPay miles to KrisFlyer miles

Do not forget the second step! If you wait more than 21 days, or spend any of the converted KrisPay miles via Kris+, the entire balance will be stuck in the Kris+ app. KrisPay miles expire after six months, and can only be spent at a poor ratio of 100 miles = S$1.

Other card perks

Buy miles with Citi PayAll

|

| Citi PayAll |

Citi PayAll is a platform that allows Citi cardholders to pay various types of bills and earn rewards points, for a small fee.

The following categories of payment are currently supported:

| 💰 Citi PayAll: Supported Payments | |

| Category | Monthly Cap |

|

S$200,000 |

|

S$100,000 |

|

S$30,000 (each category) |

|

Outstanding balance with IRAS |

| ⚠️ Earn miles for free! |

|

While most of the abovementioned categories are excluded from rewards by most card issuers, there are still a handful of exceptions out there. Before resorting to Citi PayAll, be sure to check whether any of your existing cards would let you earn miles for free! |

Citi Rewards Cardholders will earn 0.4 mpd on all payments with a service fee of 2.6%, which means that under regular circumstances, you would be paying 6.5 cents per mile. That’s ludicrously expensive, and not worth considering.

But Citi has historically run promotions that have upsized the earn rate to as much as 2.5 mpd, lowering the cost per mile to just 0.8 cents each!

Unfortunately, the generosity has been dialed back significantly in recent times. Citi’s most recent promotion reduced the admin fee to 2.1%, which for Citi Rewards Cardholders still meant a very unattractive price of 5.25 cents per mile.

I’ve written a comprehensive guide to Citi PayAll, so be sure to check out the article below.

For the avoidance of doubt, Citi PayAll transactions will count towards the minimum spend for welcome offers and other promotions, provided the service fee is paid.

Summary Review: Citi Rewards Card

|

|||

| Apply | |||

| 🦁 MileLion Verdict | |||

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

The Citi Rewards Card may have started life as a niche offering for fashionistas, but today it’s one of the most versatile tools for miles collectors. With 4 mpd on a wide range of online transactions and 11 transfer partners to choose from, it’s an easy recommendation.

Sure, it’s not perfect. Amaze’s addition of a 1% fee for SGD-denominated transactions hampers the use case for local spending (but doesn’t kill it completely), and longstanding issues like the lack of points pooling and the confusing “up to” five years validity still remain.

Also, you’ll want to be careful about the exclusion for travel and in-app mobile wallet spending, which can trip up some first-timers.

But I’m more than willing to overlook these shortcomings because of the many mileage programmes it lets me access, and if you’re lucky enough to hold both the Mastercard and Visa, you that’s an easy 96,000 miles per year— at least until the Visa is sunset!

So that’s my review of the Citi Rewards Card. What do you think?

I’m not sure about the new MasterCard but when I registered for reward visa back in march (before it became MC exclusive), the card expiry date is march 2025

This means that my cc has an effective 5 years validity and I should use up all my thankpoints when the cc expiry is up.

If reward MC also has a 5 years card validity, you can also use that date as a marker in which you have to exchange all thankpoints before that date.

Yup pretty much so! Cards issued have 5 year validity so it’s an easy point of ref

I noticed that Citi line of credit cards tend to have 5 years validity and that coincide with the validity of the thankpoint duration (according to this article)

It will be easier to track if you keep in mind that you need to use up all the thankpoints before the credit card expiry date

Curiously though, the Citi lazada card is 36 months validity. Why I have no idea

Ah, by statement month, learnt it the hard way last year 🙁

Will you be doing a review on the UOB Lady’s Card too?

Yup! One at a time…

Aaron, is it possible to also have an article explaining miles awarded on

1) statement month vs calendar month and

2) transaction date vs posted date?

Hey Aaron, would you recommend the Citi Rewards or PremierMiles for a first timer? Or should i get both and use them whenever applicable?

Also, i’d like to ask, if i transfer the miles i’ve earned from the Rewards card to my KrisFlyer, can i also transfer my PremierMiles miles to the same KrisFlyer account? (Although i’ll have to pay the transfer fee twice)

Get both and use when applicable. Alternatively, get DBS Altitude + WWMC which are both similar to the Citi Premiermiles + Rewards combo but the points pool.

What do you think of using the CRV to top up the GPMC and using GPMC to pay for FCY purchases? Grab charges a 2% FX fee, so your cpm is 0.50 cpm.

i think people who use GPMC are looking for situations where you can’t earn 4 mpd (e.g doctor, insurance, government). overseas spending can earn 4 mpd already with uob vs.

Well, GPMC does have a lower FX fee so my point still stands that it’s a viable alternative. For example, if you would normally put your FX spending on the CRV, you could instead top up the GPMC with your CRV and then use that for your online spending.

yup! it’s definitely a valid route if that’s your end goal

Hey there, thank you for writing this! I have been using the Citibank Rewards Mastercard for the past two years and have accumulated 216,614 points on it (it’s my primary card). I recently also signed up for the DBS Altitude Visa card and am thinking of making a switch to that as my primary card given the non-expiry of points and waiver of annual fees above a certain spend. I didn’t think that the Citibank Rewards offered much. Should I transfer my points to Krisflyer to use at some future date or cash it all out (it’s 22,000 points for… Read more »

you should definitely put it in krisflyer. the cash rebate is abysmal value. if you fancy dabbling with other FFPs, you may find some value with british airways avios (for short haul economy) or turkish airlines miles and smiles (for cheap J class to Europe)

Thank you! Appreciate the response!

Does using Apple Pay with this card gets around the issue with some online retailers? ie foodpanda/redmart for example?

I suggest to be careful with this card – I was fan for couple years but last 3 months having issues with Visa version

– They claim Amazon Prime Singapore is not eligible(Visa version) -those show Prime Now doesn’t get points – I did raise issue but can’t resolve

– also if you pay for Online services like Deliveroo, Food panda etc by Apple Pay – they claim this is mobile wallet so don’t give bonus(maybe more understandable)

Used to be a very straight card – getting bonuses

Can someone clarify this for me? Statement month starts on the statement date I see on the statement or the day after?

the day after.

Does recurring singtel/starhub bills receive 10x? Does manual bill payment on the app get also?

I can confirm manual payment for Singtel on its website/app gets 10x points on the Visa version.

I can confirm recurring pay through amaze for telco received 10x points.

Hi, I have the Citi Rewards Visa card and recently got the Mastercard given that Amaze only works with Mastercard. Given that there is limit to 4 miles benefit, which is up to $1000 spend per statement month, now that I have both cards (Visa and Mastercard), do I get to enjoy up to $2000 spend per statement month ($1000 for Visa and $1000 for Mastercard)?

Yes you do. Card pools individually

I currently have the Citi Rewards Visa. Do you think it’s worth getting the MC version, and switch over ahead of my card expiry?

I have both. You’ll need the MC version to pair with Amaze. The visa and MC points don’t pool, so you’ll need to earn just enough points on the visa to cash out before switching permanently to the MC version.

HSBC Revo also should probably be in the list of How this card compares to others

Yup, good point. Will get that added

“…shop at a brick-and-mortar merchant, pay with the Amaze Card and earn 4 mpd with the Citi Rewards”

This should be “…shop at a brick-and-mortar merchant (except department stores, or shops selling bags, shoes and clothes) pay with the Amaze Card and earn 4 mpd with the Citi Rewards” right?

Why? It doesn’t matter what the Mcc is so long as it isn’t travel or exclusion list

Does paying overseas taxi and transit (bus/mrt) via Amaze->CRM get 4mpd? Unsure about the MCC, I guess in some places bus/mrt is government but most places it isn’t and I can’t see any obvious exclusion.

Taxi is considered a transport transaction, not travel. Diff mcc

sorry, getting alil confuse, does this mean that i will not earn 4mpd if i use amaze (linked to CRM) for travel expenses?

Any travel related expenses (e.g Hotels, Flights etc) just avoid using Amaze + CRM

Thanks for this article, I havent realised that travel transactions are excluded. Does tapping rewards card at supermarket transactions give 4mpd? I was comparing this with DBS Altitude and realised that DBS awards points for in blocks of $5 although it provides points for transports like mrt and bus but each transport ride is usually below $5??

Tapping the card is not an online transaction and will not earn 4mpd, unless you’re buying stuff at a department store, bags, shoes or clothes.

Save yourself from memorizing what earns 4mpd and what doesn’t by keeping it in the drawer and pairing it with the Amaze card for use in shops instead. You’ll just have to remember not to use it for travel expenses.

Thanks for this! Is it possible if I use amaze card in apple wallet or must i tap the physical amaze card?

i just tried, amaze cant be added in apple wallet.

i can add the amaze card into google pay.

will amaze capture payments made via google pay as online transactions and earn the 4mpd when linked to citi rewards?

Yes

What’s the mpd when using in PayAll?

Wondering if I should my monthly gym fee to Citi Rewards. Gym subscriptions are certainly not on the blacklist, but I’m also not sure if those count as “online transactions”. Anyone have a clue?

aaron,

between premiermiles vs prestige , if we fit the min income, which one will you choose for miles? am looking to cancel my ascend card soon.

If I pair the Citi Rewards to Amaze and set up Amaze on Google Pay, do I earn both Kris+ miles and Citi points when using Kris+ on participating merchants?

Citibank website mentions 10x rewards with Grab, Gojek and “more”. Any idea if “more” includes Comfort(Zig) and other ride sharing apps such as TADA and Ryde

Does spending on Hospital (medical checkup) earn 4mpd (x10 rewards)?

Just checked with Citi. Take a note that recurring payment from telco doesn’t earn bonus points.

MCC for the transaction is 4814 which is under Telecommunication Services including but not limited to prepaid phone services and recurring phone services.

correct. you must make ad-hoc payments via the app to earn. the same rule applies to WWMC.

hi, able to advise where does it state recurring payment for MCC 4814 will not be eligible for the credit card points?

Hi Aaron, understand the recurring payment from telco doesn’t earn bonus points. But what about recurring payments from Netflix and Disney+?

I just checked my Amaze + Citi Rewards for Netflix recurring bill payment, and I can confirm I received 10x TY points (or 4mpd). I have to use this Amaze combination because Netflix gave me problem to register my Citi credit card in Netflix payment method. Other OCBC / UOB cards have no problem.

I noticed that the Singtel app now uses AXS e-station to process ad-hoc payments via the Singtel app. Does this mean ad-hoc payments via the Singtel app now earn zero points for both Citi Rewards Card and DBS Woman’s World Card?

Does topping up grab credit using amaze card earn miles for citi reward points?

No.

Do you still get 10x rewards if the payment is made via Favepay?

Is it possible to have 2 citi rewards card? One for Visa and one for master

i doubt there is any Visa card available. They have transit to Mastercard…

does recurring payment for gym membership i.e. anytime fitness, earn any reward points?

How does 4mpd = 2.5% cashback?

Can I use this card to pay for Spotify and earn 4mpd?

Is Amazon SG and CRMC still a no 10x? I searched the telegram group and here but no latest update

Does Citi regards card clock the 4mpd by topping up/ buying vouchers on Kris+ and then paying with Kris miles to stack say the additional 6mpd as well to result in 10 mpd in total?

Do BlueSG, GetGo transactions earn bonus points, even when paired with Amaze?

I’ve tried it myself. No bonus points because GetGo, BlueSG are car rental agencies.

Would anyone know – if I were to use the Citi Rewards card directly to book overseas train tickets online (e.g. from London to Manchester), would this qualify for the 4mpd? I’m assuming this falls under the transport and not travel category so it should qualify…

Or must I use the Amaze card route?

I believe train tickets fall under MCC 4112 Passenger Railways, which is in the list of exclusions for Citi Rewards card.

With many restaurants now offer web app online order + payment for dining, does that consider an online payment?

Hi

i just want to clarify if Citi Rewards 4mpd works on transactions made in store via apply pay contactless payment. (not via amaze)

i read the review a few times and only saw in-app apple/google pay doesnt work.

Appreciate if someone can clarify this for me thanks! 🙂

I was unable to get the rewards point for transactions made in store with apple pay. Called citi and they clarified that bonus points wont be rewarded。

If I pair the Citi Rewards to Amaze and set up Amaze on Google Pay, do I earn both Kris+ miles and Citi points when using Kris+ on participating merchants?

Yes u will earn both kris+ miles and citi points. I tried on gongcha and it worked.

That’s because the Amaze processes all transactions online, even if they were made physically in-store. This means you could dine in a restaurant or shop at a brick-and-mortar merchant, pay with the Amaze Card paired to a Citi Rewards Card, and earn 4 mpd on your spending!

Kindly advise we can still earn 4 mpd even the transaction do not fall into the correct MCC?

Hi Aaron, would we earn the 4mpd on citi rewards, if we top up youtrip with Amaze (given we have linked citirewards to amaze)?

Is there any reason to not use amaze and pay directly with citi rewards given that the 4mpd is awarded for online payment (excluding some MCC)

When transferring rewards points to miles, can the card user transfer the miles to different KrisFlyer account?

Why does Cardup only collect at 0.4mpd and not 4mpd? Usually cards either allow or block fully.

I just got my CitiRewards card but unable to pair with amaze! It said the card issuer has rejected my request

Can you use Citi rewards in massage parlor for bonus thank you points if paired up with amaze?

Just a question about this card’s in app payment thing, where google pay is mentioned to not work.

I was thinking since pairing this card with Amaze works for Kris+, and that app only works by linking to google pay, does that mean that using Google Pay, for example on deliveroo, with your Amaze card, then linked to Citi rewards card, will this qualify for the 4mpd?

If you are following the Milelion strategy, you are getting a lot of miles from UOB and DBS cards such as Lady Solitaire, Visa Signature and Woman’s World. Citi PayAll was recently nerfed, and a Singapore Airlines round trip Advantage ticket to Europe is about 250,000 miles. The maximum miles per year from Citi Rewards is 48,000 miles. If you get a lot of miles from UOB and DBS, especially if you use CardUp heavily, is it right to postpone redemption of Citi Rewards points especially if you want to convert to non-Krisfyler miles? Or de-prioritize Citi Rewards because of… Read more »

For someone with high enough spending, did anyone get both Citi Rewards Visa and MC after the UOB and Revolution nerfs? Is this worth doing even if Citi Rewards Visa does not work with Amaze?

i own a rewards visa since 2013 and never once did my points appear in the expiry section of my statement. anybody owned this card that long? what is your expiry date? because it seems like the 60 months validity period doesn’t apply??

For petrol wise, can I go to Caltex, use Amaze to pay for 4mpd, and at the same time enjoy discounts as I used Citibank card?

If cannot, which other miles card should I use? Thinking of UOB Lady for petrol only (transport as category) but I doubt I can hit the minimum $500 spend per month for bonus interest rate in my UOB One Account.

Hi, how does one determine if it is an online transaction? Dies payment of my telco bill (SIMBA) via their app count as online?

How do we get the validity period renewed? (i.e. do I have to cancel the card and re-apply, or simply wait for the new card issuance upon the expiry date of the card?

Wait for new card to be issued. It’s all automatic.

If I pair the Citi Rewards Card with the Amaze card, and I make payment with the Amaze card via Apple wallet – Will I still get 4mpd? Many thanks in advance!

No. I have just been told my CITI. I bought Bee Cheng Hiang using Amaze links with Citi Reward earing 0 points.

So that means, using Amaze paired with Citi Rewards and using Amaze to pay for brick and motar transactions no longer works anymore?

Looks like Bonus Points are capped at 9000 points per statement month. So the max spend is $900 after rounding down each transaction to nearest dollar.