Here’s The MileLion’s review of the Standard Chartered Visa Infinite, which not too long ago was destined for the scrap heap of history. Rumours said that the X Card would soon become the bank’s flagship offering, and sure enough, marketing was discontinued, applications were closed, and the card was scrubbed from the internet.

-dramatic pause-

Well, we all know how that turned out. Barely one year later, applications reopened and the Visa Infinite slid back into the portfolio like nothing ever happened. And, in a stroke of delicious irony, it was the X Card which got sent to the junk pile instead.

But even though the Visa Infinite may have won the internal battle, on the industry level, it’s far from a winner. And with the launch of the Beyond Card in November 2024, it’s not even the top dog in the Standard Chartered pantheon anymore, so where does that leave it?

Standard Chartered Visa Infinite Standard Chartered Visa Infinite |

|

| 🦁 MileLion Verdict | |

| ☐ Take It ☐ Take It Or Leave It ☑ Leave It |

|

| What do these ratings mean? |

|

| The StanChart Visa Infinite offers very little for its annual fee, and with rival cards stepping up their FCY bonuses, it’s hard to see a reason for cardholders to stay. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: Standard Chartered Visa Infinite

Let’s start this review by looking at the key features of the Standard Chartered Visa Infinite.

|

|||

| Apply | |||

| Income Req. | S$150,000 p.a. | Points Validity | No expiry |

| Annual Fee | S$599.50 |

Min. Transfer |

25,000 points (10,000 miles) |

| Miles with Annual Fee |

35,000 (first year only) |

Transfer Partners |

2 |

| FCY Fee | 3.5% | Transfer Fee | S$27.25 |

| Local Earn | Up to 1.4 mpd | Points Pool? | Yes |

| FCY Earn | Up to 3 mpd |

Lounge Access? | Yes |

| Special Earn | N/A | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

Standard Chartered actually has two different Visa Infinite cards:

- the Visa Infinite, a brown-coloured card that is available to the general public (and the focus of this review)

- the Priority Visa Infinite, a blue-coloured card that is available to Priority Banking customers (though they can also apply for the regular Visa Infinite if they wish)

The Visa Infinite offers better earn rates, but the Priority Visa Infinite has a lower annual fee and offers as many as 12 lounge visits per year (it was previously up to 24), provided the cardholder meets the minimum AUM and wealth holdings requirement.

Regardless of which card you choose, however, it still comes in standard plastic cardstock. No reassuring metal clang here!

How much must I earn to qualify for a Standard Chartered Visa Infinite?

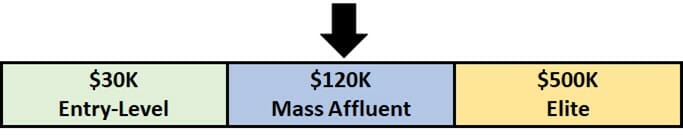

The Standard Chartered Visa Infinite has a S$150,000 p.a. income requirement, which is 25% higher than the usual S$120,000 you’d expect for cards in its weight class. It’s not clear how strictly Standard Chartered enforces this requirement, though I have heard anecdotal reports that they’ll accept anyone earning at least S$80,000 per year.

However, if you have a Priority Banking (min AUM: S$200K) or Priority Private (min AUM: S$1.5M) relationship, the income requirement is reduced to just S$30,000 p.a.

How much is the Standard Chartered Visa Infinite’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$599.50 | Up to five cards free |

| Subsequent | S$599.50 | Up to five cards free |

The Standard Chartered Visa Infinite has an annual fee of S$599.50. Up to four supplementary cards are free for life.

No annual fee waivers are offered for this card, regardless of how much you spend per year.

Officially, no miles are offered for renewal. I say “officially”, because reports say that those who call in to appeal are sometimes given 25,000 miles. That wouldn’t be enough to retain me, but at least it’s something.

What sign-up bonus or gifts are available?

|

| Apply |

From 1 April to 31 December 2025, new applicants for a StanChart Visa Infinite card will receive a total of 50,000 bonus miles when they pay the first year’s S$599.50 annual fee and spend at least S$2,000 within 60 days of approval.

| 💳 StanChart Visa Infinite Welcome Offer |

|

| Criteria | Bonus Miles |

| Pay S$599.50 annual fee | 25,000 miles |

| Spend S$2,000 within the first 60 days of approval | 25,000 miles |

| Total | 50,000 miles |

Both new and existing Standard Chartered cardholders are eligible for this offer.

Paying S$599.50 for 50,000 bonus miles works out to 1.2 cents per mile, which is a good price by market standards- probably one of the best things about this card!

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| Up to 1.4 mpd | Up to 3 mpd | N/A |

SGD/FCY Spend

Standard Chartered Visa Infinite Cardholders normally earn:

- 1 mpd for spending in Singapore Dollars (2.5 SC points per S$1)

- 1 mpd for spending in FCY (2.5 SC points per S$1)

However, if they spend at least $2,000 per statement month, they will earn

- 1.4 mpd for spending in Singapore Dollars (3.5 SC points per S$1)

- 3 mpd for spending in FCY (7.5 SC points per S$1)

For the avoidance of doubt, this applies to all spend from the first S$1 onwards, not just the incremental spend above S$2,000. For example, if you spend S$3,000 per statement month, all in SGD, you’ll earn 4,200 miles.

Provided you’re able to meet the minimum spend, this would be the highest-earning card in the $120K segment.

| 💳 Earn Rates for S$120K Cards (sorted by sum of local and FCY earn rate) |

||

| Card | Local | FCY |

StanChart Visa Infinite StanChart Visa Infinite |

1.4 mpd* | 3 mpd* |

Maybank Visa Infinite Maybank Visa Infinite |

1.2 mpd | 3.2 mpd@ |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

1.4 mpd | 2.4 mpd |

DBS Vantage DBS Vantage |

1.5 mpd | 2.2 mpd |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd | 2.2 mpd |

Citi Prestige Citi Prestige |

1.3 mpd^ | 2 mpd^ |

HSBC Visa Infinite HSBC Visa Infinite |

1 mpd | 2 mpd |

AMEX Platinum Reserve AMEX Platinum Reserve |

0.69 mpd | 0.69 mpd |

| *With minimum S$2K spend per statement month. Otherwise 1 mpd @With minimum S$4K spend per calendar month. Otherwise 2 mpd ^Additional 0.02 to 0.12 mpd awarded based on tenure with bank |

||

Is that reason enough to get a Standard Chartered Visa Infinite? Well, if you staunchly insist on using one card for everything and spend big on FCY transactions, maybe. But keep in mind that its star attraction — 3 mpd for overseas spend — comes with a hefty 3.5% FCY fee, the highest in the market.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

It should be noted that you could earn up to 4 mpd on overseas spend by pairing the right card with Amaze and paying an implicit FCY fee of ~2%, or an FCY-specialised credit card and an FCY fee of 3.25%, albeit with a cap.

But what if you’re a big spender and regularly bust the 4 mpd caps on specialised spending cards? Even then, I’d argue that the Maybank Horizon Visa Signature would be the better option.

|

|

|

| StanChart VI | MB Horizon | |

| Annual Fee | S$599.50 (no waiver) |

S$196.20 (3 year waiver) |

| FCY Earn | 3 mpd | 2.8 mpd |

| Min. Spend | S$2,000 per s. month | S$800 per c. month |

| FCY Fee | 3.5% | 3.25% |

| Cost Per Mile | 1.17¢ | 1.16¢ |

Maybank Horizon Cardholders earn an uncapped 2.8 mpd on FCY spend provided they spend at least S$800 per calendar month, without the hefty annual fee of the Standard Chartered Visa Infinite. The cost per mile works out to around the same, so it’s the superior option in my opinion.

And if you’re able to meet a minimum spend of S$4,000 per calendar month instead, then the Maybank World Mastercard offers an uncapped 3.2 mpd on FCY spend, again without the mandatory annual fee of the Standard Chartered Visa Infinite (it also earns an uncapped 4 mpd on petrol in Singapore too!).

|

|

|

| StanChart VI | MB World MC | |

| Annual Fee | S$599.50 (no waiver) |

S$261.60 (FYF) |

| FCY Earn | 3 mpd | 3.2 mpd^ |

| Min. Spend | S$2,000 per s. month | S$4,000 per c. month |

| FCY Fee | 3.5% | 3.25% |

| Cost Per Mile | 1.17¢ | 1.02¢ |

| ^2.8 mpd if cardholder spends at least S$800 but less than S$4,000 per calendar month | ||

Therefore, the FCY earn rate, which was once the standout feature of the Standard Chartered Visa Infinite, now seems far less compelling as other cards offer comparable or better rates with lower fees.

Transaction date or posting date?

The Standard Chartered Visa Infinite tracks spending based on the posting date, not transaction date.

If you’re accumulating spend towards your welcome bonus, or to unlock the enhanced earn rates, be careful about making transactions towards the end of the qualifying period– anything that posts beyond the deadline will not be included!

Which cards track spending by transaction date vs posting date?

When are SC Rewards Points credited?

Cardholders will initially receive the base rate of 2.5 SC points per S$1 when the transaction posts.

If they meet the minimum S$2,000 spend required for the enhanced earn rates, the additional 1/5 SC points per S$1 will be credited within five days after the end of the statement cycle month.

How are SC Rewards Points calculated?

Here’s how you can work out the SC Rewards Points earned on your Standard Chartered Visa Infinite Card.

Regular rate (Monthly spend <S$2K)

| Local Spend (2.5x) | Multiply transaction by 2.5, then round to nearest whole number |

| FCY Spend (5x) |

Multiply transaction by 2.5, then round to nearest whole number |

The minimum spend to earn points would be S$0.20 (SGD & FCY).

Regular rate (Monthly spend ≥S$2K)

| Local Spend (3.5x) | Multiply transaction by 2.5, then round to nearest whole number. Multiply transaction by 1, then round to nearest whole number. Add both numbers |

| FCY Spend (7.5x) |

Multiply transaction by 2.5, then round to nearest whole number. Multiply transaction by 5, then round to nearest whole number. Add both numbers |

The minimum spend to earn points would be S$0.20 (SGD) and S$0.10 (FCY).

For what it’s worth, Standard Chartered has a more forgiving rounding policy than banks like OCBC and UOB, which enables the Standard Chartered Visa Infinite Card to outperform ostensibly higher-earning cards for smaller transactions- even if you’re on the regular rate!

An illustration is provided below.

StanChart VI StanChart VI1 mpd |

UOB VI Metal UOB VI Metal 1.4 mpd |

|

| S$5 | 5.2 miles | 6 miles |

| S$9.99 | 10 miles | 6 miles |

| S$15 | 15.2 miles | 20 miles |

| S$19.99 | 20 miles | 20 miles |

| S$25 | 25.2 miles | 34 miles |

| S$29.99 | 30 miles | 34 miles |

If you’re an Excel geek, here are the formulas you need to calculate points:

Regular rate

| Local Spend | =ROUND(X*2.5,0) |

| FCY Spend |

=ROUND(X*2.5,0) |

| Where X= Amount Spent |

|

Step-up rate

| Local Spend | =ROUND(X*2.5,0) + ROUND(X*1,0) |

| FCY Spend |

=ROUND(X*2.5,0) + ROUND(X*5,0) |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for SC points?

A full list of transactions that do not earn points can be found here.

I’ve highlighted a few noteworthy categories below:

- Charitable donations

- Education

- Government services

- GrabPay and YouTrip top-ups

- Hospitals

- Insurance premiums

- Utilities

For the avoidance of doubt, CardUp transactions will earn points, and do count towards the minimum spend for welcome offers.

What do I need to know about SC points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| No expiry | Yes |

S$27.25 (per conversion) |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 10,000 miles | 2 | 1-3 working days (for KF) |

Expiry

Points earned on the Standard Chartered Visa Infinite Card never expire, so long as the card account remains active.

Pooling

Standard Chartered divides its credit cards into two tiers:

- Tier 1: Beyond, Journey, Visa Infinite, Priority Visa Infinite

- Tier 2: All other cards

Points pool within tiers, but not across tiers (so you can’t combine Tier 1 and 2 points in a single redemption, for example).

Transfer Partners & Fees

Standard Chartered used to have 10 different airline and hotel transfer partners, one of the widest ranges in Singapore.

Unfortunately, that changed in March 2024, when nine of them were unceremoniously dumped. Cathay Pacific Asia Miles was added, but the overall lineup is a lot thinner than before.

| Frequent Flyer Programme |

Conversion Ratio (SC Points: Partner) |

|

| Tier 1 | Tier 2 | |

|

25,000 : 10,000 | 34,500 : 10,000 |

|

25,000 : 10,000 | 34,500 : 10,000 |

Transfers cost S$27.25 each, regardless of the number of points transferred.

Transfer Time

Conversions to KrisFlyer miles are generally completed within three working days.

Other card perks

Six complimentary lounge visits

|

| Registration |

Principal Standard Chartered Visa Infinite Card cardholders enjoy six complimentary Priority Pass lounge visits per membership year. A US$35 fee per visit applies after the free visits have been fully utilised.

These visits can be shared with a maximum of one guest each time. For example, if the cardholder visits with two guests, he will need to pay a US$35 fee, notwithstanding the fact he/she still has free visits left.

As far as cards in the $120K segment go, this is woefully uncompetitive. In fact, it would be the second worst option, if not for the Maybank Visa Infinite’s decision to set the bar even lower!

| 💳 Airport Lounge Benefits (Income Req.: S$120K) |

|||

| Card | Lounge Network | Free Visits (Per Year) |

|

| Main | Supp. | ||

HSBC Visa Infinite HSBC Visa Infinite |

LoungeKey | ∞ | ∞ Up to 5 supp. cards |

OCBC VOYAGE Card OCBC VOYAGE Card |

Dragon Pass Lounge only |

∞ | 2 |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

Dragon Pass | ∞ + 1 guest* | N/A |

Citi Prestige Card Citi Prestige Card |

Priority Pass | 12 Multi Guests |

N/A |

DBS Vantage Card DBS Vantage Card |

Priority Pass | 10 Multi Guests |

N/A |

StanChart Visa Infinite StanChart Visa Infinite |

Priority Pass | 6 1x Guest |

N/A |

Maybank Visa Infinite Maybank Visa Infinite |

Priority Pass | 4 | N/A |

AMEX Platinum Reserve AMEX Platinum Reserve |

N/A | N/A | N/A |

| *Will be reduced to 12 visits per calendar year from 1 June 2026 |

|||

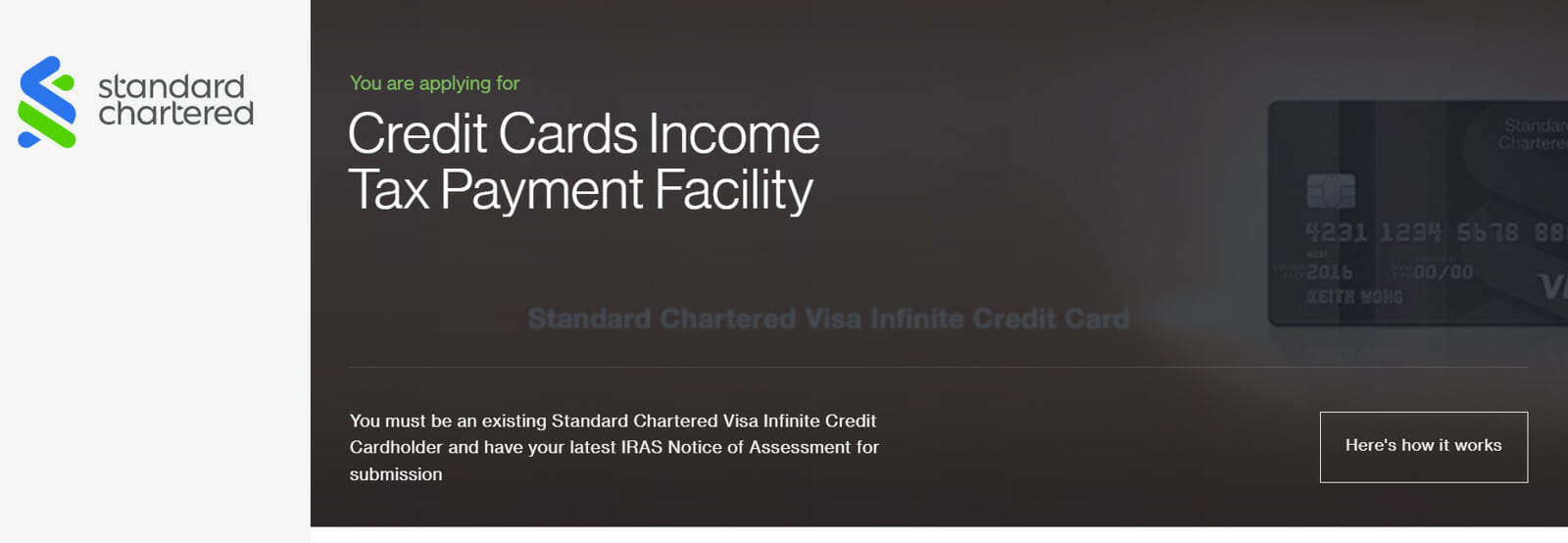

Tax payment facility

|

| Tax Payment Facility |

| The tax payment facility is not available to SC Priority Banking Visa Infinite, SC Journey or SC X Cardholders |

For a card so short on benefits, the income tax payment facility is arguably the Standard Chartered Visa Infinite’s ace in the hole.

This allows you to purchase miles by paying your income tax bill. ‘Here’s an illustration of how it works, for a cardholder with a S$10,000 tax bill:

- Cardholder completes an online application form and uploads a copy of their IRAS NOA

- S$10,190 is charged to his Standard Chartered Visa Infinite Card (S$10,000 tax due + S$190 admin fee @ 1.9%)

- S$10,000 will be deposited into his designated bank account within seven business days, with 14,000 miles credited

- He uses the funds to pay IRAS

Step (4) is optional. Whether or not you pay IRAS with those funds credited is your business. You’re perfectly at liberty to keep your current GIRO payment plan, or even use another bill payment platform like Citi PayAll or CardUp to buy more miles while paying IRAS.

Given a 1.9% admin fee and a 1.4 mpd earn rate, you’re paying 1.36 cents per mile. I’ve confirmed with a Standard Chartered spokesperson that any amounts charged to the tax payment facility will count towards the S$2,000 minimum spend required to trigger the 1.4 mpd earn rate.

However, there are two main drawbacks.

- 1.36 cents is a good price, but it used to be even better. Prior to 15 March 2024, the admin fee was 1.6%, which meant a lower cost per mile of 1.14 cents each!

- The number of miles you can buy is limited by the amount on your NOA. In our example of a taxpayer with a S$10,000 bill, the maximum miles he can buy is 14,000 (@ 1.4 mpd). Even if you’re more of a whale, a S$50,000 tax bill would yield 70,000 miles- not even enough for a one-way Business Class ticket to Europe!

Do note that cardholders can only pay their own personal tax bill (not friends or family members), but supplementary cardholders are also allowed to use the same tax payment facility too.

FAQs for the tax payment facility can be found here.

Complimentary travel insurance

| Accidental Death | S$1,000,000 |

| Medical Expenses | S$50,000 |

| Others | Delayed Luggage: S$1,000 Lost Luggage: S$5,000 |

| Policy Wording | |

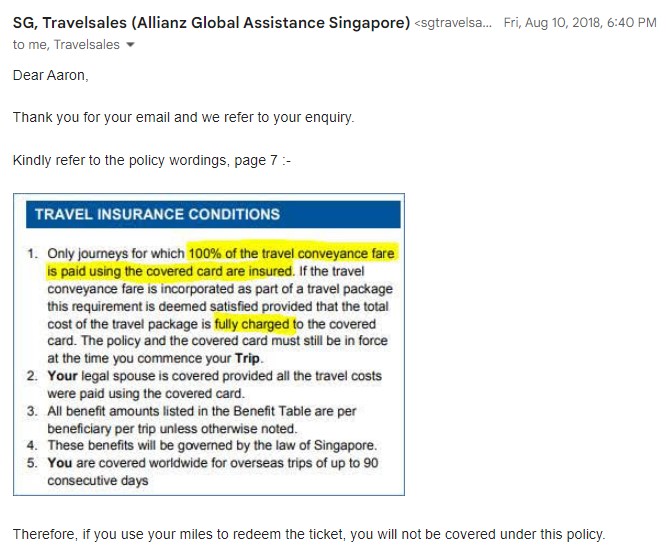

Standard Chartered Visa Infinite Cardholders enjoy complimentary travel insurance underwritten by Allianz.

This includes up to S$1,000,000 coverage for death and total permanent disability, S$100,000 emergency medical evacuation, S$50,000 overseas medical expenses, S$5,000 for lost baggage and S$1,000 for delayed baggage.

Do note there is no coverage for trip cancellation and disruption, delayed flights, rental car excess, or personal liability. I personally would not feel comfortable without this, so I’d recommend you purchase additional coverage.

Coverage is automatically activated when the full airfare is charged to the card. Allianz has previously clarified that coverage does not apply to award tickets, unfortunately.

Visa Infinite benefits

StanChart Visa Infinite Cardholders enjoy the following additional perks, provided by Visa.

| 🏨 Hotel Elite Status | |

| 🚗 Rental Car Elite Status | |

| 👍Other Perks |

For more information on how these perks work, refer to the post below.

Terms & Conditions

Summary Review: Standard Chartered Visa Infinite

|

|||

| Apply | |||

| 🦁 MileLion Verdict | |||

| ☐ Take It ☐ Take It Or Leave It ☑ Leave It |

The Standard Chartered Visa Infinite has one of the priciest annual fees in the $120K segment, but has surprisingly little to show for it.

The two main selling points are:

- The uncapped 3 mpd FCY earn rate

- The tax payment facility

(1) is only attractive if you’ve maxed out the 4 mpd possibilities with other cards, and don’t mind paying a higher-than-average 3.5% FCY fee. But I’d much rather use the Maybank Horizon Visa Signature for 2.8 mpd, given its lower 3.25% FCY fee and three-year fee waiver, or the Maybank World Mastercard for 3.2 mpd if you can meet the minimum S$4,000 spend requirement.

(2) can be a low cost way of earning miles, but you’re capped by your NOA, and the admin fee has increased from 1.6% to 1.9%.

The rest of its benefits are so lacklustre, it’s almost comical. No airport limo transfers. Only six lounge visits. Two transfer partners. Points that do and don’t pool, in a needlessly confusing manner. You might get it for one year in order to take advantage of the welcome bonus, but I don’t see why anyone would be willing to pay S$599.50 from the second year onwards.

Maybe the X Card should have won, eh?

Aaron, Which priority banking in Singapore that you think offer the best travel and miles benefit?

Hi. I have this card. Can’t say its for everyone but it’s a keeper for me. Anyway, I get 50,000 points i.e. 20,000 miles automatically every year on renewal. I called once long ago and was told it was automatic. Since then I haven’t called and just check the points after my renewal month. Has always been credited without fail every year. Just got the annual points again about 2 months ago – I didn’t call in. I believe it is the same for some other card holders.

The article is not very accurate. For me the annual fee was waived easily through mobile banking recently. The supplementary cards are not free contrary to the article. At least that’s what the RM told me a few months ago.

the website states very clearly: This annual fee is strictly non-waivable.

if your personal experience is different, that’s great. but it’s certainly not official policy, and people can’t expect the same to happen for them.

likewise, the website states that up to five supplementary cards are provided free (https://www.sc.com/sg/pricing-guide/#table-content-610040-8)

It is possible that John might be referring to the Priority Banking SCB VI card (blue card) since he has an RM – unless he specifically asked for the non-PB version of the VI card. The blue card has a waivable $324/$327 AF for a year but the supplementary cards are chargeable thereafter (so his RM is correct). I’ve heard that some PB clients get waived subsequent years on request and maybe with some minimum AUM/spend criteria but I’ve never bothered with this version anyway since it earns 1mpd, doesn’t have the IRAS facility and I get free lounge entries… Read more »

yup- if you can get guaranteed renewal miles each year, then someone with a high enough NOA could potentially generate enough miles to make it worthwhile. keep in mind, however, that we’re talking a very sizeable NOA, well in excess of an income of $150k per year.

You’re right. The only effort needed is to remember to do the 5-minute online IRAS facility once a year. I just do it when I see my online NOA. All the IRAS miles for NOA>84K will generate value at 0.36 cpm (at 1.5cpm redemption value). No other card has a simple non-promotion uncapped value like this (except maybe the 2 cards with bonus free hotel nights).

U are just being bitter at those that has income in access of 150k per year?

Do you also a priority private client with significant credit card spending so they offer fee waiver?

Hi Aaron, thank you for the wonderful information. I am new to the Miles game and would like to seek your advise on which cc to use for furniture purchases (Aircon/fridge/Sofa) at Harvey Norman, Courts, Gain City as well as Shopee/Lazada. Many thanks in advance!

This card was really good when there were 30% off dining offers and a spend 70k(?) a year and redeem a free yacht charter. Good times …

one good benefit for SC is the ability to transfer points to other SC card holders. so this actually allows legitimate transfer of airmiles for the purpose of group travel. useful if you have busted your redemption nominees