We’re just past the half-way point of 2020, and now’s as good a time as any to reassess your credit card game plan.

In the seven months that have passed since I first came up with my 2020 Credit Card Strategy, we’ve seen promotions come and go, major product nerfs and enhancements, as well as that minor inconvenience of not being able to fly anywhere.

Long story short, I’m still keeping the faith with miles, but I’ve also temporarily adjusted my valuation down to around the 1.5 cent mark- hence my willingness to cash out some points for statement rebates under the recent AMEX Platinum promotion.

I still believe we’ll see leisure travel returning by mid-2021, and I’m personally not concerned about the prospect of a KrisFlyer devalution in the near term (as laid out in this discussion). So until then, here’s my updated take on card strategy.

📱 Contactless & Mobile Payments: HSBC Revolution or UOB Preferred Platinum Visa

| Earn Rate | Remarks | |

| 4.0 mpd | S$1,000 per calendar month, selected merchants only Review |

|

|

|

4.0 mpd | S$1,110 per calendar month, except SMART$ merchants. Must use mobile payments Review |

The UOB Preferred Platinum Visa continues to be the go-to card in this category, but take note that since 22 May, there’s been no more 4 mpd for tapping the physical card at contactless readers. Instead, you’ll need to add your card to your mobile wallet (Apple/ Fitbit/ Google/ Samsung Pay), an exercise which takes all of 30 seconds.

Alternatively, you can use the HSBC Revolution, fresh from its 1 August makeover. Cardholders can now earn 4 mpd on contactless payments at:

- Travel merchants like airlines and hotels

- Department and retail stores

- Supermarkets, dining and food delivery

- Transportation (excluding public transport)

It’s not quite the “4 mpd everywhere” that the UOB Preferred Platinum Visa offers, but still a very wide range of day-to-day merchants.

| ⚠️ It’s also possible to use the UOB Visa Signature, but you’ll need to spend at least S$1,000 on contactless + petrol in a statement month to earn 4 mpd |

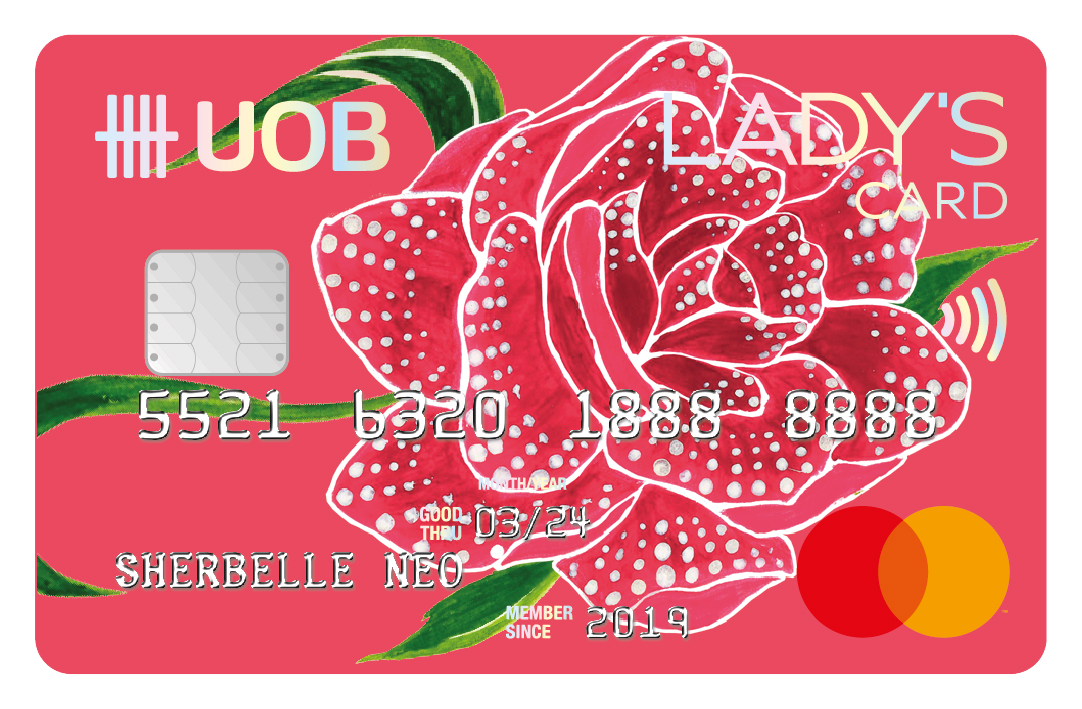

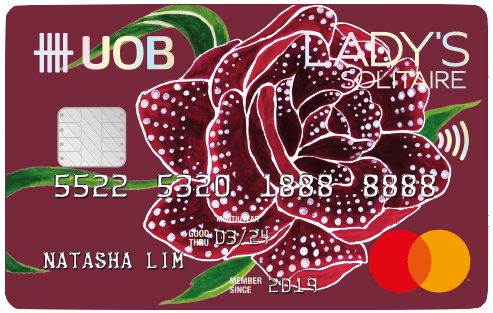

🍽️ Dining: HSBC Revolution or UOB Lady’s Card/Lady’s Solitaire

| Earn Rate | Remarks | |

| 4.0 mpd | S$1,000 per calendar month Review |

|

UOB Lady’s Card UOB Lady’s CardApply here |

4.0 mpd | S$1,000 per calendar month. Must choose dining as 10X category. Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply here |

4.0 mpd | S$3,000 per calendar month. Must choose dining as 10X category. Review |

2020 started with limited 4 mpd options for dining. To earn this, you’d need to:

- hold a long-discontinued UOB Preferred Platinum AMEX

- hope the restaurant accepted contactless payments, and burn your UOB Preferred Platinum Visa’s 4 mpd cap

- have lady parts

If you ticked “no to all”, then the Maybank Horizon Visa Signature was the only solution, and a sub-optimal one at that. You’d earn 3.2 mpd with a minimum spend of S$300, and only at MCC 5812 (Restaurants)- no bonus for fast food, caterers, or bars.

Therefore, the HSBC Revolution’s renaissance has been just what the doctor ordered. Cardholders can now earn 4 mpd whenever they use contactless payments at :

- MCC 5811: Caterers

- MCC 5812: Restaurants

- MCC 5813: Bars, Cocktail Lounges, Nightclubs

- MCC 5814: Fast Food Restaurants

- MCC 5499: Misc Food Stores

Those categories are wide enough to settle all your dining needs.

🌎 Foreign Currency (FCY): UOB Visa Signature

| Earn Rate | Remarks | |

| 4.0 mpd | Min S$1,000 Max S$2,000 on FCY spending. Payment processing must be done overseas |

Sadly, the OCBC 90°N’s uncapped 4 mpd on FCY spending ended in March, dropping to a more sedate 2.1 mpd.

In any case, no one’s really traveling at the moment, and since there are plenty of 4 mpd cards you can use when paying online in FCY, there’s no real need for a dedicated FCY card right now.

Should that situation change, my weapon of choice would still be the UOB Visa Signature. This earns 4 mpd on FCY spending, provided (1) you spend at least S$1,000 in foreign currency in a given statement month, and (2) the payment processing is done outside of Singapore.

🛒 Offline Shopping: Citi Rewards or OCBC Titanium Rewards

| Earn Rate | Remarks | |

| 4.0 mpd | S$1,000 per statement month Review |

|

|

|

4.0 mpd | S$12,000 per membership year Review |

No changes here, although I’d tend to use the OCBC Titanium Rewards for offline shopping and save the Citi Reward’s less restrictive 4 mpd cap for online spending.

Remember, you can get both the Blue and Pink versions of the OCBC Titanium Rewards card to double your annual 4 mpd cap. You could equally use the HSBC Revolution or the UOB Lady’s/Lady’s Solitaire Cards (with fashion selected as your 10X category) for this category.

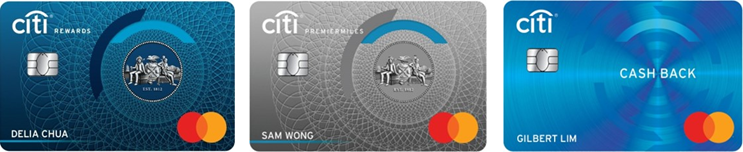

🖥️ Online Transactions: Citi Rewards or DBS Woman’s World Card

| Earn Rate | Remarks | |

| 4.0 mpd | S$1,000 per statement month, excludes travel Review |

|

|

|

4.0 mpd | S$2,000 per calendar month Review |

The most significant development on this front has been the discontinuation of the Citi Rewards Visa. For the uninitiated, Citibank made the decision back in March to switch all non co-brand cards to the Mastercard network.

Normally this wouldn’t be a big deal, since Mastercard is accepted pretty much everywhere Visa is. But it was a huge deal for the Citi Rewards Card, because the Citi Rewards Mastercard is quite a different beast from the Visa.

The Mastercard version does not earn 4 mpd on GrabPay top-ups (but to be fair, neither does the Visa since 17 July), and is rife with reports of cardmembers not earning the 4 mpd they should be for online spending.

That said, my advice would still be to stick to the Citi Rewards and DBS Woman’s World Card for online spending (just that Citi Rewards Mastercard users will need to check their points balance very carefully). These are the easiest to use, thanks to their “blacklist” approach- so long as it isn’t in the list of exclusions (e.g insurance, government), all online transactions will earn 4 mpd.

| ❓ Blacklist vs Whitelist |

| In contrast, other online spending cards like the HSBC Revolution and UOB Preferred Platinum Visa adopt a “whitelist” approach, which means an online transaction doesn’t earn 4 mpd unless its MCC falls within the inclusion list. |

⛽ Petrol: Maybank World Mastercard or UOB Visa Signature

| Earn Rate | Remarks | |

Maybank World Mastercard Maybank World MastercardApply here |

4.0 mpd | |

|

|

4.0 mpd | Min S$1,000 Max S$2,000 on petrol + contactless spending per statement month. Excludes Shell, SPC |

| 👉 Full Article: What’s the best card to use for petrol? |

Although I feel the best card for petrol is the one that gives the biggest discount, the Maybank World Mastercard and UOB Visa Signature continue to earn the highest miles.

The Maybank World Mastercard is probably the better choice, because you don’t have to deal with minimum spending restrictions nor avoid Shell and SPC. Give some thought to how much you spend on petrol, however, because you may end up with orphan points otherwise.

| You could also use the UOB Lady’s or Lady’s Solitaire Card here, assuming you declare “transport” as your quarterly 10X category. If contactless payments are accepted, and you’re not at a Shell or SPC station, you can also use the UOB Preferred Platinum Visa |

🚆 Public Transport: UOB Lady’s Card/Lady’s Solitaire or Maybank Horizon Visa Signature

| Earn Rate | Remarks | |

UOB Lady’s Card UOB Lady’s CardApply here |

4.0 mpd | S$1,000 per calendar month. Must choose transport as 10X category. Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply here |

4.0 mpd | S$3,000 per calendar month. Must choose transport as 10X category. Review |

|

|

3.2 mpd | Min S$300 per calendar month |

| 👉 Full Article: What’s the best card to use for SimplyGo and public transport? |

Public transport won’t be a huge component of your monthly expenditure, but it’s still a category worth optimizing. Unfortunately, the UOB PRVI Miles has not extended its 4.4 mpd promotion on SimplyGo, which means there are currently no ongoing promotions here.

Instead, females can use the UOB Lady’s Card/Lady’s Solitaire Card for 4 mpd, with transport selected as the quarterly 10X category. Everyone else can use the Maybank Horizon Visa Signature for 3.2 mpd (with a minimum monthly spend of S$300 on any category).

Alternatively, you could use the KrisFlyer UOB Credit Card for 3 mpd, but you’d need to spend at least S$500 on SIA-group transactions in a membership year- a little tricky in the current climate.

💳 General Spending: UOB PRVI Miles Card

| Earn Rate | Remarks | |

|

|

1.4 mpd (local) 2.4 mpd (overseas) |

Awarded per S$5 of spending Review |

| If you have access to a general spending card that earns 1.6 mpd, such as the Citi ULTIMA, UOB Reserve, DBS Insignia or Premier/Private Banking versions of the OCBC VOYAGE, by all means go ahead and use it. |

At the start of 2020 I was still using the BOC Elite Miles World Mastercard as my general spending card. But thanks to its ignominious nuking and the nerf of the BOC SmartSaver, I’m finally free to move on.

This means the UOB PRVI Miles gets called up for duty once more, although it speaks volumes to the proliferation of contactless payments and online shopping that I hardly use it. Remember: your general spending card is a card of last resort. Save it for occasions where 4 mpd opportunities don’t exist.

Best Cards for Other Categories

Should you be spending on other categories not explicitly mentioned above, you might want to refer to the guides below:

- What’s the best card for charitable donations?

- What’s the best card for hospital bills?

- What’s the best card for insurance premiums?

- What’s the best card for utilities bills?

Otherwise, have a check of The Milelion’s Credit Card Guide, which covers some additional categories.

Conclusion

So that’s my game plan for the rest of 2020! There are of course many roads to Rome, and if you have alternative strategies, feel free to share them below.

Finally, I’ve not said a word about sign up bonuses, on the assumption that you’ve already exhausted them. If not, check out this page where I keep track of the latest sign up bonuses on the market- they’re a great way to jump start your miles collection.

OCBC Titanium Rewards

OCBC Titanium Rewards

Maybank Horizon

Maybank Horizon UOB PRVI Miles

UOB PRVI Miles

UOB Preferred Platinum will also apply for dining (as long as contactless payment) and online transactions?

Yup, one card can pull multiple duty. But ppv online is more restricted

Do note the article said that contactless has to be via mobile wallet (eg Google Pay or Samsung Pay) and not just contactless PayWave terminal with the phycial UOB PPV card.

Maybe a new strategy for this pandemic? As some say travel only will restart maybe year 2024. UOB miles life = 5 year, N90 No expiry date, Citi Reward 8 Years… just a thought..

Who is some ? Travel “full” capacity is expected to resume by 2024. Get your facts right. Travel in next year is definitely allowed.

Another thing: DO NOT KEEP YOUR MILES FOR TOO LONG

relax…does not really matter who is some or full capacity by 2024… u want to travel now also can what. What im trying to say is that probably it might be safe to travel maybe by 2024.. if there is vaccine probably much earlier.. who want to keep miles long?? For me once i got the target miles i want i will use it. But for this pandemic i will have alot of miles hanging on my account which i dont really like it. So was hoping to see what kind strategy for this pandemic situation. Currently putting on my… Read more »

There is indeed a real risk with accumulating too many miles currently. While people continue to chalk up miles with credit card spend, there are almost no redemptions given the restrictions on air travel. This means a situation of demand for redemption seats outstripping supply even when flights resume. Plus, it is unlikely that we will see flight schedules return to 2019 levels until 2024. Faced with this situation, there is a real possibility that airlines will devalue miles as a strategy to soak up the excess demand. If there is a time to consider cashback, this is it.

Citi Rewards points expire every five years, counted from your card approval date (with an additional 3-month grace period).

Yeh im holding a broad range of credit card. Citi reward is 1 of them..

Mainly all the x 10 reward card I already have. And the miles is accumulating faster then i predict.

Worse case scenario will be using kris shop…

Should UOB Visa Signature be included in “Contactless & Mobile Payments” category for 4mpd as well? Or did UOB changed some terms?

you can, provided you’re willing to spend at least $1K

Hey. Can you review the JCB-UOB card?

wrote about it a while ago but don’t think it’s really worth an updated post

https://milelion.com/2016/10/04/is-it-worth-getting-the-jcb-card-for-a-single-trip-to-japan/

You get unlimited lounge access in Japan and Hawaii, and 4 lounge passes in Germany, Korea, Malaysia, Singapore, Taiwan and Thailand, so it’s worth getting for the lounge passes. Of course that’s moot at this point in time…

hi aaron, how about which miles card gives the best conversion to cash rebate rate if need be? i know you dont encourage but some of e pts do have expiry and there’s no pt keeping till the last day or convert to KF miles to redeem for premiums. thanks

there was a recent article on this. please search the site.

Is it worth paying the annual fee of DBS Altitude card for 10k miles?

Hi Aaron, what would you recommend in these circumstances:

• $1,000-2,000 spend (combined) on food delivery and taxi / Grab monthly

• Occasional shopping and dining (<$1,000)

• Prefer to have credit card from just 1 bank (for ease of tracking)

Thanks

Assuming you’re a guy – probably DBS WWMC (online spending – that would be your food delivery, Grab) + DBS Altitude (everything else) would be best for you. If you’re a female, you could go for UOB Lady’s Card (declare transport as 10X category – taxi + Grab on it) + UOB PPV (online food delivery + contactless spending at shopping and dining) + UOB PRVI Miles (everything else).