The Standard Chartered X Card launched in July 2019, which means that the inaugural batch of cardholders will soon be facing the annual “keep or cancel” question.

For the past two years, this has been settled almost by default, with Standard Chartered offering an “exceptional” waiver of the annual fee in 2020 and 2021. I’m not complaining, though it does make a mockery of the bank’s claim that “the annual fee is strictly non-waivable”.

What’s changed with the X Card in the 12 months since I wrote last year’s keep or cancel piece? Will 2022 see another “exceptional” waiver? And can something really be considered “exceptional” if it’s, um, kind of the norm?

SCB X Card: The story so far

The SCB X Card officially launched on 25 July 2019 with a sensational 100,000 miles sign-up bonus. This was unprecedented in Singapore, and proved so popular that it had to be pulled just six days after launch. The replacement sign-up offer of 60,000 miles was still good, though obviously not as attractive as the original.

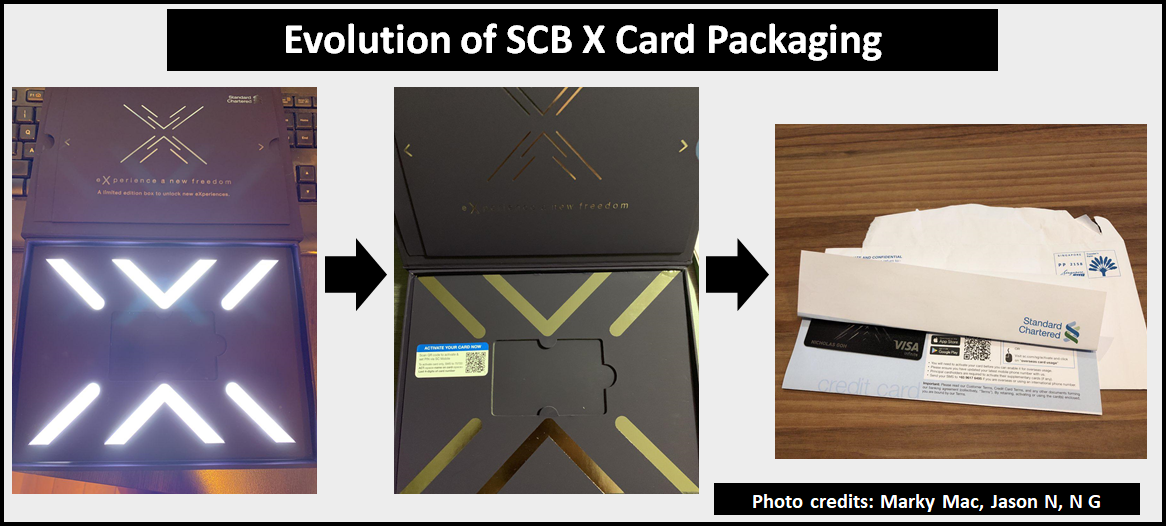

Even so, Standard Chartered had difficulty keeping up with demand. This was nowhere more apparent than the packaging. When it first launched, the SCB X Card came in a beautiful box that lit up when opened. A few weeks later and that became a regular box sans lights. A few weeks more, and just a plain envelope.

So overwhelming was the response that Standard Chartered eventually decided to suspend any new applications on 20 August 2019. There then followed a limbo period, and at one point the X Card had been closed for applications twice as long as it’d been open!

The moratorium came to an end on 16 October 2019 when the SCB X Card relaunched in plastic form. Cardholders would get an IOU for a metal card, with the same 60,000 miles sign-up bonus.

Then in February 2020, Standard Chartered decided to cease accepting new applications for the SCB Visa Infinite. “This is it,” I thought. “This is the moment where Standard Chartered makes the X Card its flagship and puts all its firepower behind it.”

Fat chance- the rest of the year was largely uneventful (though I imagine COVID had something to do with that). We saw transfer bonuses to Emirates and IHG Rewards, a 3 mpd offer for foreign currency spend, and a 50,000 miles anniversary spending promotion (much less impressive than it sounded on paper), but that was it until the second year’s fee waiver came round.

The 2020/2021 cycle was even quieter, with Qantas and EVA Air specific sign-up bonuses the only things warranting a mention (other than a stealth devaluation of transfers to Qatar Privilege Club). Oh, and the SCB Visa Infinite that the X Card supposedly killed? It got relaunched in January 2021.

July 2021 saw a waiver of the third year’s annual fee as well, but the downward spiral has only continued in 2021/2022 where the X Card has somehow managed to become even more anonymous. I’ve checked the archives, and the only article I wrote in the last 12 months was about the suspension of the X Card’s travel credit option in April 2022 (tl;dr: don’t sweat it).

Keep or cancel?

Here’s the basic problem with the SCB X Card.

While there have been some sporadic offers here and there, there has been no improvement to the core value proposition since the day it launched. For the princely sum of S$695.50, cardholders enjoy two complimentary lounge visits, and 20-30% off selected restaurants at Marina Bay Sands.

That’s it. There’s no airport limo, no private club access, no dining memberships, no hotel perks, nothing you’d expect from a premium credit card. If anything, you might even argue that the SCB X Card has gotten worse while standing still, since its two-visit Priority Pass now excludes access to Plaza Premium Lounges.

Cardholders who call up to cancel are sometimes offered 20,000 miles as a retention bonus, but let’s be clear: this is woefully inadequate. Based on my value of 1.5 cents per mile, 20,000 miles would not even cover half the S$695.50 annual fee!

| 💳 Premium Cards & Renewal Miles |

|||

| Card | ↓ Annual Fee | Year 1 | Year 2 onwards |

SCB X Card SCB X Card |

S$695.50 | 30,000 miles | 20,000 miles* |

HSBC Visa Infinite HSBC Visa Infinite |

S$650 (S$488 for HSBC Premier) |

35,000 miles | N/A |

UOB VI Metal Card UOB VI Metal Card |

S$642 | 25,000 miles | 25,000 miles |

DBS Vantage DBS Vantage |

S$588.50 | 25,000 miles | 25,000 miles |

SCB Visa Infinite SCB Visa Infinite |

S$588.50 | 35,000 miles | 20,000 miles* |

Citi Prestige Citi Prestige |

S$535 | 25,000 miles | 25,000 miles |

OCBC VOYAGE OCBC VOYAGE |

S$488 |

15,000 miles | 15,000 miles |

| *On appeal |

|||

The only other argument I could see for keeping the X Card is to earn 4 mpd on foreign currency spend with the Rewards+, but even that logic is backwards- you get the Rewards+ if you’ve decided to keep the X Card, not vice versa.

Therefore, I simply do not see any case for renewing the SCB X Card.

A word about cancellations

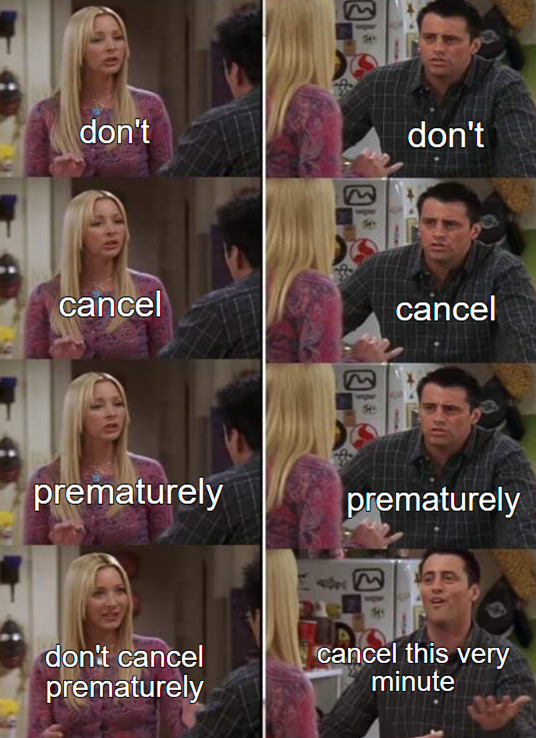

Here’s the graphic I trot out every year regarding cancelling the SCB X Card before the annual fee is charged.

My stance is that it makes little sense to cancel a credit card ahead of the upcoming year’s annual fee, since you won’t get a partial refund on the current year anyway. Once the annual fee has been charged, you can always call up the bank to cancel and claim a refund.

However, I’ve read a couple of stories of CSOs refusing to waive the annual fee even with card cancellation. That makes no sense to me at all, since the annual fee is charged in respect of the upcoming year (not the year that’s passed). If you cancel the card, why should there be anything payable?

I can’t say how widespread a problem this is, but I figured I’d throw that out there. Personally, I won’t cancel until it’s confirmed there’s no waiver. I realise I’m missing out on the opportunity to “reset” my new-to-bank status; by cancelling I could come back in 12 months and get a nice S$300+ cash gift. All the same, I do value having a card from every bank (if only to take advantage of generic discounts), plus a morbid fascination regarding the future of the X Card.

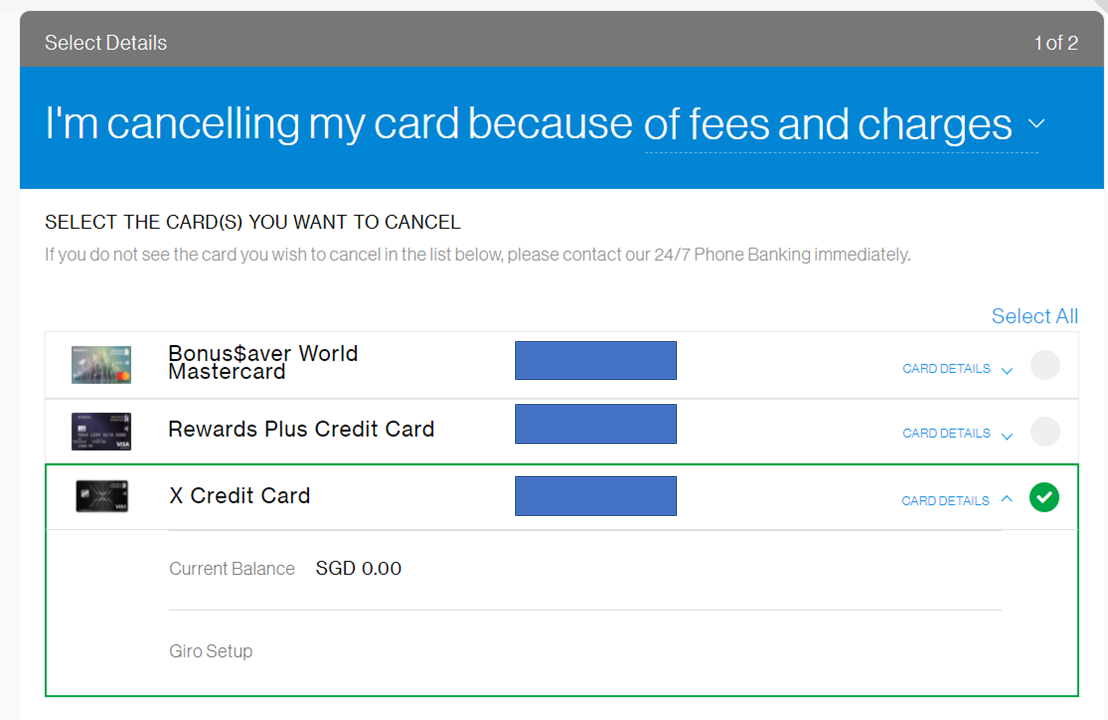

If you plan to cancel, do take note of the following.

It is possible to cancel a Standard Chartered credit card via the SCB app/ibanking portal, provided there’s no outstanding balance. If your annual fee has been posted, that counts as a balance and you’ll need to call up the bank to get the cancellation processed manually.

It’s not that big a hassle to make a phone call, although CSOs have been trained to punt the issue to an RM, who will arrange a call back to convince you to stay. That might draw out the cancellation process somewhat.

Before you cancel your X Card, be sure to redeem all your rewards points (no, they haven’t removed KrisFlyer, stop asking). If you happen to also hold a SCB Visa Infinite, you can ask the bank to transfer your X Card points over to the Visa Infinite account before cancelling (at least based on a couple of data points I’ve seen- YMMV). However, you will not be able to do this if you hold any other SCB credit cards (since points earned on the X Card and Visa Infinite enjoy a special rate when transferred to KrisFlyer).

Conclusion

Will Standard Chartered waive the X Card’s fourth year annual fee? The jury’s still out, but they must surely know that the failure to do so will trigger an exodus on the scale of the Israelites from Egypt.

No one in the right mind is going to pay S$695.50 for a couple of lounge visits and assorted MBS dining discounts, and the fundamental issue remains that Standard Chartered has not created a product worth paying S$695.50 for.

Are you cancelling your X Card ahead of renewal, or waiting for a waiver?

Even the MBS dining benefits are very weak, only 10-20% discount with 200+ SGD minimum spend for most restaurants

I wanted to flag a really unpleasant experience I had with the X Card. I was billed for my annual fee in 2021. I called in to cancel – was told that the annual fee was not waivable (completely illogical, as you explain in your article). So I requested the CSO to escalate this matter, and foreseeing what eventually became reality, I explicitly informed him to let me know of the bank’s decision before proceeding with any action. The next week, I received an SMS informing me that my waiver was approved. I thought all was well and good until… Read more »

Why did you start off by calling to cancel, without first transferring out the points? Best to never even suggest you *might* cancel, while you have points you still want.