| 🕰️ Hello, time traveller! |

| Found this page through a search engine? Look for the latest edition of this guide here |

As 2021 gets under way, it’s time once again to examine your credit card game plan for the year ahead. Which cards should feature most prominently in your miles accumulation strategy? Which cards should get sock drawered; which ones should be cut up?

We’ve already received a major blessing to kick off the year: the Visa Supplier Locator. tl;dr: this little tool lets you look up the MCC of any given merchant in Singapore (so long as they accept Visa). This means there’s now really no excuse not to use the right card in every situation.

What card would that be? Here’s my take.

Credit Card Strategy: Overview

With the right credit cards, you can earn up to 4 mpd on your spending. Your job is to make this the norm, rather than the exception. In other words, the overall objective of your card strategy is:

| 💡 Maximize 4 mpd opportunities 💡 |

It’s not rocket science. The very reason why we don’t use one card for everything is because we don’t want to pass up 4 mpd opportunities. If you’re happily swiping your Citi PremierMiles Card everywhere, you’re losing up to 2.8 miles for every dollar spent, and your path to a free flight will be significantly slower than someone who optimizes.

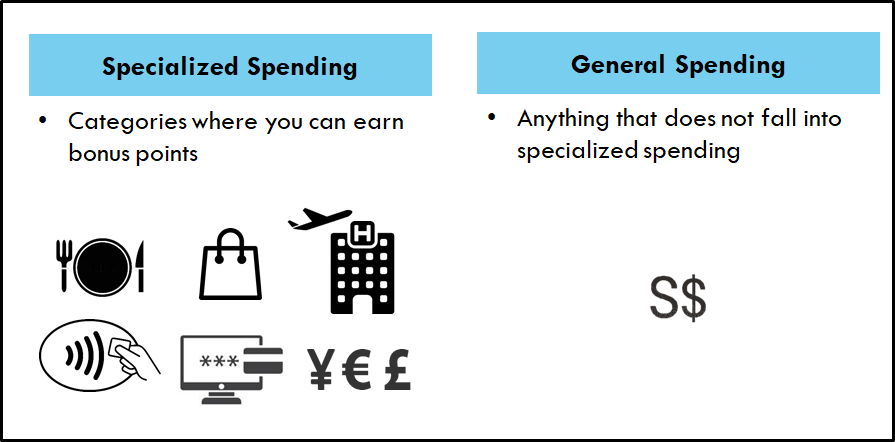

It’s helpful to classify all your spending into one of two buckets:

- Specialized

- General

Specialized spending refers to categories where 4 mpd opportunities exist. General spending is the catchall term for everything else, where the best you can do is 1.2-1.6 mpd. The upshot is: Every time you use a general spending card for a specialized spending category, you’re leaving money on the table.

We certainly don’t want that, so here’s the cards to use for common categories of spending.

📱 Contactless & Mobile Payments: HSBC Revolution, UOB Preferred Platinum Visa, or UOB Visa Signature

| Earn Rate | Remarks | |

| 4.0 mpd | Max S$1K per c. month, selected merchants only Review |

|

|

|

4.0 mpd | Max S$1,110 per c. month, must use mobile payments Review |

| 4.0 mpd | Min S$1K Max S$2K on contactless/ petrol per s. month | |

| C. Month= Calendar Month, S. Month= Statement Month | ||

Contactless payment terminals are so ubiquitous nowadays that you should be earning 4 mpd on the vast majority of your transactions.

The UOB Preferred Platinum Visa continues to be the go-to card in this category, with 4 mpd on all mobile payment transactions except SMART$ merchants and UOB’s standard exclusion list.

| ⚠️ To earn 4 mpd on the UOB Preferred Platinum Visa, you must add the card to your mobile wallet and use it; you won’t earn the bonus if you tap the physical card |

The UOB Visa Signature also offers 4 mpd on contactless transactions, provided you spend at least S$1,000 per statement month on contactless and/or petrol transactions. Do note that from 1 February 2021, hospitals will be added to the exclusion list for UOB.

Alternatively, you can use the HSBC Revolution for 4 mpd on contactless payments at:

- Airlines and hotels

- Department and retail stores

- Supermarkets, dining and food delivery

- Transportation (excluding public transport)

It’s not quite the “4 mpd everywhere” that the UOB cards offer, but still a very wide range of day-to-day merchants. Even better, it covers both restaurants and hotels, which means no more confusion about what card to use when you’re dining at a hotel.

HSBC only supports Apple Pay, so all other mobile device users will need to carry the physical card around with them.

🍽️ Dining: HSBC Revolution or UOB Lady’s Card/Lady’s Solitaire

| Earn Rate | Remarks | |

| 4.0 mpd | Max S$1K per c. month Review |

|

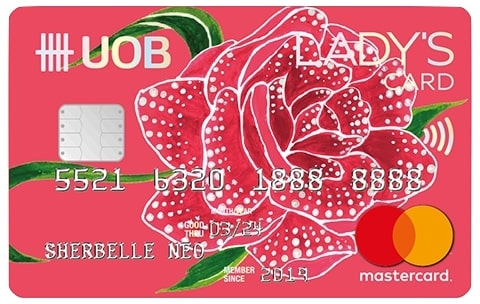

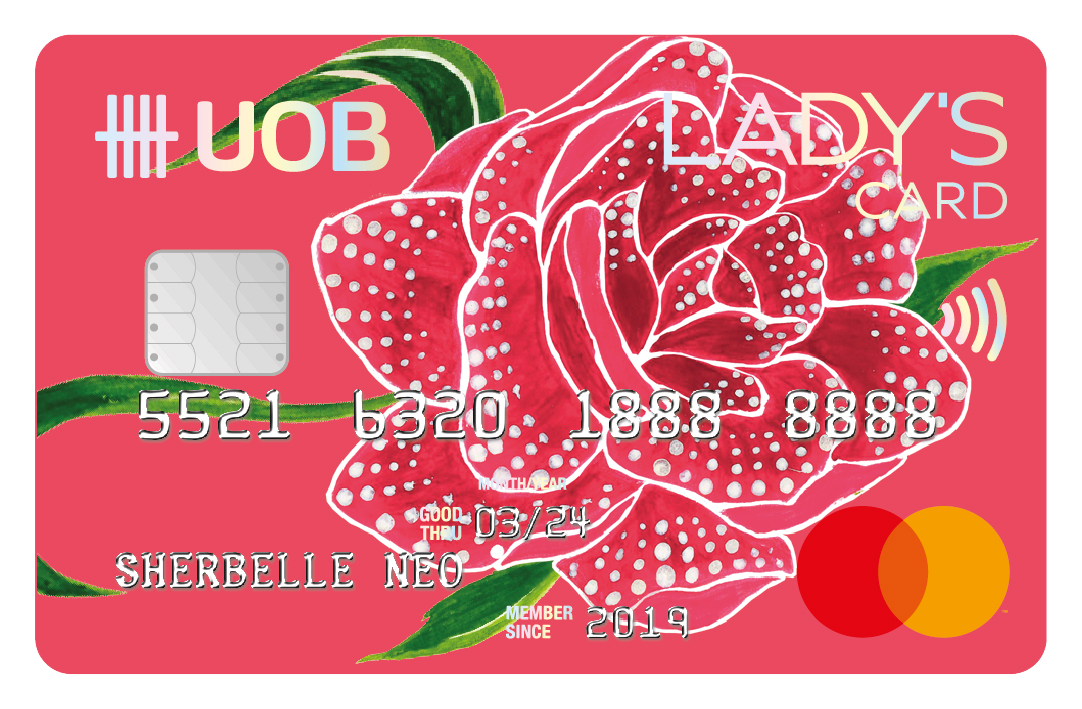

UOB Lady’s Card UOB Lady’s CardApply here |

4.0 mpd | Max S$1K per c. month. Must choose dining as 10X category. Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply here |

4.0 mpd | Max S$3K per c. month. Must choose dining as 10X category. Review |

| C. Month= Calendar Month | ||

The HSBC Revolution’s 2020 renaissance provides a dining card option for those without lady bits, and in fact, might just be the best dining card on the market.

Why? Dining includes a wide range of MCCs, and the HSBC Revolution covers them all.

| Comparison of Dining Card MCC Coverage | ||||

|

|

|

|

|

| HSBC Revo | MB Horizon | UOB PPA | UOB Lady’s Card | |

| 5811 | ✅ | ✅ | ||

| 5812 | ✅ | ✅ | ✅ | ✅ |

| 5813 | ✅ | ✅ | ||

| 5814 | ✅ | ✅ | ✅ | |

| 5441 | ✅ | |||

| 5462 | ✅ | |||

| 5499 | ✅ | ✅ | ||

| Glossary & Examples | ||||

|

||||

If you don’t mind a slightly narrower definition of dining, the UOB Lady’s Card and Lady’s Solitaire Card are also good choices. One workaround for the gender restriction, if you’re a guy, is to get your wife/girlfriend to apply for the card and then add it to your mobile wallet.

Those of you with the (discontinued) UOB Preferred Platinum AMEX can of course continue using it for dining, but do remember the S$6,000 cap per calendar year.

🌎 Foreign Currency (FCY): SCB Rewards+ or UOB Visa Signature

| Earn Rate | Remarks | |

|

|

4.0 mpd | Max S$2,222 FCY per m. year. Must have SCB X Card or SCB Visa Infinite |

| 4.0 mpd | Min S$1K Max S$2K per s. month on FCY spending |

|

| M. Year= Membership Year, S. Month= Statement Month | ||

The big discovery towards the tail end of last year was that Standard Chartered now pools credit card points across all cards. This means the normally-useless SCB Rewards+ Card suddenly gets new lease of life, at least for those who also hold the SCB X Card or SCB Visa Infinite.

I’ve explained everything in detail here, but tl;dr: SCB X Card or SCB Visa Infinite cardholders can use the SCB Rewards+ Card to earn 4 mpd on FCY spending, capped at S$2,222 per membership year. That’s a low cap to be fair, but given the wide variety of transfer partners SCB has, may still be worth your time.

For everyone else, there’s still the good old UOB Visa Signature. This earns 4 mpd on FCY spending, provided (1) you spend at least S$1,000 in foreign currency in a given statement month, and (2) the payment processing is done outside of Singapore.

🛒 Offline Shopping: Citi Rewards or OCBC Titanium Rewards

| Earn Rate | Remarks | |

| 4.0 mpd | Max S$1K per s. month Review |

|

|

|

4.0 mpd | Max S$12K per m. year. Pink and Blue cards have their own cap Review |

| M. Year= Membership Year, S. Month= Statement Month | ||

No changes here from last year- my default choice is to use the OCBC Titanium Rewards for offline shopping, and save the Citi Reward’s more flexible 4 mpd cap for online transactions like food delivery or Grab rides.

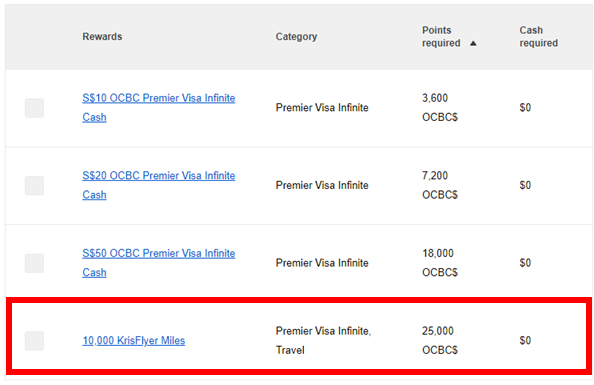

If possible, OCBC Titanium Rewards cardholders should try and get their hands on an OCBC Premier Banking Visa Infinite. This no-fee card offers free conversions to KrisFlyer, and since OCBC$ are pooled, serves as a no-cost way of cashing out the OCBC$ from the Titanium Rewards.

🖥️ Online Transactions: Citi Rewards or DBS Woman’s World Card

| Earn Rate | Remarks | |

| 4.0 mpd | Max S$1K per s. month, excludes travel Review |

|

|

|

4.0 mpd | Max S$2K per c. month Review |

| C. Month= Calendar Month, S. Month= Statement Month | ||

Again, no real change here. My advice would be to stick to the Citi Rewards or DBS Woman’s World Card for online spending. These are the easiest to use, thanks to their “blacklist” approach- so long as it isn’t in the list of exclusions (e.g insurance, government), all online transactions will earn 4 mpd.

| ❓ Blacklist vs Whitelist |

| Why not the HSBC Revolution or UOB Preferred Platinum Visa? These cards can earn 4 mpd for online spending, but they follow a “whitelist” approach- a given online transaction doesn’t earn 4 mpd unless its MCC falls within the inclusion list. |

If you’re a Citi Rewards Mastercard user, be sure to check your points balance very carefully every month and ensure your bonus points are crediting properly. This card has earned a reputation as a troublemaker, unlike its no-nonsense Citi Rewards Visa brethren (no longer issued).

⛽ Petrol: Maybank World Mastercard, UOB Visa Signature or UOB Lady’s Card

| Earn Rate | Remarks | |

Maybank World Mastercard Maybank World MastercardApply here |

4.0 mpd | |

|

|

4.0 mpd | Min S$1K Max S$2K on petrol + contactless per s. month |

UOB Lady’s Card UOB Lady’s CardApply here |

4.0 mpd | Max S$1K per c. month. Must choose transport as 10X category. Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply here |

4.0 mpd | Max S$3K per c. month. Must choose transport as 10X category. Review |

| C. Month= Calendar Month, S. Month= Statement Month | ||

| 👉 Full Article: What’s the best card to use for petrol? |

Although I feel the best card for petrol is the one that gives the biggest discount, if we’re talking miles then it’s either the Maybank World Mastercard, the UOB Visa Signature, or the UOB Lady’s Card.

The Maybank World Mastercard is probably the best choice, because you don’t have to deal with minimum spending or merchant restrictions . Plus, you can apply for the Corporate Fuel Card and enjoy 15% off petrol at Shell.

If you prefer to stick with UOB, then the UOB Visa Signature will earn 4 mpd on petrol, provided you spend at least S$1,000 on contactless payments and/or petrol in a given statement month. UOB Lady’s Card members can earn 4 mpd on petrol as well, provided they choose transport as their quarterly 10X bonus category.

UOB cardholders will need to avoid Shell and SPC though, because these merchants will not earn UNI$. I’ve heard that SPC transactions unofficially earn UNI$ with the UOB Lady’s Card, however, but don’t quote me on that.

🚆 Public Transport: UOB Lady’s Card or Maybank Horizon Visa Signature

| Earn Rate | Remarks | |

UOB Lady’s Card UOB Lady’s CardApply here |

4.0 mpd | Max S$1K per c. month. Must choose transport as 10X category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply here |

4.0 mpd | Max S$3K per c. month. Must choose transport as 10X category Review |

|

|

3.2 mpd | Min S$300 per c. month |

| C. Month= Calendar Month | ||

| 👉 Full Article: What’s the best card to use for SimplyGo and public transport? |

Public transport won’t be a huge component of your monthly expenditure, but it’s still a category worth optimizing.

Females can use the UOB Lady’s Card/Lady’s Solitaire Card for 4 mpd, with transport selected as the quarterly 10X category. Everyone else can use the Maybank Horizon Visa Signature for 3.2 mpd (with a minimum monthly spend of S$300 on any category).

Alternatively, you could use the KrisFlyer UOB Credit Card for 3 mpd, but you’d need to spend at least S$500 on SIA-group transactions in a membership year- a little tricky in the current climate.

💳 General Spending: UOB PRVI Miles Card

| Earn Rate | Remarks | |

|

|

1.4 mpd (local) 2.4 mpd (overseas) |

Awarded per S$5 of spending Review |

| If you have access to a general spending card that earns 1.6 mpd, such as the Citi ULTIMA, UOB Reserve, DBS Insignia or Premier/Private Banking versions of the OCBC VOYAGE, by all means go ahead and use it. |

2020 saw the nerfing of the BOC Elite Miles World Mastercard, which went from offering 1.5/3.0 mpd on local/FCY spending to just 1.0/2.0 mpd. The product has faded to near irrelevance by now, but man, what a crazy ride it was.

This means the UOB PRVI Miles becomes the best (entry-level) general spending card on the market, although it speaks volumes to the proliferation of contactless payments and online shopping that I hardly use it. Remember: your general spending card is a card of last resort. Save it for occasions where 4 mpd opportunities don’t exist.

While the DBS Altitude/ Citi PremierMiles/ OCBC 90N Card will earn slightly fewer miles at 1.2 mpd, I don’t see much harm in using them either. Ideally, you’d be putting minimal spending on your general spending cards anyway, and a 0.2 mpd difference should not be too material.

| In fact, despite its lower earn rate, the Citi PremierMiles Card might be a better option for smaller transactions thanks to its more generous rounding policy |

Best Cards for Other Categories

I’ve put together a few stand-alone guides for selected transactions:

Otherwise, have a check of The Milelion’s Credit Card Guide, which covers some additional categories.

🧾 Bill Payments

If all else fails and none of your credit cards award points for a particular transaction, it may still be possible to earn miles in exchange for paying a small fee.

We occasionally see targeted promotions that bring down the cost of miles even further; for example, in September 2020 Citibank offered a jaw-dropping 1% fee for PayAll, which reduced the cost per mile to as low as 0.625 cents each- almost impossible to lose.

Is it possible to over-optimize?

As much as we want to maximize 4 mpd everywhere, is it possible to overdo it?

Yes, definitely. The way I see it, there are two additional considerations:

(1) Conversion Fees

By spreading your cards across multiple banks, you’re undertaking to pay more conversion fees. Frankly speaking, I’m not too worried about this. Conversion fees are annoying and we try to minimize them where we can, but paying them isn’t the end of the world. In the grand scheme of things, a S$25 fee here and there isn’t going to destroy the overall value proposition of the miles game.

Moreover, it doesn’t necessarily mean more cards= more fees. If you own multiple cards from the same bank, you may still pay only a single conversion fee, provided the points are pooled. For example, there’s a UOB customer could hold a UOB PRVI Miles, UOB Preferred Platinum Visa, UOB Visa Signature and UOB Lady’s Card while paying only a single conversion fee.

(2) Orphan Points

Orphans points are a bigger concern than conversion fees in my book. If you spread yourself too thin, you may end up in a situation where you’re optimizing on individual transactions, but not in an overall sense.

To illustrate, suppose I drive very infrequently but get a Maybank World Mastercard just so I can earn 4 mpd on petrol. I may be optimizing on that particular transaction, but it counts for very little if I end up with a small chunk of TREATS points that I can’t cash out.

So my take on the situation is that optimization is good, but you need to look at both the micro and macro picture. If you don’t spend a significant amount on a particular category, then consider using your general spending card instead.

Conclusion

Needless to say, there’s a lot more permutations you could consider. The UOB Preferred Platinum Visa can just as well be used as a dining or offline shopping card, because you’ll still earn 4 mpd so long as mobile payments are accepted. However, the general rule is to always use the most restrictive cap first. I’m more likely to spend online than to spend in foreign currency, so I utilize the foreign currency cap first when the opportunity arises. Likewise, I utilize my dining cap before my contactless cap, because the latter is more flexible.

Finally, I’ve not said a word about sign up bonuses, on the assumption that you’ve already exhausted them. If not, check out this page where I keep track of the latest sign up bonuses on the market- they’re a great way to jump start your miles collection.

Any other cards you think should feature in the game plan? Sound out below.

OCBC Titanium Rewards

OCBC Titanium Rewards

Maybank Horizon

Maybank Horizon UOB PRVI Miles

UOB PRVI Miles

Overall winner goes to the HSBC Revolution I guess?

it’s fast becoming one of my new favourite cards, although the uob ppv is equally useful if not more so.

Bit confused here as I also plan out my 2021 miles strategy in the hope that travel opens up! For contactless local payments for groceries, e.g. Fairprice, Cold Storage, WhatCard is indicating that the HSBC Revolution Card is only earning 2mpd. Can you clarify? I am not sure WhatCard is correct here, as it is recommending UOB Visa Signature for a spend of $500 at Fairprice, for example, but UOB VS has a minimum spend requirement of S$1k per month, so if the spend is only $500 then it’s not meeting that minimum and therefore not earning the 4mpd…

Confused…

hsbc revo earns 4 mpd on groceries confirm plus chop.

Whatcard is an unverified source. They don’t update the website and what card to use information is not correct. Can take the MCC as reference and figure it out what card to use by yourself.

The MCC shown by whatcard is also not reliable. For example Apple, the actual MCC is 5045 the MCC shown by whatcard is 5732. This means UOB PPV earns .4mpd and not 4mpd as shown on whatcard.

I tested Apple txn using WWMC and MCC is indeed 5732.

Maybe it is on mastercard. On Visa the MCC is definitely 5045 – I checked with three different cards. You can also google “apple mcc 5045” if you want additional data points.

There’s no way to track the accuracy of the pts from the HSBC Revo, yes? I’ve called in recently and still unable to resolve the variance btw my own tracking and what’s in the statements.

It’s worthwhile having one of the Amex KF cards. Even though the earn rates are poor. The number of offers more than make up for it. At the moment I earn 5.1mpd. There is no conversion fee, no stupid rounding and very few exclusions. And getting an annual fee waiver seems to be very easy.

by 5.1 mpd I assume you’re talking about the 4 mpd bonus for mobile payments. that’s fine, but note that it’s capped at quite a low amount.

Thanks Aaron for the great article ! I have a quick question regarding UOB Visa Signature; I already spent 2000 SGD in FCY and was credited the 4000 UNI$ for it in Nov. I now have to get this expense refunded in Jan and will have to separately spend 4000$ in Jan (all expenses being eligible for 4mpd, everything to settle in Jan); then what will happen to my UNI$: 1) The initial 4000 UNI$ obtained will be reversed and I will be credited a new 4000 UNI$ for the first 2k spent (here disregarding the next 2k spent and… Read more »

i’m pretty sure it’s (1), but i can’t be sure. actually, i’m quite curious to find out.

I will then charge 2000$ in Jan and see what happens. Will be able to share the result somewhere in Feb !

On your comments with orphan points with Maybank from using the Maybank World Master, I have a way around it. The MB WM makes all MB points non-expiring anyway and can pool with all other MB cards. Use the MB WM with a MB Horizon Visa… don’t use the Horizon for dining because there are better cards for 4mpd opportunities, but use iHorizon every month to top up the G wallet… no other card gives u 3.2 mod for top-up anymore. You just need to ensure you top up at least $300 each month. Use both cards together and you… Read more »

Don’t share things that are not allowed in tnc please.

interesting, didn’t know about that option! IIRC, 3.2 mpd for GP with horizon is YMMV, some people get and others don’t. might depend on when you saved your card to the app (or not, i haven’t been following that closely)

Petrol can stick to SPC. You get auto discount and can still get decent miles from it

How do you account for credit card fees incurred due to maintaining all these cards?

well, to put it simply, you don’t.

with the exception of my amex platinum charge, i’ve not paid an annual fee in years. fee waivers are very simple to get, even with modest amounts of spending. and if they don’t waive, transfer your points out and cancel the card. apply again down the road. simple.

Hi Aaron, just wanna say thank you to you for creating this beautiful and detailed guidelines to open our eyes to the miles collecting journey.

Your guides have been helping me so much! You are the best in the game sir.

Thank you once again.

Regards,

Your sincere admirer

thank you for the kind words sir! happy 2021!

DBS WWMC – i’ve been using this card for a decade and this is the first time my fee waiver request has been rejected… (despite it being extensively used, paid off in full each month, and no reduction in credit status or any of my other DBS services). Wonder if this is a new norm?

($180 annual fee)

$192.60 after GST, actually! I’ve always got my DBS annual fees waived, for what it’s worth

Eagerly waiting for the 2022 strategy!