Every 12 months, AMEX Platinum Charge cardholders have to confront the annual “S$1,712 question”, which this year becomes the “S$1,728 question” thanks to the GST hike: should they renew or cancel their card?

Make no mistake: a four-digit annual fee is a lot of money to pay for a credit card, and since no one gets an AMEX Platinum Charge for its miles-earning potential (except maybe big spenders at 10Xcelerator merchants), the only way the math works out is if you make full use of all the benefits on offer.

That’s why every time my renewal comes round, I do an audit of the past 12 months to get a sense of just how much value I managed to get out of my card.

Summary: AMEX Platinum Charge 2022/23

Below is a summary of my AMEX Platinum Charge for the 2022/23 membership year, which in my case runs from October to September.

My 2022/23 Membership Year My 2022/23 Membership Year |

|

| Perk | Value |

| Platinum Statement Credits | S$1,286* |

| Airline & Hotel Credit | S$800 |

| Comoclub C5 vouchers | S$780 |

| 1-Night Hotel Stay | S$400 |

| Dining Vouchers | S$380 |

| Airport Lounge Access | S$300 |

| Hilton Gold status | S$300 |

| Love Dining & Chillax | S$250 |

| 2-night Frasers Hospitality voucher | S$250 |

| Retention Offer (20K points) | S$188 |

| Wine Vouchers | S$140 |

| Total | S$5,074 |

| *These are commonly quoted as S$1,354, but the Entertainment credit is awarded per calendar month. We need to adjust for that in 2023 since the credits only launched in February | |

The unique thing about this year’s post is that we’ve just had a “crossover year”, where American Express replaced the legacy S$800 airline and hotel credits with S$1,354 of dining, entertainment, airlines, fashion and lifestyle credits.

This means that existing cardholders got to double dip on two sets of credits in a single membership year:

- When I renewed my card in October 2022, I received a S$400 airline and S$400 hotel credit

- When American Express launched the new credits in February 2023, I received another S$1,354 to spend

Regardless of how you feel about the new statement credits, they’re basically icing on the cake to anyone whose membership year straddled these two periods. If you don’t like them, you can still burn them before cancelling your card for the upcoming membership year (subject to the restrictions noted in this article).

| ⚠️ Entertainment Credit |

| Do note that the S$204 Entertainment credit is disbursed as S$17 per month, so if you cancel your AMEX Platinum Charge for the upcoming membership year, you may not be able to spend it in its entirety. |

That, together with the Comoclub C5 membership and its birthday vouchers, gave a big boost to the value compared to last year.

Caveats

Before we go into the analysis, some caveats apply.

Renewal vs first-time

This article is written from the perspective of a renewing AMEX Platinum Charge cardholder.

A first-time cardholder would get even more value because of

- the welcome bonus

- the ability to use two sets of Platinum Statement Credits in the first membership year

With regards to the welcome bonus, American Express is currently running one of the best offers we’ve seen in a long time: new and existing customers can earn a bonus of 132,500/85,000 MR points respectively, or 82,813/53,125 miles That’s worth a further S$1,242/S$796, based on a value of 1.5 cents per mile.

AMEX Platinum Charge AMEX Platinum Charge |

||

| Apply Here |

||

| New Customers | Existing Customers | |

| Spend S$5,000 (Mo. 1-3) |

5K | 5K |

| Spend S$6,000 (Mo. 1-2) |

127.5K | 80K |

| Base Points from S$6,000 (@ 2 pts/S$1.60) |

7.5K | 7.5K |

| Total Spend | S$6K | S$6K |

| Total Points | 140K | 92.5K |

| S$1,728 annual fee must be paid | ||

With regards to Platinum Statement Credits, the key thing to remember is that they’re issued by calendar year, not membership year. This means a new cardholder can enjoy two sets in their first membership year, enhancing their value significantly.

For more information, refer to the post below.

AMEX Platinum Reserve benefits

Historically speaking, AMEX Platinum Charge cardholders would enjoy a perpetual fee waiver for the AMEX Platinum Reserve, which comes with perks like a 2-night stay at selected Frasers properties, a S$100 Tower Club voucher and assorted wine vouchers.

However, this no longer applies to anyone approved for an AMEX Platinum Charge from 1 November 2022 onwards, so if that’s you, then you’ll need to adjust your figures accordingly.

For avoidance of doubt, AMEX Platinum Charge cardholders who were approved for an AMEX Platinum Reserve prior to 1 November 2022 will continue to enjoy a perpetual annual fee waiver, so long as they hold the AMEX Platinum Charge card.

Value is subjective!

Finally, the most important caveat: valuation is inherently subjective, and what you get out of the AMEX Platinum Charge will very much depend on your individual preferences, travel patterns and lifestyle. For example, a teetotaller wouldn’t find much value in Chillax or the wine vouchers, and someone who always flies First or Business Class may not value a lounge membership.

The same goes for the rest of the vouchers and statement credits- your valuation should take into account whether these are the kinds of places you’d normally be spending money at, even in their absence. And if not, then some sort of haircut is in order.

How much of a haircut should that be? Only you can say. Ultimately, I don’t know your lifestyle patterns and preferences, so I can’t speak to your particular situation. What I do know is that you shouldn’t take my figures wholesale. Make adjustments as needed!

tl;dr: The AMEX Platinum Charge is big money investment, and you should only be taking the plunge if you’re confident you can get a lot more out of it than you put in.

Now, on to the main event…

Platinum Statement Credits: S$1,286

The annual Platinum Statement Credits are key to recovering the value of your annual fee, so much so I’ve written a separate guide covering each of these in full detail.

Guide: AMEX Platinum Charge annual S$1,354 statement credits

While these are normally quoted as S$1,354, I need to make an adjustment for my 2022/23 membership year because the Entertainment credit is disbursed by calendar month instead of calendar year.

Airline credit: S$200

| ✈️ Airline Credit | |

| ❓What’s this? | AMEX Platinum Charge cardholders receive a S$200 airline credit every calendar year that can be used at Singapore Airlines or Scoot, with a minimum spend of S$600 in one or more transactions. |

I maxed out the S$200 airline credit simply by using the AMEX Platinum Charge to pay for the taxes and surcharges on my SIA award tickets.

This comes with the added benefit of complimentary travel insurance which is fairly comprehensive (see below for details).

Dining credit (local): S$200

| 🍽️ Local Dining Credit | |

| ❓What’s this? | AMEX Platinum Charge cardholders receive a S$200 local dining credit every calendar year that can be used at participating restaurants in Singapore. No minimum spend is required. |

I used this year’s S$200 local dining credit at Basque Kitchen, a few months before it closed down.

I stacked the credit with one of the S$50 Basque Kitchen vouchers that came in the membership kit, which reduced the damage to S$172.93 (so you can only imagine how pricey it’d be without the credit and voucher).

Verdict: food was great, but I can understand why they went under. The menu is prohibitively expensive, even for the power lunch crowd, and we were the only two guests in the dining room the whole time.

Dining credit (overseas): S$200

| 🍽️ Overseas Dining Credit | |

| ❓What’s this? | AMEX Platinum Charge cardholders receive a S$200 overseas dining credit every calendar year that can be used at more than 1,400 participating restaurants worldwide. No minimum spend is required. |

My choice for the S$200 overseas dining credit was Sushi Yuden in Osaka, a one Michelin Star restaurant where omakase cost 48,400 JPY (~S$442) for two people (note: if you’re booking restaurants in Japan, you’ll need to do so via Pocket Concierge).

This was, from start to finish, a symphony of a meal. The ingredients were impeccably fresh, even by Japan’s usual high standards, the chef (who spoke very good English) made the effort to explain every dish to us, and we ended up having a fun chat with the other local patrons too!

Entertainment credit: S$136

| 📺 Entertainment Credit | |

| ❓What’s this? | AMEX Platinum Charge cardholders receive a S$17 entertainment credit every calendar month that can be used at Audible, Eventbrite, Disney+, Netflix Singapore, SPH Media, and Ticketmaster. No minimum spend is required. |

I’ve been spending the S$17/monthly entertainment on a Disney+ and Netflix subscription (which requires an additional top-up).

While this benefit is quoted at S$204 (S$17 x 12 months), my 2022/23 membership year value will be S$136, since the credits started in February 2023 and my membership year ends in September 2023.

Fashion credit: S$150

| 👒 Fashion Credit | |

| ❓What’s this? | AMEX Platinum Charge cardholders receive a S$150 fashion credit, disbursed as two bi-annual credits of S$75 each (1 Jan to 30 Jun, 1 Jul to 31 Dec) and usable at NET-A-PORTER & MR PORTER |

While I have very little interest in fashion (a fact I believe is self-evident), Mr Porter sells much more than just bags, shoes and clothes.

I’ve been using my S$150 credits to stock up on Aesop, if only so I can refill it with NTUC hand soap and see which houseguests can tell the difference.

Free shipping is normally offered for orders above 200 GBP, but the code mrp10pmx (no idea when it expires) removes the minimum spend requirement. Don’t forget that NET-A-PORTER and MR PORTER are both on ShopBack, so you can earn extra cashback on your order too.

Lifestyle credit: S$400

| 🍷 Lifestyle Credit | |

| ❓What’s this? | AMEX Platinum Charge cardholders receive a S$400 lifestyle credit every calendar year that can be used at Adeva Spa, Follicle at Adeva, Spa Rael, The Ultima, The Spa by The Ultimate, and Grand Cru Wine Concierge with a minimum spend of S$600 in a single transaction. |

I personally don’t care for spas, but I do care for wines. My S$400 lifestyle credit went towards upsizing my champagne collection, adding the sort of bottles you won’t find at your neighbourhood Cold Storage.

One important thing to note here: you may not be able to take the Lifestyle credit at face value when spending it at Grand Cru, because prices on the Platinum portal are sometimes higher than the public website. I’ve spotted a few instances of these in the past, though there’s no consistent pattern and I can’t say whether it’s accident or design.

Airline and hotel credit: S$800

This was the final year that the S$800 airline and hotel credit was issued, and used my hotel credit for a return visit to the Waldorf Astoria Bangkok, a favourite property of mine. The swimming pool is beautiful, the breakfast is one of the best I’ve had in any hotel, and the Fine Hotels & Resorts perks were just the icing on the cake.

The S$400 airline credit was used to cover the cost of the air tickets.

Comoclub C5 membership: S$780

|

| AMEX x COMO |

One highlight this year was the addition of a complimentary 12-month Comoclub C5 membership, bypassing the usual S$50,000 minimum spending requirement.

This comes with various discounts throughout the Como Group, but the real highlight to me are the birthday perks:

- S$200 shopping vouchers at Club21 Singapore, Kids21 Singapore and Dover Street Market Singapore

- S$40 dining voucher at COMO Dempsey

- S$20 grocery voucher for SuperNature Singapore or Culina Market Singapore

- COMO Shambhala signature Invigorate essential oil and mask diffuser

- Corkage waiver at COMO Dempsey

- DrHair deep cleansing scalp treatment

That’s S$260 of vouchers (all of which have no minimum spend), and since the benefit also applies to supplementary cardholders, a cardholder who applies for his/her two free supplementary cards will have S$780 in total.

The big disappointment for me was the nerfing of the Maserati-for-a-day benefit, which loaned you a Maserati Levante or Grecale. This must have been ravenously received by cardholders, because in August COMO added a 10,000 points requirement (S$2,000 spend with the Como Group) to redeem it.

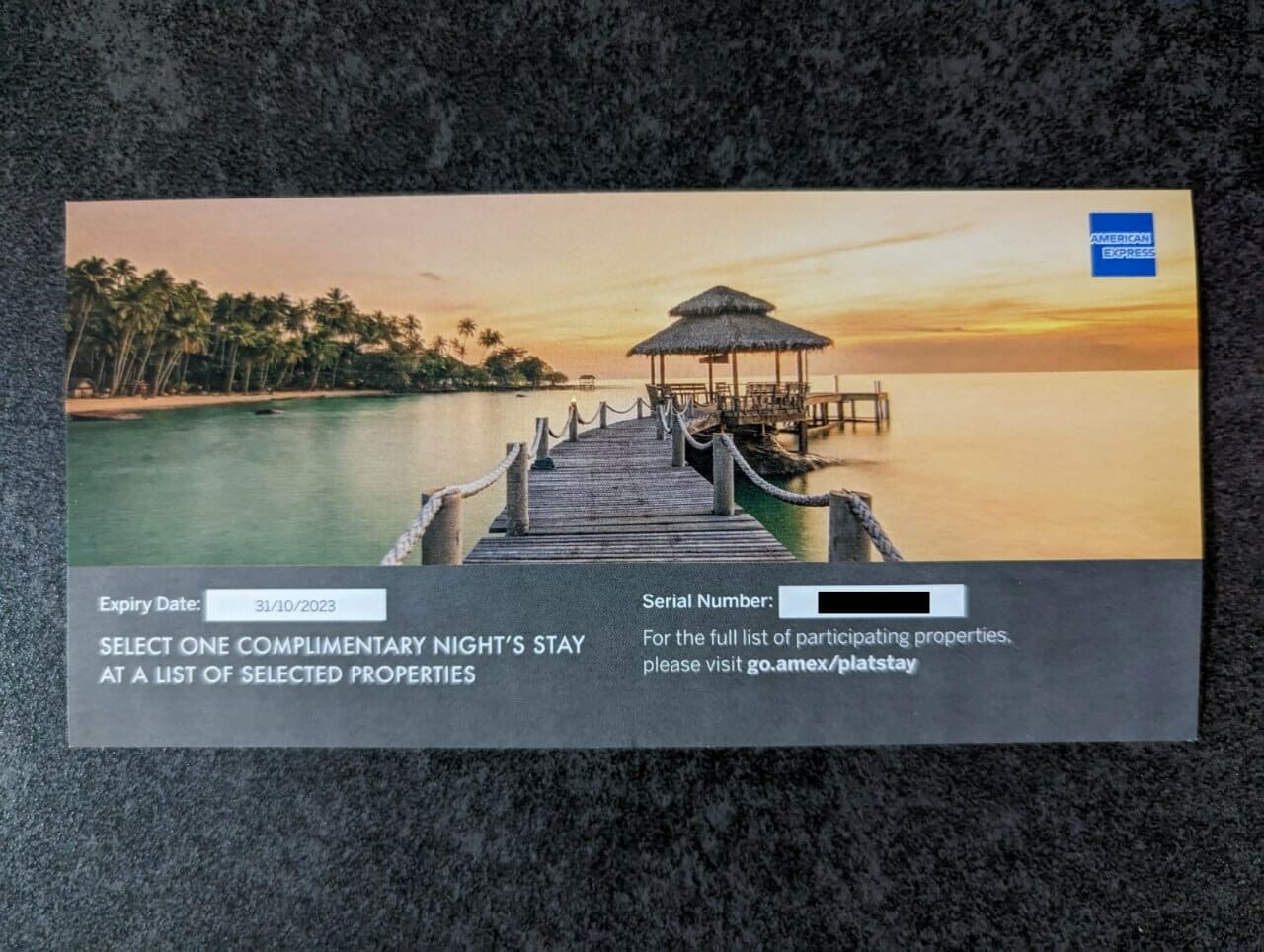

1-Night Hotel Stay: S$400

AMEX Platinum Charge members receive a voucher for a complimentary hotel night each year, currently valid for stays at 25 different properties worldwide:

|

|

I redeemed my voucher this year at the Banyan Tree Kuala Lumpur, and while I’m normally not a fan of the chain’s rustic style (see my reviews of the Koh Samui and Lang Co properties), this was a very pleasant change.

Styled like an urban resort, the room had high ceilings, modern fittings (any hotel with a TOTO bidet charms me, because the way to my heart is through my, um, never mind), and excellent location right in the middle of the Bukit Bintang area.

Based on a breakfast-included rate, I saved roughly S$400.

Platinum dining vouchers: S$380

Out of the dining vouchers included in my 2022/23 Platinum Charge renewal kit, I made use of:

- S$100 Tower Club voucher (+S$100 more from AMEX Platinum Reserve)

- S$50 Wan Hao Restaurant voucher (+S$50 more from AMEX Platinum Reserve)

- S$50 off Mikuni

- S$50 off Basque Kitchen (min. 2 diners, cap 1 voucher per visit)

This is one area where the AMEX Platinum Charge has been notably devalued over the years. In the early days, cardholders could look forward to S$200 of St. Regis dining vouchers, with no minimum spend and stackable with Love Dining.

These have since been replaced with highly-restrictive Basque Kitchen and JAAN vouchers, though I managed to use one piece this year when using my S$200 local dining credit at the former.

Apart from that, I used both Tower Club vouchers (which I’m adjusting to S$180 due to the fact that all affiliate members need to pay a 10% surcharge on orders), as well as both Wan Hao restaurant vouchers (useful for solo diners or groups of three, because S$50 off S$100 is better than the 15/35% Love Dining discount you’d otherwise receive).

This gives me a grand total of S$380.

Airport lounge access: S$300

AMEX Platinum Charge cardholders receive access to the following lounges:

- Centurion Lounges (+2 guests)

- Delta Sky Clubs

- International American Express Lounges (+2 guests)

- Priority Pass (+1 guest)

- Plaza Premium Lounges (+2 guests)

These benefits are equally applicable to all supplementary cardholders, although only the first supplementary cardholder will enjoy a Priority Pass membership.

While I try to redeem Business Class tickets wherever possible, there’s some trips where there’s no award space, or where it simply doesn’t make sense (e.g. Kuala Lumpur to Singapore).

In those cases, I rely on my AMEX Platinum Charge for access, and just like last year, I’m ballparking the benefits at S$100 per cardholder, or S$300 total.

It boils down to how frequently and in what cabins you fly, and how much you’d have spent on airport F&B otherwise.

Hilton Gold status: S$300

AMEX Platinum Charge members receive complimentary status with several programmes including Marriott Bonvoy and Radisson Rewards, but the truly useful one is Hilton Gold.

Hilton Gold means free breakfast, which can easily save S$100 or more per couple per day at high cost locations. It’s why I’ve been gravitating towards Hilton properties over the past 12 months: Conrad London St James, Hilton Tokyo, Roku Kyoto, Conrad Osaka, Hilton Milan, Conrad New York Midtown and Conrad New York Downtown to name a few.

Like I mentioned last year, I already hold Hilton Diamond status, so Gold offers no incremental benefit for me. However, my supplementary cardholders also enjoy Hilton Gold status, which I estimate to be worth about S$300, based on the cost of savings on breakfast on their stays.

2-night Fraser Hospitality voucher: S$250

A 2-night Fraser Hospitality voucher comes with the AMEX Platinum Reserve, and can be redeemed at more than 40 properties worldwide.

Like last year, I used my voucher at the Moderna by Fraser Bangkok. The location isn’t great for tourists (it’s located in a business area, roughly a 15-minute drive from Siam Paragon- but who knows, given Bangkok traffic).

The cost of a two-night stay was S$250.

Love Dining & Chillax: S$250

American Express Love Dining isn’t an exclusive privilege of the AMEX Platinum Charge (it’s offered on the AMEX Platinum Credit Card and Reserve too), but it can help save a fair chunk on dining nonetheless.

Here’s the current list of participating restaurants and hotels.

|

|

| Restaurants (20) | |

|

|

| T&Cs | |

| Hotels (7) | |

|

|

| T&Cs | |

| *No Love Dining @ Hotels savings available; cardholders instead enjoy 20% off total bill | |

I didn’t visit quite as many Love Dining restaurants this year compared to last year, so based on my savings I’m coming up to a lower S$250 valuation.

Fortunately, the list of Love Dining venues has grown slightly this year, arresting a decline that started in 2021. Soi Social and CHIFA! were even offering complimentary Grab vouchers for the first few Love Dining customers, which sweetened the deal further.

| 🍽️ AMEX Love Dining Changes (since previous 2021/22 membership year) |

|

| – Left | + Joined |

|

|

Retention offer: S$188

When the time comes to renew my AMEX Platinum Charge, I always make a point of calling up customer service to ask about a retention offer (do it after your annual fee has been billed to your statement; the CSO won’t be able to assist you before that).

American Express usually offers cardholders bonus points upon renewal, but they’re not automatically awarded; if you don’t ask, you don’t get.

This year, like previous years, I received 20,000 MR points (12,500 miles) for renewing. At 1.5 cents per mile, this is worth ~S$188.

Bigger spenders have reported receiving up to 40,000 MR points (25,000 miles), so it’s really a YMMV situation.

Platinum wine vouchers: S$140

AMEX Platinum Charge cardholders receive a total of seven wine vouchers (most of them from the AMEX Platinum Reserve), redeemable for seven bottles of wine at the following outlets:

| From | Voucher | Conditions |

AMEX Plat. Charge AMEX Plat. Charge |

2x vouchers for wine (or cake) at Fairmont Hotel & Swissotel The Stamford | At least 1 dine-in item, max 2 vouchers per visit |

AMEX Plat. Reserve AMEX Plat. Reserve |

2x vouchers for wine (or cake) at Fairmont Hotel & Swissotel The Stamford | At least 1 dine-in item, max 2 vouchers per visit |

| 2x vouchers for Grand Cru Wines | N/A | |

| 1x voucher for Napoleon | N/A |

The Grand Cru Wines and Napoleon vouchers are absolute no-brainers. No minimum spend is required; just show up and collect your bottles. Don’t feel bad, you’re not the first to do this, and you won’t be the last.

The Fairmont Hotel & Swissotel The Stamford vouchers require a minimum order of one dine-in item. Most people simply have a coffee or dessert and redeem two wine vouchers each time. The wine need not be drank at the restaurant; you can take it in sealed bottles to go.

As for the quality of the wines, let’s just say it’s not Robert Parker 90 points stuff. These are best described as “table wines”, better used for daytime drinking or cooking.

Depending on available stock, you may receive any of the following:

- La Minga Sauvignon Blanc 2022

- Mâcon Uchizy 2015

- Triennes Merlot 2014

- L’Autantique Sauvignon 2020

- Karku Nocturno Sauvignon Blanc 2020

- Karku Nocturno Merlot 2020

- Famille Perrin Ventoux 2019

Like last year, I’m going to give a S$20 value to each bottle, for a total of S$140.

Other perks

I’ve not given a value to any of the perks below, but thought I’d mention them for completeness’ sake.

AMEX Fine Hotels & Resorts

|

| AMEX Fine Hotels & Resorts |

AMEX Platinum Charge members can book Fine Hotels & Resorts (FHR) rates at luxury hotels worldwide, which include perks such as:

- Room upgrade

- Daily breakfast for two

- US$100 hotel credit

- 12 p.m check-in (subject to availability)

- 4 p.m check-out (guaranteed)

- Complimentary Wi-Fi

FHR rates price the same as the hotel’s best flexible rate, and are eligible to earn hotel points and elite status credits.

Some hotels I’ve booked with FHR include the Six Senses Yao Noi and Waldorf Astoria Bangkok and on both occasions I got multi-category upgrades (Ocean Deluxe Pool Villa at Six Senses Yao Noi, Deluxe Suite at Waldorf Astoria Bangkok), some very nice breakfasts, as well as the opportunity to try restaurants and spa treatments with the hotel credits.

However, I’m not including this in the valuation because you can book similar luxury agent rates through a free platform like HoteLux.

Spa vouchers

AMEX Platinum Charge members receive the following spa vouchers:

- S$100 credit at Aveda Spa (min. S$180 spend)

- S$100 credit at Spa Rael (min. S$180 spend)

- S$130 credit at The Ultimate Spa (min. S$180 spend)

I might have given these a token value back when the treatments were completely free, but now that they have minimum spends I just ignore them completely.

Complimentary travel insurance

|

| Policy Wording |

AMEX Platinum Charge cardholders receive complimentary travel insurance when they pay for air tickets (or taxes and surcharges on award tickets) with their card.

This is a fairly comprehensive policy, which includes:

- S$1 million for death or total permanent disability

- S$1 million of medical expense coverage

- S$10,000 trip cancellation and postponement

- S$4,000 of emergency dental treatment

- S$1,500 for lost personal belongings

- S$400 for flight or baggage delays

- S$150 hospital cash allowance

However, it does not cover bookings made with airline miles (e.g. you redeem a Spontaneous Escapes ticket and can’t travel because of illness), which is a deal-breaker for me. So I use this as a source of secondary coverage, and purchase a separate Singlife insurance plan that protects my frequent flyer miles and points.

Regional Golf Programme

|

| Regional Golf Programme |

AMEX Platinum Charge, Platinum Reserve and Platinum Credit Card members enjoy complimentary green fees when they bring along one paying guest on weekdays, and two paying guests on weekends under the Regional Golf Programme,

This features Orchid Country Club, Sembawang Country Club and Warren Golf & Country Club in Singapore, along with courses in Cambodia, Indonesia, Japan, Malaysia, Philippines, Thailand and Vietnam.

I don’t golf, so I don’t assign this any value.

Great World Parking

|

| Great World Parking |

AMEX Platinum Charge cardholders enjoy complimentary all-day parking at Great World City on Fridays, Saturdays and Sundays. This is capped at 50 redemptions per day, so you’ll need to come early if you want to take advantage of this (redemptions start from 10 a.m).

I don’t give this any value because until recently, I didn’t own a car.

Conclusion

|

| Apply Here |

2022/23 was a year where most AMEX Platinum Charge cardholders should have been able to obtain higher-than-average value, thanks to the overlapping old and new statement credits, and the addition of the Comoclub C5 membership with its assorted birthday vouchers. With travel restrictions now a thing of the past, other perks like lounge access and Hilton Gold should be seeing a lot more use too.

At the risk of belabouring the point, value is subjective. The way you value the perks may be different from mine, so be sure to look at your travel and lifestyle patterns and decide whether the AMEX Platinum Charge is still a good fit (or whether a $120K card (with annual fees around S$500-600) could work just as well for your needs.

Until the S$1,744 question next year, then…

For the hotel loyalty programme, if I just register as a Hilton Honors member and get this AMEX card, I will enjoy Hilton Gold status (40+ nights per year). Then If I want to upgrade to Diamond status (60+ nights per year), do I need to stay an additional 20 (60-40) nights or 60 nights within a year? How about Marriott?

Quick answer is no

Um, I’m asking for an answer in numbers, not yes or no.

60 within a year, they give you the status but not the qualifying night.both Marriott and Hilton.

Thank you!

I applied for the card through the link you provided and received the card a few days later on Oct.26.

Now I am wondering at which end of the month I have to fulfill the $6000 spend requirement to receive the bonus points. November or December?

spend criteria must be met within 60 days of approval. check with AMEX what your approval date is.

On the offer page, it says “✔ Receive 127,500 Membership Rewards® points with annual fee payment and min. spending of S$6,000 within first 2 months of Card approval.” no 60 days were mentioned.

amex defines 2 months as 60 days. but you’re free to call them and verify that yourself.

How did you use your $200 flight credit on taxes and surcharges if min spend is $600? Do u redeem 3 or more flights together since taxes are typically <$250 per ticket?

there is no need to spend it all in a single transaction. once you hit $600 cumulative, you get a $200 credit.