While Amaze has been taking hit after hit lately— a 1% fee on all SGD transactions, the gutting of its InstaPoints programme, and banks slamming the door on rewards — you shouldn’t write it off just yet.

If you’re travelling overseas and looking to earn credit card miles, then Amaze still offers a more cost-effective option than most banks, and with the recent launch of the Maybank XL Rewards Card, there’s a brand new 4 mpd option to pair with it.

In this post, we’ll look at the best cards to pair with Amaze, and compare them to alternative options to see which provides the best value.

|

| Apply here |

| Review |

| Use code MILELION for 3,000 bonus InstaPoints |

| 💳 tl;dr: Amaze Card |

|

| 💳 What’s the Best Card for… | ||

| ❓ Overall Guide |

||

| ✈️ Air Tickets |

🌎 Amaze | 🛍️ Atome |

| 💰 CardUp | 🚗 Car Rental | 💗 Charity |

| 🍽️ Dining | 🏫 Education | ⚡ EV Charging |

| 🥡 Food Delivery | 🏨 Hotels | ☂️ Insurance |

| 📱 Kris+ | ⚕️ Medical | 🏖️ Overseas |

| 💊 Pharmacies | ⛽ Petrol | 🚍 Public Transport |

| 🛒 Supermarkets | 🚰 Utilities | 💒 Weddings |

What card should I pair with Amaze?

First, a brief reminder of the ground rules regarding Amaze:

- Amaze transactions code as online

- Amaze transactions will be billed in SGD

- Amaze transactions retain the original MCC of the underlying merchant

- Amaze transaction descriptions are changed to AMAZE*merchant name

- Amaze can be paired with Mastercard cards only

- DBS, POSB and UOB cards no longer award points for Amaze transactions

- Citi excludes certain Amaze transactions related to AXS and transit (i.e. bus/MRT/EZ-Link), but otherwise awards points

The spread that Amaze charges (compared to the Mastercard rate) is usually ~2%, though I should emphasise there can be situations where you’ll pay more than this. It depends on what currency you’re charging, and whether there’s any volatility at the time. Some have noted that Amaze is quick to adjust rates upwards when there is a negative movement, but slower to adjust them downwards when there is a favourable movement.

In my recent experience (with USD-denominated transactions), the spread over Mastercard has been 2.1% at most. YMMV.

There are three main cards that I’d recommend for pairing with Amaze.

| 💳 Recommended Amaze Pairings |

||

| Card | Earn Rate | Remarks |

Citi Rewards Card Citi Rewards CardApply |

4 mpd1 | Max S$1K per s. month |

Maybank XL Rewards Maybank XL RewardsApply |

4 mpd2 | Min. S$500, max S$1K per c. month |

OCBC Rewards Card OCBC Rewards CardApply |

4 mpd3 | Max S$1.1K per c. month |

| 1. All online transactions except travel (airlines, hotels, rental cars, tour agency, cruises etc.) and in-app mobile wallet (T&Cs) 2. Dining, entertainment, shopping, travel (T&Cs) 3. Clothes, bags, shoes and shopping (T&Cs) |

||

#1: Citi Rewards Card

Citi Rewards Card Citi Rewards Card |

|

| Apply | |

| Earn Rate | 4 mpd |

| Eligible Transactions | All online transactions except Travel and in-app mobile wallet (though pairing with Amaze circumvents the latter restriction) |

| Min. spend | None |

| Capped at | S$1,000 per statement month |

The Citi Rewards Card earns 4 mpd on all online transactions, capped at S$1,000 per statement month. And since Amaze converts all transactions into online spending, pairing the two is a simple way of earning 4 mpd almost everywhere.

The only exclusion (aside from general exclusion categories like insurance and donations) are travel-related transactions, which Citi defines as the following:

| ❌ Travel-Related Blacklist | |

| MCC | Description |

| MCC 3000 to 3350 MCC 4511 | Airlines |

| MCC 3351 to 3500 MCC 7512 | Car Rental Agencies |

| MCC 3501 to 3999 MCC 7011 | Lodging- Hotels Motels, Resorts |

| MCC 4111 MCC 4112* MCC 4789* | Passenger Transport and Railways |

| MCC 4411 | Cruise Lines |

| MCC 4722 MCC 4723* | Travel Agencies and Tour Operators |

| MCC 5962 | Direct Marketing- Travel Related Arrangement Services |

| MCC 7012 | Timeshares |

In other words, don’t use your Amaze x Citi Rewards to pay for:

- Flight tickets

- Hotel stays

- Tour agencies or activities providers

- Train tickets

- Rental cars

- Cruises

Fortunately, there’s still many other categories where you could slot this in, like dining, groceries, shopping and transport (e.g. taxis and ride-hailing).

Another use case for pairing Amaze with Citi Rewards is to circumvent Citi’s restriction on in-app mobile wallet payments. As a reminder, if you add the Citi Rewards Card to Apple or Google Pay, and use Apple or Google Pay to make an in-app transaction with an app like Deliveroo or Kris+, you will only earn 0.4 mpd instead of 4 mpd.

You can solve this problem by:

- Pairing the Citi Rewards Card with Amaze

- Adding Amaze to Google Pay

- Paying in-app with Google Pay using Amaze

There’s really no need to do this with Deliveroo, since the app accepts naked cards, but Kris+ requires you to pay with Apple or Google Pay.

However, it’s important to highlight that Amaze now imposes a 1% fee for all SGD-denominated transactions, with a minimum fee of S$0.50. This doesn’t completely rule out using it for local spend, but you’ll need to do the sums and see if it’s worth it. I’ve covered this more in the post below.

#2: Maybank XL Rewards Card

Maybank XL Rewards Card Maybank XL Rewards Card |

|

| Apply | |

| Earn Rate | 4 mpd |

| Eligible Transactions | Dining, entertainment, shopping, travel |

| Min. spend | S$500 per calendar month |

| Capped at | S$1,000 per calendar month |

The Maybank XL Card earns 4 mpd on all FCY spend, as well as SGD spend on dining, shopping, travel and entertainment. This requires a minimum spend of S$500 per calendar month, and is capped at S$1,000 per calendar month.

| Category | MCCs | Description |

| 🍽️ Dine |

5811 | Caterers |

| 5812 | Restaurants | |

| 5814 | Fast Food | |

| 5462 | Bakeries | |

| 🛍️ Shop |

5262 | Marketplaces |

| 5310 | Discount Stores | |

| 5311 | Department Stores | |

| 5331 | Variety Stores | |

| 5399 | Misc. General Merchandise | |

| 5621 | Women’s Ready to Wear | |

| 5631 | Women’s Accessory and Specialty | |

| 5651 | Family Clothing | |

| 5655 | Sports and Riding Apparel | |

| 5661 | Shoe Stores | |

| 5691 | Men’s and Women’s Clothing Stores | |

| 5699 | Misc. Accessory and Apparel | |

| 5941 | Sporting Goods Stores | |

| ✈️ Travel | 3000 – 3299, 3300 – 3308, 4511 | Airlines |

| 4722 | Travel Agencies | |

| 7011 | Hotels and Lodging | |

| 📽️ Entertainment | 4899 | Cable, Satellite, Pay Television and Radio |

| 5813 | Bars, Cocktail Lounges, Nightclubs | |

| 5815 | Digital Goods: Books, Movies, Music | |

| 7832 | Theatres | |

| 7993 | Video Amusement Game Supplies | |

| 7994 | Video Game Arcades |

Since it already earns 4 mpd on FCY transactions, and Amaze converts all spending into SGD, we need to be a bit careful here.

There are four scenarios to consider, based on currency (SGD or FCY), and whether the transaction falls under a bonus category (dining, shopping, travel, entertainment).

| In SGD | In FCY | |

| Whitelisted categories | XL Rewards (4 mpd) |

Amaze + XL Rewards (4 mpd + 2% fee) |

| All other spend | Use a different card | XL Rewards (4 mpd + 3.25% fee) |

SGD spending, non-whitelisted category

Don’t use Amaze, or the XL Rewards Card for that matter. You’d earn only 0.4 mpd either way, but Amaze would make it even worse with its 1% admin fee for SGD transactions.

SGD spending, whitelisted category

Don’t use Amaze. Using a naked XL Rewards Card would be sufficient to earn 4 mpd, and again, we don’t want to incur the 1% admin fee for SGD transactions if we don’t have to.

FCY spending, whitelisted category

Use Amaze + XL Rewards to reduce the FCY fee to ~2%, while still earning 4 mpd.

FCY spending, non-whitelisted category

Use a naked XL Rewards Card to earn 4 mpd, with a 3.25% FCY fee.

If you brought Amaze into the picture, you’d earn 0.4 mpd with a ~2% FCY fee, because the transaction effectively becomes SGD spending in a non-whitelisted category.

#3: OCBC Rewards Card

OCBC Rewards Card OCBC Rewards Card |

|

| Apply | |

| Earn Rate | 4 mpd |

| Eligible Transactions | Clothes, bags, shoes and other shopping |

| Min. spend | none |

| Capped at | S$1,110 per c. month |

| If you have the legacy OCBC Titanium Rewards Blue and Pink cards, each of them has their own 4 mpd cap | |

The OCBC Rewards Card earns 4 mpd on the first S$1,110 per calendar month spent on shopping, which is defined as the following MCCs.

| 🛍️ Shopping Transactions | |

| MCC | Examples (non-exhaustive) |

| MCC 5309 Duty-Free Shops |

Lotte Duty Free, King Power Duty Free, The Shilla Duty Free |

| MCC 5311 Departmental Stores |

Takashimaya, TANGS, Isetan, OG, Metro, BHG, Marks & Spencer |

| MCC 5611 Men’s and Boys’ Clothing and Accessories Stores |

Benjamin Barker, Timberland, Edit Suits, Berluti |

| MCC 5621 Women’s Ready to Wear Stores |

Zara, H&M, Mothercare |

| MCC 5631 Women’s Accessory and Speciality Stores |

Tory Burch, Love Bonito, Pandora |

| MCC 5641 Children’s and Infants’ Wear Stores |

Kiddy Palace, Mummys Market, Pupsik, Motherswork |

| MCC 5651 Family Clothing Stores |

Uniqlo, ASOS, Club 21, Burberry, Yoox |

| MCC 5655 Sports and Riding Apparel |

Nike, Lululemon, Adidas |

| MCC 5661 Shoe Stores |

Skechers, Charles & Keith, Bata, Foot Locker, Pazzion |

| MCC 5691 Men’s and Women’s Clothing Stores |

Ezbuy, Zalora, Fartech |

| MCC 5699 Miscellaneous Apparel and Accessory Shops |

Cotton On, Reebonz |

| MCC 5941 Sporting Goods Stores |

Decathlon, Fila, New Balance |

| MCC 5948 Luggage or Leather Goods Stores |

Louis Vuitton, Coach, Rimowa |

Unfortunately, this is nowhere as broad as the Citi Rewards Card’s scope, so the main scenario for pairing Amaze would be for overseas shopping at factory outlets, department stores and duty-free outlets.

OCBC also has a specific list of bonus merchants like Alibaba, AliExpress, Amazon and Taobao, but pairing Amaze would not work in this case because bonuses are awarded based on transaction descriptions, as opposed to MCCs. Amaze modifies the transaction description (to Amaze*Merchant Name), so bonus miles will not be awarded.

What about general spending cards?

In addition to these three cards, it is possible to pair general spending Mastercards with Amaze.

There is a trade-off involved, however. Even though Amaze will have a lower FCY fee than the bank (~2% vs 3.25%), it also converts transactions into SGD. Therefore, you’ll be earning at the local general spending rate instead.

The workings are summarised in the table below, where Earn Rate and Cost Per Mile are shown for the different options.

| Card | With Amaze (~2% FCY fee) |

Without Amaze (3.25% FCY fee)^ |

BOC Elite Miles Card BOC Elite Miles CardApply |

1.4 mpd 1.43¢ |

2.8 mpd 1.07¢ ✅ |

Citi PremierMiles Card Citi PremierMiles CardApply |

1.2 mpd 1.67¢ |

2.2 mpd 1.47¢ ✅ |

Citi Prestige Card Citi Prestige CardApply |

1.3 mpd 1.54¢ ✅ |

2 mpd 1.63¢ |

Citi ULTIMA Card Citi ULTIMA CardApply |

1.6 mpd 1.25¢ ✅ |

2 mpd 1.63¢ |

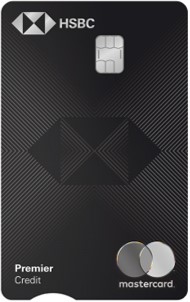

HSBC Premier Mastercard HSBC Premier MastercardApply |

1.68 mpd 1.19¢ |

2.76 mpd 1.18¢ ✅ |

HSBC TravelOne Card HSBC TravelOne CardApply |

1.2 mpd 1.67¢ |

2.4 mpd 1.35¢ ✅ |

Maybank World MC Maybank World MCApply |

0.4 mpd 5¢ |

3.2 mpd* 1.01¢ ✅ |

OCBC 90°N Mastercard OCBC 90°N MastercardApply |

1.3 mpd 1.54¢ ✅ |

2.1 mpd 1.55¢ |

StanChart Beyond Card StanChart Beyond Card(Regular) Apply |

1.5 mpd 1.33¢ |

3 mpd 1.17¢ ✅ |

StanChart Beyond Card StanChart Beyond Card(Priority Banking) Apply |

2 mpd 1¢ |

3.5 mpd 1¢ |

StanChart Beyond Card StanChart Beyond Card(Priority Private) Apply |

2 mpd 1¢ |

4 mpd 0.88¢ ✅ |

| *With a min. spend of S$4,000 per c. month. 2.8 mpd with min. spend of S$800 per c. month ^3% FCY fee for BOC Elite Miles Card, 3.5% FCY fee for StanChart |

||

Based on the figures, there are only two general spending cards which are worth pairing with Amaze: Citi ULTIMA and Citi Prestige (it’s marginal for the OCBC 90°N Card and StanChart Beyond Priority Banking Card).

This is owing to their relatively poor FCY earn rates, and the general rule — unsurprisingly — is that the better your card’s native FCY earn rate, the more likely you should use it naked instead of with Amaze.

Mind you, it’s better to pair the Citi ULTIMA/Prestige with Amaze than to use it naked for FCY spending, but it’s even better to just use another card like BOC Elite Miles (1.07 cpm) or StanChart Beyond Card (<1.08 cpm) in the first place.

What about non-Amaze compatible cards?

While some cards are incompatible with Amaze, either because they’re Visas, or because the issuer excludes Amaze, they can still offer a lower cost per mile.

| Card | Earn Rate CPM^ |

Remarks |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd 0.81¢ |

Online only. Cap S$1K per c. month |

HSBC Revolution HSBC RevolutionApply |

4 mpd 0.81¢ |

Cap S$1.5K per c. month on selected MCCs* |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd 0.81¢ |

Cap S$1K per c. month on selected bonus category |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd 0.81¢ |

Cap S$750 per c. month on selected bonus categories |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd 0.81¢ |

Mobile contactless only. Cap S$1.1K per c. month |

UOB Visa Signature UOB Visa Signature Apply |

4 mpd 0.81¢ |

Min. S$1K, max X$1.2K per s. month |

Maybank Horizon Visa Maybank Horizon VisaApply |

2.8 mpd 1.16¢ |

Min. S$800 per c. month |

| *Until 31 October 2025, after which the bonus cap reverts to S$1,000 per c. month, and bonuses for offline spending removed | ||

The catch here is that minimum spends and caps apply to some of the cards above, and bonuses may only apply to certain categories of spend.

Conclusion

As things stand, there are only really three cards worth pairing with Amaze: Citi Rewards, Maybank XL and OCBC Rewards.

The Citi Rewards Card is the best by far, though you’ll have to be careful to avoid airline, hotel or other travel-related transactions. The Maybank XL can help cover dining, shopping, travel and entertainment, and the OCBC Rewards can cover selected shopping and duty-free.

If you’re already hit the caps on these three cards, I’d be more inclined to use naked cards instead, like the UOB Visa Signature or Maybank World Mastercard, rather than pair Amaze with a general spending card.

Any idea what is current spread FCY ? Seems to be getting less competitive in recent times

https://milelion.com/2023/03/19/what-is-amazes-real-foreign-currency-transaction-fee/

The UOB Krisflyer card cannot be linked to Amaze.

I managed to link mine

The terms and conditions of the travel category for uob lady’s card seems to suggest only that very few airlines listed on top of via uob travel portal. Surprising that list didn’t even include Singapore airlines.

Last saw today April 17.

https://milelion.com/2023/03/20/explained-which-mccs-are-included-in-the-uob-ladys-card-travel-category/

Thanks Aaron!

Hi there anybody else facing issues with Amaze paired with OCBC titanium? Over the last 3 weeks my transactions have been blocked. Amaze has confirmed its at OCBC end. OCBC CRM says its the vendor itself.

Hi all,

anyone can help to explain further? I still don’t see the benefit of pairing amaze card to OCBC titanium, it also gain the same 4mpd and also is limited to the same list of MCC and worst still pairing to amaze card those selected merchant with transaction description will not earn 4mpd….so what is the benefits of amaze pairing to OCBC titanium card?? Can help to explain?

Thanks

4 mpd with lower FCY fees than using TR directly.

Paired Amazed with Citi rewards. Paid my PUB bill but wasnt given the 10x reward. Do i still have to abide by citibank MCC classification?

if i linked amaze card with citirewards & use for general spendings by paywave in restaurant/supermarket does it still gives me 4mpd?

With the current offer from Citi offering 3.25% cash rebate on FCY spending, if I want to purchase an item from a luxury boutique overseas (>S$1K), which is the better option: OCBC TR + Amaze or Citi Rewards alone?

Also, if going with the former, is there a risk of the transaction not being recognized and thence no bonus points?

Is there a benefit to link a Citi Premiermiles card to Amaze? I get 2 mpd for foreign currency spend but I’ll get 1.2 mpd with Amaze so the math doesn’t really check out.

$1000 spot foreign currency spend at 3.25% FCY = 1032.5 SGD = 2064 miles

$1000 spot foreign currency spend at 1.3% FCY (1.8% – rebate of 0.5%) = 1013 SGD = 1215 miles

your math is fine, but you’re missing the last step:

difference in miles= 2064-1215= 849

difference in fees= 1032.5-1013= $19.5

cost per mile= 19.50/849= 2.3 cents each

most people would argue that’s way too much to pay per mile

Hi, can I pair my Amaze card with my HSBC Revolution card? It is 4 miles per dollar for contactless and online transactions….

cannot because it is visa

Just made a large US Amazon marketplace transaction via Amaze, and later on I saw the category was Education. Anyone knows why of all categories it’ll be under Education? Now I’m panicking!

Does anyone know if paying for non-SGD SIA transactions using the UOB Krisflyer card counts for 3mpd as well as the min spend required to unlock the bonus 1.8mpd for the year’s spend?

if you can’t change your UOB Lady card category into travel, what card will you pair with your amaze card for any travel related oeverseas expenss?

For online travel transactions in SGD, would it still be ok to use Instarem paired with UOB lady / solitaire versus the UOB lady / solitaire direct? I assume going through Instarem we would earn some Instarem points as a bonus while earning the 6 miles per dollar still?

thanks!

Read the article – no uob.

If I pair the UOB Lady Card (with selected category as Dining) with the Amaze Card, will I still earn Bonus Uni$? Since it’s marked as a ‘local transaction’ and with MCC dining.

Is it correct never to use Amaze with UOB PRVI Miles Mastercard for overseas spending because the cost per mile without Amaze is lower, if you include the forex charge when using Amaze in the computation?

Amaze forex charges have gone up since this article was first written.

Why do i need to pair amaze card with UOB lady’s card when I can just use the card directly? Is it for overseas spend?

Does Amaze + general spend card still have a worthwhile cpm?

I’ve just had a Courtyard Marriott hotel stay code as “Housing” instead of “Travel” when I paid with my Amazed paired with UOB Lady’s Card. Does that mean I’m not going to be eligible for my bonus points??!!!

Waiting for the updated article after the Amaze nerf today.

My understanding is that MCC of Taobao (mobile app purchase) is 5311 Department stores. Is this correct and in this case, does that mean I could still be able to pair Amaze with OCBC Rewards Card on Taobao app purchase to enjoy both lower FCY conversion fees and 6mpd promotion this quarter right?

Hi, can amaze actually unlock the online spending for citi smrt card if i purchase appliances overseas?

If you’re thinking of pairing the Citi SMRT card, the Amaze card can’t be used with Visa cards, unfortunately.

If I am pairing the Amaze with Citi Rewards, does insurance spend counted as part of the $1k spending for 4mpd?

No.

all the special category are excluded as per all other cards. insurance, donation, heathcare,edu

Once Citi go down the route of DBS and UOB (which is surely just a matter of time), this card will be DEAD. There will be no competitive advantage left. Will it also usher in the demise of Instarem? Really can’t see how they will survive.

Can still use it to check MCCs. It’s the gold standard for that!

101% agree

As we speak, im already applying and receiving some of my other options (if and when Citi nerfs Amaze)

ofcourse if citi does do that, it also means a huge dropoff in user base

The issue with me using Amaze card is that the amount of added fee on top of the MC Forex Rate is not iron clad. Floor rate is like 2 percent but I have experienced more than that. This concern makes me use the Trustbank Cashback Card as it does not charge me 3.25% plus 1 percent rebate making it 4.25%. As I travel a lot, I generally do not have issue hitting the 2K per month tier for each quarter so I generally max out on the 250 dollar additional travel rebates. Not a huge plus but really there… Read more »

Why not with MBB FnF and Citi CashBack?

Cos you are in Milelion?

And not CashbackLion?

Hello can you elaborate on this?

bonuses are awarded based on transaction descriptions, as opposed to MCCs. Amaze modifies the transaction description, so bonuses will not be awarded.

Does that mean I can’t pair amaze with OCBC rewards to purchase from shopee?

Hi! Just to check, should we pair amaze card with UOB visa signature, or just use tap with phone to pay?

Likewise for UOB PP and UOB Lady’s card as well. Thanks!

goodness me.

already 3 years into this and still questions like this.

Stick the card on your forehead and tap your head at the payment machine. That works for 98mpd.

How do you calculate 1.63¢ for Citi Prestige card without Amaze?

Appreciate if someone can show the calculations behind.

Instarem just had a incident where users logged in and see the profile of other users. And multiple users were in the same technical chat (which should be a 1on1 chat). Seems like a data breach / serious technical issue / hack. Do look into it.

Hi can I check with the latest updated post August 2025 regarding Maybank XL cards pairing. I read in the terms of conditions attached that foreign transactions are excluded. So does amaze pairing work in these cases?

Hi, anyone knows if i qualify for the 10x rewards if i pay for gym membership online (e.g. class pass) with citi rewards card?

Is the standard chartered beyond card pair-able with Amaze to double-dip on reward points?