The miles game has always involved a certain degree of tedium, whether it’s tracking minimum spends, monitoring bonus caps (or sub-caps!), checking MCCs, or paying attention to other minor (yet important) details like earning blocks or rounding.

We refer to this as “cognitive load”, which is just a fancy way of saying ma fan or leceh. Cognitive load is why so many people resort to using the same card everywhere, or write off collecting miles altogether.

But cognitive load is also why some cards can be more rewarding than others. After all, banks can’t just offer 8 mpd everywhere (or can they?) — they have to set conditions to ensure sustainability, or trip up the unsuspecting, depending on how cynical you’re feeling.

So which cards keep things simple, and which require you to jump through hoops?

How would I rank card complexity?

Here’s my completely unscientific method of ranking card complexity, ranging from “no-brainer” to “PhD required.”

| Level | Type | Min. Spend | Caps |

| 1 | General | ||

| 2 | General | ✅ | |

| 3 | Specialised Blacklist |

✅ | |

| 4 | Specialised Whitelist |

✅ | |

| 5 | Specialised Whitelist |

✅ | ✅ |

| 6 | Specialised Whitelist |

✅ Sub-Caps |

|

| 7 | Specialised Blacklist |

✅ | ✅ Sub-Caps |

Now, I’m sure there are some out there who find even Level 7 to be child’s play, and for that, I congratulate you. Go apply your learned mind towards solving society’s ills, like toenail clipping on the bus.

For the rest of us mortals, however, my rankings are based on how I’d feel if I were explaining a card to a friend or family member who’s never collected miles before. Which would be intuitive enough to understand, and which would make their eyes glaze over?

One more caveat: when I talk about complexity here, I’m referring to the difficulty involved in fully maximising a card’s value.

For example, you could argue that the UOB Visa Signature (Level 7 on my schema) is actually very easy to use, since it’s a blacklist card that earns 4 mpd on all foreign currency and/or local contactless payments— no MCC memorisation required.

Fair enough, but fully maximising its value means utilising both of its bonus categories, which will require you to (1) spend between S$1,000 and S$1,200 in SGD per statement month, and (2) spend between S$1,000 and S$1,200 in FCY per statement month. As we’ll see later, this can get very messy, very fast!

Level 1: General Spending cards

Level 1 features your classic general spending cards. These are the easiest, least mentally taxing option because the earn rates are the same everywhere— only differing by currency.

| Card | Local Earn | FCY Earn |

Citi PremierMiles Card Citi PremierMiles CardApply |

1.2 mpd | 2.2 mpd |

DBS Altitude Card DBS Altitude CardApply |

1.3 mpd | 2.2 mpd |

OCBC 90°N Card OCBC 90°N CardApply |

1.3 mpd | 2.1 mpd |

For example, the DBS Altitude earns 1.3 mpd on all local spend, and 2.2 mpd on all FCY spend, regardless of merchant (general exclusions aside, obviously). No bonus categories to memorise, no minimum spends to hit, no caps to worry about.

Given this simplicity, it’s no wonder so many people are content to just get a single general spending card and use it everywhere. But this convenience comes at a cost. General spending cards have mediocre earn rates compared to specialised spending alternatives, which can offer 2-3X more miles. Those who insist on using one card for everything will invariably have to spend more for the same reward.

Level 2: General spending cards with minimum spend

Level 2 includes general spending cards that offer enhanced earn rates if the cardholder meets a certain minimum spend.

| Card | Regular Earn (Local/FCY) |

Enhanced Earn (Local/FCY) |

DCS Imperium DCS ImperiumApply |

1.6/2.4 mpd | 1.6/4 mpd Min. S$4K |

Maybank Visa Infinite Maybank Visa InfiniteApply |

1.2/2mpd | 1.2/3.2 mpd Min. S$4K |

Maybank World Mastercard Maybank World MastercardApply |

0.4/0.4 mpd | 0.4/2.8 mpd Min. S$800 0.4/3.2 mpd Min. S$4K |

StanChart Visa Infinite StanChart Visa InfiniteApply |

1/1 mpd | 1.4/3 mpd Min. S$2K |

The minimum spends aren’t that difficult to grasp, tracking them adds an item to your to-do list nonetheless. And falling short could be very costly! For example, the StanChart Visa Infinite offers 1.4/3 mpd on local/FCY spend, but only if you spend at least S$2,000 per statement month. If you don’t, you earn just 1 mpd for both.

Level 3: Specialised blacklist cards with caps

Level 3 features specialised blacklist cards with bonus caps. These earn 4 mpd on all spending, up to a cap, except for merchants on the exclusion list (aka blacklist).

| Card | Earn Rate | Remarks |

Citi Rewards Card Citi Rewards CardApply |

4 mpd | Max S$1K per s. month. For online spending excluding Travel and in-app mobile wallet payments |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd | Max S$1K per c. month. For online spending |

Level 3 cards are slightly more difficult than Levels 1 & 2 because:

- You need to spend in a particular manner

- There is a cap on the maximum bonus

(1) is honestly no big deal. All you need to remember is to use these cards for online transactions only (still, you’ll be shocked at how many people use these cards to pay in store!), and in the case of the Citi Rewards, avoiding the “travel” and “in-app mobile wallet” category.

| 💳 Citi Rewards Card |

| The Citi Rewards Card also earns 4 mpd for offline spending in department stores, or stores selling bags, shoes or clothes. However, given how many alternative cards can be used for those categories, it’s best reserved for online spending. |

(2) requires you to keep tabs on your total spending for the month, because once you go beyond the cap, you’ll earn just 0.4 mpd. At that point, you’d be better off using a general spending card.

There’s a little bit more work here, but it’s hardly rocket science. That’s why I believe Level 3 is the sweet spot for those who want to earn miles faster, but find the idea of MCCs and minimum spends intimidating.

| ❓ Where’s the UOB Preferred Platinum Visa and Visa Signature? |

| You might have been expecting to see the UOB Preferred Platinum Visa and UOB Visa Signature here. But their recent introduction of bonus sub-caps makes them more difficult to fully utilise. We’ll get to these later. |

Level 4: Specialised whitelist cards with caps

Level 4 consists of specialised whitelist cards with bonus caps. These earn bonuses on selected merchants (aka whitelist), up to a cap.

| Card | Earn Rate | Remarks |

HSBC Revolution HSBC RevolutionApply |

4 mpd | For whitelisted MCCs. Max S$1.5K per c. month* |

OCBC Rewards Card OCBC Rewards CardApply |

4 mpd | For whitelisted MCCs. Max S$1.1K per c. month |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | For whitelisted MCCs. Max S$1K per c. month |

| *Bonus cap will revert to S$1,000 per calendar month from 28 February 2026 |

||

Whitelist cards require more thinking than blacklist cards because only specific MCCs are rewarded. Not only will you need to familiarise yourself with which ones are eligible, you’ll also need to get into the habit of checking MCCs.

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

| Note: “Ease of use” and “reliability” are all relative. HeyMax already provides a solid baseline for reliability, and the DBS digibot is still simple enough to use, despite requiring more steps than the other two methods. | ||

Moreover, just like Level 3 cards, you’ll also need to monitor your overall spending for the month, to ensure you stay within the 4 mpd cap.

Level 4 is where we start seeing a bigger drop-off in the number of people willing to play along, as checking MCCs adds friction to the checkout process, and getting them wrong could be a costly mistake (e.g. if a dining transaction codes as MCC 5814 (Fast Food), it will only earn 0.4 mpd with the HSBC Revolution instead of 4 mpd).

Then again, there are some who use these cards while being blissfully ignorant of the need to keep within certain categories. Far too many people have the impression that the HSBC Revolution earns 4 mpd on all contactless spending, for whatever reason!

Level 5: Specialised whitelist cards with min. spend and caps

Level 5 consists of specialised whitelist cards with minimum spend and caps. These earn bonuses on selected merchants, subject to a minimum spend, and with an overall bonus cap.

| Card | Earn Rate | Remarks |

DBS yuu Card DBS yuu CardApply |

10 mpd | For yuu merchants & SimplyGo. Min. spend S$800, cap S$823 per c. month, and 4x participating merchants |

Maybank XL Rewards Maybank XL RewardsApply |

4 mpd | For selected MCCs. Min. spend S$500, cap S$1K per c. month |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

2.8 mpd | For air tickets and FCY spend. Min. spend S$800, cap S$10K per c. month (cap applies to air tickets; FCY is uncapped) |

Just like Level 4, you have to be mindful to only spend at specific merchants, and keep within the bonus cap. But for Level 5 cards, it’s not enough to stay below the bonus cap. You will also need to spend above the minimum spend, or the bonus rate won’t even be triggered.

This creates a sweet spot for spending, and for some cards, it’s very wide. For example, Maybank Horizon Visa Signature cardholders who spend at least S$800 a month can earn 2.8 mpd on up to S$10,000 of air ticket purchases.

For others, the sweet spot is considerably narrower. DBS yuu Cardholders have to spend at least S$800 per month to unlock the 10 mpd rate for yuu merchants, which is capped at S$823 per month. That’s a very narrow range to stay within!

Level 6: Specialised whitelist cards with sub-caps

Level 6 consists of specialised whitelist cards with sub-caps. These earn bonuses on selected merchants, and have two separate bonus caps covering different categories of spend.

| Card | Earn Rate | Remarks |

UOB Lady’s Solitaire UOB Lady’s Solitaire Apply |

4 mpd | Two bonus categories, each with cap of S$750 |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd | Two bonus categories, each with cap of S$600 |

Unlike Level 5, where you have the freedom to allocate your bonus cap as you see fit (e.g. I could spend the entire bonus cap of the HSBC Revolution on dining alone if I were so inclined), Level 6 forces you to split your spending in a pre-defined way.

This approach, once confined to the world of cashback cards, has been progressively introduced by the UOB Lady’s Solitaire, UOB Preferred Platinum Visa and UOB Visa Signature. These cards split their bonus caps into two equal sub-caps, effectively turning them into “2-in-1” cards (because you have two different bonus criteria to satisfy on a single card).

If you want to fully utilise the card’s earning potential, you must spend across both bonus categories. That’s easier said than done, because spending across both categories can get real messy, real fast.

UOB does not categorise your spending for you, so the only way to figure out how much bonus cap remains for each category is to go through your ibanking and tally up items line by line — which transactions belong to Category 1, which transactions belong to Category 2?

There are a couple of ways to simplify things:

- You could apply for a supplementary card and use it exclusively for Category 2, while using the principal card for Category 1

- You could max out one bonus category at the start of every month (e.g. by buying vouchers), meaning any incremental spending is for the second bonus category only

Even so, it’s still a big step up in overall complexity, and I’m willing to bet that the average cardholder will fall well short of the maximum possible bonus.

| ❓ Isn’t the UOB Preferred Platinum Visa much simpler? |

|

The UOB Preferred Platinum Visa straddles levels. If you use it purely for its mobile contactless bonus, then it’s basically a Level 3 blacklist card with no MCCs to memorise. All you need to do is tap your phone wherever contactless payments are accepted, and 4 mpd is yours. But that would limit you to 50% of its monthly bonus cap. If you want to fully maximise its potential, you will also need to utilise its bonuses for selected online transactions, such as food delivery, groceries, shopping and entertainment. That makes it more like a Level 4 whitelist card. Remember, we’re defining complexity based on how difficult it is to fully maximise a card’s value, so putting the two tasks together bumps up the UOB Preferred Platinum Visa’s level. |

Level 7: Specialised blacklist cards with min. spend and sub-caps

Level 7 consists of specialised blacklist cards with minimum spends and sub-caps.

| Card | Earn Rate | Remarks |

UOB Visa Signature UOB Visa SignatureApply |

4 mpd | Two bonus categories, each with min. spend S$1K and cap of S$1.2K |

At the moment, there’s only one card in this tier: the UOB Visa Signature. If you thought the previous levels were hard, try keeping above the minimum spend and below the cap for two separate bonus categories. The only consolation is that it’s a blacklist and not a whitelist card!

This was always one of the trickier cards to use, with its minimum spend requirement a common source of confusion. And now with the added sub-caps, it’s almost impossible to fully max out the bonus cap, unless you have a way of consistently spending at least S$1,000 in FCY each month.

Of course, if you use the UOB Visa Signature as a single-category card, it can be significantly simpler.

- You can use it for 4 mpd on local contactless spending, subject to a minimum spend of S$1,000 (in SGD) and a cap of S$1,200

- You can use it for 4 mpd on FCY spending, subject to a minimum spend of S$1,000 (in FCY) and a cap of S$1,200

In either case, I’d rank it as only slightly more complicated to use than the DBS Woman’s World Card or Citi Rewards Card, because of the need to mind the minimum spend.

But like I said at the start, I’m measuring “complexity” based on how difficult it is to fully maximise the value from a card. When you want to spend across two categories, you not only have to deal with the sub-caps problem, you have to find a way to spend S$1,000 in FCY each month.

How to navigate the UOB Visa Signature’s tricky new bonus caps

Level 8: Amex Platinum Charge

I didn’t mention this in my table, but I don’t think we can have any discussion about card complexity without a special shout out to the AMEX Platinum Charge!

This card isn’t complex because of earn rates. It’s complex because of its “killer feature”— the S$1,354 of annual statement credits. In theory, this offsets up to 78% of the annual fee. In practice, you’re going to develop several aneurysms trying to use them, since they’re:

- Issued half-yearly

- Split across six different categories (two of which have a minimum spend)

- Valid at selected merchants only

| 💳 Platinum Statement Credits |

||

| Credit | Amt. | No. of Trxns. |

| Local Dining | S$100 per 6 mo. | Multiple |

| Overseas Dining | S$100 per 6 mo. | Multiple |

| Lifestyle | S$200 per 6 mo. (min. S$300 spend) |

Single |

| Entertainment | S$17 per mo. | Multiple |

| Airline | S$100 per 6 mo. (min. S$300 spend) |

Single |

| Fashion | S$75 per 6 mo. | Multiple |

Further complexity is added by the fact that certain categories allow you to spend across multiple transactions, while others require a single transaction.

What makes it worse is the added pressure presented by the annual fee. I mean, it’s unfortunate if you fail to max out the bonuses on your UOB Visa Signature, but at the end of the day, it’s a free card. The AMEX Platinum Charge is a S$1,744 commitment, and it’s going to hurt a lot more if you don’t get your money’s worth.

All this to say that while some get a kick out of thinking up ingenious ways of maximising value, most people find the cognitive load of this “coupon book” too much to handle. I certainly did!

Other sources of complexity

Maybank, OCBC and UOB: S$5 earning blocks

Maybank, OCBC and UOB cards have S$5 earning blocks, which means that transactions are rounded down to the nearest S$5 before points are awarded. In other words, a S$9.99 transaction earns the same number of points as a S$5 transaction, and a S$4.99 transaction earns no points at all!

This can be especially painful with smaller transactions, as the lost miles represent a larger percentage of the entire amount earned.

| 💳 For 4 mpd cards | |||

| Spend | Miles Awarded (No rounding) |

Miles Awarded (S$5 blocks) |

Miles Lost |

| S$9.99 | 39.96 miles | 20 miles | 19.96 miles (~50% loss) |

| S$99.99 | 399.96 miles | 380 miles | 19.96 miles (~5% loss) |

For example, if you spend S$99.99 on a 4 mpd card, you lose 19.96 miles due to S$5 earning blocks— about 5% of the miles you would have earned in the absence of rounding. But if you spend S$9.99 on a 4 mpd card, the 19.96 lost miles come up to almost 50%!

So there’s extra cognitive load here in trying to keep your transactions in S$5 intervals. Sometimes, adding a 5 cent plastic bag at self check-out could be the difference between S$19.95 and S$20, and with it 20 miles (at 400 mpd, probably the best 5 cents you ever spent!).

| ⚠️ Does not affect all cards equally! |

| S$5 earning blocks are annoying, but the impact is relatively muted for certain cards like the UOB Visa Signature and UOB Lady’s Solitaire. On these cards, the base points (0.4 mpd) are subject to transaction-level rounding, but the bonus points (3.6 mpd) are awarded based on the sum of the entire month’s eligible spending (including cents), which is rounded down once. |

DBS yuu Cards: 4x participating merchants requirement

In addition to the minimum spend requirement, the DBS yuu Cards also require that cardholders transact with a minimum of four participating merchants each month to earn the 10 mpd bonus rate.

| Participating Merchant | Consists Of |

| 🏪 7-Eleven |

|

| 🍵 CHAGEE |

|

| ⚡Charge+ Visa only |

|

| 🛒 Cold Storage |

|

| 🍽️ foodpanda |

|

| 🛒 Giant |

|

| 💊 Guardian |

|

| 🚕 Gojek |

|

| 📱 Singtel |

|

| 🚆 SimplyGo* |

|

| *SimplyGo is not a yuu merchant per se, but is still eligible for the bonus earn rate |

|

Given the wide range of yuu merchants (SimplyGo is included too), it’s not that difficult to find four options to spend at. But you will have to keep reminding yourself to do it month after month, and forgetting could be a costly mistake.

BOC and UOB: Payment processor location

For most banks, an overseas transaction is defined as any transaction in a currency other than SGD (i.e. FCY).

For Bank of China and UOB, however, an overseas transaction is defined as:

- a transaction in a currency other than SGD, and

- processed by a payment gateway outside of Singapore

The first criteria is obvious. The second may not be. It’s pretty clear cut if you’re spending in-store while physically overseas, but what if you’re paying online? For example, Agoda processes Visa payments through a gateway in Singapore, so even if you’re paying in FCY, you’ll be awarded miles according to the local spend rate!

Thankfully, it is possible to find out where online payments are processed, but it’s yet another step to do.

Use the HeyMax Card Maximiser

|

| Sign up here |

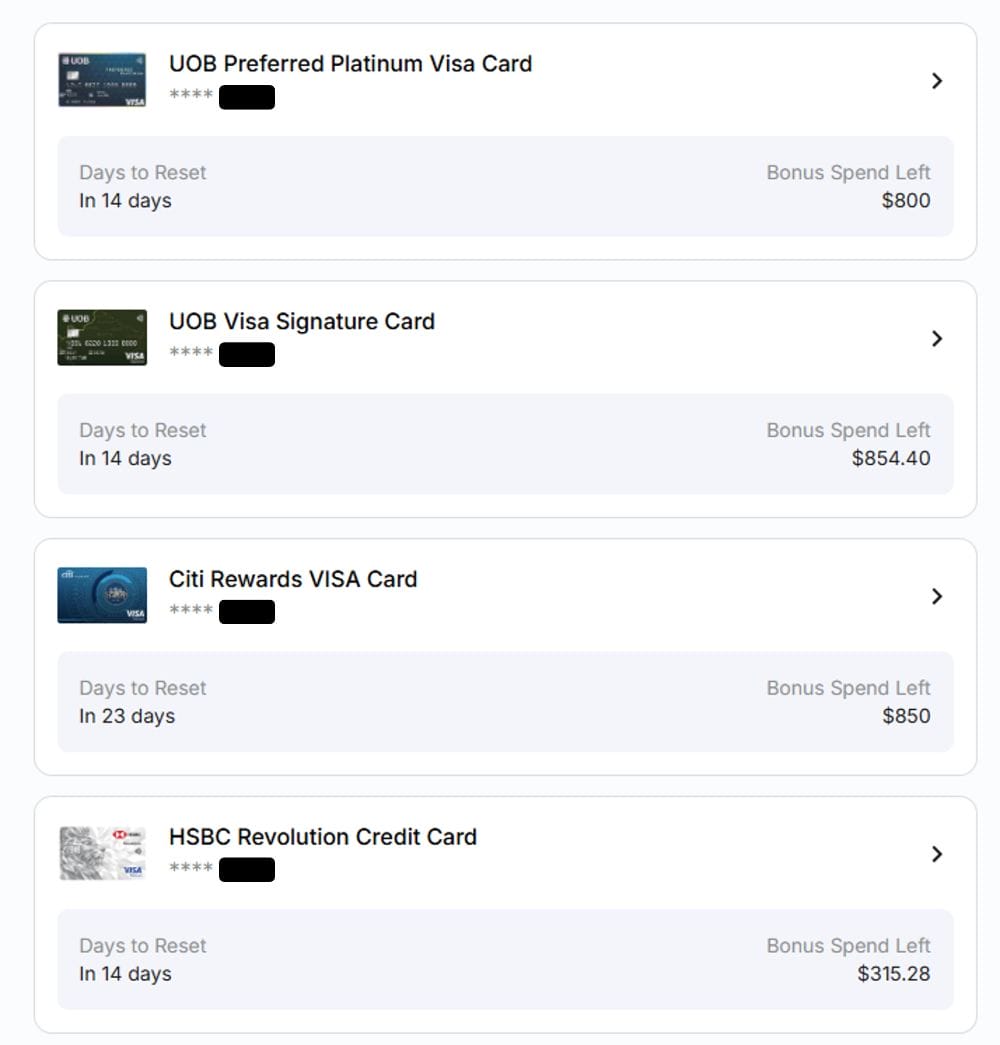

If tracking spending is more cognitive load than you’re willing to handle, then you should check out the HeyMax Card Maximiser feature.

This allows you to link your cards and keep a running tally of how much bonus cap remains for the month (for cards which track caps by statement month, you’ll need to enter your statement date).

The catch is that the tracker only supports Visa cards, which limits its usefulness to the Citi Rewards Visa, HSBC Revolution, UOB Preferred Platinum Visa and UOB Visa Signature (and even then, I don’t think it’s been updated to handle the sub-caps properly).

There is no equivalent for Mastercards, so anyone with a Citi Rewards Mastercard, DBS Woman’s World Card, Maybank XL Rewards, OCBC Rewards, UOB Lady’s Card or UOB Lady’s Solitaire will have to do things the old-fashioned way.

Conclusion

At the end of the day, playing the miles game necessitates some level of hoop-jumping. The only question is how much?

If you’re the kind who really hates having to track spending and memorise categories, then Level 1-3 cards are probably as far as you’d take things. But it’s Levels 4-7 that really help you rack up the miles faster, with the added bonus caps and bonus category coverage.

I’m sure there are some seasoned miles chasers out there for whom complexity is a feature, not a bug. I can understand how optimising caps, minimum spends and MCCs scratches the same itch as a good puzzle.

That said, I did chuckle at a suggestion in the MileChat that if miles chasers devoted the same amount of effort into learning investing or getting really good at their jobs, they could be buying Suites tickets with cash. They’re probably right, but what’s the fun in that?

Which cards do you find the most difficult to use?

For dp, it’s been about one week and three locations where Singtel kiosks don’t accept payment via Visa… there goes yuu

Hi Aaron,

Which category (Level) would you classify the Maybank Manchester United Credit Card in? Didn’t see it in your article today.

definitely towards the higher end, because of its three different earn tiers, special treatment of selected categories, caps and other quirks.

cancelled every thing beyond level 5. Not worth the effort…

Sometimes i wonder if new employee of the UOB credit card team can understand the rules or not.

Agree. UOB cards are among the most difficult cards to use.

100% agree. The latest revision with the subcaps make it even harder to maximize but I just don’t see any better “ecosystem” at the moment, given my spending patterns.

How about the Standard Chartered Journey card?

You’re truly World-Class with this article.

Hi

Can you commend on HSBC Premier Master Card.

Thanks

It’s really not fair to say UOB PPV is a harder-to-use card than yuu card based on this metric, and in general, putting sub-cap on the same level as a minimum spend. To most people, it’s harder to meet a minimum spend than staying within sub-cap

Despite being specialised, UOB PPV’s “whitelist” covers all most all normal use case. That, and the lack of a minimum spend make earning 4mpd possible every single month, for almost every transaction.

remember: we’re gauging difficulty based on how hard it is to FULLY max out the card’s earning potential.

of course it’s super easy to use the UOB PPV as a 4 mpd everywhere card. but that way you’d only get 50% of its miles cap. you must engage with the online spending categories- and balance it with the cap for offline contactless – in order to fully max it out.

Even so, utilising PPV’s online sub-cap is still much easier than hitting yuu’s merchant list. Supermarket, ecommerce and department store are a much bigger whitelist than yuu merchant list. And they don’t require any minimum spend either