| 🕰️ Hello, time traveller! |

| Found this page through a search engine? Look for the latest edition of this guide here |

Some people say there’s no point in laying out a detailed credit card strategy, because all it takes is a new promotion, a new launch, or a T&C tweak to turn everything on its head.

That’s true, I suppose, but the same could be said about investment planning, or any other kind of planning for that matter. The fact that things can change doesn’t mean there’s no value in laying out a game plan and adapting as you go along.

So as 2020 kicks off, why not pause for a minute and formulate your card strategy for the year ahead: which combination of cards is going to rake in the most miles?

The overall objective for card strategy

With the right credit cards, you can earn up to 4 mpd on certain transactions. Your job is to make this the norm, rather than the exception. In other words, the overall objective of your card strategy is:

Maximize 4 mpd opportunities

It’s not rocket science. The very reason why we don’t use one card for everything is because we don’t want to pass up 4 mpd opportunities. If you’re happily swiping your Citi PremierMiles Visa everywhere, you’re missing out on up to 2.8 miles for every dollar spent. Your path to a free flight will be significantly slower than someone who optimizes.

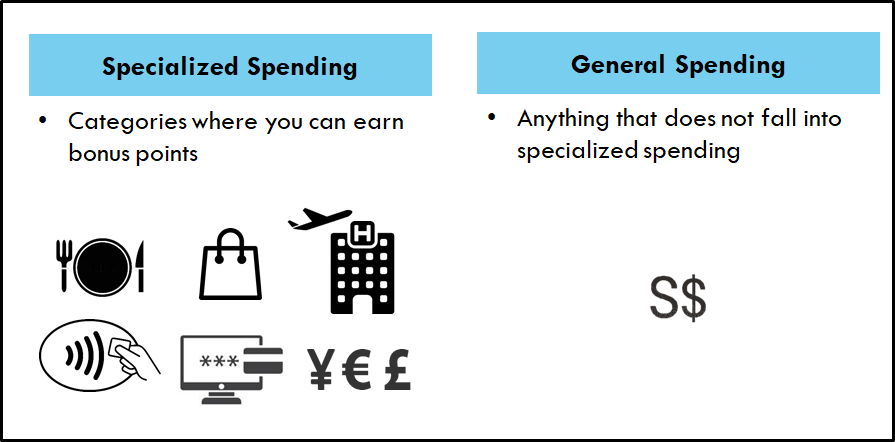

Start by categorizing your spending

Think of all your spending as either specialized, or general. Specialized spending refers to categories that you can earn 4 mpd on. General spending is the catchall term for everything else, where the best you can do is 1.2-1.6 mpd.

Every time you use a general spending card for a specialized spending category, you’re leaving money on the table; the bank would have awarded you more miles, but you didn’t take it.

So the first step is to think about the categories you spend the most on. For the majority of people, the following list should be pretty exhaustive:

- Online

- Contactless

- Foreign currency

- Dining

- Petrol

- Offline shopping

- Transport

- Bill payments

Transactions won’t always fit nicely into one category, but that isn’t really a concern. If I’m dining overseas, I can use either a foreign currency card, or a dining card. If I’m buying Europe train tickets online, I can either use a foreign currency card, or an online spending card. If I’m dining in Singapore at a place that takes Paywave, I can either use a contactless spending card or a dining card.

The trick to optimization is to know how to manage your caps, because, with some very limited exceptions, most 4 mpd opportunities are capped. The general rule is to always use the most restrictive cap first. I’m more likely to spend online than to spend in foreign currency, so I utilize the foreign currency cap first when the opportunity arises. Likewise, I utilize my dining cap before my contactless cap, because the latter is more flexible.

Online: DBS Woman’s World Mastercard or Citi Rewards Visa

| Earn Rate | Cap | Remarks | |

DBS Woman’s World Card DBS Woman’s World CardApply here |

4.0 mpd | S$2,000 per calendar month | |

Citi Rewards Visa Apply here |

4.0 mpd | S$1,000 per statement month | Excludes travel |

Think of how many online transactions you do in a typical month: Grab/gojek rides, Lazada/RedMart/Qoo10, movie tickets, Deliveroo/foodpanda, entertainment subscriptions, air tickets…it’s a very broad category, and definitely something you need to have a specialized card for.

Although 2019 saw the debut of pretenders like the Citi Lazada Card and the KrisFlyer UOB Credit Card, both of which offer bonuses on online spending, the DBS Woman’s World Card (DBS WWMC) and Citi Rewards Visa remain my picks for another year running.

The DBS WWMC (which doesn’t require you to have lady bits nor earn S$80K a year) offers 4 mpd on all online spending, capped at S$2,000 per calendar month.

Once that’s exhausted, you can use the Citi Rewards Visa, which also offers 4 mpd on all online spending (except travel-related spending like airfares, lodging and car rentals), capped at S$1,000 per statement month. Incidentally, the Citi Rewards Visa also earns 4 mpd (for now) on something that rhymes with crabhey bopups.

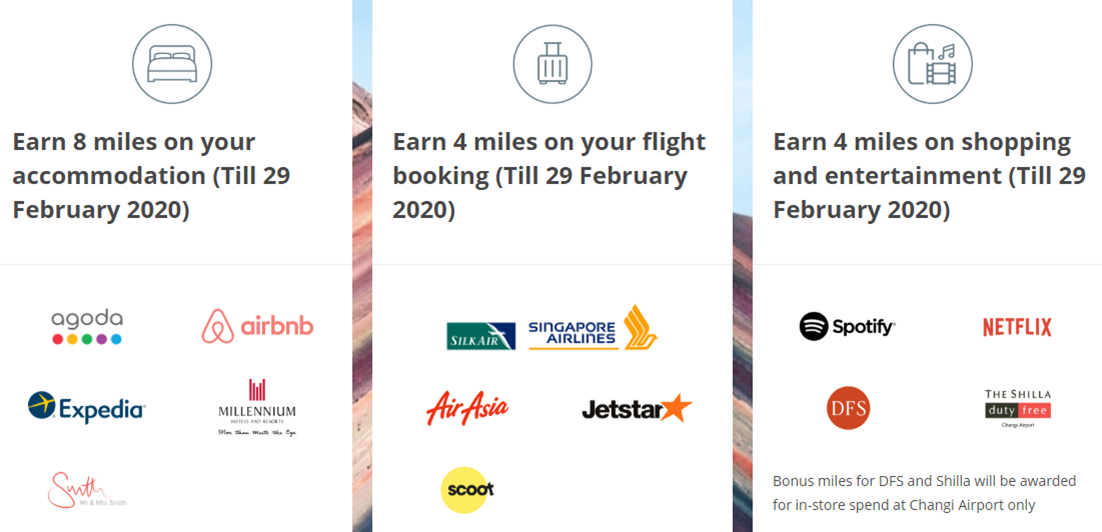

To better optimize my caps, I’m using the OCBC 90N on Netflix, Spotify, Singapore Airlines, Scoot, SilkAir, AirAsia, and Jetstar tickets until 29 Feb 2020.

This gives me 4 mpd with no cap, allowing me to conserve the 4 mpd cap on the DBS WWMC and Citi Rewards Visa.

Contactless: UOB Preferred Platinum Visa or UOB Visa Signature

| Earn Rate | Cap | Remarks | |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply here |

4.0 mpd | S$1,110 per calendar month | Except at places where SMART$ are awarded |

UOB Visa Signature Apply here |

4.0 mpd | S$2,000 per statement month | Min S$1,000 spending on contactless + petrol |

Just like online spending, contactless is a very broad category. Contactless terminals have sprung up almost everywhere, from supermarkets to doctor’s offices, from convenience stores to car repair shops. From a miles collector’s point of view, this is fantastic; it means even a trip to the dentist is a chance to earn 4 mpd.

To do that, you’ll need a UOB Preferred Platinum Visa. This earns you 4 mpd on the first S$1,110 of contactless spending per calendar month (technically S$1,000, but UOB’s systems have a funny way of awarding the bonus), except at places where SMART$ are awarded. It pays to familiarize yourself with SMART$ merchants; some of the bigger ones are Cold Storage, Giant, Jasons, Market Place, BreadTalk, Cathay Cineplexes, Shell, and Guardian.

| There’s no need to tap the physical UOB PPV card; using it via your mobile wallet (Google, Apple, Samsung or Fitbit Pay) will still earn you the bonus miles |

Assuming you spend more than S$1,110 in a month, consider using the UOB Visa Signature instead. This earns 4 mpd on contactless spending, provided you spend a minimum of S$1,000 and maximum of S$2,000 on contactless + petrol spending per statement period (see below for more details on petrol spending).

Since the UOB Visa Signature has a minimum spend threshold to meet, only use it if you’re very sure you’ll spend at least S$1,000. Anything below that earns a measly 0.4 mpd!

Foreign currency: OCBC 90N or UOB Visa Signature (after 29 Feb 2020)

| Earn Rate | Cap | Remarks | |

OCBC 90N OCBC 90NApply here |

4.0 mpd | None | Until 29 Feb 2020 |

UOB Visa Signature Apply here |

4.0 mpd | S$2,000 per statement month | Min S$1,000 spending on foreign currency. Payment processing must be done overseas |

With an uncapped 4 mpd on foreign currency spending, using the OCBC 90N is a no-brainer. This won’t last forever, sadly, and after 29 Feb 2020 it reverts to a more sedate 2.1 mpd.

I’m hopeful that another bank will step in to fill the void, but if not, the UOB Visa Signature gets called up for duty. This gives you 4 mpd on foreign currency spending, provided (1) you spend at least S$1,000 in foreign currency in a given statement month, and (2) the payment processing is done outside of Singapore

| If you’re physically swiping your card overseas, you don’t need to worry about the payment processing bit (do look out for DCC though). If you’re paying for something online, be careful when paying in foreign currency on websites with .sg domains (e.g Hotels.com) |

Do note that the 4 mpd on foreign currency is capped at S$2,000 per statement month, and this cap is shared with contactless + petrol transactions. In other words, the only way you could earn 4 mpd on both is to spend exactly S$1,000 on foreign currency and S$1,000 on contactless + petrol. In reality you won’t, so pick one or the other.

Dining: UOB Preferred Platinum AMEX or UOB Lady’s/Lady’s Solitare Card

| Earn Rate | Cap | Remarks | |

UOB Preferred Platinum AMEX |

4.0 mpd | S$6,000 per calendar year | No longer issued |

UOB Lady’s Card UOB Lady’s CardApply here |

4.0 mpd | S$1,000 per calendar month | Dining must be selected as your quarterly 10X category |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply here |

4.0 mpd | S$3,000 per calendar month | Dining must be selected as one of your two quarterly 10X categories |

If you managed to get a UOB Preferred Platinum AMEX before the card was discontinued, great! Continue using it for the first S$6,000 of dining spend each year.

The UOB Lady’s Card (which unlike the DBS WWMC is strictly for women only) lets you earn 4 mpd on 1 of 7 categories every quarter– one of which is dining. This makes it the only 4 mpd dining card still open for applications.

The 4 mpd is capped at S$1,000 per calendar month, but if you qualify for a UOB Lady’s Solitaire (min income: S$120K) you enjoy a S$3,000 cap, plus an additional bonus category.

It’s not all doom and gloom for men though, as you can ask your girlfriend/wife to apply for a Lady’s Card and add it to your mobile wallet. If you have no girlfriend/wife, then the good news is that contactless terminals are pretty common at restaurants too.

Alternatively, you may consider a HSBC Revolution, which gives 2 mpd on dining with no cap. It may be worth considering if you spend a lot on dining where contactless isn’t an option, but otherwise I’d avoid the risk of orphan points.

Petrol: UOB Visa Signature or Maybank World Mastercard

| Earn Rate | Cap | Remarks | |

UOB Visa Signature Apply here |

4.0 mpd | S$2,000 per statement month | Min S$1,000 spending on petrol + contactless, excludes Shell and SPC |

Maybank World Mastercard Maybank World MastercardApply here |

4.0 mpd | None(?) |

The UOB Visa Signature has popped up quite a few times in previous sections, so I won’t repeat myself again here- just note that Shell and SPC are ineligible for 4 mpd (which leaves Esso, Caltex, and Sinpoec).

If you don’t want to deal with minimum spends and exclusions, then the Maybank World Mastercard is probably a better choice. This offers 4 mpd on petrol, period, and based on the website, there doesn’t seem to be any cap.

Offline shopping: Citi Rewards Visa + OCBC Titanium Rewards

| Earn Rate | Cap | Remarks | |

Citi Rewards Visa Citi Rewards VisaApply here |

4.0 mpd | S$1,000 per statement month | |

OCBC Titanium RewardsApply here OCBC Titanium RewardsApply here |

4.0 mpd | S$12,000 per membership year | Both Pink and Blue cards have their own caps |

The Citi Rewards Visa will earn 4 mpd on spending at any department store, or any shop selling bags, shoes or clothes. However, since its 4 mpd cap is very valuable and ideally preserved for slabmay hopups, I’d instead use the OCBC Titanium Rewards for offline shopping.

The OCBC Titanium Rewards gives 4 mpd on the first S$12,000 each membership year spent at any of the following merchants:

| MCC 5311 | Departmental Stores |

| MCC 5611 | Men’s and Boy’s Clothing and Accessories Stores |

| MCC 5621 | Women’s Ready to Wear Stores |

| MCC 5631 | Women’s Accessories and Specialities Stores |

| MCC 5641 | Children’s and Infant’s Wear Stores |

| MCC 5651 | Family Clothing Stores |

| MCC 5661 | Shoe Stores |

| MCC 5691 | Men’s and Women’s Clothing Stores |

| MCC 5045 | Computers, Peripherals, and Software |

| MCC 5732 | Electronic Stores |

| MCC 5699 | Miscellaneous Apparel and Accessory Shop |

The cap is particularly noteworthy because you can utilize all of it at one go, great for big ticket purchases (e.g laptops). There are two versions of the OCBC Titanium Rewards (Pink & Blue), and each comes with its own S$12,000 cap.

Public transport: UOB PRVI Miles Mastercard or Visa

| Earn Rate | Cap | Remarks | |

UOB PRVI Miles Mastercard or Visa UOB PRVI Miles Mastercard or VisaApply here |

4.4 mpd | S$80 per calendar month | Until 29 Feb 2020 |

It looks like banks have decided to run tactical promotions for SimplyGo. Last year, we saw DBS running a 4 mpd promo on the Altitude Visa, and UOB replying with a 4.4 mpd promo of their own. The DBS promo lapsed and wasn’t renewed (although new DBS Altitude customers can enjoy 4 mpd on SimplyGo for the first 3 months), but UOB has extended theirs until 29 Feb 2020.

As a reminder, registration is required for this promotion, and you have to pay for your rides via mobile contactless (i.e Apple Pay, Fitbit Pay, Google Pay or Samsung Pay). You will not earn any bonus miles if you tap your physical card at the reader.

The relatively small amounts transacted on SimplyGo means such promotions probably don’t cost too much to run, and they’re good for building daily touch points with the product. I’d expect a new one to come along in Q2 2020.

Bill Payments: CardUp or Citi PayAll

If you were hoping to earn some free miles while paying bills, then the bad news is AXS no longer accepts GrabPay.

This leaves very few avenues to earn miles without a surcharge. The only ones I’m aware of are (please contribute if you know others):

- SP Utilities and Singtel bills earn points with American Express cards

- Insurance bills earn points with the HSBC Revolution and BOC Elite Miles

- Telco bills earn points on the Citi Rewards Visa if paid online or via app, provided you don’t set the up as a recurring payment

- Keppel Electric and SP Utilities bills earn points with the UOB PRVI Miles

Otherwise, if you don’t mind paying a small fee, both CardUp and Citi PayAll are good options. PayAll is marginally cheaper, but limits you to rent, tax, education, MCST and electricity bills. CardUp supports more types of payments, and is currently offering a fee of 2.25% with the code GET225.

If you want to pay rent in particular, then your cheapest option is RentHero, which is offering a 1.85% discounted admin fee to Milelion readers until 30 June 2020.

General spending: BOC Elite Miles World Mastercard

| Earn Rate | Cap | Remarks | |

BOC Elite Miles BOC Elite MilesApply here |

Local: 1.5 mpd Overseas: 3.0 mpd |

None | Are you sure? |

UOB PRVI Miles UOB PRVI MilesApply here |

Local: 1.4 mpd Overseas: 2.4 mpd |

None | Awarded per S$5 of spending |

| If you have access to a general spending card that earns 1.6 mpd, such as the Citi ULTIMA, UOB Reserve, DBS Insignia or premier/private banking versions of the OCBC VOYAGE, by all means go ahead and use it |

I’m still using the BOC Elite Miles World Mastercard as my general spending card. And believe me, I hate myself for it. Despite the mysterious interest charges, annual fee fiasco and general skullduggery, I’m tied to this product until I can quit the BOC SmartSaver honeytrap.

The BOC SmartSaver is one of the easiest ways to earn 3.55% p.a on the first S$60,000 of your savings. There’s no need to buy any investment products or insurance; just spend at least S$1,500 on your credit card, credit a salary of S$6,000 or more, and pay 3 bills via GIRO or ibanking.

If you don’t use the SmartSaver, however, I’d suggest you use the UOB PRVI Miles card instead. You’ll lose out on 0.1 mpd, and you’ll need to watch out for UOB’s infamous S$5 rounding policy, but I’d wager your blood pressure will thank you.

Remember, your general spending card is your card of last resort. Only use it when opportunities to earn 4 mpd don’t exist.

Benefits card: AMEX Platinum Charge

In addition to my spending cards, I also keep what I call a “benefits card”- held not primarily for spending, but because of the benefits it gives.

For 2020, that’s the AMEX Platinum Charge. Yes, the S$1,712 annual fee is pretty eye watering, but I had a very good experience over the past year and the valuation still makes sense for me.

With the AMEX Platinum Charge, I’ll be fully utilizing:

- S$800 of airline and hotel credit

- S$200 of St Regis dining vouchers

- Unlimited airport lounge access for principal cardholder + 2 supplementary cardholders

- 1 staycation at the St Regis or W Singapore

- 2 nights at selected Frasers Hospitality residences (thanks to the voucher I get from holding the AMEX Platinum Reserve, with no annual fee)

- Three complimentary spa treatments

- Elite status for hotels

- Love Dining benefits

If you just can’t part with a four-digit annual fee, then the Citi Prestige (AF: S$535) may be a good alternative, depending on how you feel about the following:

- 25,000 miles

- 4th night free on hotel stays

- Complimentary airport limo transfers (hefty spend required though)

- Unlimited airport lounge access for principal cardholder + 1 guest

How much should we specialize?

As much as we want to maximize 4 mpd everywhere, is it possible to overdo it?

That’s a great question. The way I see it, there are two additional considerations:

(1) Conversion Fees

The more cards you hold, the more conversion fees you pay…sometimes. If you hold multiple UOB cards, you still pay one conversion fee because your points are pooled. If you hold multiple Citibank cards, you pay as many conversion fees as you have cards. Have a read of this article to learn which banks pool points.

If you’re spreading your cards across multiple banks, then you’ll of course pay more conversion fees. Honestly though, I’m not overly worried about conversion fees. We try to minimize them where we can, but it’s not the end of the world if you end up paying a few- I guarantee you they’ll be the last thing you think about when you’re sitting in your First or Business Class seat.

(2) Orphan Points

I’m a bit more concerned about orphan points. If you spread yourself too thin, you may end up in a situation where you’re optimizing on transactions, but not in an overall sense.

For example, if I drive very infrequently but get a Maybank World Mastercard just so I can earn 4 mpd on petrol, I may be optimizing on the transaction, but that counts for little if I end up with a small chunk of TREATS points I can’t cash out.

So my take on the situation is that optimization is good, but you need to look at both the micro and macro picture. If you don’t spend a significant amount on a particular category, then consider using your general spending card instead.

Conclusion

So that’s the game plan for 2020! Once again, I’d stress that the key is to be flexible and know how to adapt. We all know that the miles and points game can change at a minute’s notice, and it’s important to keep an eye out for the latest developments.

The list presented here is not necessarily comprehensive, and there are many roads to Rome. If you have alternative strategies, I’d love to read about them in the comments below.

Finally, I’ve not said a word about sign up bonuses, on the assumption that you’ve already exhausted them. If not, check out this page where I keep track of the latest sign up bonuses on the market- they’re a great way to jump start your miles collection.

Hi aaron, any reason why the grabpay mastercard has not been given more credit in the analysis? With grabpay card, general spend no longer exists – everything earns 4mpd (using the right cards to top up – eg uob lady solitaire or citi rewards visa etc) up to $30k a year per account.

not quite…you’re still subject to the $1K top up cap.

yup, citi rewards $1k per month (4mpd), uob lady solitaire $3k per month (4mpd), maybank horizon unlimited (3.2mpd) – :)))

you might want to check some of your data points 🙂

Sure hope you didn’t top up 3k with the Lady’s Solitaire recently – what a disaster that would have been.

Why disaster? No longer getting 4MPD? So far used twice (Previous two months) and got 4MPD..

I thought it was Maybank horizon that Aaron was referring to as “wrong”

er… I believe I am still getting 4mpd for uob lady solitaire and 3.2mpd for maybank horizon. dunno what’s the fuss??

When was the last time you topped up Grabpay with your UOB Lady Solitaire?

I don’t understand the likes of @dwr and @ARCHIEPOVERTY… if you have a contribution to make, make it.. even better if you would cite reasons/explanations.. but riddles and vagueness aren’t positive contributions to the community…

I do it at the beginning of each month – $3000. Last month I checked I got the uni$. So I don’t know what’s the issue. I used the card exclusively for grab hence there will be no doubts. I also called CSO previously who confirmed that grab qualifies. Unless UOB is going to claw back my uni$ otherwise no drama yet. I have topped up last week but will wait till next statement to know.

The drama is Grab top ups are now under MCC 6540, which is rightfully excluded as per the TnC. The change went into effect on the 18th/19th of December, so the top up you made on the 1st of December still earned you points, no problem, but the one you made on the 1st of Jan will be unlikely to get you any.

Much betta, @dwr.. now THAT’S a great contribution! 👍🏻👍🏻👏🏻👏🏻

And yes, I did read the Ts & Cs back then and rightfully TopUps should not have been considered as a “Qualifying Spend”, but I did manage to gain 2 months worth of $3k @4mpd.. time to pick a different group..

Yup I just read about that in telegram. No choice la, just wait for next statement to see if I got the uni$ from UOB. But I also read that Maybank horizon is still giving the 3.2miles. Will keep my fingers crossed. I won’t lose sleep la, even if I lose a potential 12,000 miles still got many ways to get more. Thanks for the riddle anyway.

I’ve used the physical GrabPay card on SP App successfully for 1.1MPD (for Grab Platinum, assuming I do redeem for KF Miles) and 4MPD for TopUps using Citi Rewards MC and VS and UOB LSC.. total up to 5.1MPD..

Grab has ‘funny’ limits tho.. allegedly imposed by MAS.. $30k max Calendar p.a., which I wish it wasn’t but get it.. but also a monthly cap of $10k, which isn’t calendar but T-minus-29-days, which can be a pain to keep track..

not sure about UOB cards but from what i gathered online, based on user replies 1) citi reward will no longer give any point (0!!!) for topping up grabpay unless it is a saved card, and u must have saved the card before the change in mcc. might be made totally invalid in the future. 2) someone actually called maybank hotline to check if maybank horizon will get 3.2miles. The reply was it does but the bank is intending to change this because it is not working-as-intended. They are working out so that only grab rides will get 3.2miles This… Read more »

HSBC Visa Infinite also gives points for SP services (at least it does if you physically pay the bill at the desk- although now the service centre has moved out of CBD it’s less useful)

I thought DBS altitude card still earn miles for SP bill not just AMEX card. And Telco can still earn 4 miles if paid online via women card?

I’ve not tested it in a while so couldn’t say. But good to hear it’s still working!

Isn’ HDB HUB SP services equipped with Paywave facility?

Yes, SP Svc Ctr at HDB Hub has Paywave.. something that Manulife Ctr did not.. tho this no longer matters..

not anymore since Nov 19 (using the SP app, not sure about counter payment)

Any reason why ipaymy is not listed?

their ceo would prefer we not write about them. i’m inclined to honor that request

https://milelion.com/2018/08/12/responding-to-allegations-made-by-the-ipaymy-ceo/

How about Citi Premier Miles for 1.5mpd if able to hit 3k spending per month or is this promo no longer available?

ended 31 dec

Is Citi rewards cap of 1k per category or in total (i.e offline shopping and online spend each allows 1k or total is still 1!?

Total is 1k. Read the T&Cs

Could’ve finished your comment at the full stop. If you’re trying to encourage him to be self sufficient, then you could’ve only included the part after the full stop.

Hi Aaron thank you for the comprehensive article! Which card is best for earning miles on insurance premium payments?

SCB VI + Easybill, imo.

or Grabpay card for rewards and miles (indirectly)

HSBC Revolution (2mpd) or BOC Elite Miles (1.5mpd)

Hi! Does anyone know if UOB Preferred Platinum Visa still grants 4.0 mpd for contactless spending overseas?

it dont grant

It does

Hi Aaron, there’s ipaymy for rent, taxes, insurance and other payments. Fees are 2.25%, cheaper with promo codes

What happened to dining, UOB PPA doesn’t offer 4mpd capped 6k anymore?

updated to add it in. i didn’t put it initially because it’s no longer issued, but i suppose if you already have it, it’s still the “right” card

i wonder if they still send you a new card when the current card expires?

Very likely. Don’t ask me how I know that though 🙂

Hahah good to know. Give me a scare! To the other readers, they do send, just got mine not too long ago even after they stopped new signups through all means.

Thanks Aaron! 😁

My general spend card is going to be the OCBC 90 because I value the ability to make (free) transfers in 1,000 mile increments over the additional 0.2-0.3 miles/dollar earned with other cards.

If u have DBS WW, you can also consider using DBS Altitude as your general spend card since the points pool, and Altitude points do not expire.

Comparing OCBC 90N and DBS Altitude for general local spend, 90N would be a better choice. Both earns 1.2 mpd and points don’t expire, but 90N has a much lower transfer-to-miles requirement, and transfers are FREE.

Thanks for the detailed list! I’m struggling to decide a suitable card for categories like utilities payment, telco bills, insurance payment, groceries, luxury items at retail stores. I guess I should use citi rewards or Dbs woman’s for telco/ utilities, PPV for groceries, PRVI for luxury spend and still no card (other than scb VI) for insurance? :S

Any other categories out there, the cards in the market are not addressing in your view?

Did you get the annual fee waiver for BOC Elite card? Or you paid for it?

waiver. wouldn’t have paid the AF, it would have cut into my Smartsaver ROI something fierce.

Hi, thanks for the great article !

BOC SmartSaver actually doesn’t easily pay 3.55% on the first $60k. This 3.55% actually includes a 0.60% component that is only paid on the $60k-1mm tranche. Wouldn’t it be more accurate to say it easily pays off 2.95% on the first $60k balance ?

Regarding the Amex Platinum; what about the 2 nights at Banyan Tree / Mandarin Oriental (fairly big value added)

Cheers,

LS

BOC smartsaver: 1.2% for salary credit $6K+, 0.35% for bill payments, 1.6% for card spending $1.5K+, 0.4% base interest, total 3.55%. it doesn’t include the 0.6%.

as for amex plat charge, mandarin oriental gift is great, but first year only. i’m on second year, so don’t count it.

I totally missed that; thanks a lot for the prompt reply !

If you are getting electricity from Geneco, you can use GrabPay directly on Geneco’s website to pay for the bill

Hello

For uob rounding down issue, is each transaction treated and adjusted uniquely or all transactions on a priv card are consolidated at the end of the statement month and then rounded down to the nearest $5? Any idea thanks!

it’s stated in another articlehttps://milelion.com/2019/08/16/how-do-banks-round-credit-card-points-and-whats-the-minimum-spend-to-earn-them/ linked in this article

If UOB still doesn’t award points for transactions below 5$, using the 4mpd UOB PRVI Visa on SimplyGo wouldn’t make sense.

SimplyGo charges rides with Visa cards on a daily basis, and I guess a strong minority spends more than 5$ per day on public transport.

Even if you do, the cap is 80$ per month. UOB being “smart”…

(SimplyGo charges MasterCards on a 5 day basis).

copied and pasted from another post this is a common point of confusion regarding UOB and simplygo, so i’d better add this in the main post too Although you need to spend >$5 to earn miles on the UOB PRVI Miles cards, with simplygo this works differently 1. Visa Cardmembers earn UNI$ for every S$5 spent on SimplyGo Transactions per submission by the merchant, except for SimplyGo Transactions performed on UOB Visa Cards, where UNI$ are earned based on the accumulated spend on SimplyGo Transactions per calendar month, and awarded to Cardmembers on the 7th calendar day of the following… Read more »

SimplyGo works slightly differently on UOB Visa cards to avoid the “below $5” issue you mentioned. See the site for more info:

https://www.uob.com.sg/personal/cards/cards-privileges/simplygo.page

#Cardmembers earn UNI$ for every S$5 spent on SimplyGo Transactions per submission by the merchant, except for SimplyGo Transactions performed on UOB Visa Cards, where UNI$ are earned based on the accumulated spend on SimplyGo Transactions per calendar month, and awarded to Cardmembers on the 7th calendar day of the following month. Visit uob.com.sg/rewards for details.

Yep got my 4.4 miles credited for my oct simply go and they accumulated total to awards

What are your thoughts on DBS Altitude Visa card? It gives 3 mpd for online hotel and air ticket bookings with a monthly cap of $5,000. I think it can be useful if the maximum for DBS World Women card ($2,000) is reached.

I think…. singtel doesnt accept amex anymore- i tried and it said only mastercard and visa

Doesn’t Amex only charge you one fee per year? Why don’t you also sign up with the cheapest amex platinum and get the one night free at swissotel each year?

Why sign up for platinum basic when he can get reserve for free

Hey man any chance you can do a version of this that is only for cards that a) don’t have minimum spend / caps per category and b) excludes UOB.

I’m all for maximising points but brainpower is focused elsewhere to keep track of numbers per category per card. Plus UOB…..I just can’t – too painful every time.

Come on, do some legwork instead of expecting the guy to spoonfeed every step of the way. It’s not even that difficult if you’re serious about collecting miles.

The guy’s not coming across as demanding at all nor is he giving off a negative demeanour (albeit hard to gauge via text).

But I agree with the comment below that if he’s not willing to deal with caps then just stick to general spending cards.

You’re…..kidding right? The purpose of these blogs is that they do the “legwork” for you and in exchange get paid AD revenue when we read the articles / use their MGM links (which I did last month for Aaron’s 1712 link). It was an article suggestion – learn to understand how business works haha

Article suggestions need to be relevant to a broad audience – your request is so narrowly specific that it’s unlikely to draw much attention from most people. Few people hate UOB so much that they swear off their cards, especially when you dangle a shiny “4 MPD!!!” in front of them. Also, any miles chaser worth their salt will tell you that caps are part of the game, and they bear with it. You either take uncapped but gen spend rates (1.5mpd max) or 4mpd but capped. That’s life – live with it.

I disagree, there are plenty of non-hardcore miles chasers and many special cards with no minimum spend (voyage 1.6 for dining, Many 2+ for overseas, Dbs altitude 3 for hotel/flights). I was just suggesting an article for the less hardcore miles chasers and it was just that a suggestion – not a demand – geez some people on this blog can be kinda toxic! Were you bullied at school?

Boohoo, need someone to guide you to the nurse’s office?

“a) don’t have minimum spend / caps per category and b) excludes UOB”

Ok, then go to Aaron’s previous list of cards he recommends for various spending categories and take your pick from the general spend cards. Don’t get lost alright?

You’ll very rarely get uncapped >4mpd opportunities – and these are usually limited time only (think Citi Rewards Apple Pay or the ongoing OCBC 90N promo). As Aaron has mentioned before, banks lose money on 4mpd, so they’ll always find a way to cap their losses. If you avoid UOB, you’ll lose the very useful PPV, which basically gives you 4mpd almost everywhere. If you don’t want to put in the effort to track spending categories and want uncapped miles with no minimum spending, I got a strategy for you. Just use your general spending card on everything. Leave the… Read more »

go read up hsbc revolution. i believe it is what you needed but i’m not sure if it covers the entirety of what u seek.

but main points are: no cap, 2 miles(5 hsbc point) for online, dining and entertainment, miles expire after 3 years, point exchange is a per-year-subscription service (40 sgd). but if any of these is a pain, skip it.

for more details such as the perk, you need to read it up yourself.

You’ll want to check your data again on Altitude bonus miles on hotel/flights – it’s capped at $5K a month. There are a few cards that offer uncapped earning. Off the top of my head, the ones I can think of are: – UOB KrisFlyer Credit Card: 1.2 mpd general spending, 3 mpd on SIA-group spending, 3 mpd on dining, food delivery, online shopping, travel and transport with a minimum spend of $500 on SIA-group related spending. But you swore off UOB, so this won’t work for you. – HSBC Revolution, as the poster above me mentioned: 2 mpd on… Read more »

most of the cards here don’t have minimum spend, but you won’t find no caps except for ocbc 90n.

https://milelion.com/2019/10/21/why-cant-i-just-use-one-credit-card-for-everything/

may be helpful- but i mentioned uob krisflyer as a potential one card strategy

Thanks all for the useful responses (obvious exception being the man on the moon who if you need a therapist I’d be happy to make a referral) 😉

For UOB lady’s card if transport is the selected category, pumping petrol at SPC is not excluded right?

Great review Aaron, honestly! 😀

Which card is the best for payment for medical or hospitalization other than the SCB Visa infinite (which comes with a high annual fee) ?

Hi,

I read the blog thoroughly but I can’t get how men can enjoy UOB Lady’s cards through their wife.

Should I ask her to get the card and then link it to my KF account ?

If so, what if she already has other UOB card linked to her KF account (e.g. UOB KF) ?

Could it be used on a joined account ?

Thanks !

1. wife applies for card

2. you add card to your digital wallet

Hi Aaron, thanks for the prompt feedback.

I am not familiar with digital wallets; if I add her card to my wallet; I would assume the UNI$ to be credited to her account; how could I then retrieve them ?

Can she convert her UNI$ to KF miles in my KF account ?

since CRV is so valuable for plabgay hopups, shouldn’t we be using wwmc for SIngtel (telco) bills instead?

can someone help to clarify if UOB VS requirement: min 1k overseas AND Petrol/Contactless. Meaning i must have at least some overseas spending? as in the min 1k requirement cannot be only petrol or contactless??

1k can be just petrol and contactless. No need fcy

thanks aaron!

Thanks Aaron, would PPV be eligible for 4MPD under 1K at Petrol stations apart from Shell & SPC ? Most stations accept contactless payments these days.

Yes, can.

What card to use for Singpost? They have Paywave terminals but unsure if they earn miles. Regular courier services can add up to quite substantial spend.