The UOB Lady’s Card, UOB Lady’s Solitaire Card and UOB Lady’s Solitaire Metal Card — which I’ll collectively refer to as the UOB Lady’s Cards — are among the most versatile rewards cards on the market.

With 4 mpd on a wide range of everyday spending categories including dining, travel, supermarkets and petrol, and an extra 2-6 mpd from the UOB Lady’s Savings Account, it’s understandable why men were lining up around the block when the card went gender neutral in July 2023.

However, the UOB Lady’s Solitaire — arguably the MVP of the trio — has taken a hit in recent times, with its bonus cap cut from S$3,000 to S$2,000 and now S$1,500, along with new restrictions making it harder to fully utilise. Coupled with the rise of the Maybank XL Rewards Card and revitalisation (temporary though it may be) of the HSBC Revolution, and the UOB Lady’s Cards suddenly have their work cut out for them. So how should this card fit into your strategy?

UOB Lady’s Card & Lady’s Solitaire Card UOB Lady’s Card & Lady’s Solitaire Card |

|

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

|

| The UOB Lady’s Cards remain a versatile solution for miles chasers, though recent nerfs mean the Solitaire now requires more micromanagement | |

| What do these ratings mean? |

|

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: UOB Lady’s Cards

Let’s start this review by looking at the key features of the UOB Lady’s Cards.

|

|||

| Apply | |||

|

|||

| Apply | |||

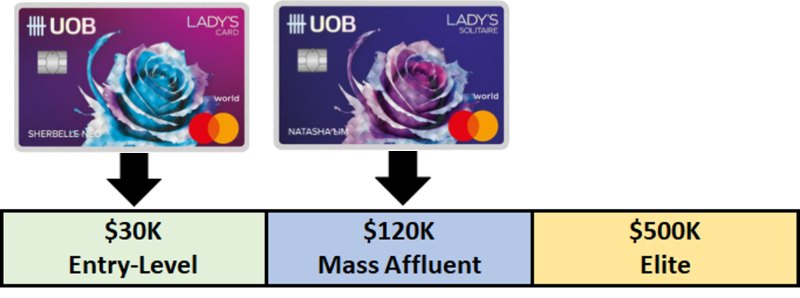

| Income Req. |

S$30,000 p.a. (Lady’s) |

Points Validity |

2 years |

| S$120,000 p.a. (Solitaire) |

|||

| Annual Fee |

S$196.20 (Lady’s-FYF) |

Min. Transfer |

5,000 UNI$ (10,000 miles) |

| S$414.20 (Solitaire-FYF) |

|||

| FCY Fee | 3.25% | Transfer Fee | S$25 |

| Local Earn | 0.4 mpd | Points Pool? | Yes |

| FCY Earn | 0.4 mpd | Lounge Access? | No |

| Special Earn | 4 mpd on your choice of 1 or 2 bonus categories | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

As mentioned, there’s actually a third amigo in the portfolio: the UOB Lady’s Solitaire Metal Card.

This is a premium, invite-only card with a non-waivable annual fee of S$589.99. Cardholders enjoy additional benefits such as one complimentary airport transfer and six lounge visits per year, as well as World Elite Mastercard perks.

You must spend at least S$45,000 in a 3-month period on the UOB Lady’s Solitaire for the possibility of receiving an invitation to upgrade.

I personally think there’s no reason to be spending so much on the UOB Lady’s Solitaire in the first place, because of the opportunity cost involved (any spending beyond the monthly bonus cap earns just 0.4 mpd!).

Therefore, I’ll only mention it sparingly, and devote the majority of the review to the UOB Lady’s Card and UOB Lady’s Solitaire.

Can I hold multiple UOB Lady’s Cards?

By right, you cannot hold multiple UOB Lady’s Cards at a time.

UOB states (at points 18-23 of the T&Cs) that any existing card will be automatically terminated within one month of upgrading (e.g. from UOB Lady’s Card to Lady’s Solitaire) or downgrading (e.g. UOB Lady’s Solitaire to UOB Lady’s Card).

In practice, it seems like some customers fly under the radar and end up holding both. But even if that happens, there’s no upside because bonus cap and categories of the most recently approved card applies.

For example, if a UOB Lady’s Cardholder upgrades to the UOB Lady’s Solitaire and holds both cards, their bonus cap will still be S$1,500 per calendar month, for two bonus categories. Likewise, if a UOB Lady’s Solitaire Cardholder downgrades to the UOB Lady’s Card and holds both cards, their bonus cap will still be S$1,000 per calendar month, for one bonus category.

How much must I earn to qualify for a UOB Lady’s Card?

The UOB Lady’s Card has a minimum income requirement of S$30,000 per year. If you do not meet the minimum annual income, you can place a S$10,000 fixed deposit with UOB to get a secured version of the card.

The UOB Lady’s Solitaire has a much higher income requirement of S$120,000 per year, putting it in the so-called mass affluent tier. If you do not meet the minimum annual income, you can place a S$30,000 fixed deposit with UOB to get a secured version of the card.

UOB used to be less strict with the income requirement for the Solitaire, approving applications from customers who fell short of the S$120,000 requirement. However, more recent data points suggest they’re tightening the requirements.

One way to improve your chances of approval is to apply via SMS instead of via the website (this only works if you’re an existing UOB cardholder). This may work for customers who are shy of the minimum income requirement, but YMMV.

| 📱 SMS to 77672 |

| YesSolitaire<space>Last 4 digits of any existing UOB Card<space>NRIC (Example: If the last 4 digits of your UOB card are 1234 and NRIC is S1234567A, send “YesSolitaire 1234 S1234567A”) |

How much is the UOB Lady’s Card’s annual fee?

UOB Lady’s Card UOB Lady’s Card |

||

| Principal Card | Supp. Card | |

| First Year | Free | First 1 Free, S$98.10 after |

| Subsequent | S$196.20 | First 1 Free, S$98.10 after |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

||

| Principal Card | Supp. Card | |

| First Year | Free | First 2 Free, S$196.20 after |

| Subsequent | S$414.20 | First 2 Free, S$196.20 after |

The UOB Lady’s Card has an annual fee of S$196.20, which is waived for the first year. The fee for the first supplementary card is waived in perpetuity, with the second card onwards charged at S$98.10 per year.

The UOB Lady’s Solitaire has an annual fee of S$414.20, also waived for the first year. The fee for the two supplementary cards is waived in perpetuity, with the third card onwards charged at S$196.20 per year.

Waivers are fairly easy to get in my experience, but be warned that UOB’s default behaviour is to automatically deduct your UNI$ to cover the annual fee.

How do UOB’s automatic UNI$ deductions for annual fees work?

When the time comes for renewal, you will either be charged:

|

|

|

| UOB Lady’s Card | UOB Lady’s Solitaire | |

| Full Waiver | UNI$6,500 | UNI$10,000 |

| Half Waiver | UNI$3,250 + S$98.10 | UNI$5,000 + S$207.10 |

If you have sufficient UNI$ for a full waiver, the full waiver option will be automatically selected, and if you only have sufficient UNI$ for a half waiver, the half waiver option will be automatically selected. If you don’t have sufficient UNI$ for either, the annual fee will be billed in pure cash.

It’s up to you to monitor your statement and request a fee waiver when this happens. Look at the expiry date on your credit card- the month corresponds to the month your annual fee will be charged.

For what it’s worth, if UOB subsequently grants you a fee waiver, the reinstated UNI$ will have a fresh 2-year validity.

How many miles do I earn?

| 🇸🇬 SGD Spending | 🌎 FCY Spending | ⭐ Bonus Spending |

| 0.4 mpd | 0.4 mpd | 4 mpd on your choice of 7 categories |

SGD/FCY Spend

The UOB Lady’s Cards earn 1 UNI$ for every S$5 spent (0.4 mpd) in Singapore Dollars or foreign currency (FCY).

All foreign currency transactions are subject to a 3.25% fee, which is par the course for the market.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

Bonus Spending

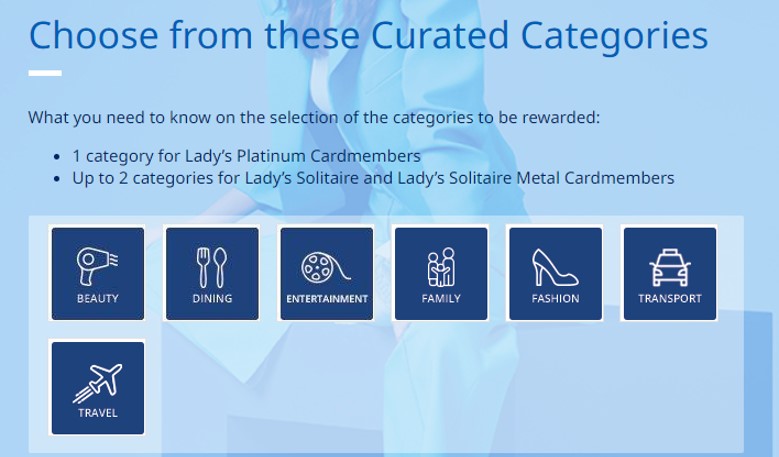

The UOB Lady’s Cards earn a bonus 10 UNI$ for every S$5 spent (4 mpd) in Singapore Dollars or FCY on a choice of bonus categories.

| Card | Bonus Categories | Monthly Bonus Cap |

UOB Lady’s Card UOB Lady’s Card |

1x | S$1,000 |

UOB Lady’s Solitaire UOB Lady’s Solitaire |

2x | S$1,500 (S$750 per category) |

UOB Lady’s Solitaire Metal Card UOB Lady’s Solitaire Metal Card |

2x | S$2,000 |

The seven possible bonus categories are listed below.

| 💳 UOB Lady’s Card Bonus Categories | |

| Category | MCCs |

| 💆 Beauty & Wellness | 5912 Drug Stores & Pharmacies 5977 Cosmetic Stores 7230 Barber & Beauty Shops 7231 Beauty, Barber Shop & Gyms 7297 Massage Parlours 7298 Health & Beauty Spas |

| 🍽️ Dining | 5811 Caterers 5812 Restaurants 5814 Fast Food 5499 Misc. Food Stores |

| 📽️ Entertainment | 5813 Bars, Lounges, Discos, Nightclubs 7832 Motion Picture Theatres 7922 Theatrical Producers, Ticketing Agencies |

| 🛒 Family | 5411 Grocery Stores & Supermarkets 5641 Children’s and Infant’s Wear Stores |

| 👗 Fashion | 5311 Department Stores 5611 Men & Boy’s Clothing and Accessories 5621 Women’s Ready to Wear 5631 Women’s Accessories 5651 Family Clothing Stores 5655 Sports Apparel Stores 5661 Shoe Stores 5691 Men’s and Women’s Clothing Stores 5699 Accessory and Apparel Stores 5948 Leather Goods & Luggage Stores |

| 🚕 Transport | 4111 Transportation Suburban & Local Commuter 4121 Taxis and Limos 4789 Transportation Services Not Elsewhere Classified 5541 Petrol Stations 5542 Automated Petrol Stations |

| ✈️ Travel [Refer here for details] |

3000-3299 4511 4582 Airlines 4411 Cruise Liners 4722 Travel Agencies 5309 Duty-free Stores 3500-3999 7011 Hotels |

| Bonuses are valid for both local and foreign currency spending, both online or offline | |

All bonus categories are defined by explicit MCC ranges, except for travel. However, I previously received confirmation from UOB regarding which MCCs qualify:

- Airlines (MCC 3000-3299, 4511, 4582)

- Cruise liners (MCC 4411)

- Duty-free stores (MCC 5309)

- Hotels (MCC 3500-3999, 7011)

- Online and offline travel agencies (MCC 4722)

Do note that bus liners, rental cars, trains and private hire cars are not included in travel.

Explained: Which MCCs are included in the UOB Lady’s Card “Travel” category

Bonus categories can be rotated every calendar quarter, which means the card can be different things to you at different times. For example, if you’re shelling out for an expensive beauty package this quarter, pick “Beauty & Wellness”. If you’re going on an overseas trip, pick “Travel”. There’s no other card in Singapore that gives this kind of flexibility.

I’ve written a separate post discussing which bonus categories you should choose, but in short I think “Fashion” is a solid option because it covers MCC 5311, used for HeyMax voucher purchases.

|

| 👍 250 Max Miles joining bonus |

| Sign up for a HeyMax account and get up to 250 Max Miles as a welcome bonus |

| 250 bonus Max Miles |

HeyMax sells a wide range of vouchers that cover numerous categories of spend:

- Supermarkets: FairPrice, Giant, Sheng Siong

- Ridehailing: Grab, Ryde, TADA

- Travel: Klook, Pelago

- Shopping: Amazon, Lazada, Shein, Zalora

- Food Delivery: Deliveroo, foodpanda

- Others: Best Denki, Courts, IKEA, Tangs

Transactions made directly at these merchants would code under a wide range of MCCs, but everything is standardised to 5311 when bought through HeyMax. It’s like not having to choose a bonus category at all!

Selecting bonus categories

|

| Choose bonus categories |

In terms of the selection mechanics:

- The first time you choose your bonus categories, they are effective immediately

- Bonus categories can be re-selected every calendar quarter, up till 2359 hours (SGT) the day before the first calendar date of the following calendar quarter

- The bank will take the most recent entry submitted as the bonus category for the following quarter. For example, if you submit ‘Fashion’ on 15 April, then submit ‘Dining’ on 21 June, your bonus category for 1 July to 30 September will be ‘Dining’

- If you do not manually re-select your bonus categories, the choices from the previous quarter will be automatically carried over

- If you upgraded from the Lady’s Card to the Lady’s Solitaire, the revised bonus cap applies immediately. However, the additional bonus category will only be effective from the following calendar quarter

- If you downgraded from the Lady’s Solitaire to the Lady’s Card, you will need to reselect your bonus category (contact UOB customer service for assistance). The revised bonus cap (S$1,000 per category instead of S$750) only applies from the following calendar month

Dealing with the Solitaire sub-cap

UOB Lady’s Solitaire Cardholders have an additional frustration to contend with.

Ever since 1 August 2025, its monthly bonus cap of S$1,500 has been subdivided into a strict S$750 per category. This means you can no longer utilise your entire bonus cap in a single category (which is still possible with the UOB Lady’s Solitaire Metal Card). Even if you select just one bonus category instead of two, your total bonus cap will be S$750, so there’s no beating the system!

Keeping track of your spending is going to be a frustrating task. UOB does not keep a running tally of how much cap you have left for each bonus category, nor does it categorise your spending. The only way to know how much cap remains for each bonus category is to go line by line and tally up the spend— which transactions belong to category 1, which transactions belong to category 2?

There are two ways of tackling this issue.

The first is to apply for a supplementary card. This does not increase your bonus cap, but it makes it much easier to track your spending. For example, you could put all the spending for bonus category #1 on the principal card, and all the spending for bonus category #2 on the supplementary card .Since these cards are shown as separate accounts on internet banking, you can just look at the total spend on a card level and ensure it doesn’t exceed S$750 per calendar month.

The second is to max out one bonus category at the start of each month, by simply buying vouchers. For example, you could purchase S$750 worth of vouchers in Category 1 (I suggest choosing HeyMax and buying vouchers across merchants you know you’ll spend with), then use the card for spending in Category 2 only. Your spending for Category 2 will basically be X – S$750, where X is the amount spent so far.

Neither solution is ideal though, and it’s obvious that the reason for the split is to ensure that fewer people can max out their bonus cap each month.

Transaction date or posting date?

The bonus cap on the UOB Lady’s Cards is enforced based on posting date, not transaction date.

For example, if you made a transaction on 31 January 2025 and it posts on 2 February 2025, that amount will count towards February 2025’s bonus cap.

Therefore, you should exercise caution when spending towards the end of the calendar month, in case transactions “leak” into the following period.

Which cards track spending by transaction date vs posting date?

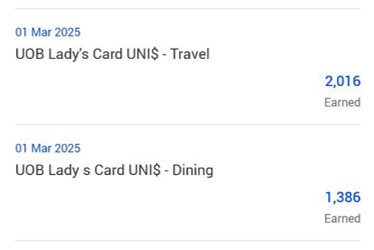

When are UNI$ credited?

The base 1 UNI$ per S$5 is credited when the transaction posts, usually in 1-3 working days. The bonus 9 UNI$ per S$5 is credited at the start of the calendar month after the transaction.

| Base Points (1X) | Credited when transaction posts |

| Bonus Points (9X) |

Credited at the start of the following calendar month |

On the UOB TMRW app, you will see a lump sum for your bonus category or categories, credited on the 1st of the following month.

How are UNI$ calculated?

Here’s how you can work out the UNI$ earned on your UOB Lady’s Card:

| Base Points (1X) | Round down transaction to the nearest S$5, divide by 5, then multiply by 1 |

| Bonus Points (9X) |

Sum all eligible transactions (including cents), round down total to the nearest S$5, divide by 5, then multiply by 9 |

Even though UOB rounds transactions down to the nearest S$5 before awarding points, the Lady’s Card is less punitive because rounding for bonus points takes place only once, as opposed to on each transaction.

To illustrate, suppose you make three transactions on your bonus category in a month: S$4.50, S$18.99 and S$22.70. Here’s how many points you’ll earn.

| Spend | Base Points (1X) | Bonus Points (9X) |

| S$4.50 | 0 | (4.5+18.99+22.70) round down to nearest 5, divide by 5 and multiply by 9 |

| S$18.99 | 3 | |

| S$22.70 | 4 | |

| Total | 7 | 81 |

A total of 88 UNI$ will be earned, or 176 miles. Notice how the S$4.50 transaction earns no 1X base points, but still counts towards the aggregated 9X bonus points calculation. Notice also how S$3.99 of the S$18.99 transaction and S$2.70 of the S$22.70 transaction are wasted for 1X base points, but count towards 9X bonus points.

For more details on how UOB’s rounding works, refer to the article below.

If you’re an Excel geek, here’s the formulas you need to calculate your points:

| Base Points (1X) | =ROUNDDOWN (X/5,0)*1 |

| Bonus Points (9X) |

= ROUNDDOWN (Y/5,0)*9 |

| Where X= Amount Spent, Y= Total Eligible Spending |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for UNI$?

A full list of transactions that do not earn UNI$ can be found in the T&Cs.

I’ve highlighted a few noteworthy categories below:

- Amaze

- Charitable Donations

- Education

- Government Services

- Insurance

- Prepaid account top-ups (e.g. GrabPay, YouTrip)

- Real Estate Agents & Managers

- Utilities

Note in particular that Amaze transactions no longer earn points with UOB cards, ever since 1 October 2024.

UNI$ will be awarded for CardUp, but not ipaymy. However, the UOB Lady’s Cards will only earn 0.4 mpd on such transactions, so you’re much better off using the UOB PRVI Miles or another general spending card instead.

What do I need to know about UNI$?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| 2 years | Yes | S$25 per conversion |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 5,000 UNI$ (10,000 miles) |

3 | 48 hours (KrisFlyer) |

Expiry

UNI$ expire 2 years from the last day of each periodic quarter in which the UNI$ was earned.

Each UNI$ period is calculated commencing from January to December of each calendar year. Expired UNI$ cannot be replaced or reinstated.

Pooling

UNI$ pool across cards. If you have 10,000 UNI$ on the UOB Lady’s Card, and 5,000 UNI$ on the UOB Preferred Platinum Visa, you can redeem 15,000 UNI$ at one shot and pay a single conversion fee.

It also means that you don’t need to transfer your UNI$ out before cancelling the UOB Lady’s Card, assuming it’s not your last UNI$-earning card.

Transfer Partners & Fees

UNI$ transfer to frequent flyer programs at a 1:2 ratio, with a minimum transfer block of 5,000 UNI$ (let’s ignore AirAsia, because converting points there is like throwing them away):

| Frequent Flyer Programme | Conversion Ratio (UNI$: Partner) |

| 5,000 : 10,000 | |

| 5,000 : 10,000 | |

| 2,500 : 4,500 |

Transfers cost S$25 per programme, regardless of how many points are transferred.

UOB also has an auto-conversion option for KrisFlyer, which costs S$50 per year. UNI$ will be automatically converted on the last day of the calendar month, in blocks of UNI$2,500 (half the regular conversion block).

|

| FAQs |

| T&Cs |

| Read Point 53-55 |

However, you’ll need to keep a minimum balance of UNI$15,000 (30,000 miles) in your account at all times. This is a hefty working capital balance! Make what you will of UOB’s reason for this policy…

|

Why must a minimum balance of UNI$15,000 be kept KrisFlyer auto conversion programme? This is to give card members the flexibility to convert the UNI$ to other items from UOB Rewards Catalogue. Card members can still choose to convert this UNI$15,000 to KrisFlyer miles by the one time miles redemption process through UOB Rewards Catalogue, subjected to S$25 conversion fee and must be in blocks of 10,000 miles. |

Cardmembers who wish to make ad-hoc conversions can still do so, subject to the payment of the usual S$25 fee per conversion, in standard blocks of 5,000 UNI$ (10,000 miles).

Here’s the pros and cons of the automatic transfer scheme:

Pros

- Pay a single fee for 12 automatic conversions a year

- Reduces the minimum conversion block from 5,000 UNI$ (10,000 KrisFlyer miles) to 2,500 UNI$ (5,000 KrisFlyer miles)

Cons

- The 3-year expiry on your KrisFlyer miles starts as soon as they are converted. Had you kept your UNI$ on the UOB side, you’d enjoy two extra years of validity

- Ad-hoc conversions still cost you S$25

- Only balances in excess of 15,000 UNI$ are converted

- Effectively locks you into KrisFlyer, as opposed to UOB’s other transfer partners (you can still make ad-hoc conversions to Asia Miles between quarters, but it’s likely you’ll need to end participation in the automatic conversion programme to acquire a critical mass)

Transfer Times

UOB transfers to KrisFlyer are typically completed within 48 hours.

If you need your points credited instantly, you can do so via Kris+. 1,000 UNI$ can be transferred to 1,700 KrisPay miles, which can then be transferred to KrisFlyer miles at a 1:1 ratio with no fees.

|

| S$5 for new Kris+ Users |

| Get S$5 (in the form of 500 KrisPay miles) when you sign-up with code W644363 and make your first transaction |

However, those 1,000 UNI$ would normally have earned you 2,000 KrisFlyer miles, so you effectively take a 15% haircut. Therefore I wouldn’t recommend taking this option, unless you need a small top-up to redeem a flight, or have an orphan UNI$ balance (<5,000 points).

If you choose to do so nonetheless, do remember that it’s a two-step process:

- Transfer UNI$ to KrisPay miles

- Transfer KrisPay miles to KrisFlyer miles

Do not forget the second step! If you wait more than 21 days, or spend any of the converted KrisPay miles via Kris+, the entire balance will be stuck in the Kris+ app. KrisPay miles expire after six months, and can only be spent at a poor rate of 100 miles = S$1.

Other card perks

Bonus miles from UOB Lady’s Savings Account

UOB Lady’s Cardholders can earn a bonus 2-6 mpd from their card spend if they have a UOB Lady’s Savings Account, as summarised in the table below.

| UOB Lady’s Savings Account x UOB Lady’s Cards | |||

| MAB | UNI$ from Savings Account | UNI$ from Card | Total |

| <S$10K | N/A | 10X UNI$ (4 mpd) |

10X UNI$ (4 mpd) |

| ≥S$10K to <S$50K | 5X UNI$ (2 mpd) |

15X UNI$ (6 mpd) |

|

| ≥S$50K to <S$100K | 10X UNI$ (4 mpd) |

20X UNI$ (8 mpd) |

|

| ≥S$100K | 15X UNI$ (6 mpd) |

25X UNI$ (10 mpd) |

|

The maximum bonus UNI$ you can earn from the Lady’s Savings Account is capped at:

- UOB Lady’s Card: S$1,000 per calendar month

- UOB Lady’s Solitaire Card: S$1,500 per calendar month (and S$750 per category)

- UOB Lady’s Solitaire Metal Card: S$2,000 per calendar month

Since the Lady’s Savings Account offers a miserly interest rate of just 0.05% p.a., you’re basically trading interest for miles. That said, I believe that a S$10,000 deposit might be the sweet spot, provided you’re confident about maxing out the bonus cap each month.

To illustrate this, refer to the table below.

- If you can earn a greater return on your money than the rates in this table, then miles are the inferior choice

- If you cannot earn a greater return on your money than the rates in this table, then miles are the superior choice

| 💰 Deposit: S$10,000 (Extra 2 mpd from Lady’s Savings Account) |

||

| Mile Value |  Lady’s Lady’s |

Solitaire Solitaire |

| 2 cents | 4.8% | 7.2% |

| 1.9 cents | 4.6% | 6.8% |

| 1.8 cents | 4.3% | 6.5% |

| 1.7 cents | 4.1% | 6.1% |

| 1.6 cents | 3.8% | 5.8% |

| 1.5 cents | 3.6% | 5.4% |

| 1.4 cents | 3.4% | 5.0% |

| 1.3 cents | 3.1% | 4.7% |

| 1.2 cents | 2.9% | 4.3% |

| 1.1 cents | 2.6% | 4.0% |

| 1 cent | 2.4% | 3.6% |

| Highlighted in yellow = my personal value of a mile | ||

For the full analysis, refer to the article below.

Complimentary travel insurance

UOB Lady’s Solitaire Cardholders enjoy complimentary travel medical insurance when they charge the entire cost of their common carrier ticket (any land, sea or air travel arrangement) to their card and register here prior to their trip.

| Maximum Benefit* |

|

| Medical Expenses | Up to US$100,000 |

| Emergency Medical Evacuation & Return of Mortal Remains | Up to US$100,000 |

| Daily In-Hospital Cash Benefit | US$100 per day (min. 3 days, max. 15 days) |

| Overseas Quarantine Allowance | US$100 per day (max. 14 days) |

| *Subject to policy wording for UOB Lady’s Solitaire Card | |

UOB Lady’s Solitaire Metal Cardholders enjoy complimentary travel insurance when they charge the entire cost of their common carrier tickets (any land, sea or air travel arrangement) to their card. No registration is required.

| Maximum Benefit^ |

|

| Travel Accident & Medical Insurance | |

| Travel Accident | US$500,000 |

| Medical Expenses | US$500,000 |

| Emergency Medical Evacuation and Repatriation | US$500,000 |

| Hospital Daily Indemnity | US$100 per day (max. 30 days) |

| Overseas Quarantine Allowance | Up to US$100 per day (max. 14 days) |

| Travel Inconvenience and Cancellation Insurance | |

| Loss of baggage | US$3,000 |

| Baggage delays over 4 hours | US$500 |

| Trip cancellation | US$7,500 |

| Trip curtailment | US$7,500 |

| Trip postponement | US$7,500 |

| Personal Liability Abroad | US$500,000 |

| Trip Delays over 4 hours | US$500 |

| Missed connections | US$500 |

| ^Subject to policy wording for UOB Lady’s Solitaire Metal Card | |

Where award tickets are concerned, coverage will apply if entire cost of ticket is redeemed with an airline mileage programme associated with the card (i.e. Asia Miles, Air Asia Rewards or KrisFlyer miles) and the card is used to pay the taxes and surcharge component.

UOB One Account

The UOB One Account is often considered the best bank account for miles chasers. Unlike other “hurdle accounts” which require customers to spend on cashback cards, purchase overpriced investment or insurance products, or take out a mortgage, the UOB One Account is refreshingly straightforward

Customers can earn up 3.3% p.a. (2.5% p.a. from 1 September 2025) by simply meeting two requirements:

- Spend at least S$500 per calendar month on selected UOB cards

- Credit a salary of at least S$1,600 per month

Spending on all three UOB Lady’s Cards is eligible for bonus interest.

| 🏦 UOB One Account (Till 31 Aug 2025) |

||

| Card Spend + GIRO | Card Spend + Salary Credit | |

| First S$75K | 1.5% | 2.3% |

| Next S$50K | 2.5% | 3.8% |

| Next S$25K | 0.05% | 5.3% |

| Above S$150K | 0.05% | 0.05% |

| Max. Effective Interest |

1.9% | 3.3% |

| Cap | S$125K | S$150K |

| 🏦 UOB One Account (From 1 Sep 2025) |

||

| Card Spend + GIRO | Card Spend + Salary Credit | |

| First S$75K | 1% | 1.5% |

| Next S$50K | 2% | 3% |

| Next S$25K | 0.05% | 4.5% |

| Above S$150K | 0.05% | 0.05% |

| Max. Effective Interest |

1.4% | 2.5% |

| Cap | S$125K | S$150K |

World Elite Mastercard benefits

The UOB Lady’s Solitaire Metal Card is a World Elite Mastercard, and therefore principal and supplementary cardmembers are entitled to the following privileges.

| 🏨 Hotel Elite Status | |

| 🚗 Rental Car Elite Status | |

| 👍Other Perks |

Summary Review: UOB Lady’s Card

|

|

| Apply | |

|

|

| Apply | |

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

The UOB Lady’s Cards remain compelling options thanks to their flexibility, and the ability to pool UNI$ with other 4 mpd cards like the UOB Preferred Platinum Visa and UOB Visa Signature. They’re even more attractive if you can leverage your spending to earn bonus miles from the UOB Lady’s Savings Account, and bonus interest from the UOB One Account.

However, life is going to be slightly more complicated for UOB Lady’s Solitaire Cardholders, who now have to juggle two separate sub-caps of S$750 each (not impossible, just annoying). Also, the limited number of transfer partners continues to be a shortcoming, and you need to be on your toes about UOB’s automatic UNI$ deductions for annual fee waivers.

Even so, I would still prioritise getting a DBS Woman’s World Card and Citi Rewards Card, and maxing out their respective bonus caps first. These cards award bonuses based on a blacklist policy (where transactions earn 4 mpd unless they’re on the exclusion list), which involves much less thinking on your part.

So that’s my review of the UOB Lady’s Cards. What do you think?

This card is basically the only dining card that gives 4mpd on dining since the unicorn disappeared…

exactly- although thankfully there are other ways to get 4 mpd on dining (e.g grabpay, uob ppv)

Doesnt HSBC Revo (non fast food) or Citi Rewards + Amaze give 4mpd on dining as well?

Now HSBC Revo is 99% crippled for dining unless the restaurants all provide QR menu and accept payments online…

and even then you have to be careful that the restaurant doesn’t code as 5814!

@Aaron,

You only earn 2% SMART$ for transactions >$100 at Dairy Farm group merchants, anything less you get 0.3%.

https://www.uob.com.sg/personal/cards/cards-privileges/smart-privileges.page#participatingmerchants

Better to use another cards for this 🙂

added that detail for clarity, thanks

Heard that UOB relaxed the min income requirements on the Solitaire for the last 2-3 months to encourage signups. My cousin managed to get it and she earns about 60k pa.

good to know. Visa has an unpublished rule that you need a minimum income of S$80k to qualify for a visa infinite card (or else a priority banking relationship), was curious as to whether mastercard had a similar rule for world elite mastercard.

I’ve been using the card for a year and here are some things that may / may not be mentioned above: 1. SMART$ vs UNI$: My personal experience: Guardian is a SMART$, meaning that I get SMART$1 instead of UNI$1, but I still get the bonus UNI$9. So I wouldn’t necessarily avoid SMART$ merchants 2. The way bonus UNI$ for the selected categories are calculated may make it worthwhile to make transactions that are less than S$5. The bonus spend is aggregated by calendar posting month and then divided by 5. 3. Grabfood isn’t counted under Dining. A bit of… Read more »

point 1 is very interesting indeed.. maybe i’ll investigate with my UOB PPV.

PPV does not get the bonus UNI$9. But XYZ’s point is specific to the Lady’s card, and worth a clarification.

Yes, I mean specifically for the Lady’s card, sorry.

I think it’s due to the way the bonus UNI$9 are calculated, as under point 2.

CS told me it was so, I have a partially redacted points statement here as well (ignore the dining highlight, it’s under health & beauty)

Wow, didn’t know UOB provides such points statements. Can anyone just call UOB’s customer service to request a copy FOC anytime?

Yes you can and you actually should. Not only does UOB classify transactions differently from other merchants (ie. GrabFood doesn’t get booked correctly), they are also very inflexible on awarding bonus points (they also don’t have an explanation for me as to why they seem to be the only bank who cannot identify GrabFood) The health and beauty category is also a big headache your large purchases are probably spa / facial packages and in my experience they NEVER get booked under the correct MCC. So you’re looking at a loss of a lot of miles. I am actually in… Read more »

Recently I tried to request a copy of the points statement from UOB but was rejected flatly by the CS. He rather check the transactions I had doubts on for me one by one via phone. Not sure if XYZ just happened to be lucky with a nice CS rep…

I completely agree the beauty category is a nightmare and customer service is really patchy. I have the UOB ladies solitaire card too and am not a fan. One of the categories I selected is “beauty and wellness” but hardly any of the transactions I make in this category qualify for the bonus points. I think beauty-related merchants somehow often use unrelated MCC that are not covered by the rather limited MCC codes UOB’s categories include. So the card is quite useless in this category. Safer to use a card with high general spend ratio. Also, it is extremely hard… Read more »

thank you for this info! have put a note in the post.

I’m wondering if discriminating by gender is even legal in Singapore for generic products like credit cards? I wonder what the reaction would be if a bank were to launch a card or a savings account for men only…

Find it extremely distasteful that the only points/miles card which spending qualifies for bonus interest for the One account is available only to women. It’s as if UOB is telling us that men on average earn/save/spend than women, thus would cost the bank too much from paying out the bonus interest/points to make sense – very misogynistic and counter-intuitive when the card purportedly espouses the strength and beauty of the modern woman…

insurers are allowed to discriminate and routinely charge younger women significantly more on health insurance products (looking at you, Aviva and Manulife).

health insurance is a need. miles chasing is not (no matter how it may feel to us lol). so the answer to your rhetorical question is: women are discriminated against in other financial products and we deal with it.

i wouldn’t mind reversing the deal and paying a $1,000 less in insurance premiums, but maybe that’s just me

Health insurers do not only discriminate against women. They are equal opportunity discriminators when it comes to making a profit. Health insurers routinely discriminate against the obese, underweight, aged, autistic, infirm, disabled, previous claimants and anybody with a hint of medical history. More young females need gynecologists more than young males need andrologists. It’s just the actuaries counting the beans. Having a card for women only might be based on some target group analysis by the bank and if this is so then fair enough. Banks are for-profit, not for-charity. Otherwise they would be called charities. Agree with XYZ. We… Read more »

Personally, the most interesting discovery is the fact that Lazada and Qo100 are classified under Fashion, but Shopee is not.

Wrt annual fee waiver, yes, they waived off mine this year for Solitaire. My spend on that card is actually not very consistent as I favour VS whenever I can paywave. My estimate is I spent less than $1K every few months on Solitaire.

thanks for the data point! if they do waive AF for solitaire then that’s pretty good isn’t it? for a 3k cap on 4 mpd

Also got my annual fee on the lady’s solitaire waived, and I do not use the card much as i default to the PPV. My categories are transport and dining, so I think I spent $250 on average each month, and near zero in the recent few months.

Feedback / warning: You should monitor your bonus transactions like a hawk, and even then you may get alot less miles than expected. Not only does UOB classify transactions differently from other merchants (ie. GrabFood doesn’t get booked correctly), they are also very inflexible on awarding bonus points (they also don’t have an explanation for me as to why they seem to be the only bank who cannot identify GrabFood) The health and beauty category is also a big headache your large purchases are probably spa / facial packages and in my experience they NEVER get booked under the correct… Read more »

thanks for the heads up! i think health and beauty may be a bit iffy (i can see how the merchants under that category could process under a wide range of MCCs, especially if they sell packages online via a 3rd party platform. I would have thought that dining would be a safe category, but from what you’re saying grabfood is problematic.

Did you know you could actually hold more than one lady’s card? Their T&C clearly say it is auto upgrade/downgrade when you apply for a new one. However, I just got off the chat with their digibot agent and she waived the UNI$ deduction on my normal Lady’s card. I applied the solitaire version last month because they charged me annual fee for the normal version. I was waiting for them to auto cancel the old card and refund me the UNI$, which obviously did not happen, had to call and ask to cancel but digibot agent say you can… Read more »

I know topping up GrabPay doesn’t clock miles anymore anywhere. But does anyone know if topping up GrabPay counts towards spending amount on the card? To hit minimum spend for UOB One Account interest rate?

anyone knows how will a purchase from Amazon usa be classified under the 7 categories?

Which category would Qoo10 purchases fall under? Fashion?

Does anyone know how I can get an invite for the metal card? I have the Solitaire now

Don’t even bother. I called up CS 2x and they were supposed to arrange callback for me regarding the metal card. It NEVER happened. I am an existing customer who banks mainly with UOB + have other existing credit cards, yet they simply do not even care to call me back with such a simple request. With this atrocious level of service, I am taking my spending to other banks and credit cards that provide better services.

Would the solitaire card not be extremely useful for someone who travels a lot for work and can use his/her own card to pay for the costs before getting reimbursed by their employer?

Just wanted to ask if someone who has chosen the Travel category for the bonus, do merchants like hotels.com, booking.com and other OTAs qualify for earning 4MPD?

hi per UOB lady features site hotels.com, expedia, airbnb and agoda is considered as travel categories. Do you have any past transactions at this site to confirm that these are qualifying?

https://www.uob.com.sg/personal/cards/credit/ladys/features.html?category=Travel

Do we have a telegram chat like those AMEX and CP chat to discuss the benefits offers and deals for UOB lady’s card too?

Hello. Does anyone know if spending in foreign currency while travelling earns bonus points? Thanks!

As a dude, can I get my wife to apply for this card, but link it to my krisflyer account?

Did anyone meet the requirement for solitaire and with good credit score but still get rejected? Happen to me without any reason given

Same experience here too. More than above the income requirement but got rejected.

sorry no

For some reason, it seems your blog benefits details i better than UOB lady’s card website

Couldnt find the benefit registration link to the complimentary travel insurance on their website…

Anyone knows how to qualify for the metal card?

Fine, give the women 6mpd to make them spend more. Does UOB care to explain why this is the only miles-earning card to satisfy the CC spend component required to trigger bonus interest for the One account? I have been curious about this for a while now.

‘One protip is to apply via SMS instead of via the website (this only works if you’re an existing UOB cardholder). This supposedly works even if you’re shy of the minimum income requirement)’. Unfortunately this protip doesn’t work. I tried few times to apply for UOB lady’s solitaire this year and the last attempt with SMS also rejected. I have UOB One Account and another credit card with them, however the result is still unfavourable. Disappointed with UOB if that’s true that ‘applicants getting approved for the card with much, much lower incomes than S$120,000’ like what stated in your… Read more »

late reply but wanted to contribute a data point – I did apply early last year with a lower income than 120000 (<100k actually) but I only had (and still only do) have one UOB card which is the solitaire. i guess they might factor in your existing cards, or another possibility is that they started becoming more stringent with the condition since lifting the gender restriction and (maybe) receiving more applications.

Hi Milelion,

quick qns, just want clarify, if I am planning for an oversea trip.

if I spend oversea with UOB lady’s card pairing with Instarem, do i pick travel as the category?

Does the 6 MPD work with Apple Pay and Paywave?

Wanted to know this too. Scrolled through entire chats to find out but unfortunately not answered

Thank you Aaron for including the link to change bonus categories. So hard to find.

Hi Aaron,

I saw this part :

“The UOB Lady’s Classic and UOB Lady’s Platinum Cards are basically identical.”

How do I know if mine is the classic or platinum? Also, if we are on classic, how do we get platinum card? (Any specific requirements?)

use live chat on uob website to ask, they should be able to help

Hello Aaron, I happen to own both UOB lady and Lady’s Solitaire Card. I like to ask about what is the max bonus for my case. My Spend is UOB Lady more 1k which the max cap is 2800 UNi$ and Lady’s Solitaire Card more than 3k which is Cap at 8400 Uni$. I suppose to receive 2800 + 8400 = 11200 uni$. However, uob only given me 2800 + 5400 = 8200 . All Transactions are eligible for Bonus point. They told me that because the Both card are combined into ONE and the max Cap is 8400 Uni$… Read more »

refer here: https://milelion.com/2023/07/02/complete-faqs-uob-ladys-ladys-solitaire-card/

Does anyone know if Amazon Fresh is not under the grocery MCC for Lady’s Card? I am not awarded the bonus miles for my Amazon Fresh transaction under the Family category.

It’s impossible to get through the call for clarification. The generic helpline can’t answer this question and they had to escalate to the “specialist”, it’s been a few attempts, the wait is just too long and I haven’t been able to get through to the specialist to get an answer for this.

If I have set my 2 categories as dining, travel, do I need to be concerned about which mode of payment is used? The article mentions online/offline is allowed. But I Was wondering if mobile contactless, physical strip/chip usage, usage via amaze, phone, paywave etc are all included? To be honest, this is the part the confuses me the most about which transactions are eligible. Is there a guide for me to refer? thanks

I believe one of the main disadvantages of using a UOB card is their hidden charge of 1% on transactions processed in SGD but supposedly outside Singapore, which obviously a customer has no control on.

I just realized the hard way that all my AirBnB as well as Agoda txns are being charged at 1% extra, even though I am paying in SGD. That’s eating into the beenfit in a fairly significant manner

Same here, I didn’t know about the 1% International Processing fee and found out when I saw the 1% increase in the bank statement. I was also charged 1% extra by UOB for Agoda and Airbnb transactions.

This clause is in https://www.uob.com.sg/personal/cards/credit-cards/terms-and-conditions.page.

I think the article should also include this 1% International Processing fee.

Can this card be used with the FairPrice mobile app? This should constitute as an in-app payment.

Test it with $1 spent to confirm the mcc. Some reported it is different if paid by app.

For those wondering, MCC for fairprice mobile app payment is 5411. you need to have “family” category

How to check my current chosen reward categories?

Unfortunately the only way is to call customer service

The bonus categories that you select are not shown anywhere on the internet banking website or app. You’ll need to keep track of your selection in the latest application.

UOB is a pain to use.

Hello Aaron, since the promo is ending this Feb 2024 would you think it is still worth getting? Thanks!

Only 6 days left of this beautiful 6mpd card. Cmon UOB give us another year!

Does anyone knows if the metal card annual fee is waivable?

Is anyone able to apply for the solitaire card? I can’t seem to get past the first page even after entering my personal details correctly. After entering the OTP, it doesn’t allow me to proceed past the first page.

10k deposit for 6mpd is a no brainer. funds are not locked in anyway

and surely nobody lives life with zero cash contingency

Opportunity cost for that can exceed the value of 2 miles

If I have both a UOB one account and a UOB lady’s account, does using my UOB lady’s credit card make me eligible for extra interest/ extra UNI$ earn rate on both accounts?

Interested to know the answer to this too!

Yes, i can confirm recently UOB has tightened requirement for Lady’s Solitaire Card. Proven like this. I have been using UOB ONE Account for many years. When i opened my account, my income was roughly 60k if i recall correctly. 1) i applied Lady’s Solitaire using my existing login UOB details. I was too lazy to use singpass at that time as i thought the application would go through/be approved since i recently joined their wealth banking out of curiosity. However it got instantly rejected the next day. So wealth banking or not does not affect approval of Lady’s Solitaire… Read more »

Haha. Same reason I have been rejected by OCBC Bank for the most basic of credit cards as they show my income as $1200 a month (when I started working decades ago and had a supp card). Come on….you pay for a credit report that shows I have loans and multiple credit cards and graded the highest possible score…..maybe OCBC had implemented automated screening since 10-15 yrs back LOL

Small error: the T&C link under the section “ What transactions aren’t eligible for UNI$?” is pointing to that for PPV.

fixed, thanks!

Seems like it’s worth paying the annual fee (10,000 UNI$) for the Solitaire card since UOB credits bonus 12,500 UNI$ for annual fee?

Does lady’s card earn bonus at SPC? assuming i’ve selected transport category. i did not find exclusion stated in the T&Cs and its not listed under UOB$ merchant. but i know PPV definitely doesn’t earn cos i tried before.

Is there an expected min spend on the Ladies Solitaire to qualify for a fee waiver? I’ve heard/read somewhere that it’s 50k. How strict are they about that?

Hi,

I have a question on FCY vs mobile contactless payment especially in overseas dealing with FCY. For example if I use Apple Pay on my phone to tap the terminal in Zurich and pay 500CHF to a travel agency (say one that sells the tour package), and if my card has Travel selected as the category, does this 500CHF count as 4 or 0.4mpd? Thank you.

Hi Aaron, you mentioned that car rental does not fall under Travel. So does it fall under Transport? What if it is booked via an OTA? Thanks!

Is the $1k per month cap, the first $1k spent on the card? Or as long as the $1k cap is reached with the designated bonus category?

UOB Lady’s Solitaire no longer waive off annual fee if you don’t hit whatever requirement they have. They’re also not willing to share what those are. They’ll also not entertain any call in to appeal for fee waiver and will direct you to use their app or automated call system.

i just got my lady’s solitaire annual fee waived, after spending $1.5-2k every month on average.

How did you request for your fee waiver – via app or automated call system?

I only had the card since May this year, and spend average $500/month for my trips. Was shocked to see them deduct uni$ for annual fee so soon

app. if you got your card in may, there is no way they could be charging annual fee. that is only due in the 2nd year

I had the Lady’s card since July last year, and only upgraded it to Lady’s Solitaire in May this year. Not sure if it’s cos of that. But the Lady’s card is a whole other mess… I’ve called them 4 times to cancel the card since I’ve upgraded. For the 1st 3 times, they claimed the card would auto close. But it didn’t and I got charged annual fee on that too (6,500 uni$), on top of the Lady’s Solitaire annual fee (10,000 uni$)… so painful. Only on the 4th time, they said they’ll do something to close it. Always… Read more »

A separate question as HEYMAX is mentioned in this UOB Mastercard article. Just to clarify – does Heymax accept other cards besides visa, such as mastercard and amex for voucher purchase and others purchases through the heymax portal site? have not used heymax for this reason