As 2025 draws to a close, it’s time to announce the winners of the second annual MileLion Awards for Outstanding Achievement in the Field of Excellence (or The Mileys for short).

In my humble opinion, this series of pointless awards, assessed on an arbitrary and secretive set of criteria and handed out in a self-congratulatory and overproduced ceremony, is just as prestigious as any FIFA Peace Prize.

This ceremony is all about excellence. We’re honoring achievement at the highest levels —record-breaking success, incredible talent, things people said couldn’t be done. But guess what? They got done. Big time. And nobody does recognition better than this ceremony, believe me.

So here we go: The 2025 Mileys, recognising the best (and not-so-best) of the miles and points game in Singapore.

| 🏆 The 2025 Mileys For Outstanding Achievement in the Field of Excellence |

Resurrection of the Year Award: HSBC Revolution

| 🏆 Winner: HSBC Revolution |

|

| Honourable mention: The BOC Elite Miles Card boosted its earn rates to 1.4/2.8 mpd on SGD/FCY spend, and launched an excellent promotion of up to 8.8 mpd on overseas spend, online spend, dining, and SIA Group spend. Sure, it got pulled early, but that’s still not bad for a card that many had long written off as a joke. |

At the start of 2025, the HSBC Revolution looked dead and buried.

It had just lost its bonuses for airlines, car rental, cruises and lodging, adding to 2024’s removal of bonuses for contactless spending, groceries, fast food, and travel agencies. In a few weeks’ time, HSBC would devalue points conversions to KrisFlyer, becoming the first bank in Singapore to offer an inferior rate for KrisFlyer compared to other frequent flyer programmes. And if that wasn’t enough, the card was also set to lose its complimentary travel insurance in April.

Then, a miracle.

In July 2025, HSBC not only restored bonuses for travel and contactless payments; it also boosted the monthly bonus cap by 50% to S$1,500. This promotion, originally scheduled to run until the end of October, was later extended to 28 February 2026.

All of a sudden, this card became a must-have again— especially when so many other cards were busy nerfing their bonus caps. It remains to be seen what happens after February 2026, but regardless, what an amazing turnaround this year has been.

Nerf(er) of the Year Award: American Express

| 🏆 Winner: American Express |

|

| Honourable mention: As annoying as UOB’s sub-category fetish is, I think the nerf to the KrisFlyer UOB Credit Card’s Accelerated Miles feature will ultimately hurt more. Why? Because the quantum of damage is uncapped. You used to earn an uncapped 3 mpd on dining, online shopping, travel and transport. That’s now an uncapped 2.4 mpd, and if you’re a big spender, it’s going to sting an awful lot. |

Oh boy. This feels like an impossible award to give, in a year that had no shortage of nerfs.

Can I cheat a bit here and give the award not for one specific nerf, but to a company in general? If so, there’s no doubt in my mind that American Express has really earned this.

After taking the sword to the AMEX KrisFlyer Ascend in late 2024…

- The Platinum Statement Credits offered by the AMEX Platinum Charge were split into half-yearly credits, increasing the likelihood of breakage

- Unlimited Priority Pass lounge access was removed for the first AMEX Platinum Charge supplementary cardholder

- AMEX Platinum Charge vouchers were quietly saddled with additional restrictions or downgrades, such as smaller rooms for Plat Stay, new minimum spending requirements for dining or wine vouchers, a 50% reduction in Tower Club value etc.

- AMEX Platinum Charge customers lost their Avis President’s Club benefit

- The AMEX HighFlyer Card hiked its annual fee to S$400 while slashing earn rates and benefits

- AMEX cards added support for SimplyGo…then promptly excluded it from rewards

- AMEX Pay was discontinued, ending a useful way of earning miles at QR code-only merchants

- The “new customer” definition for welcome offers was revised to exclude existing supplementary cardholders

There’s probably more that I’ve missed, but tl;dr: it’s been a very, very bad year for American Express customers. I’ve long given up my AMEX Platinum Charge and AMEX HighFlyer Card, downgrading to the cheaper AMEX Platinum Credit Card for Love Dining benefits and its simple-to-use S$200 annual lifestyle credit.

Annoying Trend of the Year Award: UOB’s sub-caps

| 🏆 Winner: UOB’s sub-caps |

|

| Honourable mention: Lounge nerfing became a thing in 2025, with the AMEX Platinum Charge, StanChart Priority Private, UOB Visa Infinite Metal Card and Citi Prestige Card all removing unlimited lounge visits for customers (technically the UOB Visa Infinite Metal Card’s nerf will only take place in June 2026). Blame it on Asian Street Kitchen? |

At some point in time, there must have been a meeting at UOB headquarters, wherein it was decided that sub-caps would be the investment theme of 2025.

It started with the UOB Lady’s Solitaire Card and UOB Visa Signature in August, then spread to the UOB Preferred Platinum Visa in October. All of a sudden, UOB didn’t have three rewards cards. It had three “2-in-1” cards, each with non-fungible bonus caps.

| Bonus | Cap | |

“Card #1” “Card #1” |

4 mpd on Bonus Category 1 | S$750 |

“Card #2” “Card #2” |

4 mpd on Bonus Category 2 | S$750 |

| Bonus | Cap | |

“Card #1” “Card #1” |

4 mpd on overseas spending (min. spend S$1K) |

S$1.2K |

“Card #2” “Card #2” |

4 mpd on petrol and contactless spending |

S$1.2K |

| Bonus | Cap | |

“Card #1” “Card #1” |

4 mpd on selected online transactions | S$600 |

“Card #2” “Card #2” |

4 mpd on mobile contactless | S$600 |

As I said at the time:

Now, I don’t think it takes an MBA to see what’s going on here. By introducing these finicky sub-caps, UOB is anticipating that more breakage will happen, that more cardholders will either underspend and fail to achieve the “full potential” of their cards, or overspend and end up in 0.4 mpd territory.

Think about how little time the average person has to track their cards. Think about how little inclination the average person has to track their cards. Now add a further layer of complexity in the form of sub-caps, and that’s a sure-fire recipe to reduce the cost of rewards.

If it’s any consolation, the HeyMax app now supports bonus cap tracking on the UOB Preferred Platinum Visa and UOB Visa Signature, which makes life a lot easier— though it still can’t fix the impossible. For example, not everyone will be able to regularly clock at least S$1,000 of FCY spend each month on the UOB Visa Signature, effectively forfeiting 50% of the bonus cap.

Promo of the Year Award: HSBC Premier Mastercard 106,200 miles welcome offer

| 🏆 Winner: HSBC Premier Mastercard 106,200 miles welcome offer |

|

|

Honourable mention: While not nearly as flashy, I’d like to acknowledge that the OCBC Rewards Card has been quietly chugging along with a 6 mpd promotion for the whole of 2025. In fact, for the first seven months this even covered MCC 5311, which allowed cardholders to earn 6 mpd on any HeyMax gift card: dining, transport, food delivery, shopping, electronics, travel etc. Oh, and SingSaver gave everyone S$500 eCapitaVouchers again… |

Amidst a sea of nerfs, the HSBC Premier Mastercard was a notable bright spot. Not only did HSBC give it a massive buff by boosting its earn rates, adding unlimited lounge access for up to four cardholders and doubling the airport limo rides, it also launched an excellent welcome offer worth up to 106,200 miles, with a minimum spend of just S$5,000.

Considering the fact the annual fee was waived for fully-funded HSBC Premier customers (min. S$200,000 AUM), and this was quite simply a sensational deal.

If you’re just learning about this now, I’m sorry to say that ship has sailed. While you can still enjoy all the same cardholder benefits, the welcome offer has been cut to 58,200 miles. Is it still a good deal, in and of itself? Yes. Is it hard to stomach knowing an even better deal has just gone by? Also yes.

Breakup of the Year Award: Citi Rewards and Amaze

| 🏆 Winner: Citi Rewards and Amaze |

|

| Honourable mention: The Chocolate x AXS saga (see Fail of the Year) was a pretty sordid tale too, and despite Chocolate’s claim that “we are exploring with them to see if we can resolve (sic)”, I think it’s safe to say that they, are never ever ever, getting back together. |

I don’t know if you can truly call this a break-up, in the sense that Citi has yet to exclude Amaze altogether. But it’s clear Amaze would prefer that they just be friends, at least when not on vacation.

For context: back in March 2024, Amaze introduced a 1% fee on local transactions exceeding S$1,000 per calendar month. The quantum of the cap felt carefully calibrated to say the least— what are the odds it just so happened to match the monthly cap of its BFF, the Citi Rewards Card?

But then one year later, Amaze expanded the 1% fee to cover all local transactions, from the very first S$1. If anyone wanted to use its offline-to-online alchemy within Singapore, they’d have to pay for the privilege.

Now, I can imagine some very sound arguments for paying a S$10 fee on a S$1,000 transaction to earn 4,000 miles. But very few transactions are actually that size. And because the fee has a S$0.50 minimum, it would actually be larger than 1% for any transaction below S$50!

| 💳 1% Fee and 4 mpd |

|||

| Trxn (S$) | Fee (S$) | Fee (%) | CPM |

| S$3 | S$0.50 | 16.7% | 4.17¢ |

| S$5 | S$0.50 | 10% | 2.50¢ |

| S$10 | S$0.50 | 5% | 1.25¢ |

| S$20 | S$0.50 | 2.5% | 0.63¢ |

| S$30 | S$0.50 | 1.7% | 0.42¢ |

| S$40 | S$0.50 | 1.3% | 0.31¢ |

| S$50 | S$0.50 | 1% | 0.25¢ |

That sucks, but it’s not quite a Dear John letter, because even though Amaze wants nothing to do with Citi Rewards while in Singapore, it’s quite happy to tag along for overseas trips. In fact, you should be doing this, because it’s a simple way to earn 4 mpd everywhere (with the obvious exception of travel-related merchants) with a ~2% fee.

What will 2026 bring for this starstruck couple? Hard to say, and mind you, they’ve already won the Heart Attack of the Year award at the 2024 Mileys for the one-week period where Amaze transactions stopped earning points with the Citi Rewards Card.

Still a better love story than Twilight.

Fail of the Year Award: Chocolate Finance

| 🏆 Winner: Chocolate Finance |

|

| Honourable mention: The DCS Imperium Card got a Labour Day fee cut from S$3,583.92 to S$1,294.92, but at its heart it’s still an incredibly overpriced World Elite card. |

Chocolate Finance became something of a household name this year, and probably not for reasons it would want.

It all started in February, with the launch of an amazing promotion that felt a little too good to be true: 2 Max Miles per S$1 on everything, even AXS payments! When it was clear this was getting out of hand – gee, who saw that coming? – Chocolate decided to block AXS payments.

Only that’s not what it told people. Instead, it claimed that AXS was the one who pulled support.

AXS is no longer accepting the Chocolate Debit Card as a credit card payment mechanism. We are exploring with them to see if we can resolve (sic).

-Chocolate Finance

However, AXS later provided the following statement via a spokesperson.

The removal of Chocolate Visa Card as a payment option on AXS was made at the request of Chocolate Finance. We work closely with our partners and have honored their request to implement the change. AXS strives to offer as many payment options as possible and welcomes issuers who wish to use our platform to reach more users.

-AXS Spokesperson

What struck me as particularly disingenuous is that when a Chocolate representative sent a message about the AXS nerf, the exact wording was “we have just been informed AXS is no longer accepting Chocolate card payments”, as if they had no part to play in it.

Needless to say, people weren’t happy about being led up the garden path, and a couple of YouTube videos later, this quickly spiraled into a classic not-a-bank run, forcing Chocolate to suspend its instant withdrawal feature and cap card transactions at S$250.

The company’s crisis communications went MIA, and frankly speaking, no one came out of that incident looking good. When all the dust had settled, Chocolate was a shell of its former self, with a paltry 1 Max Mile per S$1 earn rate, and a 100 Max Mile cap on so-called “bill payments”.

Maybe just tell the truth in the first place?

Goodnight Sweet Prince Award: Citi Rewards Visa

| 🏆 Winner: Citi Rewards Visa |

|

|

Honourable mention: With XNAP biting the dust last year, AMEX Pay was left to do the heavy lifting at QR code-only merchants. And to be fair, it did that job quite well, allowing cardholders to earn miles at hawker stalls and other mom-and-pop merchants that never in a million years would have accepted credit cards. But in line with American Express’ “how-can-we-make-things-worse” approach to 2025, AMEX Pay was discontinued on 31 July 2025. Yes, there’s still FavePay, Shopback Pay and Changi Pay, but chances are that if a merchant accepts any of these payment methods, it accepts direct card payments too. |

The seeds for the demise of the Citi Rewards Visa were sown 10 years ago, when Citibank signed an expanded 10-year agreement with Mastercard, under which it would progressively migrate the majority of its credit and debit card portfolios to the Mastercard network.

But it was only this year where we finally received official confirmation that Citi has begun the final steps of phasing out its remaining Visa cards, and the Citi Rewards would not be spared.

Why does this matter, when the Citi Rewards Mastercard still exists? Because both the Visa and Mastercard have their own bonus cap. By holding both cards, you could earn up to 96,000 miles a year (S$1,000 x 4 mpd x 12 months x 2 cards).

From what I understand, the end-of-life date has been set for early next year (so should this be a candidate for 2026’s awards, or 2025?), at which point it’ll be goodbye dual wielding.

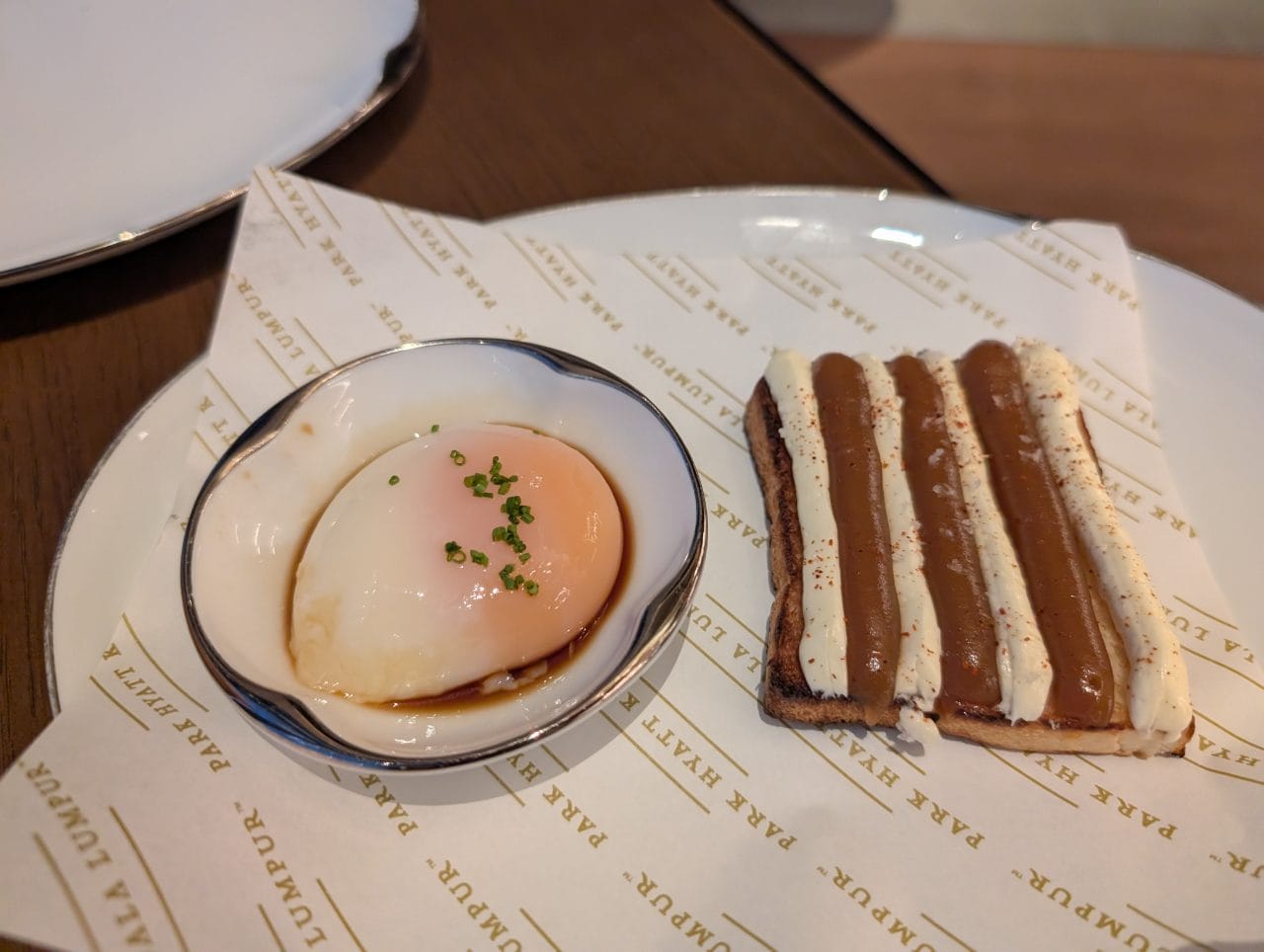

Hotel Stay of the Year Award: Park Hyatt Kuala Lumpur

| 🏆 Winner: Park Hyatt Kuala Lumpur |

|

| Honourable mention: Mesm Tokyo (part of Marriott’s Autograph Collection) was another fantastic stay, with spacious rooms, modern design and an excellent breakfast- perhaps one of the best hotel breakfasts I’ve ever had. It’s not big on facilities (no spa or swimming pool), but if that’s not important then I’d recommend it to anyone. |

I stayed at the newly-opened Park Hyatt Kuala Lumpur in October, located at the top of Merdeka 118, the second tallest building in the world.

As you might expect, the views are breathtaking in every direction, and thankfully that’s not the only claim to fame. The corner room I was upgraded to (on a Globalist Guest of Honor stay) was extremely spacious and modern, the swimming pool, jacuzzi and spa facilities were top-notch, and the high quality breakfast spread featured numerous made-to-order items.

It wasn’t a perfect stay by any means. Merdeka 118 is kind of a ghost town right now, and some areas of this hotel were already starting to show wear and tear, which is slightly alarming for a property this new.

Still, I’d consider the Park Hyatt a great addition to KL’s luxury hotel scene, and the Waldorf Astoria will have its work cut out for it if/when it finally opens.

Flight of the Year Award: STARLUX

| 🏆 Winner: STARLUX A350-900 Business Class |

|

| Honourable mention: Quite a few: JAL’s A350-1000 Business Class, Cathay Pacific Aria Suites, and even Finnair’s Air Lounge (not that new, I know) were all amazing experiences, and ones I’d happily fly again. |

There was tough competition for this award, given the excellent Business Class seats I’ve flown this year.

But if you forced me to choose, then I’d give this title to STARLUX, and their amazing Business Class experience on the A350-900. I flew this from Taipei to San Francisco, and was extremely impressed with the seat (Collins Aerospace Elements, for which STARLUX is the launch customer), the amenities and the catering. I mean, any airline which serves boba tea latte, cold-pressed juice, st1 cafe coffee and neon blue cocktails is doing something right.

The key weakness would be the ground experience. While there’s nothing overtly unpleasant about the STARLUX Galactic Lounge (and I’d give it 10/10 for theming; it really feels like a spaceport), it’s not the kind of thing you’d come early to the airport for. That said, I’d levy the same criticism against EVA and China Airlines too, as the lounge scene in Taipei has never impressed me all that much. Here’s hoping the new Terminal 3 does better!

Conclusion

A very hearty congratulations to each and every one of the 2025 Miley winners! Each of you thoroughly earned your award, and feel free to reach out so I can send you a crayon-drawn certificate.

If there’s something else from 2025 you think is worthy of a nomination, or if you have ideas for new categories for 2026, feel free to share them!