Singaporean drivers are renowned for being well-mannered, considerate, and not-at-all-impatient on the road, so it’s always great to share our driving culture with the rest of the world when on holiday.

So if you’re planning to rent a car for your next trip, here are the credit cards that will earn you the most miles, as well as some pitfalls to watch out for.

How do car rentals code?

The MCC for car rentals depends on how you make your booking, but in general, there are two possibilities:

- For direct bookings: MCC 3300-3499, or MCC 7512

- For OTA bookings: MCC 4722

Most major rental car companies will code in the MCC 3300-3499 range. For example, Sixt is MCC 3355, Hertz is MCC 3357 and Avis is MCC 3389. Those interested in seeing the full list of rental car MCCs can consult this document.

However, there’s also the possibility of it coding under MCC 7512 if it’s a smaller or non-traditional agency, like Burswood, Centauro, Omega Car Rentals, or Turo (where pre-authorisations code as MCC 4789 but final bills code as 7512).

If you make the booking through an OTA like Trip.com or Klook, the transaction will code as MCC 4722.

In case you’re uncertain about the MCC, here are three ways of looking it up before making a purchase:

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

| Note: “Ease of use” and “reliability” are all relative. HeyMax already provides a solid baseline for reliability, and the DBS digibot is still simple enough to use, despite requiring more steps than the other two methods. | ||

Booking car rentals directly

For rental car bookings made directly with the agency, you can use any of the following cards.

| 🚗 Best Cards for Rental Cars (Booked Direct) |

||

| Card | Earn Rate | Remarks |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd Online only |

Max S$1K per c. month Review |

HSBC Revolution HSBC RevolutionApply |

4 mpd | Max S$1.5K per c. month*. MCC 7512 is not included Review |

Maybank XL Rewards Card Maybank XL Rewards CardApply |

4 mpd FCY only |

Min. spend S$500 per c. month, capped at S$1K per c. month Review |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd | Max. S$600 per c. month. Must pay via mobile contactless Review |

UOB Visa Signature UOB Visa Signature Apply |

4 mpd FCY only |

Min S$1K, max S$1.2K FCY spend per s. month Review |

StanChart Beyond Card StanChart Beyond CardApply |

3-4 mpd FCY only |

3 mpd for regular, 3.5 mpd for PB, 4 mpd for PP. No cap Review |

Maybank Visa Infinite Maybank Visa InfiniteApply |

3.2 mpd FCY only |

Min. S$4K spend per c. month Review |

Maybank World Mastercard Maybank World MastercardApply |

3.2 mpd FCY only |

Min. S$4K spend per c. month. 2.8 mpd with min. S$800 spend per c. month Review |

StanChart Visa Infinite StanChart Visa InfiniteApply |

3 mpd FCY only |

Min S$2K per s. month, no cap, otherwise 1 mpd Review |

BOC Elite Miles Card BOC Elite Miles CardApply |

2.8 mpd FCY only |

No min. spend or cap Review |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

2.8 mpd FCY only |

Min. retail spend of S$800 per c. month. No cap. Review |

| *From 1 April 2026, bonuses will no longer be awarded for rental car and other travel-related spending. |

||

| ❓ Where’s the Citi Rewards Card and UOB Lady’s Card? |

|

The Citi Rewards Card earns 4 mpd on all online transactions, except travel (defined as airlines, cruises, hotels, rental cars, trains). If you use it for car rentals, you’ll earn just 0.4 mpd. As for the UOB Lady’s Card, the Travel category does not include rental cars. |

The only card to explicitly whitelist rental cars is the HSBC Revolution, but do note that MCC 7512 is not included. This could be a potential gotcha if you’re renting with a smaller agency!

However, even if you don’t have this card, you can still take advantage of online (assuming you prepay in advance on the website) or foreign currency spending bonuses (assuming you’re renting overseas).

Booked via OTA

For rental car bookings made through an OTA, you can use any of the following cards to maximise your miles.

| 🚗 Best Cards for Rental Cars (Booked via OTA) |

||

| Card | Earn Rate | Remarks |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd Online only |

Max S$1K per c. month Review |

Maybank XL Rewards Card Maybank XL Rewards CardApply |

4 mpd |

Min. spend S$500 per c. month, capped at S$1K per c. month Review |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | Max S$1K per c. month. Must choose Travel as bonus category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd | Max S$750 per c. month. Must choose Travel as bonus category Review |

UOB Visa Signature UOB Visa Signature Apply |

4 mpd FCY only |

Min S$1K, max S$1.2K FCY spend per s. month Review |

StanChart Beyond Card StanChart Beyond CardApply |

3-4 mpd FCY only |

3 mpd for regular, 3.5 mpd for PB, 4 mpd for PP. No cap Review |

Maybank World Mastercard Maybank World MastercardApply |

3.2 mpd FCY only |

Min. S$4K spend per c. month. 2.8 mpd with min. S$800 spend per c. month Review |

Maybank Visa Infinite Maybank Visa InfiniteApply |

3.2 mpd FCY only |

Min. S$4K spend per c. month Review |

BOC Elite Miles Card BOC Elite Miles CardApply |

2.8 mpd FCY only |

No min. spend or cap Review |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

2.8 mpd FCY only |

Min. retail spend of S$800 per c. month. No cap. Review |

Be careful with Amaze!

When collecting your car, you’ll often need to provide a credit card as a guarantee against any damage. This is not the right time to use your Amaze.

Amaze, you’ll recall, is actually a debit card (even if it passes transactions through to a credit card). When the rental car company puts an authorisation hold on Amaze, that becomes an actual transaction billed to your credit card. When the hold is later released, the amount credited may not be the same as the amount debited due to FX charges and movements (it really boils down to how the reversal is done).

I’ve written about this problem in the article below.

It’s always better to provide a credit card at the time of rental, and then provide your Amaze when the rental is over for final billing. This will mean you need to visit the counter after dropping off your car, however, and may not be an option for after-hour drops or contactless drop-offs.

Beware of DCC!

Rental car companies are fond of DCC scams, and I’ve been hit more than a few times.

Googling “rental car automatic DCC” will turn up plenty of reports of companies automatically opting customers into DCC, hiding the option to opt-out in the fine print or making it overly complicated to do so. Why? Because it makes them money, of course. The rates offered via DCC are vastly inflated over what you’d pay through your bank.

Unfortunately, there’s not a lot you can do about this, except to be extra vigilant or use an American Express card, because AMEX does not support DCC. On the flip side, you won’t earn quite as many miles with AMEX cards; the best option would be the UOB PRVI Miles AMEX at 2.4 mpd.

Alternatively, you can consider booking your rental car through an OTA and paying at the time of booking, so the rental car company has no further charges to make.

What about car rental insurance?

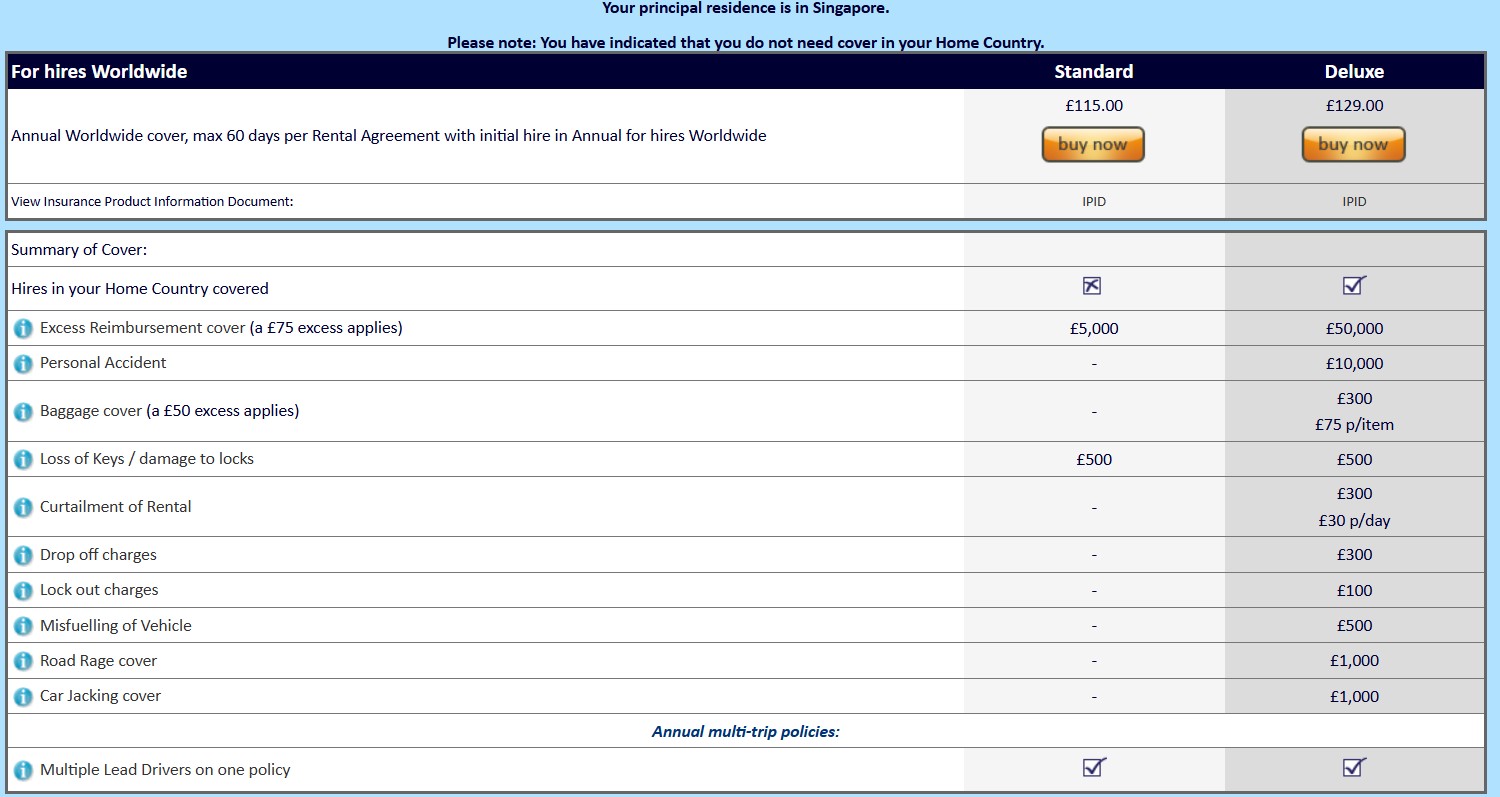

Given how expensive it can be to purchase insurance from the car rental company itself, I often look at getting third-party insurance.

One company I’ve used before is Worldwide Insure, which offers single trip plans, or an annual plan for £129 (~S$225) that covers rentals of up to 60 days. The Deluxe tier will reimburse any excess up to £50,000 (~S$87,000), with a deductible of £75 (S$130).

The main thing to flag is that Iceland is excluded from coverage. Also, I’ve never had to make a claim before, so I can’t speak to how easy the process is— that said, there are a few success stories in the MileChat from other users.

Another option is RentalCover.com, which quoted me US$9.70 per day for a car rental in the USA, with no deductible.

| 🚗 RentalCover.com coverage |

|

The newly-launched AAS RoadPlus+ is also an option, but it does require you to purchase the rental car company’s basic CDW- which I feel defeats the purpose.

AAS RoadPlus+ overseas rental car insurance: Not what I was hoping for

Conclusion

While there aren’t many cards which explicitly whitelist rental car transactions, you can circumvent this restriction by booking through an OTA, or taking advantage of foreign currency spending bonuses.

Do be mindful of the ever-present DCC scam, however, as well as authorisation holds if you’re using Amaze (or any other debit card for that matter, including Revolut and YouTrip).

Woohoo thanks alot for this Aaron! 🙂

Hi Aaron, I would’ve expected that the UOBWC would be the preferred card under travel category Even if the booking is made directly with the car rental company

what am I missing?

>Singaporean drivers are known for being well-mannered, considerate, and not-at-all-impatient on the road, and it’s always great to share our driving culture with the rest of the world on holiday.

You left the /s tag out. One other thing… in the rest of the world the law is to give way to pedestrians not pedestrians to give way to motor vehicles. No more acting Mr VIP by horning people on footpaths or when turning as it is illegal.

I had repeatedly hotels charge me with DCC successfully disputed. Produce a folio that shows billing in USD/INR/whatever, tell your bank that you never agreed to DCC. At least Citi always told the merchant to pound sand.

I suppose UOB PPV would also make it to the list since its mobile contactless purchase can also earn 4mpd without excluding 3300-3499 and 7512?

What about YouTrip Revolut? Would DCC apply?

most car rentals in Japan for example charge upon collection of car. In this case, only UOB Visa Signature will work for FCY spend (assuming more than SGD 1000 equivalent)

I’ve also booked car rental via Expedia before using HSBC but turns out the booking was processed offline by the car rental merchant and it was not an eligible travel MCC i.e. Expedia’s MCC. HSBC didn’t entertain my appeal request.

What is the current use case for Amaze? UOB/DBS exclude it. Maybank will only earn .4mpd for SGD. And Citi Rewards excludes travel. I guess when this article was originally written Amaze was a bit more relevant. Currently there seems to be no reason to use it to settle the bill let alone for the deposit.

yup, it’s certainly less relevant now, but keep in mind there may be some people who find that it’s worthwhile to earn 1.2 mpd with travelone, 1.3 mpd with ocbc 90n/citi prestige, 1.6 mpd with citi ultima and pay a 2% fee rather than their respective FCY earn rates with a 3.25% fee.

These appears to cover the rental car only, and not liability. Eg. if you hit someone and they claim you, it’s not covered. AFAIK SG car insurance liability doesn’t follow the driver worldwide.

Something to take note of.

personal liability should be covered by your travel insurance policy.

Hsbc revo shld make the list?