“What’s the best card to use for petrol?” is always a tricky question, not because I don’t know which cards give the most miles, but because of all the discounts involved.

You see, petrol pricing in Singapore is a complicated thing. You pull up to the pump and ask for S$50 of petrol, only to go to the register and pay S$45. Discounts are great, don’t get me wrong, but the complicated layers of bank, site and chain discounts make it difficult to do price comparisons on the fly.

In this post we’ll look at how you can enjoy the best of both worlds: miles and discounts.

What MCC do petrol stations code as?

Petrol stations code under two main MCCs:

- MCC 5541: Service Stations

- MCC 5542: Automated Fuel Dispensers

5541 is much more common in Singapore, but in any case the cards which reward 5541 also reward 5542, so you don’t need to worry about it.

As an aside, electric vehicle (EV) charging uses MCC 5552. There’s a different set of recommended cards for that category, so refer to the post below if that’s what you’re driving.

If you’re uncertain about the MCC, there are three ways of looking it up before making a purchase:

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

| Note: “Ease of use” and “reliability” are relative. HeyMax already provides a solid baseline for reliability, and the DBS digibot is still simple enough to use, despite requiring more steps than the other two methods. | ||

What’s the best card to use?

If the question is which card gives the most miles, period, then we can end the post here because the answer is pretty straightforward:

| ⛽ Highest Earning Miles Cards for Petrol |

||

| Card | Earn Rate | Remarks |

UOB Lady’s Card UOB Lady’s Card |

4 mpd | Max. S$1K per c. month, must choose Transport as quarterly bonus category |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

4 mpd | Max. S$750 per c. month, must choose Transport as quarterly bonus category |

UOB Visa Signature UOB Visa Signature |

4 mpd | Min. S$1K spend on SGD per s. month, max. S$1.2K per s. month |

UOB Preferred Platinum Visa UOB Preferred Platinum Visa |

4 mpd | Max. S$600 per c. month, must use mobile payments |

Maybank World Mastercard Maybank World Mastercard |

4 mpd | Offline spend only (i.e. no in-app payments). No cap. |

Amaze + Citi Rewards Mastercard Amaze + Citi Rewards Mastercard |

4 mpd | Max. S$1K per s. month. 1% admin fee applies to all SGD-denominated transactions |

| C. Month= Calendar Month, S. Month= Statement Month | ||

Where it gets complicated is that the best card from a miles perspective may not necessarily be the best card from a discounts perspective.

As much as I want to maximise the miles I earn, at the end of the day it still boils down to what’s a better deal. For example, if I have a choice between:

- 4 mpd with a 14% discount

- 1.6 mpd with a 19% discount

I should go with the larger discount unless I value a mile at more than 2.08 cents (5%/2.4 mpd) each.

In other words, there comes a point where taking a bigger discount is better than earning more miles. I hope you have your value of a mile figure handy; it’s how you evaluate whether trading an X% discount for Y miles makes sense.

Two more points before we get started:

- I’m going to be focusing on the cards that represent a good trade-off between miles and discounts. If you’re interested in pure cashback, this isn’t the article for you.

- I’m going to assume you’re pumping 92/95 grades. Petrol stations may give slightly higher discounts for premium grades like Shell V-Power or Caltex Platinum 98

| ⛽ Best Cards by Petrol Chain |

Caltex

Membership discount

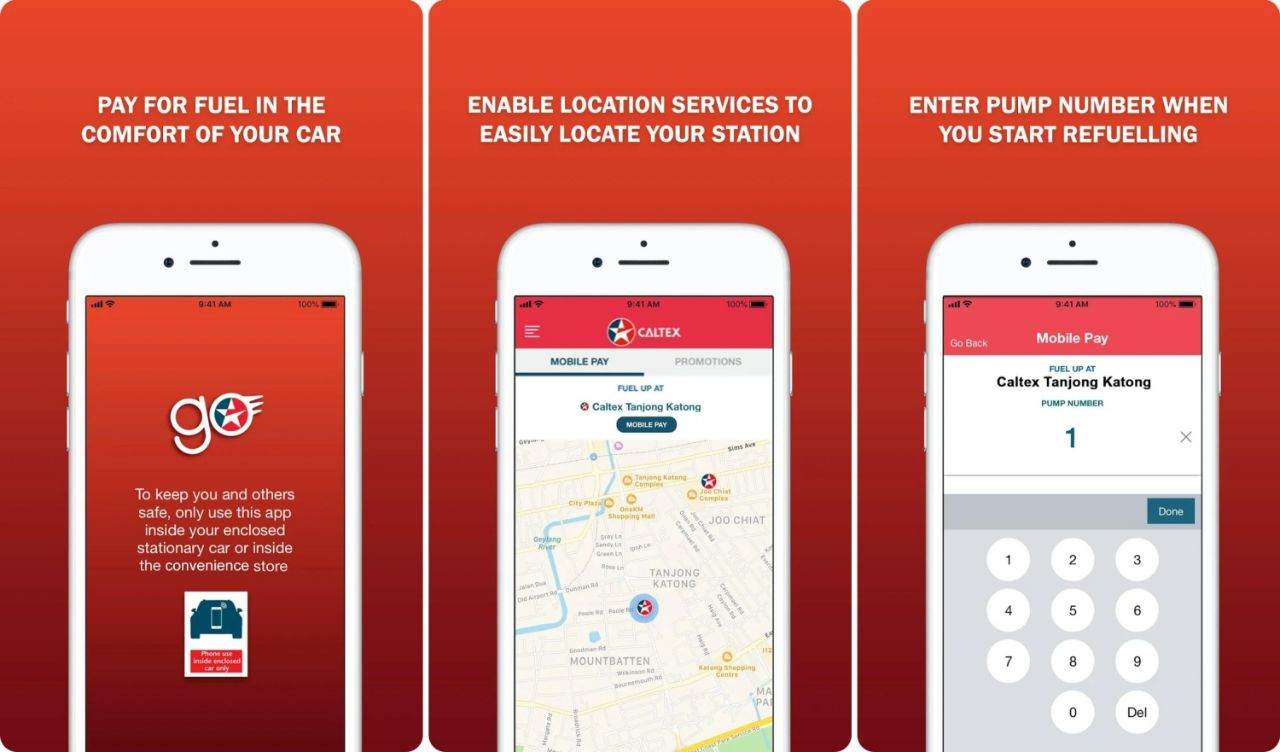

CaltexGO app CaltexGO app |

14% discount |

The free-to-use CaltexGo app (Android | iOS) allows cardholders to pay for petrol at the pump, and the default discount for CaltexGo users is 14% with any Visa or Mastercard credit/debit card.

Credit card discounts

| Bank | Additional Discount |

|

+3% |

| +2% (+3% for Premier Mastercard) |

|

| +4% (+5% for VOYAGE, Premier Visa Infinite) |

|

|

+2% (+3% for Visa Infinite) |

Citi cards enjoy an additional 3% discount (total: 17%) when paying via CaltexGo.

HSBC cards enjoy an additional 2% discount (total: 16%) when paying via CaltexGo, with the HSBC Premier Mastercard enjoying an additional 3% discount (total: 17%)

OCBC cards enjoy an additional 4% discount (total: 18%) when paying via CaltexGo, with the OCBC VOYAGE & Premier Visa Infinite enjoying an additional 5% discount (total: 19%)

Standard Chartered cards enjoy an additional 2% discount (total: 16%) when paying with the CaltexGo app, with the Standard Chartered Visa Infinite enjoying an additional 3% discount (total: 17%)

| 📱 For payments via CaltexGo | ||

| Card | Discount | Earn Rate |

Citi Rewards Card Citi Rewards Card |

17% | 4 mpd1 |

UOB Lady’s Card UOB Lady’s Card |

14% | 4 mpd2 |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

14% |

4 mpd2 |

HSBC Premier Mastercard HSBC Premier Mastercard |

17% | 1.76 mpd |

OCBC VOYAGE OCBC VOYAGE (Premier, PPC, BOS) |

19% |

1.6 mpd |

StanChart Visa Infinite StanChart Visa Infinite |

17% | 1.4 mpd3 |

OCBC 90°N Card OCBC 90°N Card |

18% |

1.3 mpd |

OCBC VOYAGE OCBC VOYAGE |

19% |

1.3 mpd |

OCBC Premier Visa Infinite OCBC Premier Visa Infinite |

19% | 1.28 mpd |

StanChart Journey Card StanChart Journey Card |

16% |

1.2 mpd |

| 1. Capped at S$1,000 per s. month 2. Must select Transport as quarterly bonus category. Capped at S$1,000 per c. month (Lady’s) or S$750 per c. month (Lady’s Solitaire) 3. Min. spend S$2,000 per statement month, otherwise 1 mpd |

||

If you prefer to pay indoors at the counter, you can also use the UOB Preferred Platinum Visa or UOB Visa Signature for a 4 mpd and a 14% discount.

Alternatively, you can apply for a Diamond Sky Fuel Card and save 20.05% while earning 4 mpd with the Maybank World Mastercard. Do note that you must pay indoors to benefit from the 4 mpd, as the Maybank World Mastercard will not award 4 mpd for online payments through the CaltexGo app.

Esso

Membership discount

All Esso Smiles Cardholders receive a 10% discount.

Esso Smiles Card Esso Smiles Card |

10% discount |

Credit card discounts

| Bank | Additional Discount |

|

+4% |

| +4% (+8% for Insignia and Vantage) |

|

| +4% | |

|

+2% |

Citibank, DBS and OCBC cardholders receive a further 4% discount at Esso (total: 14%).

DBS Insignia and DBS Vantage Cards receive a further 8% discount (total: 18%).

| Card | Discount | Earn Rate |

UOB Lady’s Card UOB Lady’s Card |

10% | 4 mpd1 |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

10% | 4 mpd1 |

Amaze + Citi Rewards Mastercard Amaze + Citi Rewards Mastercard |

10% | 4 mpd2 |

UOB Preferred Platinum Visa UOB Preferred Platinum Visa |

10% | 4 mpd3 |

UOB Visa Signature UOB Visa Signature |

10% | 4 mpd4 |

Maybank World Mastercard Maybank World Mastercard |

10% | 4 mpd |

DBS Insignia DBS Insignia |

18% | 1.6 mpd |

Citi ULTIMA Citi ULTIMA |

14% | 1.6 mpd |

OCBC VOYAGE OCBC VOYAGE (Premier, PPC, BOS) |

14% | 1.6 mpd |

DBS Vantage DBS Vantage |

18% | 1.5 mpd |

Citi Prestige Citi Prestige |

14% | 1.3 mpd |

OCBC 90°N Cards OCBC 90°N Cards |

14% | 1.3 mpd |

OCBC VOYAGE OCBC VOYAGE |

14% | 1.3 mpd |

DBS Altitude Card DBS Altitude Card |

14% | 1.3 mpd |

Citi PremierMiles Citi PremierMiles |

14% | 1.2 mpd |

| 1. Must select Transport as quarterly bonus category. Capped at S$1,000 per c. month (Lady’s) or S$750 per c. month (Lady’s Solitaire) 2. Capped at S$1,000 per s. month, 1% admin fee (min. S$0.50) for SGD transactions 3. Must use mobile contactless payments. Capped at S$600 per c. month 4. With min. S$1,000 spend in a s. month. Capped at S$1,200 per s. month |

||

Drivers who pump the premium Synergy Supreme+ grade will be eligible to double dip on KrisFlyer miles and Esso Smiles points, earning the equivalent of 2 mpd on top of credit card miles. Registration is required, and can be done via this link.

Esso is also available on Kris+, with a further 2% discount (total: 12%), and from now till 30 June 2026, the earn rate is upsized to 3 mpd.

|

| S$5 for new Kris+ Users |

| Get S$5 when you sign-up with code W644363 and make your first transaction |

These miles are on top of what you earn from your credit cards, so you can stack an extra 3-4 mpd.

| ⛽ Best Cards for Kris+ Petrol Spend |

||

| Card | Earn Rate | Remarks |

UOB Lady’s Card UOB Lady’s Card |

4 mpd | Max. S$1K per c. month, must choose Transport as bonus category |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

4 mpd | Max. S$750 per c. month, must choose Transport as bonus category |

Amaze + Citi Rewards Mastercard Amaze + Citi Rewards Mastercard |

4 mpd | Max. S$1K per s. month. 1% admin fee (min. S$0.50) for SGD transactions |

DBS Woman’s World Mastercard DBS Woman’s World Mastercard |

4 mpd | Max. S$1K per c. month |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

3 mpd | No cap |

A brief reminder that the table above refers to the best credit cards to use for petrol on Kris+.

For example, paying in-store with a DBS Woman’s World Card would only earn you 0.4 mpd, but when paying with Kris+, you earn 4 mpd because the online spending category is triggered. Likewise, paying in-store with a KrisFlyer UOB Credit Card would earn you 1.2 mpd, but when paying with Kris+, you earn 3 mpd because the Kris+ bonus is triggered.

Shell

Membership discount

Anyone with the free-to-use Shell Go+ app (Android | iOS) will receive a 10% discount.

Shell Go+ App Shell Go+ App |

10% discount (min. S$20 spend) |

Slightly higher upfront discounts apply for SAFRA members (12%) and motorcycle riders (14%-16%).

Credit card discounts

| Bank | Additional Discount |

|

+4% |

| +4% |

|

| +4% (+7% for UOB Reserve) |

Citi, HSBC and UOB cardholders receive a further 4% discount (total: 14%) at Shell.

While UOB’s T&Cs explicitly state that Shell transactions do not earn UNI$, it’s been well documented that they actually do. But since this is an unofficial feature, UOB could “fix” it at any time without warning.

| Card | Discount | Earn Rate |

UOB Lady’s Card UOB Lady’s Card |

14% |

4 mpd1 |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

14% |

4 mpd1 |

UOB Preferred Platinum Visa UOB Preferred Platinum Visa |

14% | 4 mpd2 |

UOB Visa Signature UOB Visa Signature |

14% | 4 mpd3 |

Amaze + Citi Rewards Mastercard Amaze + Citi Rewards Mastercard |

10% | 4 mpd4 |

Maybank World Mastercard Maybank World Mastercard |

10% 15% with Corporate Fuel Card |

4 mpd |

UOB Reserve UOB Reserve |

17% |

1.6 mpd |

UOB PRVI Miles Card UOB PRVI Miles Card |

14% |

1.4 mpd |

Citi Prestige Citi Prestige |

14% | 1.3 mpd |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

14% | 1.2 mpd |

Citi PremierMiles Citi PremierMiles |

14% | 1.2 mpd |

HSBC TravelOne Card HSBC TravelOne Card |

14% | 1.2 mpd |

| 1. Must select Transport as quarterly bonus category. Capped at S$1,000 per c. month (Lady’s) or S$750 per c. month (Lady’s Solitaire) 2. Must use mobile contactless payments. Capped at S$600 per c. month 3. With min. S$1,000 spend in SGD in a s. month. Capped at S$1,200 per s. month 4. Capped at S$1,000 per s. month, 1% admin fee (min. S$0.50) for SGD transactions |

||

Buy vouchers on Heymax

|

|

| Get 200 Max Miles when you sign up for a HeyMax account and complete one transaction | |

| Sign up here |

HeyMax sells Shell gift cards in denominations of S$50, S$75 and S$100.

Purchases of these gift cards from Heymax are classified under MCC 5311 (Department Stores), making them eligible to earn 4 mpd on cards that don’t otherwise reward petrol, such as the Citi Rewards Card, HSBC Revolution, Maybank XL Rewards Card and OCBC Rewards Card.

Gift cards can be used for multiple transactions until they run out, or expire.

Sinopec

Membership discount

Sinopec has its own loyalty card called the X Card, which doesn’t earn a discount per se, but allows you to accumulate rewards points. Members earn 1-1.5 points per litre pumped, and every 90 points gives you S$3 off petrol.

Credit card discounts

Sinopec keeps things very straightforward by running periodic 25-29% off discounts, valid for all grades of petrol, and all payment methods. This discount may not be available at all of its stations though, so be sure to consult the Sinopec Facebook page for the latest details.

| Card | Discount | Earn Rate |

UOB Lady’s Card UOB Lady’s Card |

Up to 29% | 4 mpd1 |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

Up to 29% | 4 mpd1 |

Amaze + Citi Rewards Mastercard Amaze + Citi Rewards Mastercard |

Up to 29% | 4 mpd2 |

UOB Preferred Platinum Visa UOB Preferred Platinum Visa |

Up to 29% | 4 mpd3 |

UOB Visa Signature UOB Visa Signature |

Up to 29% | 4 mpd4 |

Maybank World Mastercard Maybank World Mastercard |

Up to 29% | 4 mpd |

| 1. Must select Transport as quarterly bonus category. Capped at S$1,000 per c. month (Lady’s) or S$750 per c. month (Lady’s Solitaire) 2. Capped at S$1,000 per s. month, 1% admin fee (min. S$0.50) for SGD transactions 3. Must use mobile contactless payments. Capped at S$600 per c. month 4. With min. S$1,000 spend in SGD in a s. month. Capped at S$1,200 per c. month |

||

SPC

Membership discount

All SPC&U Cardholders receive a 10% discount.

SPC&U Card SPC&U Card |

10% discount |

Credit card discounts

| Bank | Additional Discount |

|

+11% |

| +5% | |

| +5% (+S$3 off every S$51 nett petrol purchase) |

American Express cardholders enjoy a total discount of 21% at SPC, broken down into:

- 10% SPC&U card discount

- 5% AMEX discount

- 7.1% statement credit on final charge amount (registration required, capped at S$120 per card)

However, do note that American Express cards will not earn any miles on SPC transactions.

DBS and UOB cardholders enjoy a further 5% discount (total: 15%) at SPC, with UOB cardholders receiving a further S$3 off every S$51 nett purchase (i.e. after all station discounts and coupons are deducted).

SPC transactions are explicitly excluded from earning rewards with UOB cards, but like Shell, it’s different in practice. The current data points I have (and mind you, this could change at any time) suggest that:

- UOB Preferred Platinum Visa will not earn any miles at SPC

- UOB Visa Signature will not earn any miles at SPC

- UOB Lady’s Cards will earn bonus miles (3.6 mpd), but not base miles at SPC

- UOB Reserve will earn base miles (1.6 mpd) at SPC

- UOB PRVI Miles will earn base miles (1.4 mpd) at SPC

| Card | Discount | Earn Rate |

Amaze + Citi Rewards Mastercard Amaze + Citi Rewards Mastercard |

10% | 4 mpd1 |

Maybank World Mastercard Maybank World Mastercard |

10% | 4 mpd |

UOB Lady’s Card UOB Lady’s Card |

15% | 3.6 mpd2 |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

15% | 3.6 mpd2 |

UOB Reserve UOB Reserve |

15% | 1.6 mpd |

DBS Insignia DBS Insignia |

15% | 1.6 mpd |

DBS Vantage DBS Vantage |

15% | 1.5 mpd |

UOB PRVI Miles Card UOB PRVI Miles Card |

15% | 1.4 mpd |

DBS Altitude Card DBS Altitude Card |

15% | 1.3 mpd |

| 1. Capped at S$1,000 per s. month, 1% admin fee (min. S$0.50) for SGD transactions 2. Must select Transport as quarterly bonus category. Capped at S$1,000 per c. month (Lady’s) or S$750 per c. month (Lady’s Solitaire) |

||

Conclusion

Pumping petrol in Singapore is not always straightforward due to the confusing mix of discount schemes, and my preference is to keep things simple by sticking to Shell or Sinopec and using a UOB Lady’s Card or UOB Preferred Platinum Visa to pay.

There may be other combinations that make sense, however, depending on how much you value a mile and which petrol stations are along your route. When trading a smaller discount for a higher earn rate, always make sure the incremental miles justify it!

Forgotten about UOB ladies card?

yes! added it in.

The FAQ for uob/SPC promo states that “No UNI$ or SMART$ will be awarded on your UOB card for any spend at SPC, unless otherwise stated for any respective UOB card entitled privileges.”

Based on this UOB ppv should earn 4mpd if you paywave at SPC

you can try if you’d like, but i’m pretty sure you’ll be disappointed.

Amex cashback card is excluded from the T&C changes in March, so using that card offers effectively another 1+% rebate, bringing the total rebate to 22+%. Sinopec (especially with PPV) is still better for now, but this isn’t far behind.

SCB Visa Infinite gives additional 10.8% ($200 cap) if >$600 monthly spend. So if you spend >$2000, you will get 1.4mpd and ~25% discount. If you spend $600-1999, then 1mpd and ~25% discount. If you spend below $600, then 1mpd and 16% discount.

For Caltex, it would be good to include the miles that you can earn should you convert your Linkpoints to miles (I believe Linkpoints has a tie up with Asia Miles)

The math:

440 Linkpoints converts to 110 Asia Miles (4:1)

1 litre of Caltex fuel earns 3 linkpoints.

Therefore, 1 litre of Caltex fuel earns 0.75 miles.

thanks! have added a note about this.

SPC x UOB

can get up to 20% on a normal VISA/MC UOB card ( but no miles 🙁 )

S$3 off is only applicable with every gross S$60 spend (or S$51 nett after all station discount and/or coupons are deducted from the gross amount), for payment made with UOB Visa, MasterCard or UnionPay Credit/Debit Cards only.

https://www.uob.com.sg/personal/cards/cards-privileges/fuel-power/spc.page

UOB one card with Shell 20.88%

For SPC, doesn’t the POSB Everyday card give the best discount. Have been using it for ages, and don’t know whether I am still mechanically flipping out the card without checking the discount anymore.

20.1%, inferior to Amex in that aspect.

Believe you are referring to the AMEX Capitastar card?

as mentioned, this post talks about the best discounts you can get given the decision to pursue miles.

13% + 3% at Caltex for Favepay, link it to Grab and it’ll open other options like CRV or UOB One for Caltex.

https://www.caltex.com/sg/motorists/rewards-and-offers/promotions/favepay-caltex.html

Don’t bother with miles with petrol. Just go for the cheapest based on your CC discount

Juat to confirm, does UOB krisflyer card get miles or SMART points at SPC?

I am pretty sure I earn UNI$ for SPC transaction back in January this year. Just make sure you choose transport as the category.

UOB no longer lists SPC as smart$ merchant?

Hi Aaron, will this be updated soon?

it’s on the to update list…

Hi Aaron, found out recently that Grabpay option allows for 16% discount. Not the best payment method to use out there right now but this can be combined with the 0.9mpd for Amex HF or 1mpd topup for Amex cards going on now.

More info: https://www.caltex.com/sg/motorists/rewards-and-offers/promotions/grabpay-caltexgo.html

yup, will get that added.

Don’t forget cashback cards, where cashback is still given and points or miles aren’t. Eg smart$ and spc transactions still count towards uob one spend targets, and amex true cashback still earns 1.5% cashback at spc.

HSBC Revo don’t enjoy 4mpd at Sinopec? Contactless …

I seem to recall being told at Esso? that using contactless payments will cause credit cards discounts not to register. Does anyone know if this is true at Esso, or any of the other brands?

that’s the first i’ve heard of it. at other merchants, i’ve always been able to take advantage of credit card discounts even when paying with mobile phone.

Yes, I have been told numerous times by the Esso station staff. Was asked to pay with physical card instead of mobile contactless option. This needs to be investigated further and the impact on discounts/miles updated on this article

Shell no longer earns Smart$. Does that mean UOB PPV is now available to earn 14% + 4MPD at Shell?

nope!

https://milelion.com/2021/05/01/shell-increases-uob-credit-card-discount-ceases-smart-participation/

Its too confusing lol.

Which card gives you best on-site upfront discount for shell petrol station ignoring miles points?

I find this the easiest. So many card with cash back or miles have so many rules on min monthly spend etc.

Just looking for the easiest instant on the spot discount for shell. Can anyone help?

Thanks in advance

Stajin

Will this article be updated? 🙂

What about Amaze + WWMC at Sinopec during their regular 23% discounts? Able to get 4 mpd?

Yes.

Would the credit card xtra discount be applied if you’re using mobile payment? I.e. UOB card through Google pay.

yeah it should (Though note some of the comments re: Esso, which is odd).

ahh ok. Though must be physical card present for the 5% to kick in (at least for SPC since it is not manually entered by the cashier but through a tap on the POS).

How about overseas petrol stations? Only VS and Amaze? How PPV?

If you’re overseas best to use Amaze + CRMC (or Lady’s, possibly) to save on FX fees,

DBS Vantage gives 18% off at Esso and earns 1.5 mpd

Amex highflier is the best card ever. A pity only $30,000 a year

FYI DBS Vantage Card gives 1.5 MPD + up to 19% petrol discounts at Esso.

Does applying for the MayBank Shell Corporate card and then linking it to the Maybank world master card provides the best of both world of discount of 15% and 4mpd?

Can update the OCBC N90 MC to 1.3 mpd

done!

Hi, how would you get 10% discount + 4mpd with Amaze + Citi combo? Because Amaze technically is not a Citi branded card?

Thx

Are petrol usually considered as “Utilities”?

Anybody had issues adding amaze card to caltex go? Order keeps decline during the verification stage

Thanks for your kind work. I always refer to your articles to work out the best way to use the various CCs. In general, I go for more discount rather than miles for petrol as it is money saving upfront and with CCs shifting T&Cs, things can fall into the gap.

Just experimented with UOB cards and shell – did get bonus points for PPV but not VS.

Tested at SPC, UOB Ladies (with Transport cat) not awarded bonus points).

thanks for the dp, will update

Tested at SPC on 29th April. Lady’s Solitaire transport cat. Got the bonus points on 2nd May

Lady’s card with Transport cat used at SPC, transaction posted on 1 Jul.

No base UNI$ received but UOB chat CSO confirmed bonus UNI$ will be awarded.

hello, how about Shell Fleet Card that offers 21% outright? would that be better option than credit cards offering?

im still in the midst of determining what miles card to get.

but curious for Caltex:

would linking your citi rewards card ($1 -> 4 miles for online shopping) or perhaps krisflyer UOB card ($1 -> $3miles for online shopping) to CaltexGo app (17% if we link citi card) result in both perks?

Or is paying via caltexGo app not considered “online”

Hi, I have been using the CaltexGo app with the Citi Rewards card. It does clock it as 4mpd while getting the 17% petrol discount. However, have not tried with the Krisflyer UOB card.

UOB VS paired with Kris+ at Esso will earn 4mpd too?

For comparison purposes, would it be possible to set say, a pump of $120 of petrol and see how much the discounts at each station would give us?

In terms of nett price paid, I believe the lowest is Smart Energy. They currently offer RON95 at $2.03 for members. You also earn points worth $0.005 (excluding GST component) on petrol pumped, which can be used to redeem things in their convenience store. They work on a prepaid/top-up system. You can earn 4 mpd using UOB VS or PPV (contactless) when you top-up the fuel card. There are only 2 stations in Singapore though – Mandai and Jalan Buroh.

can someone confirm if UOB PPV still can the uni bonus point at shell? is it more worth it to use uob one with higher upfront discount or get the 4mpd (if it’s still available)

Dont think uob pref plat card has 4mpd anymore

For Shell, UOB Lady’s and Lady’s Solitaire does not offer 17% for using SmartPay. Only the UOB Reserve Card offers an additional 3% discount for using SmartPay.

Will pumping Esso with UOB Pref. Plat. Visa paired with Kris+ works?

What about DBS Esso?

Not really a miles card

Yes it’s not a miles card but how is it comparable to the rest (value; cashback vs miles etc)?

Hi I think you have to highlight the DBS Esso Card, as it provides immediately a cashback and bonus benefits. The topic of this article – which is the best CC’s for petrol, so all options have to be highlighted even though the end benefit is cashback.

You can check cashbacklion.com for cashback articles

What about the Trust Cashback card? 17% discount + 1% cashback as part of card benefit + NTUC LinkPoints to earn @ Caltex. While not a miles card, seems like a good deal.