Hotel stays are a great opportunity to rack up miles towards your next trip. However, given the variety of ways you can book and pay, picking the right credit card isn’t always straightforward.

In this post, we’ll look at different scenarios for booking hotels, and the best card to use in each.

How do hotel transactions code?

When determining the right card to use for hotel transactions, we need to consider three things:

- Merchant Category Code (MCC)

- Whether the transaction is processed online or offline

- Whether the transaction is in SGD or foreign currency (FCY)

Merchant category code

| 🏨 Pay directly with hotel | 🌐 Pay via OTA |

|

|

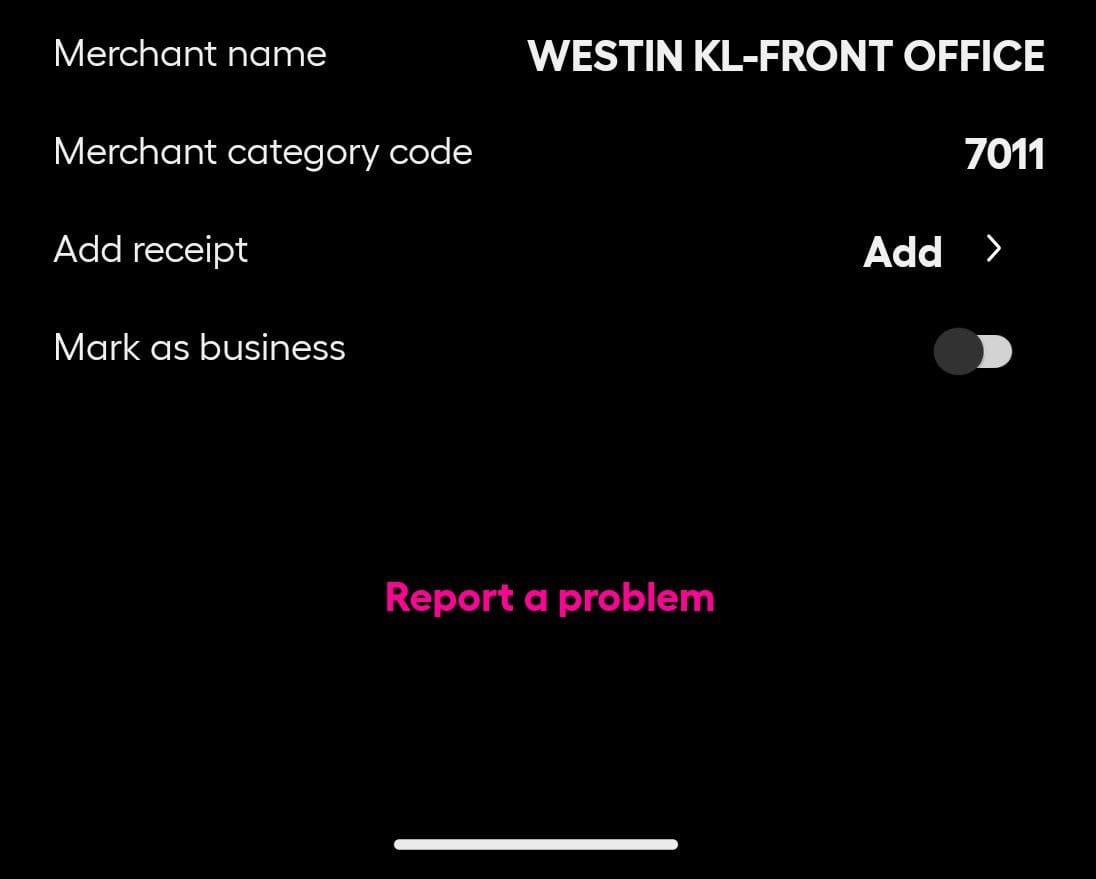

If you’re paying directly at the hotel front desk or on its official website, the transaction will code in the MCC 3501-3999 range for major hotels, or MCC 7011 for smaller hotels and Airbnb.

| ⚠️ Important Note |

|

Just because a hotel is part of a chain doesn’t guarantee it will code under the chain’s corresponding MCC in the 3501-3999 range. As shown in the screenshot below from the Westin Kuala Lumpur, it’s possible for chain hotels to code as 7011.

|

If you’re paying for a hotel through an online travel agent (OTA) like Agoda, Booking.com, Expedia, Hotels.com or Trip.com, the transaction will code as MCC 4722.

Do keep in mind that booking a hotel via an OTA is not necessarily the same as paying for a hotel via an OTA.

- If you book via an OTA and pay at the time of booking, your transaction will code as MCC 4722

- If you book via an OTA and choose a “pay at hotel” rate, your transaction will code as MCC 3501-3999/7011

In case you’re uncertain about the MCC, here are three ways of looking it up before making a purchase:

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

| Note: “Ease of use” and “reliability” are all relative. HeyMax already provides a solid baseline for reliability, and the DBS digibot is still simple enough to use, despite requiring more steps than the other two methods. | ||

Online/offline processing

Virtually every hotel will require a credit card to secure your booking. However, depending on the rate you’ve selected, payment may either be made at:

- The time of booking (for a non-refundable rate, or a rate which involves a deposit)

- The time of check-in/check-out (for a refundable rate)

The distinction is important because certain cards award bonuses for online spend only.

| ⚠️ Non-refundable rates |

| I have encountered situations with certain hotels where supposedly prepaid and non-cancellable rates were charged offline at the hotel, at the time of check-in. I can’t say why that’s the case, so when in doubt, it’s best to email the hotel to find out the exact billing arrangement. |

SGD or FCY

If you’re staying at an overseas hotel, then you can simply use any card which offers bonuses for FCY spend.

Overseas hotels are fertile ground for the DCC scam, so be sure to pay special attention. Always opt to pay in FCY instead of SGD, and if you’re not given the choice, be sure to raise a dispute!

Stays booked directly with the hotel

If you’re booking directly with the hotel, the following cards can be used to earn up to 4 mpd.

| 🏨 Bookings via Hotel (MCC 3501-3999, 7011) |

||

| Card | Earn Rate | Remarks |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd Online |

Max S$1K per c. month Review |

DCS Imperium Card DCS Imperium CardApply |

4 mpd FCY only |

Min. S$4K FCY spend per c. month Review |

HSBC Revolution HSBC RevolutionApply |

4 mpd |

Max S$1.5K per c. month. Ends 31 Mar 26. Must use online or contactless spend. Review |

Maybank XL Rewards Card Maybank XL Rewards CardApply |

4 mpd | Min. spend S$500 per c. month, capped at S$1K per c. month Review |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd |

Max S$1K per c. month. Must choose Travel as bonus category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd |

Max S$750 per c. month. Must choose Travel as bonus category Review |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd |

Max S$600 per c. month. Must use mobile contactless Review |

UOB Visa Signature UOB Visa Signature Apply |

4 mpd |

Min S$1K max S$1.2K spend per s. month. If SGD, must use contactless Review |

StanChart Beyond Card StanChart Beyond CardApply |

3-4 mpd FCY only |

3 mpd for regular, 3.5 mpd for PB, 4 mpd for PP. No cap Review |

Maybank Visa Infinite Maybank Visa InfiniteApply |

3.2 mpd FCY only |

Min. spend S$4K per c. month Review |

Maybank World Mastercard Maybank World MastercardApply |

3.2 mpd FCY only |

Min. spend S$4K per c. month, 2.8 mpd with min. spend S$800 per c. month Review |

StanChart Visa Infinite StanChart Visa InfiniteApply |

3 mpd FCY only |

Min. spend S$2K per s. month, no cap Review |

BOC Elite Miles Card BOC Elite Miles CardApply |

2.8 mpd FCY only |

No cap Review |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

2.8 mpd FCY only |

Min. spend S$800 per c. month Review |

| All other options earn less than 2.8 mpd |

||

A few points to note:

- For the DBS Woman’s World Card, your transaction must be processed online in order to earn the 4 mpd bonus rate

- If you’re using the UOB Visa Signature Card and the spend is charged in SGD, you must pay via contactless spend. If the spend is in FCY, there is no such requirement

- While the UOB Lady’s Card includes most of the MCC 3501-3999 range in its Travel category, it doesn’t cover every single MCC. Among the exclusions are some hotels in Las Vegas, as well as the Waldorf Astoria chain

Stays booked through OTAs

If you book your hotel through an OTA, you could potentially earn up to 10 mpd with the right card.

There are two possible scenarios here:

- You book through the OTA’s public landing page

- You book through the OTA’s special landing page for certain cardholders (e.g. Citi x Agoda)

Remember: the assumption here is that you choose the “pay online” rate. If you choose a “pay at hotel” rate, then your card is only charged at the time of check-in, and you should refer to the previous section.

Public landing page

| 🏨 Bookings via OTA (MCC 4722) |

||

| Card | Earn Rate | Remarks |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd |

Max S$1K per c. month Review |

DCS Imperium Card DCS Imperium CardApply |

4 mpd FCY only |

Min. S$4K FCY spend per c. month Review |

Maybank XL Rewards Card Maybank XL Rewards CardApply |

4 mpd | Min. spend S$500 per c. month, capped at S$1K per c. month Review |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd |

Max S$1K per c. month. Must choose Travel as bonus category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd |

Max S$750 per c. month. Must choose Travel as bonus category Review |

UOB Visa Signature UOB Visa Signature Apply |

4 mpd FCY only |

Min S$1K max S$1.2K FCY spend per s. month Review |

StanChart Beyond Card StanChart Beyond CardApply |

3-4 mpd FCY only |

3 mpd for regular, 3.5 mpd for PB, 4 mpd for PP. No cap Review |

Maybank Visa Infinite Maybank Visa InfiniteApply |

3.2 mpd FCY only |

Min. spend of S$4K per c. month. No cap Review |

Maybank World Mastercard Maybank World MastercardApply |

3.2 mpd FCY only |

Min. spend of S$4K per c. month, 2.8 mpd with min. spend of S$800 per c. month. No cap Review |

StanChart Visa Infinite StanChart Visa InfiniteApply |

3 mpd FCY only |

Min. spend S$2K per s. month. No cap Review |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

2.8 mpd FCY only |

Min. spend of S$800 per c. month. No cap Review |

BOC Elite Miles Card BOC Elite Miles CardApply |

2.8 mpd FCY only |

No cap Review |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit CardApply |

2.4 mpd* | With min. S$1K spend on SIA Group per m. year. No cap Review |

| * For Agoda, AirBnB, Booking.com, Expedia, Hotels.com, Kaligo, Traveloka, Trip.com, UOB Travel |

||

Special landing page

| 🏨 Bookings via OTA (Paid for online) |

|||

| Agoda | Expedia | Kaligo | |

Citi PremierMiles Card Citi PremierMiles Card |

7.2 mpd | – | 10 mpd |

OCBC 90°N OCBC 90°N |

Up to 7 mpd | – | – |

UOB PRVI Miles UOB PRVI Miles |

8 mpd | 8 mpd | – |

These bookings must be made through specific landing pages, which I’ve linked to in the table above. You will also be required to make payment at the time of booking.

A word of warning: bookings made through these pages may be more expensive than if you were to go through the generic website. You should make a point of comparison shopping, and should the price on the special landing page be higher, you need to decide if the differential is worth the miles.

Be careful with Agoda DCC!

Since we’re talking about OTAs, here’s something important to know.

Agoda processes Mastercard transactions outside of Singapore (in Hong Kong to be precise). If your hotel booking prices in SGD, and you use a Mastercard to pay, most banks including DBS and UOB will charge a 1% cross-border fee (it’s conceptually the same as walking into a store in Hong Kong and choosing to pay in SGD). You can avoid the 1% fee by paying with Atome.

Visa transactions are processed in Singapore, so if you’re using a BOC or UOB card, you will earn miles at the SGD rate, regardless of which currency you pay in.

What if I’m buying hotel points?

Purchases of hotel points from Points.com (which processes sales for Hilton Honors, IHG, Marriott Bonvoy and World of Hyatt) will not code as hotel transactions.

Instead, these code as USD transactions under MCC 7399 (Business Services Not Elsewhere Classified). You can use the following cards to earn up to 4 mpd.

| Card | Earn Rate | Remarks |

Citi Rewards Card Citi Rewards CardApply |

4 mpd | Cap of S$1K per s. month |

DCS Imperium Card DCS Imperium CardApply |

4 mpd | Min. S$4K FCY spend per c. month, otherwise 2.4 mpd |

Maybank XL Rewards Maybank XL RewardsApply |

4 mpd | Min S$500 per c. month, cap of S$1K per c. month |

UOB Visa Signature UOB Visa SignatureApply |

4 mpd | Min S$1K, max S$1.2K FCY spend per s. month |

StanChart Beyond Card StanChart Beyond CardApply |

3-4 mpd | 3 mpd for regular, 3.5 mpd for PB, 4 mpd for PP. No cap |

Maybank World Mastercard Maybank World MastercardApply |

3.2 mpd | Min. S$4K per c. month, no cap. Earn 2.8 mpd with min. S$800 per c. month |

Maybank Visa Infinite Maybank Visa InfiniteApply |

3.2 mpd | Min. S$4K per c. month, no cap, otherwise 2 mpd |

StanChart Visa Infinite StanChart Visa InfiniteApply |

3 mpd | Min S$2K per s. month, no cap, otherwise 1 mpd |

BOC Elite Miles Card BOC Elite Miles CardApply |

2.8 mpd |

No min. spend or cap |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

2.8 mpd | Min S$800 per c. month, no cap, otherwise 1.2 mpd |

| S. Month= Statement Month | C. Month= Calendar Month | ||

Remember, you can pair the Citi Rewards Card with Amaze to earn 4 mpd on Points.com purchases, while paying lower FCY fees than banks.

Do not use HSBC cards or the DBS Woman’s World Card for Points.com purchases, as MCC 7399 will not earn bonus points. You should also avoid using the Chocolate Visa Card, as MCC 7399 is now considered a “bill payment” and can only earn up to 100 Max Miles each month.

Conclusion

Using the right card for hotel bookings can earn as much as 10 mpd towards your next trip, but be careful because there’s a lot of variables at play: booking direct vs an OTA, paying online versus at the hotel, paying in local currency vs FCY.

If you’re booking through a special OTA website for bank customers, do take care that you’re not paying significantly more. Extra miles are nice, but not if you’re paying over the odds for them!

I’ve encountered a situation where booking directly through the hotel online with advance payment does not earn 4mpd on the WWMC. Guessing that this is because the hotel took the credit card info I filled and separately input them into their terminal, making it an “offline” transaction. In such cases, would it be correct to say that the UOB Lady’s card will be a safer bet if we are unsure how it’s processed since for Lady’s card it does not matter whether it’s offline or online?

Thanks for the comment and this is useful for my future travels.

Can the DBS WWMC be used for hotel points purchases, or is that excluded?

not excluded explicitly, but real world data points say no 4 mpd unless appeal, and even appeal is YMMV

You mean the HSBC Revolution doesn’t give 4mpd for stays booked via Agoda?? Oh gosh….

it will until january 2024.

Why no mention of Citi prestige card?

Because this is about the “best credit cards” rewards? Prestige will be good if 4NF can be triggered, otherwise, its mpd is nowhere near 4mpd.

If I book a hotel via one of the public landing page websites, by they say that payment will be charged directly by property, that will screw up my miles right?

Is it common to pay over counter for hilton members? It’s always that case for IHG

Needs to be updated – HSBC Revo excludes hotels now. Also don’t think it’s still 6mpd for Lady Solitaire

Does UOB Pref Plat give 4 mpd for Stays booked directly with the hotel still? since the MCC 3000-3999 is not explicitly listed as included in the card T&Cs

I believe UOB PPV gives 4 mpd for Mobile Contactless Transactions at the hotel, not online. Aaron can you confirm?

must be in -person

When booking through websites like Agoda, do they need to be charged in SGD for the bonus points? Or charging in the local currency still earns the bonus points?

Cloud you please clarify why UOB Visa Signature is applicable for Points.com transactions

(Paid for online)? is it FCY only?

Doesn’t HSBC revolution exclude 4722 for earning 4mpd?

yes that’s right. have removed it from the bottom table, thanks.

To get 7.2mpd via agoda using Citi PremierMiles Card, card owner has to be lead guest. Meaning no booking for family/ friends’ trips if card owner is not travelling too.

UOB PPV card can earn 4mpd when you book from hotel website directly? I thought this is still considered a travel transaction? (which ppv card doesn’t qualify for 4mpd)

see the footnote:

4. Must pay in person, using mobile payment (do not tap physical card)

For Section ‘Public Landing Page’, is it need to update for UOB Visa Signature?

Currently states:

Min S$1K max S$2K FCY spend per s. month

Should be max $1.2k?

updated, thanks!