At the end of each year, I come up with a list of things I’d love to see happen in the miles and points game. Some of them are pure flights of fancy, but other wishes have actually come true!

2015 Christmas Wishlist

| 🎄 2015 Christmas Wishlist |

|

2016 Christmas Wishlist

| 🎄 2016 Christmas Wishlist |

|

2018 Christmas Wishlist

| 🎄 2018 Christmas Wishlist |

|

2019 Christmas Wishlist

| 🎄 2019 Christmas Wishlist |

|

2020 Christmas Wishlist

| 🎄 2020 Christmas Wishlist |

|

2021 Christmas Wishlist

| 🎄 2021 Christmas Wishlist |

|

2022 Christmas Wishlist

| 🎄 2022 Christmas Wishlist |

|

So, in keeping with that tradition, here’s The MileLion’s Christmas wishlist for 2023, in no particular order of preference- or realism, for that matter.

(1) Scoot to resume Koh Samui flights

Prior to COVID, the SIA Group used to serve Koh Samui through SilkAir, with twice-daily flights operated by the Airbus A319.

However, ever since SilkAir was folded into Singapore Airlines and the A319s returned to lessors, the Group has lacked an aircraft capable of serving the island’s small airport. In their absence, Bangkok Airways has had a monopoly on the route, with a commensurate effect on pricing.

But earlier this year we learned that Scoot was acquiring nine Embraer E190-E2 aircraft, which would be well within the operating limits of type-restricted airports like Koh Samui. This makes me think it’s only a matter of time before we hear a happy announcement regarding this route, and since the first E190 is coming in March, I’m hoping we’ll hear something soon.

I guess the unfortunate thing is that even if Scoot does add Koh Samui, it still won’t be a good use of miles. KrisFlyer redemptions on Scoot are revenue-based, at a fixed rate of 1,050 miles=S$10. This means you’re still at the mercy of cash prices, a far cry from pre-pandemic days when you could reliably redeem SilkAir awards from 12,500 miles each way (or 8,750 miles during Spontaneous Escapes!).

Fortunately, you can redeem Qatar Airways Avios for Bangkok Airways flights at just 6,000 miles each way, which represents much better value.

(2) Easing of AMEX HighFlyer point transfer restrictions

The AMEX HighFlyer Card has the highest earn rate of any general spending card at 1.8 mpd, and I’m sure many cardholders are sitting on a huge pile of HighFlyer points from the days when you could earn them on GrabPay top-ups.

HighFlyer points can be converted to KrisFlyer miles at a 1:1 ratio, but some restrictions apply:

- Each HighFlyer account can only be linked to a maximum of five selected KrisFlyer accounts for the purpose of converting HighFlyer points to KrisFlyer miles

- Each HighFlyer account is only allowed to convert HighFlyer points to a maximum of 150,000 KrisFlyer miles per calendar year

- Each selected KrisFlyer account may receive a maximum of 30,000 KrisFlyer miles converted from HighFlyer points per calendar year, regardless of which HighFlyer accounts the points are converted from

This effectively limits your annual “cash out” to 150,000 miles, or less if you can’t think of four people you’d want to share your hard-earned points with.

While you can redeem HighFlyer points for lounge passes or Scoot vouchers, or use them to pay for flights, these represent much inferior value. If American Express and Singapore Airlines want to drive adoption of this card, this limit needs to go, and fast.

(3) Sensible implementation of anti-malware measures

Following a spate of malware-related scams, MAS has ordered banks to tighten their security measures so grandma doesn’t lose her life savings buying durians online.

Here’s the thing though: I’m quite certain the MAS directive said “improve security”, not “make your apps crappy and totally unusable”.

Unfortunately, it seems like many banks heard the latter:

- OCBC kickstarted this fiasco with its draconian “no apps from non-official app stores” policy (the bank later clarified that it was only blocking certain non-official apps with accessibility permissions- something that was clearly not communicated to its customer service and social media teams)

- HSBC upped the ante by forcing its app to crash if it detected any apps with accessibility permissions- even if those were official tools like Talkback (which helps visually impaired users navigate apps). The best part? No warning message. Frustrated users had to find out what was wrong from message boards and Google Play reviews

- Citi will also bar you from using its app if it detects “unauthorised software” on your phone- the problem is, it won’t tell you what the naughty app is, so you have to guess and check

I have nothing against well-conceptualised ideas that strike a balance between protecting the vulnerable and minimising inconvenience to the general public. In fact, I think the recently-launched “money lock” features by DBS, OCBC and UOB are great initiatives, and should have been introduced a long time ago.

But banks are taking the easy way out by adopting heavy-handed measures which punish the many for the mistakes of a few. That’s not to mention the lost productivity and untold frustration, all of which could have been avoided with clearer communication and better UX.

What a complete and utter mess this is.

(4) Unveiling of SIA’s B777X cabin products

Singapore Airlines was originally supposed to receive its first Boeing 777-9 in 2021. As things stand, it’s unlikely we’ll see any of them in the fleet until 2025, or even 2026 since SIA isn’t the launch customer.

While this is hardly the airline’s fault, it’s now in the awkward position of having a long-haul Business Class seat (the 2013J) which was never meant to be in service this long. It’s not a terrible seat by any means, but it certainly doesn’t get pulses racing the way Qsuites does.

SIA has already finalised the design of the next-generation First and Business Class seats on the B777X. However, it’s keeping its cards close to the chest, presumably keen to avoid a Lufthansa-esque farce where a new seat is announced way in advance and then goes MIA for donkey years.

I understand the reticence, but I think the airline is falling behind when it comes to hard product competitiveness. It could really stand to generate some buzz about the new seats and get people talking. Assuming SIA can get its hands on some B777-9s in late 2025/early 2026, perhaps an end-2024 unveil might not be that far-fetched?

(5) Points pooling for HSBC credit cards

When HSBC launched the TravelOne Card in May 2023, it also introduced a different type of points currency:

- HSBC points earned on the TravelOne Card could be transferred to 12 different airline and hotel partners (now 20) with no conversion fees

- HSBC points earned on all other HSBC cards could only be transferred to KrisFlyer or Asia Miles, with the regular S$43.20 annual conversion fee

The lack of points pooling meant that even though HSBC TravelOne Card points were valuable, it’d be difficult to accumulate a critical mass- a key weakness I identified in my analysis.

However, HSBC teased that points pooling was on their roadmap, and that HSBC Revolution, HSBC Visa Infinite and other cardholders could eventually combine their points across cards for redemption.

No timeline was provided, but surely it has to come in 2024?

(6) Common sense waitlist improvements

The KrisFlyer waitlist is the source of a lot of agony and anxiety for KrisFlyer members.

But it doesn’t have to be. I recently wrote about some low-hanging opportunities to improve the KrisFlyer waitlist, namely:

- Capping the number of waitlists members can add themselves to

- Requiring periodic waitlist reconfirmations

- Shortening the time members have to confirm cleared waitlists

- Giving elite members a limited number of “force clears” each year

The idea behind these initiatives is to discourage waitlist spamming, remove “zombies” from the waitlist, prevent indecisive members from bottlenecking the waitlist, and rewarding elite fliers with the ability to guarantee a waitlist clear on important trips.

The last time we saw changes to the waitlist was in 2019, so hopefully 2024 is the year when more common sense enhancements are made.

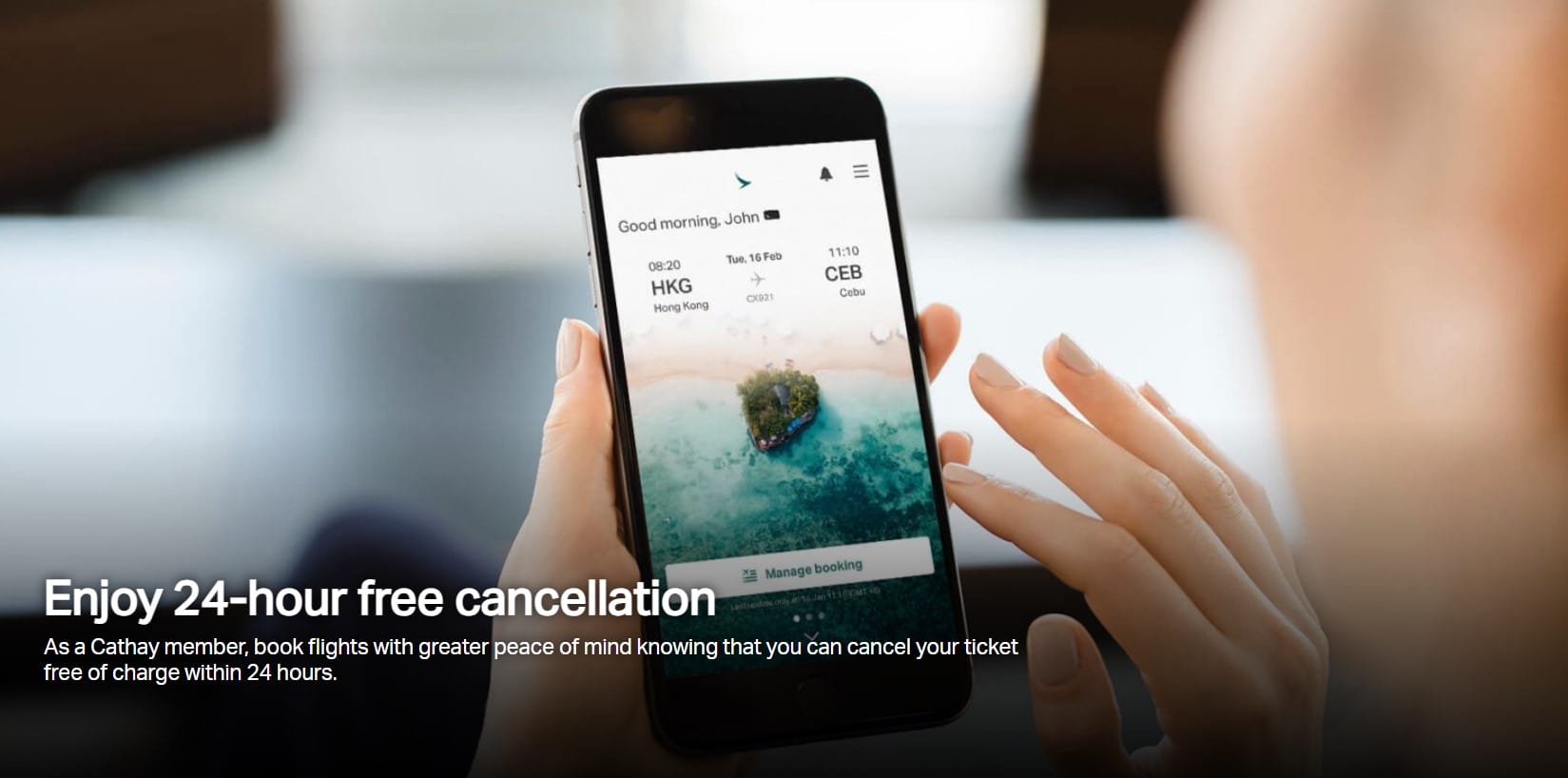

(7) 24 hour free cancellation for tickets

Have you ever marvelled at how asymmetrical the rules on mistakes are?

If an airline accidentally fat fingers a fare, most jurisdictions (including Singapore) say that it is not legally required to honour it. On the other hand, if a customer messes up their name, dates, flights, or any other information during the booking process, they’re on the hook for hefty change fees. In a worst case scenario, they might even have to forfeit the entire ticket!

There’s clearly something wrong with this picture, and some countries like the USA, Brazil and India have so-called “oops laws” which give customers a certain window to make changes or cancel their ticket, free of charge. Even where it’s not the law, some airlines have voluntarily introduced such policies, like Qantas and Cathay Pacific.

I would love to see similar protections granted in Singapore, either by legislation or voluntarily.

(8) Redeeming GHA DISCOVERY points outside a stay

GHA revamped the DISCOVERY loyalty programme at the end of 2021, introducing new tiers and replacing Local Experiences with Discovery Dollars (D$).

This basically turned the loyalty programme into a cashback scheme, though as Accor Live Limitless has shown, there’s still a market for that (it benefits customers who redeem points when hotel rates are unusually low).

The problem is that D$ can only be used during a stay. You can’t pop into a hotel and have a meal or enjoy a spa treatment and spend them. GHA has been saying that they’ll add non-stay redemptions “soon”, but it’s been two years and I don’t know if we’re any closer.

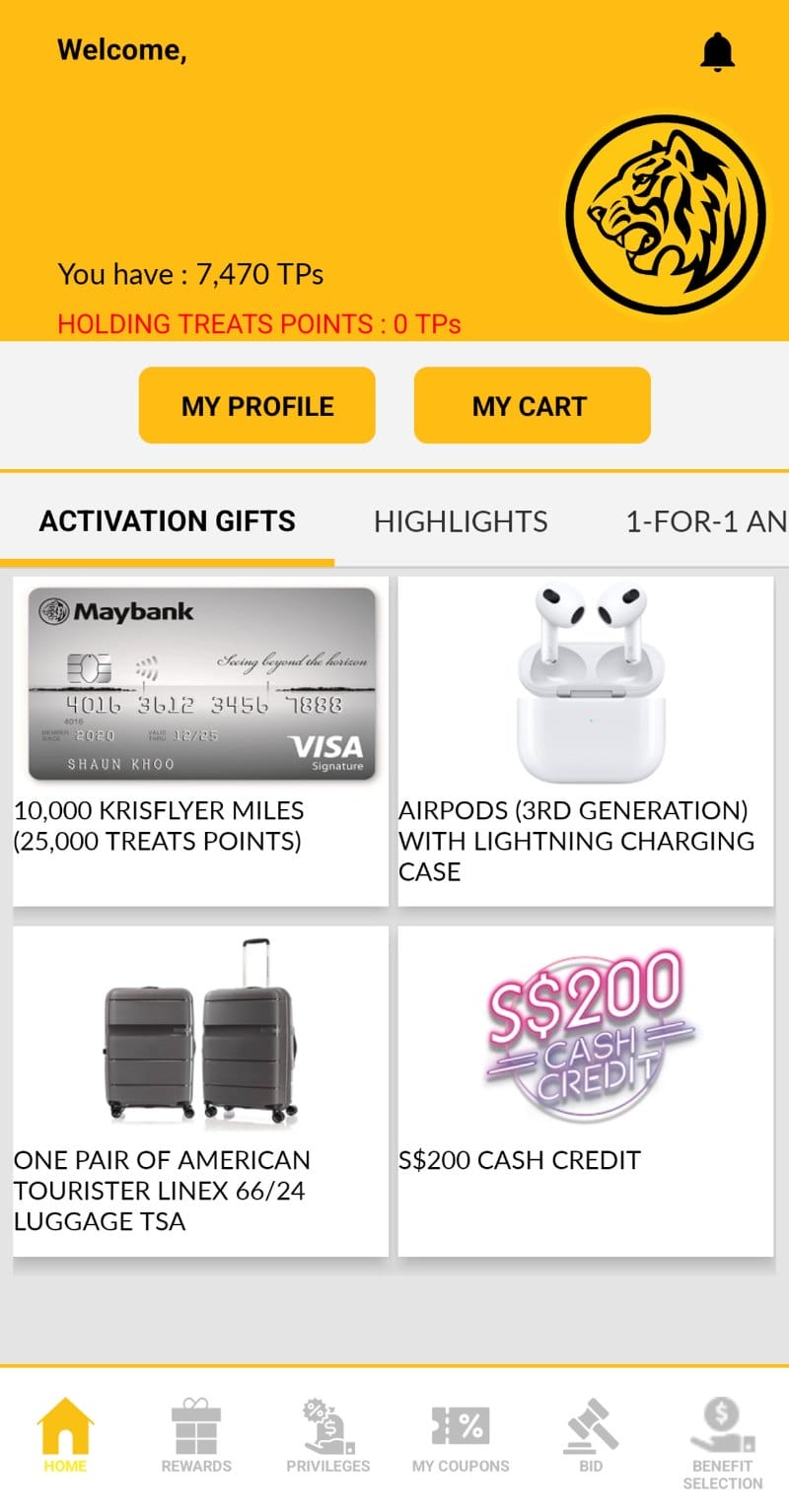

(9) More rapid gift fulfilment

And finally, since we’re talking Christmas gifts, my one revelation this year was that gift fulfillment doesn’t need to take ages.

I applied for a Maybank Horizon Visa Signature to take advantage of its uncapped 3.2 mpd on foreign currency spending (even on donations, insurance and education), plus Maybank sign-up gift. The requirement was to spend S$600 per month for the first two consecutive months. I spent S$1,200 in a single month, and five days later, received an SMS telling me my welcome gift was available for redemption.

It felt too good to be true, but there it was when I fired up my TREATS SG app. I picked the cash credit and got it credited to my statement a few days later.

In a market where some customers wait up to half a year for their gifts, this is just ludicrous speed. If Maybank can do it (and they’re not particularly known for their technological prowess, I can tell you that!) why not other banks?

Conclusion

So that’s my hopes and dreams for the miles and points game in 2024! I’d love to hear what’s on your wishlist too, and whether you think there’s a snowball’s chance any of mine will be happening.

What’s on your miles and points wishlist this year?

1. I wish Amex will scrap the platinum reserve card.

2. I wish Amex will launch Titanium Card between plat charge and centurion.

3. Revise MR earn rates on Plat Charge.

> HSBC points earned on all other HSBC cards could only be transferred to KrisFlyer or Asia Miles, with the regular S$27 conversion fee.

Did I miss something but I thought HSBC only has the $40 “annual fee” for unlimited redemptions in a year? No option for a one-time $27 fee for a single redemption.

Right- too much eggnog.

Stop crying about bank app when they are obviously right from the perspective of general common sense

Wrong.

1 – I wish UOB to continue 6mpd for the Lady’s Card past February.

2 – I wish Citibank Payall has offerings sub $10/1000 once again.

3 – I hope that no other bank Nerf’s Amaze (as DBS did).

1. For SQ to restrict KF lounge access only to guests departing from the terminal where the KF is located to reduce overcrowding in T3