I’ve been collecting miles and points for just over 10 years now, and in that time I’ve seen some absolutely insane promotions, like an uncapped 4 mpd on insurance, an uncapped 5 mpd on overseas spend, or even an uncapped 8 mpd everywhere!

I figured now would be as good a time as any to record them all down for posterity (and maybe make newcomers feel a little FOMO). While there have also been some wild deals on the airline side — like Garuda offering 90% off award tickets! — I’m going to be limiting this to credit cards.

So here we go, the 10 best deals I’ve seen, in no particular order of merit (though #10 WilL ShOCk y0u!!1one!).

(1) Imagine and FEVO: 4 mpd everywhere!

Once upon a time, there were two prepaid debit cards called Imagine and Fevo.

These were unremarkable, in and of themselves. What was remarkable was that DBS Woman’s World Cardholders could earn 4 mpd on top-ups for either card, capped at S$2,000 per month. The funds could then be spent in stores, effectively creating an “offline to online” hack well before Amaze or GrabPay existed.

Moreover, because points were earned on the top-up itself, it didn’t matter if the actual merchant you were spending at was otherwise rewards ineligible. For example, I could use my Fevo to pay insurance premiums, government services, or utilities, and still earn 4 mpd in the process (not that many of these were excluded at the time; remember, this was 10+ years ago!).

Imagine was the more popular of the two, because top-ups over S$50 were free, while Fevo had a 1% “convenience fee” regardless of amount (the convenience of having a Mastercard over AMEX, I suppose). That said, Fevo let you customise your card any way you wanted, which led to some rather…unique designs.

Sadly, Imagine was discontinued in September 2016, and Fevo quickly faded into irrelevance once the banks nerfed rewards for top-ups, before quietly disappearing in 2020.

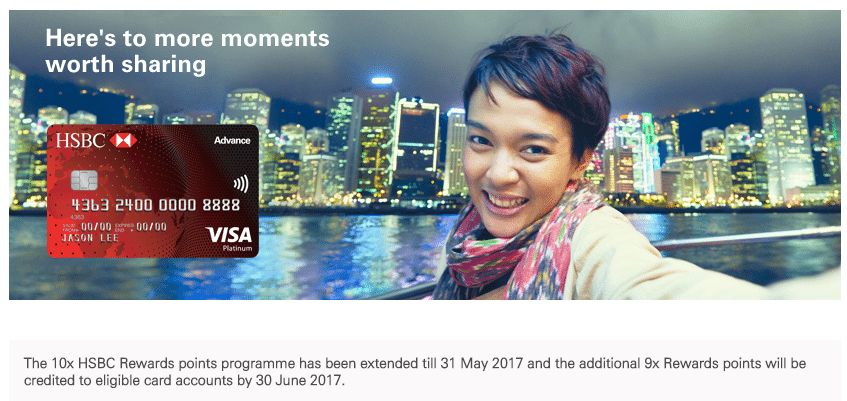

(2) HSBC Advance: Uncapped 4 mpd on dining and online spend (even insurance!)

The HSBC Advance might be a cashback card today, but in its former life it was a rewards card, and an incredible one at that.

From 2016 to 2017, it offered an uncapped 4 mpd on local dining, entertainment and online spending — even insurance premiums. And no, this wasn’t some oversight. HSBC explicitly mentioned it on their website!

The only catch was that you had to open a HSBC Advance account, though the requirements were fairly modest at S$30,000, or a recurring monthly deposit of S$2,500 per month for 12 months.

The promotion was extended several times but eventually ended in June 2017, when the HSBC Advance joined the dark side and became the cashback card we now know.

(3) OCBC Titanium Rewards: 4 mpd on all mobile payments!

When OCBC rebooted its Titanium Rewards card in October 2016, the new-and-improved version had one killer feature: 4 mpd on all mobile payments.

Yes, this was capped at S$12,000 per membership year, but you could always get the Blue and Pink versions to double your bonus cap, and 96,000 miles a year would be more than enough for a round-trip Business Class ticket to Tokyo back then.

But remember, this was 2016. Contactless payments weren’t ubiquitous yet, and many terminals were still swipe or chip only. So you couldn’t quite earn 4 mpd everywhere…unless you had a Samsung phone with Magnetic Secure Transaction (MST).

MST imitates a magnetic pulse similar to a card swipe, enabling Samsung Pay to be used even at a non-contactless terminal. I remember watching an MST transaction for the first time, and thinking it was some kind of black magic.

Sadly, the main limitation wasn’t technical, but human. There were cashiers who flat out refused to allow cardholders to use MST, insisting that their terminals didn’t support contactless payments (and wouldn’t let you touch the terminal for fear you’d pull a fast one).

So if you had the right phone — and the right powers of persuasion — this promotion allowed you to earn 4 mpd practically everywhere. Moreover, the OCBC Titanium Rewards had an annual bonus cap back in those days, so there was nothing stopping you from spending the entire amount in a single big ticket transaction. I personally used this to pay the deposit for my wedding banquet at the Grand Hyatt.

The promotion was extended for 2017, and then again at the start of 2018, before OCBC pulled it early in August 2018.

(4) The GrabPay Mastercard days!

This wasn’t a promotion as such, but it’d be strangely remiss if we didn’t talk about the wonderful period where GrabPay and the GrabPay Mastercard let you earn 4 mpd everywhere, even on AXS bill payments and CPF top-ups.

When GrabPay launched in 2017, top-ups were treated like any other retail transaction. And while GrabPay initially struggled with limited acceptance, a breakthrough came in 2019 with the launch of the physical GrabPay Card, which allowed users to spend their balance at millions of stores that accepted Mastercard.

GrabPay was basically the conduit that made bonus categories irrelevant. So long as you had a card that earned miles for GrabPay top-ups (and there were many), you could top-up GrabPay and spend the funds at any merchant you wished, even if it was otherwise excluded from rewards.

But eventually, the banks started cracking down. DBS, BOC and UOB excluded GrabPay top-ups for their individual cards, before Mastercard reclassified top-ups as MCC 6540 in December 2019, effectively killing rewards for all remaining Mastercards. Top-ups survived on Visa cards (all hail the Citi Rewards Visa!), until Visa reclassified GrabPay as a stored value facility in July 2020.

The game wasn’t up yet though, as the AMEX HighFlyer and AMEX True Cashback Card still earned rewards, and when AXS started accepting GrabPay once again in 2021, it looked like the good times were back. All you had to do was top-up your account with an AMEX card and then pay whatever bills you wanted with AXS to earn free miles or cashback (who needs CardUp?!). There was even a brief period where you could use GrabPay to top-up your CPF!

As we all know, that didn’t last very long. AXS eventually blocked GrabPay, AMEX excluded top-ups completely, and Grab discontinued the GrabPay Card in June 2024, drawing an end to a sometimes unbelievable period in the miles and points game.

I’ve written a separate article charting the rise and fall of GrabPay, which is well worth a read for anyone feeling nostalgic.

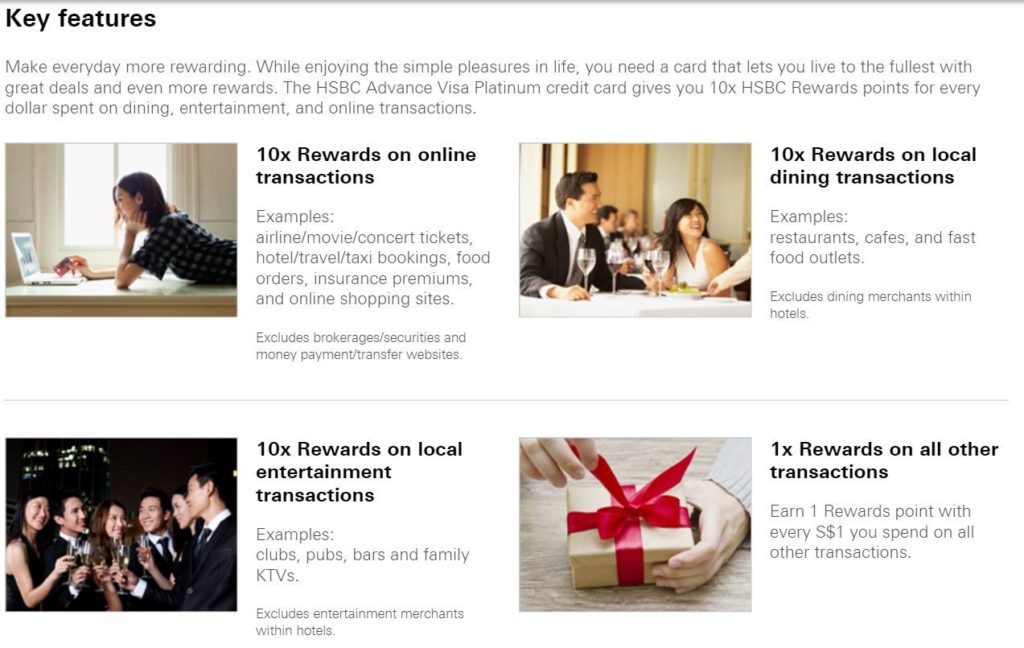

(5) BOC Elite Miles: Uncapped 2/5 mpd!

It’s hard to believe today, but there was a time when the BOC Elite Miles Card was the best miles card in Singapore, period.

At the time of launch in July 2018, it offered an uncapped 2 mpd on all local spend, and an uncapped 5 mpd on all FCY spend, with almost no rewards exclusions— not even for GrabPay and YouTrip top-ups. They even threw in 4x Plaza Premium lounge passes and a crappy piece of luggage, and waived the first year’s fee. My goodness, what a rush.

This was never meant to last forever, but it was still a compelling card even after the bank reduced earn rates to 1.5/3 mpd for local/FCY spend at the end of the year. Methinks they also had a bit of buyer’s remorse after they learned just how far some people would take advantage of the absence of exclusion categories (BOC eventually added regular exclusion clauses, and clawed back the miles from transactions I suppose they deemed egregious).

Truth be told, those crazy earn rates and lack of exclusions were probably the only reason people were willing to put up with BOC’s notorious frustrations, like processing times in the 3-4 month range, “fee waivers” that deducted points instead, unexplained interest charges, and an antiquated IT setup that required you to visit a physical branch to do basic things like linking a credit card to internet banking.

Therefore, it was little surprise that everyone decided to rage quit once BOC nuked the card in June 2020 by cutting its earn rates to just 1/2 mpd, devaluing conversion rates, and adding more rewards exclusions.

But those who kept the faith were rewarded with an even crazier promotion in March 2024, which offered up to 8 mpd — uncapped — on SIA, Scoot, KrisShop and Pelago bookings, as well as overseas and online spend. Like all good BOC promotions, however, this was run in a chaotic fashion and pulled halfway through.

For what it’s worth, we’ve just seen BOC launch another blockbuster promotion, which offers cardholders up to 8.8 mpd on FCY spend, and 7.4 mpd on online, dining and SIA Group spend all the way till 31 December 2025.

Who says history doesn’t repeat itself?

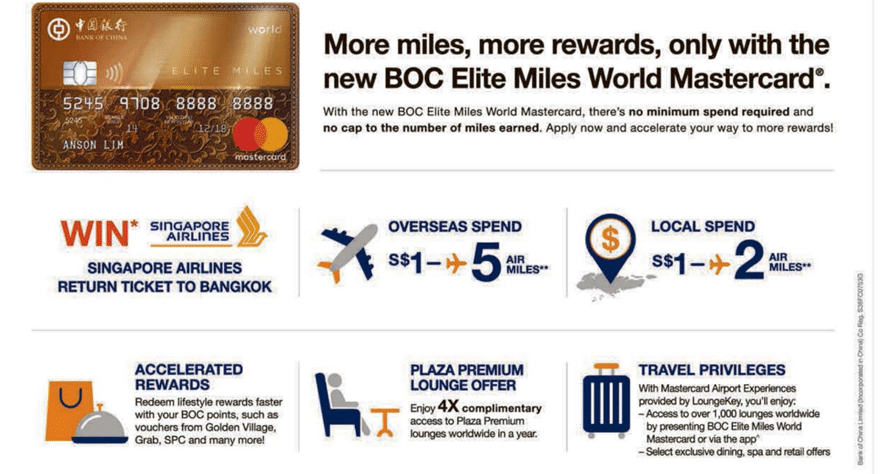

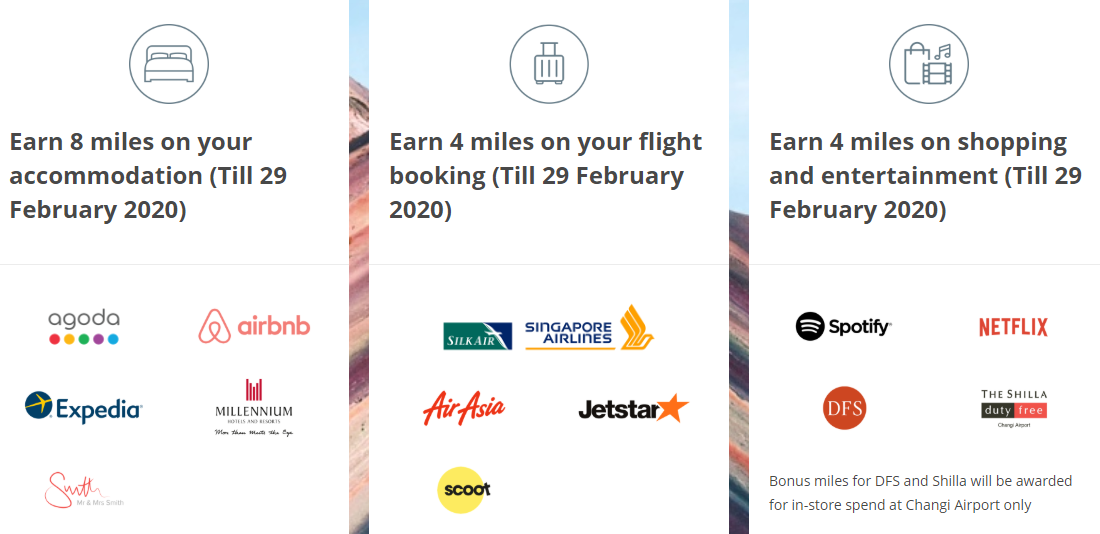

(6) OCBC 90°N Mastercard: Uncapped 4/8 mpd!

OCBC was one of the last banks to launch a mass market miles card, but when it finally came — in the form of the OCBC 90°N Mastercard — it was well worth the wait.

For a period of six months, cardholders earned an uncapped 4 mpd on all FCY spending, SIA, SilkAir, Scoot, AirAsia and Jetstar, DFS & Shilla duty-free, Netflix and Spotify. They also earned an uncapped 8 mpd on Agoda, Expedia, Airbnb, Millennium Hotels & Resorts and Mr & Mrs. Smith. The non-expiring Travel$ could be converted into KrisFlyer miles at a 1:1 ratio with no conversion fees, and it was as ambitious a launch as you could hope for.

Unfortunately, the upsized earn rates ended on 29 February 2020 (at least it was a leap year), and since then the OCBC 90°N Mastercard has become reliably mediocre.

(7) AMEX: New customer welcome bonuses for everyone!

The general rule about welcome offers is that the best ones are reserved for new-to-bank customers. Existing cardholders would be lucky to get so much as a fee waiver.

But there was a time in 2024 when American Express flipped the script by extending its new customer welcome offers to existing AMEX cardholders as well. Even if you already held another AMEX credit card, you could still enjoy a welcome bonus that went as high as 127,500 MR points, 60% more than what existing customers would normally receive.

This remarkably generous offer was available for the AMEX Platinum Charge, AMEX Platinum Credit Card and AMEX KrisFlyer Ascend, and there was nothing stopping you from applying for multiple cards if you so wished.

It’s a far cry from the situation today, where American Express has tightened the criteria so much that even holding a supplementary card will disqualify you from the new customer bonus.

(8) AMEX Platinum Charge: Double points, double statement credits!

As COVID tightened its grip on the world, American Express launched one heck of a promotion for its AMEX Platinum Charge customers.

Not only would they earn double the points on all transactions, they would also receive double the value when redeeming points for statement credits.

Double points meant that cardholders could earn up to 15.6 mpd at 10Xcelerator merchants (then called Platinum EXTRA). It even turned the AMEX Platinum Charge into a decent general spending card, with 1.56 mpd everywhere.

Double statement credits meant that 1,000 points became S$9.60, instead of the usual S$4.80 (it also meant you were effectively earning 24% cashback at 10Xcelerator merchants). I used this to pay for several of my staycations, and my only regret was that I didn’t redeem more.

(9) SingSaver: PlayStation 5s, S$500 eCV or Dyson Airwraps for all!

In November 2023, SingSaver launched a mega promotion for CIMB, Citi and Standard Chartered cards, which offered every new-to-bank customer a choice of a Sony PlayStation 5, S$500 eCapitaVoucher, or Dyson Airwrap. No cap, no “fastest fingers first”, no nonsense. You could even get all three gifts, if you applied for one card from each bank.

Needless to say, the response was voracious, and in the end the promotion had to be pulled after just one day.

And that, kids, is how I got my PlayStation 5 (I still haven’t told The MileLioness that an Airwrap was a possible alternative, and have no intention of doing so).

(10) Citi x Apple Pay: Uncapped 8 mpd everywhere!

In my mind, there can be no question about the best-ever promotion in the history of the miles game: the Citi x Apple Pay 8 mpd offer.

Citi was relatively late to add support for Apple Pay in Singapore, but when it finally did in April 2018, it came with an incredible launch promo: an uncapped 8 mpd on any Citi Prestige, Citi Rewards or Citi ULTIMA transaction paired with Apple Pay.

8 mpd. With. No. Cap.

I don’t think it’d be hyperbole to say this upended the very fabric of the economy. As I wrote in my reflections on those 97 days of insanity:

| I’ve heard of people who convinced their bosses to do a mid-year bonus giveaway in the form of supermarket vouchers (don’t trouble yourself, I’ll get them!). I’ve heard about couples who selected their wedding venue based on the acceptance of Apple Pay. I’ve heard of a guy who spent 90 minutes tapping his card 100 times at a terminal to circumvent the maximum transaction limit. I’ve heard of people bringing forward elective surgery (Shinagawa Eye Centre takes Apple Pay, you know), hair care and spa packages, gym memberships and all manner of self-improvement. |

“Frontloading” became the name of the game, as everyone tried to bring forward as much of their spending as they could to fit into the promo period.

And like every incredible promotion, some people went too far. It didn’t take long to figure out that TransferWise supported Apple Pay, and you could convert AUD into SGD (the cheapest currency pair), then use the funds to pay off the card bill and buy miles at less than half a cent each.

Citi shut that down eventually and confiscated the points, but that just moved the gamers on to other things, like buying gold and precious stones using Apple Pay, then liquidating them. Citi had to add a separate exclusion for this (that S$100K Tiffany ring will have to wait!), and I’m sure there must be plenty more that slipped past.

I personally got myself a spare Apple phone just to make hay during this period, though nowhere as much as some of the stories I heard. Till today I have no idea whether this was Citi’s intention from the start, or just a promo that got out of hand (which, to their credit, they saw through to the end and didn’t yank early).

What I do know is that an uncapped 8 mpd everywhere affected everyone, whether or not you play the miles game.

| One thing’s for sure though- 8 mpd, uncapped, has been a game changer for everyone. Front line cashiers have been educated by countless customers (some patiently, others less so) on the ins and outs of contactless payments. Supermarket managers have issued endless reams of vouchers. Boutique sales staff have come to realise the “$100 transaction limit” that was drilled into them during training was more of a serving suggestion than a dietary restriction. The world now knows that miles chasers exist, and we are ravenous. |

Conclusion

I realise there’s a tendency to romanticise the past, but when people talk about how good the miles game used to be, this is probably what they’re referring to!

That said, I’m sure there must be other insane promos or deals that I’ve just forgotten about, so if there’s any memory that makes you look back and smile, do share it too.

What’s the best credit card promo you ever saw?

Ahh, the good old days. The holy grail was 15+ years ago when the DBS Altitude card could be used to pay anything at an AXS machine and would earn miles. Running a GST registered business meant paying IRAS 7% of my turnover every quarter.. There was a daily cap on the AXS machine and it took two weeks of daily visits just to make payment. Only Advantage available for Suites to LHR.? Who cared, more miles than I knew what to do with… 🙂

oh yes, the good old time, also forgot about that. clearly not in your level of expenses but yes, that did make some hay

The uncapped 8mpd brought a wistful tear to my eye. It wouldn’t be quite accurate to say i got married to spend the 80k, but it wasn’t entirely coincidental either.

And here i thought my 30k spend on reno takes the cake. How long did you take to pay the 80k due to the $100 transaction cap.

GrabPay Mastercard topup on Citi RMC was actually 7.6mpd due to some flaw in the Citi system which double counted the bonus miles. Saved 10% on IRAS using GPMC and UOB One and AXS for $18,000 of tax payments before that was shut down – no miles but a good deal. And the Amaze/AXS loophole got miles and cashback for $0 spend (for a short while). Still some good deals out there but loose lips sink ships.

CF uncapped on axs payments. Even 0.4mpd is enough if you churned enough insurance.

too bad there is a cap on daily spend

Standard and Chartered X card 100,000 sign up was very generous. 100k 6 years ago, was definitely worth a lot more than it does now.

EZlInk 500 refund

was there ever 4mpd for insurance, etc? lik uncapped

What was the outcome of the CRAP Transferwise situation?

Did Citi restore the miles and allowed transfer out?

payment solutions like cardup are a big game changer too, especially if you don’t have time to mile hack much but earn quite abit and spend a lot on condo MCST fees, income taxes, property taxes and heck even mortgage payments if you want to.

easily 500K-1m miles a year if you use it for everything together with a 1.6mpd card.

The only crazy deal I got was a Dyson Supersonic for signing up a CIMB card. It definitely pays off for the little effort I put in. Was late in the miles game and if #10 happens again, I would have reacted the same as well.