Kris+ is Singapore Airlines’ lifestyle rewards app, which enables users to earn and redeem KrisFlyer miles at participating merchants in Singapore and Australia.

Miles earned through Kris+ can be instantly transferred to KrisFlyer at a 1:1 ratio with no conversion fees, making it a great way to top up your account for an award redemption.

|

| S$5 for new Kris+ Users |

| Get S$5 when you sign-up with code W644363 and make your first transaction |

Kris+ currently partners with over 570 merchants in Singapore, including Audio House, Challenger, Esso, Harvey Norman, iStudio, Paradise Group, and Tung Lok. Users earn anywhere from 0.33 to 9 mpd on their purchases, at no additional cost.

But that’s not all. On top of the Kris+ miles, users can stack additional credit card rewards of up to 4 mpd. Choosing the right credit card is key to maximising this double-dip opportunity, and in this post, we’ll explore the best credit cards to pair with Kris+.

What card should I use with Kris+?

Here’s a brief reminder of the ground rules for Kris+:

- All Kris+ payments must be made in-app, via Apple Pay or Google Pay

- All Kris+ transactions code as online

- Kris+ transactions usually retain the original MCC of the underlying transaction (with some very limited exceptions)

This means you should either use:

- a card that explicitly awards bonuses for Kris+

- a card that awards bonuses for online spending

- a card which awards bonuses for that particular MCC

If you’re uncertain about the MCC, here are three ways you can check it before making a purchase.

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

| Note: “Ease of use” and “reliability” are all relative. HeyMax already provides a solid baseline for reliability, and the DBS digibot is still simple enough to use, despite requiring more steps than the other two methods. | ||

All Kris+ transactions

| 💳 Best Cards for Kris+ (All Categories) | ||

| Card | Earn Rate | Remarks |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd | Max. S$1K per c. month |

Citi Rewards + Amaze Citi Rewards + AmazeApply |

4 mpd | Max. S$1K per s. month. 1% admin fee (min. S$0.50) for all SGD transactions |

KrisFlyer UOB Card KrisFlyer UOB CardApply |

3 mpd | No cap |

If you want a fuss-free solution for all Kris+ payments, then any of these cards will do the job.

The DBS Woman’s World Card earns 4 mpd on Kris+ transactions by virtue of the fact they code as online spend. This is capped at S$1,000 per calendar month.

The Citi Rewards Card, if used alone, will earn only 0.4 mpd on Kris+ transactions because of the exception clause for in-app Apple/Google Pay payments. However, pairing it with Amaze will circumvent the restriction, allowing you to earn 4 mpd on the first S$1,000 per statement month. The annoying thing is that ever since March 2025, Amaze charges a 1% admin fee (min. S$0.50) for all SGD-denominated transactions.

Finally, the KrisFlyer UOB Credit Card was enhanced in November 2022 to offer an uncapped 3 mpd on all Kris+ transactions, with no minimum spend necessary.

Kris+ Dining

| 🍴 Best Cards for Kris+ Dining |

||

| Card | Earn Rate | Remarks |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | Max S$1K per c. month. Must choose Dining as bonus category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd |

Max S$750 per c. month. Must choose Dining as bonus category Review |

HSBC Revolution HSBC RevolutionApply |

4 mpd | Max S$1.5K per c. month* Review |

Maybank XL Rewards Card Maybank XL Rewards CardApply |

4 mpd | Min. S$500, max S$1K per c. month Review |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd |

Max S$600 per c. month Review |

StanChart Journey Card StanChart Journey CardApply |

3 mpd |

Max S$1K per s. month. SGD only Review |

| *From 1 March 2026, the bonus cap will be reduced to S$1,000 per calendar month, and bonuses removed for in-person spend. The latter restriction will not affect Kris+, however, because all transactions are online | ||

If you’re paying with Kris+ at a restaurant, then the UOB Lady’s Card or UOB Lady’s Solitaire, with Dining selected as the quarterly bonus category, will earn 4 mpd on the first S$1,000 or S$750 per calendar month.

Alternatively, the HSBC Revolution, Maybank XL Rewards Card or UOB Preferred Platinum Visa will earn 4 mpd on the first S$1,500, S$1,000 or S$600 per calendar month.

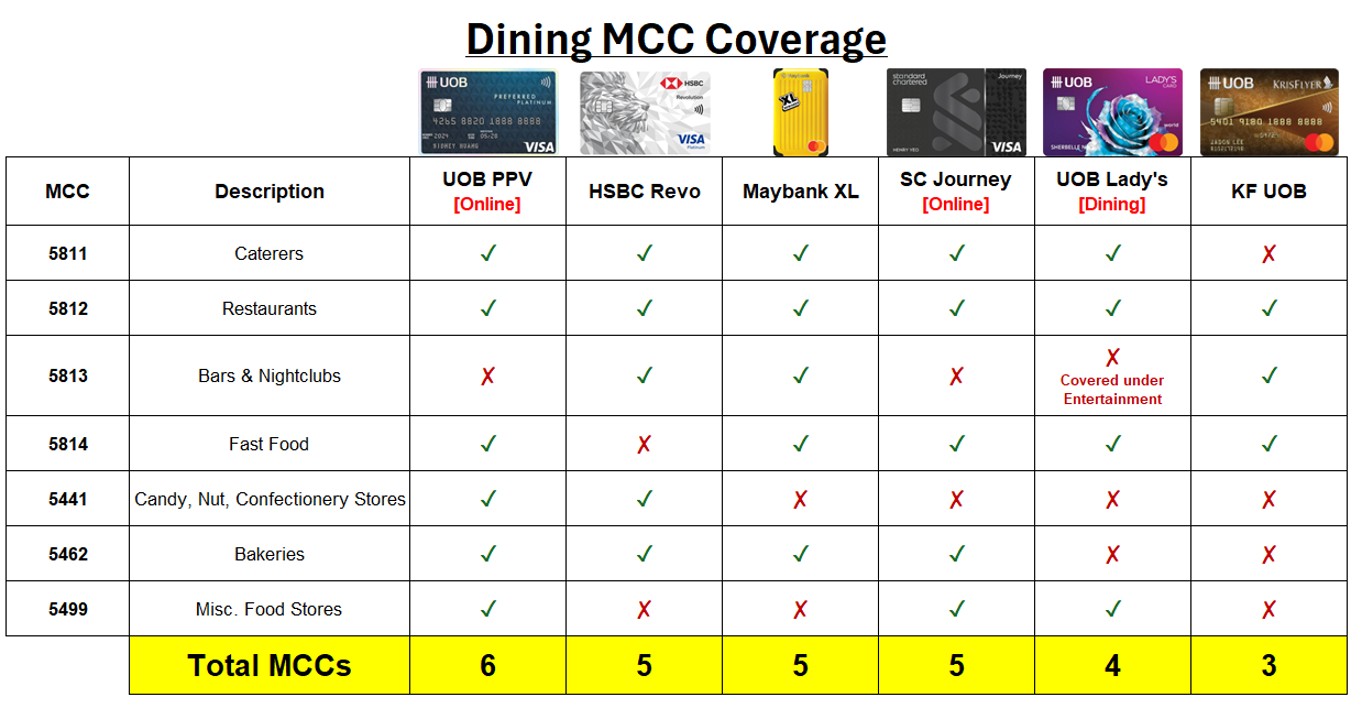

Do note that each card has a slightly different definition of dining, so the MCC matters! Most restaurants should code as MCC 5812, but other MCCs are also possible. When in doubt, always test the MCC first.

Kris+ Shopping

| 🛍️ Best Cards for Kris+ Shopping | ||

| Card | Earn Rate | Remarks |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | Max S$1K per c. month. Must choose Fashion as bonus category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd |

Max S$750 per c. month. Must choose Fashion as bonus category Review |

HSBC Revolution HSBC RevolutionApply |

4 mpd | Max S$1.5K per c. month* Review |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd |

Max S$600 per c. month Review |

OCBC Rewards OCBC RewardsApply |

4 mpd | Max. S$1.1K per c month Review |

Shopping is a bit of a tricky category because of the sheer number of possible MCCs involved. Again, the key is to check the MCC, especially if we’re talking about a big-ticket purchase.

If you’re shopping with Kris+ then the UOB Lady’s Card or UOB Lady’s Solitaire, with Shopping selected as the quarterly bonus category, will earn 4 mpd on the first S$1,000 or S$750 per calendar month.

Alternatively, you can go with the HSBC Revolution, OCBC Rewards or UOB Preferred Platinum Visa for 4 mpd on the first S$1,500 (Revolution),S$1,110 (Rewards) or S$600 (PPV) per calendar month.

Why not the UOB Visa Signature?

This is a commonly-asked question: why not use the UOB Visa Signature with Kris+?

The UOB Visa Signature earns 4 mpd on contactless transactions, but Kris+ payments aren’t considered contactless transactions. They are considered online, in-app payments, which will only earn 0.4 mpd.

| ⚠️ Exceptions |

|

There are two exceptions to this rule. Spending in Australia: When spending with Kris+ in Australia, you’ll earn 4 mpd by virtue of the fact the transaction is in AUD, provided you spend at least S$1,000 in foreign currency in a statement month. Spending on petrol: When spending with Kris+ petrol merchants, you’ll earn 4 mpd by virtue of the fact the transaction codes as MCC 5541/5542, provided you spend at least S$1,000 in SGD in a statement month. |

Along the same lines, it’s worth noting that where the UOB Preferred Platinum Visa is concerned, Kris+ transactions will count towards the “Selected Online Transactions” cap and not the “Mobile Contactless” cap.

Remember: Kris+ may feel like contactless, but it’s really online!

Transfer your miles immediately!

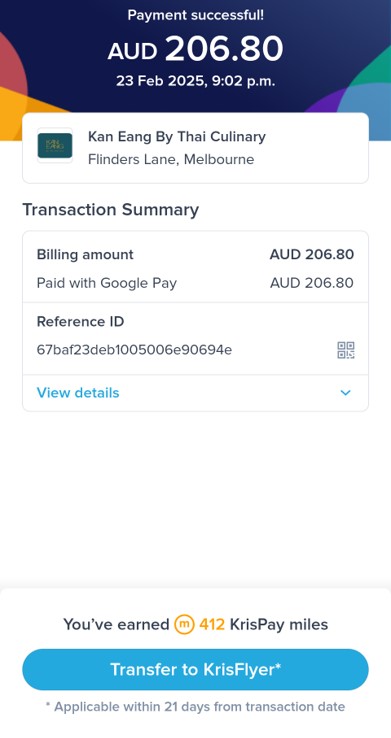

Here’s the standard Kris+ PSA: whenever you earn any miles through the Kris+ app, be sure to transfer them to your KrisFlyer account immediately.

A big “Transfer to KrisFlyer” button appears after every transaction. Alternatively, you can turn on the new auto-transfer feature, which will automatically deposit any miles earned from Kris+ into your KrisFlyer account.

If you wait longer than 21 days, or spend any portion of the KrisPay miles earned, the remaining balance will be stuck in Kris+, where they can only be spent at 0.67 cents apiece with a six-month expiry.

Earn extra miles with Challenges

Kris+ Challenges are simple tasks that award bonus KrisPay miles for spending at certain partners, or using certain payment methods.

Some recent examples include Fortune Feast, which offers up to 8,888 bonus miles for dining at participating restaurants, and Prosperity Quest, which offers 1,800 bonus miles for shopping at three different participating merchants.

Do make a point of registering for all the Challenges you see, in the off chance you trigger the reward criteria inadvertently!

Earn extra miles for restaurant bookings

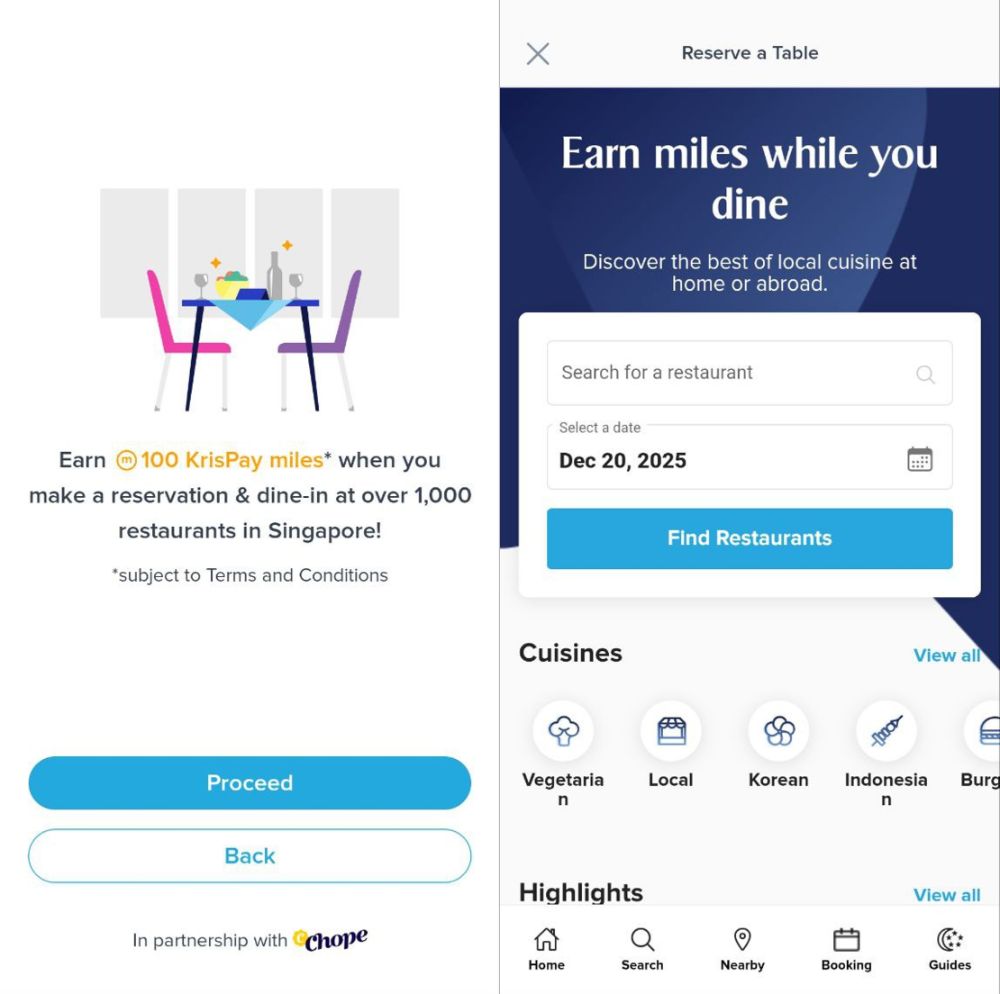

Kris+ Makan+ offers 100 KrisPay miles for each restaurant reservation made via the app. To book restaurants, simply tap the Reserve A Table button at the top of the homepage.

This isn’t a huge reward, but it costs you nothing extra to earn, and the selection is pretty substantial since it’s powered by Chope. You might even find restaurants here that aren’t Kris+ earn partners, but let you clock the 100 miles nonetheless.

Earn 100 KrisFlyer miles per restaurant reservation with Makan+

Conclusion

|

| S$5 for new Kris+ Users |

| Get S$5 when you sign-up with code W644363 and make your first transaction |

Kris+ is an easy way of earning up to 9 mpd extra on your spending, further stackable with 3-4 mpd from the right credit card.

Be sure to browse the Kris+ app periodically, because they also run limited-time flash deals with certain merchants that offer upsized miles or in-store discounts.

From 5 May to 30 Jun, there is an enhanced 12 miles promotion for selected restaurants.

Do you know if AMEX Love Dining can be used with Kris+, for example at Mikuni?

Cannot. You need to present the card to use it.

I have been using the Citi Rewards + Amaze combo (new to the miles game so thanks very much!).

I want use the Kris+ app to pay at a 9mpd restaurant (via the in-app pay function, which requires the use of Apple Pay). Can I check how am I meant to use Amaze to get the full 4mpd, since its not on Apple Pay?

Also, does this mean I get 9mpd + 4mpd at the end of this transaction?

Sorry if these are very basic questions, or if I am overlooking something.

The Amaze question was covered in the article above and Apple users are unable to utilise it. (However, do remember that Apple Pay does not support Amaze, so this is only a solution for Android users (while Apple users can download Google Pay, Kris+ won’t let you use it if you’re an iPhone user).)

Yes, you will get 9 mpd (kris+) + 4 mpd (cc).

Aaron, could you also do a similar article for the likes of ShopBack Pay and FavePay? Always find it challenging to remember the differences for each digital wallet. Thanks!

I second this. I never use any of the other wallets; shopeepay, grabpay, etc because i’m afraid I won’t get my standard CC miles / cashback

Will stacking a cashback card like Citi Cashback which provides 6% cashback for purchases deemed as food still provide me the cashback if I use it on food merchants via the Kris+ app?

Hi, can check why HSBC Revolution is not part of the first sections on “all Kris+ transactions”? Since all Kris+ are online spend, HSBC Revolution should give 4mpd as well? subject to the 1k/month cap

but does hsbc revolution give 4 mpd for all online spend? might want to refer to the T&Cs.

You can pair your uob ladys with amaze and use amaze card on kris+ app right?

Why is UOB visa signature not mentioned? I thought it gets 4 miles for contactless transactions?

contactless is not the same as online

How about Google pay + Kris+ for uob signature visa? It should qualify for 4mpd?

i paid for my meal at Lenu with Kris+ using the DBS Woman’s World card but somehow DBS awarded me 0.4 miles per dollar rather than the expected 4 miles per dollar. Any idea why?

Ok just realised the 9x bonus will come at the end of the following calendar month. lol

I recently also paid at Lenu using Kris+ with lady’s card, chosen dinning as bonus category. but I did not get the bonus 9x UNI$. I only get the base uni$. Kris+ with lady’s card with dinning as bonus category doesn’t reward bonus uni$. Maybe all Kris+ transactions MCC are all under travel category? Anyone have the same experience?

My mistake, I just called UOB and they said it’s included

WWMC is now grayed out in Kris+ for me. Could have sworn it used to work. It silently switched to another card in my Google wallet. Did DBS start blocking Kris+ for WWMC as part of the nerf to 1500?

Any idea which card should i use for klook or kkday or similar platform to earn more miles?

I’ve used Kris+ with HSBC Revo to buy Skechers: MCC5661. Seems like no points for the transactions, not even 1 point.

Used krispay to pay for an automotive service, using UOB preferred platinum. Only awarded base points, not the additional 9X points. Contacted UOB, and they said ‘krispay don’t earn any additional uni ’.

Now I’m confused

Anyone have success with Apple with Citi Rewards?

yes it works. to be safe, put amaze card on applepay and pay all using that.

But you can pair UOB Visa Signature with Kris+ to pay for petrol right, with a caveat of min. S$1K contactless/petrol spend in a month?

assuming Esso codes as the right MCC, then yes you could.

Would it be better to buy a macbook air from istudio (using KrisPay) or directly from Apple with my UOB KrisFlyer Credit Card?

Hi, does in-app payment using SCB journey card on Kris+ app qualify for the bonus points if the merchant MCC falls within the categories of the SCB card?