Here’s The MileLion’s review of the UOB PRVI Miles Card, which UOB proudly markets as “the highest limitless miles card” in Singapore.

Granted, that claim comes with numerous caveats…

| “Highest limitless miles card” refers to the highest miles earn rate on general eligible spending made locally and in Malaysia, Indonesia, Thailand and Vietnam in comparison with other comparable entry-level non-premium miles credit cards in Singapore that award miles with no minimum spend and no cap on miles earned, as of 1 November 2025. |

…but even so, it really is one of the better general spending miles cards in Singapore.

Cardholders enjoy periodic bonuses on overseas spending, and one of the best airport limo benefits on the market with the AMEX version of the card. In October 2024, the value proposition was enhanced further with the addition of four airport lounge visits, plus an uncapped “regional bonus” of 3 mpd on IDR, MYR, THB and VND transactions.

It’s not all smooth sailing. You’ll need to get used to UOB’s quirks, like punitive rounding policies and the automatic deduction of UNI$ for annual fees. But if that’s not a deal-breaker, then the UOB PRVI Miles Card can form the anchor of a UOB-centric strategy, complemented by high-earning options like the UOB Preferred Platinum Visa, UOB Visa Signature, and UOB Lady’s Card.

|

|

| UOB PRVI Miles Card |

|

| 🦁 MileLion Verdict | |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? | |

| Competitive earn rates, lounge access and an excellent airport limo benefit make the UOB PRVI Miles Card a great choice for a general spending card— assuming you’re aware of UOB’s quirks | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: UOB PRVI Miles Card

Let’s start this review by looking at the key features of the UOB PRVI Miles Card.

|

|||

| Apply (AMEX) | |||

| Apply (MC) | |||

| Apply (Visa) | |||

| Income Req. | S$30,000 p.a. | Points Validity | 2 years |

| Annual Fee | S$261.60 (FYF) |

Min. Transfer |

5,000 UNI$ (10,000 miles) |

| Miles with Annual Fee |

N/A | Transfer Partners |

3 |

| FCY Fee | 3.25% | Transfer Fee | S$27 |

| Local Earn | 1.4 mpd | Points Pool? | Yes |

| FCY Earn | 2.4 mpd (3 mpd for IDR, MYR, THB, VND) |

Lounge Access? | Yes: 4x Priority Pass |

| Special Earn | 8 mpd on Agoda, Up to 8 mpd on Expedia | Airport Limo? | Yes (AMEX only) |

| Cardholder Terms and Conditions | |||

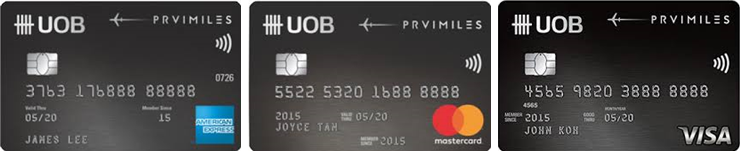

The UOB PRVI Miles Card is issued across all three card networks: American Express, Mastercard, and Visa.

Income requirements, annual fees, earn rates and benefits are the same for all, though the American Express version has two unique features:

- 20,000 bonus miles for spending at least S$50,000 in a membership year

- Complimentary airport limo transfers

I’ll discuss these in more detail below.

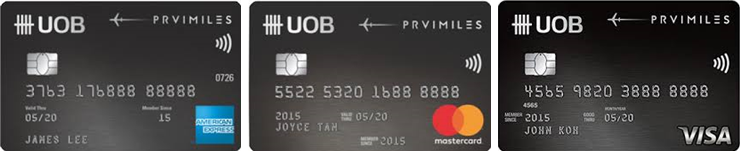

How much must I earn to qualify for a UOB PRVI Miles Card?

Once upon a time, the UOB PRVI Miles Card had an annual income requirement of S$80,000. However, the requirement was gradually lowered, and today the card has been repositioned at the S$30,000 entry-level segment.

If you don’t meet the income requirement, you can place a S$10,000 fixed deposit with UOB and get a secured version of the card. Visit any UOB branch for further information.

How much is the UOB PRVI Miles Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | Free | First 1 free, S$130.80 after |

| Subsequent | S$261.60 | First 1 free, S$130.80 after |

While other general spending cards like the Citi PremierMiles and DBS Altitude carry annual fees of S$196.20, the UOB PRVI Miles Card is slightly more expensive.

Principal cardholders are charged S$261.60 per year, with the first year waived. There is a perpetual fee waiver for the first supplementary card, and a S$130.80 annual fee for the second card onwards.

Most general spending cards charge you an annual fee if you don’t hit a minimum annual spend, but award some miles in return. With UOB, it’s the opposite:

- If you spend at least S$50,000 in a membership year on the UOB PRVI Miles AMEX, your annual fee will be waived and you’ll receive 20,000 miles. This will be credited in the form of 10,000 UNI$ within two statement periods from the card’s anniversary date

- If you fall short of the threshold, or if you hold the UOB PRVI Miles Mastercard or UOB PRVI Miles Visa, you’ll be billed the annual fee at the start of the second year, but not receive any renewal miles

Thankfully, it’s not too difficult to get an annual fee waiver. However, be warned that UOB’s default behaviour is to automatically deduct your UNI$ to cover the annual fee.

How do UOB’s automatic UNI$ deductions for annual fees work?

When the time comes for renewal, you will either be charged:

- 6,500 UNI$ for a full waiver

- 3,250 UNI$ + S$130.80 for a half waiver

- If you have at least 6,500 UNI$ in your account, you will be charged (i)

- If you have less than 6,500 UNI$ but more than 3,250 UNI$, you will be charged (ii)

- If you don’t have at least 3,250 UNI$, you’ll be charged the S$261.60 annual fee in cash.

It’s up to you to monitor your statement and request a waiver when this happens. Look at the expiry date on your credit card; the month corresponds to the month your annual fee will be charged.

For what it’s worth, if UOB subsequently grants you a fee waiver, the reinstated UNI$ will have a fresh 2-year validity.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.4 mpd | 3 mpd 🇮🇩 IDR 🇲🇾 MYR 🇹🇭 THB 🇻🇳 VND 2.4 mpd 🌍 Others |

8 mpd Agoda Up to 8 mpd Expedia |

SGD/FCY Spend

UOB PRVI Miles Card members earn:

- UNI$3.5 for every S$5 spent in Singapore Dollars

- UNI$6 for every S$5 spent in foreign currency (FCY)

- UNI$7.5 for every S$5 spent in IDR, MYR, THB and VND

1 UNI$ is worth 2 airline miles, so that’s an equivalent earn rate of 1.4 mpd for local spending, 2.4 mpd for FCY spending, and 3 mpd for IDR, MYR, THB and VND spending.

These are the highest earn rates for any general spending card at the S$30,000 income level, though you need to be careful with smaller transactions, because of UOB’s punitive rounding policy (more on that later).

| 💳 Earn Rates for General Spending Cards (Income Req: S$30K) |

||

| Cards | Local Spend | FCY Spend |

UOB PRVI Miles Card UOB PRVI Miles CardApply |

1.4 mpd | 3 mpd IDR, MYR, THB, VND 2.4 mpd All Others |

BOC Elite Miles Card BOC Elite Miles CardApply |

1.4 mpd | 2.8 mpd |

HSBC TravelOne Card HSBC TravelOne CardApply |

1.2 mpd | 2.4 mpd |

DBS Altitude Card DBS Altitude CardApply |

1.3 mpd | 2.2 mpd |

OCBC 90°N Card OCBC 90°N CardApply |

1.3 mpd | 2.1 mpd |

Citi PremierMiles Card Citi PremierMiles CardApply |

1.2 mpd | 2.2 mpd |

StanChart Journey Card StanChart Journey CardApply |

1.2 mpd | 2 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer AscendApply |

1.2 mpd | 1.2 mpd |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit CardApply |

1.2 mpd | 1.2 mpd |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit CardApply |

1.1 mpd | 1.1 mpd |

All FCY transactions are subject to a 3.25% fee, which is on par with the rest of the market.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

With a 3.25% fee, using your UOB PRVI Miles Card overseas means buying miles at:

- 1.08 cents each, for IDR, MYR, THB and VND

- 1.35 cents each, in other currencies

Unfortunately, there’s another UOB quirk here. While other banks define overseas transactions simply as those charged in currencies other than Singapore Dollars, UOB further requires that the payment gateway be overseas. As per the T&Cs:

For the avoidance of doubt, card transactions made overseas but effected/charged in Singapore dollars and online transactions effected in Singapore dollars or in foreign currencies at merchants with payment gateway in Singapore will not be treated as overseas transactions and will earn UNI$3.5 per S$5 spend

In other words, if you’re shopping on an online website which bills you US$100 (~S$140), but processes the payment within Singapore (Hotels.com is an example), you’ll earn miles at the local spending rate of 1.4 mpd.

Fortunately, there’s a way of checking this before you make a transaction, which I’ve written about in the article below.

UOB$ merchants

In the past, UOB cardholders had to be careful about UOB$ merchants, where UOB$ cashback would be awarded in lieu of UNI$ points.

However, ever since 1 November 2024, UOB cardholders can double dip on both UOB$ and UNI$ at UOB$ merchants, a reversal of the previous either/or policy. This means that UOB$ merchants are now something to be welcomed rather than feared, because it’s extra cashback on top of your miles.

I publish a periodic roundup of UOB$ merchants, which can be found here.

OTA bonuses

UOB PRVI Miles Cardholders will enjoy:

- 8 mpd on hotel bookings with Agoda and Expedia

- 8 mpd on car rentals and activities with Expedia

- 3 mpd on flight bookings with Expedia

One caveat: all bookings must be made through special landing pages, which tend to charge higher prices than publicly-available rates for hotels. This doesn’t necessarily mean it’s a bad deal — you see it as an opportunity to buy miles — but it does mean you should comparison shop and ensure the premium you pay is worth it.

Fortunately, the same rule doesn’t apply for airline tickets, which will usually be around the same price as the official website (though it doesn’t hurt to check!).

8 mpd with Agoda

|

| UOB x Agoda |

| T&Cs |

UOB PRVI Miles Cardholders will earn 8 mpd on hotel bookings with Agoda, when they book via the special UOB x Agoda landing page.

Bookings and stays must be made and completed by 31 May 2026, and all stays must be prepaid. Bookings where payment is made at the hotel will not be eligible for bonus miles.

Bonus UNI$ will be credited within 2-8 weeks after the stay is completed.

Up to 8 mpd with Expedia

|

| UOB x Expedia |

| T&Cs |

UOB PRVI Miles Cardholders will earn 8 mpd on hotel bookings, activities and car rentals, and 3 mpd on flight bookings booked via the special UOB x Expedia landing page.

This replaces the previous rate of 6 mpd for both hotels and flights, which ceased on 15 September 2025.

The following airlines are participating.

| ✈️ UOB x Expedia Participating Airlines | |

|

|

You won’t find Singapore Airlines or Cathay Pacific here, but THAI, Turkish Airlines and Qatar Airways might be useful for someone based in Singapore.

Bookings and stays made by 31 March 2026, and all stays must be prepaid. Bookings where payment is made at the hotel will not be eligible for bonus miles.

Transaction date or posting date?

The UOB PRVI Miles Card tracks spending based on the posting date, not transaction date.

If you’re accumulating spend towards your welcome bonus, be careful about making transactions towards the end of the qualifying period— anything that posts beyond the deadline will not be included, even if the transaction was made during the qualifying period!

Which cards track spending by transaction date vs posting date?

When are UNI$ credited?

UNI$ are credited when your transaction posts, which generally takes 1-3 working days.

How are UNI$ calculated?

Here’s how you can work out the UNI$ earned on your UOB PRVI Miles Card.

| Local Spend | Round down transaction to nearest S$5, then divide by 5 and multiply by 3.5. Round down to the nearest whole number |

| FCY Spend |

Round down transaction to nearest S$5, then divide by 5 and multiply by 6. Round down to the nearest whole number |

| FCY Spend (IDR, MYR, THB, VND) |

Round down transaction to nearest S$5, then divide by 5 and multiply by 7.5. Round down to the nearest whole number |

Unfortunately, UOB has one of the most punitive rounding policies in the market, which can adversely affect your earn rates especially on smaller transactions.

UOB first rounds your transaction down to the nearest S$5, divides it by 5, then multiplies the amount by 3.5 UNI$ (assuming it’s a Singapore Dollar transaction). This UNI$ figure is then rounded down again to the nearest whole number.

So imagine you spent S$9.99 on your UOB PRVI Miles Card. You might figure that’s 14 miles (S$9.99 @ 1.4 mpd), but…

- The S$9.99 is rounded down to S$5

- S$5 is awarded 3.5 UNI$

- 3.5 UNI$ is rounded down to 3 UNI$

You actually earn 3 UNI$ (6 miles), an effective rate of just 0.6 mpd!

This is an extreme example, of course, and the effect of rounding gets smaller as your transaction size increases. But it’s exactly why you should think twice about using your UOB PRVI Miles Card for small transactions that aren’t in S$5 blocks- in fact, the minimum spend required to earn miles is S$5.

| 🚆 What about SimplyGo? |

|

If the minimum transaction to earn miles is S$5, is there any point in using the UOB PRVI Miles Card for bus/MRT rides with SimplyGo? Yes, because of how points are calculated.

So with the exception of extreme circumstances (e.g. where you take just 1-2 rides a month), you’ll definitely earn some miles at least. |

This means that despite having a higher headline rate, you may actually earn fewer miles on the UOB PRVI Miles Card than the Citi PremierMiles Card depending on transaction size. Consider the following:

UOB PRVI Miles UOB PRVI Miles1.4 mpd |

Citi PremierMiles Citi PremierMiles1.2 mpd |

|

| S$5 | 6 miles | 6 miles |

| S$9.99 | 6 miles | 11 miles |

| S$15 | 20 miles | 18 miles |

| S$19.99 | 20 miles | 23 miles |

| S$25 | 34 miles | 30 miles |

| S$29.99 | 34 miles | 35 miles |

| S$35 | 48 miles | 42 miles |

| S$39.99 | 48 miles | 47 miles |

If you’re an Excel geek, here are the formulas you need to calculate points:

| Local Spend | =ROUNDDOWN (ROUNDDOWN (X/5,0) * 3.5,0) |

| FCY Spend (All Others) |

=ROUNDDOWN (ROUNDDOWN (X/5,0) * 6,0) |

| FCY Spend (IDR, MYR, THB, VND) |

=ROUNDDOWN (ROUNDDOWN (X/5,0) * 7.5,0) |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for UNI$?

A full list of transactions that do not earn UNI$ can be found in the T&Cs at Point 1(ii).

I’ve highlighted a few noteworthy categories below:

- Amaze

- Charitable donations

- Education

- Government services

- Hospitals

- Insurance premiums

- Prepaid account top-ups (e.g. GrabPay, YouTrip)

- Real estate agents & managers

- Utilities

UNI$ will be awarded for CardUp transactions, but not ipaymy.

What do I need to know about UNI$?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| 2 years | Yes | S$27 |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 5,000 UNI$ (10,000 miles) |

3 | 48 hours (KF) |

Expiry

UNI$ expire 2 years from the last day of each periodic quarter in which the UNI$ was earned.

For example, if any UNI$ earned in January 2024 will expire on 31 March 2026. This means that the validity could technically be up to 2 years 3 months in some cases.

Pooling

UNI$ pool across cards. If you have 10,000 UNI$ on the UOB Lady’s Card, and 5,000 UNI$ on the UOB PRVI Miles Card, you can redeem 15,000 UNI$ in a single conversion and pay a single fee.

It also means that you don’t need to transfer your UNI$ out before cancelling the UOB PRVI Miles Card, assuming it’s not your last UNI$-earning card.

Transfer Partners & Fees

UNI$ can be transferred to three frequent flyer programmes (though it’s really two, because converting points to AirAsia is like throwing them away) at the following ratio:

| Frequent Flyer Programme | Conversion Ratio (UNI$: Partner) |

| 5,000 : 10,000 | |

| 5,000 : 10,000 | |

| 2,500 : 4,500 |

Transfers cost S$27 each (recently increased from S$25), regardless of how many points are transferred. However, if you hold a UOB Reserve, UOB Visa Infinite Metal, UOB Visa Infinite or UOB Privilege Banking Card, you will enjoy free conversions of all UNI$, including those earned on the UOB PRVI Miles Card.

UOB also has an auto-conversion option for KrisFlyer, which costs S$50 per year. Customers who opt in will have their UNI$ automatically converted on the last day of the calendar month, in blocks of UNI$2,500 (half the regular conversion block).

|

| FAQs |

| T&Cs |

| Read Point 53-55 |

However, you’ll need to keep a minimum balance of UNI$15,000 (30,000 miles) in your account at all times. This is a hefty working capital balance! Make what you will of UOB’s reason for this policy…

|

Why must a minimum balance of UNI$15,000 be kept KrisFlyer auto conversion programme? This is to give card members the flexibility to convert the UNI$ to other items from UOB Rewards Catalogue. Card members can still choose to convert this UNI$15,000 to KrisFlyer miles by the one time miles redemption process through UOB Rewards Catalogue, subjected to S$25 conversion fee and must be in blocks of 10,000 miles. |

Cardmembers who wish to make ad-hoc conversions can still do so, subject to the payment of the usual S$27 fee per conversion, in standard blocks of 5,000 UNI$ (10,000 miles).

Here are the pros and cons of the automatic transfer scheme.

| 👍 Pros | 👎 Cons |

|

|

Transfer Times

UOB transfers to KrisFlyer are typically completed within 48 hours. Do note that transfers to Asia Miles can take significantly longer; it’s good to budget up to 3 weeks.

If you need your KrisFlyer miles credited instantly, you can move them via Kris+ at a rate of 1,000 UNI$ = 1,700 KrisPay miles. KrisPay miles can then be instantly converted to KrisFlyer miles at a 1:1 ratio.

|

| S$5 for new Kris+ Users |

| Get S$5 when you sign-up with code W644363 and make your first transaction |

However, those 1,000 UNI$ would normally have earned you 2,000 KrisFlyer miles, so you effectively take a 15% haircut. Therefore I wouldn’t recommend taking this option, unless you need a small top-up to redeem a flight, or have an orphan UNI$ balance (<5,000 points).

If you choose to do so nonetheless, do remember that it’s a two-step process:

- Transfer UNI$ to KrisPay miles

- Transfer KrisPay miles to KrisFlyer miles

Do not forget the second step! If you wait more than 21 days, or spend any of the converted KrisPay miles via Kris+, the entire balance will be stuck in the Kris+ app. KrisPay miles expire after six months, and can only be spent at a poor ratio of 100 miles = S$1.

Other card perks

Four free lounge visits

|

| Registration |

Principal UOB PRVI Miles Cardholders enjoy 4x complimentary airport lounge visits per calendar year, via Priority Pass. These lounge visits are for the principal cardholder only, and cannot be shared with guests. Any guests will be charged at US$35 per visit.

To enjoy this benefit, visit this link to register for your membership. After this, you can access lounges either via the Priority Pass app, or by presenting your physical UOB PRVI Miles Mastercard or Visa at the lounge (AMEX cardholders must use the app). If you’re using your physical card, access is available as soon as 12 hours after registration.

Do note that the visits are allocated per calendar year, which means that you can enjoy eight visits in your first membership year. For example, if my UOB PRVI Miles Card is approved in October 2024:

- Upon approval, I receive 4x lounge visits to be used by 31 December 2024

- On 1 January 2025, I receive another 4x lounge visits to be used by 31 December 2025

Also note that if you hold multiple UOB PRVI Miles Cards (e.g. UOB PRVI Miles Mastercard and UOB PRVI Miles Visa), your free visits are still capped at four per year overall.

Here’s how this compares to other cards in its segment.

| 💳 Credit Cards with Airport Lounge Access (Income Req.: S$30K p.a.) |

||

| Card | Network | Free Lounge Visits (per year) |

HSBC TravelOne Card HSBC TravelOne CardApply |

DragonPass | 4 CY Share |

UOB PRVI Miles Card UOB PRVI Miles CardApply |

Priority Pass | 4 CY No Share |

Citi PremierMiles Card Citi PremierMiles CardApply |

Priority Pass | 2 CY Share |

DBS Altitude Visa DBS Altitude VisaApply |

Priority Pass | 2 MY Share |

StanChart Journey Card StanChart Journey CardApply |

Priority Pass | 2 MY Share |

| Legend | ||

| Whether visits are tracked by calendar year CY or membership year MY Whether lounge visits can or can’t be shared with guests Share No Share |

||

Buy miles with the UOB Payment Facility

|

| UOB Payment Facility |

UOB PRVI Miles Cardholders have access to a “no questions asked” Payment Facility that lets them buy unlimited miles at 2.3 cents each, subject to their credit limit.

How it works is that cardholders fill out an online form and specify how much they’d like to charge to the facility, e.g. S$5,000. UOB will then:

- Deposit S$5,000 into their designated bank account

- Charge S$5,115 to their card (S$5,000 + 2.3% fee)

- Award UNI$ at a rate of UNI$2.5 per S$5, or 2,500 UNI$ in total (5,000 miles; the payment facility fee doesn’t earn miles)

Cardholders are then out of pocket S$115, for which they purchased 5,000 miles. This works out to 2.3 cents per mile.

Frankly speaking, 2.3 cents per mile is way above what you should be paying, when you can find cheaper alternatives with services like CardUp and Citi PayAll. The only situation where the UOB Payment Facility would make sense is to top off your UNI$ balance to the next 5,000 UNI$ block needed for a transfer.

UOB runs periodic promotions for the UOB Payment Facility which reduce the fee for UOB PRVI Miles Cardholders to 2.1%, but even at that price it’s not really worth considering.

Complimentary airport limo (AMEX only)

Not only is the UOB PRVI Miles AMEX the only S$30,000 credit card to feature a limo benefit, it also has the lowest spending requirement on the market.

By spending S$1,000 in foreign currency (excluding phone, mail or online transactions) in a calendar quarter, cardholders receive two complimentary airport limo transfers to Changi Airport.

This is the lowest spending requirement of any card in Singapore, and even more generous than cards in the $120K segment!

| Card | Qualifying Spend |

Cap |

UOB PRVI Miles AMEX UOB PRVI Miles AMEXApply |

S$1K (in-person FCY) per quarter for 2 rides (T&Cs) |

2 per quarter SG |

| Booking Book at Maxicab.sg at least 2 days in advance |

||

HSBC Premier Mastercard HSBC Premier MastercardApply |

S$12K per quarter for 2 rides (T&Cs) |

2 per quarter SG |

| Booking Book via TRB Global at least 48h in advance |

||

UOB Lady’s Solitaire Metal Card UOB Lady’s Solitaire Metal CardApply |

None (T&Cs) |

1 per year SG Overseas |

| Booking Book via Mastercard Travel Pass app at least 48h in advance |

||

HSBC Visa Infinite HSBC Visa Infinite |

S$2K per month for 1 ride No spend required for first 2 [Regular] or 4 [Premier] per year (T&Cs) |

24 per year Includes free rides SG |

| Booking Book via Ten Concierge website at least 24h in advance |

||

Maybank Visa Infinite Maybank Visa InfiniteApply |

S$3K per month for 1 ride (T&Cs) |

8 per year SG |

| Booking Book via Lylo at least 5 days in advance |

||

OCBC VOYAGE OCBC VOYAGEApply |

S$12K per quarter for 2 rides (T&Cs) |

2 per quarter SG |

| Booking Book via OCBC app, or call 6593 9999 at least 48h in advance |

||

Citi Prestige Citi PrestigeApply |

S$12K per quarter for 2 rides (T&Cs) |

2 per quarter SG |

| Booking Book via Citi Prestige Digital Concierge at least 48h in advance |

||

StanChart Beyond Card StanChart Beyond CardApply |

None (T&Cs) |

2 per year* Priority Banking & Priority Private only SG Overseas |

| Booking Book via Teleport.sg at least 48h in advance |

||

| *StanChart advertises 10 rides per year for Priority Private Beyond Cardholders. However, this figure already includes the 8 rides that Priority Private customers already enjoy, without the need for the Beyond Card | ||

Limo services need to be booked at least two days in advance of travel. Your card will initially be charged S$45, which will be automatically reimbursed within two months after quarter ends, if the spending criteria is met. In other words, you can ride first, spend later, provided both riding and spending take place in the same quarter.

A maximum of two free rides can be booked per quarter.

Complimentary travel insurance

| Coverage | Amount |

| Accidental Death | S$500,000 |

| Medical Benefits | S$50,000 |

| Travel Delay | S$200 |

| Policy Wording | |

UOB PRVI Miles Cardholders who charge air tickets to their credit card will be eligible for complimentary travel insurance. However, coverage does not kick in automatically; they must register via this link at least five working days before departure.

S$500,000 coverage for accidental death is included, as is S$50,000 coverage for emergency medical assistance, evacuation and repatriation (including COVID-19). While there is some token coverage for travel delays as well, there is no coverage for overseas medical expenses, lost or damaged bags, lost personal belongings, trip cancellation or personal liability.

Therefore, I’d highly recommend getting a comprehensive travel insurance policy instead.

Bonus miles offers

UOB PRVI Miles Cardholders enjoy periodic bonus miles offers, usually coinciding with the mid- and year-end travel peak. While a minimum spend is usually required, the resulting earn rate can outperform even specialised spending cards.

Here’s a snapshot of what we’ve seen over the years:

- November 2025: 5 mpd on overseas dining and shopping

- May 2025: 5 mpd on overseas shopping and dining

- November 2024: 5 mpd on overseas dining and shopping

- May 2024: 5 mpd on overseas dining and shopping

- September 2023: 8 mpd on airline, hotel and travel agent bookings

- May 2023: 5 mpd on overseas dining and shopping

- May 2023: 8 mpd on Expedia airline and hotel bookings

- November 2022: 5 mpd on overseas dining and shopping

- February 2022: 4.4 mpd on online dining, food delivery, groceries, pharmacies

Bonus miles with KrisFlyer UOB Account

UOB PRVI Miles Cardholders can earn bonus miles on their spending with a KrisFlyer UOB Account.

For example, if I spend on my UOB PRVI Miles AMEX in SGD, I will earn:

- A base reward of 1.4 mpd from my UOB PRVI Miles AMEX

- A bonus reward of 5-6 mpd from my KrisFlyer UOB Account

| Without Salary Crediting | With Salary Crediting | |

| UOB PRVI Miles AMEX | 1.4 mpd | 1.4 mpd |

| KrisFlyer UOB Account | 5 mpd | 6 mpd |

| Total | 6.4 mpd | 7.4 mpd |

| To unlock the salary crediting bonus, you must credit a minimum salary of S$1,600 to the KrisFlyer UOB Account |

||

However, I’d strongly advise against this, because the opportunity cost of the funds you need to deposit in the account would almost certainly outweigh the value of any miles earned. That’s mainly because the maximum miles you can earn each month are capped at 5% of your Monthly Average Balance (MAB).

For example, if your MAB is S$1,000 (the minimum required to earn miles), you can earn at most 50 miles (5% of S$1,000) from the KrisFlyer UOB Account each month. Assuming you don’t credit a salary (5 mpd), the account would stop rewarding you after spending just S$10 (50/5 mpd) on your cards!

To learn more about the KrisFlyer UOB Account, and why it’s such a raw deal, refer to the post below.

Visa Infinite

If you have a recently-issued UOB PRVI Miles Visa, you might be surprised to discover that it’s actually a “stealth” Visa Infinite!

Apparently, at some point in mid-2025, newly-issued UOB PRVI Miles Visa cards received this upgraded badge, even though it wasn’t formally announced. You can use this BIN checker to see whether your card has the Visa Infinite badge.

If it does, you’ll receive the following additional benefits.

| 🏨 Hotel Elite Status | |

| 🚗 Rental Car Elite Status | |

| 👍Other Perks |

Terms and Conditions

Summary Review: UOB PRVI Miles Card

|

|

| Apply (AMEX) | |

| Apply (MC) | |

| Apply (Visa) | |

| 🦁 MileLion Verdict | |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

If you’re looking for a general spending option, there are far worse options than the UOB PRVI Miles Card.

The earn rates obviously won’t beat those of specialised spending cards, but they are the highest among the entry-level segment, with reliable boosts during the mid- and year-end peak travel periods. Four lounge visits and complimentary airport limo rides are perks that no other competitor offers, and if nothing else, it’s a way to get a Visa Infinite card at the S$30,000 income level.

On the flip side, the transfer partners are limited, and there are annoying things like S$5 earning blocks and automatic UNI$ deductions for annual fees. But if you can live with that, then the UOB PRVI Miles Card can be the foundation around which you layer other higher-earning options like the UOB Lady’s Card, UOB Preferred Platinum Visa and UOB Visa Signature too.

So that’s my review of the UOB PRVI Miles Card. What do you think?

This has come down a long way. Back in the day before all the various category multipliers came about, the PRVI Miles Amex was a leading 1.6/2.8mpd for local and overseas spend respectively.

i remember the dbs altitude offering 1.6 mpd too! but you had to spend at least 2k

I wonder what card would be given a 5*

maybe such a card doesn’t exist….(or maybe if i happened to review the citi rewards card during the apple pay phenomenon)

Maybe a card that has a decent general spend rate, along with a range of 4 mpd bonus categories, uncapped. Something like the UOB krisflyer card without the delayed miles caveat.

1 star card candidates:

BOC Elite Miles

Krisflyer UOB debit card

UOB Preferred Platinum Mastercard

OCBC Platinum Card

truth be told i probably wont even bother reviewing most of these cards (except boc elite miles)

Timely reminder to check my statement for that annual fee and it looks like June is when my annual fee is due, for which they’ve quietly deducted 6000 UNI$

They’ve updated the list of merchants on UOB$ programme again. Seems like King Koil and some merchants have been removed and others added

thanks, will take a look at that.

For me, this is a very decent card. If you can hit $50k spend in 1 year, that’s effectively 1.8 miles per dollar for spending $50,000. Forget about all the other “perks” (for me, I never use UOB for them) and just make I don’t use the card for things like utilities or insurance, then it works well for me. No annual fees after $50k spend, so that is the magic number to make this card worth it.

here’s the qn i have though: how much of that $50k could have been put on 4 mpd cards?

i would say, zero to minimal

oh in that case then definitely, UOB PRVI miles would be a good bet (though if you could somehow get your hands on an amex highflyer, even better…)

But Amex Highflyer limits conversion of 30K miles a year for each Krisflyer account. Spending $50K will take me 3 years to convert to miles.

Looks poor. OCBC Voyage next, please! 🙏

Have a very unpleasant experienced with UOB Prvi Miles card. They could not recongised one overseas transaction due to special characters in the merchant name (it is in Swiss) hence no UNI$ rewarded. Have called UOB CS numerous times but they just kept saying have raised this up to their relevant department and no follow up at all. Standard reply is “please allow 5 to 7 working days to get back to you” and when there is no SMS, you called CS and then the cycle repeats. End of the story: Think twice when you decide to use this card… Read more »

Have a very unpleasant experience with UOB Prvi Miles card. They could not recognised one overseas transaction due to special characters in the merchant name (it is in Swiss) hence no UNI$ rewarded. Have called UOB CS numerous times but they just kept saying have raised this up to their relevant department and no follow up at all. Standard reply is “please allow 5 to 7 working days to get back to you” and when there is no SMS, you called CS and then the cycle repeats. It has been 2 months and it have not been resolved. So you… Read more »

The limo service is only TO Changi and not from? If it’s to and fro then every trip per quarter is going to be free rides with 1k FCY spent. Since it’s ‘pre-charged’ I book the ride for my trip and then meet the 1k FCY on the trip itself after I am back UOB waives the ride charge?

I read that pairing the card with UOB KrisFlyer account, there will be bonus miles at 5mpd. Is it something new as it was not mentioned here?

Pretty bad experience. The 3.25% fcy is misleading. They also charge an extra 1.5% or so on the underlying FX. So off market Fx rate and then fee on top. You’re not getting the miles rate you expect. Anyone else found this? This was confirmed to me on the phone by UOB when I put a NZD transaction through.

Yes there is a 3.25% foreign exchange fee and a 1% cross-border fee for overseas transactions. Amex is the only network that does not charge the 1% cross-border fee.

can I apply for all 3 cards and get the sign up bonuses?

they are lying on the miles earn rate with Agoda btw, you never get the actual mentioned miles, just a fraction of it. Agoda support as expected try to act blur when you question them on it, or refer you to UOB, basically both point fingers at each other and you don’t actually earn miles at the advertised rate, just a fraction of it!

Hi there! Is this card a good choice to use to pay for gym membership packages? My gym doesn’t have contactless payment so the physical card has to be used. That renders my UOB Preferred Platinum useless. My DBS Women’s World won’t help either.

Is it correct never to use Amaze with UOB PRVI Miles Mastercard for overseas spending because the cost per mile without Amaze is lower, if you include the forex charge when using Amaze in the computation?

What’s the simplest way to predict the total foreign currency transaction cost when using UOB PRVI Miles overseas? Is it right that if this total cost is less than 4%, you might still get the cost per mile of the 2.4 mpd below 1.5 cpm? The problem is, this total cost can go to 5.0-5.5% sometimes, sending cpm to 1.8-2.2. Is it safer to just use Wise overseas where you can see the actual mid-market rate being used to fund your Wise card? Using Amaze with a general spend card is not a solution because Amaze total transaction cost can… Read more »

The limo service is grab like but cant really complain since its free. It basic and the cars come with ang-kong and the like.

Just received sms that this card will have lounge privileges. 4 times a year apparently!

If you use PRVI make sure you track the bonus uni$ for FX and Agoda campaigns. Each time I need to persistently chase them until they finally credit the missing uni$. Unsure if it’s just me or if others don’t keep track and just miss out on all the bonus uni$ which are their due.

Hi Aaron, for the UOB x Expedia landing page to earn 6 mpd for flights, are the flights strictly for the airlines stated in your table only? I do see Scoot & Airasia flights in the landing page.

Thank you!

Between the MC and VISA, which is preferred? Is this the only card with no spending cap and still allows you to earn miles? because i see most cards have a S$1000 cap then thereafter would be .4 miles for local spending.

Please note that for Agoda transactions made using a UOB card, a 1% fee applies when the transaction is processed by a foreign operator. This fee remains applicable even in cases where Agoda issues a full refund. As a result, customers may effectively incur around a 2% charge if a booking is cancelled.

Now can only earn 3 miles per dollar on Expedia, I just made a booking and found out this.

How to decide if to apply for Visa, MC or Amex for this card?